Q3 Recap of Eight Key Highlights: Market Correction, Industry Developments, and New Application Breakthroughs

TechFlow Selected TechFlow Selected

Q3 Recap of Eight Key Highlights: Market Correction, Industry Developments, and New Application Breakthroughs

Even if financial markets are quiet, there are still exciting industry advancements and new applications to see.

Author: SUSS NiFT Researcher @Jesse_meta

The third quarter saw relatively weak market performance, with a brief pullback following a period of low volatility. This was expected, as Q3 has historically underperformed. Only deep cleansing can concentrate holdings into the hands of true believers—the diamond-handed. Even amid financial market calm, we witnessed exciting industry progress and new applications. Let's review the top eight highlights of Q3.

Ripple — A Milestone Victory for Crypto Markets

On July 13, the U.S. District Court for the Southern District of New York ruled on the SEC’s allegations against Ripple, determining that XRP, as a digital token, does not itself constitute a "contract, transaction, or scheme" under the Howey Test—meaning XRP is not a security. Using XRP for investment, grants, executive transfers, or order-book sales on exchanges is not considered a securities offering. However, institutional sales, OTC deals, ICOs, and IEOs involving XRP are deemed securities.

If the relatively centralized XRP is not a security, then more decentralized cryptocurrencies have even stronger claims to non-security status. Following the ruling, XRP surged 90%, with BTC and ETH rising in tandem. Previously SEC-classified securities like SOL and MATIC also rallied sharply. Coinbase subsequently relisted XRP. This marked a major win for the crypto industry amid years of aggressive SEC regulation, temporarily clearing regulatory uncertainty and indirectly affirming the legality of crypto exchanges listing tokens (after prior SEC lawsuits against Binance and Coinbase over unregistered securities trading).

The SEC later filed an appeal. The battle between the SEC and Ripple continues. Regulatory ambiguity remains a shadow over crypto markets. Clear regulations are urgently needed to reduce chaos. Only well-defined legislation can better protect investors. Industry participants should actively engage regulators to foster mutual understanding and achieve win-win outcomes.

Layer 2 — ETH Tokens Aren’t Enough Anymore!

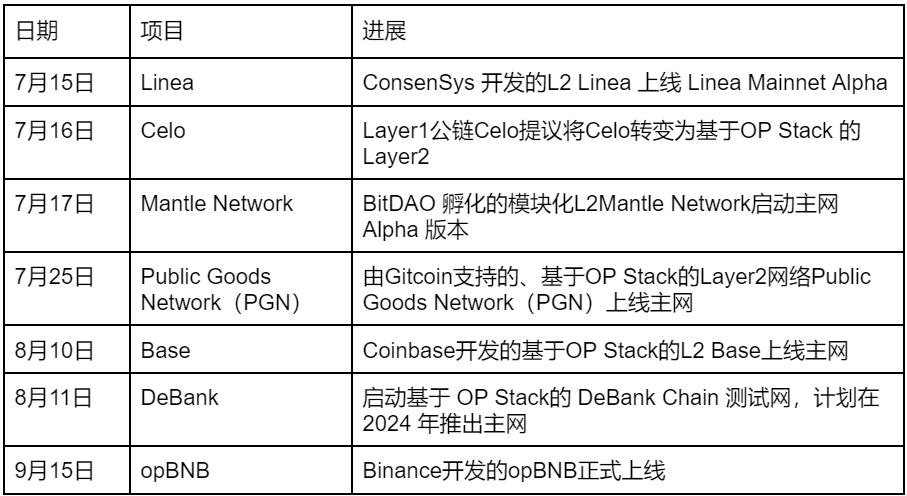

Ethereum Layer 2 networks continue their momentum, flourishing with numerous L2s launching—even competitive L1s like Celo joining the Ethereum L2 ecosystem. Airdrop hunters now complain they don’t have enough ETH to cover gas fees across all these chains.

According to L2Beat, 31 L2s are tracked, with 18 exceeding $10 million in TVL. Arbitrum leads with $5 billion in TVL, capturing 54.31% market share, far ahead of Optimism’s $2.42 billion (25.31%). ZK Rollup-based ZkSync Era ranks third with $428 million, but only 4.47% market share. OP Rollups clearly benefit from first-mover advantage. Yet this doesn’t mean OP will dominate long-term or that ZK and OP paths are mutually exclusive. Projects like Polymer are exploring hybrid solutions combining both technologies. Today’s OP-based L2s may transition to ZK Rollups in the future.

Polygon co-founder Sandeep Nailwal stated at TOKEN 2049 that today’s Ethereum resembles a user-to-chain model, transitioning toward a chain-to-chain paradigm. In the next 2–4 years, Ethereum will evolve into a foundational settlement layer, providing security, settlement guarantees, and safety functions for interconnected chains.

Worldcoin — Savior of the AI Era?

On July 24, Worldcoin released a public letter signed by OpenAI co-founder Sam Altman, announcing the official launch of the WLD token, which was immediately listed on major exchanges.

Worldcoin aims to build a globally owned identity system and financial network. It seeks to expand economic opportunities in the AI era by offering a solution to distinguish humans from AI. While preserving privacy, it explores a path toward AI-funded universal basic income by distributing tokens to wallets verified as belonging to unique human individuals.

In the AI era, massive workforce displacement due to productivity gains is foreseeable, while AI companies reap enormous profits. Worldcoin proposes redistributing those profits so every verified human receives a basic income.

To realize this vision, Worldcoin must first verify each person’s unique identity to prevent fraud and duplicate claims. After evaluating government IDs and web-of-trust models, Worldcoin chose iris-scanning biometrics. It uses a dedicated hardware orb to confirm users are real people, ensuring one person registers only one identity. The orb employs custom cameras and algorithms to extract iris features, processes everything locally, stores no images, and outputs only a signed iris code. Zero-knowledge proofs decouple this data from the user’s wallet, protecting privacy. As of September 15, 2.298 million people had registered on Worldcoin.

This is a highly ambitious and forward-thinking project that sparked broad community interest. However, critics remain. Vitalik raised concerns about privacy, centralization, security, and accessibility. Additionally, residents in economically disadvantaged regions have reportedly sold their iris scans cheaply, contradicting the project’s original intent. In August, Kenya—one of Worldcoin’s initial launch countries—paused registrations over security, privacy, and financial concerns.

Telegram Bots — Innovation and Speculation in Crypto Trading

Unibot, a Telegram-based trading bot, saw its token market cap surge from around $30 million on July 7 to $2 billion on August 10, drawing widespread attention from crypto users to Telegram bots and related tokens.

Unibot allows users to interact with the bot, monitor liquidity pools, receive alerts on newly minted tokens, trade, and copy trades. Its execution speed is six times faster than Uniswap. Token holders earn 40% of trading fees and 1% of total $UNIBOT trading volume as dividends. With fast execution, innovative features, and a solid revenue-sharing model, Unibot stands out among competitors. Especially during periods lacking technological breakthroughs and with weak market conditions, some crypto users turn to trading altcoins or meme coins for high returns—Unibot offers them a quasi-centralized exchange experience.

While meeting degen demand, the rise of such bots brings significant risks. Centralization increases attack surfaces. Users importing private keys into bots risk losing assets. Following Unibot’s success, various trading bots emerged—LootBot, Bridge Bot, MEVFree—offering different crypto services.

According to CoinGecko, $UNIBOT peaked with a 27x increase but plunged 70.47% from its all-time high just 27 days later—once again proving that innovation in crypto often goes hand-in-hand with financial speculation.

Friend.tech — Reimagining Web3 Social

Launched on Base on August 10, Friend.tech is a novel social app allowing users to buy tokenized shares of Twitter influencers to gain exclusive access to their private group chats.

Within its first week, Friend.tech processed over 7,000 ETH in trading volume, demonstrating strong market appeal. By September 12, over 210,000 users had completed 3.734 million transactions. This rapid growth stems not only from close collaboration with crypto Twitter KOLs but also from its innovative Progressive Web App (PWA) design—no download required, enabling easy browser access even for crypto newcomers.

Friend.tech’s innovation lies in using tokens to represent ownership in social interactions—akin to holding equity in a company. Each additional holder of a creator’s token drives up its price. Trading incurs a 10% fee: 5% to the protocol, 5% to the creator. Within a week, creators collectively earned $13.25 million. On August 19, Friend.tech announced a $100 million exclusive funding round from Paradigm, introducing a points system to boost user engagement.

Although user growth has slowed, Friend.tech remains in beta testing, and upcoming features could reignite adoption. Subscription-based content platforms have already proven their commercial viability, allowing fans to participate in creator economies. However, the sustainability of fan token growth requires case-by-case evaluation.

On August 21, it was revealed that Friend.tech’s API allowed direct queries of user wallet and Twitter data, exposing over 100,000 users’ information. Privacy protections need improvement. Additionally, tokenized stocks may attract scrutiny from the SEC.

PYUSD — Web2 Financial Giants Enter the Stablecoin Arena

Stablecoins are vital tools for value preservation in crypto and a cornerstone of DeFi. Beyond fiat-backed pioneers Tether and Circle, native DeFi protocols like MakerDAO, Aave, and Curve compete by over-collateralizing crypto assets to mint decentralized stablecoins. After dropping BUSD, Binance began supporting FDUSD, a stablecoin issued by a Hong Kong trust firm.

Issuers earn yield from underlying assets or seigniorage. With short-term U.S. Treasury yields reaching 5%, PayPal joined the stablecoin race on August 7, becoming the first major U.S. financial company to issue its own stablecoin.

PayPal uses Paxos as issuer, with reserves fully backed by U.S. dollar deposits, short-term U.S. Treasuries, and cash equivalents. Thus, PYUSD is a centralized USD-pegged stablecoin similar to USDT and USDC. Unlike USDT, which doesn’t serve U.S. users, PayPal offers PYUSD domestically.

As a Web2 payment giant, PayPal boasts distribution channels unmatched by Web3 firms. Despite limited initial on-chain use cases, PayPal’s strong reputation in payments could rapidly onboard millions of existing users to PYUSD—especially if incentivized—or encourage merchants to adopt PYUSD by lowering transaction fees. On September 12, PayPal launched a crypto-to-fiat redemption service for U.S. users, offering a secure off-ramp. This suggests PayPal could drive broader crypto adoption, making stablecoins part of everyday payments.

However, given recent U.S. regulatory pressure on DeFi and uncertain stablecoin rules, PYUSD’s trajectory remains to be seen.

FTX Liquidation — Can the Market Absorb the Sell Pressure?

On September 14, CoinDesk reported a court ruling allowing FTX to sell, pledge, or hedge its crypto holdings to repay creditors. FTX currently holds around $3.4 billion in liquid Class A crypto assets, including approximately $1.2 billion in SOL, $560 million in BTC, and $192 million in ETH. Illiquid Class B assets like SRM and MAPS face challenges in monetization.

Beyond crypto, FTX has about $4.5 billion in venture investments—$500 million in AI star Anthropic, $1.1 billion in major Bitcoin miner Genesis. It also engaged in asset management partnerships and fintech lending. Given the solid fundamentals of some portfolio companies, FTX may yet generate substantial returns.

According to Messari’s September 11 report, FTX and Alameda’s combined BTC and ETH holdings account for about 1% of weekly trading volume—minimal impact expected. However, FTX’s SOL and APT holdings represent 81% and 74% of their respective weekly volumes. These assets remain locked, suggesting potential long-term sell-side pressure. TRX, DOGE, and MATIC may also see moderate effects, with FTX holdings accounting for 6%–12% of weekly volume. Reports suggest a weekly liquidation cap of $100 million, reducing the likelihood of dumping entire positions at once. Market impact has likely been partially priced in.

The FTX liquidation once again reminds investors to prioritize asset liquidity. While altcoins may outperform majors like BTC during rallies, poor liquidity turns paper gains into illusion. Decentralization is Web3’s core value—only sufficient decentralization ensures real security.

Snaps — MetaMask’s Self-Disruption

MetaMask, an essential wallet for nearly every crypto user, plays a pivotal role in the Ethereum ecosystem by enabling RPC connections to EVM-compatible chains. However, non-EVM chains like Cosmos, Solana, Sui, and Starknet offer unique technical advantages and vibrant ecosystems, yet require separate dedicated wallets—hindering seamless user experience.

To solve this, MetaMask introduced Snaps—a plugin API standard that integrates non-EVM chains, allowing users to access them directly within their existing MetaMask interface, opening doors to a truly multi-chain world.

Beyond cross-chain interoperability, Snaps offer enhanced transaction insights, warning users of potential security risks before signing—greatly reducing phishing risks in self-custody. Snaps can also retrieve specific information within the wallet, adding communication capabilities.

Snaps represent MetaMask’s self-disruption—evolving from EVM wallet leader to a universal gateway for all chains and dApps. Developers can now extend functionality creatively within MetaMask, crafting entirely new Web3 experiences.

Despite internal and third-party audits, inherent smart contract risks remain. Currently, Snaps operate only in sandbox mode, unable to access MetaMask account data, ensuring isolation from users’ primary assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News