Unlocking the Full Potential of BRC20: Building Trustless Indexers

TechFlow Selected TechFlow Selected

Unlocking the Full Potential of BRC20: Building Trustless Indexers

BRC20 has existed for only three months and remains an emerging token standard, currently relying on centralized indexers to maintain the balance state of the entire system.

Author: alexGo.btc, ALEX Lab Foundation

Compiled by: TechFlow

Bitcoin has long provided the most secure and decentralized blockchain, and the Ordinals protocol—enabling BRC20 tokens—has captured the attention of the Bitcoin community like few developments in recent times.

Bitcoin has evolved beyond a pure "monetary layer" to become the ultimate "data layer," with hundreds of millions of dollars worth of BRC20 tokens being inscribed and settled on-chain.

BRC20 has existed for only three months and remains an emerging token standard that currently relies on centralized indexers to maintain the system's balance state.

What Is a BRC20 Index?

A BRC20 index is a database that tracks wallets and holdings of BRC20 tokens. Those who build and maintain this database are known as indexers. Bitcoin is not a virtual machine L1 like Ethereum. The scope of Bitcoin smart contracts is limited to “send” and “receive” transactions. It is impossible to implement fully expressive smart contracts for decentralized applications directly on the Bitcoin core protocol.

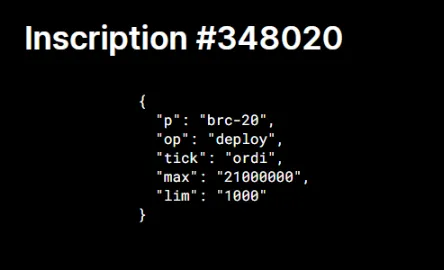

The same limitations apply to BRC20 tokens, which are simply JSON text files—or 5 lines of JavaScript—inscribed onto individual satoshis. For example, let’s examine the first BRC20 inscription created on March 8th of this year:

The inscription has been deployed, meaning it establishes the existence of the $ORDI token with a maximum supply of 21 million, allowing up to 1,000 tokens per inscription.

Note that creating $ORDI does not grant any $ORDI tokens to the creator. To hold $ORDI, users must inscribe a “mint” transaction—not a “deploy”—which mints up to 1,000 tokens per inscription until the cap is reached.

Once minted, transferring your BRC20 tokens requires inscribing a “transfer” transaction—the transfer inscription being what gets sent to a different wallet address.

This may seem rudimentary—and indeed, BRC20 is a token standard without native smart contract functionality. The Bitcoin protocol does not “see” deploy, mint, or transfer transactions because it does not interpret data. Only satoshis move from one wallet to another, just like any other Bitcoin transaction.

No Indexer, No Market

At the time of writing, $ORDI has a market capitalization approaching $200 million. If inscriptions are merely text files, what prevents malicious users from redeploying and reminting $ORDI?

This is precisely why indexers are critical to the BRC20 infrastructure. Without on-chain code that would return an error such as “$ORDI already exists,” it falls upon BRC20 market indexers to determine whether a given $ORDI token is legitimate or counterfeit.

This requires a database capable of “reading” and registering all BRC20 transaction data to verify which inscription was the first to “deploy” a new token name. Indexers must track which wallets minted the original tokens, what the maximum limits are, when minting cutoffs occur, and whether “transferred” tokens on secondary markets can be traced back to these originating wallets.

Without indexers, there is no market—only chaotic, indistinguishable text files.

Challenges Facing Indexers

Although Bitcoin itself is immutable and decentralized, the reliance of the BRC20 ecosystem on off-chain indexers represents a significant vulnerability. Centralized entities are inherent weak points, especially considering indexer states are constantly evolving.

Inscriptions that are currently unindexed or unrecognized are referred to as “cursed” (some users intentionally create these “cursed” inscriptions). Another challenge is the recent introduction of P2WSH inscriptions.

To briefly summarize, P2WSH stands for “Pay-to-Witness-Script-Hash,” using Segwit (witness data) similar to regular inscriptions but without Taproot (P2TR). Additionally, P2WSH uses ECDSA signatures instead of Schnorr signatures.

As a result, after inscription 10366012, some BRC20 indexers recognize inscriptions using this new script format while others do not, leading to discrepancies among BRC20 indexers.

These divergences caused by technical details highlight the potentially severe consequences if a major indexer acts maliciously—either intentionally or due to exploited vulnerabilities.

Moving Toward Decentralization

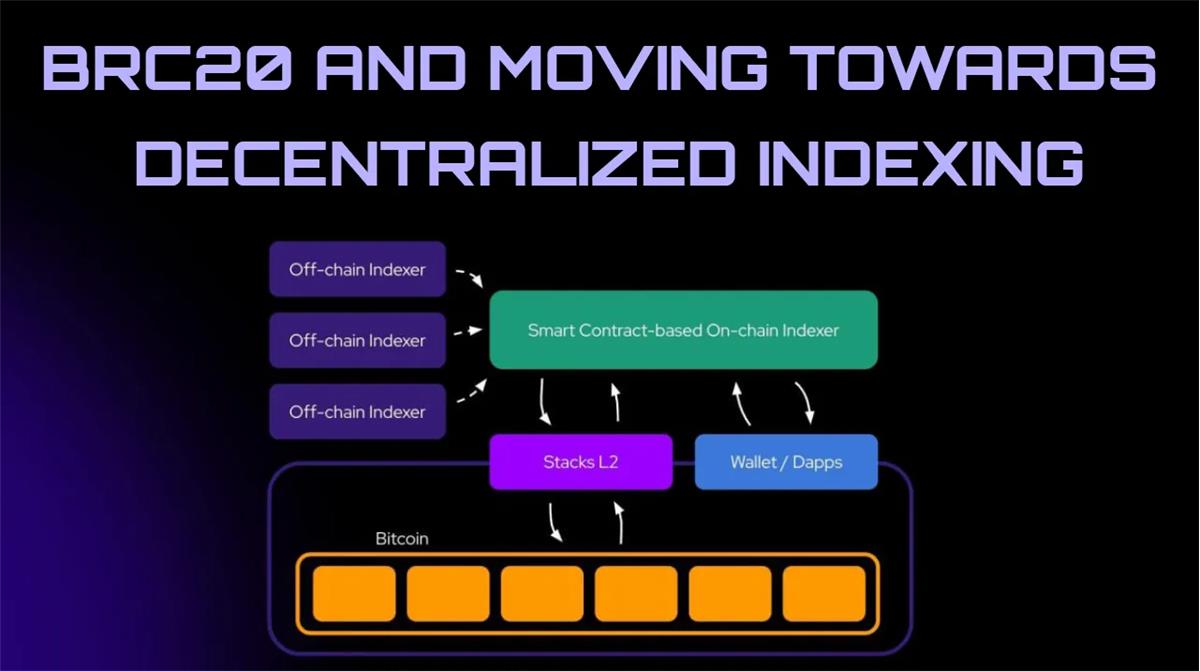

To ensure the long-term viability and growth of the BRC20 community, efforts must focus on building a universally accessible, immutable, decentralized indexer.

Such a decentralized on-chain indexer could work alongside off-chain indexers, providing a single source of truth based on verifiable proofs and smart contract logic.

The ALEX team leveraged L2 scalability to build B20, the first and fastest BRC20 orderbook DEX, enabling rapid trade confirmation while guaranteeing Bitcoin-finality security.

B20’s success demonstrates the potential of L2 solutions to complement Bitcoin’s security and compensate for its lack of native smart contract capabilities. Layer-2 solutions built atop Bitcoin offer a pathway toward constructing a decentralized on-chain indexer.

The Stacks smart contract layer shares consensus with Bitcoin. Collaborating with Stacks thought leaders, the ALEX team is building a universal and immutable indexer, with the first version set to launch within the coming months. Through transparent smart contracts, trust in off-chain indexers can be progressively minimized as the BRC20 standard matures, unlocking its full potential.

Bitcoin revolutionized the world through a trustless financial transaction system without intermediaries. It is this very spirit of Bitcoin that inspires BRC20’s evolution toward global state—eliminating the need for “trust.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News