Bitcoin L2 becomes the narrative focus—what projects on Stacks are worth watching?

TechFlow Selected TechFlow Selected

Bitcoin L2 becomes the narrative focus—what projects on Stacks are worth watching?

This article surveys the current popular projects on Stacks, providing up-to-date information for investment research and analysis.

The current cryptocurrency market is in a bull phase, and optimism surrounding Bitcoin's development is justified, driven by innovations such as Ordinals/BRC-20 on the Bitcoin network.

However, inscriptions and memes alone cannot change the overall weakness of Bitcoin’s current ecosystem. To further develop Bitcoin’s ecosystem, corresponding liquidity, DeFi services, and other common applications seen in other ecosystems must emerge at scale.

Therefore, building a thriving DeFi application layer atop the current Bitcoin ecosystem has become another key narrative—and a new hope for Bitcoin supporters.

In this domain, Stacks, which focuses on building a Layer 2 network for Bitcoin, stands as the leader.

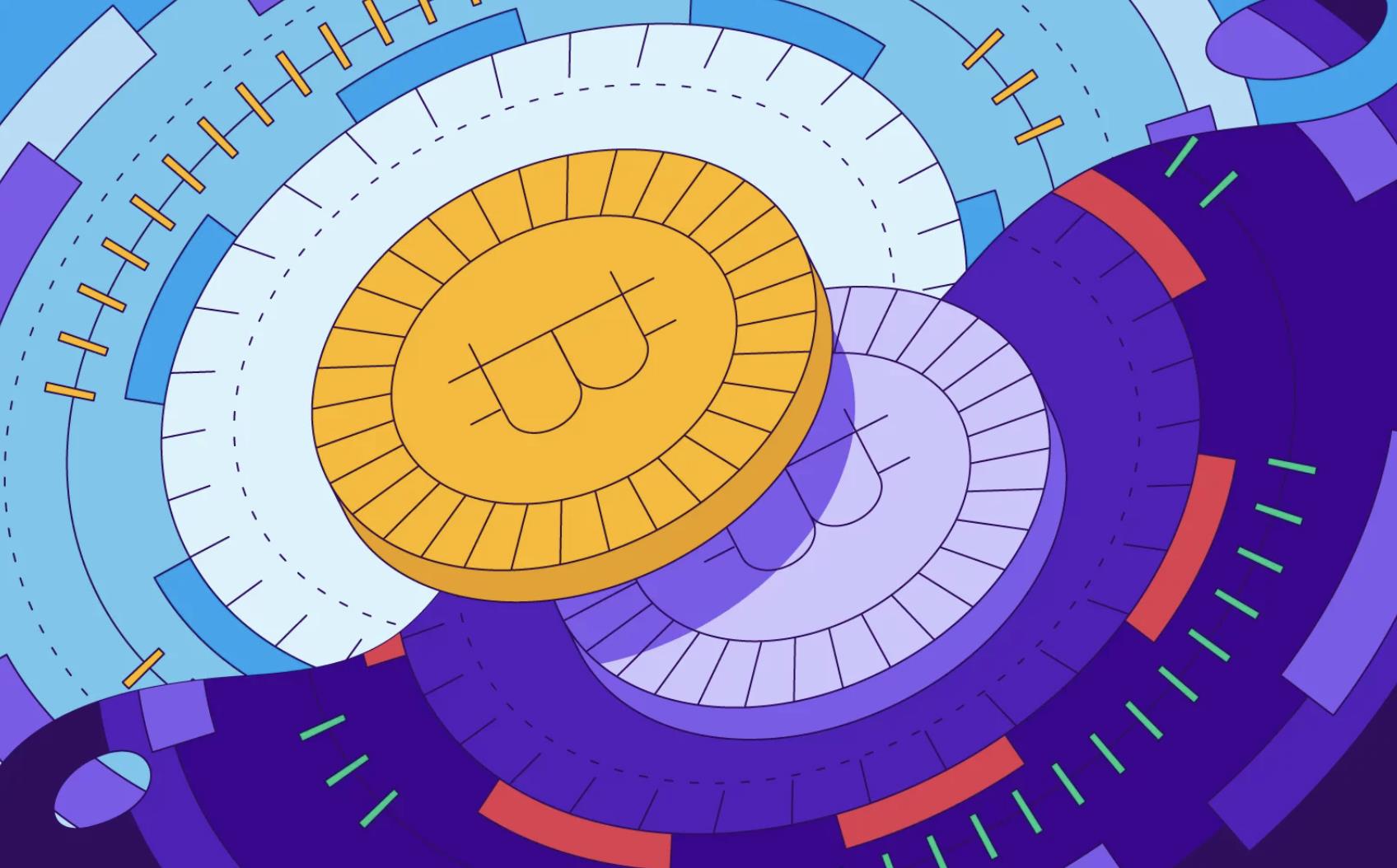

According to DefiLlama data, Stacks currently has a TVL of $34.49M, indicating significant room for growth compared to Ethereum L2s.

As a second layer for Bitcoin, Stacks is anchored to the Bitcoin blockchain but also operates as an independent protocol that introduces Ethereum-like smart contract functionality, opening new possibilities for applications such as DeFi and NFTs.

Thus, new projects built on Stacks can enable Bitcoin to be more than just a simple store of value.

As market attention increases toward the Bitcoin ecosystem—especially its inscription systems—we should continue examining whether novel financial applications are emerging on Stacks.

This article surveys the current popular projects on Stacks, providing up-to-date information for investment research and analysis.

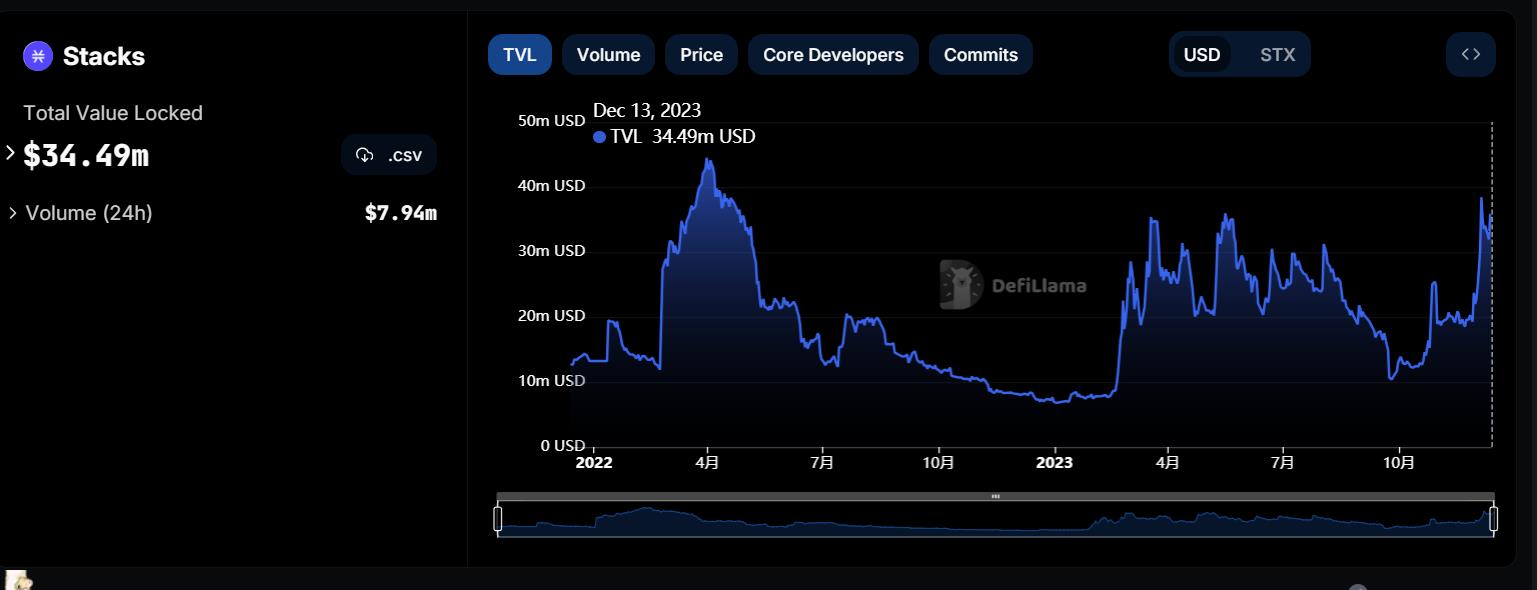

Alex: A Bitcoin DeFi Platform

Project Overview

ALEX is a Bitcoin DeFi platform built on the Stacks blockchain, aiming to unlock multiple uses for Bitcoin. ALEX primarily offers the following services: launching project tokens, fixed-rate and fixed-term loans with no liquidation risk, an AMM-based DEX (decentralized exchange), and earning interest by depositing tokens and participating in yield farming for higher returns.

ALEX aims to break down barriers between Bitcoin Layer 1 (L1) and Layer 2 (L2), delivering a seamless Bitcoin DeFi experience.

Latest Project Updates:

-

On December 11, 2023, ALEX launched the alpha version of its Bitcoin oracle, expected to complete testing by the end of Q1 2024. This version was developed in collaboration with partners including Domo, BIS, Hiro, UniSat, Xverse, and Xlink. The oracle aims to provide critical security and efficiency layers for assets on Bitcoin while maintaining decentralization and high transparency.

Official Website: https://app.alexlab.co/swap

Official Twitter: https://twitter.com/alexlabBTC

$ALEX Token

$ALEX is the participation token of the platform, offering governance rights and benefits to holders who participate in protocol and platform governance. $ALEX also serves as an incentive mechanism for users engaging in platform activities—such as providing liquidity on Alex’s DEX or staking. $ALEX can be obtained through DEX trading, LP participation, and staking, and it has three main functions:

-

Incentives: The primary use of $ALEX is to incentivize participants in platform activities—specifically those providing liquidity on the DEX and staking.

-

Staking: $ALEX can be locked to earn additional $ALEX as rewards. 50% of the initial token supply is allocated for staking, where either $ALEX or liquidity tokens can be locked to earn $ALEX rewards.

-

Voting: $ALEX holders have voting rights over matters including future platform development, fee rebates for liquidity providers, reserve allocation policies, and $ALEX token supply policies (including buybacks and emissions).

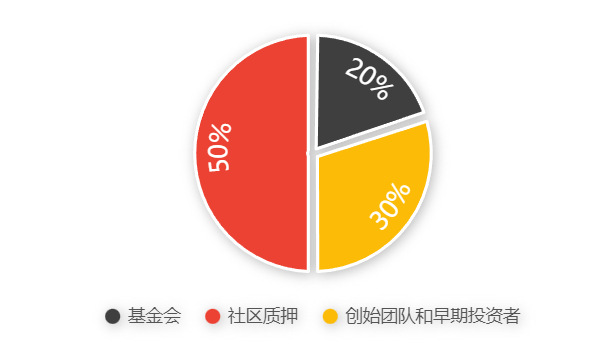

Token Distribution: Initial total supply is 1,000,000,000 $ALEX. Foundation: 20%, community staking: 50%, founding team and early investors: 30%.

Currently, $ALEX has a market cap of $116M.

As the Stacks platform continues to advance and Bitcoin technology evolves, more projects are expected to launch on Stacks. In this process, the suite of services provided by ALEX will serve as a crucial starting point for these projects. These offerings are not only highly forward-looking but will also significantly promote the continuous development of the ALEX platform.

StakingDAO: Enhancing Capital Efficiency for STX Stakers

Project Overview

StakingDAO is a project designed to improve capital efficiency for STX token stakers. Its advantage lies in enabling stakers to simultaneously earn staking rewards and utilize their assets in other DeFi applications without locking them in a staking contract.

Through StakingDAO, users deposit STX tokens into the protocol and receive stSTX in return, earning Bitcoin yields while still being able to use stSTX across other Stacks DeFi applications. Currently, the project is undergoing private testing on testnet and undergoing code audits.

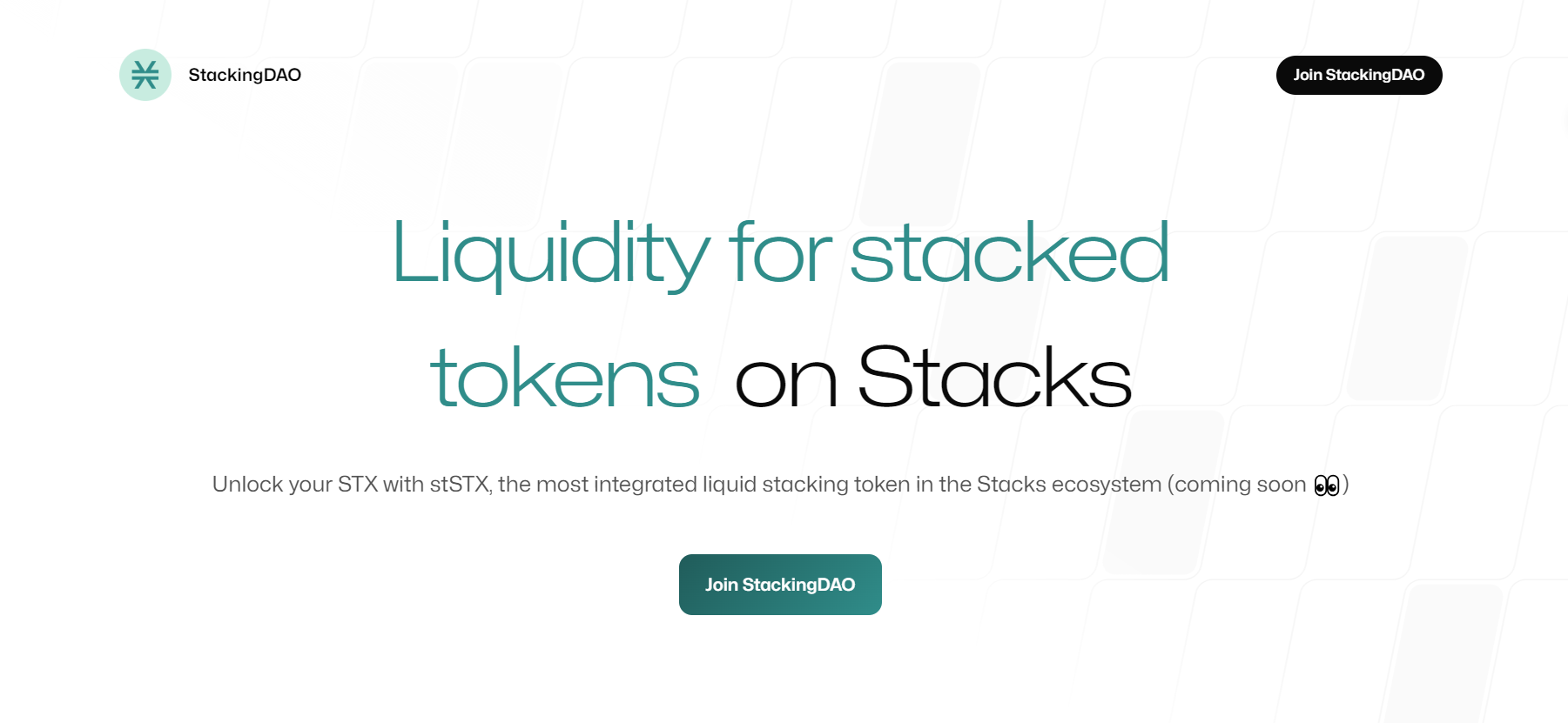

At the time of writing, nearly 400 million $STX have been staked in StakingDAO, achieving an average annual yield of 7.65%.

Official Website: https://stackingdao.com/

Official Twitter: https://twitter.com/StakingDao

$STK Token

StackingDAO will feature a governance token $STK, which users will earn by participating in the ecosystem and staking within the DAO.

The total supply of $STK will be capped at 150,000,000 tokens. The issuance rate will be limited to 5% of the total supply, with each member of the StackingDAO founding team receiving 1% of the total supply. The detailed token distribution mechanism for $STK has not yet been disclosed in the whitepaper.

The primary functions of holding the governance token $STK include governance, voting, and staking rewards, though further details have not been provided.

The $STK token is not yet listed; readers are encouraged to follow the official website and Twitter for updates.

Arkadiko Protocol: A Decentralized Liquidity Protocol

Project Overview

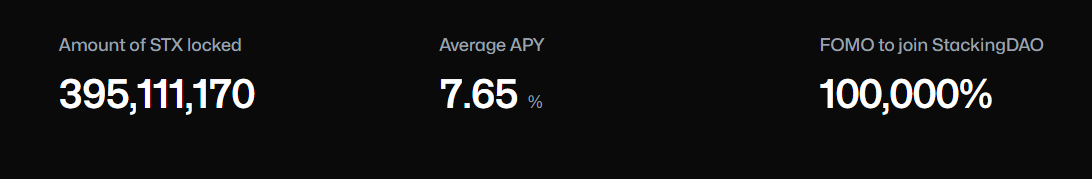

Arkadiko Protocol is a decentralized liquidity protocol built on the Stacks ecosystem. It allows users to mint Arkadiko’s own stablecoin USDA by using Stacks’ native token $STX as collateral. The project’s focus is on providing a decentralized stablecoin solution for the Stacks ecosystem, enhancing liquidity and functionality within the ecosystem.

Compared to other DeFi protocols, Arkadiko’s distinction lies in offering a dedicated stablecoin solution for the Stacks ecosystem and enabling users to gain liquidity while maintaining exposure to their assets via the PoX consensus mechanism. Arkadiko aims to drive the adoption of USDA on Bitcoin’s Layer 2 networks and enhance asset liquidity on the Stacks network.

Key Features and Functions:

-

Decentralized Stablecoin $USDA: Users can mint USDA by collateralizing $STX. USDA can be used within the Arkadiko protocol—for example, in Farms or loan repayments.

-

Swap and Lending: Arkadiko supports token swaps and lending services, increasing user flexibility.

-

Staking and Yield: Users can earn deposit interest by staking assets and gain additional rewards by participating in Stacks’ PoX consensus mechanism.

-

DEX (Decentralized Exchange): A DEX built on Stacks provides trading services, increasing liquidity and user engagement.

-

Governance Token DIKO: The DIKO token is used for protocol governance. Holders can participate in decision-making and earn DIKO by adding assets to liquidity pools.

-

Self-Repaying Loans: Users can borrow USDA by pledging STX tokens, then stake those USDA in the PoX consensus mechanism to earn rewards, which can automatically repay the USDA loan.

Latest Project Updates:

-

October 27, 2023: Partnered with PythNetwork to implement their price oracle within Arkadiko.

-

November 3, 2023: Arkadiko Protocol partnered with asigna (a non-custodial multisig wallet for Bitcoin, Stacks, and Ordinals), allowing users to directly access Arkadiko from the asigna multisig wallet.

Official Website: https://arkadiko.finance/

Official Twitter: https://twitter.com/ArkadikoFinance

$DIKO Token

$DIKO serves as the governance token of the Arkadiko protocol. Key functions include:

-

Voting: DIKO holders can stake their DIKO to convert them into stDIKO during the staking period. stDIKO carries voting weight and can be used to vote on governance proposals.

-

Incentives: By staking stDIKO in the security module, users can receive a fair share of protocol rewards.

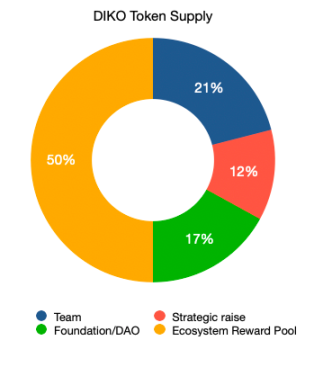

Token Distribution: Total supply is 100,000,000 tokens. Team: 21%, strategic fundraising: 12%, Arkadiko Foundation: 17%, ecosystem reward pool: 50%.

Currently, $DIKO has a market cap of $8M.

Velar Protocol: A Uniswap-Inspired DEX

Project Overview

Velar Protocol is a Bitcoin-based DeFi platform whose main goal is to unlock liquidity trapped within the Bitcoin network. Inspired by Uniswap v2, Velar plans to introduce governance, cross-chain bridges, and a perpetual derivatives exchange in future updates.

Key Features and Functions:

-

Multi-functional DeFi Platform: Velar offers various features including a decentralized exchange (DEX), trading platform, and an IDO launchpad.

-

Dharma Mainnet: A major milestone for Velar, introducing the first automated liquidity protocol on Bitcoin and delivering a seamless and efficient DeFi experience.

-

Bitcoin DeFi Innovation: Velar aims to unlock over $500 billion in potential liquid value on Bitcoin, enabling individuals to issue and trade tokens on the Bitcoin network while earning rewards for providing liquidity.

Velar is currently in testing. In the future, Velar plans to launch governance, a temporary DEX focused on liquidity, a perpetual derivatives exchange with up to 20x leverage, and a cross-chain bridge for moving assets across different L2 networks.

Latest Project Updates:

-

June 14, 2023: Velar launched its testnet; all users active on testnet from June 14 to July 14 were eligible for a $VELAR airdrop.

-

September 28, 2023: Integrated xverseApp wallet (a Bitcoin wallet) into web and mobile platforms.

-

December 7, 2023: Official Twitter announced that the roadmap would be released the following week. As of writing, the roadmap has not been published—readers are advised to stay tuned.

Official Website: https://velar.co/

Official Twitter: https://twitter.com/VelarBTC

$VELAR Token

The Velar token ($VELAR) is the core of the protocol economy. Its uses include:

-

Incentives: Rewarding liquidity providers

-

Broader ecosystem partnerships (e.g., discounts for third-party dApps)

-

Enhanced IDO allocations

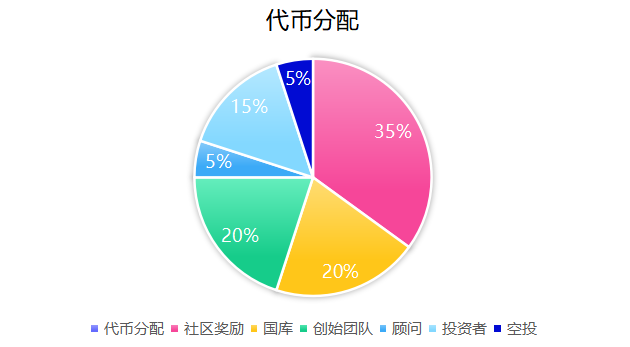

Token Distribution: Total supply not yet disclosed. Community rewards: 35%, treasury: 20%, founders and team: 20%, advisors: 5%, investors: 15%, airdrop: 5%.

The $VELAR token is not yet listed, but all testnet users between June 14 and July 14 received a $VELAR airdrop (5% of total allocation).

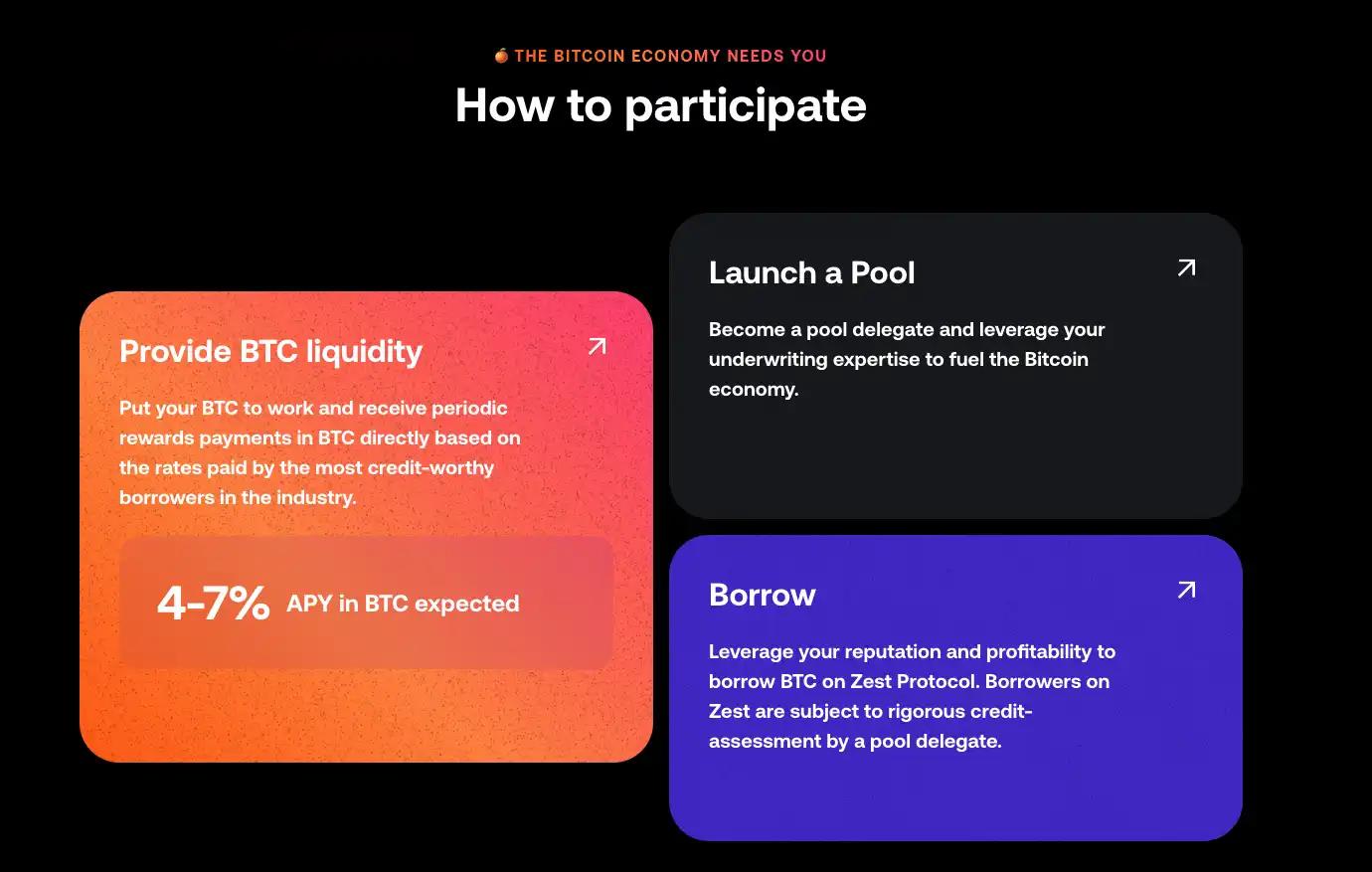

Zest Protocol: A Decentralized Lending Platform

Project Overview

Zest Protocol is a decentralized lending platform built on Bitcoin, focusing on solving a key issue in the Bitcoin economy: underutilization of Bitcoin. Often, large amounts of Bitcoin sit idle in cold storage, hindering economic growth. Zest Protocol, an open-source on-chain lending platform built on the Bitcoin blockchain, leverages smart contracts to increase transparency and auditability, offering a solution.

The protocol features two distinct pool types:

-

Yield Pools: Users earn returns by depositing Bitcoin into these pools.

-

Borrowing Pools: Allow users to borrow against their held Bitcoin.

This design enables Bitcoin holders to securely access liquidity without selling their assets, reducing reliance on centralized finance (CeFi) platforms or custodians.

Zest Protocol began development in June 2022, underwent multiple audits and testnet runs, and plans to launch its mainnet in Q2 2024.

Latest Project Updates:

-

October 10, 2023: Zest Protocol passed its second smart contract audit by LeastAuthority, ensuring users can experience the highest level of security and reliability through the Zest protocol.

Official Website: https://www.zestprotocol.com/

Official Twitter: https://twitter.com/ZestProtocol

The project has not yet issued a token, but its planned mainnet launch in Q2 2024 is worth watching. Readers are encouraged to follow the official Twitter and website for updates.

Uwu Protocol: A Lending Protocol Based on Its Own Stablecoin

Project Overview

UWU is a lending protocol built on the Stacks chain, based on the UWU Cash stablecoin, consisting of two core components: UWU Cash and UWU Shares (xUWU).

Key Features and Functions:

-

Lending Mechanism: Users can deposit STX as collateral and borrow up to 66% of the value of their deposited STX in UWU Cash. No interest is charged, and there is no fixed repayment date.

-

Stability: The UWU protocol maintains the stability of the UWU Cash stablecoin through liquidations and arbitrage mechanisms.

-

Risk: Due to the high volatility of STX—the underlying asset supporting UWU Cash—there is a risk of mass liquidations or depegging if prices drop rapidly.

-

Unique Feature: UWU Protocol attempts to introduce an independent stability module allowing users to swap UWU Cash to sUSDT at low fees.

Currently, the UWU protocol is still in testing and actively seeking early users for trial use.

Latest Project Updates:

-

June 9, 2023: Users can interact with the UWU protocol using the xverseApp mobile wallet.

-

July 19, 2023: UWU launched a new historical analytics dashboard, allowing users to easily explore past data and monitor key metrics related to the UWU protocol.

-

July 28, 2023: Launched UWU Swap, the first DEX aggregator on Stacks.

Official Website: https://uwu.cash/

Official Twitter: https://twitter.com/uwuprotocol/

UWU Tokens

The UWU protocol issues two tokens:

UWU Cash

UWU Cash is an over-collateralized stablecoin issued by the protocol. It is soft-pegged to $1.00 and backed by $1.50 worth of STX tokens, ensuring its stability and partial resistance to volatility. This means each UWU Cash is supported by at least $1.50 worth of STX collateral, maintaining a minimum collateral ratio of 150%.

UWU Share (xUWU)

UWU Share (xUWU) is a utility token responsible for capturing and distributing 100% of the protocol’s revenue to holders. This distribution is facilitated through a fee claim smart contract, allowing holders to claim their fees each cycle. Unclaimed fees roll over to the next cycle. This mechanism provides a revenue-sharing model for holders.

Token Distribution: The entire supply of xUWU tokens will be distributed to users of the UWU protocol. No pre-allocation will be made to any individual or entity, including core contributors.

The project has not yet launched its token, but it is actively running its testnet and developing new features. Readers are encouraged to follow the official Twitter and website for updates.

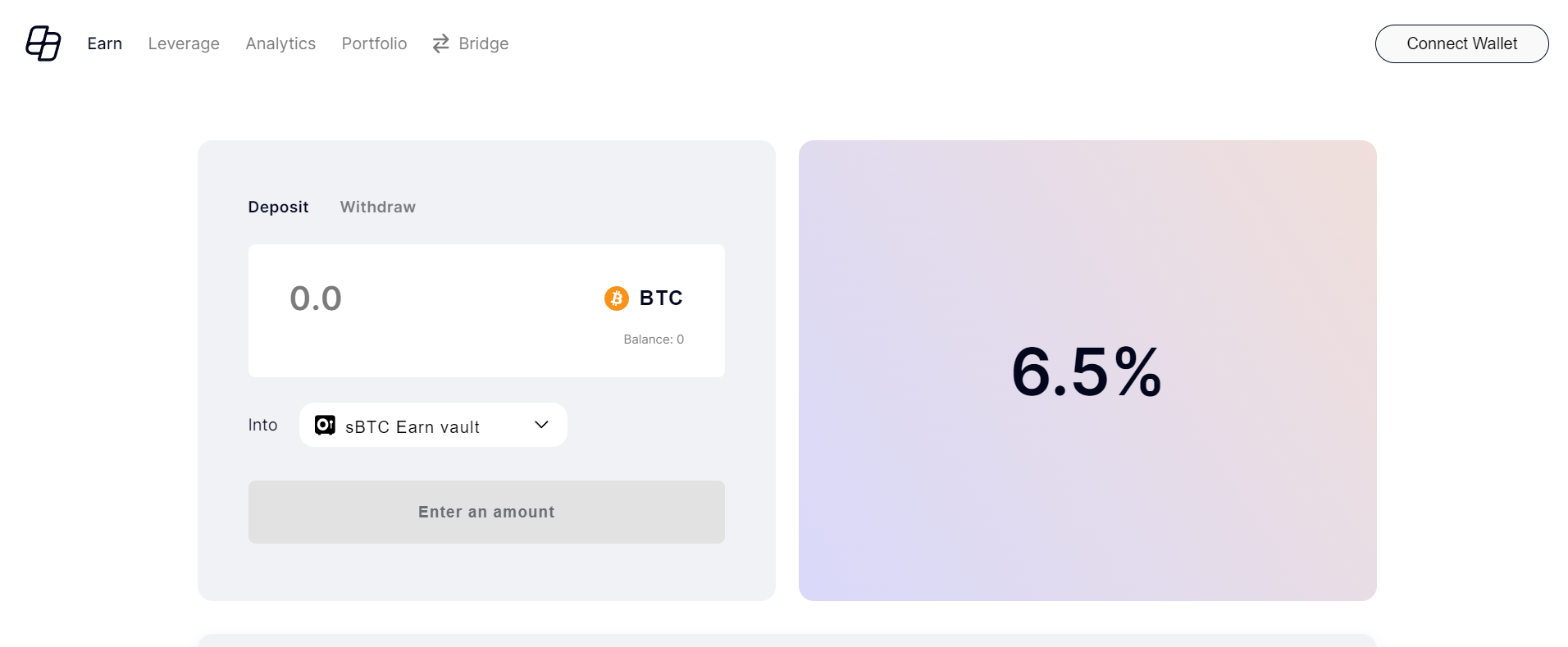

Hermetica Finance: An Options Strategy Protocol to Grow BTC Value

Project Overview

Hermetica Finance is a structured product for BTC, designed to offer users new ways to earn yield—a platform where users can participate in various income-generating, trading, and BTC-accumulating activities while maintaining non-custodial control over their digital assets.

Key Features and Functions

-

European Reverse Knock-Out (ERKO) Options Strategy: Hermetica’s core appeal lies in its innovative strategy. This strategy generates yield by setting specific price barriers, profiting when Bitcoin’s closing price falls within these ranges.

-

Price Volatility Range: If Bitcoin’s price fluctuates within 1% to 20% above or below a predetermined strike price, the strategy can generate profits.

-

Non-Custodial Structured Products Protocol: Hermetica Finance is a non-custodial structured products protocol for Bitcoin.

-

Capital Protection: Designed with capital protection in mind, limiting maximum risk per trade to 1% monthly, effectively managing downside risk.

Latest Project Updates:

-

November 3, 2023: Hermetica launched its testnet—the first fully Bitcoin-backed non-custodial Earn product.

-

December 8, 2023: The Hermetica Leverage Bull vault went live on the Hermetica testnet, enabling users to leverage BTC with no liquidation risk.

Official Website: https://www.hermetica.fi/

Official Twitter: https://twitter.com/HermeticaFi

Hermetica Token

The project has not yet issued a token, but it is actively operating its testnet and developing new features. Readers are encouraged to follow the official Twitter and website for updates.

Bitflow Finance: A Highly Transparent DEX Aggregating BTC Liquidity

Project Overview

Bitflow Finance is a decentralized exchange (DEX) designed specifically for Bitcoin enthusiasts. The platform’s primary goal is to consolidate liquidity and trading activity within the Bitcoin economy into one unified location, while providing a secure and transparent environment.

Key Features and Functions

-

Trading Bitcoin and Stablecoins: Bitflow supports trading of Bitcoin and stablecoins originating from Bitcoin Layer 2 solutions (such as Stacks and Rootstock). This provides users with a decentralized way to trade BTC-related products like sBTC and xBTC.

-

No Custodial Risk: The platform is designed so users do not face custodial risks during transactions.

-

Optimized Liquidity: Bitflow supports trading of Bitcoin-based stablecoins and provides optimized liquidity, helping reduce slippage and fees.

-

Earning Yield: Users can earn real yield by depositing Bitcoin and stablecoins. Additionally, the platform allows single-sided liquidity provision.

-

Open Source and Transparent: Bitflow is an open-source project—including its smart contracts and frontend interface—enhancing transparency and encouraging community involvement.

-

Alternative to Traditional Intermediaries: Bitflow replaces traditional intermediaries using PSBTs (Partially Signed Bitcoin Transactions), atomic swaps, Layer 2 smart contracts, and decentralized liquidity pools.

Official Website: https://www.bitflow.finance/

Official Twitter: https://twitter.com/Bitflow_Finance

Latest Project Updates:

-

August 2, 2023: Bitflow Finance launched a waitlist—joining grants early access to stableswap pools and the ability to earn Bitcoin yield.

-

November 29, 2023: sBTC swaps are now live on the Bitflow testnet.

The project is supported by the Stacks Foundation and the Bitcoin Frontier Fund and is currently in testing phase.

Bitflow Finance Token

The project has not yet issued a token, but it is actively operating its testnet and developing new features. Readers are encouraged to follow the official Twitter and website for updates.

Overall, these projects on Stacks are attempting to bring the three core DeFi components from Ethereum and other public chains—stablecoins, lending, and DEXs—into the Bitcoin ecosystem, making Bitcoin’s ecosystem more usable.

Whether Bitcoin itself should remain a singular store of value or evolve into a platform supporting more applications, like Ethereum—we cannot predict the answer.

But for now, every new attempt in either direction deserves our attention. Markets favor novelty over legacy; sometimes efforts deemed "unnecessary" may ultimately unlock tremendous potential.

Stacks is the current market leader in the Bitcoin Layer 2 space, and the DeFi projects built within its ecosystem may possess similar potential.

Exploring early, before an ecosystem becomes widely known, often leads to greater rewards.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News