Exploring the Origins, Current State, and Future of TG Bots

TechFlow Selected TechFlow Selected

Exploring the Origins, Current State, and Future of TG Bots

Backed by Telegram, TG Bots will leverage the openness of the Telegram ecosystem to achieve composability in the blockchain's decentralized ecosystem.

Following the recent announcement of Banana Gun launching its token, a wave of renewed interest in TG Bots has swept through an otherwise quiet market. Some view TG Bots as merely riding the hype cycle of meme coins; others believe that backed by Telegram’s massive user base, they represent the beginning of the next major narrative in crypto. This article aims to revisit this controversial sector amid ongoing debates and explore its future potential.

Why Did TG Bots Emerge?

Demand Driven by User Experience

Telegram, as a highly open and free social platform, has long supported third-party clients and scripts via its public API. Even before the rise of crypto-related bots, a fragmented but active ecosystem had already formed around automation and mobile notifications—primarily efficiency- and notification-focused bots based on IFTTT logic, such as stock price alerts, RSS feeds, and group management tools.

Given the significant overlap between Telegram and cryptocurrency users—and particularly poor Web3 user experiences on mobile devices—even simple trading processes often require multiple steps or switching between apps, along with risks like network congestion and MEV attacks. Sensing this pain point, developers began leveraging TG Bots to streamline interactions, leading to the emergence of crypto tracking and trading bots, with Maestro being the most prominent example.

Early Struggles of Trading Bots

Maestro is a Telegram bot offering both monitoring alerts and trade sniping capabilities. Originally launched in October 2021 under the name Catchy—with its own token—the project featured ETH and BSC token and wallet tracking functions but attracted little attention. Its initial token presale even failed due to low participation. Not until August 2022, when it introduced a sniping bot and rebranded as Maestro, did it slowly start gaining traction among traders.

However, despite various attempts at growth, the team struggled to break through user acquisition bottlenecks. On one hand, most users were accustomed to subpar trading experiences and showed limited sensitivity to improvements. On the other hand, enabling advanced automation required users to either submit private keys or use custodial wallets generated by the bot—something many security-conscious crypto users found unacceptable. This situation persisted until spring 2023.

The Meme Coin Boom Arrives

The arrival of Arbitrum's token airdrop in March sparked a full-blown meme coin season across the depressed crypto market. In April, tokens like AIDOGE on Arbitrum ("airdrop-farming" memes) and PEPE on Ethereum ("joke" memes) kicked off a series of hundred- or even thousand-fold gains for projects like LADYS, TURBO, COCO, and TEST—drawing massive capital inflows and user engagement.

Yet, the poor mobile trading experience made it difficult for users without constant desktop access to participate effectively. Take copy trading as an example: if a user spotted a target wallet initiating a transaction via a mobile app (interface, zapper, etc.), completing the same trade would typically involve:

-

Opening transaction details;

-

Copying the token contract address;

-

Switching to a wallet app (which must already have Uniswap open and authorized);

-

Pasting the contract and confirming risk warnings;

-

Entering purchase amount;

-

Confirming quote and executing buy.

This entire process can take anywhere from 10 seconds to over a minute depending on user speed and internet connection—critical delays in the context of fast-moving meme coins. For assets with lifespans as short as three minutes, a one-second difference could mean the gap between dumping early and getting rugged—literally life or death.

Thus, more efficient tools became the holy grail sought after by every trader, bringing trading bots into the spotlight.

With a trading bot, users can automatically monitor specific wallets, replicate trades within just a few blocks, avoid MEV attacks, and even set automatic profit-taking thresholds.

Most notably, the “first-block snipe” feature transformed what was once an exclusive capability reserved for elite "scientists" into something accessible to anyone with funds—no technical expertise needed. This shift fundamentally altered the balance of power between different player types. In any game, two key groups exist: wealthy players who pay to win, and skilled players who rely on technical prowess. A healthy game maintains equilibrium where both achieve similar advantages. Previously, tech-savvy traders dominated rich ones—but the rise of trading bots leveled the playing field. As a result, even premium bots like AlphaMan, charging thousands of dollars annually, maintain a loyal user base.

All these factors fueled the rapid rise of trading bots—and by extension, the broader TG Bot ecosystem—marking them as perhaps the first real-world intent-centric applications. As shown in the chart below, Maestro’s user count began skyrocketing from mid-to-late April.

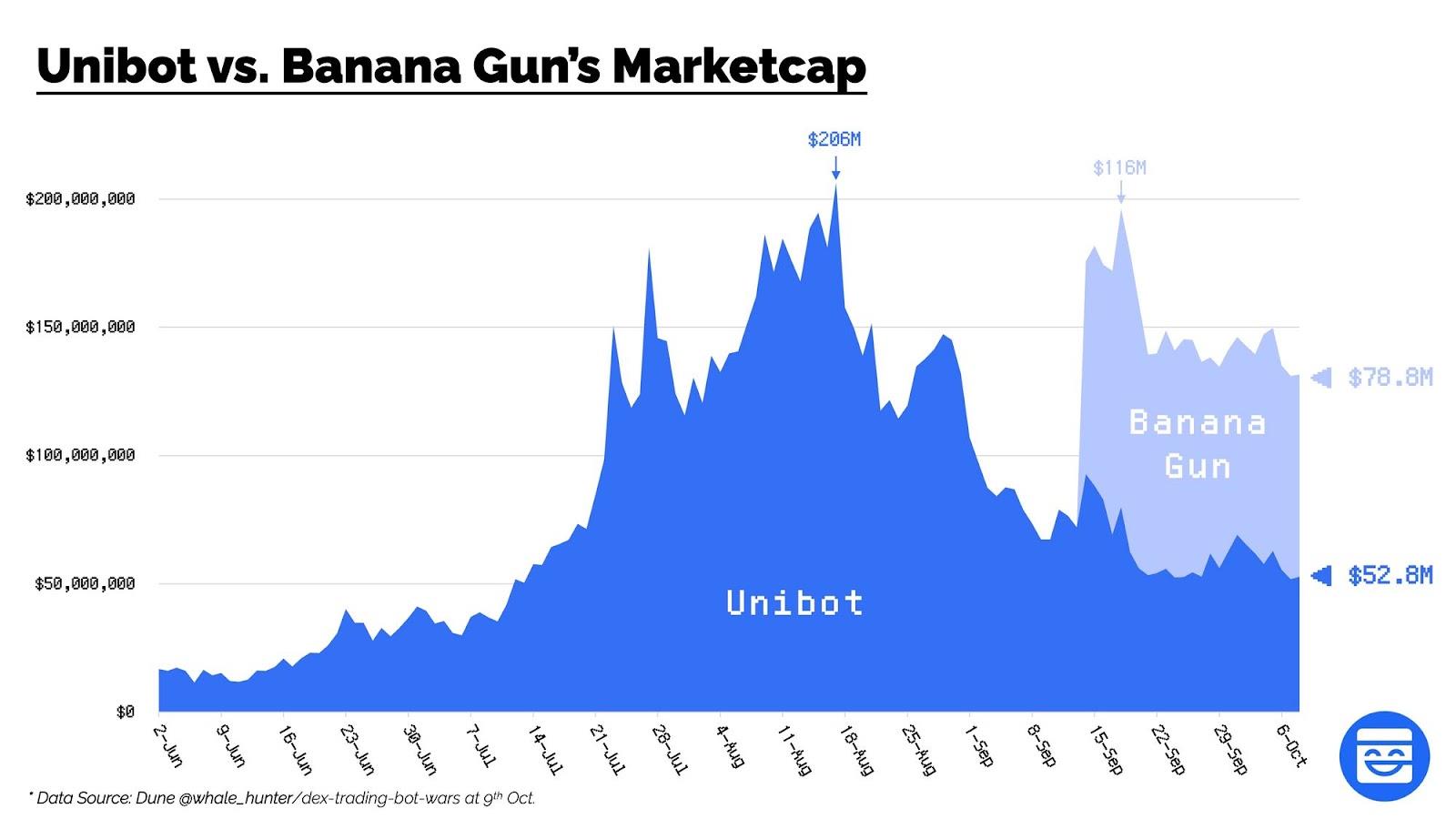

Unibot entered during this period and capitalized on the popularity of $LOOT in July, viral TikTok-driven $YYY, and the resurgence of Harry Potter-themed $BITCOIN. It further solidified its position by launching Unibot X, a web version that captured dual-platform users. Leveraging its token launch advantage, Unibot surged from $57 on July 15 to an all-time high of $199, briefly reaching a $200 million market cap and establishing itself as the dominant leader in the TG Bot space.

Current State of TG Bots

Still Dominated by Trading Bots

Looking at CoinGecko’s Telegram Apps category, the top five market caps are currently occupied by two pure trading bots* (Maestro hasn't issued a token yet)* and AI-integrated bots. However, in practice, even those incorporating AI still center their core functionality around trading.

PAAL AI allows users to deploy custom GPT bots using personalized knowledge bases. It uses GPT-4 and integrates real-time blockchain data and web access to answer queries. However, its primary revenue model remains a 4% dual-sided transaction tax on its token. The team is now developing Paal X, a mobile trading app featuring common trading functionalities like sniping.

ChainGPT follows a similar path, combining trading features with AI-powered Web3 utilities such as on-chain queries, contract generation, NFT creation, and audit automation. AimBot takes another approach—an AI acts as the trader, distributing profits to token holders via protocol rules.

Beyond trading, there are middleware bots like Collab.Land and Guild.xyz, various TG wallets represented by @wallet, and gambling-focused game bots. These applications tend to be less decentralized than trading bots, making usage patterns harder to assess. Moreover, their application scenarios remain relatively narrow, resulting in lower overall热度 compared to trading bots.

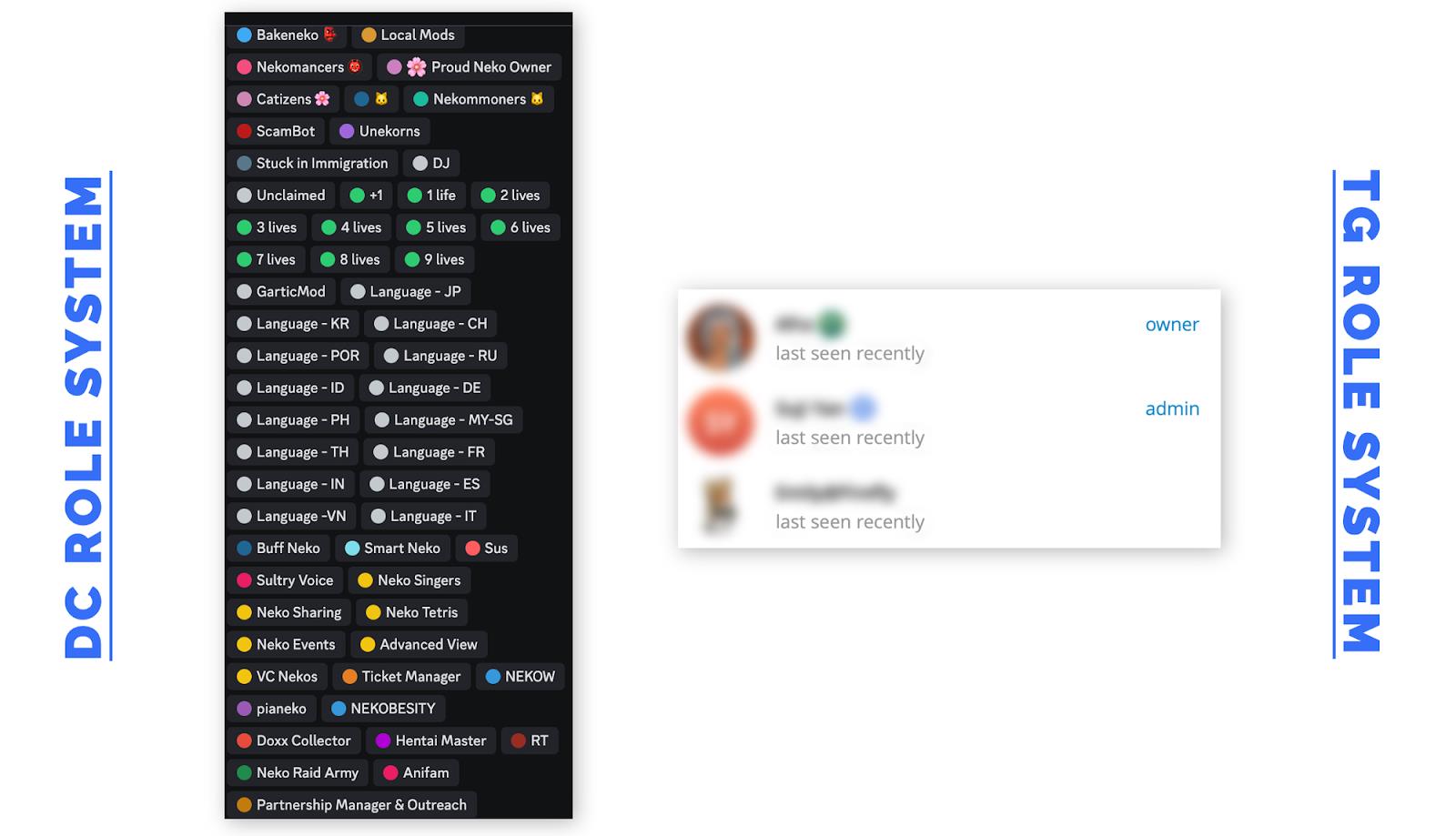

For instance, gating bots like Collab.Land and Guild.xyz dominate Discord’s ecosystem but struggle on Telegram. This is because Telegram lacks the rich identity and permission system available on Discord. Within a Telegram channel or group, there are only two roles: admin and member—leaving little room for sophisticated access control mechanisms.

Most wallet bots are built on the TON ecosystem. Cross-EVM-compatible wallets face challenges related to private key imports—a step that may be acceptable for native wallet apps but raises red flags when done inside a social messaging app.

While gambling games might seem aligned with crypto users, they actually aren’t. Crypto trading itself—especially meme coin speculation—is inherently gamified enough to satisfy most thrill-seekers. Furthermore, many gambling bots operate centrally, which turns off decentralization-focused crypto users. Although some fully decentralized gambling protocols show promise, they primarily serve traditional gamblers while requiring familiarity with Web3 interfaces—limiting their audience.

Therefore, it’s fair to say that the current crypto TG Bot landscape remains overwhelmingly dominated by trading bots.

Relatively Strong Metrics Amid Bear Market Conditions

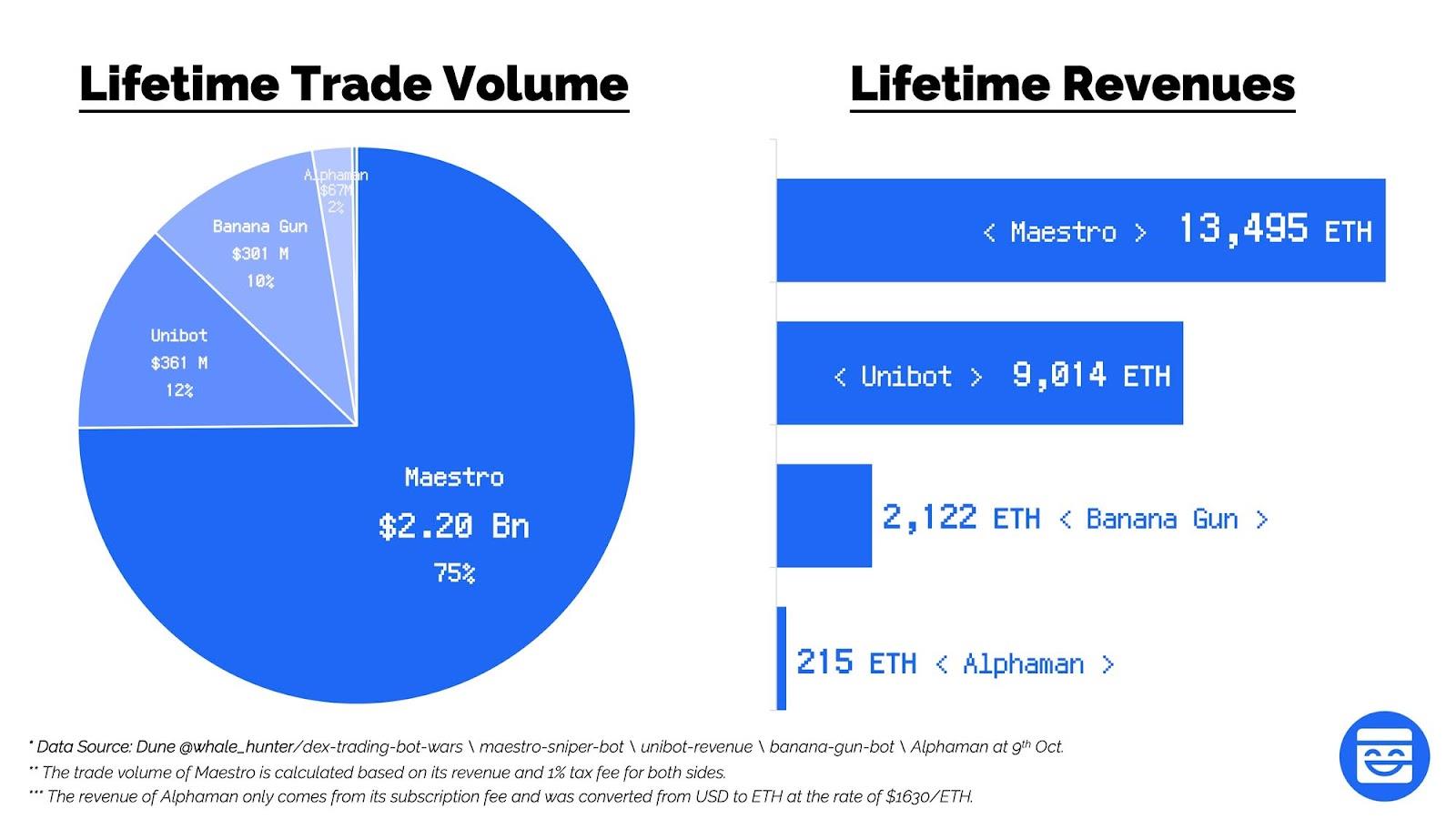

According to Dune analytics, as of October 8, 2023, trading bots have delivered respectable performance despite the broader bear market:

Total trading volume reached $2.94 billion, with 74.9% contributed by veteran Maestro, 12.3% by former leader Unibot, 10.3% by rising star Banana Gun, 2.3% by DC Bot Alphaman, and the remaining ~0.2% from others.

Note: Maestro does not appear directly on the Dune dashboard. Unlike token-issuing competitors such as Unibot and Banana Gun, Maestro earns no revenue from token taxes—only from a 1% service fee on transactions. Despite this, it has accumulated 13,495 ETH (~$22 million) in fees to date, allowing us to estimate its total historical trading volume.

In terms of market cap, Unibot held over 90%, sometimes up to 95%, of the sector’s total value before Banana Gun’s token launch, peaking at a $200 million valuation. On September 14, Banana Gun launched its token and rapidly captured market share thanks to lower fees, comparable UX, and intense social buzz—crowning it the new king.

Currently, the total market cap of the trading bot sector stands at $137 million, with Banana Gun accounting for 57.3%, Unibot 38.4%, together holding 95.7% of the total.

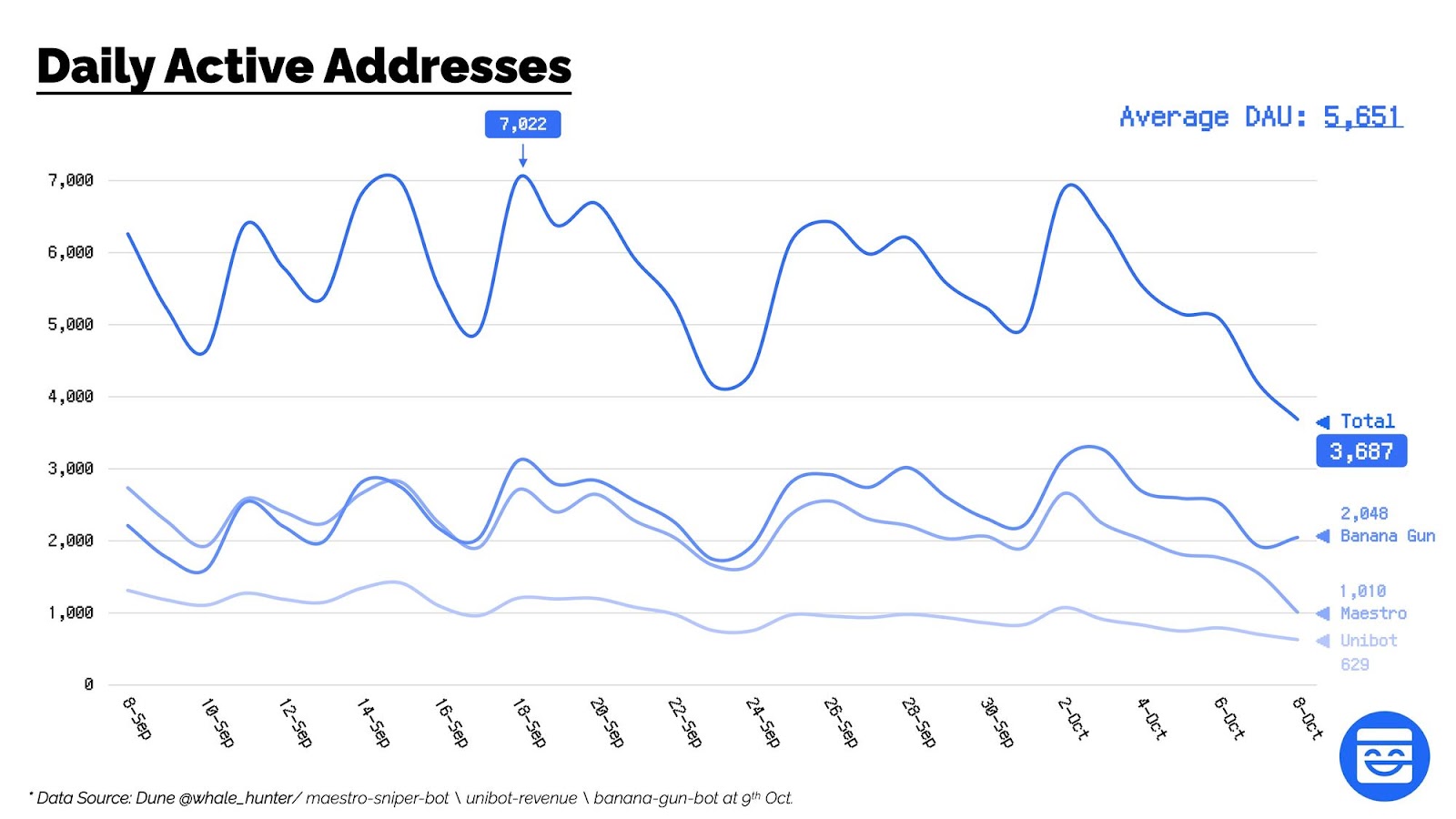

In user numbers, the average daily active addresses (DAU) for the three leading bots over the past month totaled 5,651. Newcomer Banana Gun and veteran Maestro each hover around 2,000 daily users, while Unibot maintains a stable ~1,000. All have seen declines recently due to cooling meme coin activity.

Overall, from a Web3 product perspective, trading bots demonstrate strong performance in both revenue and user metrics. Even in today’s sluggish environment, the top three projects maintain steady user bases numbering in the thousands. While some may be bots or scripts, they still hold value from a business standpoint. Maestro, the oldest and one of the few non-tokenized projects, continues to earn approximately 40–80 ETH per day solely from service fees.

Business Model Breakdown of Trading Bots

Now that we’ve discussed revenues, let’s break down the typical trading bot business model. At present, whether on Telegram or Discord, most follow similar structures:

Product Features

Functionally, offerings fall into three main categories: buying, selling, and trading assistance.

-

Buying

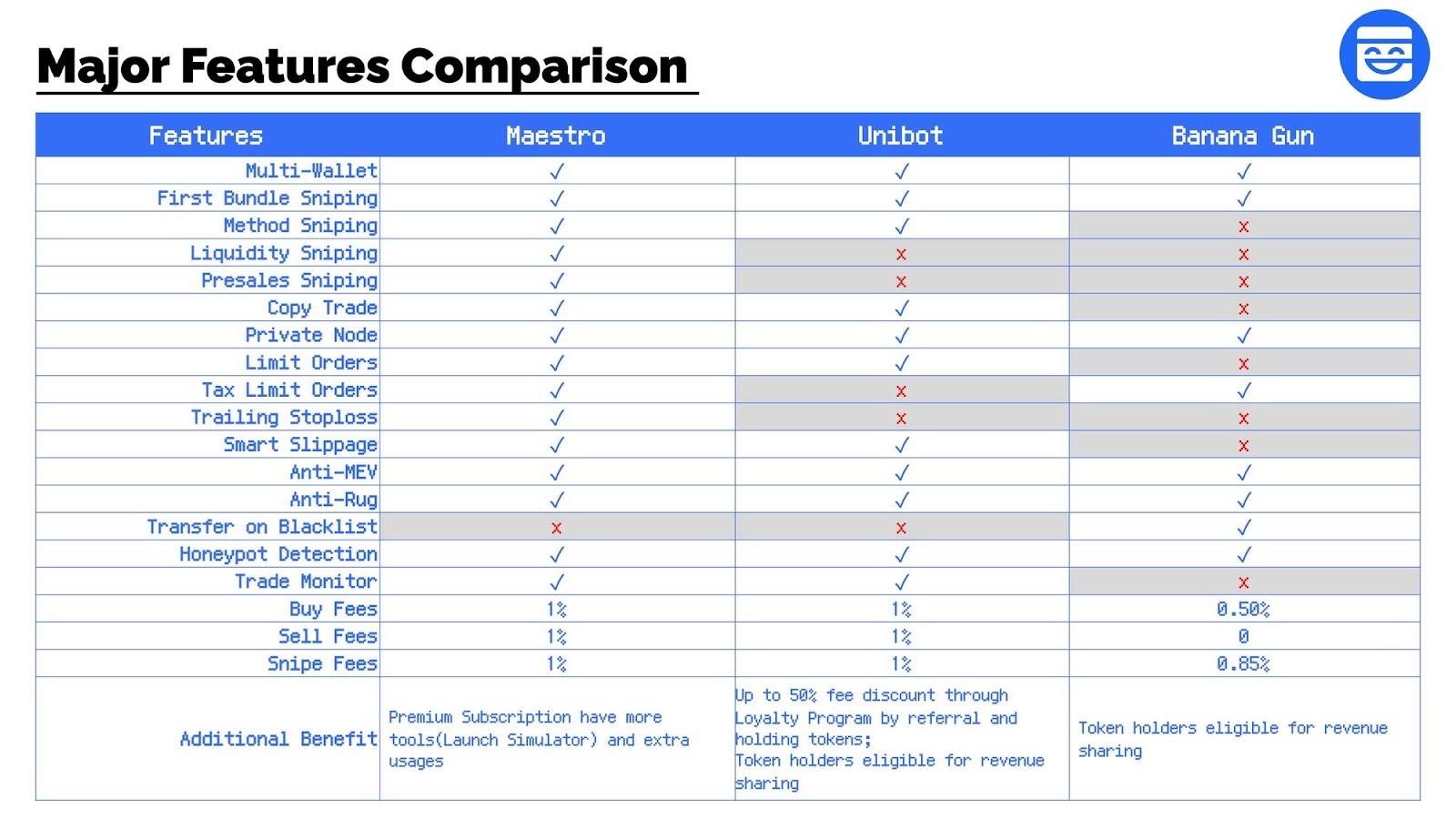

The core buying feature is token sniping, typically achieved in three ways. The most common is first-block sniping (First Bundle Sniping): monitoring the first trade of a token and bribing validators to include your transaction in the first block. Success depends entirely on how much you’re willing to pay.

The other two methods are method sniping and liquidity sniping. Method sniping detects specific functions within a contract (e.g., opening trading), while liquidity sniping monitors LP additions. Both require technical knowledge and can fail due to special contract configurations.

Other important buying features include on-chain copy trading—replicating trades from monitored wallets—and presale sniping, which currently supports only PinkSale-based launches, allowing whitelisted addresses to抢购 popular presales.

Banana Gun also offers a unique feature called tax limit orders, triggering purchases only when buy/sell taxes reach a specified level.

-

Selling

Selling features are simpler, including mainly limit orders, trailing stop-loss, and transfer-on-blacklist (front-running transfers when a token blacklist is detected).

-

Trading Assistance

These are general-purpose utilities such as private nodes, MEV protection, and honeypot detection—aimed at speeding up execution and minimizing losses.

Below is a comparison of features based on personal experience with the three major platforms:

Overall, Maestro offers the most comprehensive feature set—covering nearly everything needed, complete with dedicated call channels for direct interaction. It feels highly systematic. Unibot provides the clearest interface, ideal for beginners, with detailed guidance at every step and seamless integration with its web counterpart UnibotX. Banana Gun focuses on simplicity and low cost—offering essential features at the cheapest price.

Revenue Streams

All trading bots share a common source of income: transaction fees. As shown above, standard rates range between 0.5% and 1%, consistent across most platforms.

Where they differ lies in whether they have launched a token.

-

Token-Issuing Projects

For projects with tokens, additional revenue comes from token transaction taxes and token unlocks.

Take Banana Gun: the team holds 10% of the supply, half locked for 2 years and half for 8, linearly vested over 3 years—meaning minimal near-term gains. However, its token carries a 4% dual-sided trading tax: 2% distributed to holders, 1% to treasury, and 1% to the team. By October 9, just over two weeks post-launch, the team had already received 166 ETH (~$270K) in distributions.

For larger-scale Unibot, under a similar structure, the team earned 2,667 ETH (~$4.34M) in distribution revenue over the past three months.

In terms of total revenue composition, token taxes typically account for over 50–60%, becoming the primary income stream.

Tokens generally serve three purposes: tiered privileges, fee discounts, and revenue sharing. Different projects mix these differently, but most emphasize revenue distribution. For example, Banana Gun token holders receive only profit shares and no additional utility.

-

Non-Token Projects

Projects without tokens instead rely on subscription fees as secondary revenue. These come in two forms: gatekeeping subscriptions (e.g., Alphaman, abot), where only paying users gain access (often waiving transaction fees); and value-added subscriptions (e.g., Maestro), charging both transaction fees and offering enhanced quotas and tools.

Data suggests the latter performs better. Gatekeeping fees significantly reduce new user conversion, while frequent trading means transaction fees often exceed expected subscription income.

Where Are TG Bots Headed?

Overall, TG Bots resemble transitional products within the intent-centric trend—lightweight, efficient, and benefiting from Telegram’s social virality.

Yet, their completeness inevitably falls short of standalone apps. Hence, in the dominant trading domain, two distinct paths have emerged.

One path integrates AI, leveraging LLMs like GPT to expand into broader intent-centric use cases, aiming to build crypto AI agent-like chatbots—exemplified by ChainGPT and PAAL AI.

The other is more pragmatic—focusing purely on trading, enhancing UX through unified mobile and web apps, deepening trading-specific features, and potentially integrating Account Abstraction (AA) for superior wallet experiences. Unibot exemplifies this route, and even AI-focused PAAL AI is developing its own mobile app.

It becomes clear that, at a fundamental level, TG Bots align closely with intent-centric principles. Intent-centric design, while lacking a formal term in Web2 (closest concept being user-centered design), represents an inevitable evolution for blockchain applications. Current Web3 interfaces remain overly complex and fragmented—necessitating simplification and refinement. Rather than being just a concept, intent-centricity reflects a predetermined trajectory, with bots serving as a key manifestation.

Moreover, backed by Telegram’s vast social infrastructure, TG Bots are unlikely to disappear even after intent-centric models mature. Instead, they will likely persist as specialized vertical modules and social entry points—leveraging Telegram’s openness to enable composable, decentralized blockchain ecosystems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News