Quick Overview of the Advantages and Latest Developments of 5 Emerging Layer2 Projects

TechFlow Selected TechFlow Selected

Quick Overview of the Advantages and Latest Developments of 5 Emerging Layer2 Projects

How are the emerging Layer2 players such as Base, Blast, opBNB, Linea, and Scroll currently developing?

Author: Day, Baicai Blockchain

From launch to surpassing $600 million in TVL in less than 10 days, Blast surged as a dark horse, reigniting excitement across the Layer2 sector.

Blockchain technology has evolved to the point where the value of the Layer2 space is now widely recognized in the industry. Over the next two to three years, it will play a crucial role and has become a necessary focus for major institutions’ strategic planning.

Besides established leaders like Arbitrum and Optimism, how are newer Layer2 projects such as Base, Blast, opBNB, Linea, and Scroll currently faring? Baicai will explore the current development status of these five emerging Layer2 “newcomers” from multiple perspectives.

01 Project Overview

Let’s first examine the technologies used by these five projects, their goals, and each project’s strengths:

-

Base

Base is a Layer2 built on OP Stack launched by Coinbase, aiming to provide developers with an ideal blockchain development environment.

Tightly integrated with Ethereum and relying on its security, Base benefits from Coinbase's support and optimization practices to ensure users can seamlessly and securely switch between Coinbase, Ethereum L1, and other interoperable blockchains. It plans to evolve into a decentralized, permissionless Layer2 chain to promote growth within the crypto ecosystem.

Advantages:

Similar to opBNB, Base leverages Coinbase’s user base and resources. Developers can build dApps, access Coinbase’s products and tools, and achieve seamless integration with other Coinbase offerings. Using OP Stack enables connectivity with other projects using the same tech stack, fostering ecosystem growth.

-

Blast

On November 21, Pacman, founder of Blur, launched Blast—a Layer2 project based on OP Stack. Users depositing Ethereum into Blast earn staking rewards plus points that prepare them for future token airdrops. Its primary goals are addressing high Ethereum gas fees and idle funds tied up in Blur bids.

Advantages:

Backed by Blur and Paradigm, Blast achieved over $620 million in TVL within just one week—an exceptional performance compared to most Layer2s. Some X influencers even criticized other Layer2 teams, claiming months of progress were outdone by Blast in days, calling those teams “worthless.” Due to anticipated airdrops and its tiered referral mechanism, Blast naturally appeals to large holders, who then actively promote it. This word-of-mouth effect rapidly amplified media coverage and TVL growth.

From Blur to Friend Tech and now Blast, Paradigm has mastered leveraging airdrop expectations.

-

opBNB

As the BNB ecosystem expands, BNB Chain has become increasingly congested. High-activity applications risk overloading the network, prompting the introduction of opBNB. BA has invested heavily in gaming; improved Layer2 performance benefits gaming and similar applications.

opBNB is a Layer2 scaling solution for BNB Chain, enhancing transaction speed and reducing fees. Built on OP Stack, it extends BNB Chain’s capabilities and improves user experience.

Advantages:

opBNB builds upon BA and the BSC ecosystem. Supported by BA, it enjoys a massive user base and extensive project resources. Meanwhile, BSC, as a fully decentralized ecosystem, already hosts significant user activity and trading volume.

opBNB maintains compatibility with BSC, enabling smooth migration of apps and users. As long as BA follows through—mirroring Ethereum DeFi's success at the Layer2 level—with its abundant resources and strong backing, wealth effects are likely given its existing traffic scale. Of course, this assumes Layer2 itself holds value.

-

Linea

Linea is a Layer2 solution introduced by ConsenSys, MetaMask’s parent company, designed to enhance Ethereum’s scalability and efficiency. Using zkEVM technology and zero-knowledge proofs, it allows developers to easily build scalable dApps or migrate existing ones onto Linea. Its goal is to deliver faster, lower-cost transactions and advance the Ethereum ecosystem.

Advantages:

Linea draws attention due to ConsenSys’ backing. As MetaMask’s parent, ConsenSys holds a natural advantage in user traffic. The close relationship is evident since Linea’s team members belong to ConsenSys.

Linea integrates seamlessly with ConsenSys products like Infura, MetaMask, and Truffle. Developers can attract users via MetaMask, use Infura APIs to accelerate dApp deployment and scaling, and leverage Truffle or other environments to build, test, debug, and deploy Solidity smart contracts. Additionally, ConsenSys provides bridges for secure token transfers and optimized MetaMask user experiences, forming a commercial closed loop.

-

Scroll

Scroll is an EVM-equivalent zkRollup-based solution aimed at scaling Ethereum. It seeks to offer lower costs, faster speeds, and infinite scalability while maintaining security and decentralization. As a community-driven open-source project, it focuses on scalability, low cost, and ease of use so everyday users can access Ethereum effortlessly.

Advantages:

Scroll collaborates with the Ethereum Foundation and receives some support from it, though weaker than others. The team includes Chinese developers with solid technical expertise. Additionally, Scroll has an $1.8 billion valuation with approximately $83 million raised from top-tier investors including Polychain Capital and Sequoia China.

opBNB, Base, and Linea are all backed by major industry players already holding strong ecosystem positions—their Layer2 efforts mainly aim to strengthen their standing and create ecosystem lock-in. In contrast, Blast rose rapidly due to unique mechanics, whereas Scroll appears relatively weaker across various aspects.

From these project backgrounds, it’s clear the era of going solo is over. Success now hinges more on resources and connections—technical and financial capabilities have become baseline requirements. Ultimately, what matters most is whether a project attracts users. Next, let’s look at how these projects are progressing.

02 Current Progress

We’ll assess these projects’ current performance based on on-chain data and ecosystem developments.

-

Base

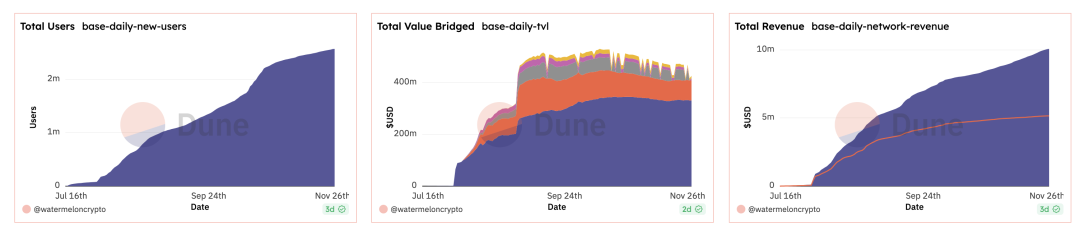

Since launching in July, Base has accumulated over $5 million in transaction fees—surpassing most other Layer2s. Current TVL is around $580 million. Achieving such figures without promising airdrops is exceptionally impressive.

Base on-chain metrics, source: dune.com

The chart above shows consistent growth across all metrics since Base’s mainnet launch. Early momentum came from the meme coin BALD, which attracted many users despite the eventual rug pull—yet both users and capital remained.

Later, the viral social app Friend Tech brought hundreds of thousands of new users, firmly establishing Base’s position. This demonstrates how a breakout ecosystem project can massively impact an entire chain, though Base’s official support also played a decisive role.

-

Blast

In about a week, Blast reached $626 million in TVL—ranking third among Layer2s. However, being newly launched, its ecosystem remains undeveloped, with only a few projects announcing support. Recently, Polygon criticized Blast for excessive centralization due to multisig risks, but users seem unconcerned—backed by Blur’s founder and offering attractive returns, even centralized solutions are acceptable, especially when competitors aren’t much better.

Although TVL appears to grow quickly, retail participation is minimal. Points are distributed based on capital size and influence. The current funding structure has essentially turned Blast into a stable investment tool exclusively for large holders.

-

opBNB

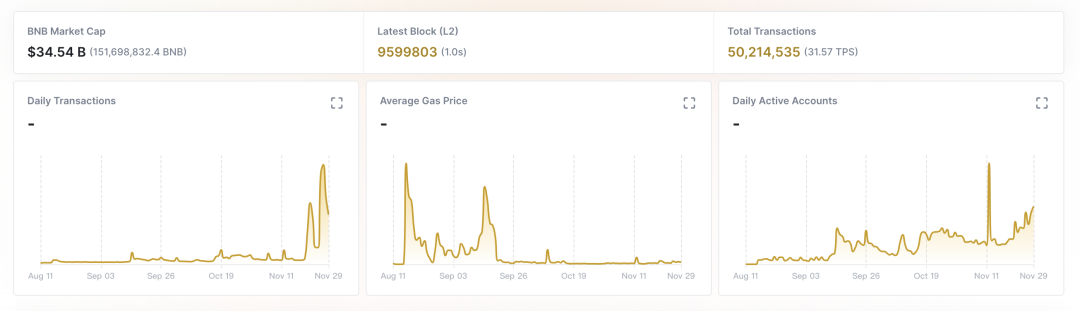

Since opBNB’s mainnet launch in mid-September, progress has been steady but unremarkable—still largely in preparation mode. The official team is attracting projects to join; new ventures funded by BA Labs and close partners like PancakeSwap have begun deploying on opBNB, gradually improving the ecosystem. Total TVL stands around $2.6 million.

Daily transaction counts and active users have increased several-fold over recent months, reaching around 100,000. Gas fees continue declining thanks to upgrades. On November 29, the team released a roadmap targeting average transaction costs reduced from $0.005 to ~$0.001 and TPS increasing from 4,000 to 10,000 within six months.

Source: opbnbscan.com

Data from Token Terminal shows core developer numbers on BNB Chain dropped this year from 70 to 46. Although CUBISWAP recently halved in value on opBNB, drawing criticism, given BA’s massive user base and traffic potential, a single breakout project could bring in huge volumes of users and capital almost instantly.

-

Linea

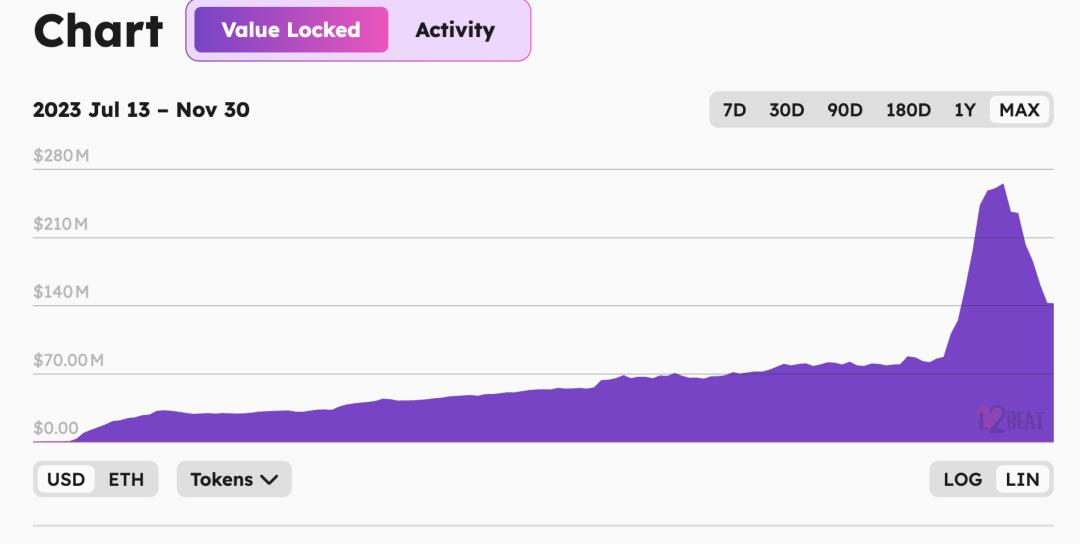

Since launching its mainnet on August 9, Linea has accumulated nearly $142 million in TVL and processed 21 million transactions—indicating it remains in early stages. A short-term doubling of TVL occurred during the second phase of the Voyage campaign, but after ending on the 22nd, TVL plummeted. Currently, aside from users participating in the Voyage campaign for potential airdrops, general interest remains lukewarm.

Source: l2beat

In terms of ecosystem, projects like LayerZero and Galxe have integrated with Linea. Also notable is Tomo, a copycat of Friend Tech promoted directly by the official team. Many other projects exist, but most simply replicate Ethereum’s ecosystem without standout innovations.

-

Scroll

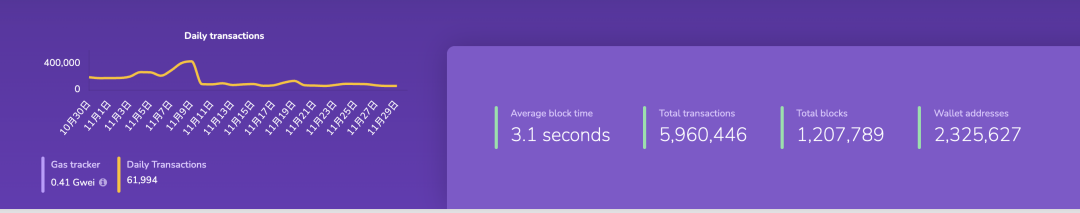

Scroll launched its mainnet on October 17. To date, it has ~$38 million in TVL, nearly 6 million total transactions, and over 2.3 million wallets. Currently, Scroll’s TVL and key metrics are growing faster due to airdrop anticipation.

Source: blockscout

Ecosystem-wise, most projects mirror Ethereum’s ecosystem. No standout dApps have emerged yet, though this is expected given the mainnet has only been live for slightly over a month.

Among the five projects, a clear takeaway emerges: the best way to energize a chain is for the team to foster breakout projects—like Friend Tech did for Base. Only by attracting users and capital can sustainable development occur. Currently, apart from Base, the other four show average ecosystem performance—partly due to their short lifespans. Linea and Scroll, using ZK technology, naturally progress slower than OP Stack counterparts.

03 Summary

Above covers introductions and updates on these five Layer2 "new" projects. Compared to Arbitrum and Optimism, all except Base are significantly behind—some still in initial stages. Given each has substantial backing, what do you think lies ahead for them—will they become unused “ghost chains,” or capital-backed blue chips?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News