Friend.Tech: A New Approach to Web3 Social or a Fleeting Phenomenon?

TechFlow Selected TechFlow Selected

Friend.Tech: A New Approach to Web3 Social or a Fleeting Phenomenon?

Friend.tech has an inherent user attention limit, which in a sense also becomes the upper bound for the product's development.

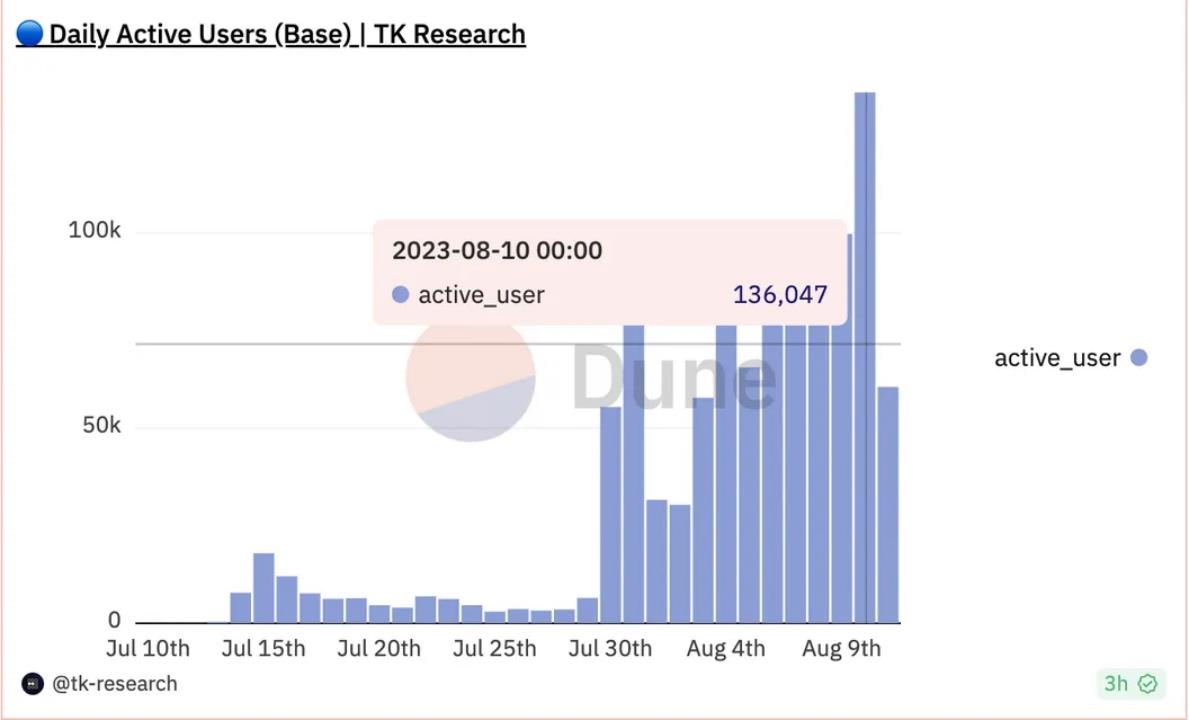

Previously covered in veDAO Research Institute's article on Base, a new sensation has recently emerged: Friend.Tech, a SocialFi DApp that has sparked a fresh wave of excitement. Since Base’s inception, a total of $175 million in cryptocurrency has been transferred to the platform, recording nearly 580,000 transactions on August 10. On the same day, Base reached a record high in daily active users at 136,000. Much of this growth is attributed to Friend.Tech, an invite-only Base-native Web3 social DApp.

Generating over $500,000 in revenue within two days, Friend.Tech—utilizing a “one-invite-three” referral mechanism similar to the early days of Clubhouse—has become the hottest SocialFi project in the Base ecosystem and one of the most discussed Web3 projects recently. According to CryptoKoryo’s data dashboard, as of 8:30 PM on August 19, just about 10 days after launch, Friend.Tech had surpassed 11,000 ETH in trading volume, over 39,000 unique users, and completed more than 518,000 transactions. The Paradigm effect proved powerful—after funding news broke, active users surged rapidly, with over 1,700 buyers in a single hour, setting a new record. In this article, let’s dive into what Friend.Tech is all about.

What is Friend.Tech?

Highly sought-after and hard to access, Friend.Tech is a DApp built on the Base ecosystem. By tightly integrating with Twitter, it allows users to buy and sell shares of any user on Friend.Tech using Ethereum on the Base chain. Investors who hold shares of a KOL gain direct access to private conversations with that KOL. It enables users to trade shares linked to Twitter accounts, granting chat room access to holders of a particular KOL’s shares.

At its core, Friend.Tech is a project that tokenizes KOLs’ influence—essentially allowing Friend.Tech to issue coins on behalf of influencers, turning personal IPs into tradable tokens. This approach monetizes the value of KOLs and represents an attempt to quantify social capital.

According to Dune Analytics, Friend.Tech attracted 7,860 users, 4,400 ETH (worth $8.1 million), and over 126,000 transactions within less than 24 hours of launching its test version—surpassing OpenSea’s transaction volume during the same period. On August 10, it pushed Base’s daily active user count to a new peak. Within four days of launch, Friend.Tech surpassed 18,000 accounts, achieved weekly trading volume of 6,900 ETH, and generated over 300 ETH in royalty revenue from share transactions.

The Background of Friend.Tech

Racer is one of the co-founders of Friend.Tech. He previously created TweetDAO, a DAO organization that granted usage rights to his Twitter account through ownership of an NFT called “TweetDAO Egg.”

Later, Racer teamed up with Shrimp, another co-founder of Friend.Tech, to build Stealcam—a photo-sharing app based on the Arbitrum ecosystem. On Stealcam, users could upload images that were automatically pixelated; other users had to “steal” (reveal) them by paying increasing fees. This design combined curiosity, celebrity appeal, Twitter virality, and owner economics, giving the project strong self-propagating qualities.

Eventually, the developers decided to reposition Stealcam and launched it as Friend.Tech. Originally planning to deploy on Arbitrum, Shrimp and Racer ultimately chose Base—likely due to market momentum—leading to today’s viral success. Friend.Tech takes things further than its predecessor by deeply integrating social interaction with cryptocurrency, enabling Twitter-based KOLs and regular users alike to create and monetize their own social tokens.

How Does Friend.Tech Work?

Every user registering on Friend.Tech must link their account to Twitter. This integration quantifies each user’s Twitter presence into a tradable social token. Other users can purchase shares of these tokens using ETH, with each share representing a stake in the user’s popularity and engagement on Twitter.

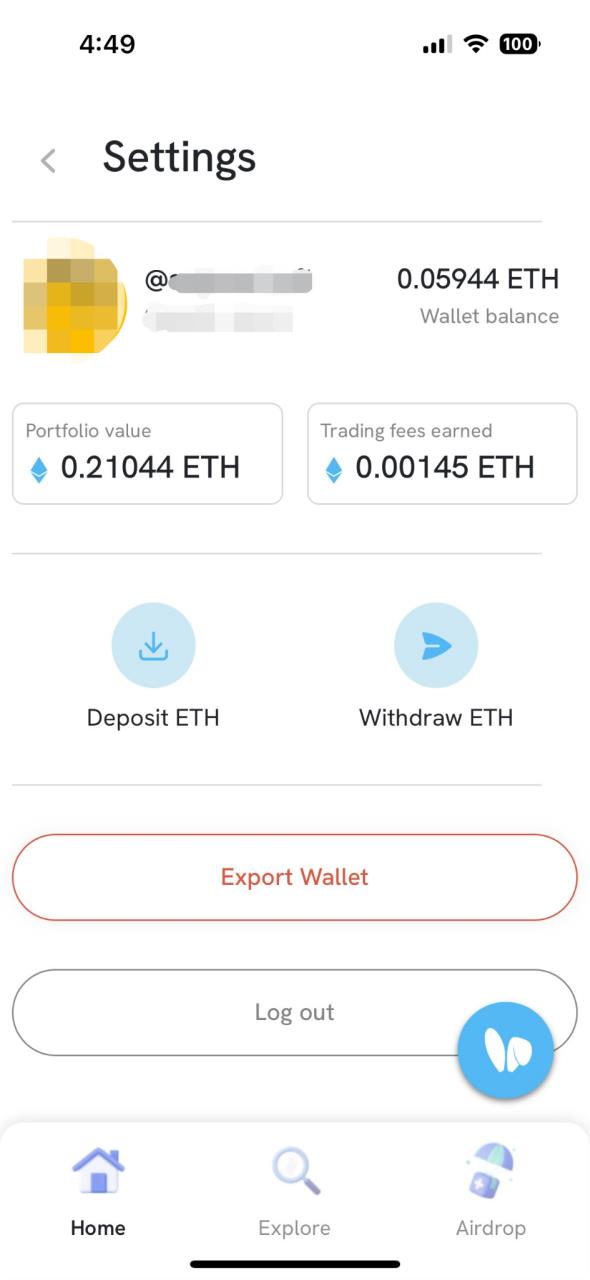

Like other digital assets, share values fluctuate. Suppose you buy shares in a user at a certain price and their floor price (minimum price) increases shortly after—you can then sell at a higher floor price for potential profit. Conversely, if the floor price drops below your purchase price, you may choose to hold or sell at a loss. All transactions are recorded and publicly viewable on-chain. For every trade—whether buying or selling—an additional 10% fee is charged: 5% goes to the protocol, and 5% goes directly to the current share holder of the traded account.

@functi0nZer0 posted a tweet on Twitter outlining a proposed pricing model for Friend.Tech shares (not officially confirmed). The model reveals a simple supply-and-demand structure. A quadratic relationship determines the next share price based on the number of existing shares held. Each new share price increases exponentially according to the formula: Price in ETH = Supply² / 16000, where Supply refers to the current number of shares owned by an individual. Point incentives play a key role in turning Twitter users into core app users—leveraging anticipated future token airdrops and tangible point rewards to drive engagement. Friend.Tech will distribute a total of 100 million points during a six-month test phase, with weekly distributions every Friday. Points are not recorded on-chain. On August 19, Friend.Tech completed its first point airdrop.

How to Use Friend.Tech

1. Access the Platform

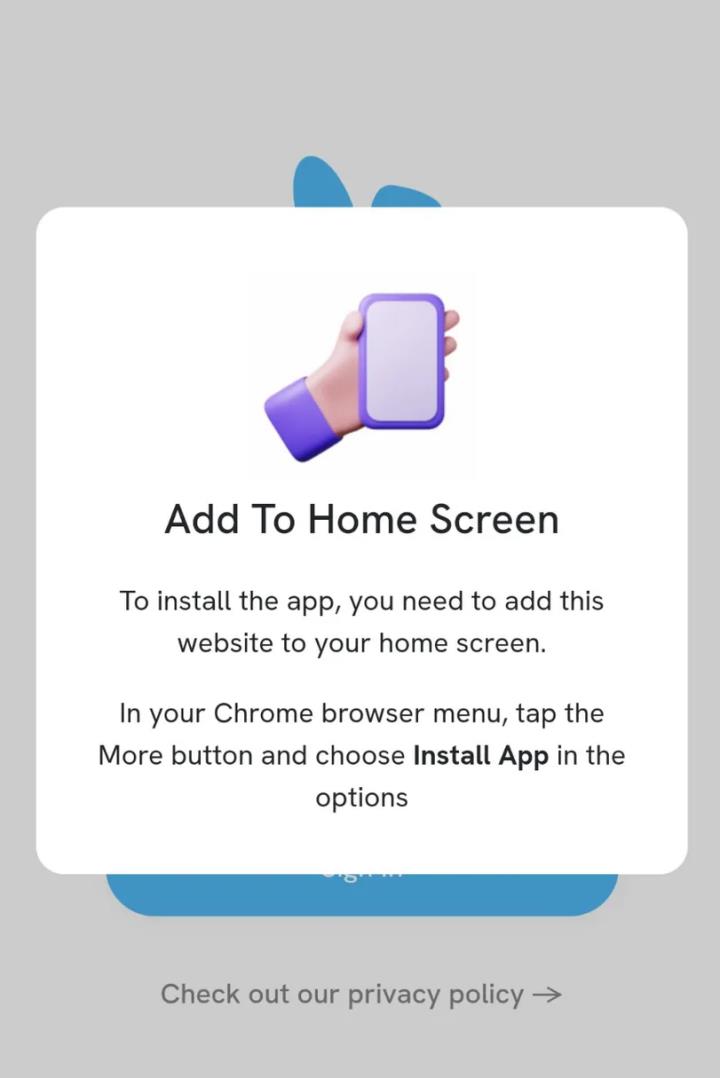

First, open the friend.tech website in your mobile browser. After entering the site, tap the “Share” button in your browser menu, then select “Add to Home Screen.” Next, open the Friend.Tech app from your phone’s home screen.

2. Register and Enter Invite Code

-

After opening Friend.Tech, register via Google or App Store login. Once registered, users must enter an invite code to unlock full functionality. Users typically receive three invite codes to share with others.

-

Set up your account

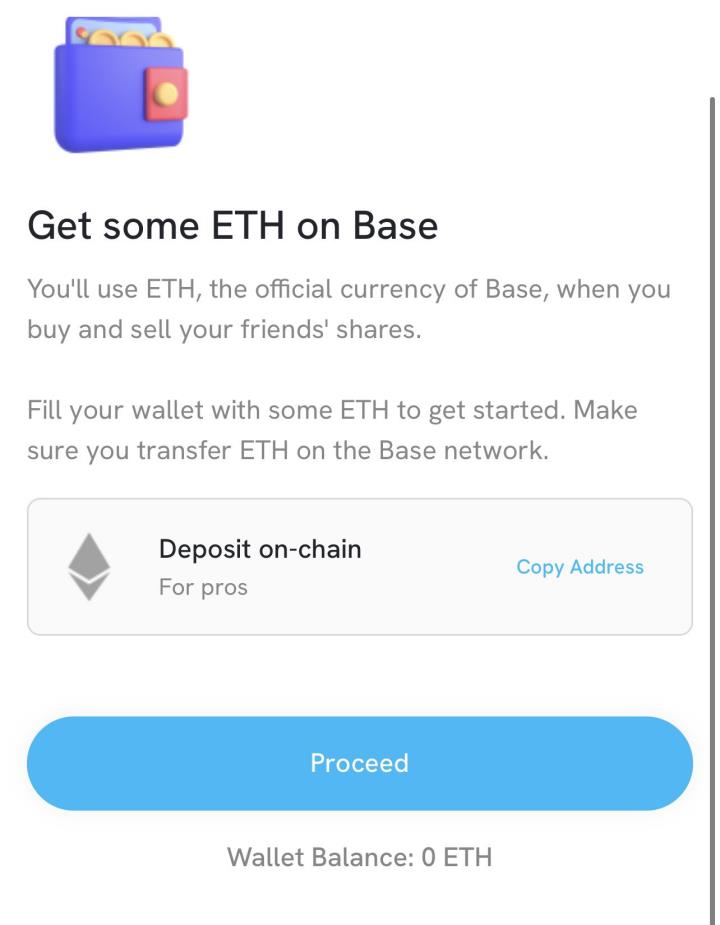

After entering the invite code, bind your Twitter account and deposit 0.01 ETH on Coinbase’s Base chain to activate your account. You can use the official Base bridge—connect your wallet and transfer ETH from the mainnet to the Base chain. Once you have ETH on Base, you’ll receive your three invite codes.

3. Buy Shares and Chat

-

Once inside the app, you can see trending users on the homepage and buy their shares. You can also search for specific users and purchase their shares. Before purchasing, clicking on a user shows a locked chat interface indicating that share ownership is required. After buying, one-on-one messaging becomes available. To prevent spam, each holder can send up to three messages before needing a reply to reset the limit.

-

Withdraw funds

If you’ve successfully earned money and wish to withdraw, click on your profile within the app to transfer ETH to your preferred address. Use the Base bridge to move funds back to the Ethereum mainnet for further use or trading.

Key Concerns to Note

Despite experiencing exponential growth within 24 hours of launch and generating profits for many crypto KOLs—with sustained buzz and discussion—some remain concerned about Friend.Tech’s pricing mechanics and data privacy practices.

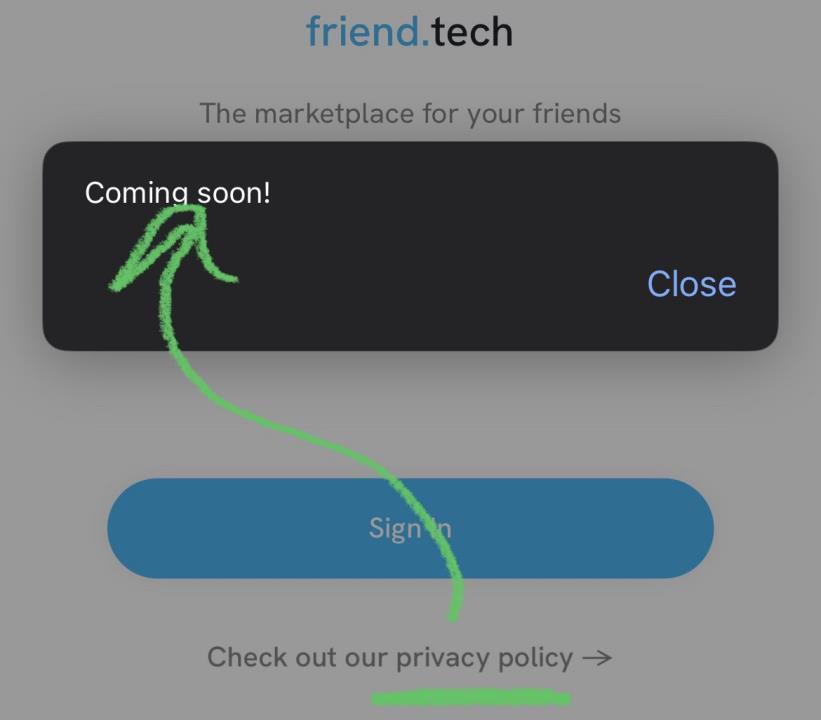

Friend.Tech’s desktop website currently directs users to download the mobile app. The minimal web presence offers little information about the project—no roadmap, founder details, or whitepaper, which are standard for Web3 projects. Even the privacy policy link simply displays “Coming soon!” when clicked.

Additionally, the user experience leaves much to be desired. On launch day, the app suffered network outages due to overwhelming traffic. As more KOLs join, users frequently report delays and crashes. In truth, rather than being a novel social product, Friend.Tech resembles a variant of NFT mechanics, operating under similar ownership logic: users invest in KOLs they believe offer valuable insights, lead active communities, or whose shares will appreciate. This means selecting high-quality KOLs becomes the most critical decision for users. Just like picking viable NFTs among countless Ordinals projects, users must first identify which Twitter accounts are active and capable of building strong communities—requiring prior analysis of KOLs’ tweet engagement metrics. Notably, most participants on Friend.Tech are currently Western KOLs, while Chinese-speaking influencers remain relatively underrepresented. Beyond initial filtering, users must also assess whether a KOL intends to sustain long-term involvement or is merely hopping on the trend temporarily. Overall, Friend.Tech effectively places a cost on attention—accessing better information requires financial investment. Yet human attention is limited; following too many KOLs may distort industry judgment. Thus, there exists a natural ceiling on user attention, which in turn constrains Friend.Tech’s own scalability and long-term development.

Conclusion

The SocialFi sector has long drawn continuous interest in the crypto world, yet no dominant leader has emerged. Will Friend.Tech’s surge reignite enthusiasm for “Web3 social” and related projects? Will it be a fleeting trend or achieve lasting success? Only time will tell. Like any Web3 innovation, Friend.Tech’s future hinges on its ability to adapt, evolve, and consistently deliver value to users. The delicate balance between social engagement and investment potential may ultimately determine its longevity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News