Author: Nancy, PANews

There was a time when the TON ecosystem rapidly rose to prominence, powered by Telegram's massive user traffic and fueled by the frenzied belief that "traffic equals value." However, as the initial traffic红利 (dividend) begins to fade, reality has set in, and TON's growth engine is slowing down. A singular narrative, imbalanced resource allocation, external shocks, and market cycle fluctuations have plunged the TON ecosystem into a period of painful adjustment.

Now, TON may be approaching a turning point after the ebb of traffic-driven hype. Recent developments—such as a $400 million funding round backed by top-tier venture capital and a series of positive announcements following its exclusive integration with Telegram—are reigniting growth expectations for TON.

$400 Million Raised, Exclusive Access to Telegram’s Traffic

On March 20, the Open Network Foundation (TON Foundation) announced a funding round exceeding $400 million. Investors include renowned venture capital firms such as Sequoia Capital, Ribbit Capital, Benchmark, Kingsway, Vy Capital, Draper Associates, Libertus Capital, and SkyBridge. Notably, this investment was not made through traditional equity or cash deals but via direct purchases of TON tokens—an approach widely seen as strong validation of TON’s long-term potential.

Public records show that TON had previously completed six funding rounds, mostly conducted via over-the-counter (OTC) transactions. The last publicly disclosed round raised $30 million, making the current $400 million raise a significant leap in fundraising capability, setting a new record for TON. More importantly, this round attracted several leading Western VCs with deep financial backing and proven track records—adding substantial credibility and narrative momentum to TON.

Ribbit Capital, a fintech and crypto-focused fund, previously backed industry giants like Revolut, Nubank, Coinbase, and Robinhood. Benchmark is known for early bets on eBay and Instagram. Meanwhile, Sequoia Capital has an expansive portfolio including Stripe, Nubank, Klarna, Fireblocks, and StarkWare.

For TON, this funding round signifies far more than just capital infusion—it marks a clear signal of mainstream institutional recognition. This is particularly significant given Telegram’s past regulatory challenges, which had cast uncertainty over TON’s development trajectory.

Beyond financial backing, TON has also received major ecosystem-level support. Although TON was previously forced to operate independently from Telegram due to regulatory pressures, the two have now re-established a deep strategic alliance. In January, Pavel Durov publicly confirmed that TON will become Telegram’s exclusive blockchain partner. As part of this exclusive partnership, all mini-apps on Telegram must migrate to the TON ecosystem, and the TON token will serve as the sole payment asset across all Telegram chat services.

Telegram’s massive user base offers vast growth potential for TON. According to the latest data shared by Pavel Durov, Telegram now boasts over 1 billion monthly active users, making it the second-largest messaging app globally (excluding China-specific WeChat). User engagement continues to rise, with each user opening the app an average of 21 times per day and spending 41 minutes daily on the platform. Telegram’s revenue has grown significantly as well, reaching a profit of $547 million in 2024. The platform is also continuously refining its product experience—for instance, recently announcing its third major update of the year, enhancing video features and AI-powered sticker search. It plans to introduce trading and yield functions within its self-custody crypto wallet and launch a loyalty program for TON holders, further driving adoption across the TON ecosystem.

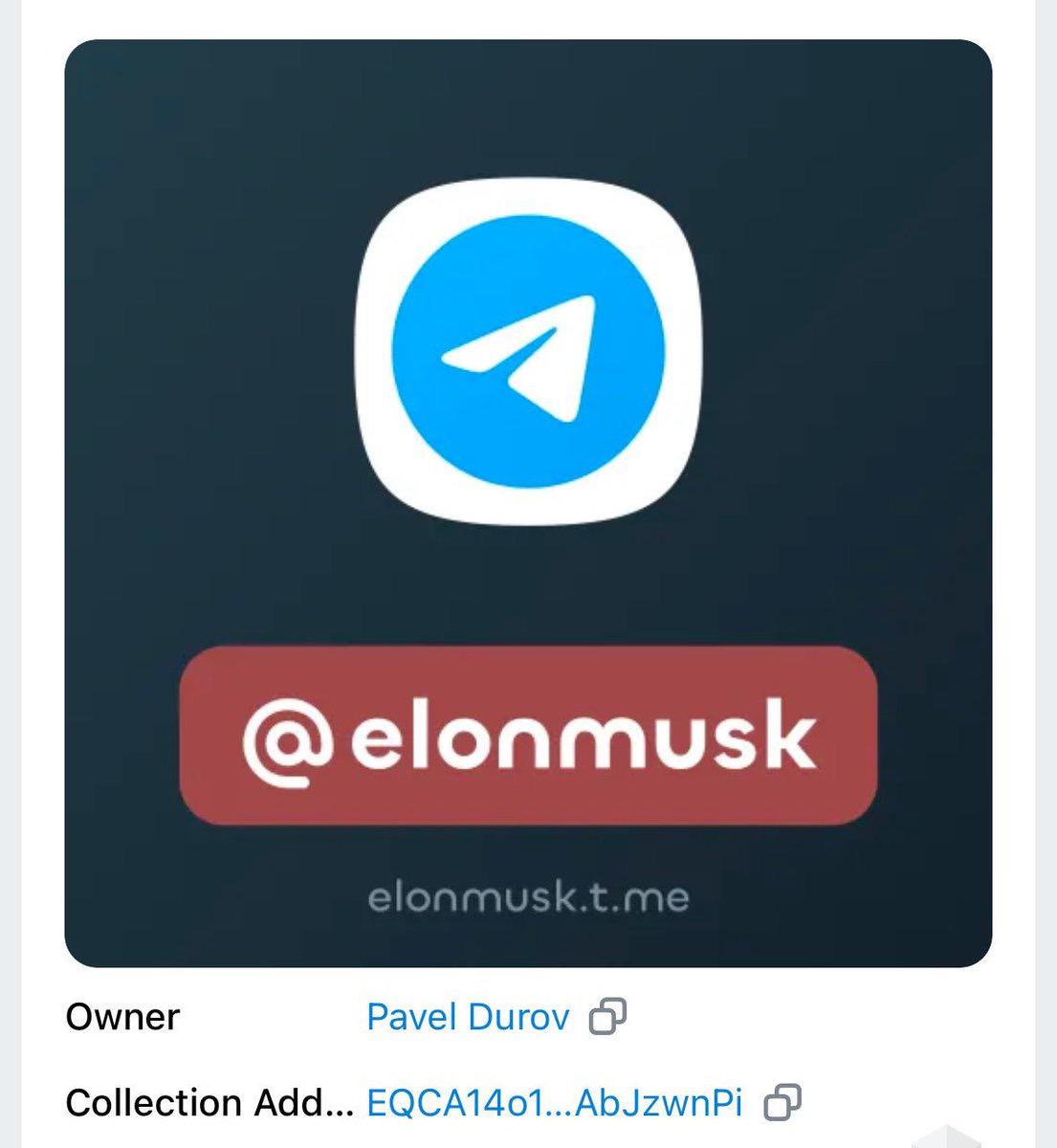

Additionally, Pavel Durov’s recent return has injected renewed confidence and momentum into the TON ecosystem. Widely regarded as TON’s key driving force, Durov’s personal situation directly impacts community morale and development pace. Last August, he was arrested in France over allegations that Telegram failed to adequately moderate illegal content, triggering a sharp drop in market confidence and causing both TVL and token price to plummet. However, French authorities have since relaxed judicial supervision conditions, allowing him to return to his long-term residence in Dubai. Since then, sentiment within the TON community has rebounded. Following his return, Durov has taken several high-profile actions—spending 5,000 TON to acquire the username “elonmusk” on Telegram, and launching xAI’s AI bot Grok on Telegram, offering free access to Premium subscribers.

With robust financial backing, endorsement from elite venture capitalists, deep integration with Telegram’s ecosystem, and Durov’s return—all these factors are collectively fueling renewed optimism around the TON narrative.

Ecosystem Frenzy Cools Down: Multiple Challenges Remain

Despite these positive signals, the TON ecosystem still faces serious challenges. Over the past year, key performance indicators have shown a significant downward trend, marking a clear transition from earlier exuberance to a cooling-off phase.

According to Artemis data, the TON token has fallen more than 54.8% from its peak, with market capitalization shrinking dramatically from a high of $25.2 billion. Concurrently, total value locked (TVL) in the TON ecosystem has dropped sharply—from over $770 million at its peak to just $170 million today, a decline of 77.9%.

Declining on-chain activity further underscores the ecosystem’s struggles. Artemis shows that daily active addresses on TON have plummeted from a peak of 2.5 million to just 137,000—less than 6% of the high—and representing a drop of over 94.5%. Daily transaction volume has similarly declined from a peak of $2.3 billion to the current $320 million, down 86.1%. These sharp declines clearly reflect a weakening internal economy, with both user participation and transaction activity severely contracted.

This downturn stems from a confluence of factors. Initially, TON relied heavily on mini-games and mini-apps within Telegram, leveraging the social platform’s vast user base to attract rapid traffic growth. However, this model—driven largely by short-term hype—proved unsustainable once the wealth-generation appeal faded and user novelty wore off. Early mechanisms like "Tap to Earn" drew many users, but failed to convert them into long-term, committed participants, resulting in a quick exhaustion of the traffic dividend.

Moreover, TON’s ecosystem narrative has largely revolved around Telegram’s social features and casual gaming. Compared to other public blockchains, TON remains underdeveloped in diverse sectors such as DeFi, AI, and DePIN, weakening its overall competitiveness. Data from DeFiLlama reveals that, over the past month, only one protocol—Tonstakers, a liquid staking solution—has surpassed $100 million in TVL. Just 13 projects have reached TVL between $1 million and $10 million. This concentration highlights both excessive centralization and a lack of diversification in the TON ecosystem.

In addition, TON’s technical barriers remain high. Its unique programming language and architectural design are not developer-friendly, slowing project development and discouraging high-quality teams from joining the ecosystem—further constraining innovation and diversity.

Compounding these issues is the imbalance in internal resource allocation. As noted, marketing efforts and resources have been overwhelmingly focused on Telegram-based mini-games such as Catizen, Notcoin, and Hamster Kombat, which achieved viral success upon launch thanks to Telegram’s network effects. However, similar success has not been replicated in other TON-based sectors. With most resources funneled into a few dominant applications, smaller and mid-sized projects struggle due to limited visibility and narrative support, making it difficult for them to attract users or investors. This imbalance not only makes the ecosystem overly reliant on a narrow segment but also undermines its resilience against risks. Combined with broader market shifts and intensifying external competition, TON’s challenges have only deepened.

In summary, whether TON can chart a new growth trajectory depends not only on sustained external traffic support but also on achieving substantive breakthroughs in ecosystem diversification, technological innovation, and effective resource integration.