Liquid Staking: The Hope to Save Cosmos

TechFlow Selected TechFlow Selected

Liquid Staking: The Hope to Save Cosmos

Liquid staking may not change Cosmos, but it can at least rekindle the flame in users' hearts.

Written by: KODI

Compiled by: TechFlow

THORchain (RUNE) is a lending protocol that allows users to swap assets across blockchain networks. It has just launched a new lending primitive. Here's how THORChain describes it:

New loans have a deflationary effect on $RUNE assets, while closing loans has an inflationary effect on $RUNE.

If the value of $RUNE relative to $BTC remains unchanged when a loan is opened and closed, there is no net inflationary effect on $RUNE (the amount burned and minted is equal, minus swap fees). However, if the collateral asset increases in value relative to $RUNE between the opening and closing of the loan, it will result in net inflation of the $RUNE supply.

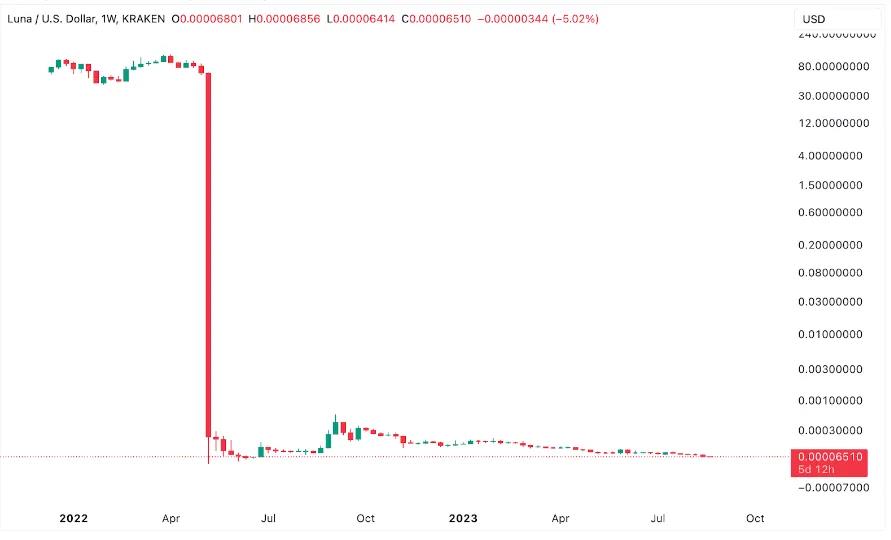

Thus, THORChain’s new mechanism simply algorithmically increases and decreases the supply of $RUNE tokens. Do you remember what happened the last time we had such a mechanism? Yes, our old friend LUNA!

For those unfamiliar, Terra was a blockchain project aiming to create a stablecoin called UST. Through an algorithmic system involving LUNA (Terra’s native token), this stablecoin was supposed to maintain a 1:1 peg with the US dollar.

At first, it was highly successful.

After UST’s circulating supply reached $18 billion, it rapidly lost its peg, causing the entire Terra ecosystem to collapse and dragging down the broader cryptocurrency market.

LUNA’s market cap plummeted from $40 billion to nearly zero, while Bitcoin and Ethereum each fell more than 30%. As for UST, it now trades at $0.0128.

But when telling the story of LUNA, one chapter is often overlooked.

LUNA was built on Cosmos, an ecosystem of independent blockchains all connected to the main Cosmos (ATOM) chain. It was constructed using the Cosmos SDK and Tendermint as its consensus algorithm—everything was very tightly integrated. It was also one of the most successful Cosmos chains, far outpacing others.

So it’s no surprise that today, Cosmos’ cumulative total value locked (TVL) looks like this:

Can you guess when the LUNA crash happened?

Cosmos-based projects relying on or built atop LUNA collapsed, and many Cosmos projects depended heavily on UST as their primary stablecoin.

Liquidity across the ecosystem dried up sharply. Osmosis (OSMO), one of the leading decentralized exchange projects in Cosmos, saw its TVL peak at $1.7 billion in April 2022 before crashing to just $150 million by June 2022—a 91% drop.

In contrast, Uniswap and Curve saw TVL declines of only 30% and 55%, respectively, during the same period.

So yes, the LUNA disaster was bad for everyone in crypto—but especially devastating for Cosmos. And it still hasn’t recovered.

In the words of Zaki Manian, a well-known figure in the Cosmos ecosystem:

Cosmos may need up to a year to find a way to create something unique and distinct that sets it apart from Ethereum or other blockchain spaces, making it a coherent standalone entity.

So, what could pull Cosmos back from the brink of death?

What Can Liquid Staking Do For Us?

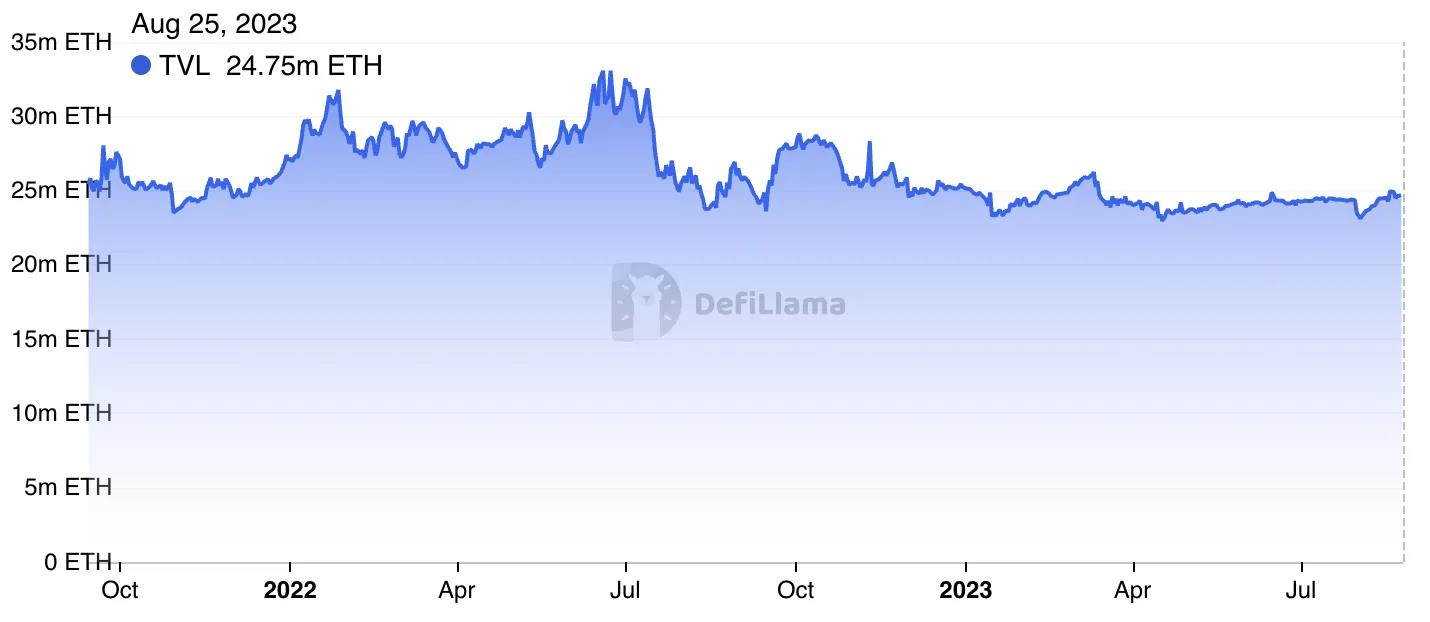

Here is a chart showing Ethereum’s total value locked (TVL) over the past two years, measured in ETH.

Now, here is Ethereum’s TVL over the past few years, excluding liquid staking derivatives (LSDs).

There’s a significant difference.

Note that the last chart includes LSDfi projects, where you can deposit liquid staked tokens like Lido’s stETH. If we exclude these projects, the TVL drops even further—to just 12.5 million ETH.

While Ethereum’s dollar-denominated TVL declined during the 2022 bear market, without liquid staking, Ethereum’s ETH-denominated TVL would have seen a sharp decline in 2023 as well.

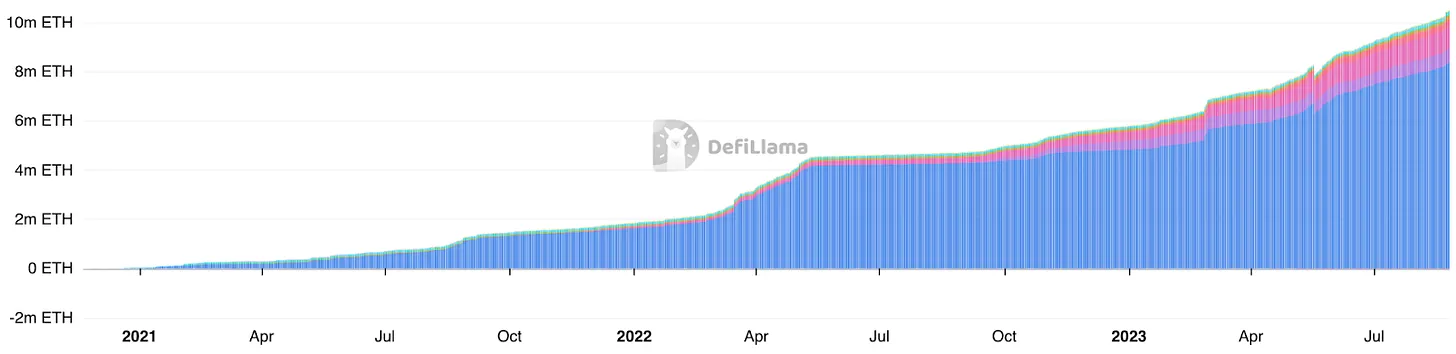

Out of the total 26 million ETH staked, liquid staking protocols hold 11 million ETH—nearly 42% of staked ETH and about 10% of the total supply. Not bad for an industry that barely existed six months ago.

Moreover, liquid staking has brought much-needed vitality and innovation to DeFi.

Currently, around $1 billion is deposited across up to 25 LSDfi protocols—none of which existed at the beginning of this year. And more are expected to launch in the coming months.

This is exactly the kind of liquidity Cosmos desperately needs to survive.

Cosmos’ New Hope

The goal of the Cosmos network is to realize the vision of app-chains: each application operates as its own PoS blockchain, all interconnected.

But the problem is that this means almost all value is locked into chains via staking their native tokens to secure network safety.

By contrast, on Ethereum, only ETH is staked. This leaves vast amounts of tokens—from DeFi tokens to stablecoins to NFTs—freely usable within the Ethereum ecosystem.

LSDs can unlock this dormant value across Cosmos. By allowing stakers to mint derivative tokens representing their staked assets, liquidity can flow freely once again.

And because staking is so central to Cosmos, adoption of LSD platforms could be rapid and widespread.

Staking is relatively new to Ethereum—withdrawals weren’t even enabled until the Shapella upgrade in April this year.

In contrast, all Cosmos chains have been PoS from day one.

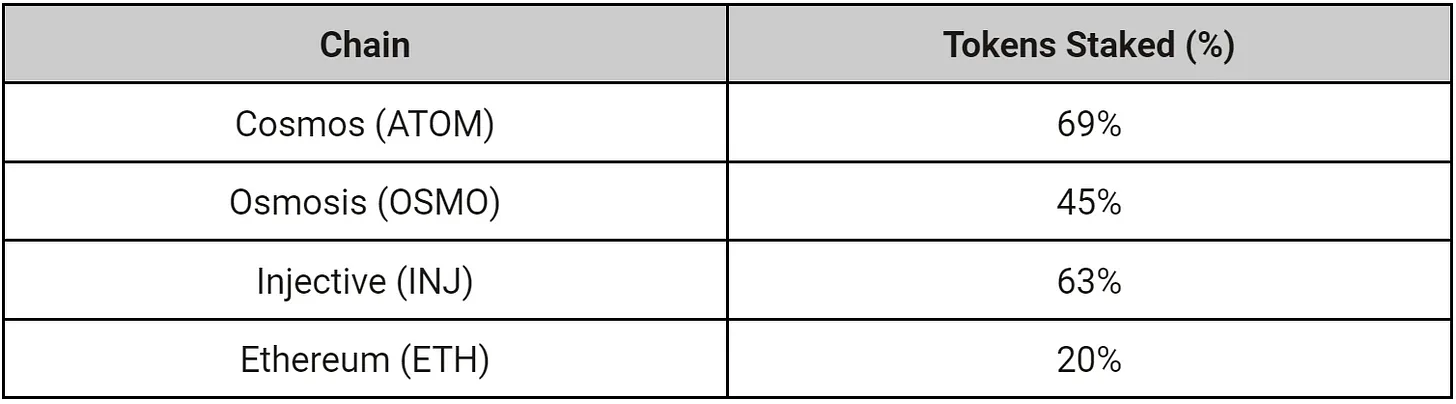

This results in much higher staking ratios across Cosmos chains.

But remember, the path to liquid staking on Ethereum is a two-step process: first, ETH is staked, then a portion flows into LSDs.

Cosmos can skip this initial phase because a large number of tokens are already staked. The demand for staking is already built-in.

LSDs might even incentivize more users to stake, since their tokens no longer need to be locked. If you can keep using your tokens across the ecosystem, why not earn extra yield?

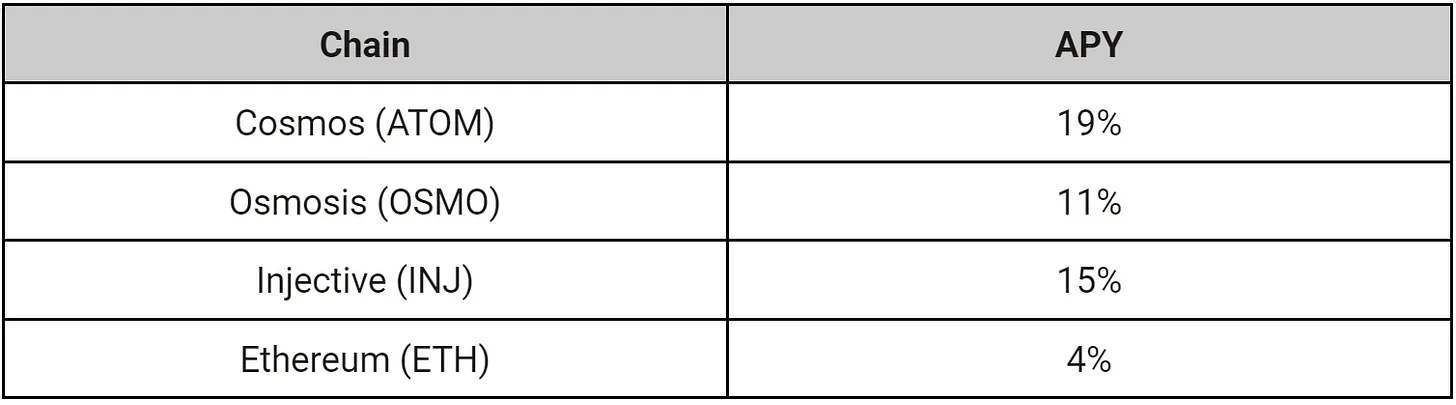

And the yields are quite substantial. ATOM and OSMO offer annual staking yields of 19% and 11%, respectively. Ethereum yields around 4%, and this rate is rapidly declining as the number of validators increases.

This massive influx of liquidity could greatly expand DeFi potential across Cosmos chains. Projects like Osmosis could see exponential growth in both TVL and trading volume. Other areas such as lending or stablecoins would also benefit significantly from increased liquidity.

Furthermore, Cosmos’ cross-chain nature is perfectly suited for LSD products. The Inter-Blockchain Communication (IBC) protocol connecting Cosmos chains enables innovative new LSD products that seamlessly interact across multiple networks.

For example, LSD vaults could use IBC to optimize yield farming across networks. Or, via IBC transfers, liquid staked assets could power lending markets and margin trading throughout the ecosystem.

Thanks to IBC, the composability of LSDs on Cosmos chains could quickly surpass innovations on Ethereum. This might be the secret sauce that unlocks the truly disruptive potential of staking in Cosmos.

I know what you’re thinking.

If liquid staking is such a huge opportunity for the Cosmos ecosystem, why hasn’t it taken off yet? The main reason is the lack of efficient and battle-tested liquid staking solutions in the ecosystem. But that may be changing.

It’s not that liquid staking has never been attempted in Cosmos.

pStake Finance, the native LSD solution from Cosmos chain Persistence, has been running since February 2022. Quicksilver launched in May 2023. But their TVLs—around $3 million and $2 million respectively—have failed to make waves.

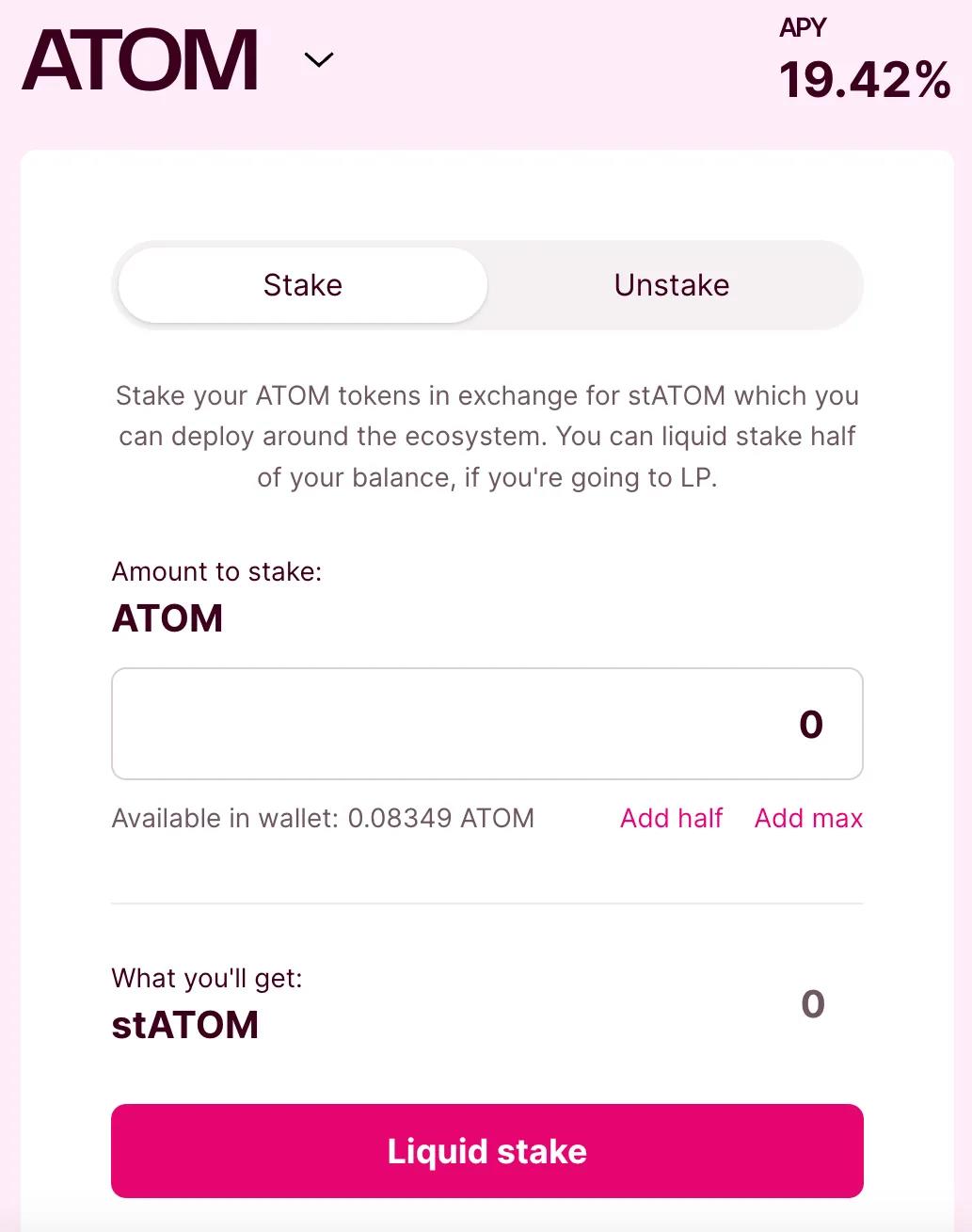

Now, Stride (STRD) enters the scene.

Stride is another Cosmos chain offering liquid staking. But unlike previous projects, it’s gaining attention.

Since its launch at the end of 2022, Stride’s TVL has rapidly grown to over $30 million, peaking in June 2023 before adoption slowed as prices of many Cosmos tokens began to fall. Yet, its price in native terms did not decline.

Its LSD tokens (stATOM and stOSMO) have also gained traction in Cosmos DeFi, with two pools (ATOM/stATOM and OSMO/stOSMO) ranking second and sixth in Osmosis’ TVL rankings.

Indeed, Stride’s stATOM/ATOM pool has accumulated $16 million in TVL, compared to Quicksilver’s qATOM/ATOM pool at just $1 million, and pStake’s TVL even lower at $500,000.

The gap is even more pronounced when comparing stOSMO and qOSMO pools. Stride’s stOSMO/OSMO pool holds $3 million in TVL, while Quicksilver’s qOSMO/OSMO pool has less than $100,000—less than 3% of Stride’s equivalent pool. pStake doesn’t even offer an OSMO pool, as the only liquid staked token it provides in Cosmos is ATOM.

We’re not trying to knock Quicksilver or pStake. But clearly, thanks to its innovation, Stride has finally shown the potential of LSDs on Cosmos.

Part of the reason is its ease of use. Staking requires just a few clicks, and Stride’s interface is clean and intuitive.

In crypto, we often overlook good user experience.

Stride even selects validators for you when staking, sparing you the tedious selection process.

Additionally, Stride recently joined Cosmos’ Interchain Security (ICS) to further secure its network. ICS allows validators from provider chains like Cosmos Hub to protect consumer chains like Stride by staking ATOM.

As a result, Stride now uses Cosmos Hub’s validators instead of its own.

The main benefit is a dramatic increase in the value securing Stride—from about $25 million in staked STRD tokens to $1.8 billion protected by ATOM stakers. This makes it far harder for any individual or group to attack the network. Enabling ICS also further aligns Stride with the broader Cosmos ecosystem.

The Next Frontier of LSD

I’d bet that liquid staking, even if it doesn’t transform Cosmos entirely, will at least reignite user interest. It will bring much-needed attention and liquidity to the ecosystem.

The growth of LSDs on Ethereum this year has been staggering. But due to how the network is structured, this may represent only a fraction of the opportunities LSDs can offer. IBC could enable Cosmos to unlock the truly disruptive potential of LSDs beyond other ecosystems.

We also believe Stride will become the dominant LSD solution in Cosmos, given its impressive growth and strategic use of interchain security.

Given the damage caused by the LUNA collapse, the road ahead remains challenging. But if anyone can help Cosmos achieve a phoenix-like rebirth, it’s the Cosmonauts.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News