Understanding Investment DAOs: The Potential, Current State, and Challenges of Democratizing Investing

TechFlow Selected TechFlow Selected

Understanding Investment DAOs: The Potential, Current State, and Challenges of Democratizing Investing

The investment DAO has arrived, aiming to democratize investing, break down the barriers of traditional finance, and empower the many rather than the few.

Written by: GLOBAL COIN RESEARCH TEAM

Translated by: TechFlow

Throughout history, the democratization of financial power has been an ongoing struggle. The story of finance is filled with examples of a few exerting power over the many. From medieval merchant guilds that controlled trade and excluded outsiders, to Wall Street giants in the 20th century who frequently acted as gatekeepers of wealth creation, the financial world has long been characterized by persistent imbalances of power.

A new chapter has arrived. Investment DAOs are here (Investment DAOs). Their goal is to democratize investing, break down the barriers of traditional finance, and empower the many rather than the few. Through blockchain technology, these organizations offer individuals a new, more inclusive way to pool resources for collective investment.

In this report, we will comprehensively explore various aspects of investment DAOs and their potential. Our aim is to uncover the future of decentralized, inclusive, and democratized investing.

Why Investment DAOs?

To truly understand the revolution brought by investment DAOs, we must first examine their unique characteristics and advantages.

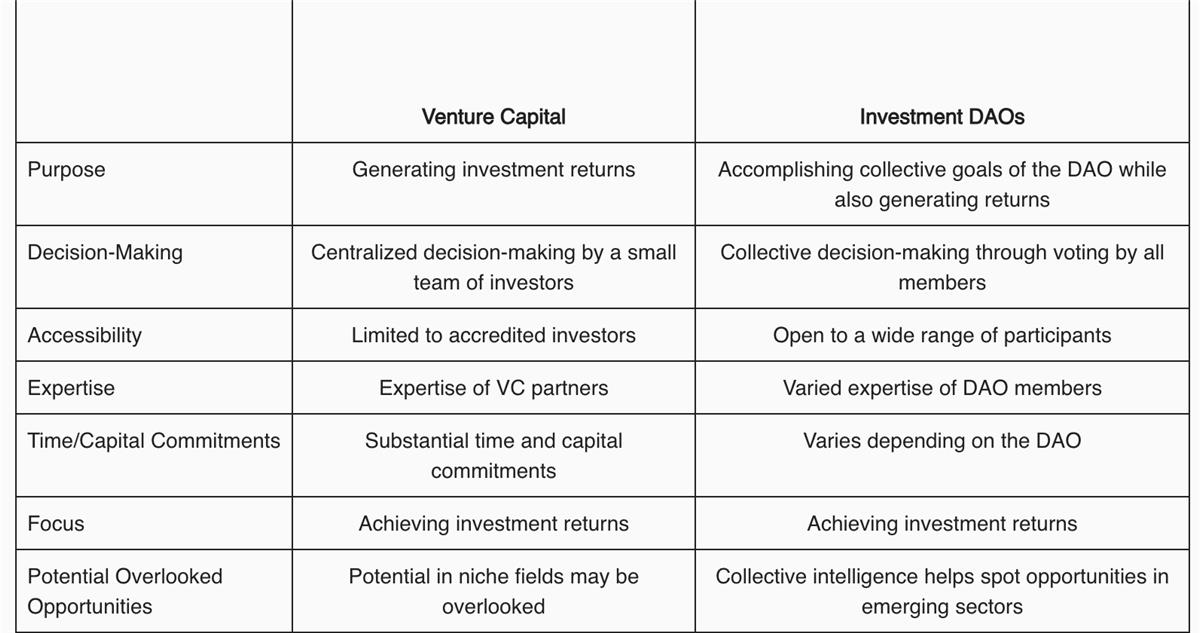

Venture capital and investment DAOs each have distinct features and roles within the financial ecosystem.

Venture capital represents the traditional model of investment, characterized by centralized decision-making. This model’s strength lies in swift decisions and partners’ expertise. However, venture capital’s limitations are evident, as it is typically restricted to accredited investors, excluding a significant portion of potentially valuable contributors.

Moreover, venture capital decisions lack the diversified insights offered by investment DAOs, which may lead to overlooked opportunities in niche areas. Additionally, the traditional venture capital model demands substantial time and capital commitments from both investors and portfolio companies, further increasing its constraints.

Investment DAOs represent a shift toward decentralization. Unlike traditional models where power is centralized, in DAOs authority is distributed, enabling all members to participate in voting on decisions. As a result, these organizations leverage collective intelligence to identify promising opportunities in emerging fields.

The table below compares venture capital and investment DAOs across dimensions such as purpose, decision-making approach, expertise, accessibility, timeliness, and potential opportunities:

Categories of Investment DAOs

Based on their focus areas, investment DAOs can be classified into different categories. Let’s go through them one by one:

Generalist Investment DAOs can include various types of assets such as tokens, equity in startups, non-fungible tokens (NFTs), and more. The key characteristic of generalist investment DAOs is their flexibility and broad scope in investment opportunities.

Examples of generalist investment DAOs include:

-

Global Coin Research: A community-first research and investment DAO focused on Web3.

-

Metacartel Ventures: An investment DAO that funds and supports early-stage projects within the Ethereum and broader Web3 ecosystem.

-

Spaceship DAO: A group of crypto-natives, founders, builders, and investors who invest in blockchain startups and emerging crypto networks.

-

BitDAO: The largest DAO-managed fund supporting the growth of open finance and helping decentralized, token-based economies thrive.

-

The LAO: A profit-driven investment DAO supporting projects in the Ethereum and blockchain ecosystems.

Domain-Focused Investment DAOs specialize in investing within specific domains or interest areas. These DAOs leverage the collective knowledge and expertise of their members to make informed investment decisions within their chosen field.

Examples of domain-focused investment DAOs include:

-

Seed Club Ventures: Supports early founders building at the intersection of Web3 and communities.

-

Layer2DAO: Invests in Layer 2 scaling solutions for the Ethereum network.

-

ZeroDAO: Supports the growth of zero-knowledge technologies.

-

Hydra Ventures: The first investment DAO fund that invests in other investment DAOs.

-

BeakerDAO: Supports the growth of decentralized science.

-

Komorebi Collective: The first investment DAO focused on funding women and non-binary crypto founders.

NFT-Focused Investment DAOs are DAOs primarily dedicated to investing in NFTs. These NFTs can represent various tangible and intangible items—from digital art and music to virtual real estate and even rare physical collectibles.

Examples of NFT-focused investment DAOs include:

-

PleasrDAO: A group of dozens of like-minded crypto investors who pool funds to purchase high-value NFTs.

-

PunkDAO: A DAO investing in Punks, Punk-related projects, and the broader ecosystem.

-

Flamingo DAO: An NFT-focused DAO aiming to explore emerging investment opportunities in ownable, blockchain-based assets.

-

Fingerprint DAO: A collective governed by its curation committee, owning a collection of high-value NFTs.

Gaming Investment DAOs are DAOs whose investment strategies center on the gaming industry. This may include investments in game development studios, gaming assets, and gaming infrastructure.

Examples of gaming investment DAOs include:

-

Dark Horse DAO: A collective focused on acquiring, managing, and maximizing yield-generating NFTs within the growing ecosystem of utility games and performance-based AI platforms.

-

Ready Player DAO: Invests in game economies through asset acquisition, strategic partnerships, and guild development.

-

Blackpool DAO: Owns and manages a range of digital assets, from in-game revenue-generating items to metaverse land parcels.

Geographically Focused Investment DAOs are decentralized autonomous organizations that make investments based on specific geographic regions. These DAOs recognize that different regions present unique markets, opportunities, and challenges, and leverage this understanding for strategic investment.

Examples of geographically focused investment DAOs include:

-

Glimmer DAO: An NFT collectors DAO focused on Asia.

-

Upside DAO: An investment DAO focused on Australia.

-

Afropolitan: An investment DAO focused on creating a digital nation enabling all Africans to live prosperous lives.

However, it's important to note that while these DAOs have geographic focuses, their membership is typically global, leveraging the power of the internet and blockchain technology to bring together investors from around the world to invest in specific regions.

Current Structures of Investment DAOs

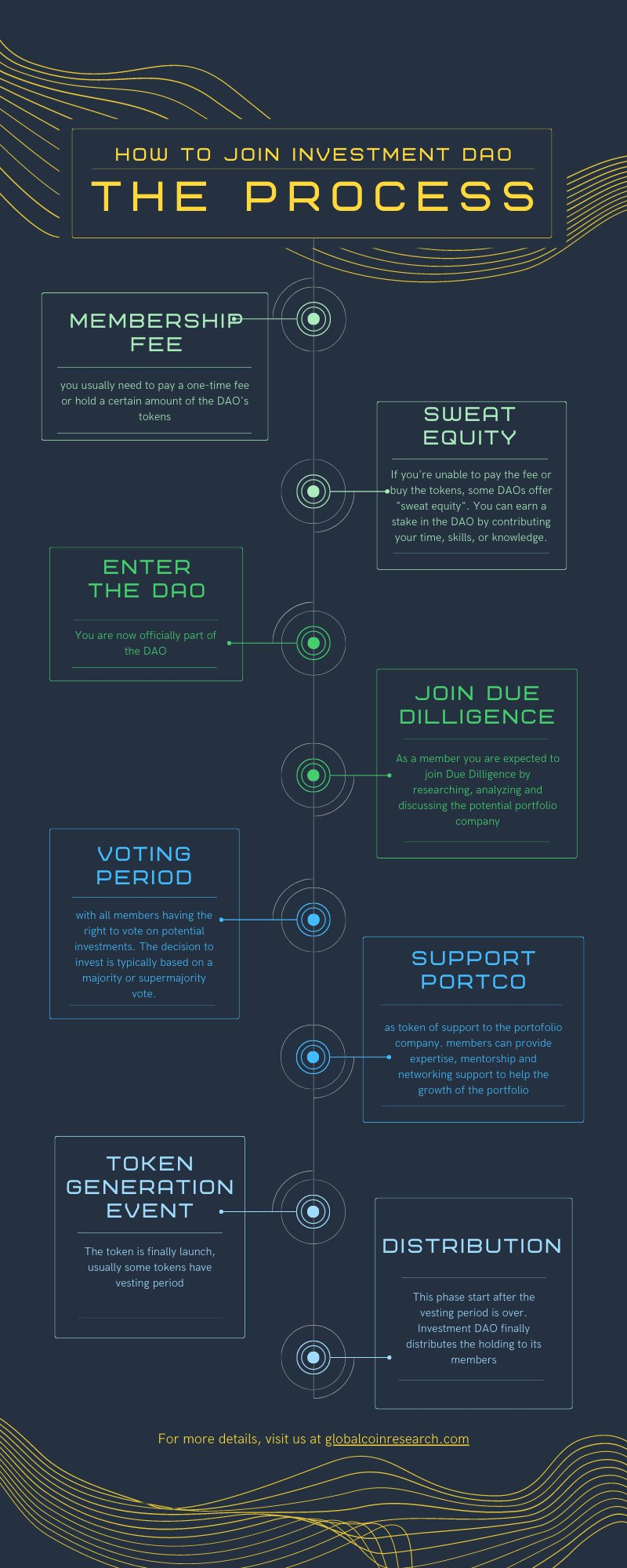

Investment DAOs introduce a new investment structure powered by decentralization and blockchain technology. Typically, there are two main models for joining an investment DAO:

-

Membership Fee Only: Requires paying a one-time fee, contributing valuable assets (e.g., NFTs), or holding a certain amount of the DAO’s tokens. Examples include Global Coin Research, Blackpool DAO, and BitDAO.

-

Membership Fee + Work Contribution: Requires paying a fee and actively contributing to the DAO in some capacity. Often, membership is vetted, and some DAOs include incentive mechanisms. Examples include ZeroDAO and Hydra Ventures.

Once you’re in, the game begins. As a DAO member, you’ll participate in due diligence and calls with prospective portfolio companies. You gain a voice, voting rights, and the ability to influence whether the DAO invests in a project—like in BitDAO. Other DAOs allow you to deploy personal capital into a project, as seen with Global Coin Research.

Some DAOs use membership fees to invest varying amounts across different projects—examples include Hydra Ventures, Seed Club Ventures, and Flamingo DAO. Both models give members greater control over their portfolio exposure and risk levels.

Finally, members wait for the TGE (Token Generation Event) so their holdings become liquid. During this period, members can support portfolio companies through marketing, recruiting, and other assistance to increase the likelihood of success for their investments.

Design Space for Investment DAOs

While revolutionary, investment DAOs also face a series of challenges. As we delve into the complexities of these entities, we’ve identified six key areas that, if addressed, could significantly enhance their functionality and impact.

First, let’s start with Risk Management. Like any investment entity, investment DAOs face risks. But in the world of DAOs, these risks are amplified by their decentralized nature and the inherent volatility of crypto markets. Imagine if we could develop robust, tailored risk management strategies specifically for DAOs—protecting downside while preserving upside potential—the impact would be transformative.

Next, consider the concept of Dynamic Voting Rights. In current systems, voting power is static and based solely on token holdings. But what if we implemented a dynamic system where voting rights are also influenced by a member’s contributions to the DAO? Successful investment proposals or active participation in governance could grant you greater influence in decision-making.

Then there’s the idea of a Cross-DAO Reputation System. Imagine a reputation system that works across multiple DAOs, incentivizing positive behavior and discouraging malicious actions. Members earn reputation points through constructive contributions and lose them through negative behavior—it’s like a credit score for the DAO world.

We also see strong potential in DAO Incubator Programs. Experienced DAO members could mentor newer DAOs, guiding them through common challenges and helping them avoid pitfalls. It’s like having mentorship programs for DAOs, fostering a supportive environment for growth and learning.

The concept of DAO-to-DAO Services is another promising frontier. DAOs could provide services to other DAOs—from technical development to governance consulting. This could create a vibrant ecosystem where DAOs support each other, cultivating a sense of community and shared progress.

Finally, there’s a need for comprehensive DAO Operations and Legal Toolkits. The complex legal landscape can be daunting for DAOs. A toolkit including template legal documents, regulatory guidance, and operational best practices would be invaluable for operators, potentially leading to an explosion in the number of investment DAOs.

Exploring investment DAOs opens new frontiers in the financial world. While this journey is partially uncharted, its revolutionary potential could reshape the very landscape of investing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News