A New Paradigm for Asset Issuance: The Next Wave of Bitcoin Metadata Protocols Has Arrived

TechFlow Selected TechFlow Selected

A New Paradigm for Asset Issuance: The Next Wave of Bitcoin Metadata Protocols Has Arrived

The main differences between various metadata protocols lie in the distinct locations and methods of data recording on the blockchain, as well as differing approaches to ledger maintenance.

Author: PSE Trading Intern

This year, asset issuance protocols on the Bitcoin blockchain have become the focus of widespread discussion. These protocols all belong to metadata protocols—assets are defined by recording information within Bitcoin transactions. The differences lie in where and how this data is recorded, and these variations determine the distinctions between protocols.

1. What Is a Metadata Protocol?

A blockchain is a linked list structure with hash pointers, essentially a database maintained by distributed nodes. Satoshi Nakamoto chose to record transaction data secured by elliptic curve and hash functions on the blockchain, thus creating Bitcoin. The key point here is that as long as there’s a way to record which address transferred how much of which asset to another address—and to verify asset provenance, unspent status, and valid transaction signatures—creating a digital asset becomes feasible.

In Bitcoin's early days, people proposed using the op_return output to store such information, thereby inheriting Bitcoin's security and enabling new assets to be issued directly on the Bitcoin chain without requiring a separate blockchain. This was the Colored Coins protocol—the first-ever metadata protocol. Unfortunately, the concept was too advanced for its time, when even Bitcoin’s own value was still questioned. At that time, it was more convincing to create a new blockchain and use a new "ledger" to track asset transfers.

2. BRC-20: A New Paradigm via Witness Fields

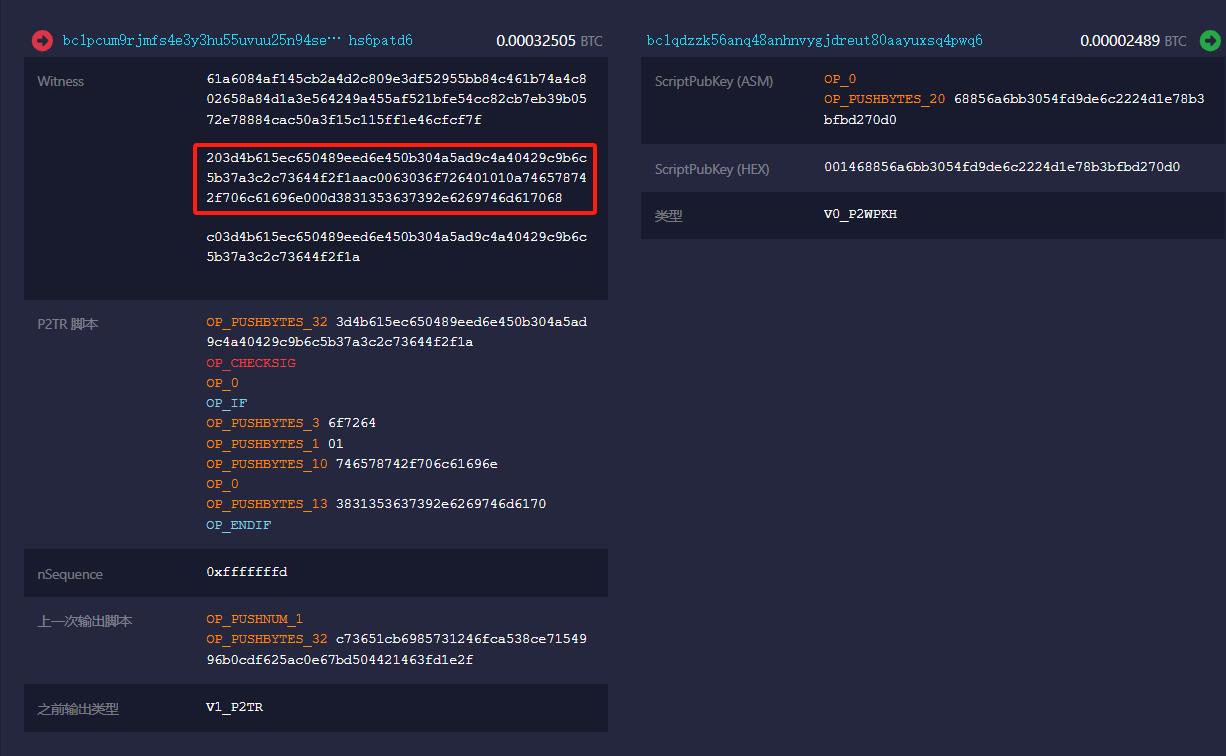

In February 2023, the emergence of the Ordinals protocol reignited imagination around the Bitcoin ecosystem. The Ordinals protocol assigns a unique number to each satoshi based on its mining order and embeds arbitrary data into the witness field of a Bitcoin transaction, calling it an "inscription." Ownership of the inscription is then assigned to the owner of the first satoshi in that transaction’s UTXO output.

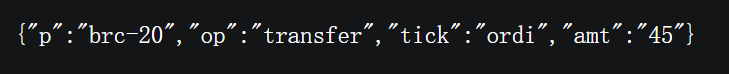

Since any data can be placed in the witness field, it naturally follows that transaction-related text data could also be stored there. This gave rise to the BRC-20 series of protocols, which embed text data—including protocol version, operation type, asset name, and transfer amount—into the witness field of a Bitcoin transaction input to define the deployment, minting, and transfer of a BRC-20 asset.

The BRC-20 protocol sparked strong interest, with major assets including $Ordi and $Sats. $Ordi, the first BRC-20 token, was deployed on March 8 and fully minted within two days, with a total supply of 21 million. Its market cap peaked at $630 million in May and currently stands around $410 million. The popularity of $Ordi led to a surge in new BRC-20 deployments, most notably $Sats, deployed on March 9 with a total supply of 2.1 quadrillion, which wasn’t fully minted until September 24. $Sats once surpassed $Ordi in market cap and now holds a market cap of approximately $270 million.

Following BRC-20, a series of Ordinals-based asset issuance protocols emerged, though they share no fundamental differences—all store metadata in the witness field. Their main advantages are permissionless deployment, public minting, simplicity, and high transparency. All information is publicly recorded on-chain, allowing anyone to verify exactly what they’re transacting. These traits fueled a speculative frenzy, drawing in "gamblers" eager to deploy or mint assets they believe will multiply in value.

On the downside, BRC-20-style protocols have driven up Bitcoin transaction fees significantly—a boon for large miners but a burden for small nodes maintaining the Bitcoin state. BRC-20 transactions leave a heavy on-chain footprint and generate numerous UTXOs worth just 546 satoshis, increasing operational costs for node operators.

3. Runestone: The Return of op_return

Casey Rodarmor, creator of the Ordinals protocol, tweeted on September 26, 2023, proposing a new metadata-based asset issuance protocol called Runes (later renamed Runestone). Casey stated that the original vision for Ordinals was to create a refined “art gallery” within Bitcoin, but the speculative mania around BRC-20 is harming Bitcoin. Since nothing can stop “gamblers” from gambling, he proposed a cleaner metadata protocol so that speculation could continue without burdening nodes with excessive UTXOs.

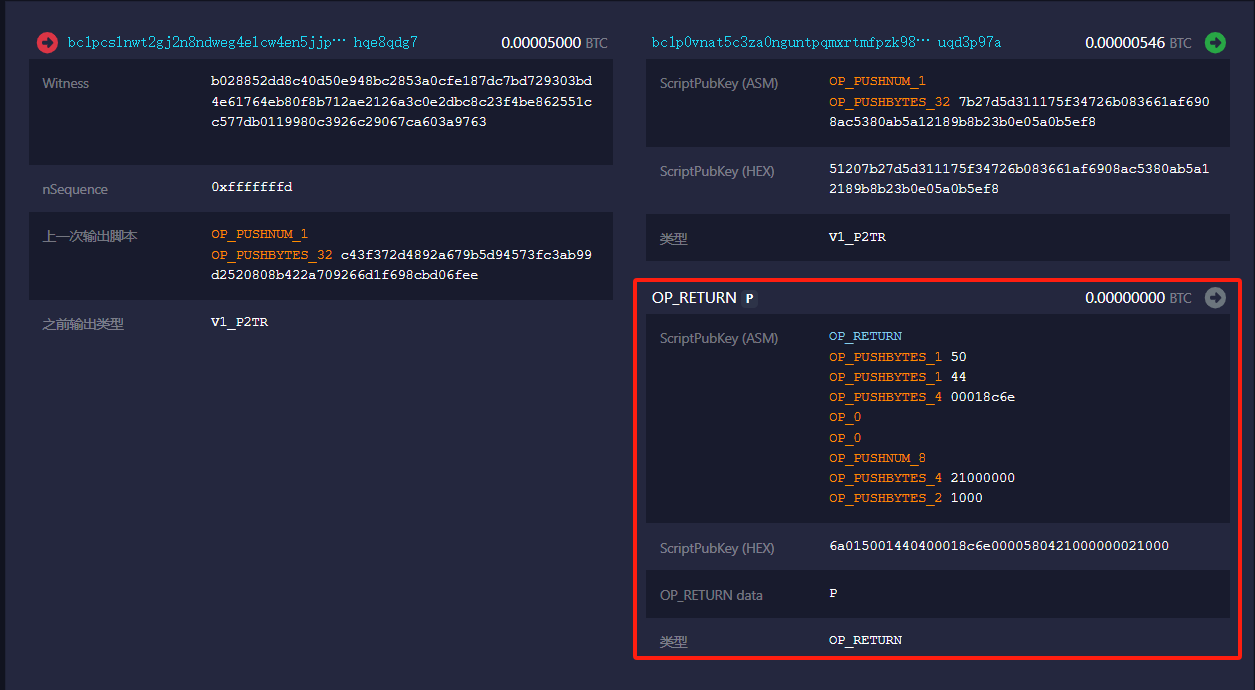

Runestone revives the old Colored Coins approach by storing asset-defining metadata in the op_return output of a Bitcoin transaction. op_return is a special Bitcoin script opcode; any instructions following op_return are not executed, meaning UTXOs containing op_return are considered permanently unspendable and can be removed from the UTXO set, reducing node maintenance costs. Thus, arbitrary data can be recorded in op_return outputs (without needing to include bitcoin), resulting in a cleaner on-chain footprint and lower burden on nodes.

The Runestone concept sparked intense debate, but unfortunately, it has yet to be implemented. However, Benny, founder of TRAC, quickly launched a similar protocol—Pipe Protocol—which also stores data in op_return outputs. Pipe inherits Casey’s goal of creating a cleaner on-chain footprint while adopting BRC-20’s core principles: permissionless deployment and public minting. Notably, this openness was not part of Casey’s original Runestone plan—he views free deployment and public minting as the root cause of Bitcoin blockchain congestion. In his vision, Runestone would be project-led via airdrops. But the market clearly favors open, permissionless models.

The inaugural token of Pipe Protocol, $Pipe, was deployed on September 28 with a total supply of 21 million and a current market cap of around $30 million. While $Pipe uses public minting, it is one of the few tokens in this space with an active development team. The TRAC team states that $Pipe will be governed by $Tap, the first token of TAP Protocol—a BRC-20-like asset issuance protocol developed by TRAC—while $Tap itself will be governed by $Trac, a BRC-20 token.

The main limitation of protocols like Runestone and Pipe is the limited storage capacity of op_return. While this constraint isn’t severe for fungible assets, it poses significant challenges for non-fungible assets.

4. Taproot Assets Protocol: Massive Scalability via On-Chain Commitments

Efforts to issue assets on Bitcoin have persisted over time. For many idealistic cypherpunks, launching speculative assets for “gamblers” and miners to exploit is unnecessary. They strive to prevent asset issuance protocols from interfering with Bitcoin’s normal operations, investing more time in developing sophisticated technical solutions.

Lightning Labs, the team behind the Bitcoin Lightning Network, began developing a stablecoin protocol called Taro in April 2022. It was renamed Taproot Assets in May 2023 and officially launched its first mainnet version on October 19, 2023. Lightning Labs’ vision is to integrate stablecoins with the Lightning Network, enabling global foreign exchange transactions and potentially replacing fiat-dominated retail payment systems in certain regions.

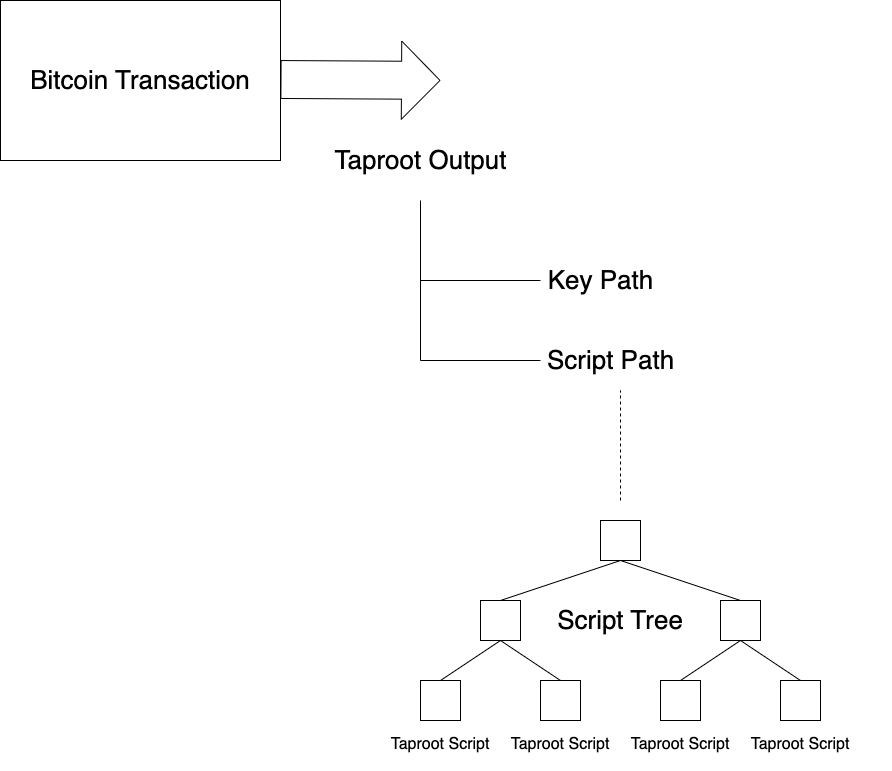

Taproot Assets is also a metadata-based asset issuance protocol, but unlike others, it does not store data in witness fields or op_return outputs. Instead, it commits data into the script path of a P2TR-type UTXO. As a result, deploying or transferring a Taproot Asset leaves almost no visible footprint on-chain—onlookers simply see a standard Bitcoin transfer to a Taproot address.

Is this secure? Yes. Every Taproot Asset transfer requires submitting a Merkle proof of the metadata. Any double-spend or unexpected change would result in a mismatched root hash, leading to rejection.

Due to technical complexity, few assets have been issued via Taproot Assets so far. The most notable is Nostr Assets Protocol—an ecosystem project combining Nostr, Taproot Assets, and the Lightning Network. It launched two tokens, $Trick and $Treat, each with a supply of 210 million. Only 20% have been airdropped so far, with the rest held by the Nostr Assets team. Both are issued via Taproot Assets, and the team plans to introduce public minting, allowing users to freely deploy and mint Taproot Asset tokens on their platform.

However, Taproot Assets is not a perfect solution. Its technical complexity makes it difficult for users to understand and trust, raising concerns about unforeseen vulnerabilities. Additionally, verification costs grow exponentially, posing a significant burden for both users and third parties. Most critically, since metadata is not stored on-chain, users must either keep it locally or rely on third-party services like Universe to store it.

5. After the BRC-20 Wave: How Do Runestone and Taproot Assets Compare?

BRC-20 vs. Runestone Series

1. The biggest advantage of Runestone-series protocols—also the greatest weakness of BRC-20—is the lighter on-chain footprint. BRC-20 generates many stale UTXOs because it uses an account-based model to track balances, requiring users to inscribe a "Transfer" every time they send assets. In contrast, Runestone-series protocols use a UTXO model similar to Bitcoin: specifying the amount sent to the recipient and the change returned to the sender. This design reduces on-chain bloat and lowers indexing costs for off-chain indexers.

2. Runestone-series protocols are better suited for large-scale airdrop distributions. This may not appeal to “gamblers,” but institutional investors might prefer it. That said, exceptions exist—Pipe Protocol supports the public minting format favored by speculators.

3. BRC-20 offers greater storage capacity. BRC-20 leverages the witness field of transactions, benefiting from SegWit fee discounts. Theoretically, as long as the data fits, transactions can approach 4MB in size (the largest Ordinals NFT is 3.94MB, nearly filling an entire block). Recursive inscription techniques allow even larger NFTs. In contrast, Runestone-series protocols are limited by op_return’s 80KB cap, severely restricting NFT issuance and limiting batch issuance of fungible tokens.

Taproot Assets vs. the First Two Series

Taproot Assets’ complex design aims to minimize on-chain footprint and ensure compatibility with the Lightning Network—it serves a fundamentally different purpose. Yet, as an open-source protocol, it too can be exploited by “gamblers.” Here we compare Taproot Assets only on this level.

1. Like the other two series, Taproot Assets requires third-party trust: the first two rely on off-chain indexers, while Taproot Assets depends on Universe for metadata storage and validation. However, differences exist. Taproot Assets’ data structure ensures simpler and more reliable validation by Universe. Still, due to its complexity, user understanding and trust remain low, and validation costs are uncertain. Moreover, significant investment has already gone into BRC-20 indexing infrastructure. Therefore, in the short term, Taproot Assets Universe likely faces higher overall costs due to slow adoption. Long-term, however, its costs may fall below those of BRC-20.

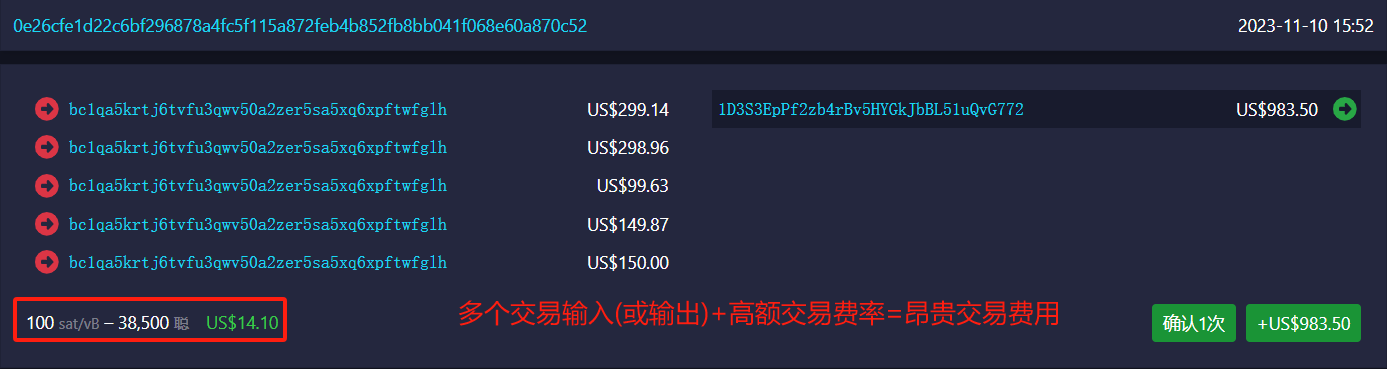

2. Lightning Labs engineered Taproot Assets with Lightning Network integration in mind—a key advantage over the first two series. Taproot Assets can be traded on the Lightning Network, further reducing on-chain activity, avoiding fee spikes on Bitcoin, and sparing users high transaction costs. In contrast, BRC-20 inflates Bitcoin fees, and users often face transaction costs exceeding $10 due to fragmented UTXOs in their wallets.

3. Similar to Runestone, Taproot Assets is well-suited for large-scale airdrops. But again, exceptions exist—Nostr Assets Protocol, for instance, promises to support public minting.

4. However, Taproot Assets is weaker than the first two series and Ordinals in issuing non-fungible assets. As Elon Musk acknowledged, the first two series and Ordinals actually write data onto the blockchain—every pixel of an image is inscribed. In contrast, Taproot Assets only commits hashes to the chain; actual data is stored locally or on Universe. If the data is lost for any reason, the on-chain hash becomes meaningless.

6. Conclusion

The primary differences among metadata protocols lie in where and how data is recorded on the blockchain, as well as how the ledger is maintained. These differences define each protocol’s characteristics. Protocols storing data in witness fields—like BRC-20—offer ample data space but leave a heavy on-chain footprint and generate many abandoned UTXOs, burdening nodes. Protocols using op_return—such as Runestone or Pipe—improve on this front. Taproot Assets, which commits data to the chain, leaves the cleanest footprint but suffers from high technical complexity, making it harder for users to understand and trust.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News