Beyond Memes: Practical Use Case Narratives — A Review of Popular Projects in the BRC20 Ecosystem

TechFlow Selected TechFlow Selected

Beyond Memes: Practical Use Case Narratives — A Review of Popular Projects in the BRC20 Ecosystem

This article will introduce recent BRC-20 ecosystem projects that have gained significant market attention.

By: TechFlow

In 2023, the Bitcoin ecosystem showcased a continuous series of highlights, with new protocols emerging one after another. Ecosystems built around Ordinals, Lightning Network, Stacks, RGB, and Atomicals rapidly expanded.

Recently, as Ordi's price surged past $60—marking a gain exceeding ten thousandfold—the significant wealth effect has made the Bitcoin ecosystem a focal point for investor attention.

Although many Bitcoin-related protocols are still in early development stages, beyond Ordi and the BRC-20 inscription ecosystem, numerous other promising investment opportunities have emerged. After thorough research, this article will introduce several BRC-20 ecosystem projects currently gaining market momentum.

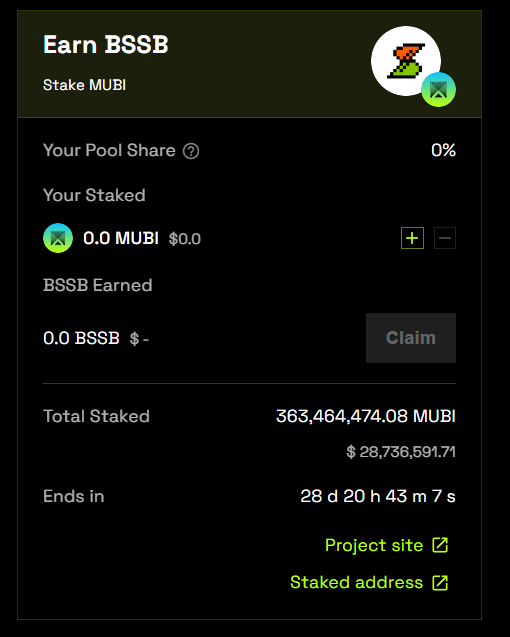

BitStable ($BSSB): A Bitcoin-Based Stablecoin System

Overview

BitStable is a decentralized asset protocol built on the Bitcoin network that enables users globally to generate collateralized assets tied to the Bitcoin ecosystem—specifically the stablecoin $DAII. The platform employs a dual-token system consisting primarily of $DAII and $BSSB, while also supporting cross-chain operations to enhance compatibility with other blockchain networks.

Official website: https://bitstable.finance/

Twitter: https://twitter.com/bssbstable

$BSSB Token

BitStable operates a dual-token system comprising $DAII and $BSSB.

-

$DAII is a stablecoin whose value and stability derive from assets within the Bitcoin ecosystem, such as BRC-20, RSK, and the Lightning Network. Designed to leverage cross-chain functionality, DAII aims to bring Ethereum community participants into the Bitcoin ecosystem. The total supply of this token is capped at 1 billion.

-

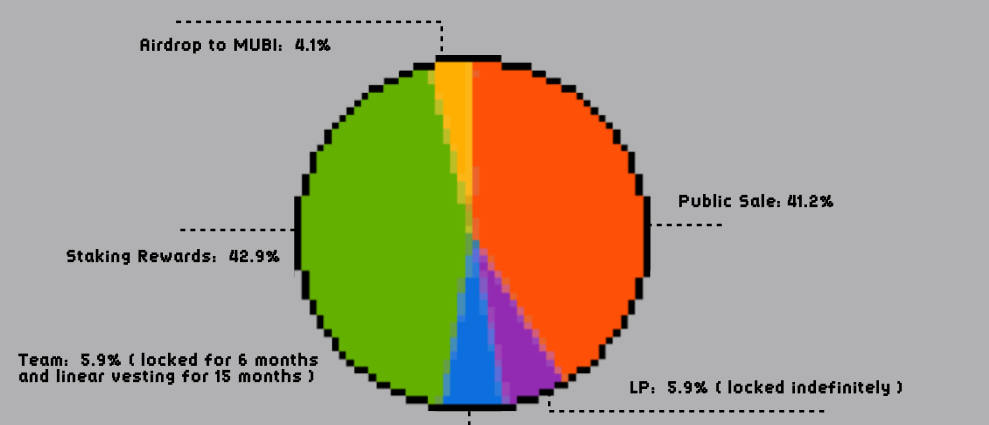

$BSSB is the platform’s governance token used to maintain the system and manage $DAII. BitStable incentivizes $BSSB holders through dividends and other reward mechanisms. The total supply of BSSB is 21 million, distributed as follows: 4.1% via airdrop, 41.2% through public sale, 42.9% allocated to staking rewards, 5.9% reserved for the team (linearly unlocked over 15 months after a 6-month lock-up), and 5.9% for liquidity provision.

-

Current market cap of $BSSB: $20.81M

Notably, during its IDO on November 29, 2023, BitStable suffered a DDoS attack on the Bounce Finance platform, resulting in uneven token distribution. To address this issue, BitStable implemented corrective measures, including burning 75% of the BSSB tokens and retaining 25% for claims. However, high gas fees and additional costs significantly increased expenses for participants.

Overall, BitStable enhances liquidity and stability within the Bitcoin ecosystem through its unique token model and cross-chain capabilities, while offering community members opportunities to participate in and influence the platform's evolution.

Multibit ($MUBI): BRC-20 Asset Bridge

Overview

Multibit is an emerging bridge protocol launched in May 2023, focusing on connecting BRC-20 assets to EVM-compatible networks. This protocol enables seamless token transfers between Ethereum (ETH), Binance Smart Chain (BNB), and the Bitcoin (BTC) network.

The operation of Multibit is streamlined and efficient. First, users transfer their BRC-20 tokens to a dedicated BRC-20 address. Upon confirmation, the Multibit protocol mints an equivalent amount of tokens on either the Ethereum or BNB chain. These tokens are then securely stored in a unified cold wallet. When users wish to withdraw, Multibit burns the corresponding amount on the EVM chain and transfers the equivalent tokens from the cold wallet back to the user.

On November 26, Multibit launched a staking system allowing users to stake MUBI tokens and earn rewards in ERC-20 or BRC-20 formats. Currently, users can receive NHUB and BSSB tokens as staking rewards, with over 360 million MUBI already staked on the platform.

Official website: https://multibit.exchange/

Twitter: https://twitter.com/Multibit_Bridge

$MUBI Token

Multibit’s $MUBI token has a total supply of 1,000,000,000, all of which is currently in circulation, with a market cap of $154.2M.

$MUBI is a core component of the MultiBit platform, providing users with various functions and benefits. Below are the rights granted to $MUBI holders:

-

Governance Rights: $MUBI holders have voting power in MultiBit’s governance process, enabling them to vote on key decisions such as platform upgrades, listing of new tokens, and fee structure adjustments.

-

Users can stake their $MUBI tokens on the MultiBit platform to earn rewards in ERC-20 or BRC-20 token forms. This not only boosts platform liquidity and security but also provides stakers with additional returns.

Additionally, a portion of the transaction fees collected by MultiBit will be tokenized and distributed to $MUBI stakers. The allocation is as follows:

-

50% for growth, including 5% for core contributors, 5% for team finances, 20% for development, and 20% for marketing.

-

The remaining 50% is distributed to staked $MUBI holders as part of the protocol revenue generated by Multibit.

-

Note: Due to lack of public data, the exact current token distribution remains unclear.

Chamcha ($Chax): Inscription Asset Management Platform

Overview

Chamcha is a platform based on the Ordinals asset liquidity protocol, focused on providing a secure and convenient environment for buying, selling, earning, and custodizing NFT assets. It integrates blockchain technology and smart contracts to combine traditional financial scenarios with the potential of cyclical and streaming NFT assets.

Chamcha also adopts a BRC-20 cross-chain protocol and has launched CHAX (the Chamcha token) to support a new cross-chain bridge. This new bridge aims to alleviate congestion on the legacy bridge caused by excessive withdrawal requests due to large price discrepancies between MEXC and on-chain markets. So far, over 20 million CHAX tokens have been bridged to the Ethereum network.

Official website: https://chamcha.io/

Twitter: https://twitter.com/0xChamcha

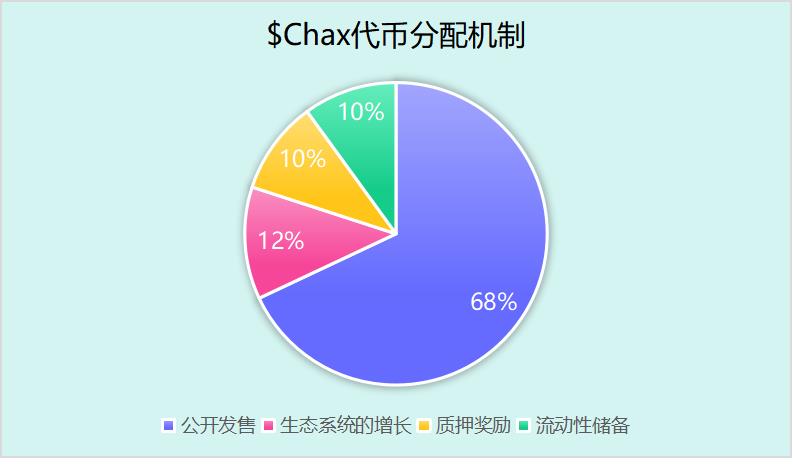

$Chax Token

The $CHAX token has a total supply of 2,100,000,000, with a current market cap of $15.7M.

Token distribution: 68% via public sale, 12% for ecosystem growth, 10% for staking rewards, and 10% for liquidity reserves.

$CHAX is not just a participation token—it also grants governance rights and incentives to holders, encouraging active engagement in platform development. Key use cases and benefits include:

-

Governance: $CHAX holders can participate in governance, exercising voting rights to influence key platform decisions, ensuring the community has a direct voice in shaping Chamcha’s ecosystem direction.

-

Liquidity Rewards: Users who provide liquidity to Chamcha’s pools and engage with the automated market maker (AMM) system can earn $CHAX tokens as rewards, incentivizing liquidity provision and promoting a healthy trading environment.

-

Staking: $CHAX holders can stake their tokens to earn additional rewards, including a share of platform transaction fees or other incentives, generating passive income.

-

Platform Utility: CHAX tokens serve multiple purposes within the Chamcha ecosystem, including paying transaction fees, accessing premium features and services, and participating in exclusive token sales and events.

Overall, $CHAX plays a crucial role in platform governance, liquidity incentives, staking rewards, and various activities and transactions within the Chamcha ecosystem.

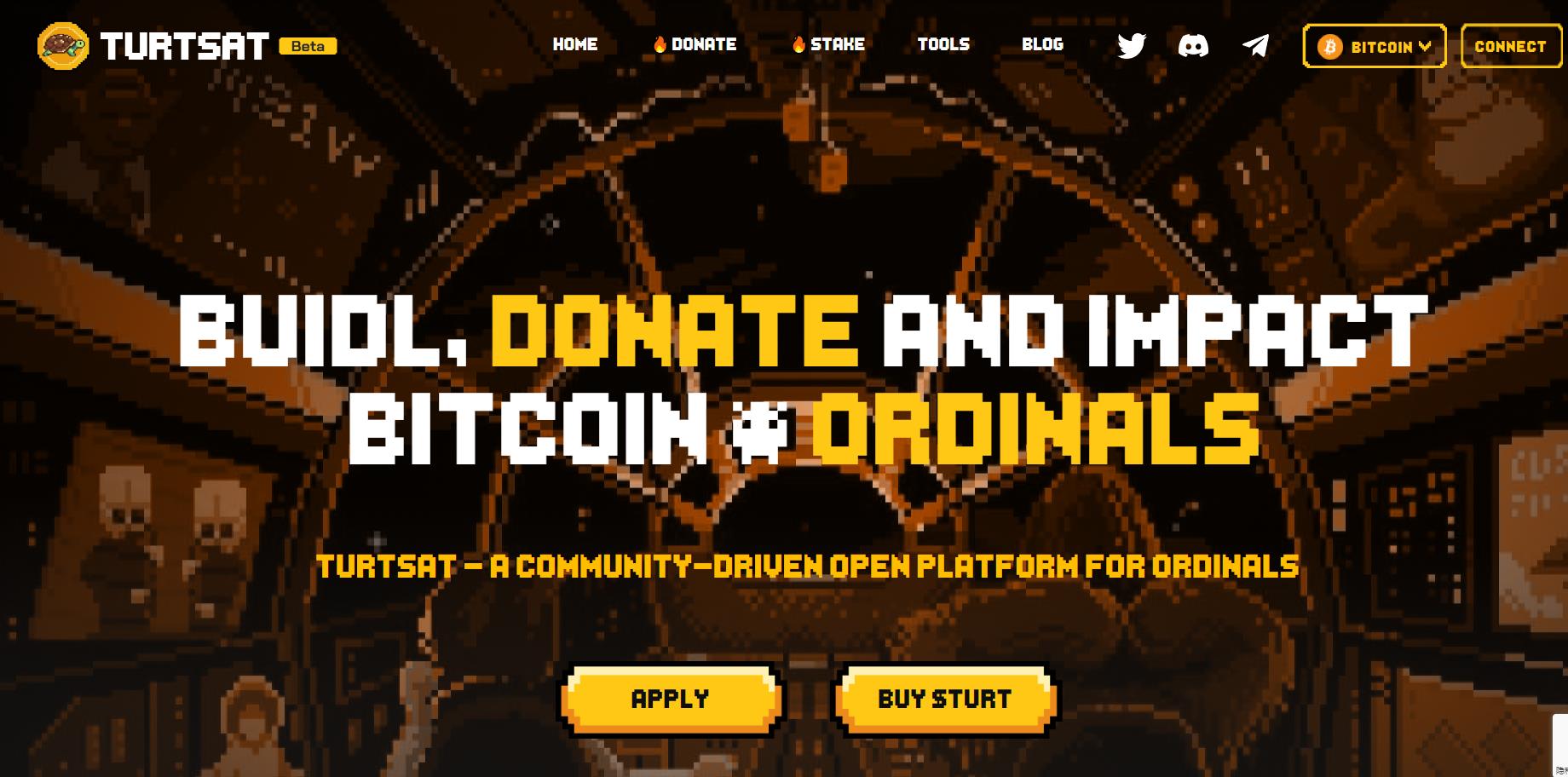

TurtSat ($Turt): Ordinals Project Launchpad

Overview

TurtSat is a project launchpad built on Ordinals, similar to Gitcoin for the Ordinals ecosystem. By establishing a foundational PSBT donation protocol, it supports open-source developers and community members in contributing to the Ordinals ecosystem and earning rewards. TurtSat is committed to fostering a positive, community-driven Ordinals ecosystem and collaborates with influential organizations to advance the development of the Ordinals protocol and the broader Bitcoin ecosystem.

TurtSat supports both BRC-20 and ERC-20 bilateral markets, allowing BRC-20 users to trade via Unisat and OKX. Since its launch, TurtSat has successfully launched four BRC-20 projects: CHAX (an asset protocol), MUBI (a cross-chain bridge), NHUB (an Ordinals aggregator), and DOVA (an Ordinals lending platform). These projects are early infrastructure builders in the BRC-20 space and have seen strong post-launch performance.

Driven by the wealth effect generated by TurtSat, multiple Ordinals builders and open-source platforms have applied to launch projects on TurtSat, highlighting its growing influence and appeal in the industry.

Official website: https://turtsat.io/

Twitter: https://twitter.com/Turtsat

$Turt Token

TURT is TurtSat’s platform token and also a meme token based on the BRC-20 turtle concept, with a current market cap of $17.17M.

$TURT is an experimental BRC-20 meme token with unique characteristics, designed to consolidate value consensus between BTC and Ordinals, enabling more individuals to understand and participate in the development of the Ordinals ecosystem and return to the BTC network.

The total supply of TURT is 1 billion, with a public sale price set at 2.5 Sats. All tokens have been fully circulated through IDO and airdrop mechanisms.

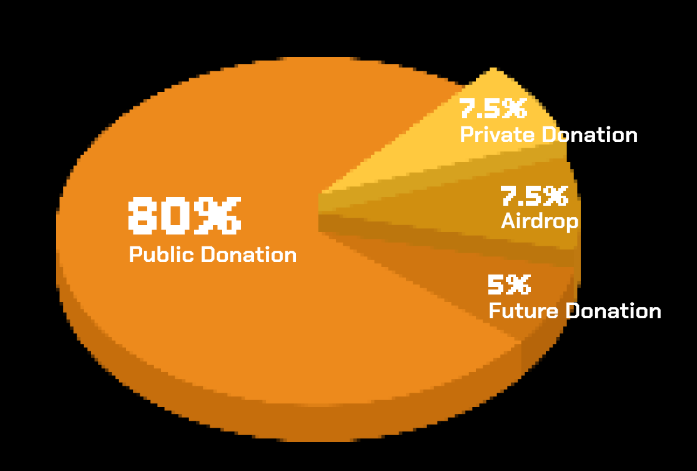

Token distribution: 80% public sale, 7.5% airdrop, 7.5% private donations, and 5% reserved for future donations.

Dova Protocol ($Dova): A DeFi Protocol on Bitcoin

Overview

Dova Protocol is an emerging decentralized finance (DeFi) protocol focused on the Bitcoin (BTC) ecosystem, aiming to bridge the gap between the Bitcoin ecosystem and EVM-compatible chains. As DeFi evolves, Dova Protocol seeks to introduce certain DeFi functionalities and liquidity to the Bitcoin network.

Three key technical features of Dova Protocol:

-

Trustless Two-Way Peg: Dova Protocol offers a trustless two-way peg between Bitcoin assets and tokenized BTC assets on EVM chains, enabling broader applications of Bitcoin ecosystem assets within DeFi ecosystems.

-

Dual-Peg Mechanism: BTC assets are locked on the Bitcoin blockchain while equivalent tokenized BTC is minted on EVM chains, which can later be redeemed for the original BTC assets.

-

Multi-Bit BTC-evm Bridge: This bridge lays the foundation for expanding Bitcoin’s use cases through DeFi, enabling functionalities such as lending, staking, and cross-chain interoperability.

Main products and features of Dova Protocol:

-

Dova Lending Protocol: Users can lend their BRC-20 holdings to earn attractive yields and receive unique BRC-30S token incentives. They can lock BRC-20 assets on the Bitcoin network while supplying them to lending pools on EVM chains.

-

Dova Staking Protocol: Native Bitcoin holdings on the Bitcoin blockchain cannot be staked until converted into tokenized BRC-20 on EVM chains. Dova enables BRC-20 staking, allowing Bitcoin holders to participate in more DeFi protocols and earn BRC-30S incentives.

$Dova Token

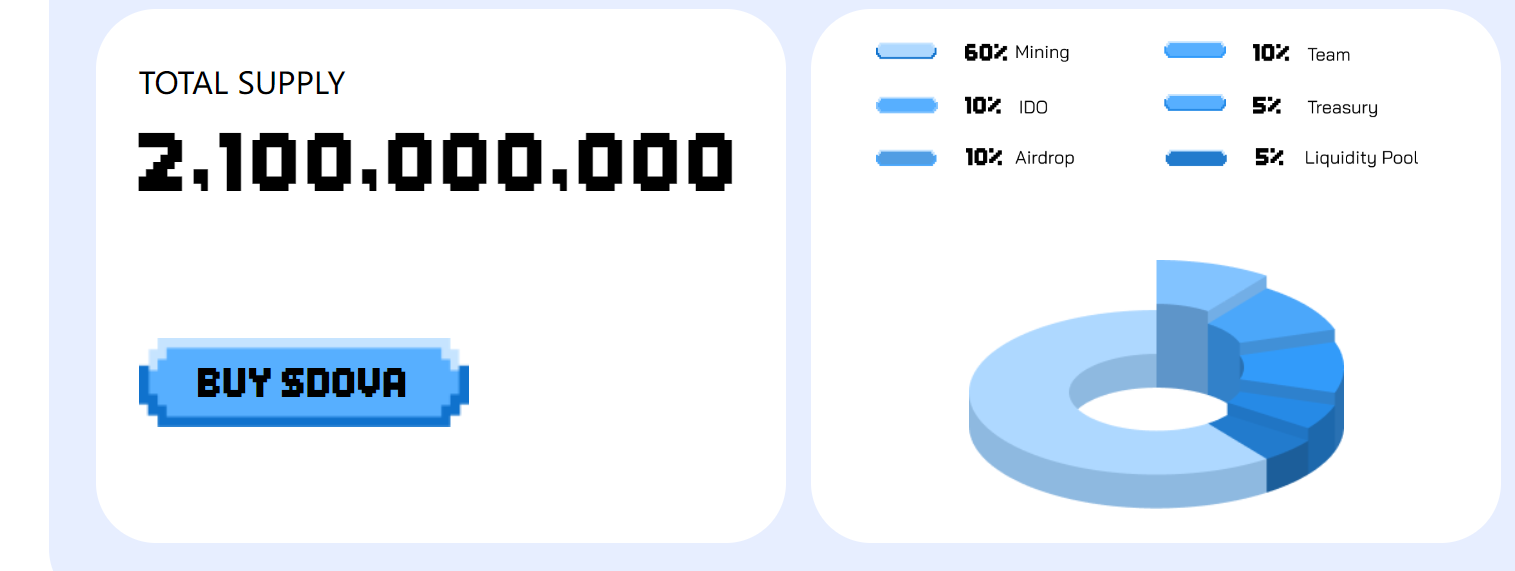

The $Dova token has a total supply of 2,100,000,000, with a current market cap of $55.56M.

Token distribution: 60% minted, 10% allocated to the team, 10% raised in the IDO round, 5% to treasury, 10% distributed via airdrop, and 5% for liquidity pools. Specific token utilities are not detailed.

Traverse ($TRVS): Crypto Asset Vault

Overview

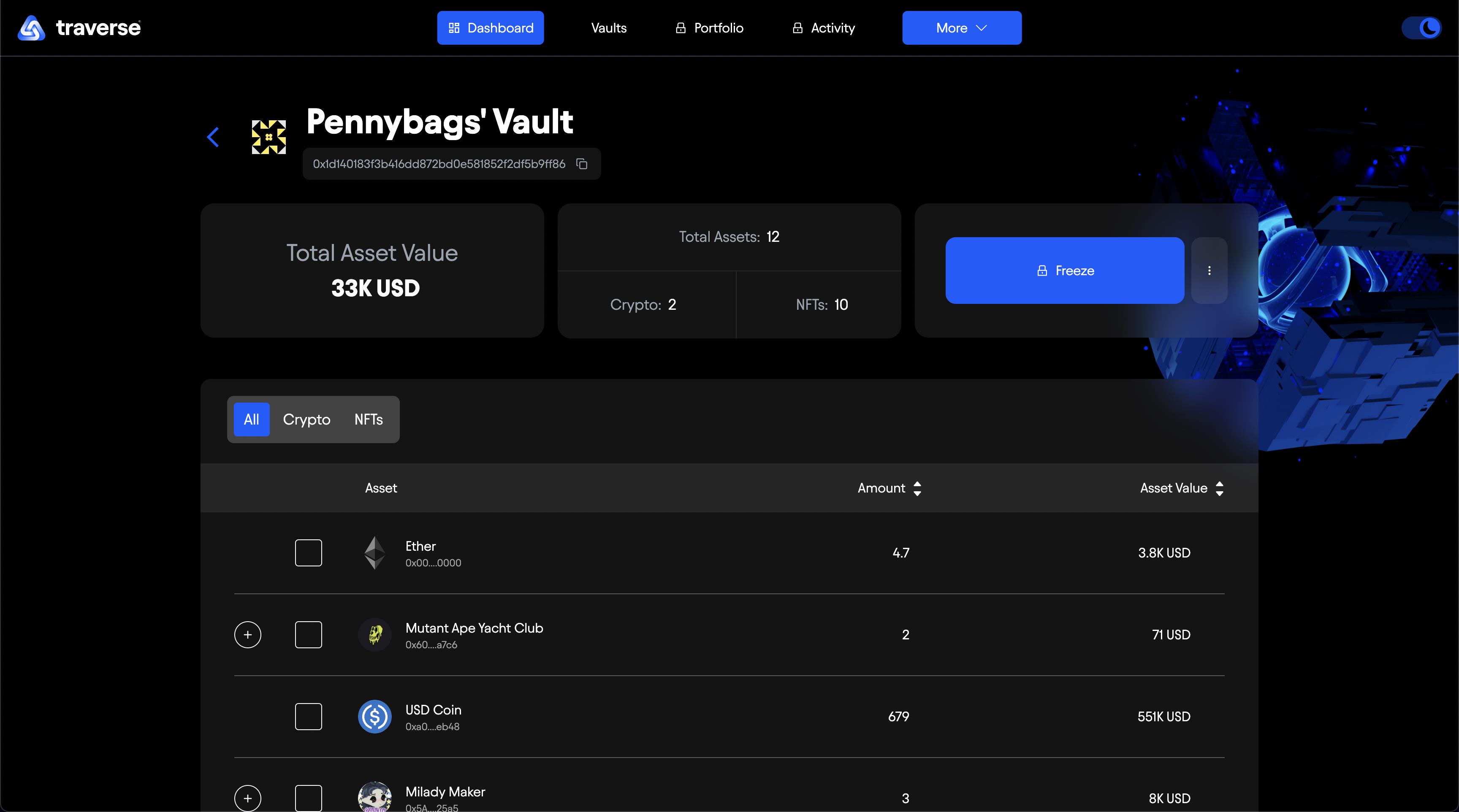

Traverse is a security solution designed for Web3. Given the complexity and privacy aspects of blockchains, they have become a haven for cyberattacks. Currently, blockchain users face suboptimal experiences with Web3 applications. Traverse aims to transform blockchain into a seamless and stress-free technology.

Although Traverse does not explicitly link itself to inscription assets on its official site, it frequently appears in inscription markets and has gained considerable traction recently.

Product Overview:

-

Traverse’s first product is a free, user-owned vault that brings traditional security features like multi-factor authentication (MFA) onto the blockchain.

-

All asset withdrawals require MFA approval, even if seed phrases are compromised. Using a novel iteration of security questions, it allows users to recover lost vaults through situational memory—where people recall event-specific details more easily than unrelated facts.

Official website: https://traverselabs.io/

Twitter: https://twitter.com/traverse_io

$TRVS Token

$TRVS is a cross-chain, cross-protocol utility token with a current market cap of $3.7M.

$TRVS is primarily used to:

-

Reduce platform fees, including those on decentralized exchanges (DEX), NFT markets, and commercial transactions;

-

Enhance Vault appearance and optimize UI design features.

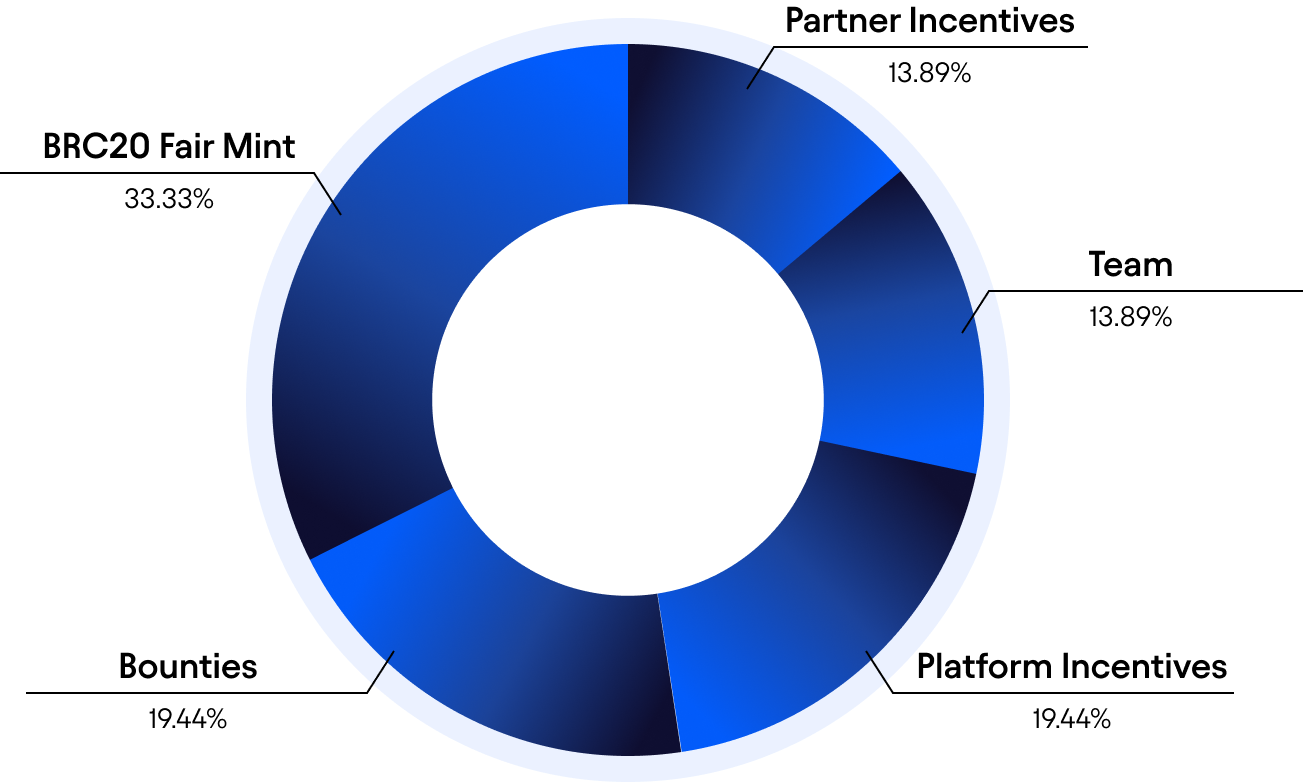

The BRC-20 fair mint will account for 33.33% of the total cross-chain token supply. The total (cross-chain) token supply is 300 billion, of which 100 billion constitutes the BRC-20 token supply. Distribution breakdown: Fair Mint 33.33%, partner incentives 13.89%, bounty rewards 19.44%, platform incentives 19.44%, and project team 13.89%.

Traverse aims to improve the Web3 user experience by integrating traditional cybersecurity practices into blockchain technology. Its product and tokenomic strategies clearly focus on increasing user engagement, enhancing security, and delivering cross-chain and cross-protocol services, thereby improving accessibility and usability across the entire blockchain ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News