Decoding Bittensor (TAO): An Ambitious AI Lego Making Algorithms Composable

TechFlow Selected TechFlow Selected

Decoding Bittensor (TAO): An Ambitious AI Lego Making Algorithms Composable

We don't create algorithms; we're just搬运 workers for high-quality algorithms.

Market trends are shifting, with multiple sectors becoming active again.

Beyond the spotlight on Bitcoin's ecosystem, the AI sector has remained a persistent hotspot this year, consistently spawning meme coins.

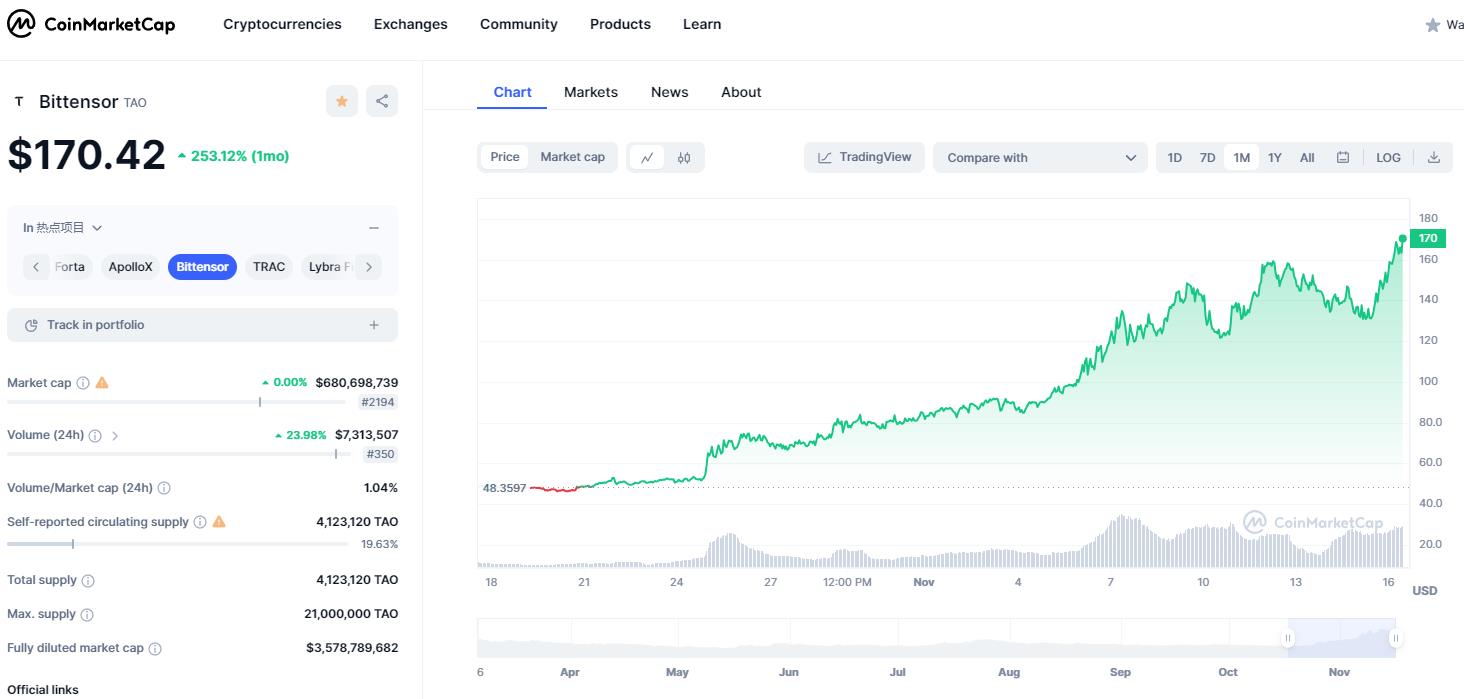

Beyond heavily hyped tokens like FET, RNDR, and OCEAN, another token named TAO has surged threefold in the past month. The project behind it, Bittensor, however, has rarely received in-depth analysis in Chinese-speaking markets.

Yet, developments overseas have moved far faster than our response.

The sharp price rise has also caught the attention of sharp-eyed investors. On Thursday, the Bittensor community announced that prominent crypto VCs Pantera and Collab Currency have become holders of the TAO token and will provide further support for the project’s ecosystem development.

VCs are skilled not only at detecting trend shifts but also at accelerating them.

What exactly makes this favored and rapidly rising TAO so special? What distinguishes its narrative, product, and tokenomics from mainstream AI projects?

In this article, we’ll dive deep into Bittensor, analyzing its sector context, project goals, technical architecture, and token valuation to help inform your judgment and decisions.

Hold On—First Understand the Investment Logic of Crypto + AI

Any token’s price increase is supported by fundamental investment logic and broader industry narratives. Before examining TAO, let’s first review the overall AI landscape.

Bond Bubble-Fueled AI Boom

AI-related tokens are hot, but AI itself would remain popular even without crypto.

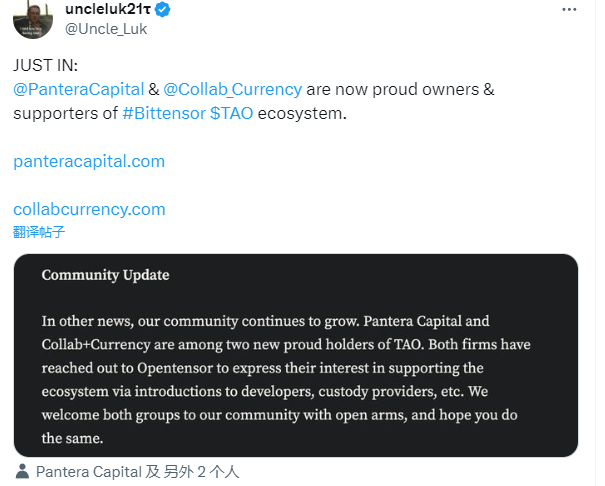

According to CB Insights, interest in generative AI surged in 2023, with total funding for AI-related companies and projects soaring to $14 billion—up from just $2.5 billion the previous year.

Image source: CB INSIGHTS

Therefore, the underlying drivers behind tokens like TAO, RNDR, or FET go far deeper than surface-level ChatGPT or NVIDIA hype.

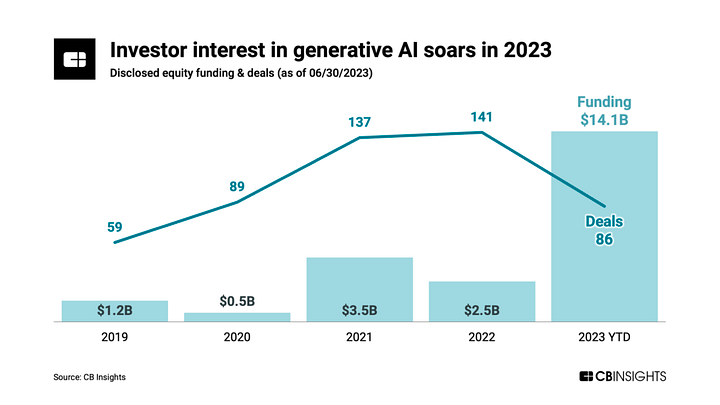

Industry veteran Arthur Hayes recently laid out a plausible—or already unfolding—scenario in his blog: a collective capital surge into AI driven by a bond bubble.

Estimates suggest that major global economies, led by the U.S., will need to roll over or issue approximately $33.58 trillion in government debt over the next three years due to fiscal deficits.

When governments issue bonds promising interest payments, high yields attract capital away from the private sector (i.e., non-governmental enterprises), squeezing other investment opportunities—such as corporate fundraising or stock market performance.

Arthur argues that central banks will inevitably resort to printing money to buy their own debt, mitigating pressure on the private sector. This could lead to a massive expansion of the world’s fiat money supply by 2026—possibly exceeding even the levels seen during the pandemic.

Where will all this excess liquidity flow?

“Money will flow into new technology companies that promise explosive returns when mature. Every fiat liquidity bubble features a new form of technology that attracts investor attention and vast amounts of capital.”

The 1990s had the dot-com bubble; post-2008 crisis saw online advertising and social media; now, it’s AI’s turn.

This may be one of the deeper reasons why generative AI attracted so much investment this year. While GPT’s technological achievements are undeniable, under a broader lens, it stands as the brightest jewel in a flood of capital now rushing into AI.

Crypto + AI: Narrative Frameworks

With capital flowing in, the next question is: what to invest in? Let’s examine the investment logic of Crypto + AI more closely.

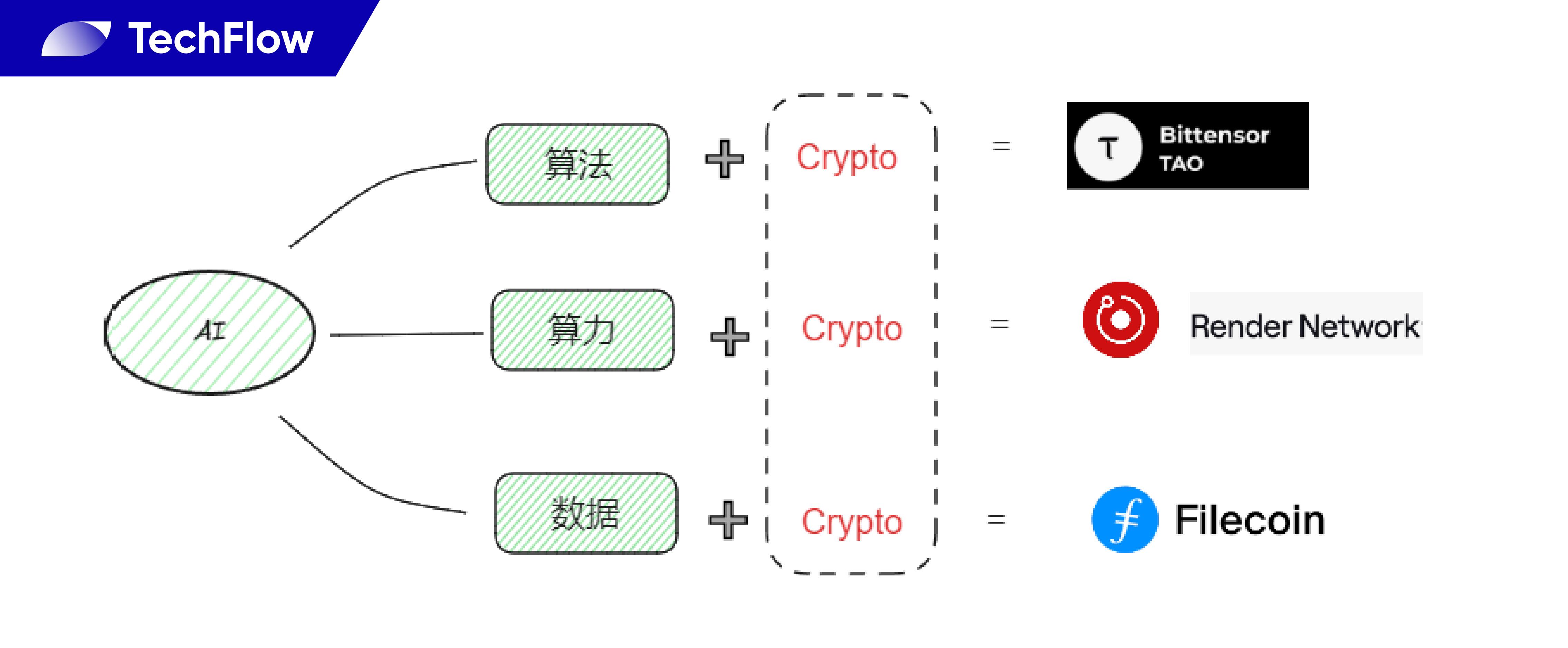

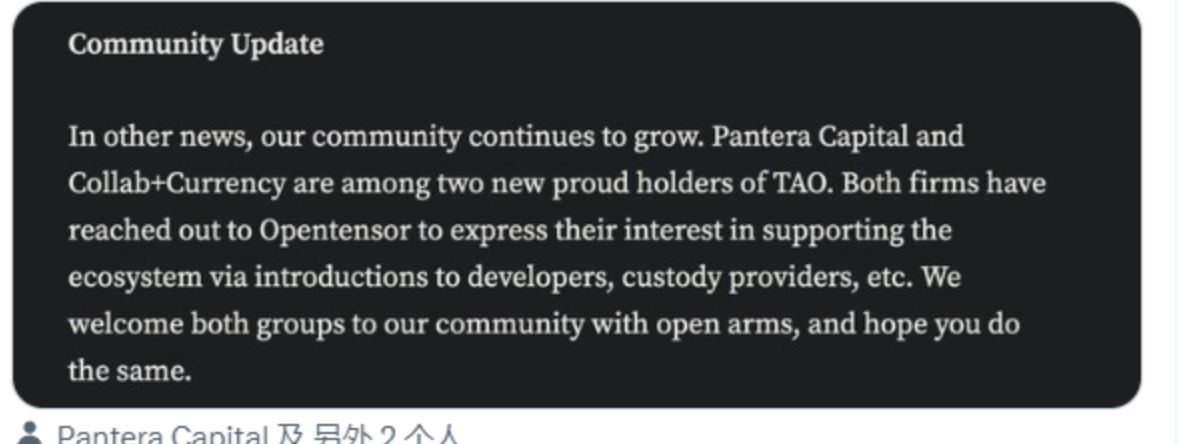

As commonly understood, AI is fundamentally an advanced productive force whose rapid development relies on three core elements: data, algorithms, and computing power. Cryptocurrencies and blockchains, by contrast, represent changes in production relations—using incentives, coordination, and organizational models to enhance these three elements.

Tokens that can improve any of these three components gain potential relevance.

Setting feasibility aside, existing projects have largely focused on two narrative directions: crypto + data and crypto + computing power:

-Crypto + Data: AI requires massive datasets for model training. Blockchains can incentivize data contributors or use decentralized storage to enable more democratic and distributed data training.

Under this narrative, beneficiaries include decentralized infrastructure projects like Filecoin, which Arthur strongly advocates.

-Crypto + Computing Power: Running AI models demands significant computational resources. While large firms control much of this capacity, long-tail participants—such as individuals offering GPU power—can contribute via decentralized networks and earn crypto rewards.

Projects like RNDR and similar compute-sharing initiatives benefit under this model.

The third element—algorithms—follows a different logic.

-Crypto + Algorithms: Unlike the resource-intensive nature of data and computing, algorithms are highly technical and proprietary—the secret sauce continually refined by AI companies. It’s difficult to use crypto incentives to “create” better algorithms from scratch. Incentive mechanisms don’t easily apply to algorithm creation.

(Note: An AI model is the output of algorithmic training. Strictly speaking, there’s a distinction between algorithms and models. However, for clarity, they are used interchangeably here.)

However, you can use incentives to “select” better algorithms from existing ones, avoiding reliance on a single provider. Similar to how oracle projects use incentives to encourage competition among data sources.

Few standout projects exist in this niche, but Bittensor is one of them—neither contributing data nor computing power directly, but using a blockchain network and incentive mechanism to orchestrate and select among various algorithms, creating a free-market ecosystem where AI models compete and share knowledge.

Quick Guide to Bittensor’s Narrative: AI LEGO, Making Algorithms Composable

Sounds complicated?

To simplify, here’s a one-liner summary of Bittensor: We don’t create algorithms—we’re just movers of high-quality ones.

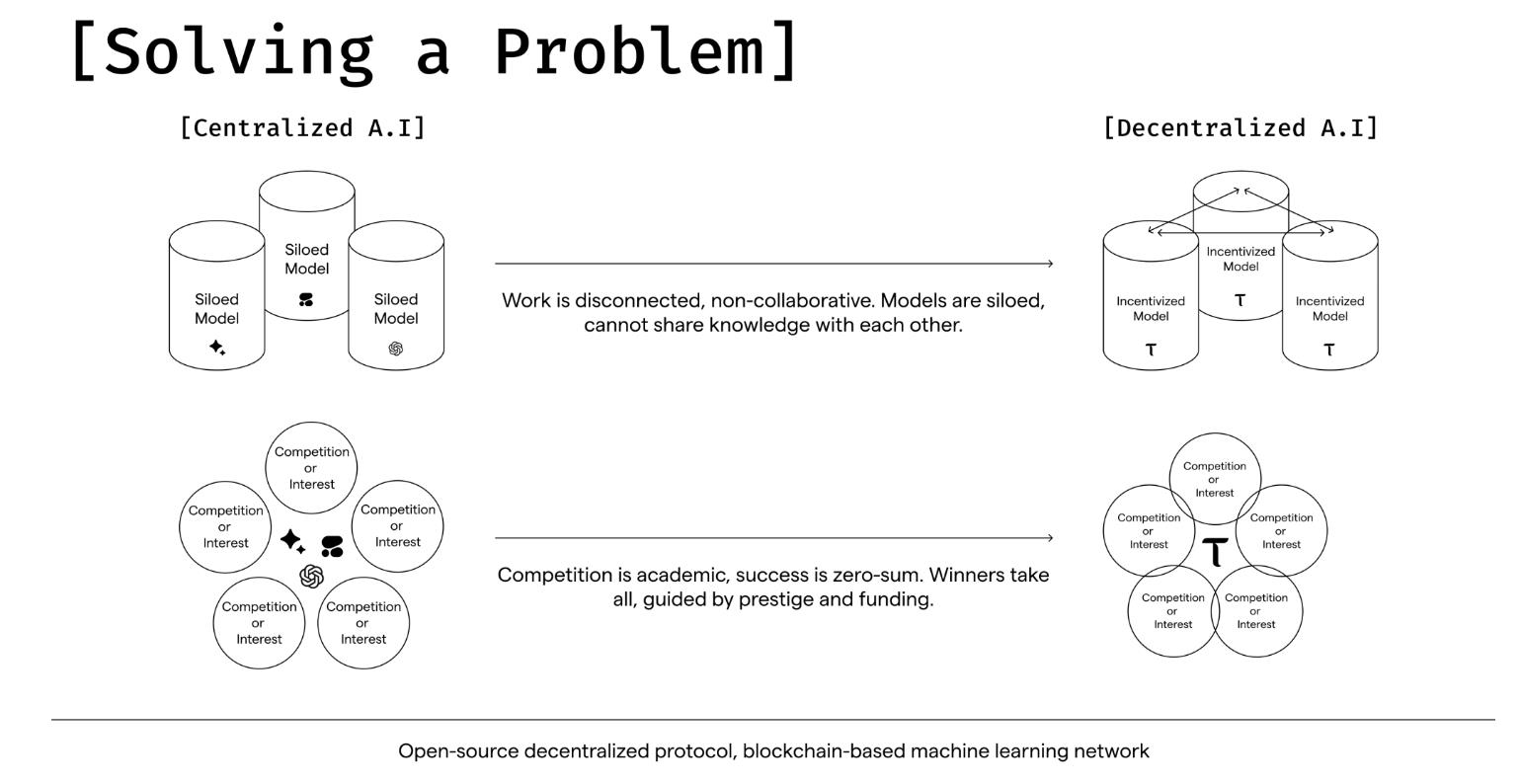

Why move algorithms? Looking at today’s AI landscape reveals the problem.

Current AI players operate with isolated algorithms and models. Due to commercial competition, companies won’t let their models learn from each other. From the supply side, this makes AI a zero-sum game: one winner takes all, others get left behind.

Image source: Bittensor official website

For the winners, this works fine.

But Bittensor argues this harms overall AI progress and innovation efficiency. Isolated models and winner-take-all services mean anyone developing a new model must start from scratch.

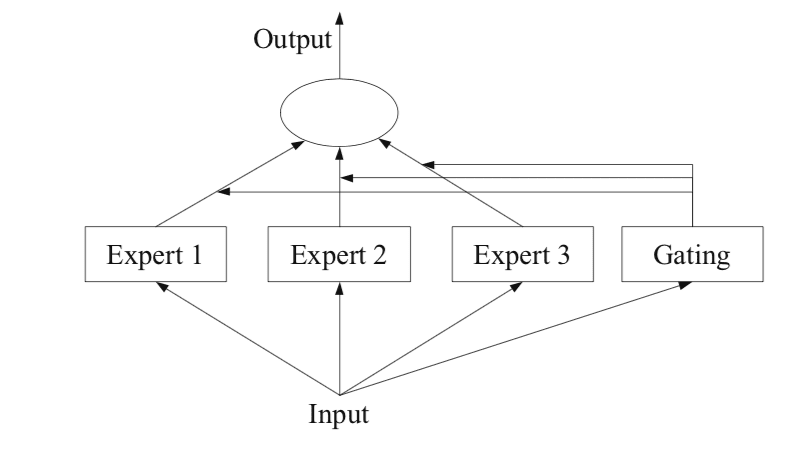

Suppose Model A excels in Spanish and Model B in coding. If a user wants an AI to explain code with Spanish comments, combining both models clearly produces better results—but current systems can’t do this.

Additionally, because third-party apps require permission from model owners, limited functionality restricts value creation—the full collaborative potential of AI remains untapped.

Thus, Bittensor’s overarching goal is to enable different AI algorithms and models to collaborate, learn from, and combine with one another, forming stronger models that better serve developers and users.

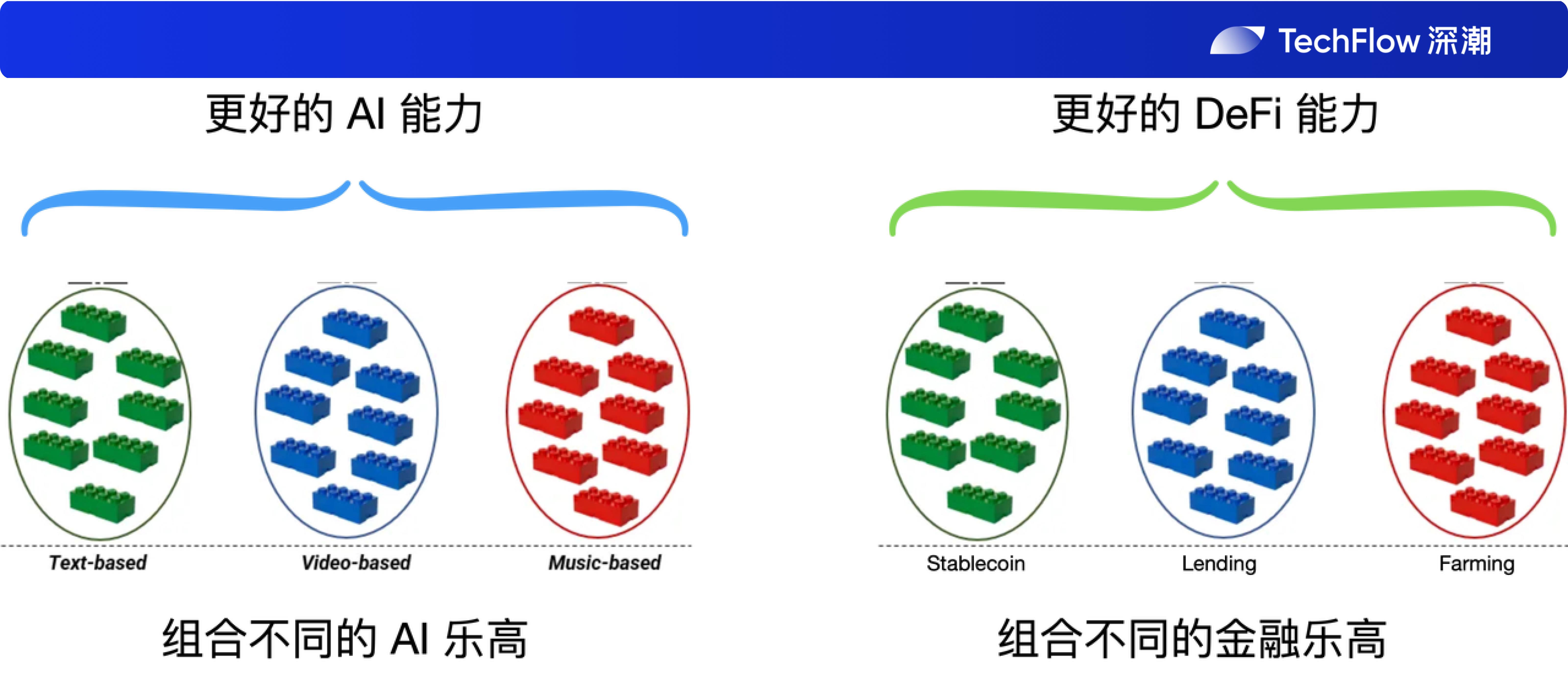

We’ve seen this approach before—in DeFi Summer—with financial legos.

Stablecoins, lending protocols, and liquidity mining were all open-source and permissionless. Users could freely combine them like LEGO bricks to build new products and services.

Similarly, AI models specialized in image processing, text generation, or audio analysis can be combined to serve diverse tasks—forming AI Legos.

So, Bittensor itself neither performs computations nor provides on-chain machine learning data. Instead, it coordinates external off-chain AI models to work together.

Theoretically, by assembling AI LEGO blocks, Bittensor could expand its AI capabilities faster and more efficiently than isolated models.

However, whether real-world AI providers will participate, how commercial adoption will proceed, and practical implementation remain to be seen.

Using Mining and Incentives to Build an AI Model “Oracle”

Enabling collaboration among diverse AI models is an ambitious goal—but how does Bittensor achieve it?

Bittensor’s answer is to build a blockchain network coordinated through mining incentives.

At its core, Bittensor uses Polkadot’s parachain (application-specific chain) design—an independent chain dedicated to coordinating AI models, with its own $TAO token for incentives.

To understand how this chain operates, we need to clarify three key aspects:

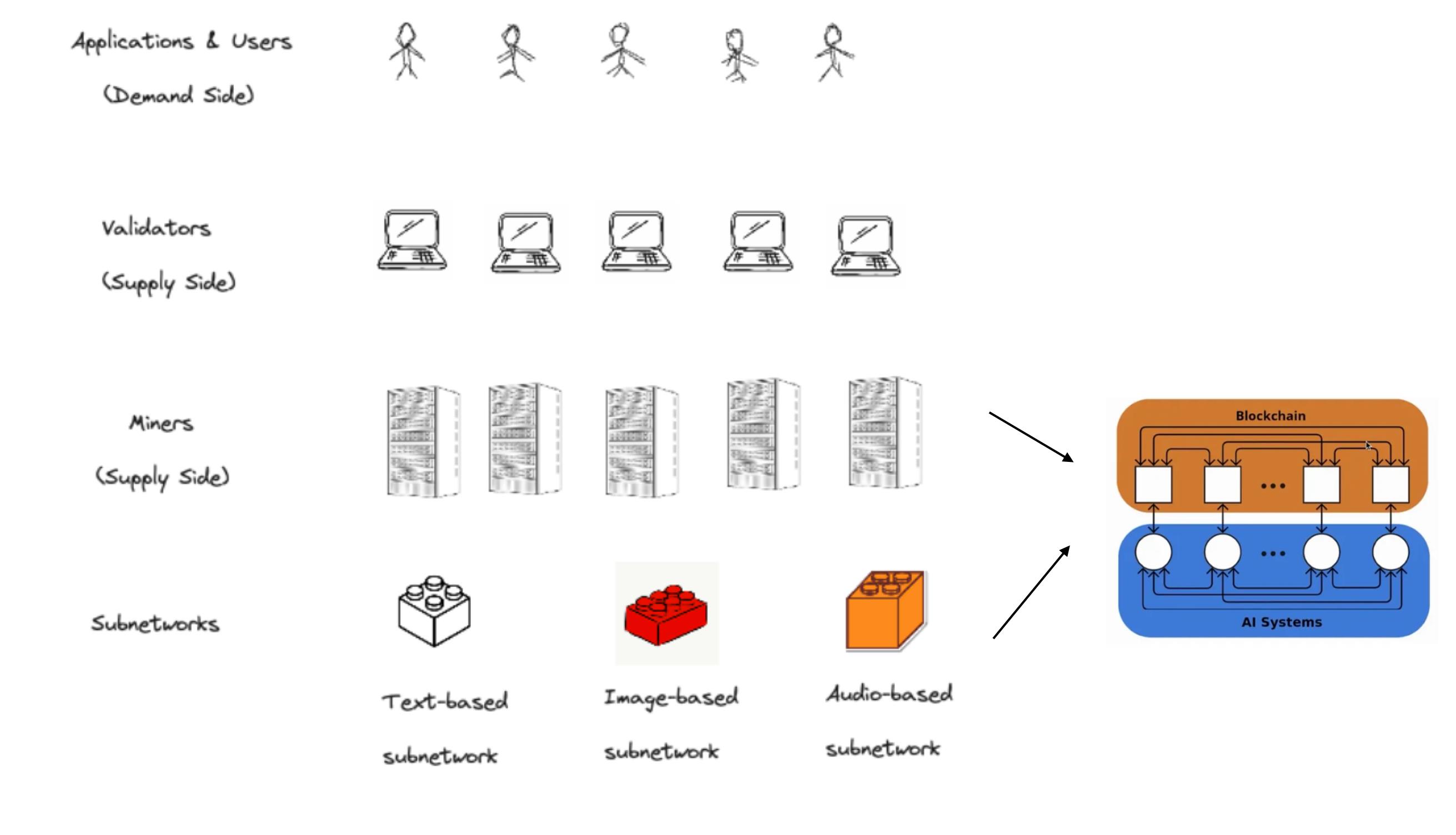

First, who are the participants on this chain?

Second, what do they do, and how are they connected?

Third, what behaviors does the token incentivize?

-

On-chain Roles and Functions:

-

Miners: Providers of AI models worldwide. They host AI models and offer them to the Bittensor network. Different model types form subnets—for example, models specializing in images or audio.

-

Validators: Evaluators within the Bittensor network. They assess the quality and effectiveness of AI models, ranking them based on task-specific performance to help users find optimal solutions.

(Note: Current validators appear to be primarily affiliated with the project teamorganizations, raising decentralization concerns. But as the network grows, other entities may join as validators.)

-

Nominators: Stake TAO tokens to delegate support to specific validators, similar to staking tokens with Lido in DeFi for yield.

-

Users: End consumers of AI models provided by Bittensor—individuals or developers building applications.

-

Interactions Between Roles:

Users seek better AI models, validators evaluate and rank models by use case, miners supply their models, and nominators back preferred validators.

In essence, it’s an open AI supply-demand chain: some provide models, others evaluate them, and users consume the best outputs available.

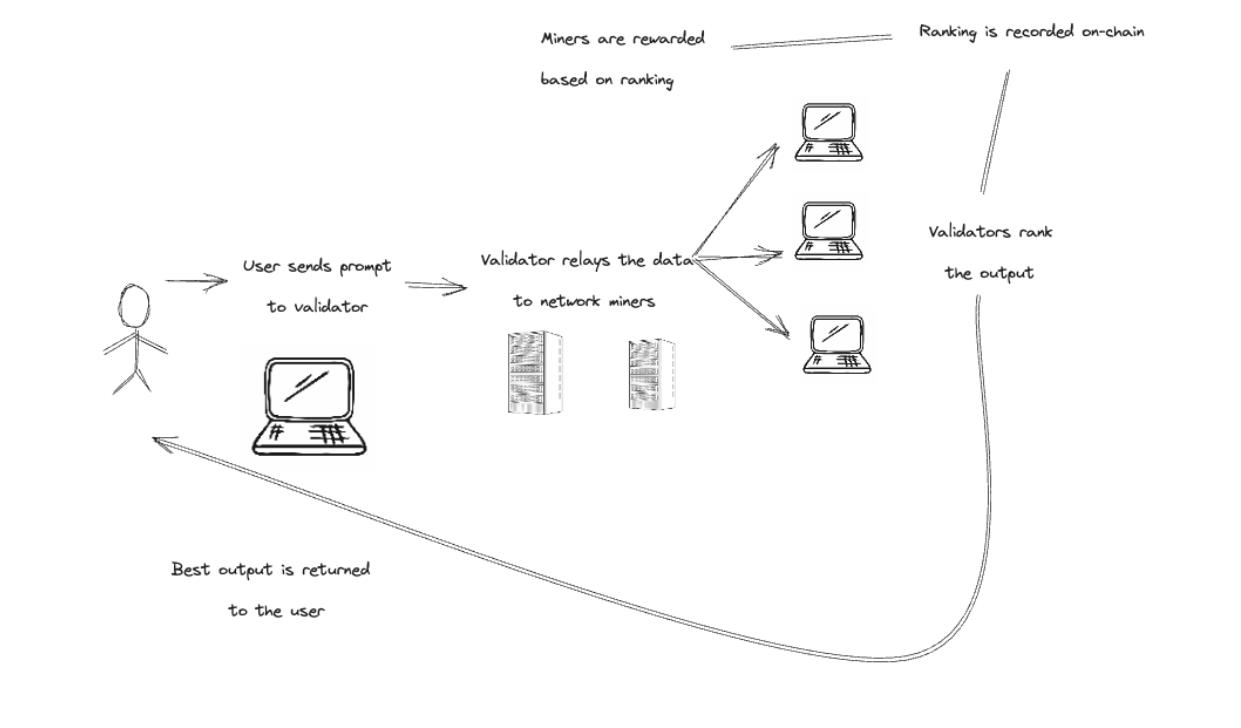

Image source: ReveloIntel

The diagram above illustrates this simply: users submit requests, validators route them to miners across the Bittensor network; miners return responses, validators score their quality, and final results are delivered to users.

-

What Does the TAO Token Incentivize?

-

For Validators: The more accurate and consistent their model evaluations, the higher their rewards. Becoming a validator requires staking a certain amount of TAO.

-

For Miners: Earn TAO by responding to user queries with their models.

-

For Nominators: Receive staking-like rewards by delegating TAO to validators.

-

For Users: Pay TAO to initiate tasks—essentially consuming the service.

Ideally, different AI models in this network collaborate, and performance varies by task. Since all activities are recorded on-chain and visible to nodes, models can actually learn from each other and adapt accordingly.

Image source: ReveloIntel

A useful analogy: Bittensor is like an AI "oracle." Just as DeFi oracles feed applications the best prices, Bittensor feeds AI users the best models.

Details on joining the network as a validator or miner involve technical code and developer interfaces, which we won’t cover here. Interested readers can refer to the official documentation.

$TAO Token: How Should We Value It?

-

Tokenomics Model

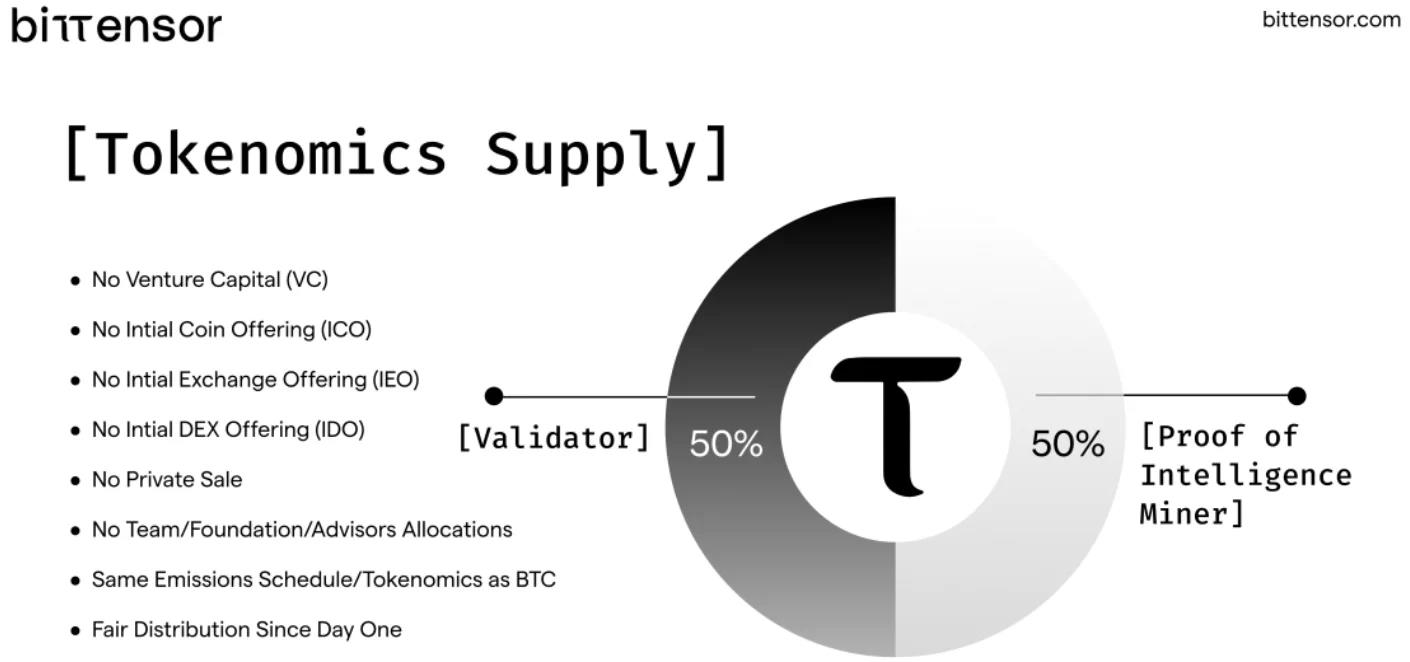

According to official documents, Bittensor launched in 2021 via a “fair launch” (no pre-mine), with the token named TAO.

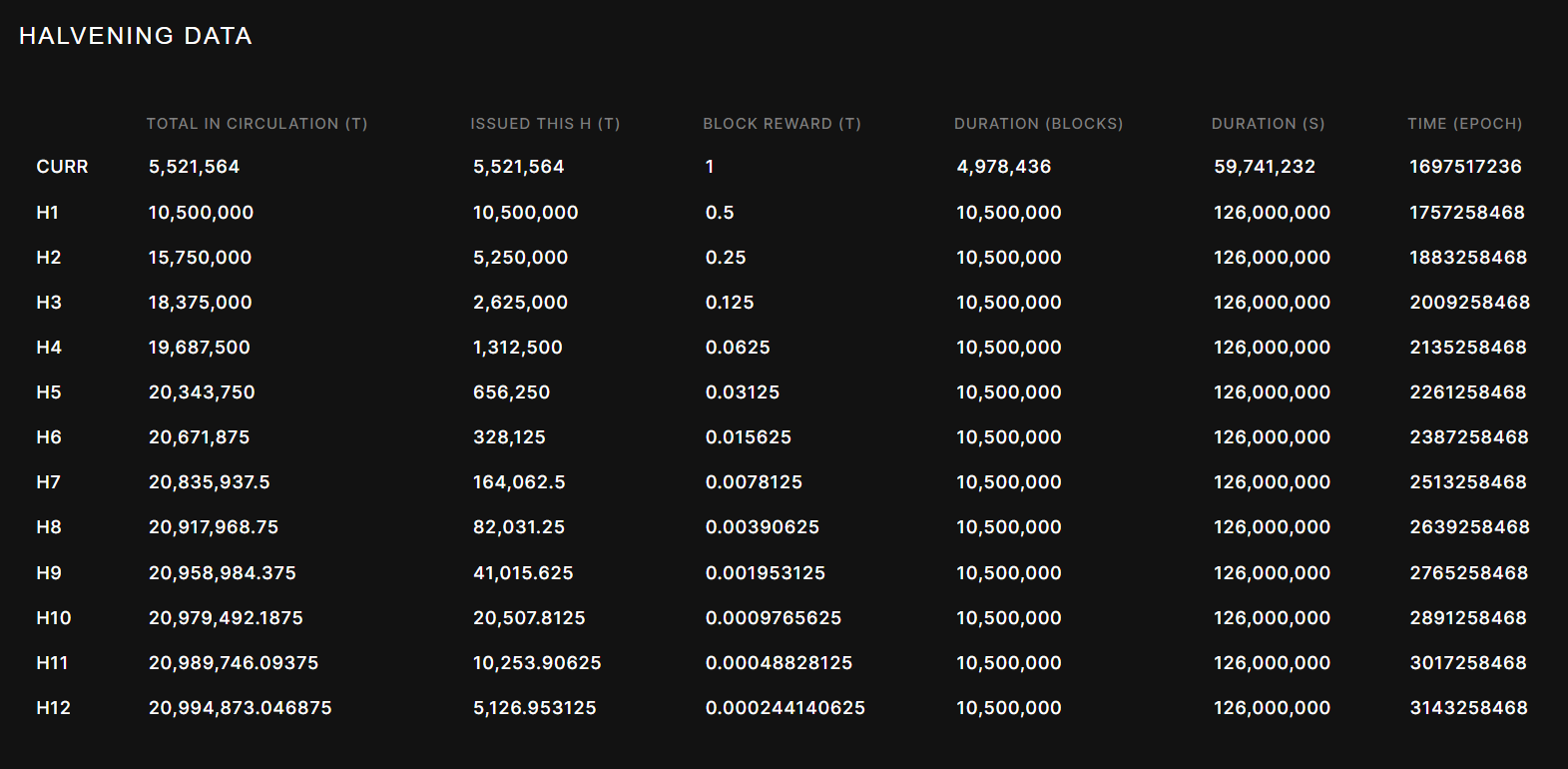

The total supply of TAO is capped at 21,000,000 (a nod to BTC), with a four-year halving cycle—block rewards cut in half every 10.5 million blocks. There will be 64 halvings in total, with the next occurring in August 2025.

Somewhat sci-fi: it will take 256 years to fully mine all TAO tokens under this schedule.

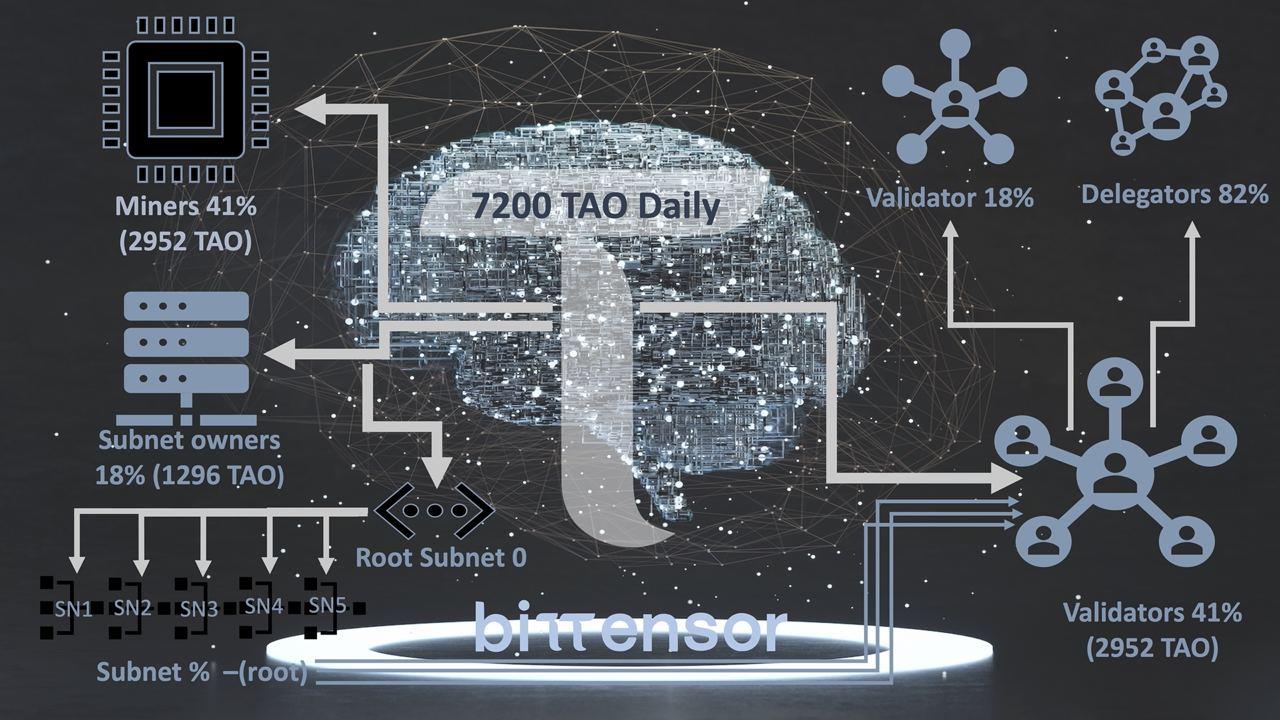

Currently, one TAO is issued every 12 seconds. Roughly 7,200 TAO are minted daily, split evenly between miners and validators.

TAO’s fair launch means no VC rounds, private sales, ICOs/IEOs/IDOs, or foundation reserves—making it a pure mining-based token.

Each reward round distributes newly minted TAO between validators and miners.

Yet, Bittensor’s website lists well-known backers such as DCG, GSR, Polychain, and Firstmask.

A reasonable explanation: since most current validators are linked to Bittensor-affiliated organizations, mined tokens likely end up in their hands, then distributed to market makers.

Additionally, large institutions can act as validators or miners themselves, directly participating in TAO mining.

As mentioned earlier, Pantera and other crypto VCs have recently acquired TAO. So while Bittensor was fairly launched, VC involvement wasn’t entirely absent.

However, in this market cycle, the traditional “VC-to-public” token distribution model is losing favor. TAO’s approach—fair launch first, then attracting institutional capital—has arguably achieved a relatively fair balance.

-

Market Performance and Valuation

Looking solely at TAO’s market performance, the token has risen over fivefold from its 2023 low.

But so have other AI projects. For instance, RNDR has also gained about fivefold since the beginning of the year.

So absolute price gains alone aren’t meaningful indicators.

Compared to other popular AI projects, TAO’s market cap currently ranks second only to RNDR. However, due to its long-term four-year halving release schedule, TAO has the lowest ratio of market cap to fully diluted valuation (FDV) among peers—meaning its circulating supply is relatively low, but its unit price is high.

Original chart: X user @Moomsxxx; TAO price calculated by author at time of publication

Low circulation can mean smaller float and easier price manipulation. Assuming a stable price (~$160), selling all 7,200 daily mined TAO would generate ~$1.15M in sell pressure. Given current trading volume (~$5M daily), the market can absorb this without difficulty.

Valuing TAO meaningfully requires comparing it to similar-stage, functionally comparable projects.

As previously explained, Bittensor focuses on crypto + algorithms/models, making direct comparisons with compute-provisioning projects like RNDR inappropriate.

According to Nansen’s AI sector research report below, Bittensor belongs in the “Model Training” category, alongside Gensyn and Together—both backed by notable investors like a16z.

However, neither has launched a public token yet, making direct valuation comparisons impossible.

Image source: Nansen Research

David Attermann, co-founder of Omnichain Capital, proposed a bolder approach in a May blog post: directly benchmarking Bittensor against OpenAI.

Interestingly, David explicitly stated he held no TAO at the time, underscoring his objectivity.

Both focus on training models for user access—one closed-source, the other coordinating global AI models. Their paths differ, but both aim to make AI more accessible.

Given OpenAI’s prior $29B private-market valuation from Microsoft, and TAO’s current FDV of ~$3.6B, this suggests TAO still has roughly 8x room for valuation growth.

I don’t fully endorse this comparison method. Web3 and Web2 projects differ fundamentally in fundamentals, growth trajectories, and market focus. An 8x valuation gap should be taken as illustrative, not definitive—actual performance depends more on TAO’s own catalysts and capital momentum.

Conclusion

In summary, TAO/Bittensor offers a distinct narrative beyond familiar AI-themed crypto projects—eschewing direct involvement in productive inputs (compute and data), instead leveraging production relations to coordinate collaboration, competition, and optimization among AI models.

This narrative is inherently appealing, but critical challenges—including model integration, validator centralization, and evaluation accuracy—cannot be solved by a whitepaper alone. AI itself may be simple, but commercial dynamics are not. Whether token incentives can sufficiently motivate participation and convince tech firms to collaborate remains debatable.

Beyond fundamentals, the token’s price surge reflects broad market enthusiasm for AI. With no similarly sized competitor in its niche, TAO may continue benefiting from sector-wide momentum. However, due to the lack of clear valuation benchmarks, its long-term holding appeal remains uncertain.

Closely monitoring project updates and sudden trading volume changes may be the most practical approach.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News