Behind CAKE's Surge: Liquidity Optimization and Token Deflation, Multi-Chain Strategy Begins to Bear Fruit

TechFlow Selected TechFlow Selected

Behind CAKE's Surge: Liquidity Optimization and Token Deflation, Multi-Chain Strategy Begins to Bear Fruit

Facing a sideways market, PancakeSwap increased its total trading volume by 77% from the first quarter to the second quarter of 2023.

Author: CMC Research

Translation: TechFlow

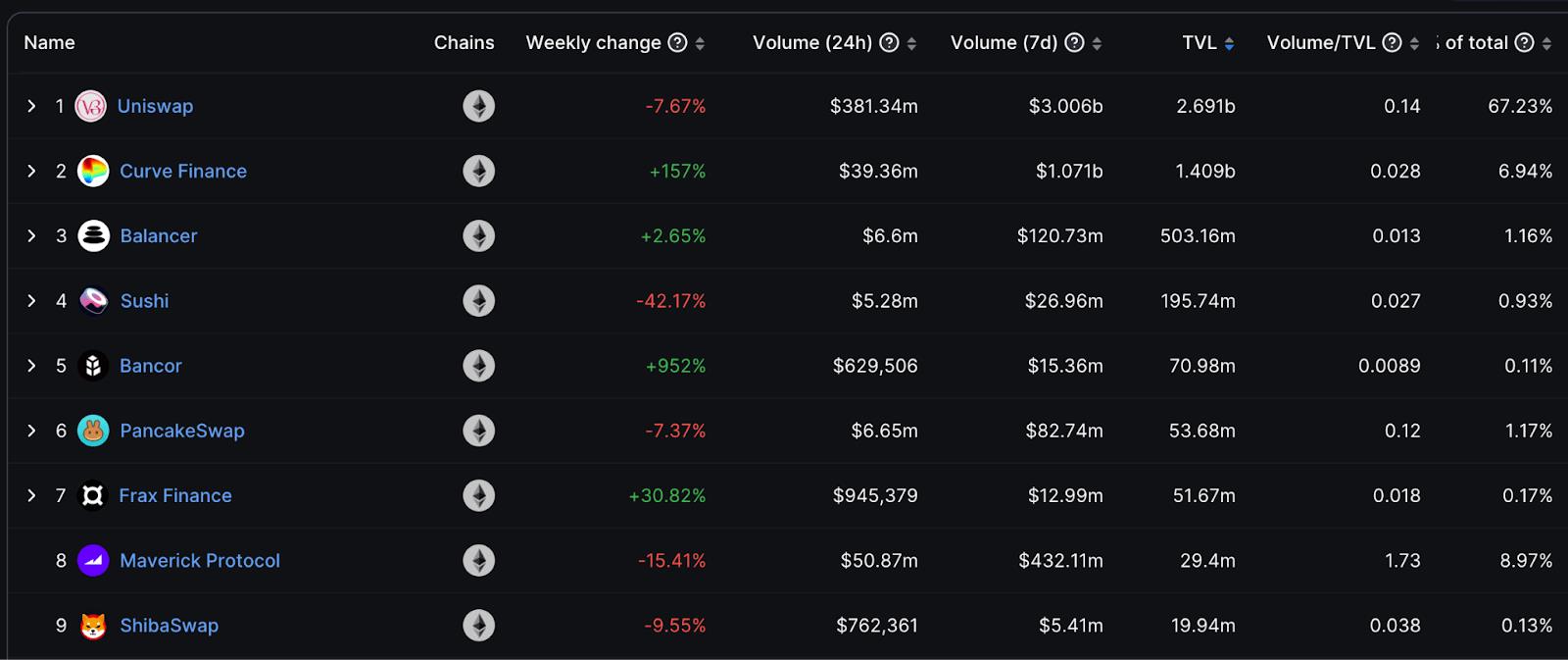

In 2023, the decentralized exchange (DEX) market demonstrated a healthy consolidation trend centered around several leading players. Uniswap (UNI) continues to lead other exchanges in terms of total value locked (TVL) and trading volume. However, PancakeSwap (CAKE), a household name, has maintained its position as one of the top contenders. Compared to 2022, overall DEX industry trading volume has declined.

Amid a sideways market, PancakeSwap increased its total trading volume by 77% from Q1 to Q2 of 2023. Since launching its V3 version, its market share among decentralized exchanges has doubled. Expansion onto Ethereum and Layer-2 solutions, a new CAKE tokenomics model, and additional product launches have helped PancakeSwap remain at the forefront of DEX innovation.

What is PancakeSwap?

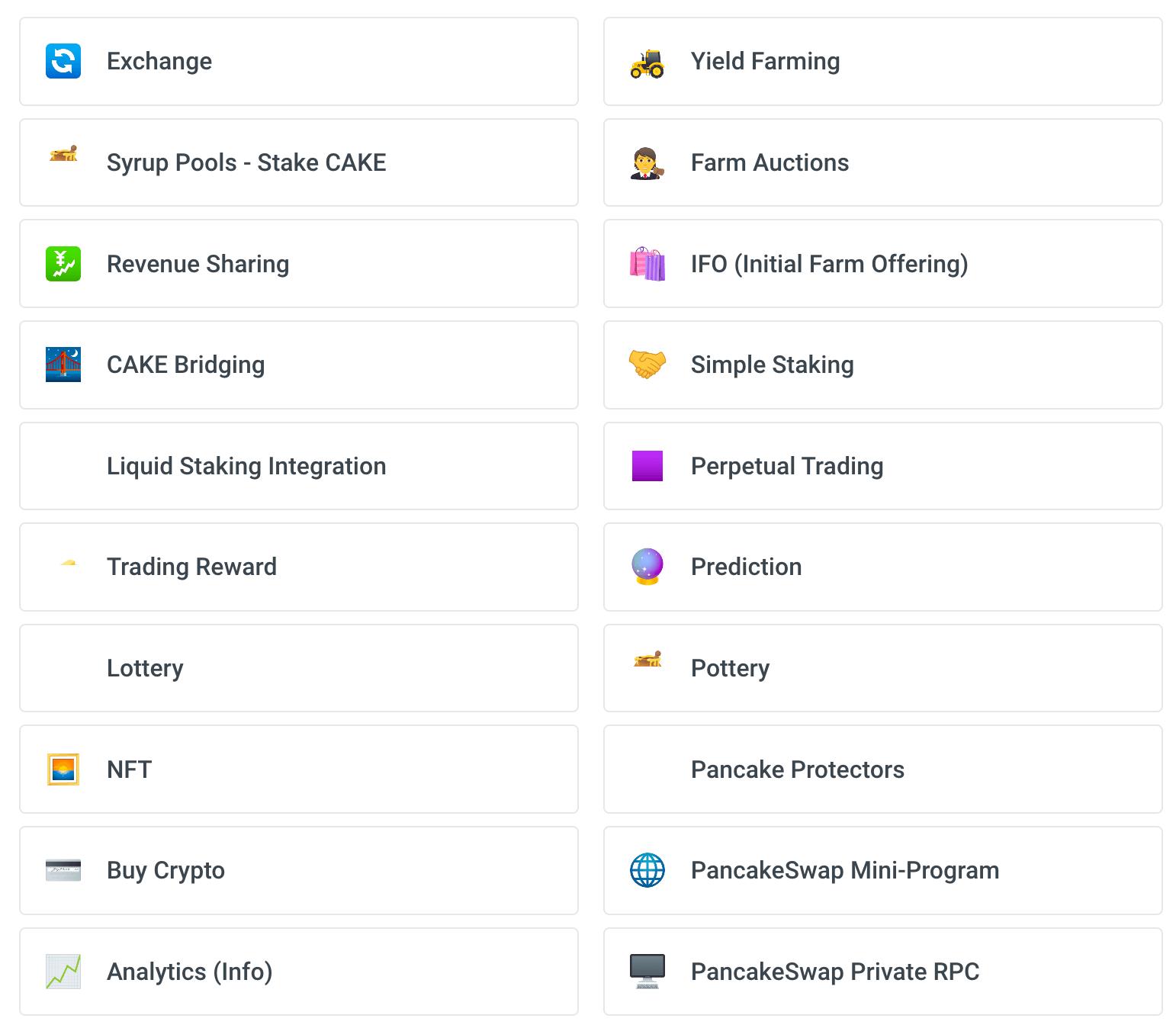

Originally built on the BNB Chain, PancakeSwap enables users to trade tokens without relying on centralized exchanges. It offers a wide range of products, including:

-

A token-swapping exchange

-

Yield farming for earning rewards

-

Syrup Pools for staking CAKE tokens

-

Liquid staking on Ethereum (wBETH) and simple staking

-

Pancake Protectors game

-

V3 Position Manager (new feature)

-

A prediction market

-

IFO token launches

-

Cross-chain bridges connecting CAKE to Ethereum and Aptos

-

A lottery system

-

An NFT marketplace

PancakeSwap innovates rapidly and regularly introduces new products. In April 2023, PancakeSwap voted to transition to a deflationary token model called "Ultrasound CAKE." The protocol passed a proposal named CAKE Tokenomics v2.5 to create a structure combining real yield (without supply impact) with reduced token emissions. Over 102% of CAKE is burned weekly. This aims to create breathing room for issuance over multiple years and incentivize locking CAKE, making the token more valuable over the long term.

PancakeSwap is operated by an anonymous team known as the "Chefs," who work in the "Kitchen" of PancakeSwap. The platform is open-source and has undergone audits by several well-known blockchain security firms such as PeckShield and SlowMist.

Despite the bear market impacting the protocol’s TVL and trading volume, PancakeSwap still generates $27 million in annualized revenue, with 42% of CAKE staked:

What is PancakeSwap V3?

PancakeSwap V3 introduced several key innovations and features to enhance capital efficiency, reduce traders’ fees, increase liquidity providers’ returns, and improve the overall user experience.

PancakeSwap V3 allows concentrated liquidity, enabling liquidity providers to allocate their capital within specific price ranges rather than spreading it uniformly across the entire price spectrum. By concentrating capital where trading activity is most frequent, this approach can achieve up to 4,000x higher capital efficiency compared to V2—especially for stablecoin pools. As a result, liquidity providers earn more fees on the same amount of liquidity.

Traders also benefit from lower fees under V3, which now features four fee tiers: 0.01%, 0.05%, 0.25%, and 1%, compared to the fixed 0.25% fee in V2. These tiers are designed to meet the needs of different trading pairs based on expected volatility and trading activity. Concentrated liquidity within active price ranges also reduces slippage for traders. V3 also implements a smart router that finds optimal trading routes across V3, V2, and StableSwap pools.

For liquidity providers, selecting fee tiers, customizing price ranges, creating non-fungible liquidity positions, and concentrating capital offer greater flexibility and opportunities to maximize returns. V3 also introduces active yield farming, rewarding users with CAKE tokens when prices fall within the active price range of their liquidity positions.

One of the newest and most innovative features added to PancakeSwap is the Position Manager. It enables automatic compounding of rewards, so all fees and rewards earned from liquidity positions are automatically reinvested into the pool. Over time, through the power of compounding, LP positions grow exponentially. Additionally, the Position Manager automatically handles gas fees and rebalances positions, thereby reducing the risk of impermanent loss. LPs can provide liquidity within concentrated price ranges to maximize fee earnings from high-volume trades and select strategies optimized for their risk tolerance.

Ultrasound CAKE Tokenomics Model

In October 2023, PancakeSwap burned over 1.76 million CAKE tokens while only minting 1.42 million new ones. This resulted in a net reduction of 337,000 CAKE, decreasing the total supply by 0.086%.

PancakeSwap has been committed to transforming CAKE into a deflationary token through strategic burn mechanisms. The exchange has implemented several changes that drive organic trading volume and activity:

-

Reducing the per-block issuance of CAKE from an initial 40 down to approximately 1.8374 currently. This was achieved by gradually allocating fewer CAKE rewards to pools over time.

-

Planning to reduce the maximum supply cap of CAKE by 750 million. With a current circulating supply of around 388 million and a deflationary trajectory, CAKE may never reach its maximum cap.

-

Implementing burn mechanisms across various products:

-

0.001–0.23% of each transaction in V3

-

0.0575% of each transaction in V2

-

0.004–0.016% of each transaction in StableSwap

-

100% of CAKE sent to developer addresses

-

100% of CAKE performance fees from IFOs

-

100% of CAKE used to create profiles and mint NFTs

-

100% of CAKE from winning bids in Farm auctions

-

20% of CAKE spent on lottery tickets

-

20% of all profits from perpetual trading

-

8% of the weekly Pottery prize pool allocation

-

3% per round in the BNB prediction market used to buy and burn CAKE

-

3% per round in the CAKE prediction market

-

2% of every harvest from flexible staking CAKE pools

-

2% of each NFT sale on the NFT marketplace used to buy and burn CAKE

-

To align incentives with loyalty, PancakeSwap also launched a revenue-sharing program. A portion of trading fees is distributed weekly to CAKE stakers based on the amount and duration of their staked CAKE. Staked CAKE earns users shares (also known as rCAKE), which are recalculated based on:

-

The quantity of staked CAKE

-

The remaining lock-up period of staked CAKE, rounded down to weeks, and capped at the maximum allowed lock-up duration (52 weeks). For example, staking 50 CAKE for 10 weeks, with a maximum of 52 weeks, would generate approximately 9.61 virtual shares (rCAKE) in the revenue-sharing pool. This provides CAKE stakers with real yield on their holdings. The longer the lock-up period, the higher the proportional share of trading fee income.

This mechanism of locking CAKE resembles Curve Wars and how protocols like Convex Finance reward locked CRV tokens. There are some similarities between them:

-

Both CAKE and CRV are governance tokens that grant voting power when locked for a period. The longer the lock-up, the greater the voting power.

-

Locking either token grants holders additional rewards and benefits. For CAKE, these include trading fee rebates and enhanced Farm yields. For CRV, the benefit is increased CRV rewards.

-

Locking creates scarcity for both tokens and aligns incentives between the protocol and long-term-oriented users.

However, there are key differences where PancakeSwap holds advantages over Curve:

-

The CAKE revenue share rewards loyal lockers with a portion of platform fees based on lock-up duration. CRV does not have a similar revenue-sharing model.

-

Locked CAKE increases their initial Farm allocation and Farm yields in launchpads (IFOs). Locked CRV does not offer these specific benefits, only additional CRV rewards.

-

CRV is essential for liquidity provision and voting in Curve's pools. CAKE is not required for providing liquidity on PancakeSwap.

-

PancakeSwap’s reduced emission schedule has already put CAKE on a deflationary path. CRV’s issuance remains inflationary. While both aim to incentivize governance token locking, CAKE locking offers more benefits, such as revenue sharing. With its focus on rewarding the community and long-term growth, PancakeSwap is well-positioned to capture a significant share of the expanding Ethereum L2 ecosystem.

PancakeSwap’s Multi-Chain Expansion

PancakeSwap has pursued a multi-chain strategy, deploying its decentralized exchange and CAKE token across various Layer-1 and Layer-2 blockchains.

Since launching its V3 version in early Q2 (April 2023), PancakeSwap has seen month-over-month growth in monthly trading volume and market share within the DEX sector. Total trading volume in Q2 increased 77% quarter-on-quarter, while Q3 volume rose 11.2% compared to Q1.

Meanwhile, its market share in DEX trading volume grew 110% from Q1 to Q2, and Q3 market share increased 92% compared to Q1.

PancakeSwap Monthly Trading Volume

DEX Trading Volume Market Share

The exchange launched on Ethereum in September 2022 and on Aptos in October 2022. Since then, it has expanded to several Ethereum L2s, including Base, opBNB, Arbitrum, Linea, zkSync Era, and Polygon zkEVM.

PancakeSwap on Ethereum

PancakeSwap launched on Ethereum in September 2022, and its trading volume has grown steadily over the past 12 months:

In terms of total value locked, PancakeSwap lags behind Uniswap and Sushiswap. However, its volume-to-TVL ratio is comparable to Uniswap, indicating a sustainable growth pattern and potentially higher capital efficiency:

PancakeSwap on zkSync ERA

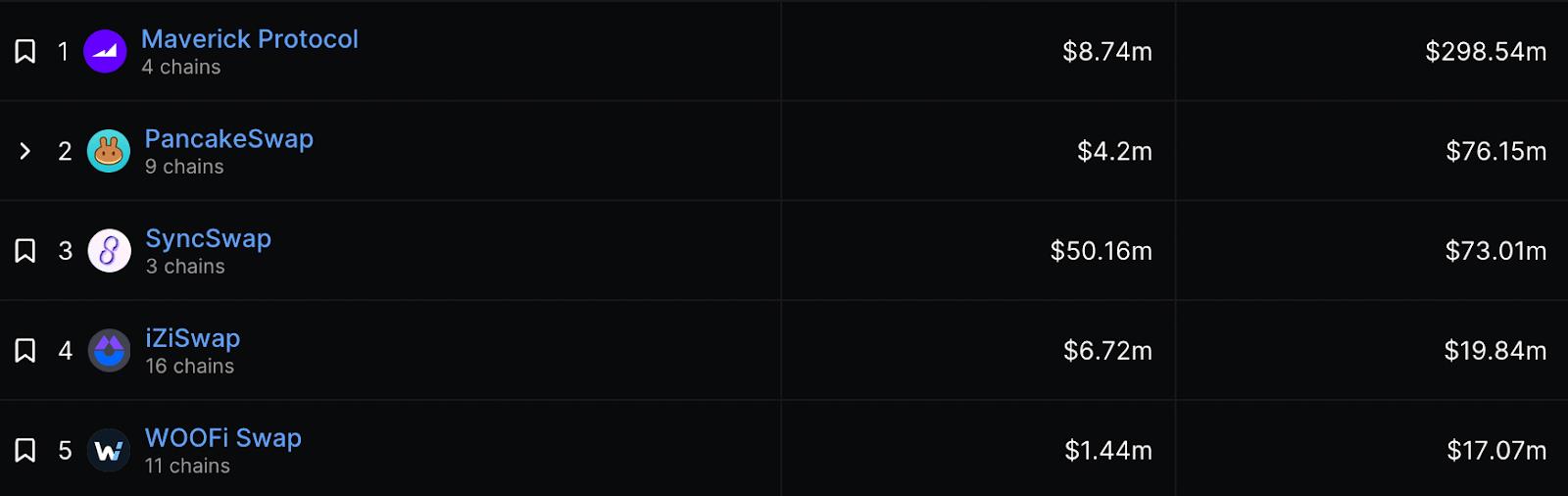

zkSync ERA is one of the primary zk-based Layer-2 solutions for Ethereum. PancakeSwap has become one of the leading decentralized exchanges in this ecosystem, ranking second in trading volume and fifth in total value locked:

Additionally, both metrics have shown explosive growth since its launch in July 2023:

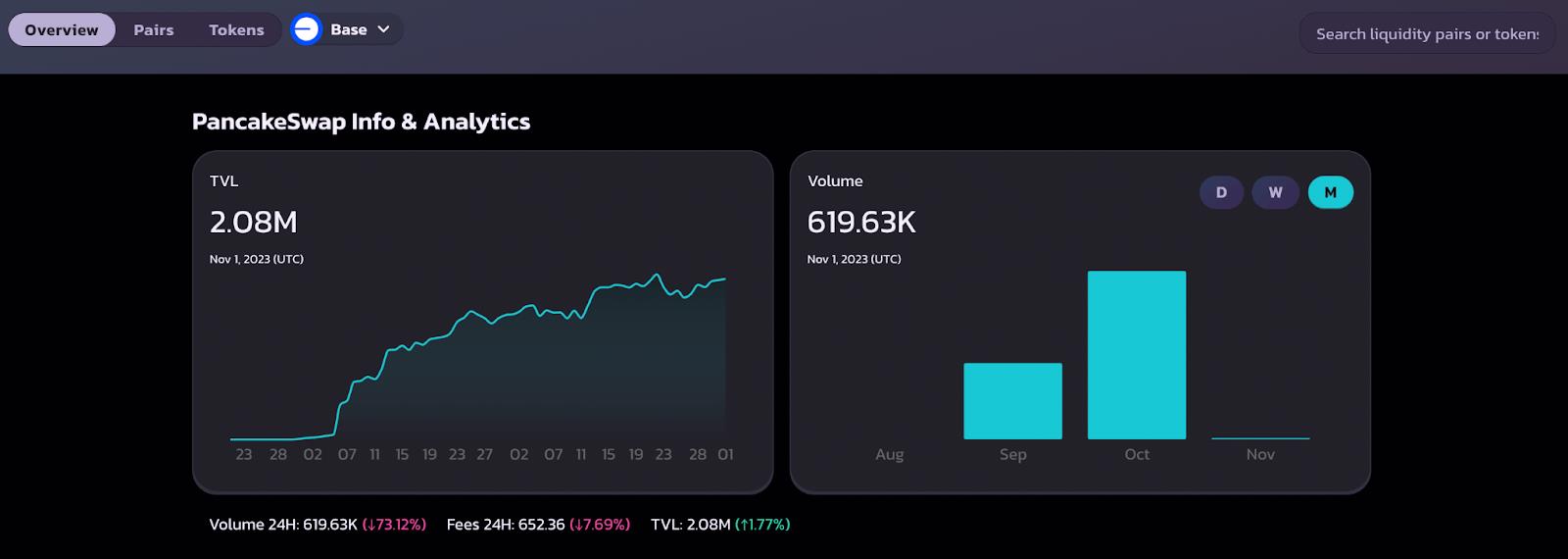

PancakeSwap on Base

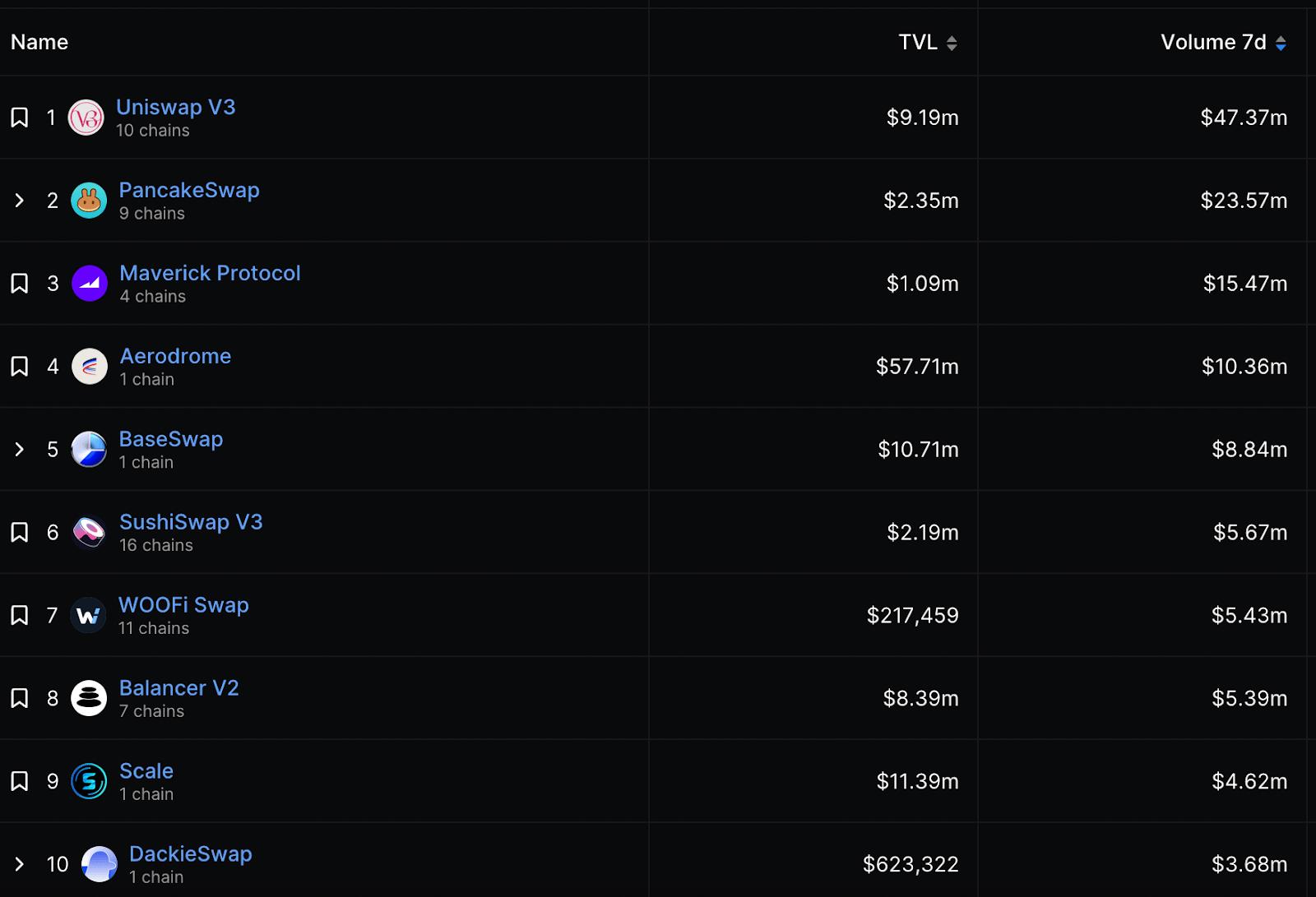

PancakeSwap launched on Base in August 2023 and quickly became one of the leading DEXs in the ecosystem in terms of trading volume, despite having relatively low TVL compared to Uniswap and Aerodrome.

Total value locked on Base has steadily increased over the past two months, currently hovering around $2 million:

PancakeSwap on Linea

PancakeSwap is the highest-volume DEX on Linea, an EVM-compatible L1 using zk-rollups as a scaling solution:

PancakeSwap on Polygon zkEVM

PancakeSwap has rapidly become one of the top two DEXs on Polygon zkEVM. Polygon zkEVM is an emerging ecosystem with relatively lower trading volume and TVL compared to others. However, it uses zk-rollups as its scaling technology—one of the primary scaling solutions for next-generation blockchains:

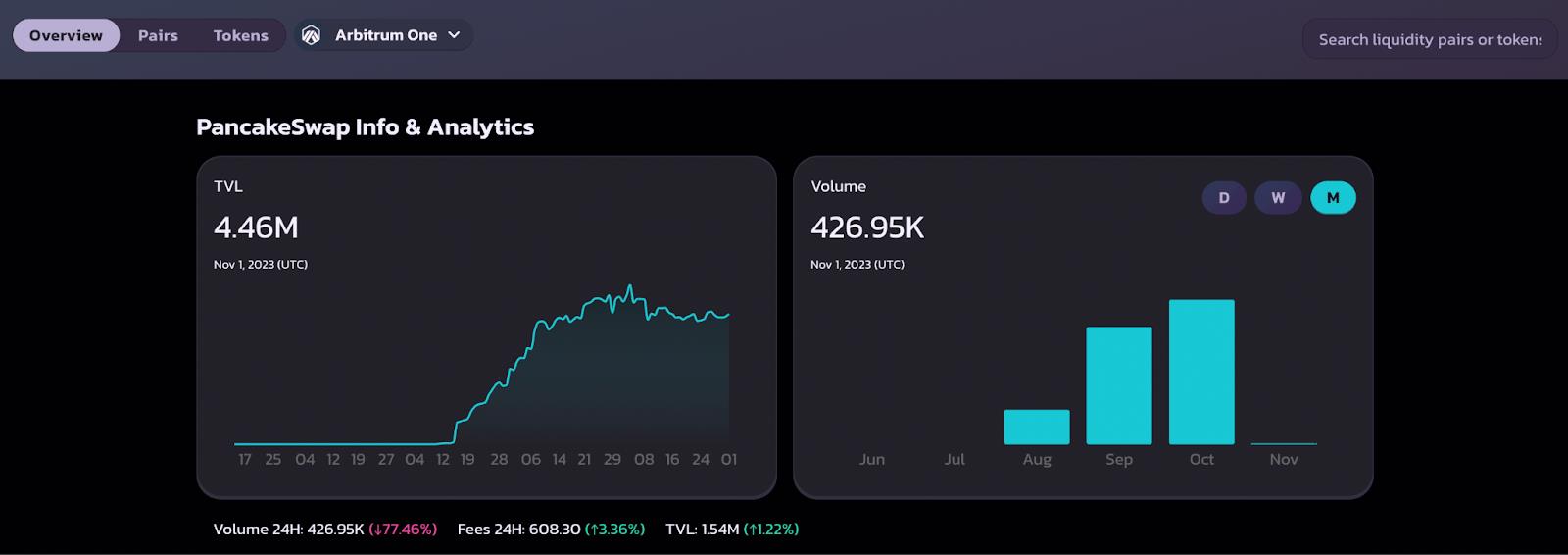

PancakeSwap on Arbitrum

PancakeSwap launched on Arbitrum in August 2023 and ranks within the top 20 in both total value locked and trading volume. Due to entrenched competition on Arbitrum, PancakeSwap’s growth hasn’t been as explosive as on Base, but it has maintained a steady growth trajectory:

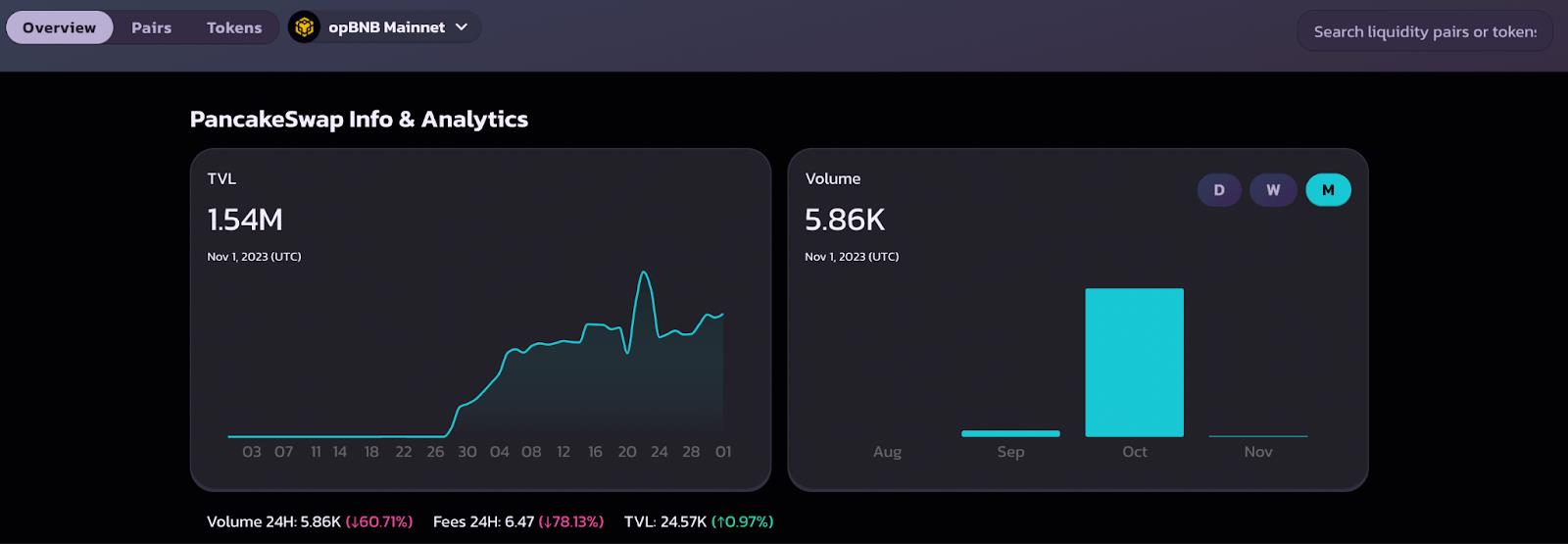

PancakeSwap on opBNB

opBNB is a Layer-2 chain built on Optimism’s tech stack, extending Binance’s BNB Chain. To date, PancakeSwap is the only decentralized exchange on opBNB, allowing it to capture 100% of the growth in this rapidly expanding ecosystem:

PancakeSwap’s New Products

PancakeSwap offers a rich suite of products for trading users:

Beyond its core exchange and Farms, PancakeSwap launched several entirely new products and services in 2023. The introduction of Pancake Protectors marked PancakeSwap’s first step into the blockchain gaming space. This PvP game offers an engaging experience alongside NFT rewards.

PancakeSwap also added fiat on-ramps through partners such as MoonPay, Mercuryo, and Transak. Users can now directly purchase cryptocurrency using credit cards, bank transfers, and other fiat payment methods.

Other new offerings include liquid staking via Synclub and the revival of previously paused Farm auctions. PancakeSwap also launched a revenue-sharing program to reward loyal CAKE stakers. Additionally, PancakeSwap’s signature yield farming continues to expand. In 2023, over 200 new Farms were added across multiple chains. Products like bCAKE v3 help users maximize their yields.

Finally, PancakeSwap has enhanced the trading experience by integrating features that improve execution efficiency and reduce costs. In addition to launching PancakeSwap V3, perpetual trading underwent a major V2 upgrade, introducing new features such as Degen Mode. Integration with market makers and leveraging Celer Network’s bridging capabilities enables zero-slippage trading for non-BNB chain pairs. Adoption of Bloxroute’s Private RPC security solution aims to protect users from bots and front-running.

Roadmap and Future Outlook

PancakeSwap has an ambitious roadmap focused on enhancing user experience through innovation across multiple aspects of its platform.

In Q4 2023, PancakeSwap launched the Position Manager, automating liquidity provision. Users simply deposit assets, which are then automatically deployed into pools and Farms to optimize yield. This eliminates the complex calculations and gas fees associated with manual management. PancakeSwap also plans to launch veCAKE, allowing CAKE holders to vote on governance proposals based on their veCAKE balance, increasing community participation. A voting gauge will also be added, enabling the community to direct CAKE emissions and yields toward preferred protocols—similar to the CRV model.

Furthermore, PancakeSwap intends to bring all its DEX products—including trading, yield farming, lotteries, etc.—to all supported chains. This includes introducing multi-chain gaming.

Other planned major updates include:

-

Integration of a notification system: This will enable important alerts and updates to be pushed directly to users through the PancakeSwap interface and connected wallets.

-

Increase prediction fees through multi-chain expansion: PancakeSwap is considering increasing prediction fees by expanding and attracting users from other chains, thereby increasing CAKE burns.

-

Reduce maximum supply: PancakeSwap plans to reduce CAKE’s maximum supply from the current 750 million before year-end. The expected timeline is end of 2023.

-

Resume trading competitions: Depending on market conditions, PancakeSwap may resume trading competitions in the future to boost user engagement. Current trading rewards are more flexible.

-

Integration with asset-backed partners: PancakeSwap is exploring collaborations with protocols backed by real-world assets to attract institutional capital.

-

GameFi expansion: PancakeSwap is exploring a gaming platform where third-party developers can build and launch their multi-chain games on PancakeSwap.

In the long term, PancakeSwap aims to become a seamless, user-friendly, decentralized one-stop DeFi platform accessible across multiple blockchains. The exchange continues to build and launch innovative products while optimizing its tokenomics model.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News