Will the launch of Taproot Assets on the Lightning Network spark a new wave of BRC20 token issuance?

TechFlow Selected TechFlow Selected

Will the launch of Taproot Assets on the Lightning Network spark a new wave of BRC20 token issuance?

What is the technical implementation logic of Taproot Assets?

Author: Haotian

Last night, Lightning Labs released the mainnet alpha version of Taproot Assets for the Lightning Network, meaning stablecoins and other assets can now be built directly on the Bitcoin network. These assets are fully controlled through Bitcoin's Script programmability for issuance, entirely decentralized, and ultimately deployed via the Lightning Network. At first glance, does this mean Bitcoin has finally entered a true BRC20 era?

So, what is the technical logic behind Taproot Assets? How does it differ from BRC20 on Ordinals? Will it trigger another wave of new BRC20 token launches? Let’s try to objectively unpack these questions.

Technical Implementation Logic

In my previous article explaining BitVM, I introduced Bitcoin’s limited yet feasible programming capabilities—namely, writing "simple code" into the Script of a Taproot address, which then acts as spending conditions for UTXOs.

In the context of asset issuance with Taproot Assets, this sequence of simple opcodes can define rules such as total token supply, issuance time, and recipient addresses. A set of multi-signature addresses can jointly trigger execution of these opcodes. For example, if user A generates a multi-sig address B and plans to issue 10,000 USDT tokens to address C via B, then address A can be considered the project owner (Owner) of the USDT asset on Bitcoin, while address C becomes the initial holder receiving those tokens.

Successful token issuance requires a signature from address A. Similarly, when address C wants to transfer assets to other addresses, it also needs A’s signature to initiate the transaction. You might ask: if C needs to distribute tokens to thousands of addresses, surely they can't wait in line for A to sign each one? Good question—the key lies here. Address C, as a recipient, is typically deployed on the Lightning Network, enabling efficient, low-cost, high-frequency interactions between two parties within an established bidirectional channel.

Originally, the Lightning Network only supported point-to-point transactions. However, the new Taproot Assets protocol enables point-to-multipoint functionality, allowing a single payment channel to forward payments to multiple recipients. The script can conditionally transfer assets to multiple addresses, enabling mass distribution of tokens issued to address C across many addresses via the Lightning Network, thereby achieving decentralized asset ownership. This completes the closed-loop technical mechanism for issuing tokens entirely on the Bitcoin network.

Moreover, address C could be managed by relay nodes on the Lightning Network that execute accounting according to predefined rules. Similar addresses can be administered through different relay nodes for asset distribution (for instance, an owner may delegate their USDT tokens to 10 relay distributors—each acting like a centralized exchange hot wallet—and let them handle secondary distribution and bookkeeping).

Thus, through the combined functions of Owner, issuance-condition address, receiving-condition address, multi-signature triggers, and an efficient, trustworthy distribution network, along with other essential components, a fully decentralized system for asset issuance, management, and distribution emerges.

“Real” or “Fake” BRC20?

The BRC20 logic on Ordinals works by embedding JSON data packets into Script, where parameters like Mint and Transfer define asset circulation rules. Ultimately, interpretation is determined by the third-party Ordinals protocol. Throughout this process, the Bitcoin network merely serves as a passive data notary—it doesn’t participate in validation or computation, cannot resolve ownership disputes, and even suffers bugs during transfer processing. Users become the primary actors in minting and transferring assets, with no central project team, utility, or strong liquidity.

In contrast, issuing multi-assets on Taproot Assets represents a more advanced and sophisticated approach. There is a clear project Owner; asset issuance and destruction are governed by boolean outcomes (True/False) within Script opcodes, and subsequent circulation is supported by the technically robust Lightning Network—an environment inherently designed for high-frequency transactions. While nothing is absolute, compared to BRC20, the multi-asset network enabled by Taproot Assets aligns much more closely with what tech enthusiasts would consider a logical and meaningful “new” token standard. (Note: This analysis focuses solely on technical distinctions; speculative dynamics, scarcity-driven profit motives, and other market factors are beyond the scope of this discussion.)

A New Wave of BRC20 Token Launches?

Perhaps now many people are imagining: since real BRC20 tokens have arrived, can we simply replicate the earlier boom seen on Ordinals? Theoretically, yes—but personally, I believe Taproot Assets involves a more complex systemic infrastructure. Deploying a complete project isn’t easy due to its multi-signature system, issuance and transfer logic, and especially the operational overhead of managing point-to-multipoint ledger operations on the Lightning Network. Unlike Ordinals, where launching a token takes just one transaction, replicating the BRC20 frenzy will be significantly harder. Instead, the Lightning Network is naturally suited for high-frequency consumer use cases, making stablecoins like USDT and USDC the ideal candidates for Taproot Assets issuance.

Clearly, the Lightning Network team itself emphasizes stablecoin applications. That said, if other projects choose to bypass the more advanced Ethereum EVM smart contract platform and instead invest effort into deploying tokens on Bitcoin, it’s certainly possible—as long as project teams are willing and markets receptive, anything goes. Given the Lightning Network’s inherent strengths in payments, the most natural fit remains payment-oriented tokens. Proof-of-Stake staking tokens, however, would feel awkward here (if at all). Other applications like DEXs, lending platforms, and derivatives are theoretically feasible too—it just depends on whether anyone is willing to bear the higher implementation costs.

That’s all.

To be honest, I prefer describing Taproot Assets as ushering in a multi-asset era for Bitcoin. Referring to it as BRC20 is merely for ease of understanding and highlighting its innovativeness. As for the market moving forward, whether Taproot Assets will spark a new narrative cycle remains uncertain—though it certainly possesses the qualities and potential. Regardless of whether or how much speculation surrounds Taproot Assets, two promising visions are already clear:

1) Stablecoins like USDT will re-enter the Bitcoin network and potentially become dominant currencies within Lightning Network applications. Whether they can reclaim the top position from TRON-based stablecoins remains to be seen;

2) Adoption of Lightning Network-compatible wallets and metrics such as offline payment channels will see significant growth—a potential turning point for the Lightning Network. It remains to be observed whether this will provide momentum for emerging Nostr-related social platforms.

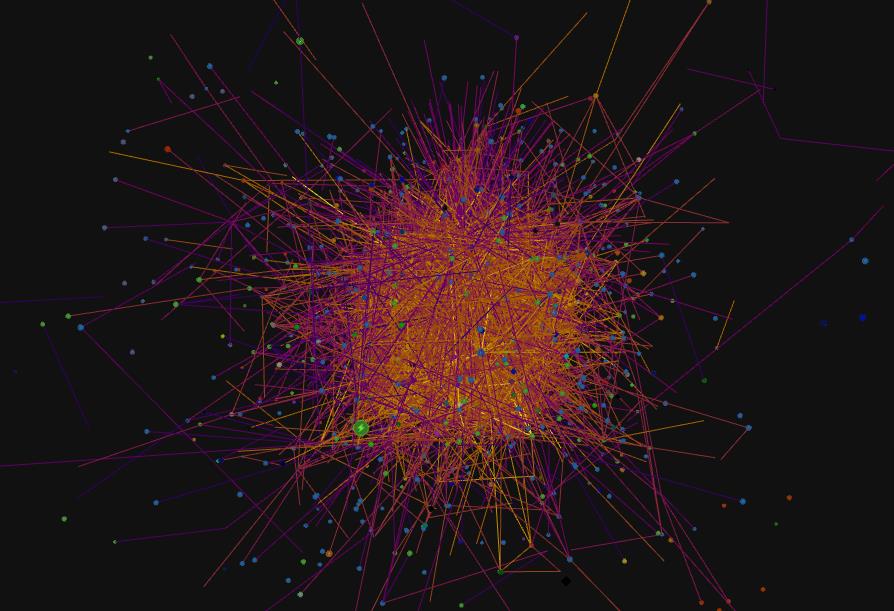

Note: Current global distribution of Lightning Network channels

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News