A Closer Look at the Top 10 Web3 Applications That Continue to "Raise Millions" During the Bear Market

TechFlow Selected TechFlow Selected

A Closer Look at the Top 10 Web3 Applications That Continue to "Raise Millions" During the Bear Market

What are the top ten most profitable protocols in the DeFi space currently?

Author | HuoHuo

After reaching high valuations in 2021, the crypto space has seen a comprehensive market cooldown this year. However, every challenge brings opportunity—under calmer conditions, crypto infrastructure has been able to mature and develop steadily, particularly DeFi protocols with strong revenue, real demand, and positive returns. Looking at broader market trends, there’s an emerging shift from the traditional “fat protocol, thin application” model toward a “thin protocol, fat application” paradigm.

What are "fat/thin protocols" and "fat/thin applications"? This concept originated from early internet architecture, which resembled a "thin protocol network"—built on foundational but often overlooked technologies like TCP, IP, and HTTP. The value of these protocols was largely captured by application-layer software (apps). For example, platforms like TikTok, WeChat, and Meituan represent the "thin protocol, fat application" model.

However, blockchain's decentralized nature concentrates value at the shared protocol layer, with only a small portion distributed to the application layer—making it a "fat protocol, thin application" stack.

Today, we’ll explore this evolution further and take a look at the top ten most profitable DeFi protocols currently leading the field.

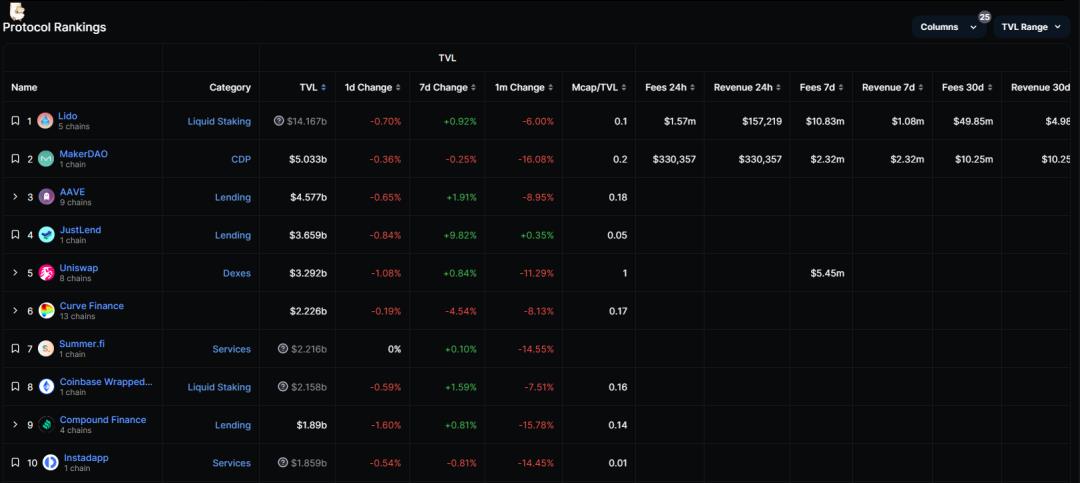

Source: DefiLlama data as of September 9

01 Lido

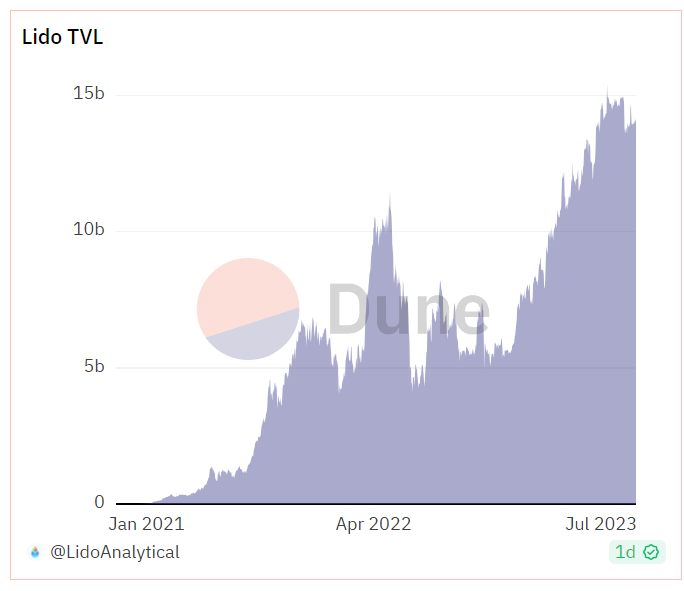

Lido is currently the largest crypto protocol in the staking sector, founded in 2020, primarily offering liquid staking solutions for ETH and other PoS blockchains.

When users deposit PoS assets into Lido, their tokens are staked via the Lido protocol on PoS blockchains. This allows them to earn staking rewards while also receiving tokenized assets that can be used elsewhere to generate additional yield.

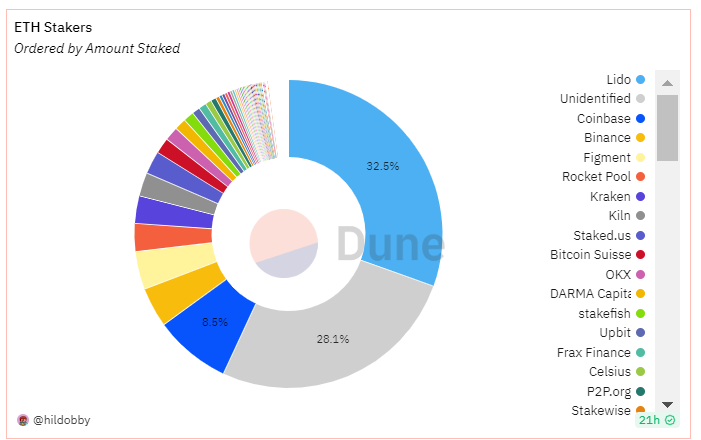

Since the beginning of this year, Lido’s TVL has continued to rise. Why has Lido grown into the largest staking protocol and the highest-TVl DeFi protocol in the market, capturing 32.5% of the staking sector—almost four times larger than second-place Coinbase, with nearly $14.2 billion in TVL? Several key factors contribute:

1) First-mover advantage, user-friendly for beginners:

Since the launch of the ETH 2.0 contract in December 2020, many ordinary users have been unwilling to lock up 32 ETH directly. At that time, PoS and PoW had not yet merged, and ETH could only flow one-way from the PoW chain to the PoS chain, losing liquidity due to irreversibility. Under these circumstances, Lido emerged naturally. Designed specifically to address Ethereum’s transition-phase staking challenges, Lido quickly became the preferred choice for retail users to participate in ETH 2.0 staking, driving massive growth.

2) Support for multiple major public chains:

Including Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM), Lido boasts a powerful ecosystem. Due to its large user base and diversified portfolio, Lido offers the highest liquidity compared to other platforms, creating a Matthew effect. Especially after the Ethereum Shanghai upgrade, Lido’s network effect around stETH became even more pronounced.

Lido’s current revenue model mainly relies on taking a 10% cut from staking rewards—5% goes to node operators, and the remaining 5% flows into the Lido treasury for governance purposes.

According to reports, despite enabling withdrawals of staked ETH earlier this year, the protocol continues to see significant net inflows of ETH deposits monthly. Lido’s July report revealed that total value locked (TVL) surpassed $15 billion for the first time since May 2022, with staked ETH potentially exceeding 8 million by September. Given this trajectory, Lido is expected to maintain its dominance and potentially double profits in the medium to short term.

02 MakerDAO

MakerDAO is a decentralized autonomous organization (DAO) on the Ethereum blockchain, dedicated to advancing cryptocurrency lending and borrowing. Founded in 2015, it is the longest-running project on Ethereum and currently ranks second in TVL at approximately $5 billion.

MakerDAO consists of DAI, a dollar-pegged stablecoin, and the Maker Protocol—a smart contract system running on Ethereum (a dApp). DAI, built atop the Maker Protocol, launched in 2017.

As the first DAO on Ethereum, DAI leads in scale among decentralized stablecoins. Moreover, MakerDAO made groundbreaking contributions to DeFi—their over-collateralization mechanism eliminated risks associated with “printing money out of thin air” and operates entirely on-chain, marking a breakthrough in mitigating centralized custodial risks.

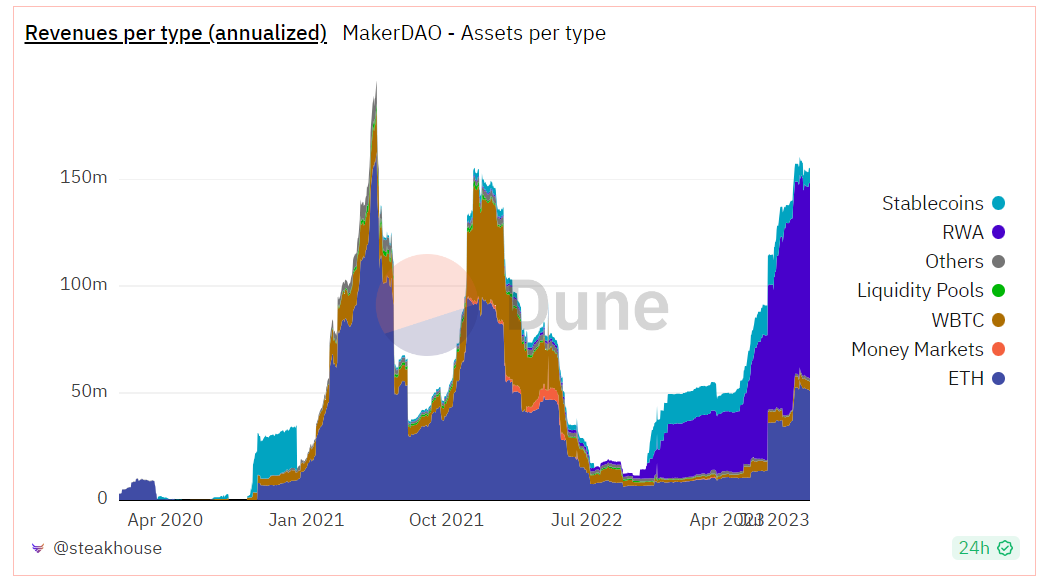

MakerDAO currently generates income from three main sources:

1) Stability fees earned from over-collateralized vaults

2) Liquidation penalties collected when vaults are liquidated

3) Stablecoin exchange transaction fees

Before 2022, stability fees and liquidation penalties from ETH-based asset vaults were the primary monthly revenue source. However, as investments in RWA (real-world assets) increased, RWA-related earnings now account for 56.4% of total revenue, clearly indicating RWA’s dominant contribution to protocol income.

03 AAVE

Aave is another major crypto lending protocol, originally known as ETHLend, established in Switzerland in 2017 with the goal of enabling peer-to-peer crypto and RWA lending without centralized intermediaries. Initially built on Ethereum—with all tokens processed via Ethereum’s blockchain—it has since expanded to other networks including Avalanche, Fantom, and Harmony.

Users can deposit various crypto assets into Aave’s smart contracts to form “liquidity pools,” which serve as sources for loans. Borrowers must provide collateral to secure loans, while depositors earn interest on their holdings.

The AAVE token plays a crucial role within the protocol, used for governance and fee payments. Aave’s advantages include support for multiple crypto assets and high liquidity, though it carries risk due to price volatility affecting both lending and collateral values.

Its revenue model is similar to MakerDAO—Aave earns income through various fees charged on its platform, which are then deposited into the Aave community treasury. AAVE token holders decide how these funds are allocated.

Specifically, Aave collects fees through:

1) Borrowing fees: Charged to borrowers, typically ranging from 0.01% to 25%, depending on the borrowed asset, loan-to-value ratio, and duration;

2) Flash loan fees: Charged to users utilizing the “flash loan” feature, allowing uncollateralized short-term borrowing. The fee is usually 0.09% of the amount borrowed;

3) Other functional fees: In V3, Aave introduces additional fees such as those for liquidations, instant liquidity, and portal bridges;

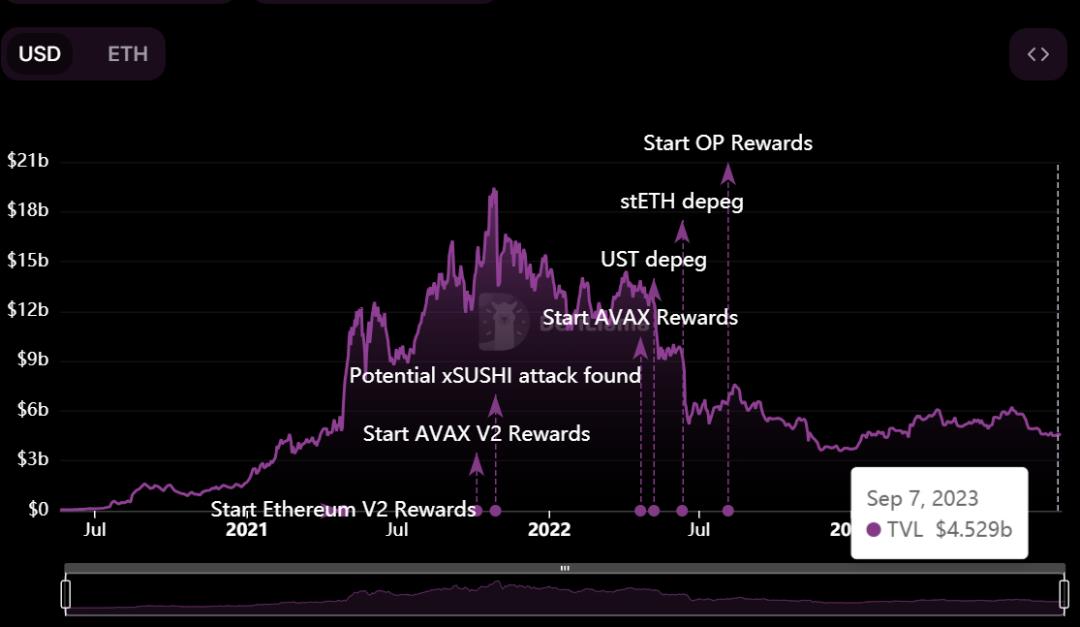

Currently, AAVE’s TVL stands at around $4.5 billion, closely tracking overall market movements.

04 JustLend

JustLend is a TRON-based decentralized lending protocol launched in Q3 2020 by Justin Sun. Its name derives from the first four letters of the founder’s name.

JustLend offers various DeFi products including JustStable, JustLend, JustSwap, JustLink, and cross-chain tokens, forming algorithmic asset pools that allow users to earn interest across different asset classes. Users can generate returns by supplying assets, obtain digital assets via collateral, and stake TRX on the TRON blockchain.

The core DeFi product is JustStable, backed by USDJ, a dollar-pegged stablecoin. JustStable serves as a cross-border stablecoin lending platform where users supply collateral to borrow stablecoins.

JustLend’s current revenue model includes:

1) Interest margin: By lending funds, the platform charges higher interest from borrowers and pays lower rates to depositors—the spread becomes platform profit;

2) Lending service fees: The platform may charge borrowers certain processing fees;

3) Platform token appreciation: If a platform token exists, its value may increase if users are incentivized to use it for fee payments or discounts.

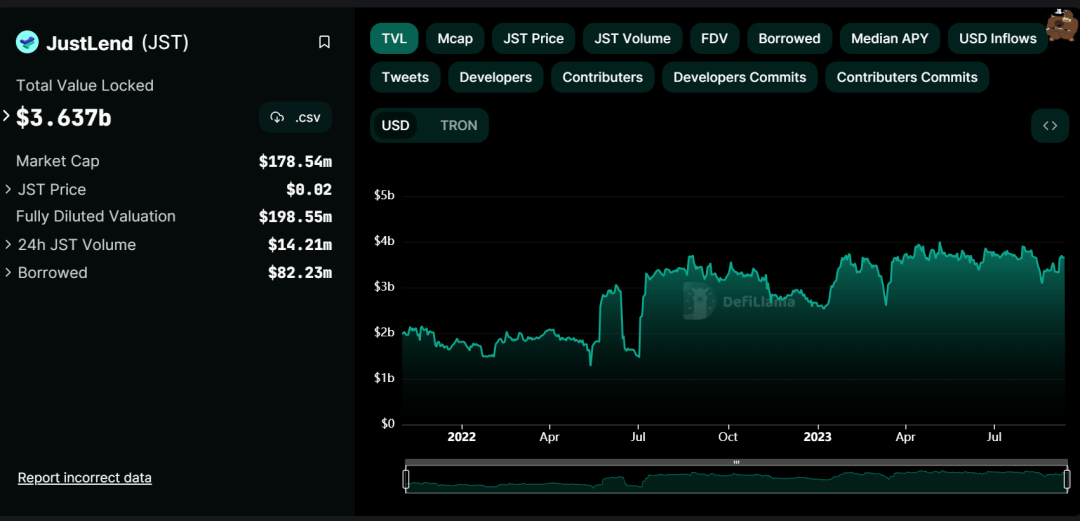

JustLend has grown rapidly due to generous APY rewards on its lending market—sometimes reaching as high as 30%. Backed by the TRON ecosystem, it has gained substantial users and resources, allowing its TVL to actually increase during a bear market, currently standing at around $3.6 billion, ranking fourth.

05 Uniswap

Uniswap is a DEX launched in 2018 on Ethereum. The idea was initially proposed by Ethereum co-founder Vitalik Buterin and implemented by former Siemens mechanical engineer Hayden Adams. Uniswap’s underlying technology has undergone multiple iterations and is now on Uniswap v3, with one of the most notable improvements being enhanced capital efficiency and deeper market liquidity.

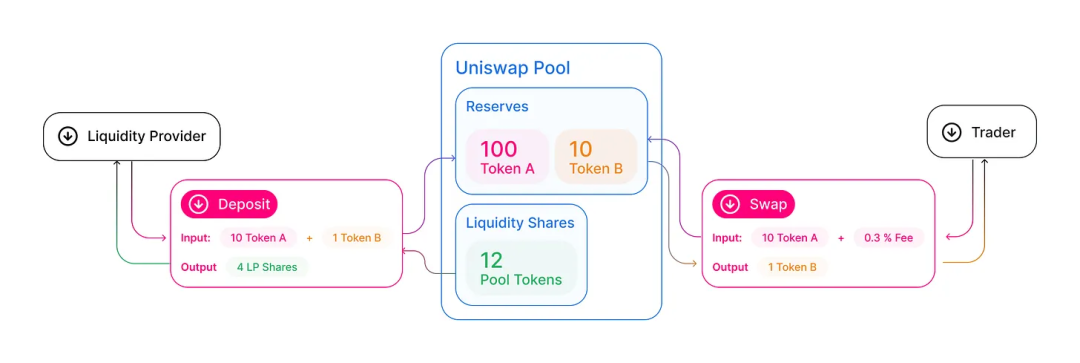

As an automated liquidity protocol, Uniswap operates without order books or centralized intermediaries, enabling users to trade directly—offering high decentralization and censorship resistance, making it the leading project in the DEX space.

Uniswap currently holds about $3.3 billion in TVL. However, due to its fully decentralized design, Uniswap’s creators do not take a cut from trades. Instead, liquidity providers control transactions and collect fees for their services.

Overall performance aligns with current market conditions—peaking during the 2021 bull run with over $20 billion in TVL.

Source: Coingecko

Uniswap v3 pools employ variable fee tiers of 0.01%, 0.05%, 0.3%, and 1%. In contrast, v2 pools use a standard 0.3% rate. These fees are automatically added to liquidity pools but can be withdrawn by LPs at any time. Fees are distributed based on each provider’s share of the pool, with a portion reserved for Uniswap’s development and upgrades.

Structure of V2 liquidity pools

06 Curve Finance

Curve Finance is an automated market maker (AMM) protocol launched in January 2020, designed as a DEX using AMM architecture focused on stablecoins, synthetic assets, and derivatives. Primarily operating on Ethereum, it has also deployed across multiple chains including Fantom, Polygon, Avalanche, Arbitrum, and Optimism.

On Ethereum, Curve is one of the most popular AMMs, offering low-fee, low-slippage swaps between stablecoins in a non-custodial manner. It acts as a decentralized liquidity aggregator, allowing anyone to add assets to various liquidity pools and earn fees.

Curve’s fees range between 0.04% and 0.4%, split between liquidity providers and veCRV holders. Its main revenue streams include:

1) Trading fees: Collected as a percentage from user trades;

2) Lending and stablecoin exchange: Earns fees from lending and stablecoin conversion services;

3) Synthetic asset trading: Supports synthetic asset trading, attracting more liquidity and generating yield.

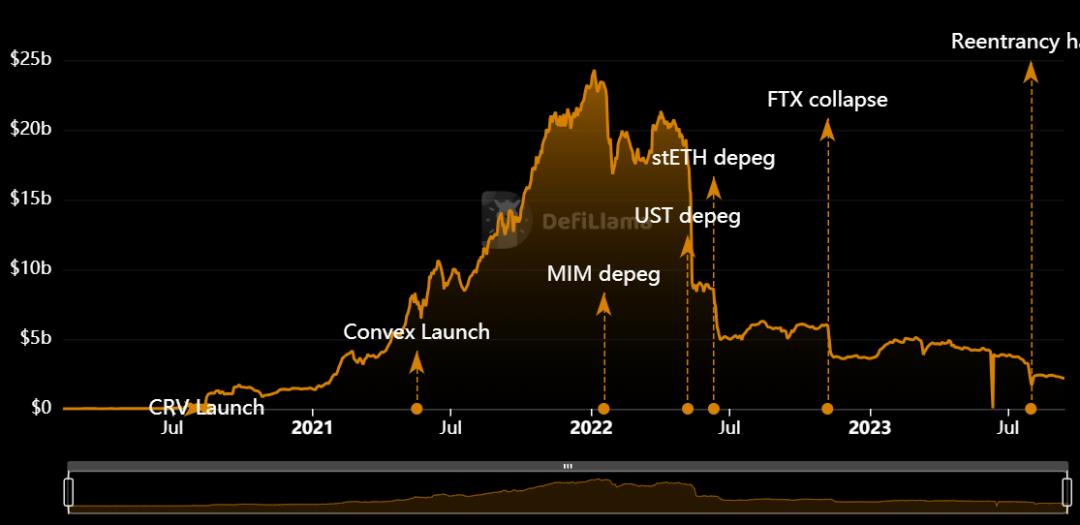

Curve Finance occupies a central position in DeFi. After launching Curve DAO in August 2020 and issuing its native CRV token, the protocol’s TVL began rising steadily, briefly becoming the largest DEX by TVL. Despite a turbulent period in crypto—including a reentrancy vulnerability in some pools in August—the protocol remains among the top DeFi protocols by TVL, currently holding over $2.2 billion. Beyond its popular liquidity pools, its widespread integration across other blockchain protocols enables composability with various decentralized applications.

07 Summer.fi

Summer.fi was formerly Oasis, originating from MakerDAO and dating back to 2016—even predating DAI’s 2017 launch. OasisDEX was the first DEX deployed by MakerDAO on Ethereum, initially used to swap MKR governance tokens for WETH. In June 2021, as part of the Maker Foundation’s dissolution, development and operation of Oasis.app transitioned to an independent entity.

Recently rebranded as Summer.fi, symbolizing sunshine, joy, and relaxation, reflecting the team’s vision of delivering an enhanced user experience for traders.

Summer.fi currently offers three main services: lending, leverage, and staking. Like other decentralized protocols, Summer.fi charges fees for its services—referred to as stability fees rather than interest rates. These fees vary depending on the vault and token type, determined by MKR token holders, ranging from 0% to 4.5%. Additional applicable fees include:

1) Lending: No direct fee, but users incur ETH gas costs;

2) Leverage: 0.2% fee, plus ETH gas costs;

3) Staking: 0.04% fee for setting up a vault;

4) Stop-loss: 0.2% fee to close a vault, plus gas costs upon trigger.

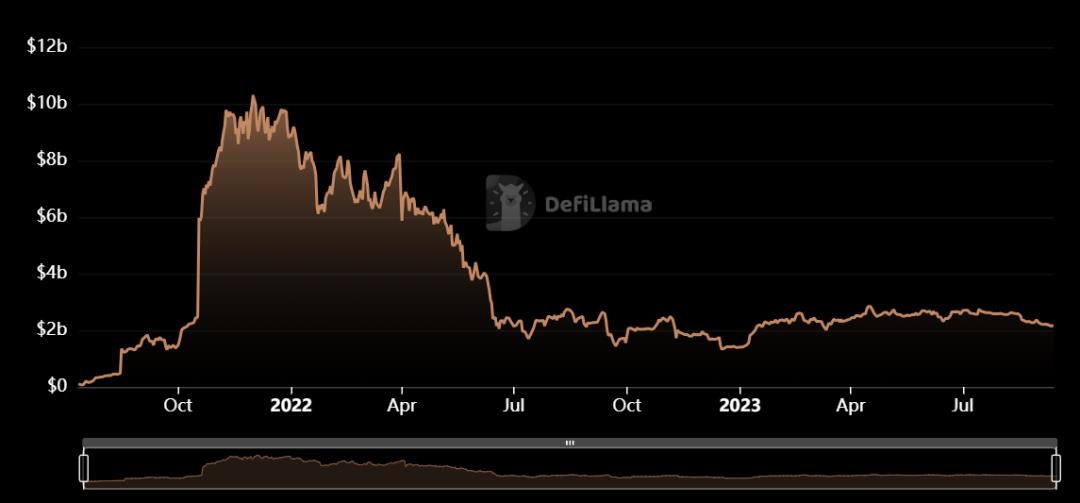

Since going independent in 2021, its TVL has followed the bull cycle to peak and is now stabilizing, currently at around $2.2 billion, ranking seventh.

08 Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH (cbETH) launched in June 2022, representing Ethereum staked through Coinbase custody, functioning as an ERC-20-like token compatible with Ethereum-based dApps. 1 cbETH equals 1 ETH in value.

Users can wrap ETH into cbETH at no cost, trade it on Coinbase, and use it on CEXs like Uniswap and Curve. Designed for seamless compatibility with DeFi apps, cbETH provides rewards on staked ETH without locking, offering secure, fee-free custody, liquidity, and broad DeFi platform compatibility.

Users can earn a 3.3% annual yield on Coinbase and additional returns through various DeFi protocols. Backed by Coinbase’s robust security infrastructure, cbETH offers a user-friendly way to maximize staking rewards and is considered a secure, transformative utility token within the crypto ecosystem.

Coinbase stated in its August 2022 cbETH whitepaper: “We hope cbETH will be widely adopted in DeFi applications for trading, transfers, and usage.” “Through cbETH, Coinbase aims to contribute to the broader crypto ecosystem by creating highly useful wrapped tokens and open-source smart contracts.”

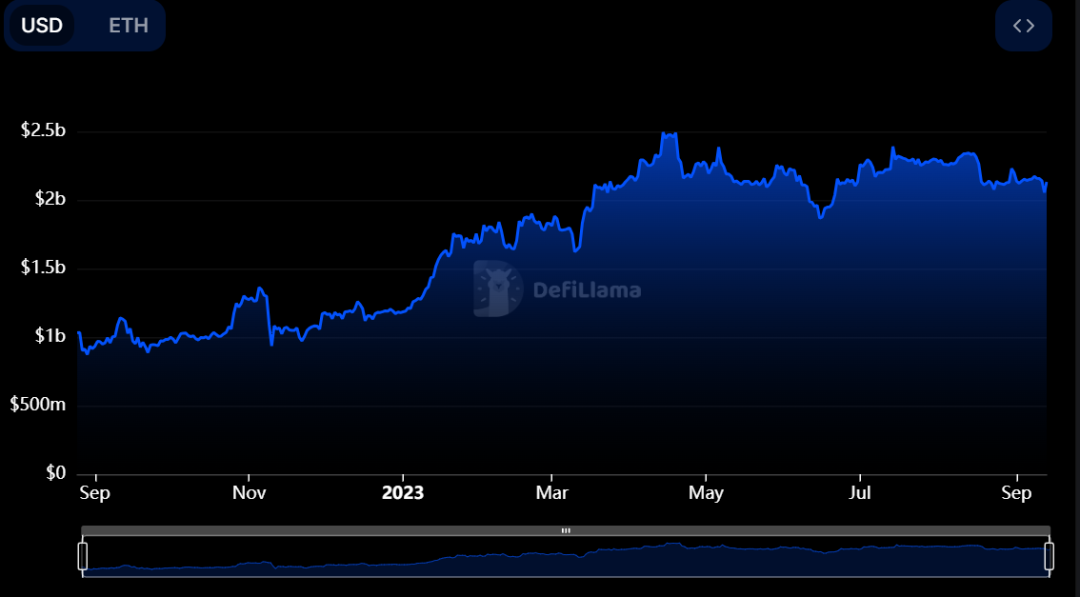

Overall, backed by the U.S.’s largest compliant CEX, Coinbase, cbETH benefits from a vast user base and resources. In terms of revenue, wrapping ETH into cbETH is free, but Coinbase, acting as an Ethereum validator, takes a delegation fee ranging from 0.5% to 4.5% of staking rewards. Launched during a market downturn and aligned with staking sector growth, cbETH has seen steady growth, currently holding around $2.1 billion in TVL.

09 Compound Finance

Compound Finance is a decentralized lending protocol launched in 2018 on the Ethereum network, enabling users to lend and borrow crypto assets without third parties. It operates as an algorithmic money market, allowing users to earn interest on idle assets, maximizing returns from dormant wallets and generating passive income. Anyone with a Web3 wallet (e.g., MetaMask) can access and begin earning.

Initially funded by venture capitalists, Compound later introduced the COMP token, granting holders rights to fees and governance, shifting toward decentralized control.

Compound Finance now operates in a decentralized manner and is EVM-compatible. The latest version, Compound V3, introduces several enhancements for improved security, usability, lower risk, and easier management.

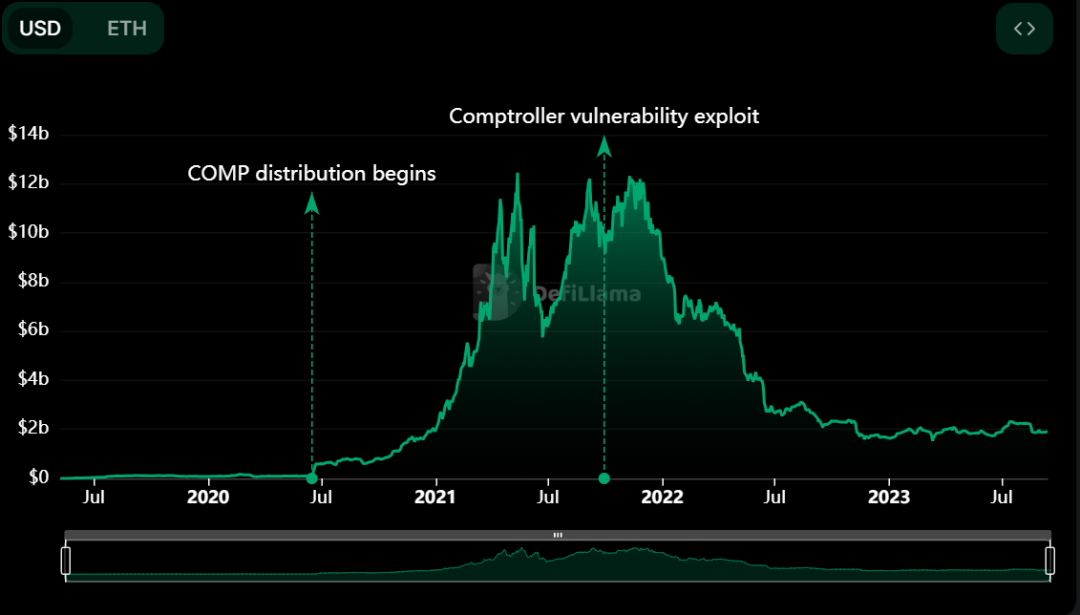

Compound competes directly with protocols like JustLend, MakerDAO, and Aave. Although surpassed in recent years, as a pioneer of liquidity mining, its contributions to user profitability and liquidity in DeFi lending remain significant.

Compound’s revenue model resembles its peers—primarily profiting from the interest rate spread between borrowing and lending rates. Borrowing interest rates are algorithmically determined by supply and demand on the platform. The protocol retains 10% of borrowing interest as platform revenue and distributes the remaining 90% equally among depositors of that token.

Compound Finance currently holds nearly $1.9 billion in TVL. According to DefiLlama, its total TVL is heavily influenced by crypto market cycles, but as the saying goes, “a camel is still bigger than a horse even when skinny”—it remains within the top ten.

10 Instadapp

Instadapp is a middleware protocol that simplifies and unifies DeFi frontends—essentially a DeFi aggregator, founded in 2018 with the goal of reducing DeFi complexity and becoming a unified gateway for DeFi, enabling seamless asset management. It currently integrates major DeFi protocols like Maker, Aave, Compound, and Uniswap via smart wallets and bridging protocols, supporting features like cross-protocol collateral migration.

Instadapp aims to become the entry point for DeFi—serving both novice users and developers or fund managers. Drawing parallels to successful internet platforms like Google or Taobao, which are essentially aggregators or “platforms.” However, many DeFi users remain unfamiliar with Instadapp, so its ultimate success remains to be proven by the market.

Instadapp offers three main products: Avocado, Instadapp Pro, and Instadapp Lite.

Avocado is an account-abstraction Web3 wallet; Instadapp Pro aggregates multiple DeFi protocols into a single, upgradable smart contract layer; Instadapp Lite was launched post-Shanghai upgrade to capitalize on LSDFi trends—a vault accepting only ETH deposits, tailored for various stETH-related strategies.

Lite v2 enhances LSD yields through cyclical market operations, with Instadapp taking a 20% cut. Even after this fee, depositors still earn slightly higher returns than Lido’s stETH, demonstrating highly efficient capital utilization.

Currently, its main revenue comes from taking 20% of profits, which are directed to the DAO for allocation and use. Affected by market cycles, it is operating steadily with approximately $1.8 billion in TVL.

11 Summary

From the above TVL rankings, it’s clear that DeFi remains the leading sector within the entire crypto industry. Uniswap and Curve dominate the trading赛道, while MakerDAO, Aave, and Compound lead in lending. Lido provides a powerful decentralized staking solution for ETH2.0; Aave’s safety module innovation improves fund security; and Curve’s algorithms offer lower slippage for large stablecoin trades. JustLend and Coinbase Wrapped Staked ETH have each leveraged TRON and Coinbase’s ecosystems to build massive user bases and resource advantages.

Within the ever-evolving DeFi ecosystem, these projects play pivotal roles in driving continuous innovation and advancement in blockchain and cryptocurrency.

What are your thoughts on these rapidly growing high-TVl application protocols?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News