Cowswap Governance Proposal Update: Introducing Protocol Fees – A New Boost for COW Token?

TechFlow Selected TechFlow Selected

Cowswap Governance Proposal Update: Introducing Protocol Fees – A New Boost for COW Token?

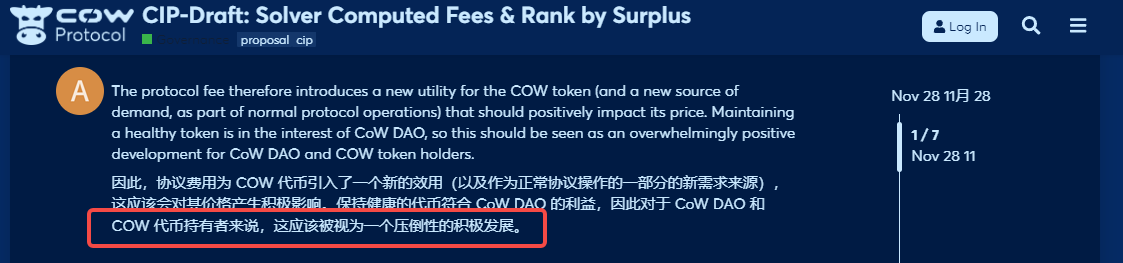

The proposal itself is highly positive for COW token holders.

Author: TechFlow

In the DEX sector, beyond established players like Uniswap and Sushiswap, which emerging projects are worth watching?

Today’s DEXs have long moved past the era of simply competing on number of trading pairs, liquidity, and depth. The focus now is increasingly on reducing costs and improving efficiency for users—achieving more effective trades at lower transaction costs.

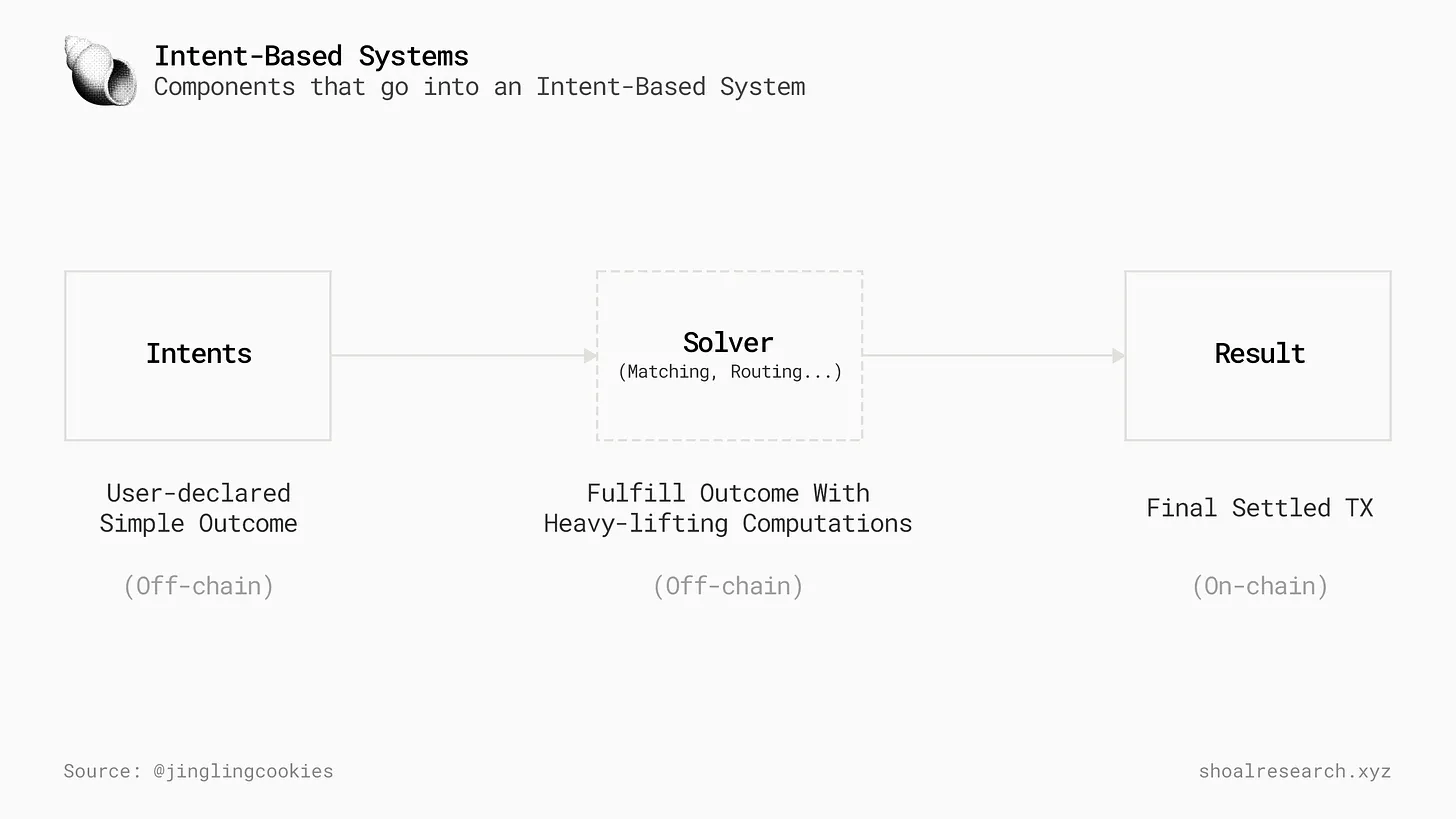

Therefore, when evaluating new protocols, it's important to consider alignment with current narrative trends such as “intents” and MEV. The former can significantly enhance trade execution efficiency, while the latter helps reduce transaction costs.

Following this logic, Cowswap is undoubtedly a project that stands out.

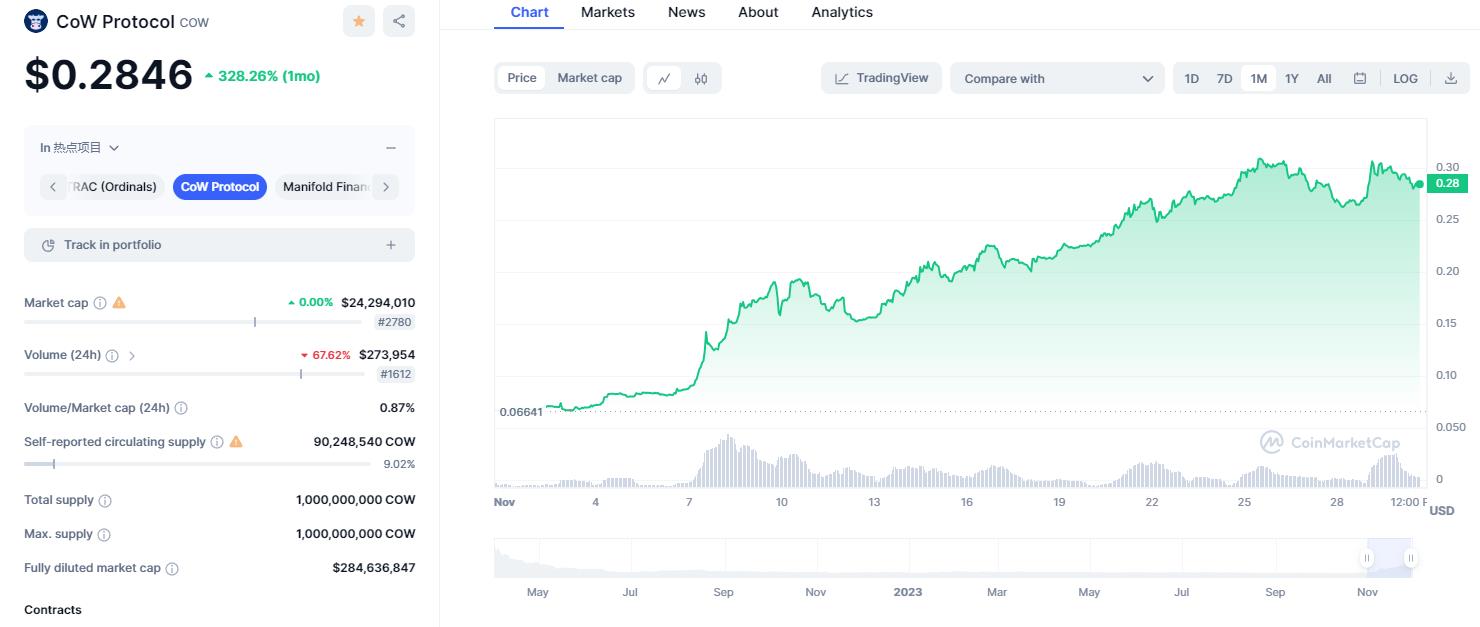

Combining batch trading, intent-based execution, and MEV protection, Cowswap targets cost reduction and efficiency gains in user trading. It has rapidly risen during this recent market uptick, with its COW token surging 360% over the past month;

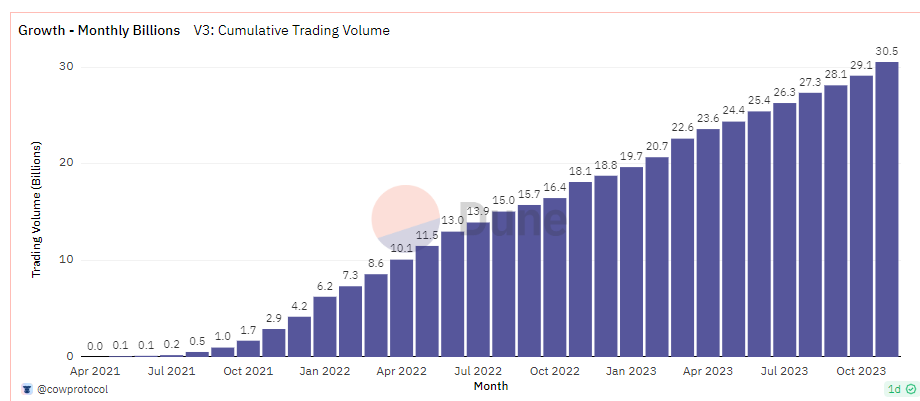

On fundamental metrics, trading volume on Cowswap continues to climb, reaching $30 billion in the last month alone. While still far behind giants like Uniswap in scale, its upward momentum has made it a focal point across crypto social media and research circles recently.

Beyond these background facts, on November 28, Cowswap’s community quietly launched a proposal aiming to improve the protocol’s current fee distribution model, creating a win-win-win scenario for users, solvers (a key role in the protocol responsible for executing trades), and the protocol itself.

Additionally, the proposal introduces the concept of protocol fees, signaling that Cowswap will now generate its own revenue.

For us, however, the key takeaway is this: the official proposal explicitly states that this proposal carries strong positive implications for holders of the COW token.

In other words, the value of the COW token may increase due to this proposal, potentially serving as a bullish catalyst for its secondary market price.

Given that the COW token has already seen significant gains recently, could this proposal act as a new catalyst to sustain its upward trajectory?

In this article, we’ll break down the proposal and examine Cowswap’s core innovations.

Governance Proposal Update: Introducing Protocol Fees and Incentivizing Solver Competition

Before understanding the proposal, it’s essential to clarify a critical role within Cowswap: the Solver.

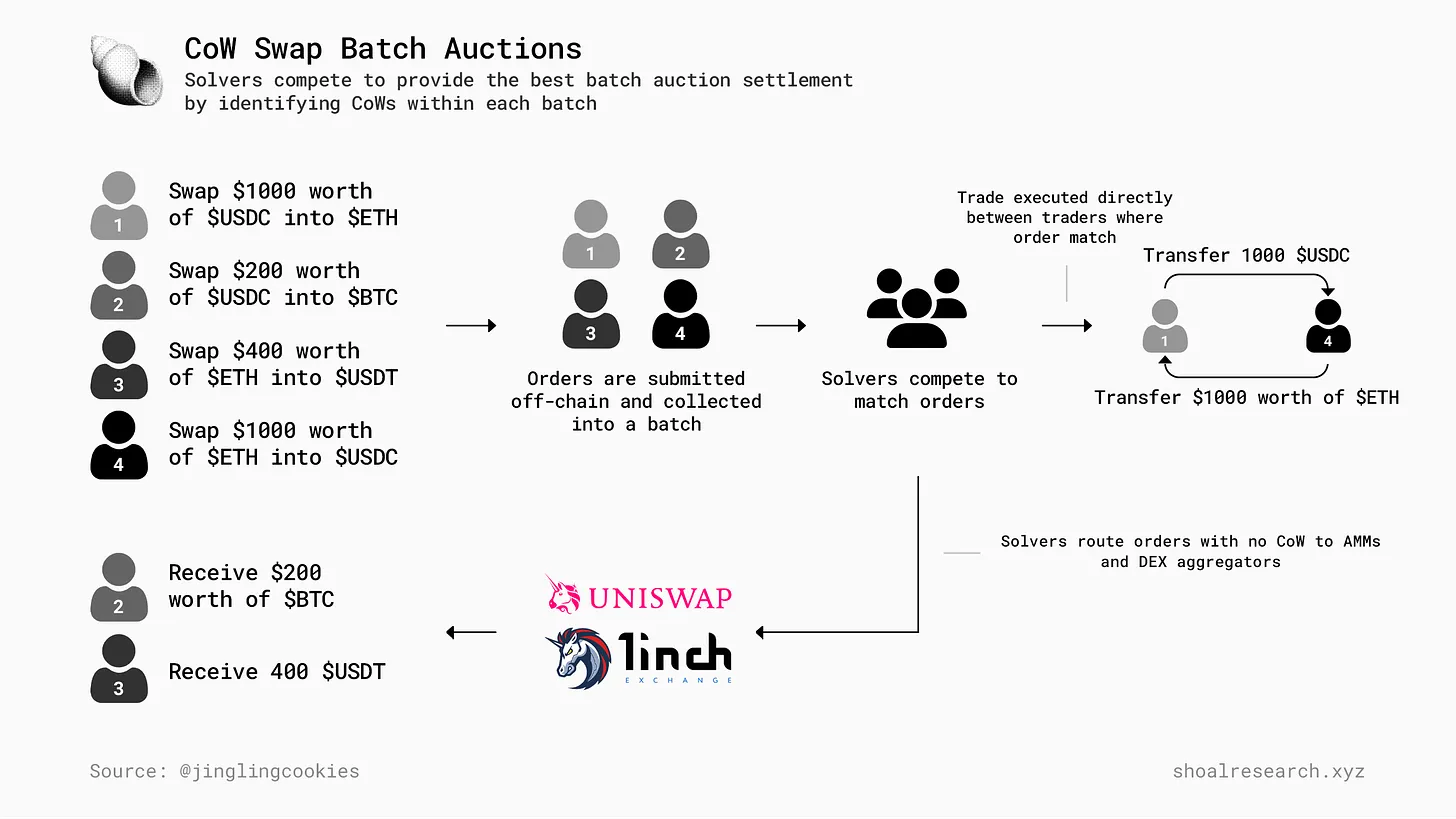

Unlike traditional AMMs or order book models, Solvers play a central role in trade settlement on Cowswap:

-

Users express their trading intent—what outcome they want from a trade;

-

Cowswap bundles these intents into batches of grouped orders;

-

Solvers compete to provide the optimal execution path for these batches, maximizing user surplus (i.e., how much more value users receive compared to default market rates);

-

Solvers may use a combination of off-chain matching and on-chain swaps. Those who successfully execute orders in the batch auction are rewarded.

Setting aside complex DeFi terminology, we can understand this process simply:

You want to trade; I find a Solver to do it for you—and reward them accordingly.

Why involve a Solver?

In the world of CoW Swap, Solvers act like sharp financial brokers, constantly searching for the best possible trade routes to ensure every transaction clears at the optimal price and lowest cost. Their work is precise and complex, requiring deep market insight and strategic acumen.

Put another way, a Solver functions as an optimized trading agent.

For example, if you want to swap 1,000 USDC for ETH, and a Solver finds someone looking to do the reverse, the two orders can be matched directly off-chain. This reduces transaction costs and achieves the cost-efficiency goal mentioned earlier.

This situation is known as a coincidence of wants—the very principle behind Cowswap’s name.

With the role of the Solver clarified, let’s now analyze the changes proposed in the governance update.

-

Before the Proposal: Charge First, Reimburse Later

What motivated Solvers to seek optimal trade paths before the proposal?

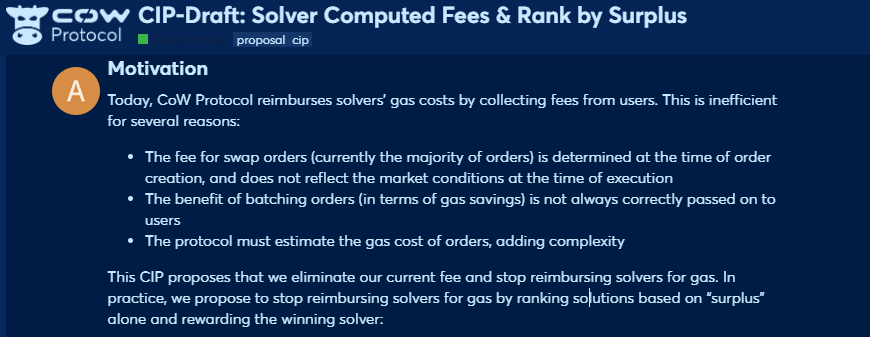

Previously, CoW Protocol charged users a fee upfront, then used those funds to reimburse Solvers for their gas costs incurred during execution.

Additionally, the system selected the solution offering the best clearing price—maximizing user returns (e.g., minimizing slippage)—and the Solver submitting the best solution received a reward in COW tokens.

However, charging users first and later reimbursing Solvers led to several issues:

1. The swap fee charged to users was fixed at order creation and did not reflect real-time market conditions. During execution, gas prices might spike, leaving the collected fee insufficient to cover actual gas costs.

2. Users were charged upfront, making it difficult for them to appreciate the nuanced benefits of having a Solver match and bundle their orders. Even though this ultimately leads to lower slippage and better pricing, being charged immediately feels less favorable.

3. Cowswap had to pre-estimate gas costs for each user order, increasing computational load and complexity for the protocol.

-

After the Proposal: Self-Charging and Encouraging Competition

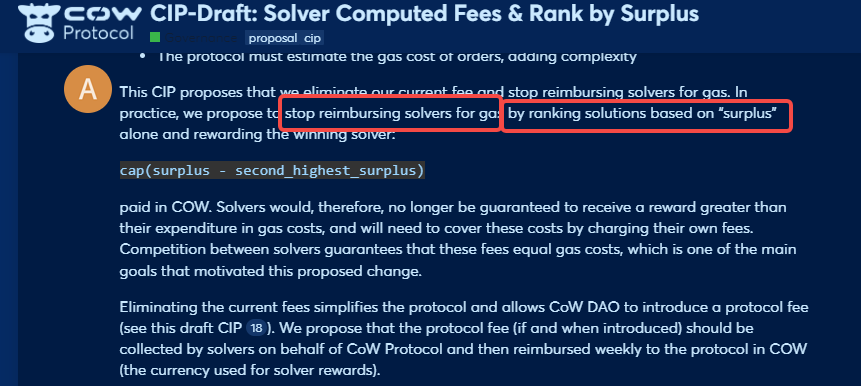

1. Under the new proposal, Solvers are no longer guaranteed reimbursement exceeding their gas costs.

2. Instead of charging users upfront, Cowswap allows Solvers to directly charge users a “network fee” at execution time based on current network conditions, covering their operational costs.

3. Solver rewards will now depend entirely on how much “surplus” they generate for users—the extra value users gain through optimized trade matching, typically reflected as lower slippage than standard benchmarks.

4. Additionally, the proposal enables CoW DAO to introduce a protocol fee. This fee would be collected by Solvers on behalf of the protocol and then reimbursed weekly to the protocol treasury in the form of COW tokens.

In essence, instead of the protocol collecting optimization fees from users, Solvers now collect them directly—with a portion flowing back to the DAO in COW tokens, forming a genuine protocol revenue stream.

From the user’s perspective, the quoted price during a swap remains unchanged—the difference lies only in the internal accounting.

Under the new model, Solvers are incentivized to maximize user surplus—delivering better-than-expected execution (e.g., tighter slippage). This improves user experience and encourages Solvers to become more efficient in finding optimal trade routes.

Positive for the COW Token?

How might this proposal impact the COW token?

As previously noted by TechFlow in our translated piece titled CoW Protocol: A Promising Project Backed by High Revenue Expectations and MEV Business, over the past 18 months, $COW has underperformed relative to $ETH.

One contributing factor was the inflationary COW token rewards paid to Solvers.

Under the old model, the protocol charged users, used part of the proceeds to reimburse Solvers for gas, and additionally rewarded them in COW tokens for optimizing trades.

Under the new proposal, Solvers can charge users directly—meaning they expect to recover gas costs and make some profit on top.

A key shift here is that the collected fees will likely be in ETH (since Cowswap operates on Ethereum), making it natural to use ETH for gas payments.

This means the protocol may no longer need to pay Solvers in COW tokens, but instead allow them to keep excess ETH after covering gas. Moreover, due to the introduction of the “protocol fee,” Solvers must now return a certain amount of COW tokens to the protocol weekly. This implies:

The circulating supply of COW tokens will decrease.

According to overseas analysts’ estimates, if Cowswap successfully “flips the fee switch”—paying Solvers in ETH or stablecoins—the issuance of COW tokens could decline by over 40%.

This proposal represents exactly that step. With protocol fees now enabled, as long as there is trading activity, the protocol will continuously collect fees in the form of COW tokens directed to the DAO treasury—effectively reducing the circulating supply.

Real revenue + reduced circulation + MEV protection/intent narrative—all theoretically bullish for the COW token price.

That said, Cowswap still lags significantly behind leading DEXs in terms of market cap and volume. Sustained user adoption and ability to capture greater market share will ultimately determine the project’s success.

The proposal offers a promising economic outlook, but real-world performance depends on market validation and user choice.

Moreover, the proposal has not yet been formally approved and, following governance timelines, may not take effect until next year.

As a utility-driven rather than meme-based protocol, solid fundamentals set the floor. Short-term narratives and incentive programs may briefly lift the ceiling, but investors should weigh both long- and short-term factors alongside their personal strategies.

Lastly, due to space constraints and the excellent work already done by others, this article does not go into full detail on Cowswap’s product design or tokenomics—plenty of resources already cover those topics extensively.

Some references:

Cowswap growth outlook: CoW Protocol: A Promising Project Backed by High Revenue Expectations and MEV Business

Product design deep dive: CoW Swap: Intents, MEV, and Batch Auctions

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News