The Myth of Decentralization: Deconstructing Lido's Reality, Beliefs, and Pursuits in the Crypto Sphere (Part 1)

TechFlow Selected TechFlow Selected

The Myth of Decentralization: Deconstructing Lido's Reality, Beliefs, and Pursuits in the Crypto Sphere (Part 1)

Ethereum staking mechanisms, comparison of staking solutions, and the current state of the staking ecosystem.

Authors: Jake, Jay, Antalpha Ventures

Ethereum History: Upgrading from Ethereum 1.0 PoW to Ethereum 2.0 PoS

Since the release of the Ethereum whitepaper, Ethereum has achieved significant milestones, including developing a general-purpose smart contract platform and expanding its community and ecosystem. However, Ethereum's development could not be accomplished overnight, so a multi-phase roadmap was established. According to this roadmap, Ethereum’s development follows four strategic phases: Frontier, Homestead, Metropolis, and Serenity.

-

Frontier: The initial phase of Ethereum, which had limited usability but provided strong network security through centralized protective measures. With mining rewards in place, Ethereum incentivized early miner participation and strengthened resistance against hacker attacks.

-

Homestead: Ethereum’s first hard fork. During this phase, the "canary contract" was removed, enhancing decentralization. The Mist wallet was introduced, enabling users to transact and hold ETH. Ethereum thus evolved from a tool for developers and technicians into a platform accessible to ordinary users.

-

Metropolis: Implemented via two hard forks—Byzantium and Constantinople. The Byzantium upgrade adjusted block difficulty calculations, increased mining difficulty, reduced mining rewards, and delayed the “difficulty bomb” to facilitate the transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). The Constantinople upgrade further reduced gas fees, lowered block rewards, and enabled smart contracts to verify hashes of other smart contracts, improving validation efficiency.

-

Serenity: The Istanbul hard fork reduced precompiles, code costs, and gas fees, increasing Ethereum’s TPS to 3,000. The Berlin upgrade optimized mainnet performance, improved contract execution, updated EVM code reading methods, enhanced gas efficiency, and strengthened defenses against denial-of-service (DDoS) attacks.

The most critical update following the merge between Ethereum’s Beacon Chain and the original Ethereum Proof-of-Work chain was the transition from PoW to PoS consensus.

-

Proof of Stake (PoS): A method for validating and confirming cryptocurrency transactions, differing from Bitcoin’s Proof of Work. PoS relies on the amount of cryptocurrency held (“stake”) rather than computational power.

-

In a PoS system, network security and consensus are secured through staking by token holders. Participants stake a certain number of tokens to become validators and block producers. By selecting valid nodes, they earn token rewards as incentives. If validators act maliciously, they risk losing part or all of their staked tokens as penalties.

Ethereum’s Staking Mechanism (Proof of Stake)

On the Ethereum network, staking involves depositing 32 ETH to activate validator software. Validators are responsible for storing data, processing transactions, and adding new blocks to the blockchain. This process secures Ethereum, and validators earn newly minted ETH as rewards. The Beacon Chain introduced Proof of Stake to the Ethereum ecosystem and merged with the original Ethereum PoW chain in September 2022. The consensus logic and block broadcasting protocol introduced by the Beacon Chain now protect Ethereum.

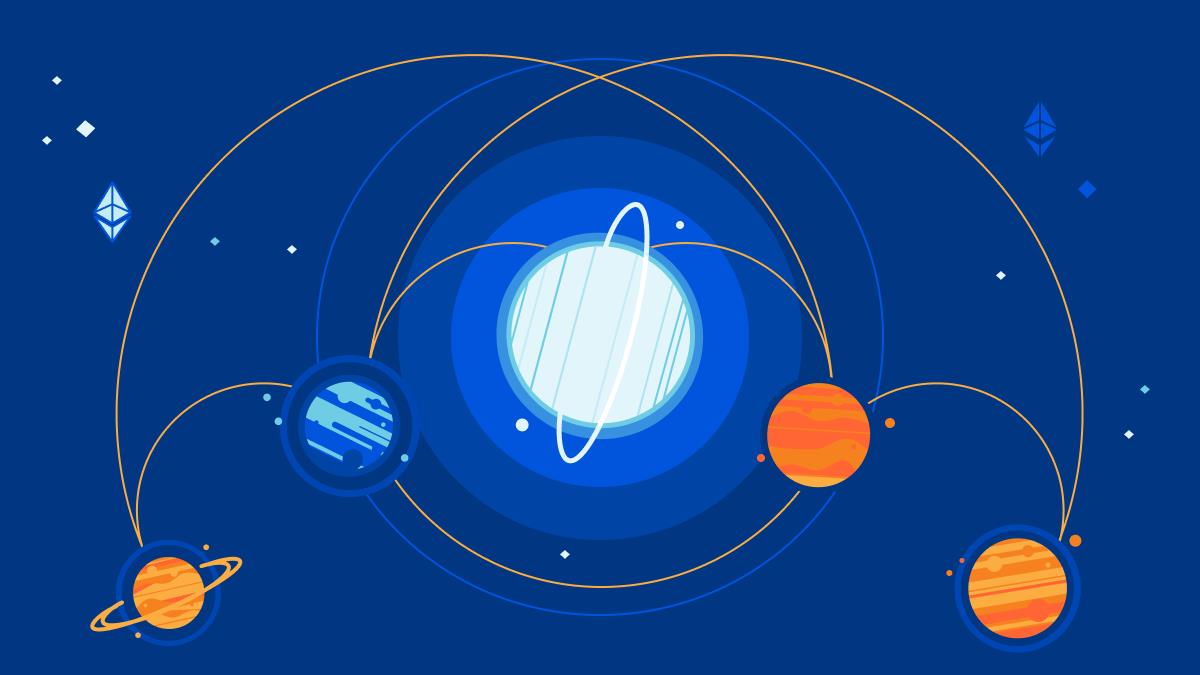

By staking ETH, participants help secure the Ethereum network at the validation layer. In return, the Ethereum network provides stakers with corresponding staking rewards. These rewards follow a diminishing returns model: when less ETH is staked, the yield is higher; as more ETH is staked, the yield gradually decreases. For example, when the total staked ETH reaches 12 million, the annualized staking yield drops to around 4.5%. Broadly speaking, staking is a cryptographic-economic model that uses rewards and penalties to incentivize honest behavior among network participants, thereby enhancing underlying security.

Source: Public market information

Within the Ethereum network, different types of participants gain various benefits from staking ETH:

-

For the Ethereum network, increased staking strengthens network security. To attack the network, an adversary must control a majority of validators, meaning they would need to acquire most of the staked ETH. Therefore, decentralized staking enhances Ethereum’s overall security;

-

For institutions and users, staking offers opportunities to earn rewards. Consensus participation is rewarded—anyone running software that correctly packages transactions into new blocks and verifies other validators’ work receives rewards.

However, it should be noted that staking ETH is not 100% risk-free. The following risks remain during the staking process:

-

After becoming a validator, one must maintain continuous online operation with healthy network conditions. If a validator goes offline, it risks being penalized, leading to financial losses;

-

Different staking solutions carry code-related risks. Clients, like any new software, may encounter bugs. Users or institutions bear the responsibility for issues such as downtime or reduced earnings caused by these bugs.

Overall, staking is a method to help secure Proof-of-Stake blockchains like Ethereum. Network participants run validator nodes by putting their tokens “at risk”—if the node behaves maliciously or unreliably, its tokens can be “slashed” (partially or fully confiscated as punishment). It should be emphasized that penalties are deducted directly from the staked 32 ETH. Validators cannot reset their validator status by replenishing or replacing the originally staked ETH. If a validator’s balance falls below 16 ETH due to slashing, the validator will be automatically ejected from the network.

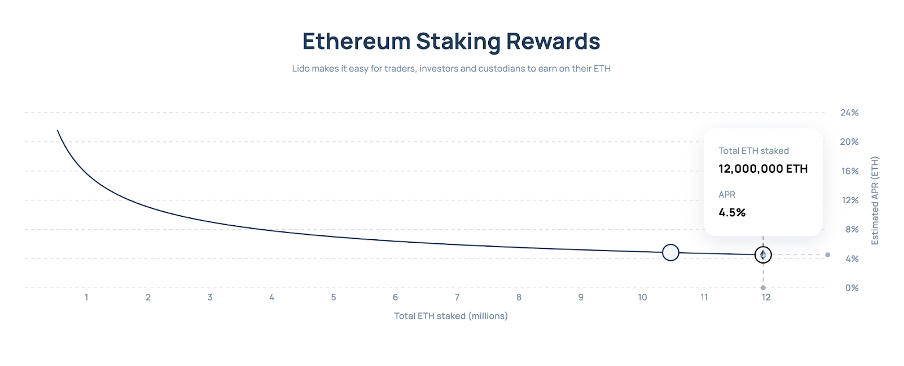

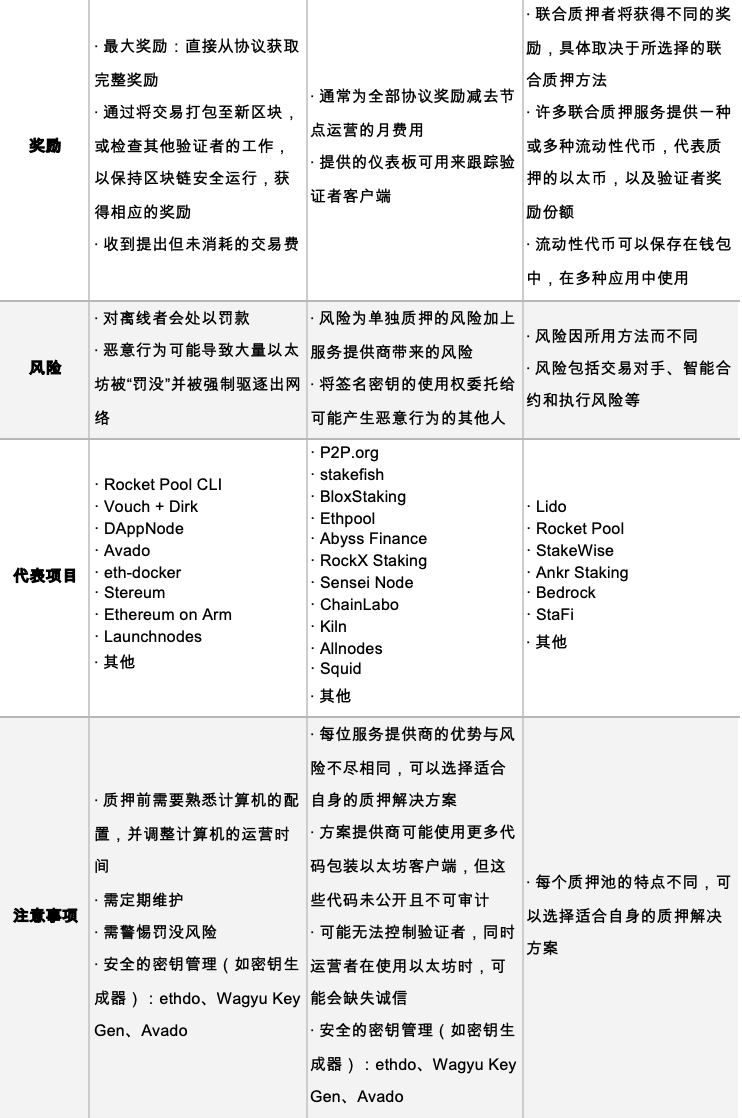

Looking at ETH circulation under the PoS mechanism, as of September 2023, nearly 30% of ETH is staked—significantly higher than Layer 2 adoption (less than 2%). Among all staking solutions, Lido is particularly favored by users and institutions, accounting for 7.2551% of total circulating ETH staked, surpassing other liquid staking service providers such as Rocket Pool, Frax, and StakeWise. Additionally, according to the ETH circulation diagram below, demand for liquid staking exceeds other forms of staking, such as centralized exchange staking or staking pools. See the figure below for details.

Source: Eth Wave (Twitter: @TrueWaveBreak)

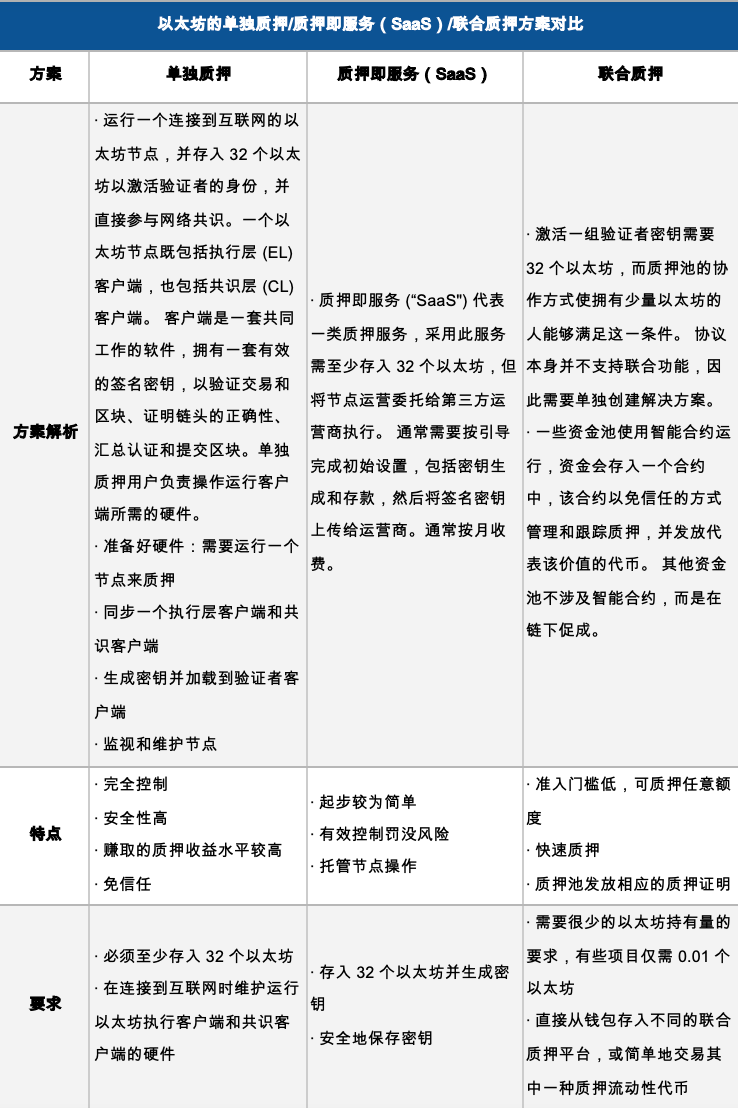

Comparison of Ethereum Staking Solutions

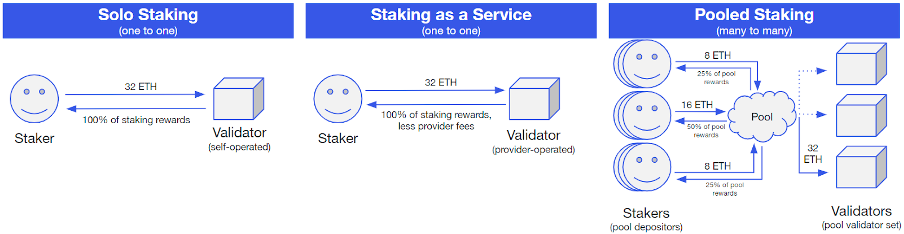

Each Ethereum staking solution has unique characteristics, allowing institutions and users to choose the most suitable option. Some users opt for centralized exchange staking, while others prefer individual staking or pooled staking. Staking allows entities to earn passive income from their ETH holdings with minimal time and effort. Centralized exchanges typically pool large amounts of ETH to operate numerous validators. The diagram below illustrates the differences between solo staking, staking-as-a-service (SaaS), and pooled staking.

Source: Public market information

Based on the three staking solutions above, the table below compares solo staking, staking-as-a-service (SaaS), and pooled staking across key aspects such as features, requirements, rewards, and risks.

Source: Public market information

Liquid Staking

Liquid staking providers accept user deposits, stake tokens on their behalf, and issue receipt tokens representing claims on the staked assets (plus or minus rewards and penalties). These receipt tokens can be traded or used as collateral in DeFi protocols, unlocking liquidity for otherwise locked staked assets. Liquid staking providers address illiquidity by minting new tokens that represent claims on the underlying staked assets, which can then be traded or deposited across DeFi. For instance, a user can deposit ETH into Lido’s staking pool and receive stETH (staked ETH) tokens as proof of deposit, then use stETH as collateral in Aave. Essentially, liquid staking builds upon existing staking systems by unlocking the liquidity of staked tokens.

Benefits of Liquid Staking

-

Liquidity Unlocking: Tokens staked on networks like Ethereum are typically locked and cannot be traded or used as collateral. Liquid staking tokens unlock the intrinsic value of staked assets, enabling them to be traded or pledged within DeFi protocols.

-

Composability in DeFi: By representing staking receipts as tokens, they become interoperable across various DeFi protocols, such as lending platforms and decentralized exchanges.

-

Reward Opportunities: Traditional staking rewards users for validating transactions. Liquid staking allows users to continue earning these rewards while also generating additional yields through various DeFi protocols.

-

Outsourced Infrastructure Requirements: Liquid staking enables anyone to share in staking rewards without maintaining complex staking infrastructure. For example, even users who do not possess the minimum 32 ETH required to operate an independent validator on Ethereum can still participate and earn block rewards.

Risks and Limitations of Liquid Staking

-

Slashing Risk: Users of liquid staking services essentially outsource validator node operations. If the service provider acts maliciously or unreliably, funds face the full risk of being slashed.

-

Private Key Exposure: If a node operator’s private keys are compromised or if there are exploitable smart contract vulnerabilities in the protocol, funds deposited into liquid staking services are at risk.

-

Secondary Market Volatility: The price of liquid staking tokens does not always perfectly track their underlying assets. While they often trade at par or slight discounts, during periods of liquidity crunch or unexpected events, they may trade significantly below the value of the underlying asset. Due to typically lower trading volumes compared to base assets, market shocks can greatly amplify volatility in liquid staking tokens.

Staking Ecosystem and Current State

Ecosystem Participants: Around the Ethereum protocol, the staking ecosystem includes several key roles: the Ethereum protocol itself, client software, MEV (Maximal Extractable Value), staking service providers, and custodial staking platforms. Each plays a distinct role in the broader staking ecosystem. The table below summarizes the functions of each role:

Source: Public market information

Source: Public market information

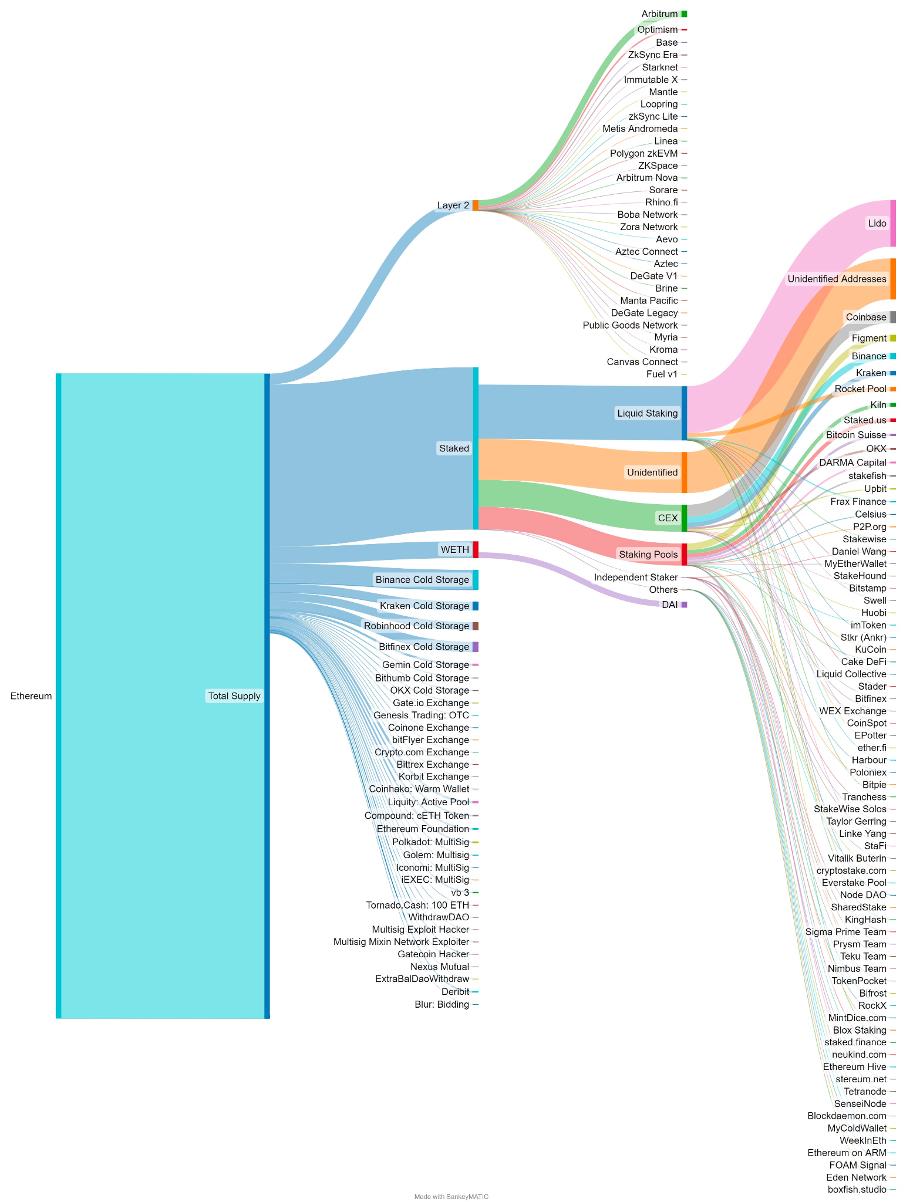

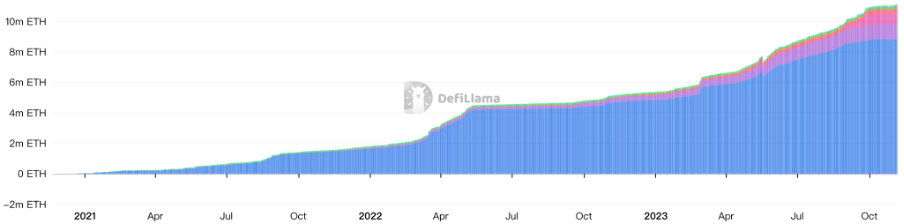

According to DefiLlama data, a total of $21.788 billion (11.52 million ETH) is currently staked. The top three liquid staking providers by TVL are Lido, Rocket Pool, and Binance. Lido alone holds over 8.9 million ETH staked, capturing 77.28% market share—far exceeding competitors. Over the past 30 days, Stader and Liquid Collective experienced the fastest growth, increasing by 85.31% and 43.17% respectively. Only two liquid staking providers saw declines in TVL: Coinbase and Ankr, down 1.8% and 2.17% respectively. Overall, however, the liquid staking segment has shown positive growth over the past month.

Source: DefiLlama

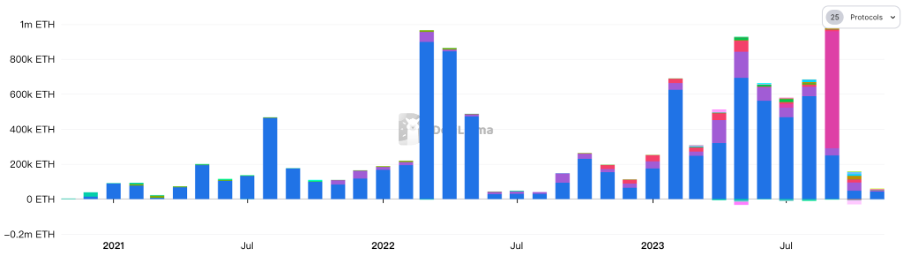

Moreover, short-term net inflows into ETH liquid staking are highly sensitive to market sentiment. For example, in June 2022, amid the collapse of Terra and related events, crypto market sentiment hit a multi-year low, resulting in the lowest monthly inflow into ETH liquid staking that year. Over the past two years, sudden shocks have caused sharp but temporary declines in staking inflows. However, inflows generally remain positive. After short-term pessimism subsides, inflows rebound sharply—indicating that long-term holders continue accumulating positions in ETH liquid staking, while short-term investors, though sentiment-driven, still maintain strong interest and allocate capital accordingly.

Source: DefiLlama

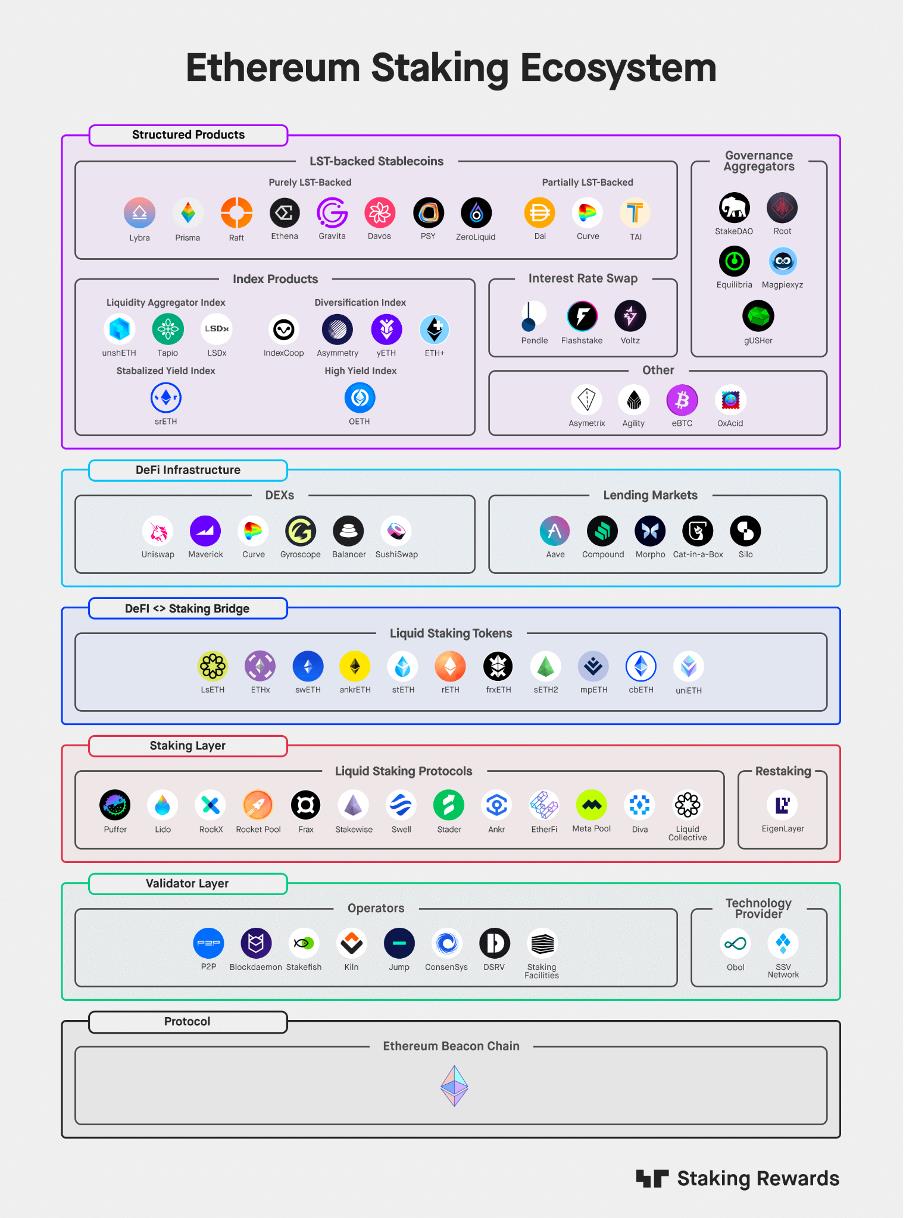

Within the ETH staking ecosystem, various stakeholders collaborate to drive growth and innovation. Key sub-sectors include lending protocols, decentralized exchanges, stablecoin protocols, and restaking. In terms of TVL, liquid staking protocols have become one of the largest DeFi categories, issuing over $20 billion in tokens. These interconnected assets and DeFi products are having a profound impact across the DeFi landscape, increasingly serving as dominant collateral types influencing loan protocols, stablecoin issuers, and DEX asset pools. Below is a brief analysis of the ETH staking ecosystem:

-

Liquid Staking Protocols: Investors stake assets to receive liquid tokens representing their stake. In return, they receive staking derivative tokens (e.g., stETH) at a 1:1 ratio, similar to LP tokens in decentralized exchanges. These tokens can be redeemed anytime, allowing investors to reclaim their original tokens without waiting for lock-up periods. Representative projects: Lido, Rocket Pool, Frax, etc.;

-

Restaking: EigenLayer is a restaking protocol that allows ETH stakers and validators to use their staked ETH to secure additional networks. These networks gain access to Ethereum’s vast staked capital and validator pool, paying extra service rewards to ETH stakers in return. EigenLayer’s external rewards can significantly raise the game-theoretically optimal staking rate from 33% to over 60%. It currently supports liquid staking tokens such as stETH, rETH, and cbETH;

-

Lending Protocols: ETH-related staking tokens are key assets in Ethereum’s DeFi ecosystem. LST-type assets can enhance lending rates or subsidize borrowing costs. However, LST assets carry some depegging risk. Representative projects: MakerDAO, Spark, Aave, Compound, etc.;

-

DEXs: LSTs serve as collateral and must maintain a peg with ETH. Liquid staking protocols require deep liquidity pools on DEXs to enable fast swaps between LSTs and ETH. Representative projects: Uniswap, Curve, Balancer, etc.;

-

Structured LST Products: Given the high correlation and potential volatility between LSTs and ETH, diverse structured products have emerged. For example, interest rate swaps allow conversion between floating and fixed rates, helping institutions hedge interest rate risks. Aggregators distribute stakes across multiple protocols to diversify risk. Index-based products, stablecoin protocols, and other structured offerings are increasingly attracting institutional and retail interest. Representative projects: Pendle, IndexCoop, Lybra, Prisma, Asymetrix, etc.

Source: Public market information

Among all ETH-related staking projects, Lido is currently the largest liquid staking protocol. Users and institutions can stake tokens and earn daily rewards without locking up tokens or managing infrastructure. By staking ETH, users receive stETH as a receipt. The next section provides a detailed analysis of Lido as a representative project.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News