Delphi Digital: Friend.Tech Ripples Again – Data Reveals Trading Activity and Profit Strategies

TechFlow Selected TechFlow Selected

Delphi Digital: Friend.Tech Ripples Again – Data Reveals Trading Activity and Profit Strategies

FT core community members are typically excited about the platform's potential and enjoy using it and/or leveraging it to maximize profits.

Written by: Bitcoin Sage

Compiled by: TechFlow

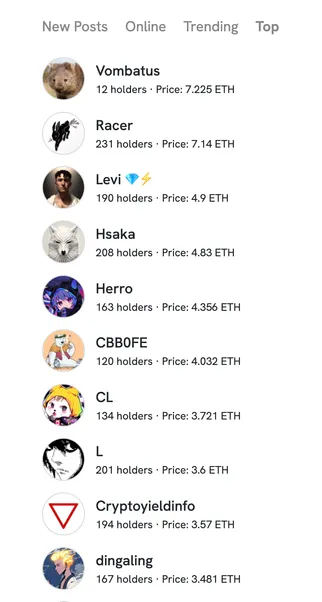

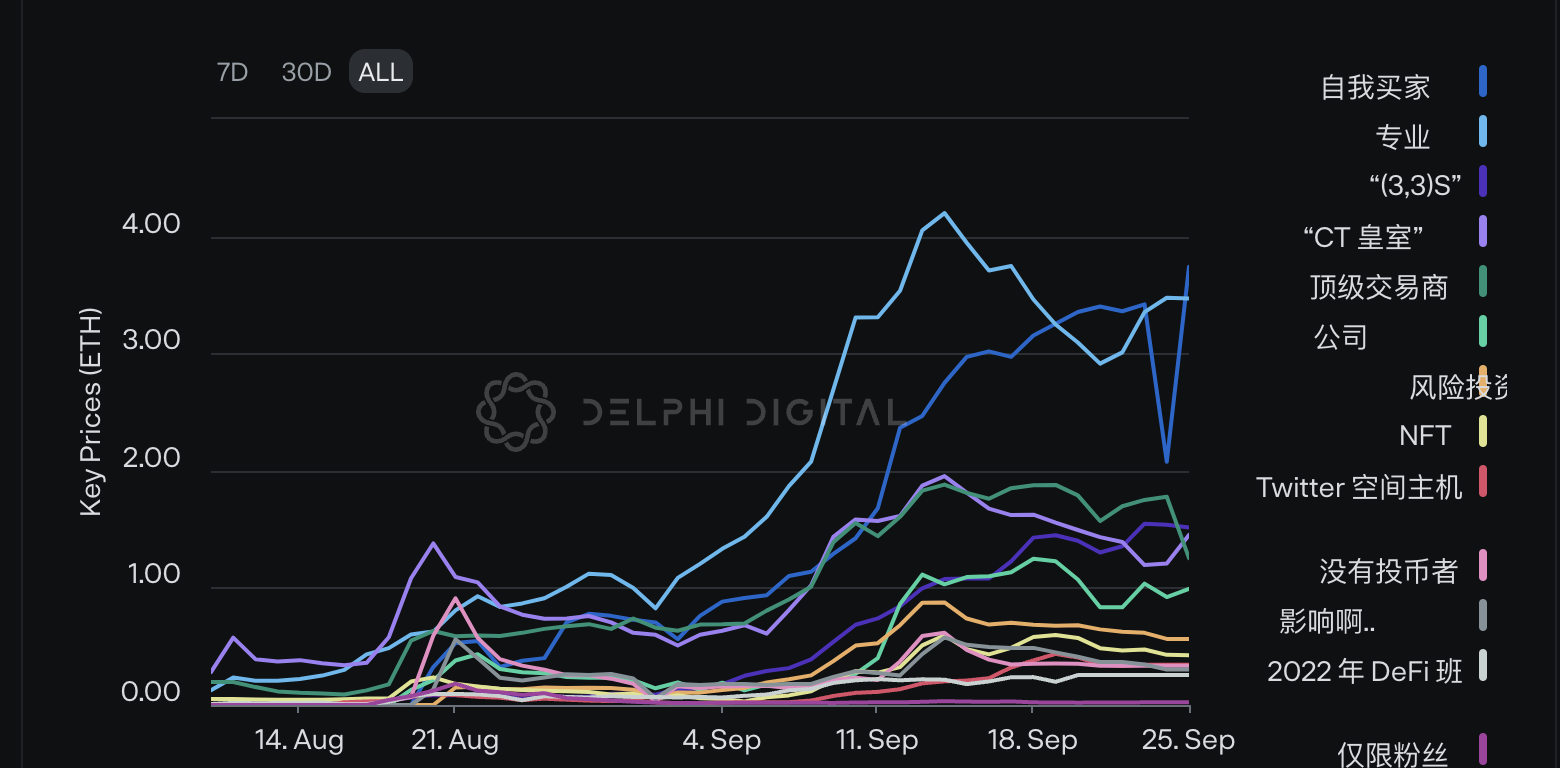

Over the past few weeks, Friend.Tech (FT) has driven momentum in SocialFi. Many prominent crypto Twitter personalities are now actively participating there, generating significant hype. Hsaka and CL have key prices of 5 and 4 ETH respectively. Currently, Vombatus leads with a self-purchased key price slightly above 7 ETH.

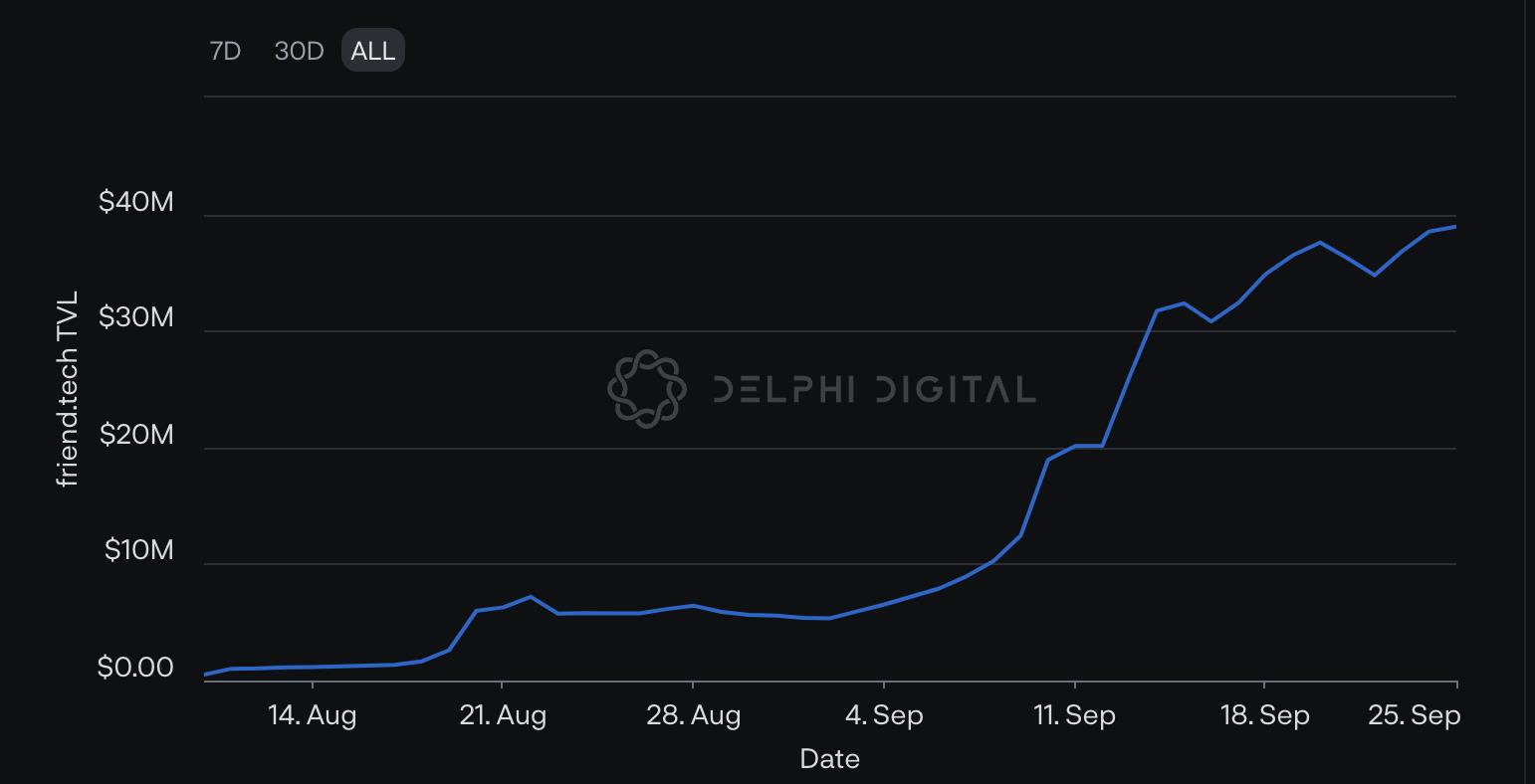

At the beginning of September, total value locked (TVL) was $5.3 million. It is now at $39 million, an increase of nearly 700%. While parabolic growth in TVL has recently slowed, it continues to rise steadily.

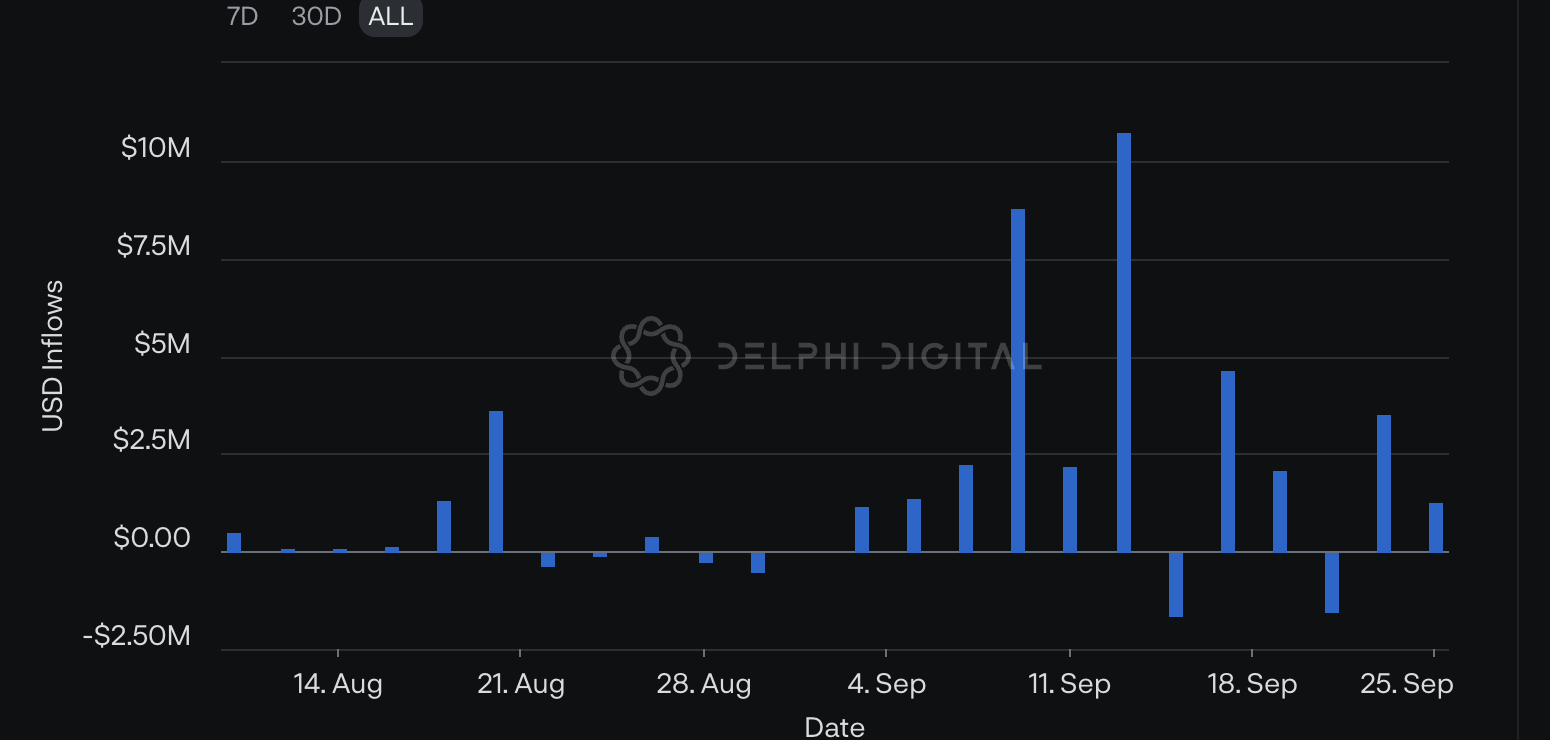

From a daily dollar inflow perspective, it's clear that overall inflows remain healthy. A peak occurred over the weekend of September 10, 2022, when TVL grew by 50% in a single day.

Since early September, FT’s trading volume has surged significantly. Over the past week, volumes have stabilized around $10 million per day. Notably, there has been a shift between sell and buy volumes—last week saw a marked increase in selling pressure, indicating profit-taking and possible user exits. However, since last Friday’s implementation of reduced points for self-purchases, buyer confidence has returned, as shown by increased buying volume relative to selling.

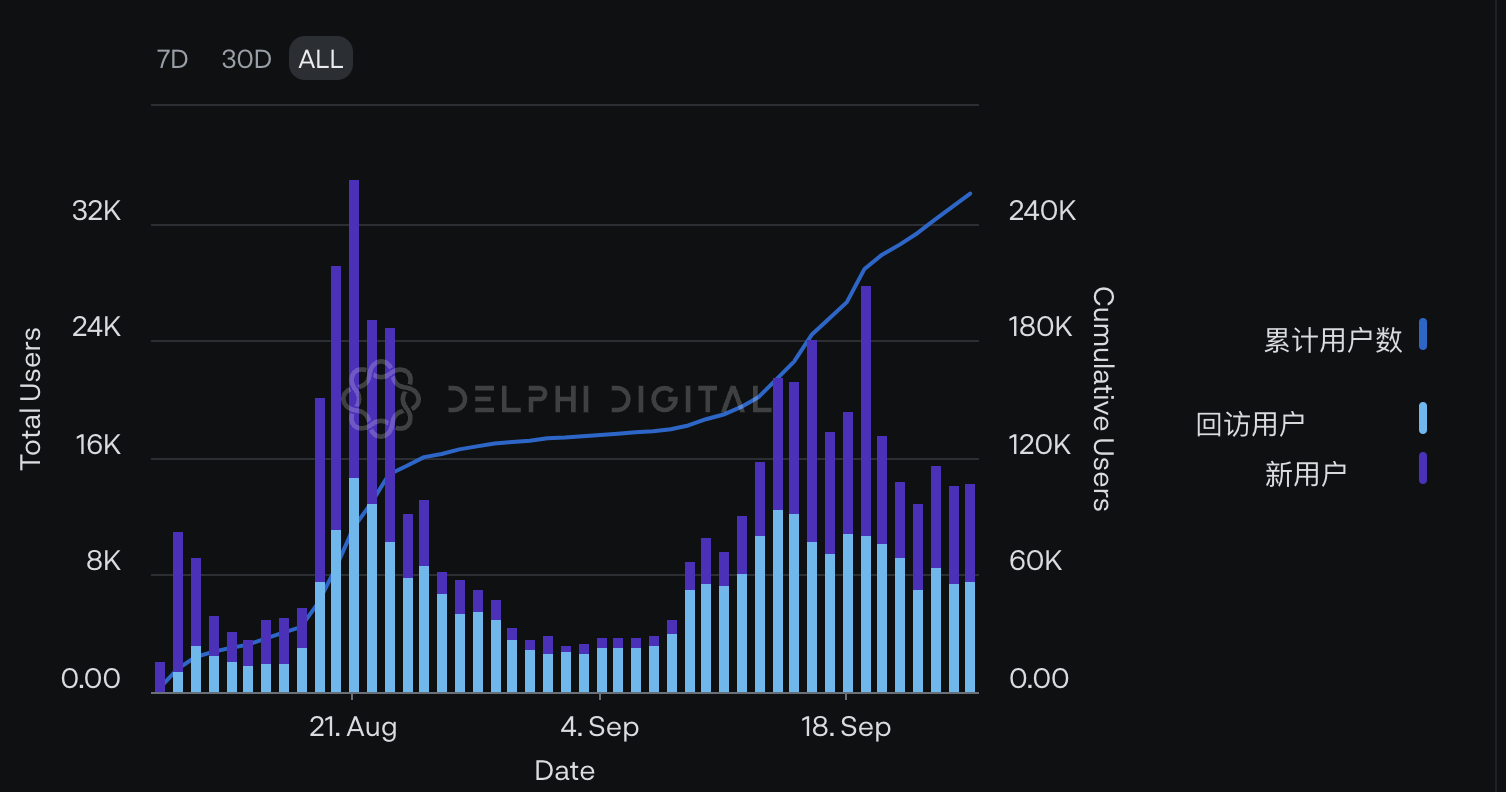

Consistent with TVL and trading volume, user activity has also grown significantly since early September—a healthy sign of product-market fit. FT currently has approximately 10,000 returning users daily, with an average of 90,000 new users added each day last week.

When reviewing these numbers, it's important to recognize that many trading bots are active on FT, making it unclear how many users are actually bots.

Strategies

FT has developed a highly active core community. This core group is generally enthusiastic about the platform’s potential and enjoys either using it or leveraging it for profit maximization. The primary objectives for core community members aiming to maximize profits are:

-

Accumulating airdrop points;

-

Trading keys to increase portfolio value;

-

Increasing their own key price.

To achieve these goals, several main strategies have been adopted.

(3,3)

This is a well-known principle originating from OHM—mutually purchasing each other’s keys and holding. This increases both parties’ key prices, portfolio values, and weekly airdrop points distributed every Friday. Point allocation criteria vary weekly but typically depend heavily on the size of a user’s portfolio. This strategy works particularly well for users without an existing following on other social platforms, as (3,3) participants analyze on-chain data to find suitable (3,3) partners and tend to follow up purchases reciprocally. Thus, it’s also an excellent way to drive room activity.

Over the past few weeks, (3,3) has outperformed other segments by a wide margin, making it one of—if not the most—profitable general strategies available today.

Like OHM, this strategy exhibits strong reflexivity, potentially leading to disastrous consequences for its users. However, due to FT’s social component and the potential to enhance keyholder value through other means—such as content creation, access to exclusive tools, and network opportunities—it may not necessarily end the same way.

(3,3) communities are arguably the most dedicated, having built numerous dashboards and tools that not only track but also incentivize desired long-term behaviors. As a result, (3,3) rooms are often highly active and deeply focused on all things FT. It’s fascinating to observe users proactively addressing (potential) negative issues to ensure the prosperity of their community and FT as a whole.

Self-Purchasing

Over the past few weeks, the most effective method for accumulating points has been purchasing one’s own key, whether through a main account or alt accounts.

With this strategy, users purchase their own key from the outset. This results in them owning all initial keys, eliminating downside price risk, and achieving a portfolio value multiplier of approximately 2.5x compared to buying someone else’s key. This is because self-purchasing increases the key price with each subsequent buy, thereby increasing portfolio value. The only cost incurred by the user is the 5% fee paid to the protocol upon buying and eventually selling the key.

Currently, 15 out of the top 50 keys belong to self-buyers. Additionally, there may be alt buyers, which are harder to identify. Therefore, a significant portion of points has been accumulated by self-buyers.

However, over recent weeks, many argued that self-purchasing needed to be weakened, as it adds no value to the platform. Moreover, it dilutes incentives for organic users. More importantly, an increasing share of new liquidity relative to existing keys has been flowing toward self-buyers.

Last Friday, FT made drastic changes to its points distribution algorithm, significantly weakening self-purchases. For example, the top-ranked user "Vombatus" received 3.33 points per ETH, while (3,3) pairs averaged around 90 points per ETH. Over the weekend, this caused several self-buyers to sell their own keys and switch to the (3,3) strategy, purchasing (3,3) partners’ keys in hopes of reciprocal buys.

As shown in the chart below, the key price rises rapidly as more identical keys are purchased.

Sniping

Snipers use bots to buy the first keys from newly joined users. Initial key prices can be as low as a few cents. Subsequent purchases quickly raise the price, allowing snipers to often realize profits within hours of a successful snipe.

For those technically skilled enough to compete effectively, this may have been—and may still be—the most profitable strategy.

Buying KOLs

A simpler strategy involves buying keys from professionals or KOLs who are likely to stay near the top of the leaderboard. The main reason is to gain broad exposure to FT’s upside while keeping things relatively manageable and limiting downside risk.

Over the past few weeks, this strategy has been highly profitable, as top keys rose from 1–2 ETH to peaks of around 4–8 ETH. However, as seen in the table above, it is not competitive compared to the (3,3) strategy.

Others

Many other strategies are in use, though they fall outside the scope of this article. Other notable strategies include:

-

Purchasing accounts with large followings on X but little activity;

-

NFT community members buying each other’s accounts—for example, Punks buying Punks. This is very similar to the (3,3) strategy but has so far been less extreme.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News