The King of Clones, Why Is He Surrounded on All Sides?

TechFlow Selected TechFlow Selected

The King of Clones, Why Is He Surrounded on All Sides?

The industry's despair stems not only from the depressed prices in the secondary market, but also from confusion about its future direction.

Author: YBB Capital Researcher Zeke

Introduction

The halving narrative is beginning to fail, and altcoins are languishing. Speculators are exiting, believers are starting to doubt themselves. The industry's despair stems not only from depressed secondary market prices but also from confusion about the future direction. Criticism has become the dominant theme within the space, ranging from application scarcity to minute details in major public chains' financial reports. Now, the criticism is turning toward what was once crypto’s hottest ground—Ethereum. So, what exactly are the internal struggles of this so-called king of altcoins?

I. Horizontal Expansion of Mainchains, Vertical Rise of Layers

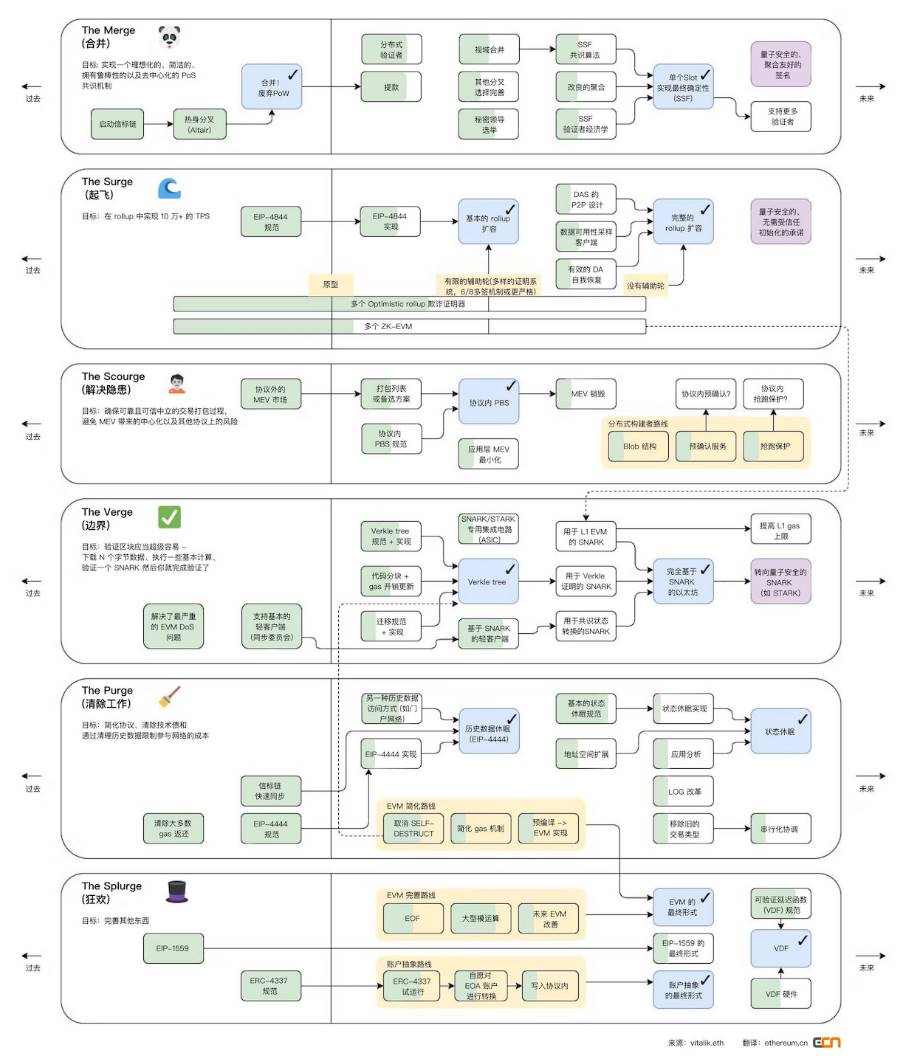

Fully modular fractal scaling was Vitalik’s envisioned endgame for Ethereum between 2018 and 2019—optimizing the base layer for data availability (DA), enabling infinite scalability at higher layers, thus escaping the blockchain trilemma. Ethereum would become a settlement layer for countless chains, ultimately achieving the endgame of blockchain scaling.

After confirming the feasibility of this vision, Ethereum rapidly accelerated its roadmap on both horizontal and vertical fronts. In 2023, the successful merge of the mainnet with the Beacon Chain marked the beginning of modularity taking center stage in the Ethereum ecosystem. With the recent Deneb upgrade marking the first step toward EIP-4844, the mainnet has nearly realized Vitalik’s early vision. Meanwhile, the upper layers have flourished—gas efficiency, TPS, and diversity have gradually outpaced former competitors. Aside from fragmentation issues, any “Ethereum killer” narratives based on heterogeneous chains should now be considered obsolete. Yet the harsh reality contradicts this: TON and Solana continue to rise, and numerous infrastructure projects that merely copy modular narratives are outperforming even ETF-backed “legitimate modular” projects in the secondary markets. What explains this discrepancy?

The shift from PoW to PoS and the development of Layer2s have recently become focal points of criticism against Ethereum. However, in my view, neither Ethereum developers nor Vitalik were wrong in pursuing modularity. If there is any fault, it may lie in moving too fast and being overly idealistic. I wrote in an article earlier this year something along these lines: if blockchains are to see widespread use beyond finance and mass adoption is inevitable, then Ethereum’s move toward modularity makes sense. Clearly, however, Ethereum has been too idealistic here—there is currently no evidence suggesting either condition holds true. The same applies to pricing curves for DA: given the current state of Layer2s, the anticipated explosion in application-layer activity simply hasn’t materialized. Moreover, most general-purpose chains have faded into obscurity, leaving only a few top-tier players like ARB, OP, and Base still active. Relying solely on DA revenue cannot possibly sustain Ethereum’s positive feedback loop. Other problems remain: gas consumption has dropped by tens or even hundreds of times—tasks that once required 0.1 ETH now cost just 0.001 ETH—yet user activity hasn't increased proportionally, leading to supply far exceeding demand. Still, pushing public chains toward mass adoption while maximizing decentralization and security doesn’t seem misguided. That Ethereum has gradually turned eight years’ worth of promises into reality is already rare and commendable in the crypto world. Unfortunately, reality is ruthlessly pragmatic—markets won’t pay for ideals. Amid today’s lack of applications and liquidity, the tension between technological idealism and investor interests will only deepen.

II. Human Nature

Ethereum’s idealism extends not only to its assumptions about the future of applications but also to its understanding of human nature. Currently, two issues dominate discussions around Layer2s: 1) centralized sequencers; and 2) tokens. Technically speaking, Layer2s can achieve decentralization. But from a human perspective, leading Layer2 projects are unlikely to relinquish the enormous profits generated by centralized sequencers—unless decentralization itself unlocks greater token value and profit potential. For instance, the aforementioned top Layer2s could fully decentralize their sequencers, but they choose not to. These projects were built top-down, funded heavily through large-scale financing rounds, following a very Web2-style genesis and operational logic. The relationship between the community and Layer2 resembles that between consumers and cloud server providers. Just as frequent AWS users might receive coupons or cashback, Layer2 users get airdrops. But sequencer revenue is the lifeblood of Layer2s. From the project team’s standpoint, every step—from design and fundraising to development, operations, and hardware procurement—does not rely on community support. In their view, users contribute little (which explains why many Layer2 teams treat users poorly), let alone deserve a role in decentralizing sequencers. Morality alone cannot constrain Layer2 behavior. To push sequencer decentralization forward, new models must align with Layer2 operators’ economic incentives. Given the controversy such designs would provoke, a more convenient path is simply to erase or bury sequencer decentralization deep within roadmaps. Today’s Layer2s contradict Ethereum’s original intent behind embracing modularity—most are merely redefining concepts and extracting value from Ethereum.

Now consider tokens. Layer2s represent a relatively new type of blockchain in crypto, and the existence of tokens remains deeply contradictory when viewed from three angles: Ethereum, Layer2 teams, and the community. Let’s start with Ethereum’s perspective: Layer2s shouldn’t have native tokens. To Ethereum, a Layer2 is nothing more than a high-performance scaling solution requiring cross-chain interaction—a “server” charging service fees. This model keeps both parties healthy and ensures long-term sustainability by stabilizing ETH’s value and dominance. To make it more concrete: if we compare the entire Layer2 ecosystem to the European Union, maintaining euro stability is essential. If too many member states issue national currencies undermining the euro, both the EU and the euro will collapse. Interestingly, Ethereum does not restrict Layer2s from issuing tokens, nor does it mandate ETH as the sole gas fee currency. This open regulatory stance is indeed very “crypto.” However, as ETH continues to weaken, these “EU members” are getting restless. Leading Layer2 launch tools now clearly allow projects to set any token as gas and integrate any available DA solution. Additionally, one-click chain deployment could lead to the formation of small Layer2 alliances.

On the other hand, from the Layer2 and community perspectives, even if ETH rebounds strongly in the future, the position of tokens remains awkward. Top Layer2 teams were initially hesitant about launching tokens—not only because of conflicts with Ethereum, but also due to regulatory risks, sufficient funding without needing token-based financing, difficulty in properly assigning utility to tokens, and the fact that using ETH directly accelerates TVL and ecosystem growth. Issuing their own token might contradict this goal, especially since no token can match ETH’s liquidity.

Again, it comes down to human nature: who could resist printing billions out of thin air? Furthermore, from the community and ecosystem development standpoint, tokens arguably should exist—why settle for fixed service fees when you can also have a treasury to liquidate at any time? But token design must account for the above constraints, minimizing utility. Thus emerged a series of air tokens—unstakable, unmineable, serving only voting purposes—with linear releases constantly siphoning liquidity from the market. Over time, these unmotivated tokens inevitably decline after initial airdrops, failing to deliver results for either communities or investors. Should they add utility? Any meaningful utility would clash with previous concerns, creating a catch-22. The current state of the “Four Heavenly Kings” well illustrates this dilemma.

Base, which hasn’t issued a token, is now thriving far more than zkSync or Starknet, with sequencer revenue even surpassing OP—the creator of Superchain. As previously discussed in articles on attention economics, leveraging social media influence, marketing, and pump-driven wealth effects across memes and multiple projects functions as an indirect, repeated micro-airdrop—much healthier than direct token issuance followed by one-time airdrops. It sustains attraction while avoiding numerous pitfalls. Allocating part of sequencer revenue monthly allows continuous engagement and fosters a virtuous cycle. One final note: current Web3 loyalty programs barely scratch the surface of PDD’s mechanics. Coinbase’s steady, long-term operational strategy vastly outperforms overnight successes like Bitget.

III. Destructive Competition

Homogenization exists not only between L1 and L2, but among L2s themselves. This stems from a critical issue: this cycle hasn’t produced many independent applications capable of supporting dedicated app-chains, and the few that did succeed eventually “ran away” (e.g., DYDX). As things stand, all Layer2s essentially target the same users—even overlapping with Ethereum’s core user base. A troubling trend has emerged: Layer2s are cannibalizing Ethereum, while competing viciously among themselves for TVL. No one understands the differences between these chains; users decide where to deposit funds or trade based solely on reward campaigns. Homogenization, fragmentation, and liquidity scarcity—within Web3’s public chain ecosystem, Ethereum currently stands alone in embodying all three simultaneously. These problems also stem from the downsides of Ethereum’s own open ethos. We may soon witness the natural elimination of many Layer2s, while centralization issues trigger further chaos.

IV. The Guru Doesn’t Understand Web3

Whether referring to the past "V God" or today’s KOL-coined “Little V,” Vitalik’s contributions to infrastructure have undeniably fueled the industry’s prosperity since Satoshi’s era—an undeniable fact. Yet the reason he’s now called “Little V” goes beyond personal matters—it reflects a popular belief that the Ethereum guru doesn’t understand DApps, let alone DeFi. I partially agree. Before delving deeper, however, one thing must be clarified: Vitalik is just Vitalik—neither an omnipotent deity nor an authoritarian failure. In my eyes, he’s actually one of the more humble and diligent public chain leaders. Anyone reading his blog knows he publishes one to three articles monthly on philosophy, politics, infrastructure, and DApp topics, and actively shares thoughts on Twitter. Compared to other chain leaders who frequently attack Ethereum, Vitalik appears far more pragmatic.

Having said the positives, here are three issues I see with Vitalik:

1. His influence over the space is too great—ranging from retail investors to VCs. Everyone watches his words and actions; “To Vitalik” entrepreneurship has become a pathological trend among Web3 founders;

2. He is overly committed to technologies he personally favors, sometimes even endorsing them publicly;

3. He may genuinely not understand what crypto users really want.

Let’s begin with Ethereum’s scaling needs. The argument that Ethereum urgently requires scaling often cites the surge in on-chain activity during 2021–2022, driven by abundant external liquidity. But whenever Vitalik discusses this, he seems to miss that this was clearly a short-term phenomenon and fails to grasp why users came to the chain in the first place. Another example: he repeatedly emphasizes ZK’s technical superiority on Layer2s, yet ZK solutions are clearly less friendly in terms of user experience and ecosystem growth. Today, countless ZK Rollups created “To Vitalik”—including not just Tier 2 or Tier 3 projects, but even the two leading giants—are on the brink of collapse. Meanwhile, the performance of the three major Optimistic Rollups exceeds the sum of dozens of ZK Rollups combined. Other examples include his sweeping criticisms of MPC wallets last mid-year, where he directly endorsed AA wallets instead. Earlier, he proposed SBTs, which proved largely impractical and were later abandoned. Overall, the technical directions Vitalik has supported in recent years have performed poorly in the market. Most recently, his comments on DeFi have been puzzling. All things considered, Vitalik is far from perfect—he’s an excellent, idealistic developer, yet lacks deep understanding of user needs and occasionally expresses subjective opinions on topics he doesn’t fully grasp. The industry needs to demystify him and objectively evaluate the controversies surrounding him.

V. From Virtual to Real

From the ICO boom of 2016 to the P2E bubble of 2022, throughout the history of constrained and evolving infrastructure, each era has seen its matching Ponzi schemes and emerging narratives, driving the industry toward ever-larger bubbles. Now, we’re experiencing a period of bubble deflation—well-funded projects self-destructing, grand narratives repeatedly failing, and a growing value gap between Bitcoin and altcoins. How to do meaningful work has been the central theme I’ve emphasized in multiple articles this year. The shift from virtual to real is now the prevailing trend. When Ethereum embraced modularity, many declared the end of “Ethereum killer” narratives. Yet today’s hottest ecosystems are TON and Solana—have they introduced any innovations that truly change crypto? Are they more decentralized or secure than Ethereum? No. Do they offer any novel narratives? Not really. They simply take abstract-sounding ideas and implement them more like actual applications, integrating blockchain advantages at a level closer to Web2 standards—and that’s it.

In an environment where internal volume grows geometrically but external liquidity remains scarce, striving for new narratives still cannot fill Ethereum’s Layer2 blockspace. As the industry leader, Ethereum must first address fragmentation and internal decay within its Layer2 ecosystem. Particularly concerning is the Ethereum Foundation (EF)—not mentioned earlier—which, despite spending vast sums, has failed to deliver commensurate impact. With Layer2 infrastructure already excessively saturated, why does EF still prioritize funding infrastructure above all else? Even leading CEXs are humbling themselves and seeking transformation. Yet EF, a key organization meant to accelerate ecosystem growth, is moving in reverse.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News