2024 Crypto Investment Guide: Which Narratives Are Worth Watching?

TechFlow Selected TechFlow Selected

2024 Crypto Investment Guide: Which Narratives Are Worth Watching?

The top of a bull market comes when funds start joining; the next bull market top arrives when nations begin buying.

Author: 0XKYLE

Translation: TechFlow

As we approach 2024, my core investment portfolio is now fully allocated. This article outlines my perspective on how I see developments unfolding in 2024. I’ll do my best to clearly express my investment views here, but this is not financial advice—just an insight into how I view the crypto landscape for 2024.

If you don’t plan ahead, your investments will fail

Over the past few months, Bitcoin has finally broken out of its nearly 500-day consolidation range between $15K and $32K, and now everyone is anticipating a bull market.

But as my favorite Twitter account, 0x_Kun, often says:

Make an investment plan. Stick to your investment plan. Because when the market turns bad, you'll know what to do.

Therefore, the core of this article is a deep dive into my 2024 investment plan. It’s divided into two main parts:

-

How I see 2024 unfolding

-

Which narratives I believe will perform well

Part 1: The Case for a Major Bull Run in 2024

When investing, I always prefer a top-down approach: macro first, then micro. Here are what I consider the most critical bullish narratives driving the market:

-

Bitcoin ETFs

-

Interest rate cuts

-

Bitcoin halving

There are many other smaller factors—like the U.S. presidential election year and China’s stimulus policies—but I believe these three are the most significant and have the greatest impact on my portfolio. If you worry about every minor factor, you’ll never make a trade.

Next, I like to list a series of possible events and assign probabilities to each. In my view, the smartest way to invest is to determine how the cycle will unfold over the longer term.

Scenario Analysis

Before diving into the scenarios, let me explain some of my basic assumptions regarding the key narratives I’ve listed.

The BTC Halving Is Certain

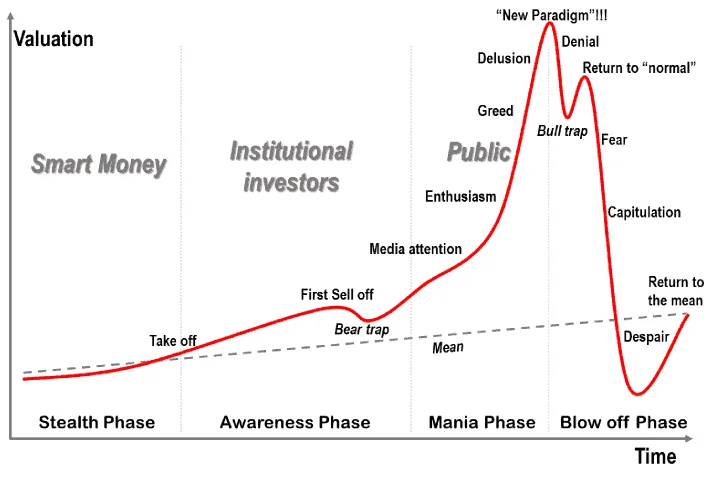

Across all these scenarios, I believe the Bitcoin halving does not necessarily mean immediate price appreciation.

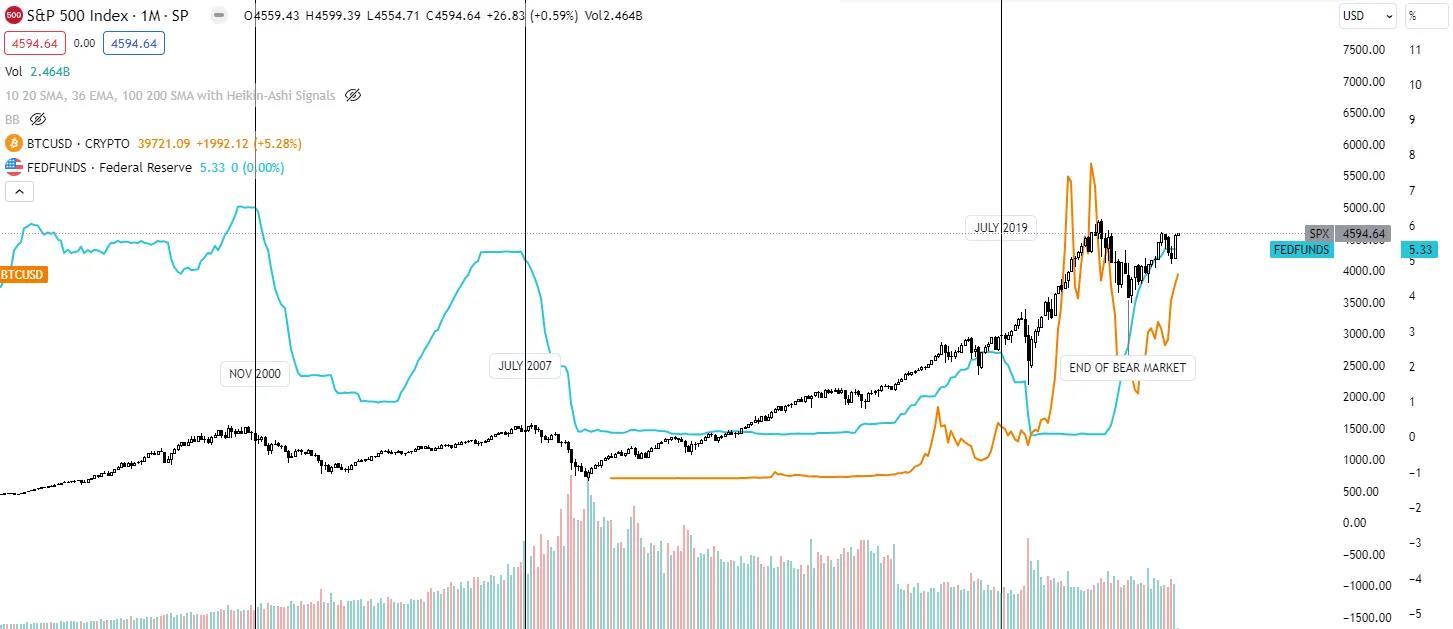

As shown in the chart above, Bitcoin halvings always precede bull markets, but they are never the direct catalyst. There is always a delay between the halving event and the subsequent price rise.

Rate Cuts Are Bearish

Lower interest rates can actually drive Bitcoin prices down.

Secondly, I believe rate cuts are bearish. Like the halving, they are events that happen before a bull market, but when rate cuts occur, they tend to be negative for the market.

With that said, here are the five scenarios I consider most likely.

Could This Bull Market Be Different From Previous Ones?

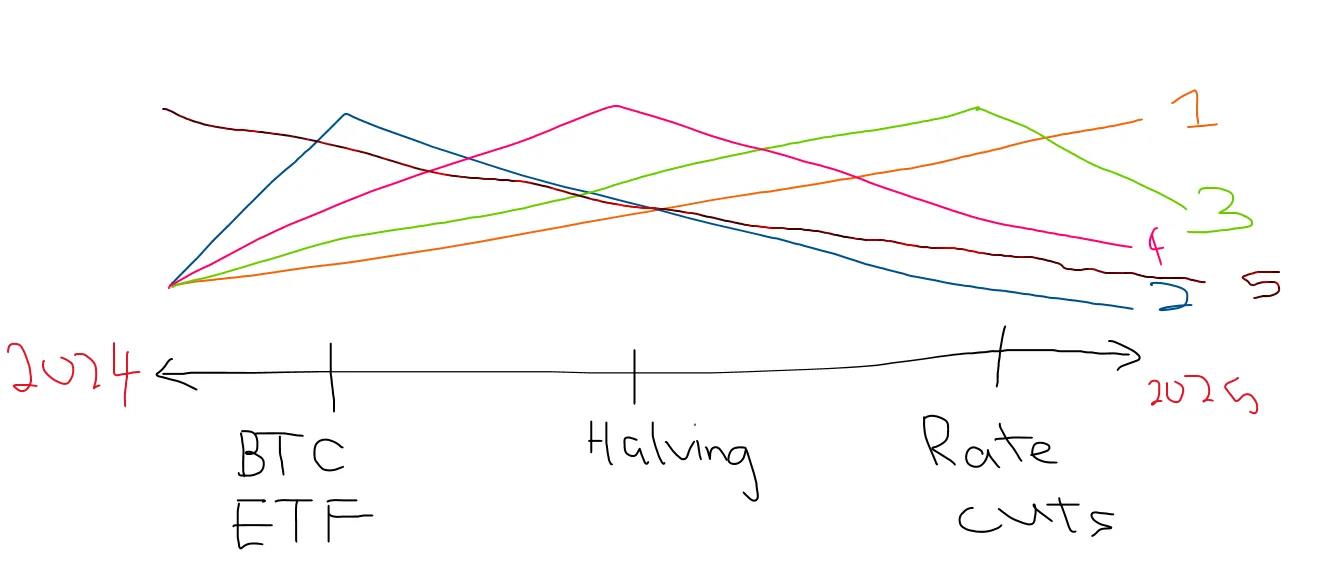

The market could follow five different paths, each with varying outcomes based on event timing.

Scenario 1 – Best Case, But Least Likely

In Scenario 1, we enter a bull market from 2024 into 2025 with sustained price increases. Not much explanation needed here.

Scenario 2 – Price Drops After ETF Approval, Also Unlikely

A Bitcoin ETF creates a local top, followed by a decline before eventually rising again later. If you’ve followed me before, you know I previously argued that ETF approval would lead to price declines because BTC tends to rally in anticipation of the event. At the time, no one believed the ETF would cause a drop—everyone was just rushing to buy before official approval.

My stance has evolved. Now that everyone is talking about a post-ETF dip, I think it could trigger massive volatility.

Scenario 3 – Rate Cuts Are Bearish, Most Likely

Compared to traditional financial markets, crypto hasn’t existed long enough for extensive historical analysis. When it comes to Bitcoin’s behavior under high interest rates, we only have one data point: 2019.

2019 bears a striking resemblance to our current situation. I believe this is the most probable scenario: we see a local top in 2024 due to rate cuts, followed by several months of decline, then entry into the largest bull market we’ve ever seen.

ETFs, halving, and rate cuts primarily set the stage for a larger bull run. 2024 will definitely not be a simple upward trajectory.

Scenario 4 – Halving Is Bearish, Unlikely

Not much more to say—this is similar to Scenario 2, except the peak occurs right before the halving.

Scenario 5 – Prices Only Decline; Also Unlikely

If prices keep falling, it could catch the entire market off guard. But I don’t expect this to happen.

Scenario 6 – Local Top Followed by Rebound

I didn’t include this in the chart above because it would complicate things, but Scenario 6 is essentially any of the previous five scenarios where instead of reaching the expected high, prices drop sharply afterward. This means short sellers and sidelined capital get caught off guard as people wait for a “better entry point.”

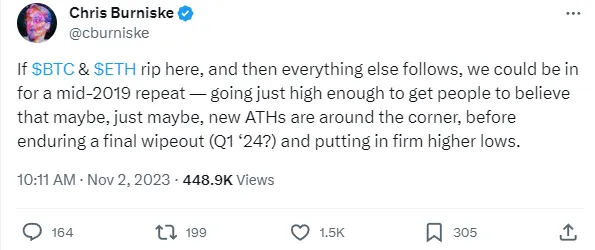

So the conclusion is: I believe we’ll see something similar to 2019, where a downturn occurs at some point even as people anticipate new all-time highs. This tweet almost perfectly summarizes what I think will happen:

So what will I do?

The biggest mistake I made in 2023 was having too small a position, knowing full well that prices would eventually surge again.

As a retail investor, I’m not bound by LPs (limited partners) or forced to constantly optimize returns. I can manage my assets however I want.

Therefore, my strategy will lean heavily toward left-side investing: I’ll reduce risk exposure in my portfolio ahead of rate cuts, then repurchase at lower prices while holding the rest steady.

It’s a simple strategy. I prefer optimizing simplicity over maximizing returns. I believe more complex strategies increase the chance of errors. This won’t yield the highest returns, but it’s highly manageable.

Additionally, I may hedge by shorting major cryptocurrencies or reducing long exposure. Other options include diversifying into more defensive assets or buying far out-of-the-money options.

Like I said, retail investors should keep investment strategies simple. 😎

To summarize, I anticipate prices will fall after rate cuts, then rise afterward.

Part 2: Narratives to Watch

Which narratives will dominate in 2024?

Again, we must take a top-down approach. The key question is: Who is buying?

I believe 2024 will be largely institution-driven. With the launch of Bitcoin ETFs and growing attention to crypto, this is obvious. Narratives are essentially hype—everyone jumps on board trying to exit before others.

Therefore, the best-performing narratives will be those with the most buyers—and I believe these buyers are primarily institutions. I think the strongest narratives will meet certain criteria:

-

Regulated

-

Products with proven product-market fit

This doesn’t mean every narrative must meet these standards. Over the past month, we’ve seen various crypto narratives emerge—RWA, DeSci, etc. These will certainly continue during the bull run, but for simplicity, I’d rather focus on those I expect to consistently perform well.

1. ETF Beneficiaries

ETF inflows into Bitcoin could lead to strong short-term performance. We’ve already seen this with assets like STX, ORDI, and TRAC.

After Bitcoin ETF approval, we may see sustained institutional buying from traditional finance.

Top Picks: COIN (stock) / BTC / ETH

Given that Coinbase has been selected by 9 out of 12 ETF issuers, I believe it will be a major beneficiary of the ETF narrative. As money flows in purely due to performance chasing, Coinbase becomes the direct gateway into the crypto ecosystem.

Imagine: BlackRock, Franklin Templeton, and other giants come to you saying they want to use your platform to custody their products. That alone could boost the stock price.

Naturally, we might also see an Ethereum ETF, so expect ETH to rally when that happens.

Derivative narratives: BRC-20 / LSTs

As derivatives of BTC and ETH, BRC-20 and LSTs will also benefit.

2. Lindy Effect

(TechFlow note: The Lindy Effect suggests that for non-perishable things like technologies or ideas, the longer they survive, the longer their expected future lifespan. The author uses this to argue for the increasing antifragility of certain crypto assets over time.)

In crypto, antifragility is crucial. We’ve seen VanEck’s thesis on Solana, showing that traditional finance seeks higher returns but avoids meme coins—making Solana a perfect fit.

Top Pick: SOL

I wrote a full report explaining why I think SOL will surge around $20; you can read it here. I believe once FTX estate fully liquidates its remaining uncollateralized SOL, foundations will begin accumulating it as a high-quality asset. Solana could become the next Ethereum.

Derivative narratives: TIA / Aptos / L2s

TIA isn’t a classic Lindy play, but when investors ask “What’s SOL beta?”, TIA is often the first ecosystem mentioned.

Aptos has strong potential due to its execution. While MATIC may have the best BD team, Aptos’ partnerships with Windows and Alibaba this year are impressive.

Finally, L2s offer solid products with real use cases, but with over 10 new L2s emerging in the past month—from Blast to… a board game L2?—I’m somewhat bearish, as many seem like random experiments rather than true innovation.

Community strength matters greatly in building resilient tokens. Solana has a highly resilient community, whereas communities focused more on breadth than depth tend to underperform.

3. Regulation & Product-Market Fit

I believe 2024 will also be a year of regulation. When DeFi regulation remains unclear, funds are hesitant to invest. Instead, investors will favor projects that have passed regulatory scrutiny and demonstrated clear product-market fit.

There’s really only one vertical that fits both criteria: exchanges.

Top Picks: MMX / dYdX

Exchanges are among the few crypto products solving core problems. I believe perpetual DEXs will rebound, especially as the SEC now regulates centralized exchanges—first Binance, now Bybit.

I see MMX and dYdX as prime beneficiaries. Historically, negative news for any CEX almost always correlates with dYdX rallies (CEX vs DEX narrative). dYdX continues to innovate—now with v4 live, funds may see it as a more "revenue-generating" play.

MMX is also a bet on Saudi capital. Recently, Phoenix Group (a BTC miner) saw its IPO oversubscribed 33x, signaling strong appetite for crypto investments.

You might wonder—why no DeFi on my list? As I said, DeFi is currently in regulatory limbo. I suspect targeted DeFi regulations may emerge soon.

Derivative narrative: Other Perp DEXes

GMX, Hyperliquid, Level Finance, Synthetix, etc.

4. Decentralized AI

On this topic, I wrote an in-depth piece explaining why you should be bullish on DecAI. This could be my primary narrative for 2024—you have a product revolutionizing the 21st century, and ordinary investors genuinely support decentralization.

Sam Altman’s recent saga left a bitter taste, highlighting the dangers of centralization and fueling demand for “open-source” AI.

Preferred: TAO / OLAS

Edge narratives: TAO subnet tokens / RNDR / AKASH / other AI tokens

I don’t think RNDR will perform as well due to large holders from previous cycles who may manipulate the market and dump profits.

5. GameFi

We were fascinated by GameFi last cycle, and this cycle we’ll see actual game launches. Many crypto OGs hate GameFi—play-to-earn, play-and-earn—but who cares? Those were high-FDV tokens that deserved to be dumped.

Many funds are scarred from investing in high-FDV GameFi projects, which is why GameFi faces skepticism. But this cycle, Web3 games that truly built something amazing will thrive.

Top Picks: Overworld / Treeverse / Prime / L3E7

Derivative Narrative: NFTs → BLUR

The bottom for NFTs may be in. I believe we’ll see renewed focus on gaming NFTs.

6. Other Potential Narratives

Beyond the five above, here are additional narratives I believe show promise based on recent trends:

-

dePIN / RWAs

-

deSci

-

Memes (BONK / DOGE / PEPE / HPOS10INU)

-

RUNE / CACAO

-

GambleFi

-

Airdrops (LayerZero / Starknet / ZKSync)

Closing Thoughts

Congratulations if you’ve made it this far! This article summarizes my outlook on the 2024 crypto market.

One thing I haven’t discussed yet is how I think this cycle will end. Recently, I’ve increasingly reflected on GCR’s view: “The top of a bull market is when funds join. The next top is when nations start buying.”

That sounded absurd at the time, but after learning that high-inflation countries are considering adding Bitcoin to their reserves (e.g., Argentina), it’s becoming more plausible.

But that’s a topic for another article. Wishing everyone a happy new year in advance!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News