Decentralization Myth: Deconstructing Lido's Reality, Belief, and Pursuit in the Crypto Realm (Part 2)

TechFlow Selected TechFlow Selected

Decentralization Myth: Deconstructing Lido's Reality, Belief, and Pursuit in the Crypto Realm (Part 2)

There is no absolute decentralization; perhaps what we can do is maintain the spirit of resistance against centralization.

Authors: Jake, Jay, Antalpha Ventures

This is the second part of the full article. For the first half, please read "The Myth of Decentralization: Deconstructing Lido's Reality, Beliefs, and Ambitions in Crypto (Part 1)".

Analysis of Lido, a Leading Project in the ETH Staking Sector

1. Lido’s Product

Lido is a liquid staking solution supported by industry-leading staking service providers. It allows users to stake their tokens without locking up assets or maintaining infrastructure such as hardware or software, while simultaneously participating in on-chain activities (e.g., lending, yield farming).

Lido has two primary goals: to simplify staking as much as possible and to enable broader participation in maintaining network decentralization and transitioning Ethereum toward a low-carbon Proof-of-Stake (PoS) system.

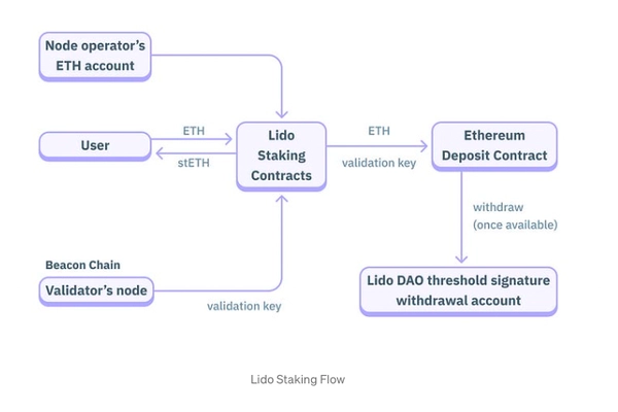

2. Lido’s ETH Liquid Staking Mechanism

This section should explain Lido’s mechanism from the perspective of fund flows when ETH is converted into stETH. Most users do not fully understand the process of liquid staking. Understanding this flow is essential for recognizing that, at the protocol level, asset security is inherently strong—whether due to node failures or attacks on Lido’s staking contract, the underlying assets remain secure, which significantly differentiates it from nearly all other DeFi protocols—and that its liquid staking tokens (LSTs) are superior even to exchange-custodied alternatives.

The selection of node operators forms the foundation of this mechanism.

DAO selects: how many new node operators to add per round, the criteria for new operators, and votes on whether to approve their inclusion.

After joining, new node operators undergo testing: they are limited to activating up to 100 validator keys (3,200 ETH) initially. This allows Lido to verify the capabilities of newly onboarded operators without exposing stETH holders to risk, while still providing operators with operational revenue.

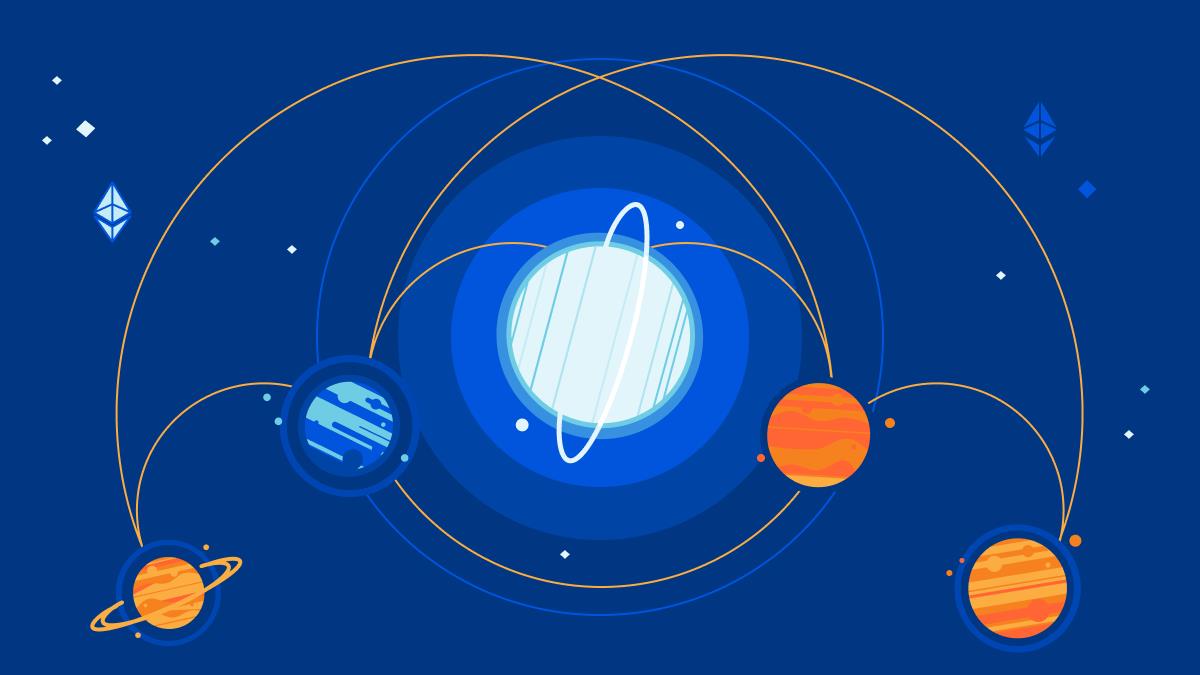

Node target: Each node operator must not run more than 1% of the total staked ETH to ensure decentralization. Once stabilized, each operator plans to run between 500 and 2,000 validators (i.e., 16,000–64,000 ETH).

Protocol fee is 10%, with 5% allocated to node operators.

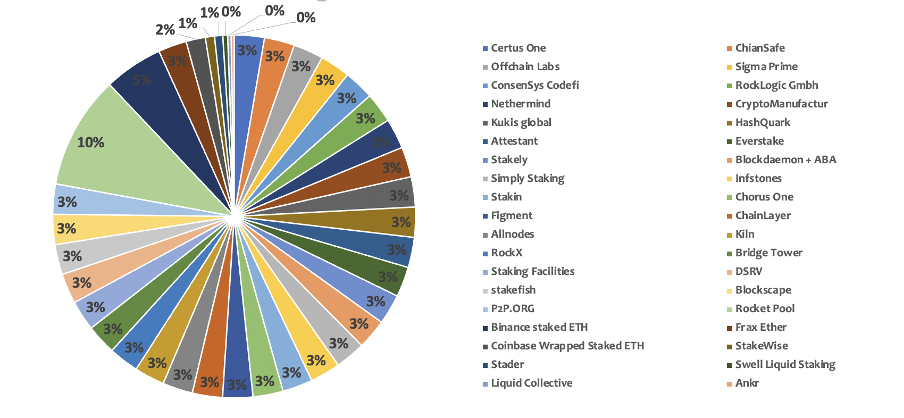

Current node status:

Source: Public market data

As of November 2023, Lido had 37 node operators.

Source: Dune

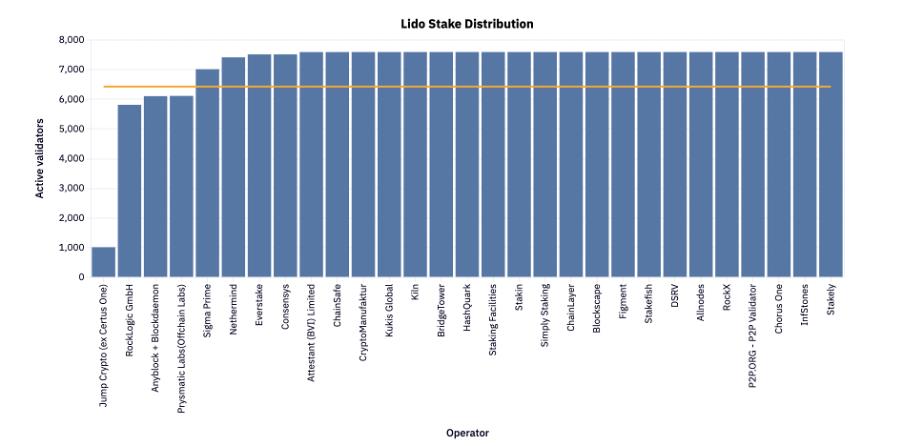

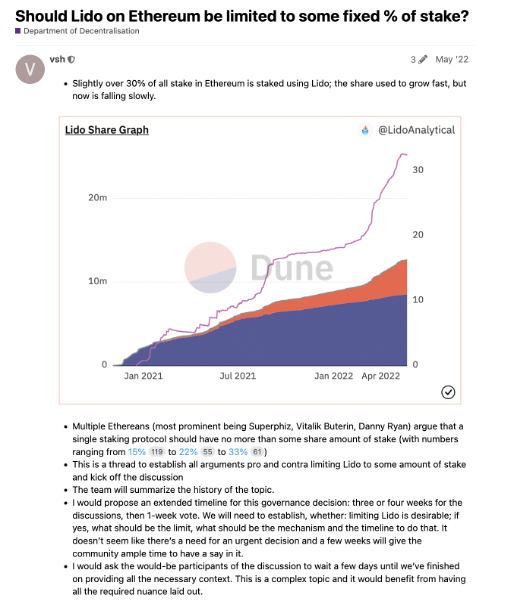

Even before the transition to PoS, Vitalik suggested that all staking service providers limit their market share to below 15%. Currently, Lido alone controls 31% of the staking market, exceeding the threshold by a factor of two.

However, from the standpoint of maintaining PoS network security and stability, what truly matters are the “node operators”—a point often misunderstood. Lido itself is not a true "node operator"; rather, it functions as a “network of node operators.” The actual responsibility for running Ethereum nodes lies with the 29 individual operators within this network.

Therefore, if we disaggregate Lido’s 78% market share across these 29 operators, the real distribution looks like this:

Source: Public market data

These 29 node operators collectively secure the Ethereum network and receive commission incentives from delegators—they are the true backbone of network security and stability. Lido serves merely as the bridge connecting ETH stakers and node operators.

Looking ahead, Lido plans to onboard additional node operators, aiming to keep each operator’s share of total staked ETH under 1%. This implies that the number of node operators will need to grow at least threefold—to around 58—to achieve meaningful decentralization. However, if Lido expands further, this would clearly conflict with Ethereum’s original vision advocated by Vitalik, where no single pooled staking protocol should exceed 15% market share.

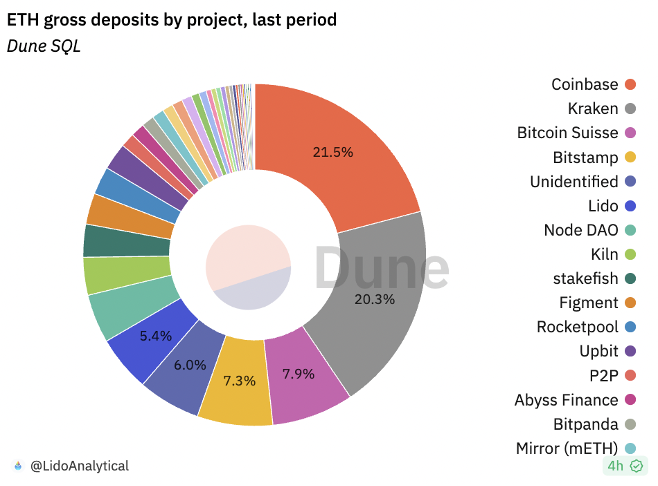

Source: Dune

On the other hand, any decentralized staking protocol is preferable to centralized exchanges or institutions—and Lido is no exception. In terms of total ETH deposits, centralized exchanges such as Coinbase, Kraken, Bitcoin Suisse, and Bitstamp collectively control over 50% of staked ETH. Despite the intense scrutiny around Lido’s centralization, its deposit volume remains less than 10% of that held by centralized exchanges. In other words, without Lido, the majority of Ethereum staking nodes could easily be monopolized by large exchanges.

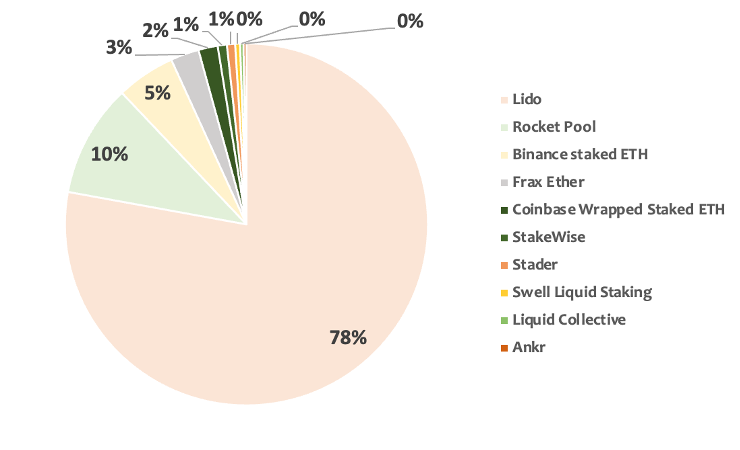

Source: Public market data

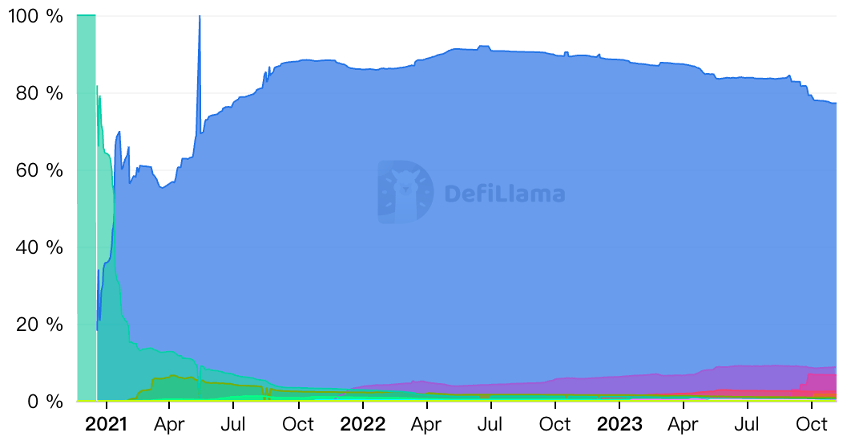

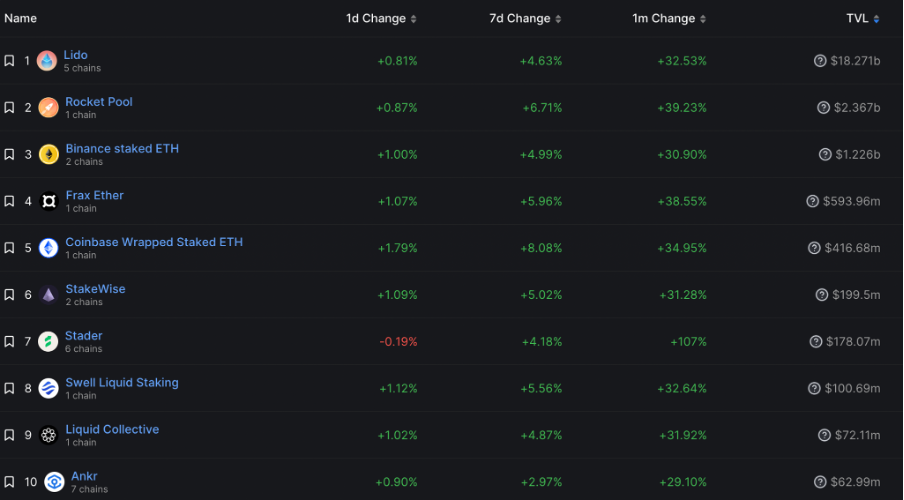

According to DefiLlama, Lido currently holds close to 80% market share, while all other staking services combined account for about 20%. Dynamically speaking, since 2021, Lido’s market share has been steadily increasing, peaking in 2022. Since 2023, the LSD (Liquid Staking Derivatives) segment has seen a slow decline, and so has Lido’s market share, settling at current levels. Notably, Rocket Pool and Frax have gradually gained market share since 2022. Meanwhile, centralized exchanges like Binance and Coinbase have also begun attracting user and institutional interest in ETH staking, capturing 6.65% and 1.66% market share respectively.

Source: DefiLlama

From 2021 to 2023, Lido attracted the largest inflow of funds into ETH staking, totaling over 8 million ETH. Although the pace of capital inflow slowed in 2023, its dominance in the sector remains unchallenged. That said, other staking providers began catching up in 2023—for example, in September 2023, Binance’s staking service absorbed over 670,000 ETH, compared to Lido’s ~240,000 ETH, making Binance’s inflow approximately 2.79 times larger than Lido’s during that period. Overall, total inflows into ETH staking continue to rise with no signs of outflows. From the provider side, the number of competitors is growing, intensifying competition.

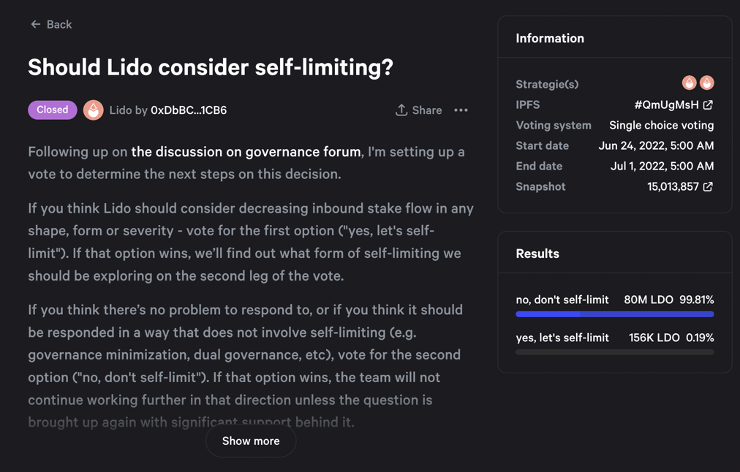

Since both Lido and Rocket Pool have issued governance tokens, their staked ETH and native tokens ($LDO, $RPL) are included in TVL rankings, inflating Lido’s TVL—which now accounts for 78% of the entire liquid staking sector. The price surge of $LDO has contributed significantly to Lido’s staggering TVL. As a result, Lido token holders who benefited from this appreciation tend to prioritize profitability over decentralization when voting in DAO proposals. This mindset led to the controversial rejection of a proposal to self-impose staking limits on Ethereum.

Source: Dune

Ultimately, the DAO vote rejected the self-limiting proposal with an overwhelming 99.81% opposition, marking a case where a decentralized vote defeated a proposal bearing the banner of decentralization.

(Four smaller Ethereum staking protocols, trailing behind Lido in market share, signed a commitment not to exceed 22% combined market share.)

Source: Public market data

Drawbacks of Centralization

When centralization exceeds acceptable thresholds, several significant drawbacks arise:

-

Unexpected reduction in validators may lead to increased centralization or network instability.

-

Governance votes may be unexpectedly manipulated—e.g., a proposal with 5% voter turnout sees 10% of tokens suddenly cast against it one second before closure—leading to abrupt shifts in development direction.

-

Even minor smart contract vulnerabilities could prove fatal to both Ethereum and the Lido protocol.

-

Excessive market dominance enables Lido to engage in multi-block MEV arbitrage or even censor certain transactions, potentially undermining key Ethereum roadmap upgrades such as EIP-4844 Danksharding.

3. Potential Solutions to Centralization

i) If a staking pool’s market share exceeds 15%, increase its fee until it falls back below 15%.

ii) Use alternative small-scale liquid staking protocols.

iii) Self-stake Ethereum directly.

In practice, all three options face major hurdles. The first fails because the Lido DAO will unlikely pass proposals that increase its own costs. The latter two suffer from prohibitively high entry barriers.

4. Lido’s Technical Implementation

The Lido protocol consists of three main components:

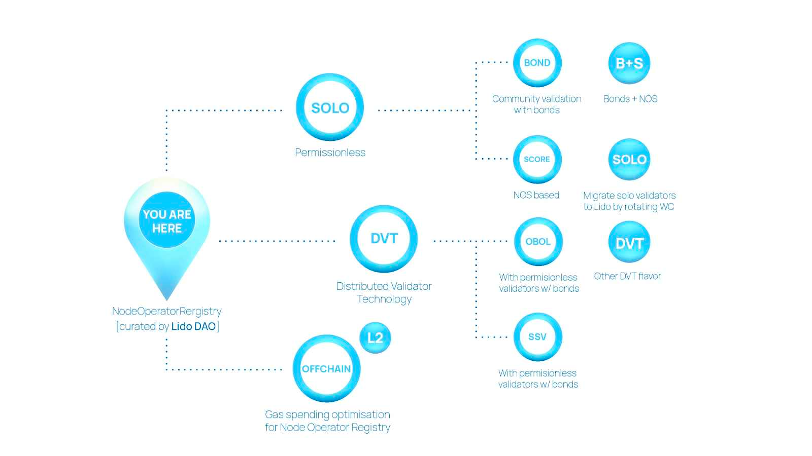

Updating the node operator registry, storing validator keys, off-chain allocation of equity stakes, and on-chain distribution of fees—these form Lido’s Staking Router module.

Node operators verified through Lido’s whitelist can either operate independently or use DVT (Distributed Validator Technology) for collective validation. This improves node reliability and significantly reduces slashing and downtime risks. Current major DVT solutions include SSV and Obol.

Lido’s technical team assists operators with gas optimization, reward distribution, and computational load balancing.

5. Comparative Analysis of Ethereum Staking Protocols

Source: Public market data

Source: Public market data

As of November 2023, among the top ten Ethereum staking platforms, the decentralized ones include Lido, Rocket Pool, Frax, StakeWise, Stader, Swell, Liquid Collective, and Ankr. Below, we analyze the pros and cons of protocols with TVL exceeding $100M.

i) Lido:

Lido’s Protocol Architecture

Lido’s Protocol Architecture

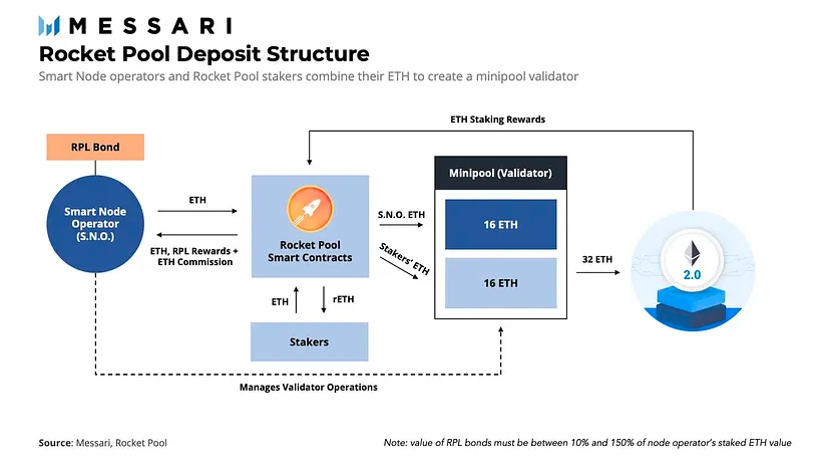

ii) Rocket Pool:

Lido eliminates the need for ordinary users to hold 32 ETH to participate in staking, resulting in extremely low entry barriers and attracting the broadest user base. The massive amount of staked ETH continuously draws in more node operators, enhancing the liquidity of its staking token stETH and ensuring its price remains tightly pegged to ETH—outperforming other staking protocols.

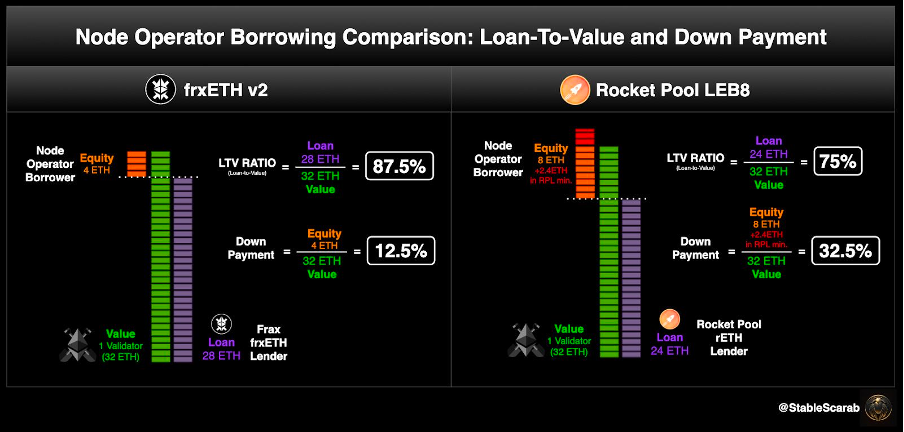

Rocket Pool offers greater decentralization. However, every node operator must create a Minipool, contributing 8 ETH plus $RPL worth 2.4 ETH (as collateral against slashing), while stakers contribute 24 ETH—forming a full 32 ETH node. This design lowers entry barriers for both operators and users, but requires extensive manual configuration for each minipool, demanding substantial time investment from participants. As a result, protocol growth is constrained by operational overhead.

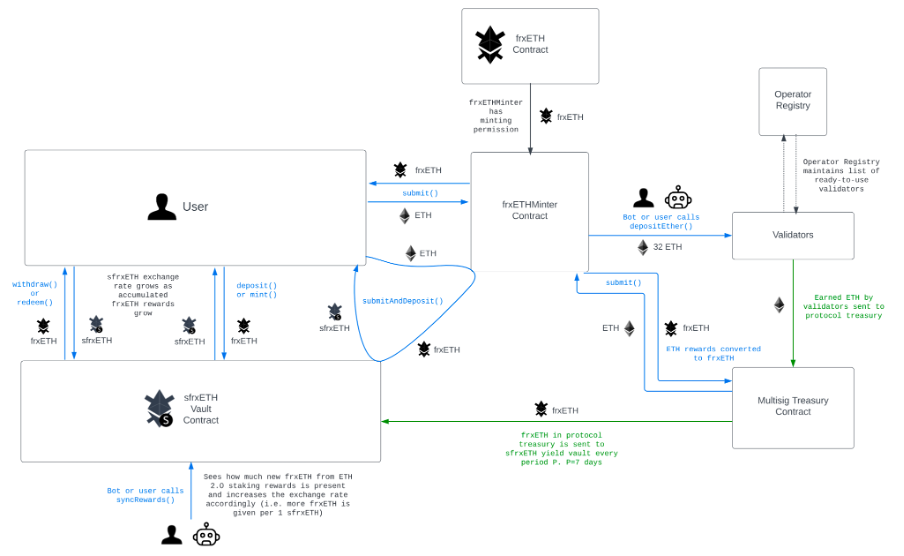

iii) Frax:

Frax comprises four core products: stablecoin FRAX, lending protocol Fraxlend, swap platform Fraxswap, and staking protocol sfrxETH. Thus, Ethereum staking is just one component of Frax’s ecosystem.

Source: Public market data

Source: Public market data

Frax’s staking mechanism closely resembles Rocket Pool’s, but lowers the required ETH contribution from validators even further—only 4 ETH needed from node operators, with the remaining 28 ETH provided by stakers. Functionally, it differs little from Rocket Pool. However, Frax benefits from its integrated ecosystem (lending, stablecoins, swaps), which naturally accumulates large amounts of ETH, making it easier to assemble complete 32 ETH validator pools.

Frax is more decentralized than Lido and more scalable than Rocket Pool, with inherent advantages from its ecosystem for growing the staking network. However, in its current state, Frax lags behind Lido in adoption, timing, and accessibility.

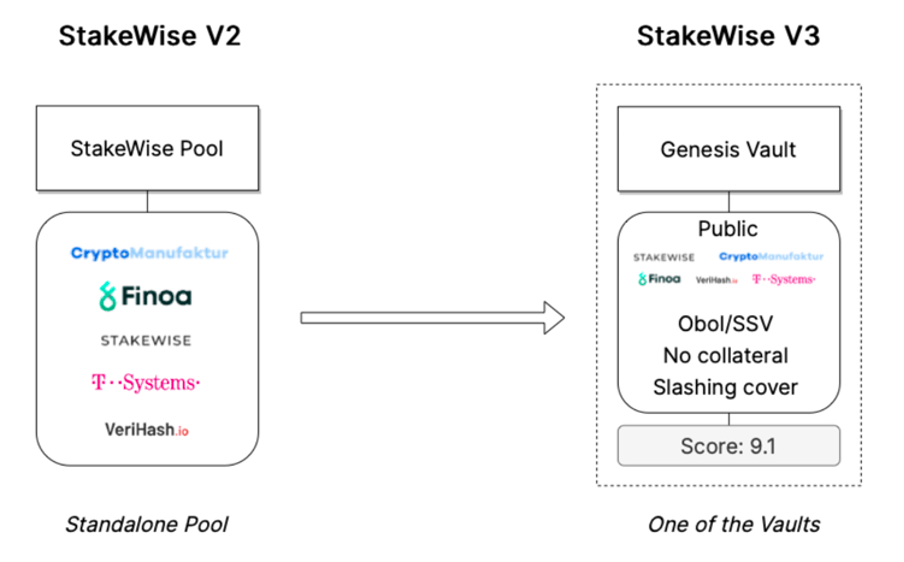

iv) StakeWise:

Source: Public market data

StakeWise resembles a hybrid of Lido and Rocket Pool—it offers Lido-like low entry barriers (users don’t need specific ETH amounts to earn staking rewards), while refraining from vetting node operators. Instead, it acts as a referee, rating each node operator and allowing users to choose where to stake.

Unfortunately, StakeWise has undergone frequent iterations—for instance, shifting from a dual-token model to a single-token model early this year. Such significant changes have slowed user acquisition. The authors believe StakeWise has the strongest potential to challenge Lido’s dominance, given its near-Lido-level accessibility and clear advantages over Rocket Pool and Frax.

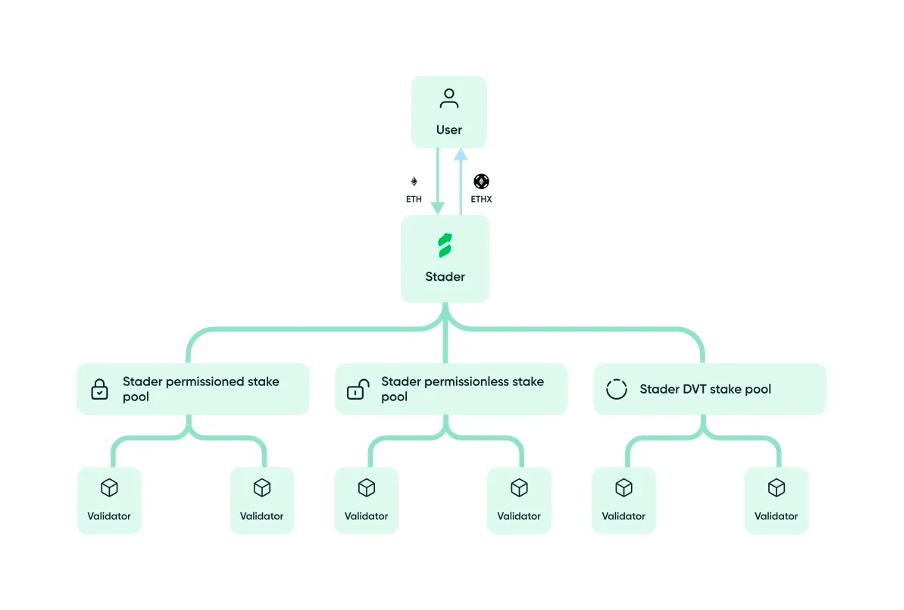

v) Stader:

Source: Public market data

Similar to Frax, Stader requires only 4 ETH to become a node operator. Its staking pools resemble Lido’s—users can stake in permissioned or permissionless pools. However, due to weaker first-mover advantage, lower TVL, and undifferentiated product features, Stader remains a relatively small player in the Ethereum staking space.

6. Common Drawbacks of Ethereum Staking:

-

Tokens generally lack effective utility and serve almost exclusively as governance tokens.

-

Staking protocols follow transactional business models, requiring frequent decision-making via proposals, yet DAO voter turnout is typically low and token ownership highly concentrated.

-

Post-staking liquidity tokens are fragmented across protocols, creating a chaotic landscape of liquid ETH derivatives. These tokens often trade at discounts and have experienced temporary de-pegging events. Smaller protocols face varying degrees of liquidity risk with their liquid ETH tokens.

7. Controversies Surrounding Lido

Even if every protocol reduced its market share below 15%, centralization issues might persist.

Suppose there were 50 decentralized liquid staking protocols, each holding only 2% market share. Would that solve decentralization? Clearly not. Consider today’s reality: within dominant Lido, the top 100 token holders control 95% of $LDO supply. Now imagine 50 similar protocols, each with 2% share—wouldn’t the leading node operators across them likely be the same individuals? When voting, they’d still favor proposals benefiting their own interests, not those enhancing network decentralization.

The 80/20 rule applies in the real world—and on-chain. The truth is often more extreme than imagined. Whether it’s ratios of smart money vs losing wallets, whale vs retail holdings per asset, dominant project TVL across sectors (Gaming, NFTs, DeFi, stablecoins), mining pool concentration, MEV relayer dominance, or centralized exchange vs on-chain options trading volume—the disparities are consistently far beyond 80/20. The only difference is that these centralized dynamics haven’t yet disrupted Vitalik’s vision of a decentralized Ethereum roadmap.

8. There Is No Absolute Decentralization—Perhaps All We Can Do Is Maintain the Spirit of Resistance Against Centralization.

History repeats itself. Every attempt to break absolute monopolies merely replaces them with oligopolies (e.g., Facebook acquiring Instagram—even if antitrust succeeded, Instagram would simply be bought by another tech giant). And when monopolies are truly dismantled, they’re often replaced by monopolies in other industries (e.g., India dominating global customer service, only to be displaced by AI—shifting monopoly from Indian labor to hardware/software giants).

9. What Can Be Done?

One-third of Ethereum’s PoS staking journey has passed. Decentralized protocols like Lido and Rocket Pool, centralized exchanges such as Coinbase and Kraken, staking solution providers like Figment, and other decentralized protocols such as Frax have all played roles in promoting staking adoption, accelerating PoS network formation, reducing energy consumption, and improving blockchain sustainability. As staking rates rise, network security improves—but this may also reduce circulating supply, potentially triggering unforeseen consequences. What we should focus on is increasing DAO voter participation, building more useful on-chain applications, improving user experience, lowering costs, and driving mass adoption.

In short, focusing on growth—not existing distribution—is the only viable path to resolving current challenges in the blockchain space, including concerns over centralization in Ethereum’s liquid staking sector. If large traditional capital enters the space, centralized exchange staking will benefit first and become Lido’s main competitor, alleviating Lido’s current dominance. During the early phase of on-chain staking, Lido’s lead stems largely from crypto-native power users. But for future growth, centralized exchange staking will be the default choice for new users.

We believe the liquid staking landscape will eventually mirror the NFT market’s dynamic between OpenSea and Blur. This shift could be driven by offering ETH staking tokens with lower discounts, significantly boosting node operator revenues, or achieving the same level of stability currently requiring the combined use of Lido, SSV, and Obol. When that day comes, early users of centralized exchange staking will naturally migrate to faster, better, and more decentralized alternatives. Until then, we believe every liquid staking protocol plays a crucial role in advancing Ethereum’s roadmap.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News