Introducing Sonic: The First Game-Focused L2 on Solana, Leading the "One-Click Chain Deployment" Gaming Revolution

TechFlow Selected TechFlow Selected

Introducing Sonic: The First Game-Focused L2 on Solana, Leading the "One-Click Chain Deployment" Gaming Revolution

From "Boring Summer" to "Gaming Bonanza": Which Projects Will Be the Key Drivers?

The market is dull, lacking breakout new projects to drive narrative shifts.

But looking back, Solana remains an ecosystem worth watching. There's clear user demand, with transaction frequency and activity consistently maintained at a certain level.

When liquidity and attention are accumulating, what’s needed is a catalyst to break the stagnant market structure.

Currently, games on Solana have been overshadowed by meme hype, yet their potential is enormous:

First, no game ecosystem matching Ethereum's scale has emerged yet; second, amid mobile adoption and narrative rotation, the Solana gaming sector as a whole remains dormant, poised to absorb existing liquidity and attention.

From a "boring summer" to a "gaming feast," which projects will become key drivers, pushing forward progress in technology, ecosystem, and funding?

Sonic, the first Layer 2 built for gaming on Solana and also Solana’s first modular SVM chain, may be one to watch.

The project introduces a Rollup scaling framework called HyperGrid, combining Solana’s speed with customizable, game-specific rollups, creating conditions for an explosion in Solana’s gaming ecosystem.

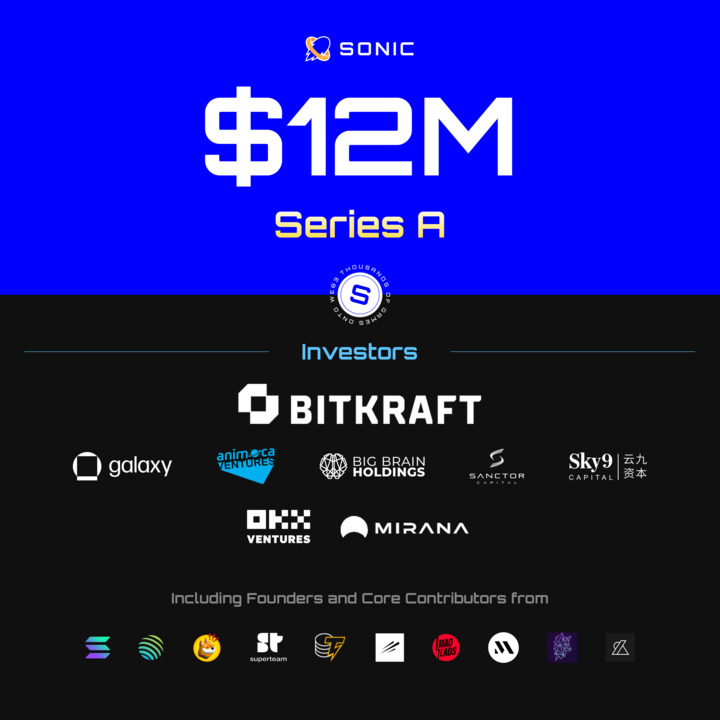

In June this year, Sonic raised $12 million in funding led by Bitkraft, with participation from Galaxy and Big Brain Holding. Its token is set for TGE in October—expectations are high. Publicly available information indicates that Sonic is running a game and partner collaboration program, aiming to incentivize more games to join the Solana ecosystem;

For more degen users, Sonic recently launched a node pre-sale, adding even more reasons to pay attention.

In this article, we’ll dive into Sonic, examine its rationale for existence, and analyze it from product, technical, and ecosystem resource perspectives.

Timing Makes the Hero: Sonic’s Internal Logic and Opportunity

Don’t rush in just yet.

Whether a project is worth watching hinges significantly on whether it meets demand and achieves narrative “coherence.”

Before diving into Sonic itself, you’re probably wondering: Does Solana, already known for speed, really need an L2? And what unique capabilities does Sonic possess to meet such needs?

At first glance, these might seem like contradictions. But upon closer inspection, new market opportunities emerge.

For example, Solana’s second-generation phone received 60,000 orders within three weeks—demonstrating strong market demand for mobile devices. Yet while the hardware exists, gaming content within the ecosystem is missing (setting aside debates about whether Web3 games are fun—the primary issue is simply whether games exist at all):

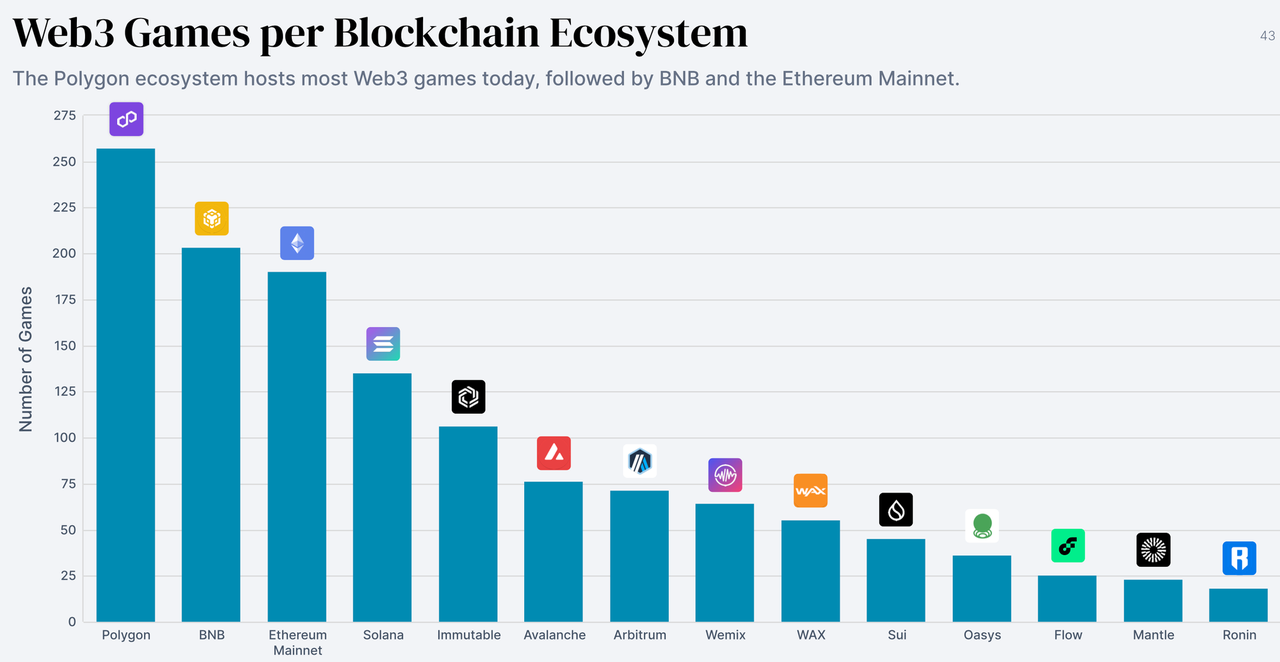

Most major Web3 games today run on Polygon, BNB, or Ethereum. Although Solana is often called the “retail chain,” the most retail-friendly game categories remain underdeveloped.

Data from DappRadar shows none of the top 25 games by UAW (unique active wallets) operate on Solana; similarly, none of the top 10 games by market cap are on Solana.

This duality means that while there's currently a lack of games, it also implies a huge opportunity: providing seats for games could yield massive returns.

Regarding the other question—whether Solana needs an L2—technical, community, and application signals all point toward growing demand.

Technically, Solana’s L1 faces foreseeable performance pressure and requires offloading mechanisms; L2 rollups are a viable option.

As dApp and DeFi activity on Solana accelerates, daily on-chain transactions surpassed 200 million in January 2024. Analysts conservatively estimate transaction volume will exceed 4 billion by 2026.

Under such predictable load, Solana’s TPS hovers around 2,500–4,000, with average cluster ping times fluctuating between 6 and 80 seconds. When TPS nears or exceeds 4,000, transaction success rates drop to 70%–85%.

Meanwhile, frequent meme trades impact other applications; high-frequency game interactions are also hindered by L1 performance bottlenecks.

On the application side, some projects are already exploring rollup-like designs.

Due to Solana’s lack of advanced data structures tailored for gaming, developers must manually implement them via smart contracts, increasing game development difficulty. The absence of caching mechanisms further complicates common gaming operations like cross-transaction calls and data account access, compounding development challenges.

Non-gaming projects illustrate similar trends—Pyth is building an appchain on Solana, while Grass uses zk aggregation to bundle high-frequency DePIN data before submitting it to L1. These behaviors resemble L2 solutions.

For applications (especially games), having their own L2 rollup offers clear advantages: better fee capture, privacy, and real-time settlement capabilities.

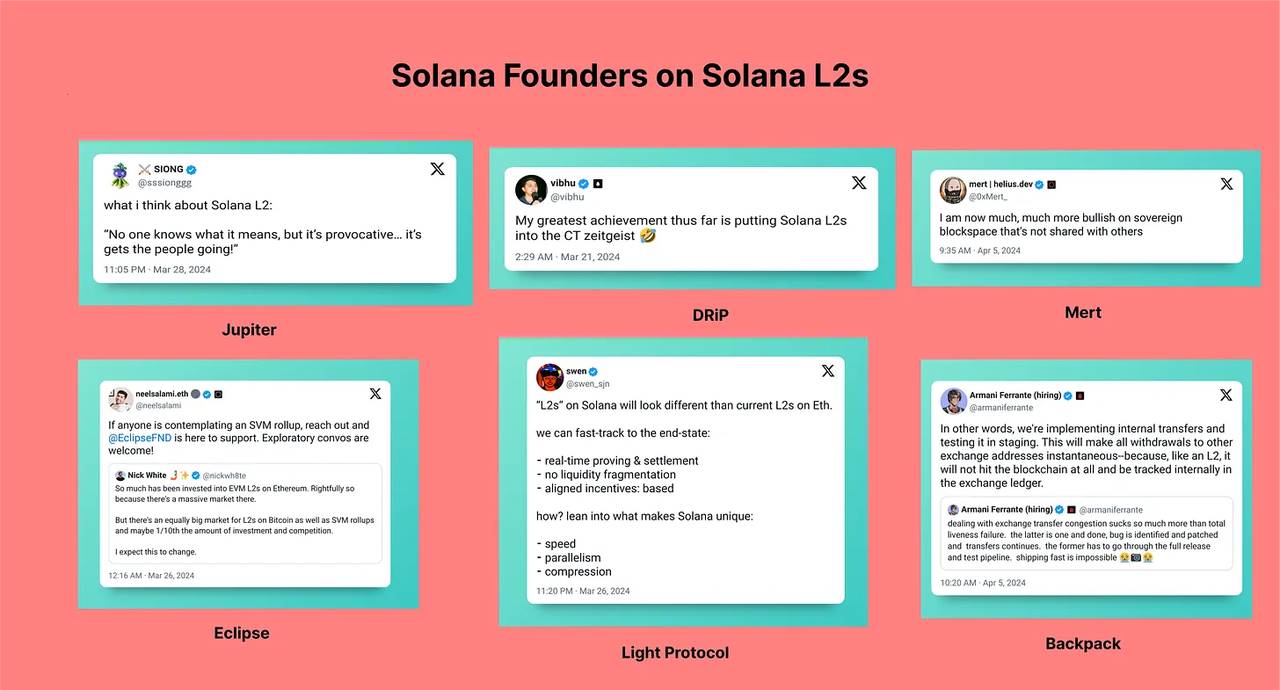

Even in public discourse, founders of Solana-based ecosystem projects frequently discuss the need for L2s.

From the perspectives of performance, ecosystem maturity, application needs, and community sentiment, Solana clearly needs a dedicated gaming chain to expand its ecosystem.

Reframing this from an investment research angle, the convergence of these factors suggests: whoever first addresses Solana’s ecosystem gaps stands the best chance of becoming the next alpha.

This is precisely Sonic’s internal logic and timing.

HyperGrid: The Secret Weapon Behind “One-Click Chain Launch”

Having established necessity, let’s now explore how Sonic plans to build its L2.

Sonic’s standout feature is HyperGrid—a horizontally scalable Rollup architecture designed specifically for Solana SVM.

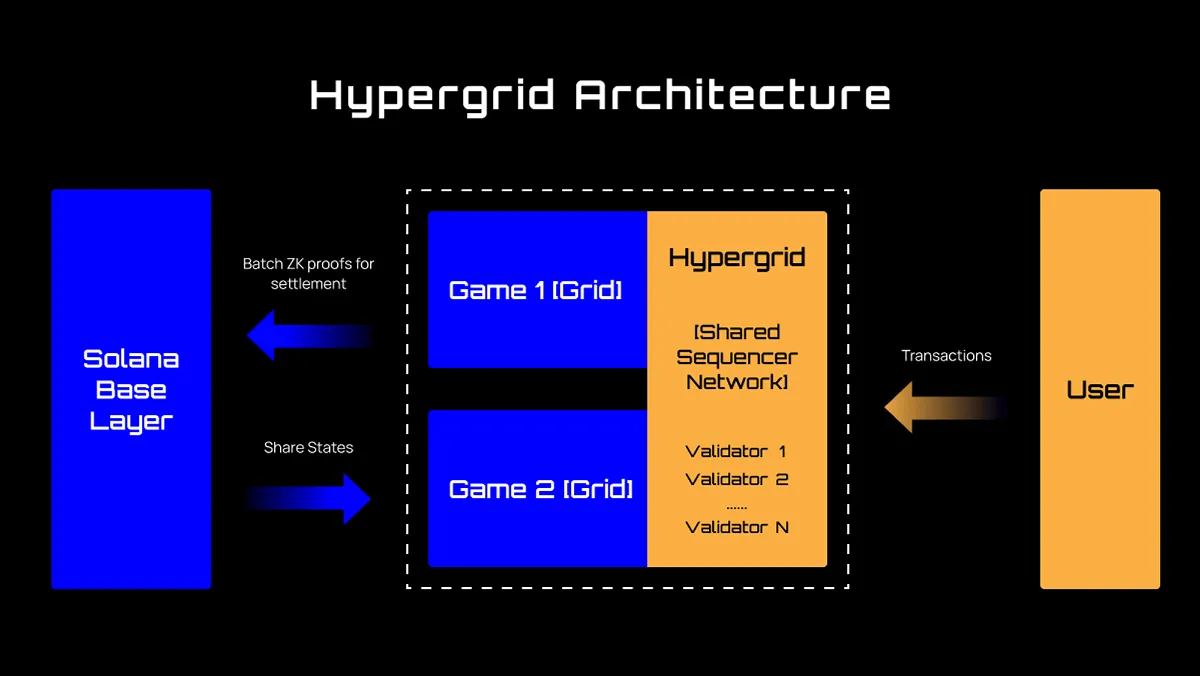

You can think of Sonic’s L2 as being built atop HyperGrid—it’s Solana’s first concurrent scaling framework. More profoundly, the name “HyperGrid” signifies that multiple independent grids can run simultaneously, each processing transactions independently while ultimately achieving consensus and finality through the Solana mainnet.

This design greatly enhances system scalability and performance.

Think of it as a "self-governing yet centralized system":

-

Independent Operation: Each grid processes its own transactions—including validation, logging, and state changes—ensuring applications within one grid don’t interfere with others.

-

Connected to Mainnet: Despite independent operation, final consensus and confirmation rely on the Solana mainnet, ensuring data consistency and security across all grids.

-

Flexible Scalability: Developers can choose to use shared public grids or create private ones for higher performance isolation and control.

If that’s still unclear, consider a simpler analogy: a large shopping mall with independently operated stores.

Imagine HyperGrid as a giant mall, where each grid represents an individual store. Each store (grid) runs independently, handling its own customers and transactions (application operations).

The property owner (Solana mainnet) ensures overall mall security and management, guaranteeing every store’s records are finalized. If one store gets too busy, it can open a branch (create a new grid) without affecting others.

Architecturally, HyperGrid consists of several components:

-

Solana Base Layer: Responsible for final consensus and data recording. It receives batch zero-knowledge proofs (ZK proofs) from HyperGrid for settlement and shares state information.

-

HyperGrid: A shared sequencer network coordinating multiple grids, including validators responsible for processing and verifying transactions.

-

Multiple Grids: Each functions as an independent application or service (e.g., a game), managing its own transactions and state transitions.

-

Users: Interact with HyperGrid by submitting transactions, which are processed by validators and settled on the Solana base layer.

Architecture alone isn't enough—usability tools are essential to maximize effectiveness.

First, an EVM interpreter allows Ethereum-based games to deploy on HyperGrid with minimal modifications. Additionally, HyperGrid features a native game engine supporting runtime loops, game-specific types, containers, and sandbox environments—lowering barriers to integration, development, and debugging.

At the asset interaction layer, HyperGrid provides full payment and settlement infrastructure—including embedded NFT markets, token swaps, bridges, liquidity pools, identity verification, and wallet tools.

Thus, combined with these tools, HyperGrid enables developers to quickly launch customized rollups for games—without rebuilding everything from scratch, leveraging ready-made architectures and toolkits to handle all aspects of Web3 game development end-to-end.

Moreover, benefits to developers eventually spill over to all stakeholders in the Solana ecosystem.

Crypto players enjoy improved transaction and gaming experiences—though they may not perceive technical changes directly, subjectively noticing only faster speeds. For the broader Solana ecosystem, custom rollups reduce mainnet performance strain, encouraging more game projects to join. Each game brings users and liquidity to in-game assets, which in turn enriches Solana’s base layer.

Notably, HyperGrid implements a staking mechanism: validators must stake SOL to operate nodes, indirectly enhancing SOL’s value accrual.

In sum, Sonic’s HyperGrid design dramatically improves scalability and performance while ensuring data consistency and security—benefiting all parties in the Solana ecosystem. This, in our view, represents a rational, inclusive, and incentive-aligned architectural choice.

Beyond Technology: What Else Matters

As a foundational L2 project benefiting multiple stakeholders, technology is important—but even more critical is how many partners join, and how effectively it expands its business network.

Therefore, factors like Sonic’s resources, partnership capabilities, community building, and go-to-market strategy become paramount.

In June, Sonic announced a $12 million Series A round led by Bitkraft, with Galaxy Interactive and Big Brain Holdings participating.

Behind Sonic lies Mirror World—a team with even stronger credentials. They secured a $4 million seed round back in 2022, with CEXs like OKX and Bybit participating. With Sonic’s upcoming token TGE, exchange listing expectations grow even higher.

Additionally, Sonic and Mirror World maintain close ties with Solana.

Public records show that Solana’s APAC growth team, gaming team, and ecosystem tech leads serve as advisors and angel investors in Sonic—adding legitimacy and credibility.

Closer institutional connections mean broader networks and resources, facilitating smoother collaborations within Solana’s ecosystem and paving the way for project growth.

In practice, Mirror World’s SDK has already been deployed across 50 game clients as initial distribution points, establishing solid relationships with existing games—making migration to Sonic easier and enabling a smoother ecosystem cold start.

Currently, over ten on-chain games have successfully deployed on Sonic’s testnet. These include Zeebit, Solana’s first on-chain casino, and Lowlife Forms, a top-tier shooter game backed by Solana Foundation.

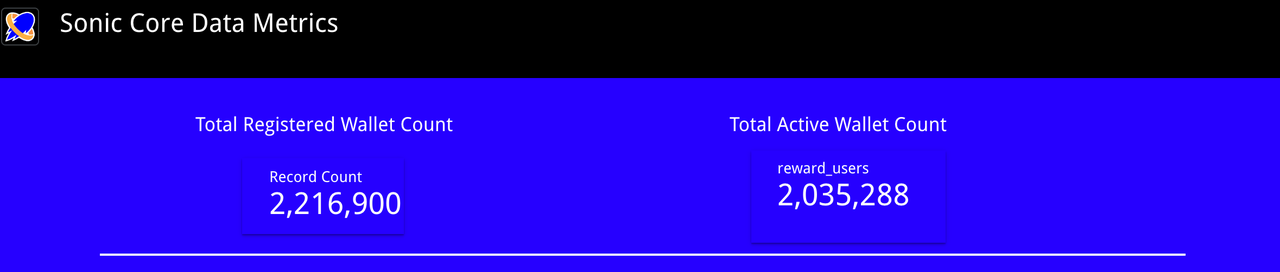

Moreover, Sonic’s testnet is already gaining scale.

According to official dashboard data, Sonic already boasts over 2 million active wallets. With Sonic’s mainnet launch expected in September, we can anticipate even more game integrations—and if a breakout hit emerges, this number will only rise.

Everyone knows Web3 games won’t initially attract outsiders—so activating existing crypto users and injecting early traffic and attention is crucial.

We’ve always emphasized that for infrastructure projects, the ability to organize and mobilize resources directly determines the project’s floor. Here, Sonic holds a clear advantage—its key strength lies in forming strong partnerships with non-gaming projects to provide liquidity, traffic, and security support.

For instance, Backpack, OKX Wallet, Metaplex, Solayer (with over $25 million in staked SOL), Jito, and other exchanges, DeFi, and LST projects have joined as partners, collectively fueling this L2.

Beyond partner integration, Sonic has recently increased its community presence to strengthen brand recognition.

As a globally focused L2, Sonic has recruited ambassadors worldwide and hosted community meetups in emerging Web3 markets like Turkey and Nigeria, reinforcing its position in users’ and developers’ minds.

Recent actions also reflect accelerated visibility. Sonic co-hosts major Solana ecosystem events like Hacker House and Breakpoint, and actively participates in speaker sessions across both Chinese and global Solana communities.

Through these cumulative efforts, Sonic emerges as a multi-VC-backed, Solana-officially-supported project with global reach, strong engagement, robust connectivity, and early-stage ecosystem momentum.

More importantly, Sonic’s narrative leadership—as the first gaming-focused L2 on Solana—adds another compelling reason to pay attention.

Current Participation Opportunity: HyperFuse Guardian Node NFT Sale

Currently, Sonic’s $SONIC token is scheduled for TGE in October. While direct token participation isn’t yet possible, you can learn about its economic model and utility, and participate in the upcoming node pre-sale.

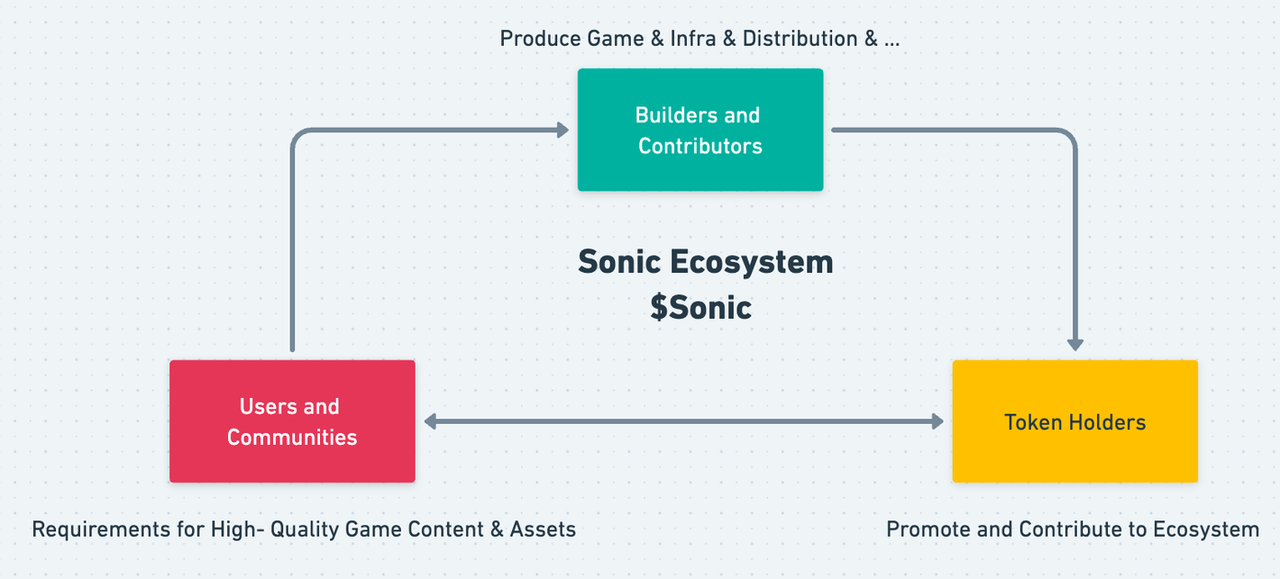

First, $SONIC serves three core roles: token holders, builders/contributors, and users/community members.

-

Token Holders: Can convert $SONIC to $veSONIC at a 1:1 ratio for governance voting or delegate to validators for additional rewards.

-

Builders & Contributors: Can join the Sonic Partner Innovation Network (SPIN) and Sonic Accelerator Program to receive ecosystem support, helping build high-quality games, infrastructure tools, or other ecosystem components.

-

Users & Community: Engage in interactive experiences within ecosystem projects. Through Sonic campaigns, users earn points redeemable for tokens or other ecosystem rewards.

So, what current opportunities exist for users to participate and earn token rewards?

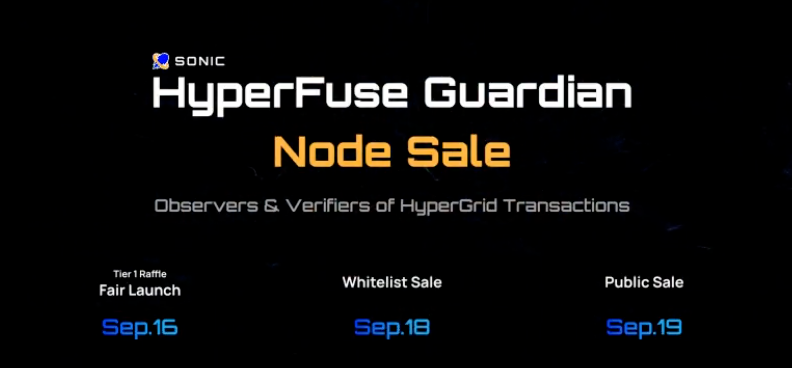

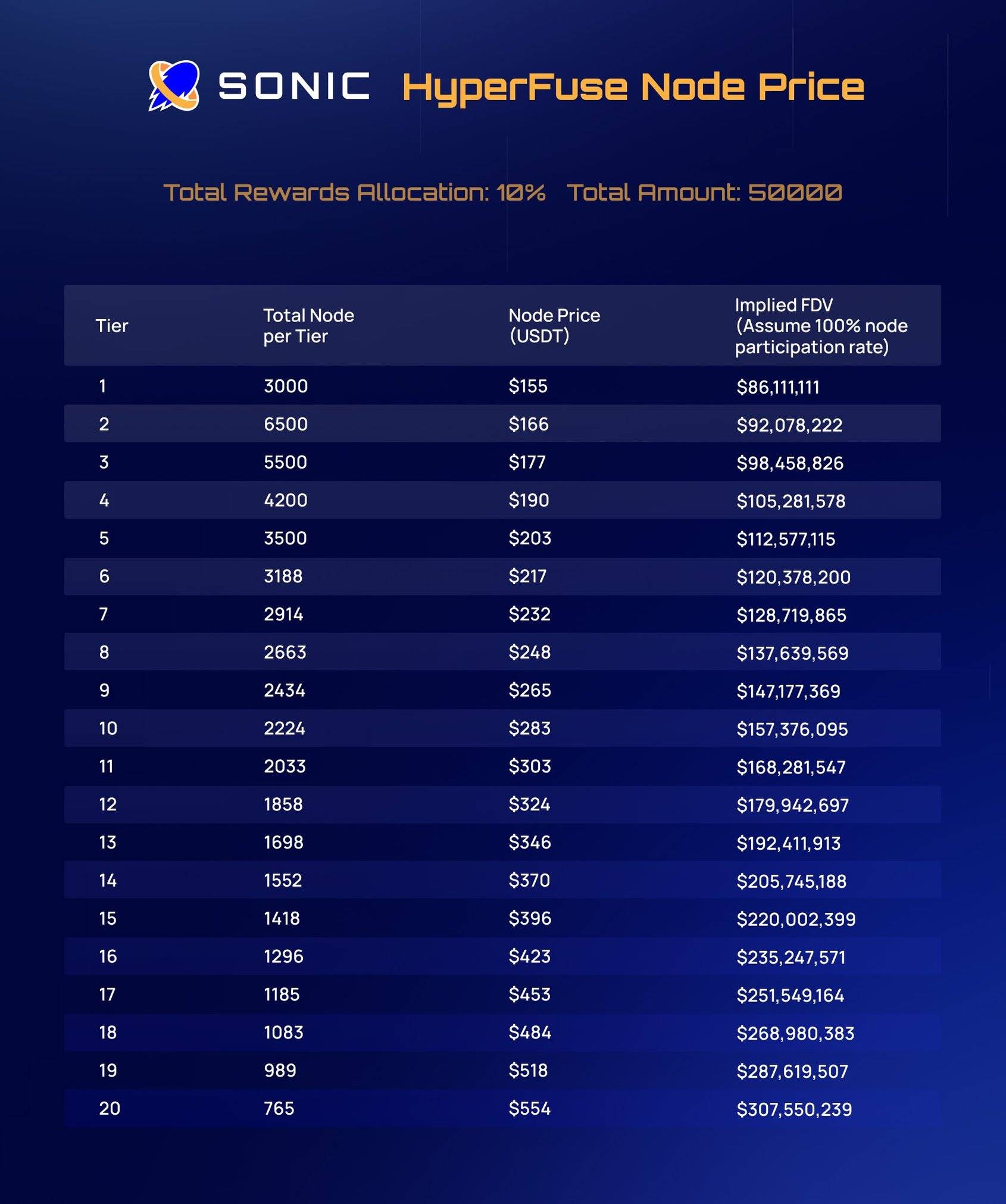

On September 16, Sonic will launch the HyperFuse Guardian Node NFT sale (visit here). The offering includes 50,000 NFTs representing operational rights to run nodes on Sonic’s HyperGrid network.

Each NFT grants operating rights for a Guardian Node, with different tiers offering varying node weights and reward proportions.

First, what exactly does running a HyperFuse Guardian Node do?

Within HyperGrid, Guardian Nodes play a vital role in maintaining network integrity. Their responsibilities include monitoring transactions and state transitions, detecting anomalies, validating whether the HyperGrid Shared State Network (HSSN) correctly submits states to Solana, and ensuring all Grid rollup operations comply with security standards.

Think of them as “watchdog validators.”

Notably, even users without technical expertise can purchase NFTs and delegate node operations to others, still earning rewards.

Furthermore, the barrier to entry is low—nodes can be run lightweight with just a browser.

Thus, participating in HyperFuse Guardian Node operations not only helps secure the network but also offers potential economic returns.

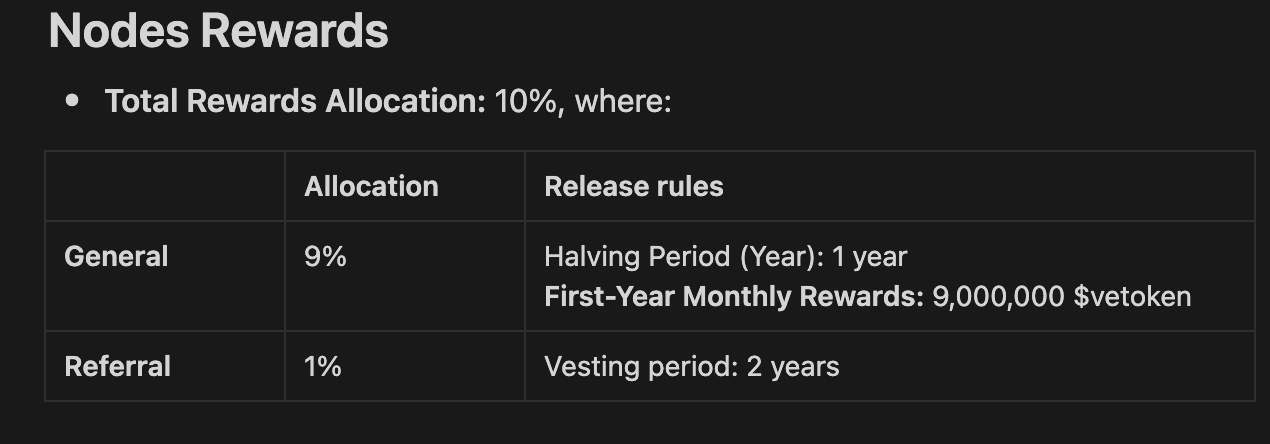

Token Rewards: 10% of the total token supply is allocated for incentives—9% for node operation rewards and 1% for network expansion (e.g., referrals and invites). Unlock rules vary accordingly.

Specifically, Sonic divides the node NFT pre-sale into three phases:

-

Lottery Phase: September 16, 2024, 13:00 UTC (lasts 24 hours)

-

Whitelist Sale: September 18, 2024, 13:00 UTC (lasts 24 hours)

-

Public Sale: Begins September 19, 2024, 13:00 UTC

Node pricing follows a dynamic model, ranging from $155 to $554. Payments accepted in SOL, USDT, or USDC on the Solana network. Different NFT tiers have purchase caps to ensure broad community participation.

Notably, initial node prices are low—starting at $155—and 70% of nodes cost under $300.

Tier 1 nodes (the cheapest) use a fair launch model, making participation relatively equitable and highly attractive due to low cost. Interested users should prepare ahead of time to participate on the 16th.

Tiers 2–8 are exclusive to whitelisted participants, priced between $166–$248. Whitelist spots can be earned through the testnet Odyssey campaign or partner communities.

Known partner communities include prominent Solana groups like MadLads, Solayer, Send, MonkeDAO, and broader crypto communities.

Players interested in detailed rules can refer to here for more information.

From a valuation standpoint, the node pre-sale is good news for the community and retail investors—some nodes offer lower costs than VC round pricing.

In the first 30% of node sales, fully diluted valuation (FDV) stays below $100 million—lower than the previous VC round. This gives early participants a chance to enter at favorable prices with upside potential.

The tiered pricing strategy rewards early supporters while offering access to investors with different budgets—helping broaden the community base.

Conclusion

Solana’s Game Summer hasn’t arrived yet—but those laying the groundwork deserve attention.

Sonic’s strong networking power, targeted product design, and proactive initiatives give existing liquidity and attention a new destination. Whether you're a professional points farmer, casual player, or game developer, new, user-friendly, and high-expectation projects will naturally become market favorites.

Yet lasting favor depends on Sonic’s own execution and continued evolution—success isn’t just about being first, but about sustained momentum. Iterating continuously amid shifting market expectations and demands is the survival philosophy that allows Web3 projects to thrive long-term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News