When Exchanges Enter the Wallet Arena: A Preemptive Battle for Traffic

TechFlow Selected TechFlow Selected

When Exchanges Enter the Wallet Arena: A Preemptive Battle for Traffic

Exchanges are positioning themselves in wallet services from a forward-looking perspective—it's both a competitive trend and a top-tier instinct at the upstream of the industry food chain.

Recently, exchanges have been making frequent moves in the wallet space, signaling an increasingly strong intent to build during the bear market.

On August 10, BitKeep, a Web3 multi-chain wallet, completed a rebranding and changed its name to Bitget Wallet. Previously, Bitget Exchange invested an additional $30 million into it, becoming its controlling shareholder;

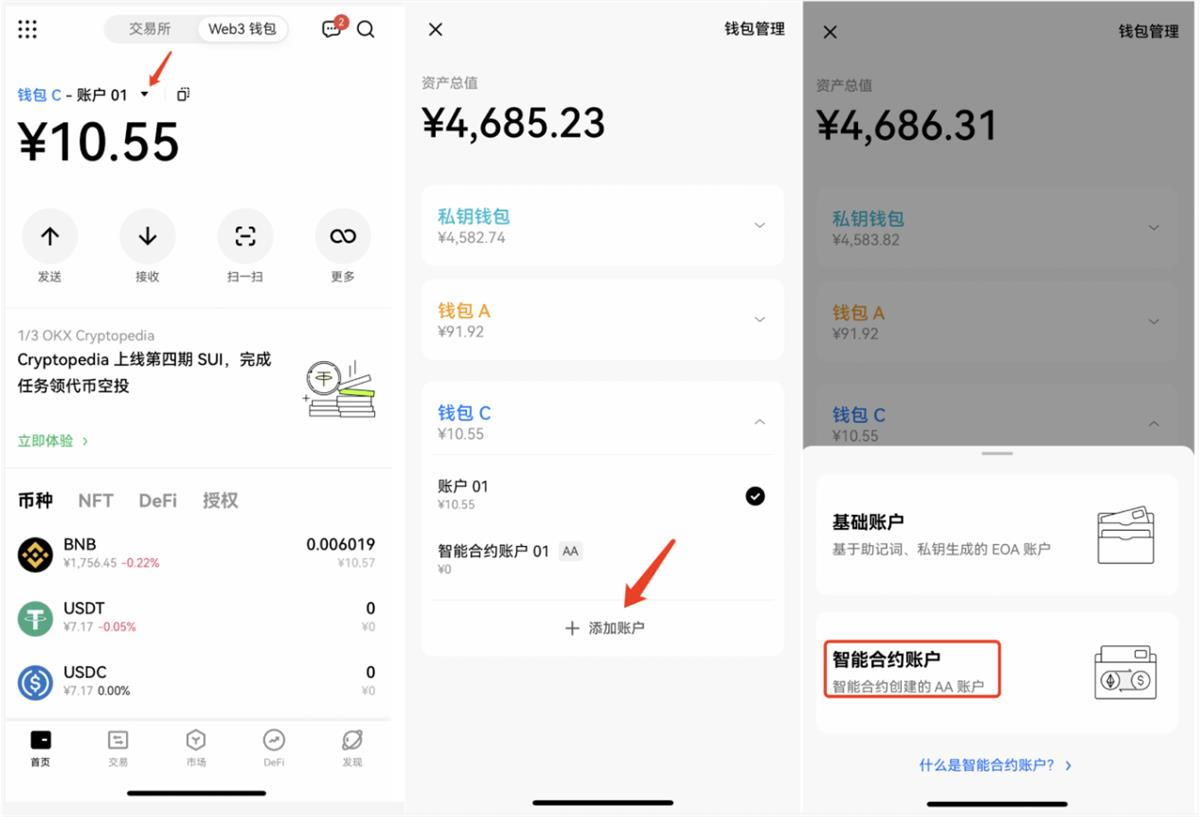

And just a week earlier, OKX announced the launch of its AA (Account Abstraction) smart contract wallet, taking the lead among many CEXs in implementing account abstraction.

Whether through investment and acquisition or independent development, CEXs’ investments in wallets are clearly visible. Note that these are not traditional custodial wallets on CEXs, but self-custody wallets fully controlled by users—bearing the branding of the CEX.

Years ago, as an old-timer in the space, I didn’t perceive non-custodial wallets as popular. Deposit funds, buy tokens, sell tokens, withdraw... CEXs seemed to be the main gateway to the entire crypto world, while wallets were more like an exit for pulling out assets.

But today, with growing emphasis on decentralization and increasingly fragmented on-chain activity, “interaction” has renewed the possibility of wallets serving as traffic gateways. Meanwhile, the emergence of account abstraction raises further expectations that wallets could become more user-friendly and attract mainstream users beyond the current ecosystem.

When CEXs start competing in wallets, beneath the calm surface of stable bear-market prices, undercurrents are stirring:

The real game across cycles is all about capturing traffic.

In Web3, Infrastructure Is the Traffic Gateway

In the internet we live in, there's a basic consensus: applications control the entry point to traffic.

For example, an article on WeChat Official Account can go viral with over 100,000 reads. In this process, you only need to focus on whether the content itself is engaging—you don’t have to worry about lacking an audience. The potential viewers are all WeChat users; the app itself holds a massive traffic pool.

If we go back 10–20 years, however, things weren’t always this way.

During the 2G or 3G era, infrastructure providers—the telecom operators—held the key to traffic. Operators invested heavily in building networks and laying cables, and also launched VAS (Value Added Services): ringback tones, MMS, mobile games, mobile news… All services went through them, paid for via phone credit.

These services may seem unfamiliar to younger generations today, but at the time, everything felt natural:

Infrastructure providers made large upfront investments in building infrastructure, then gradually recouped costs through nearly zero marginal cost voice/data plans and value-added services. Given their vast user base, it was essentially a stable, profitable business.

Does this sound familiar to how CEXs operate?

Make a large initial investment to build a trading system, continuously maintain and iterate it, and recover costs through trading fees (spot/futures). Once the core business is established, expand into additional services and areas.

Ten years ago, CEXs were unequivocally the primary traffic gateway to the crypto world—and arguably the only one.

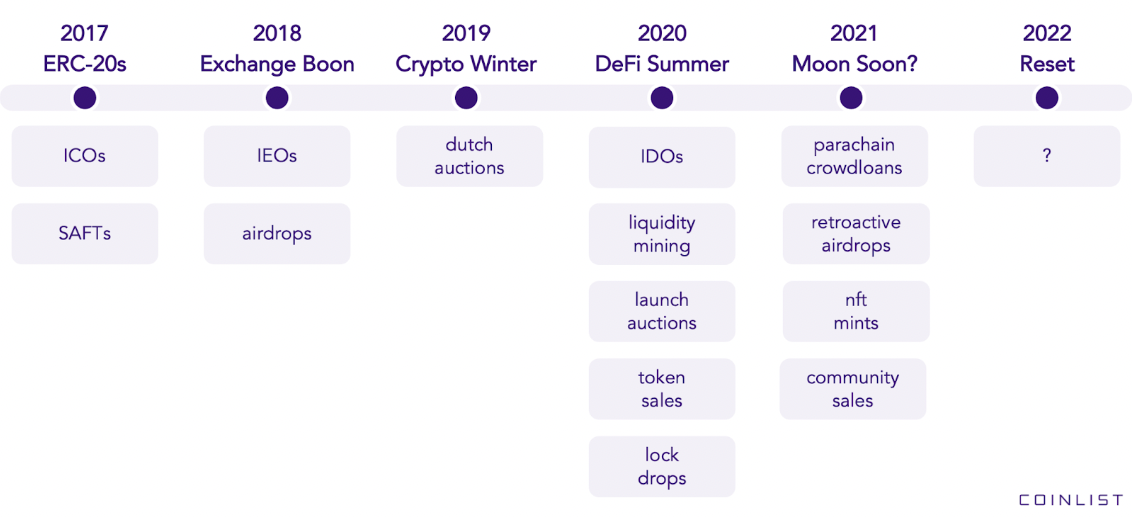

Six years ago, the ICO model surged in popularity—users could directly access a smart contract with their wallet to receive tokens;

Five years ago, CryptoKitties appeared; almost simultaneously, OpenSea launched, followed by the NFT craze—users could interact with platforms via wallets to trade NFTs;

Three years ago, Compound introduced liquidity mining, sparking the DeFi summer, allowing users to directly interact with DApps to earn token rewards...

Don’t forget: Web3 traffic inherently carries transactional value—wherever there’s profitable trading, there’s traffic.

As narratives evolve and paradigms shift, wallets—as the foundational layer for any transaction—have gradually elevated their status as traffic gateways. This dynamic also contributed to the success of MetaMask, founded in 2019.

During this transition, CEXs were somewhat slow to react. Once dominant in capturing early crypto traffic, they began losing share as on-chain trends multiplied and NFTs rose—just as telecom operators once lost ground to apps like WeChat and Alipay.

Hence, CEXs began launching IEOs, developing wallets, building NFT platforms, supporting BRC-20, and offering easier access to staking or mining opportunities—everything became logical.

Safeguarding their core business while chasing new traffic gateways amid shifting on-chain trends—and leveraging their existing user base to funnel traffic to their non-custodial wallets and other services.

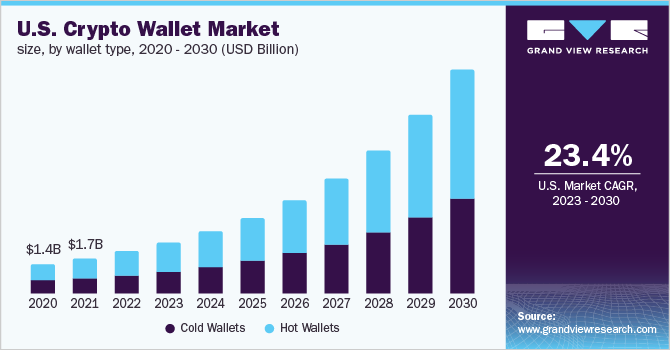

According to data from Grand View Research, global cryptocurrency wallet users increased from 76.32 million in August 2021 to 84.02 million by August 2022. The global crypto wallet market size was valued at $8.42 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 24.8% from 2023 to 2030.

Given this scale—even without precisely calculating overlap between wallet users and CEX account holders—simply looking at market size and growth rate makes it perfectly rational for CEXs to enter the wallet space.

Why wouldn’t they seize more traffic if they can?

Looking at Tomorrow from the Day After

Twenty years ago, telecom operators were the primary gateways for communication and value-added services. But what happened afterward we all know: after 3G, the mobile internet emerged, applications flourished, traffic was fragmented across vertical apps, and telecom operators—once dominant infrastructure providers—gradually became mere pipes below—building roads, but no longer collecting substantial tolls from traffic.

History doesn’t repeat itself exactly, but it often rhymes.

A day in crypto equals a year in the real world. Amid the rise of DEXs, increasing global regulatory pressure, and rapidly shifting narratives, would CEXs possibly worry about losing traffic and falling behind?

The answer is naturally yes. Currently, when CEXs build wallets—integrating them with their own L1/L2 chains, empowering their platform tokens, offering experiences similar to on-chain apps—they’re at best ensuring they “don’t fall behind.”

To truly become leaders, however, they must look ahead—from the vantage point of the day after, toward tomorrow.

If crypto has a future, mass adoption will undoubtedly be central. And in planning for mass adoption, technologically speaking, trends such as account abstraction, ERC-4337, and smart contract wallets are already emerging.

Some Layer 2 networks, such as Starknet, are gradually moving to support only AA accounts and no longer support EOA.

Although from today’s perspective, most use cases still don’t require smart contract wallets exclusively—not to mention unresolved issues like who pays gas fees after adopting AA. Their advantages—programmability, batch operations, and gas payments in non-native tokens—are more like preparations for the future:

The wallet and interaction experience post-mass adoption should look like this.

Therefore, I believe exchanges are strategically positioning themselves in wallets from a future-oriented perspective—it’s competitive instinct and top-tier industry foresight.

For instance, OKX’s release of its smart contract wallet at this moment isn’t ideal given overall market conditions. Moreover, upon closer inspection, you’ll find the smart contract wallet feature is relatively buried within the app, not prominently displayed.

But thinking long-term, launching early during a market trough allows for rapid iteration and small-scale experimentation. By the time market sentiment turns positive, the product experience might already be well-refined—giving them greater confidence to handle the surge of new traffic during a bull run.

Having learned from past “me-too” disadvantages, exchanges are now determined to achieve “better-than-others” in this phase. Whether through acquisition or in-house development, they cannot afford to lose the wallet traffic gateway—and combining it with their existing services offers room for innovation.

Also, consider this alternative view: if true mass adoption arrives, using this wallet or that wallet won’t matter much. For mainstream newcomers outside the crypto space, brand credibility, incentive programs, and user experience will outweigh debates over CEX vs. DEX—and they certainly won’t adhere to purist ideologies like “I won’t use a CEX because it’s not decentralized.” Under these conditions, CEXs—with their financial and scale advantages—might even gain momentum later in the next wave.

After all, their first wallet doesn’t have to be MetaMask.

In this endless battle for traffic, user experience will always emerge victorious.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News