The "Undervalued" Bitcoin Ecosystem: Its Supporters, Long-term Value, and Historical Context

TechFlow Selected TechFlow Selected

The "Undervalued" Bitcoin Ecosystem: Its Supporters, Long-term Value, and Historical Context

The world of crypto is, at its core, a brave explorer's game that rewards innovation and creation.

"Ordinals marks the return of builder culture!"

On July 7, Ethereum co-founder Vitalik Buterin praised the development of Ordinals and BRC-20 during a Twitter Space session titled "What Bitcoin Can Learn From Ethereum," calling them a counter to the "stagnant politics" within the Bitcoin ecosystem and a revival of a hands-on, builder-oriented culture.

It has been 14 years since Bitcoin's launch in 2009. During this time, the gradual emergence of miners, trading platforms, the Lightning Network, RGB, STX, and other innovations have led more retailers to accept Bitcoin payments, increasing its visibility and adoption.

Yet, the Bitcoin ecosystem remained relatively stagnant—until the explosive arrival of Ordinals and BRC-20. A surge of developer activity followed, with OKX Web3 team stepping in to support Bitcoin’s technological advancement—the first time an exchange-affiliated development team has contributed to Bitcoin’s core infrastructure. Once again, Bitcoin is back at the center of the crypto narrative stage.

What long-term value does the Bitcoin ecosystem hold? Who are the key players behind it? This article explores the supporters, enduring value, and historical context shaping Bitcoin’s evolution.

1. The Origins of Ordinals

Today, discussions about the Bitcoin ecosystem are inseparable from Ordinals.

In December 2022, software engineer Casey Rodarmor launched the NFT protocol "Ordinals." On January 20 of this year, the Ordinals protocol released version 4, officially introducing NFTs to the Bitcoin network through Ordinals and Inscriptions.

Bitcoin NFTs aren’t new—many existed previously on second-layer networks like STX—but Ordinals NFTs are native to Bitcoin. They operate without altering Bitcoin’s base protocol, do not rely on Layer 2 solutions, and maintain backward compatibility with the network.

Launched in June 2017, CryptoPunks was one of Ethereum’s earliest NFT projects and is often regarded by investors as the “Bitcoin of NFTs.” Now, Bitcoin has its own Punks.

On February 9, 2023, Bitcoin Punks were minted on the Ordinals protocol, occupying inscription numbers within the first 40,000—a very early batch. Notably, in early March, OKX NFT marketplace listed this NFT collection, marking the beginning of OKX’s integration with the BTC ecosystem.

Just as Ethereum’s NFT ecosystem quickly produced numerous blue-chip projects, Bitcoin NFTs rapidly gave rise to well-known collections such as TwelveFold, Taproot Wizard, and Bitcoin Frogs.

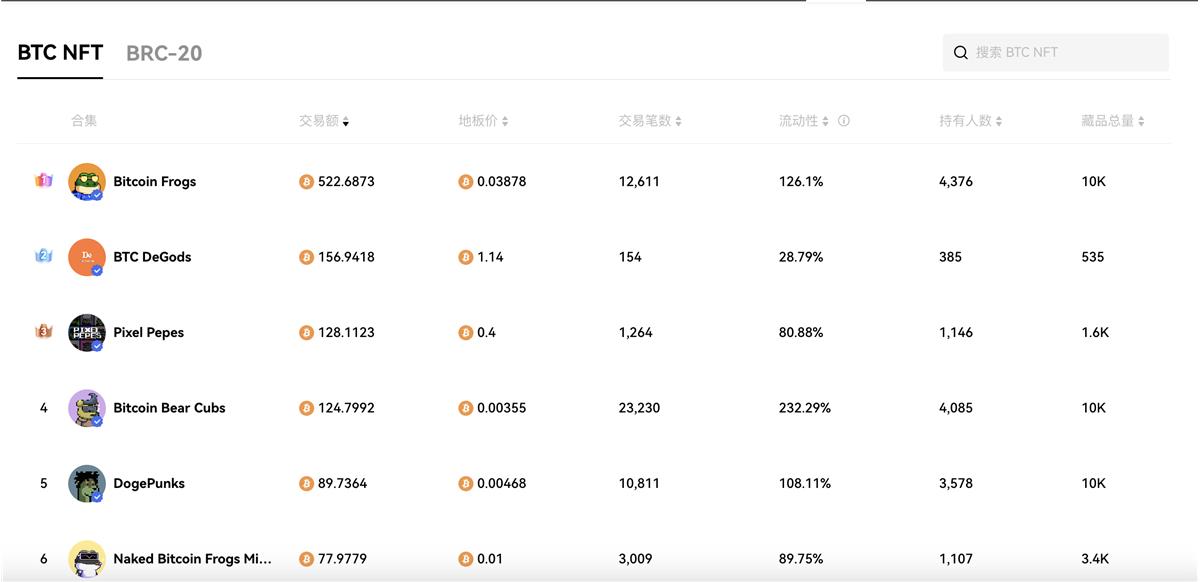

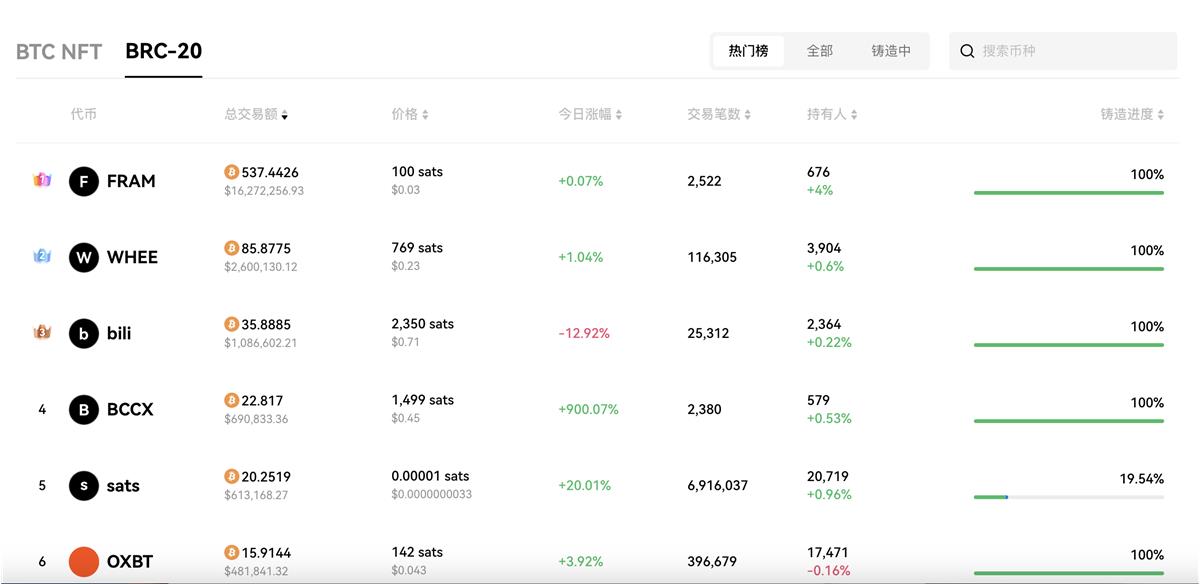

According to BTC NFT trading data from OKX on July 18, Bitcoin Frogs ranked overwhelmingly first in trading volume.

If Ethereum saw tokens gain popularity before NFTs, the Ordinals ecosystem took the opposite path.

Inspired by the Ordinals protocol, Twitter user @domodata created BRC-20—an experimental fungible token standard for Bitcoin—on March 8, 2023. The first BRC-20 token contract deployed was for the "ORDI" token, limited to 1,000 per mint with a total supply of 21 million.

Although domo viewed BRC-20 as merely a fun social experiment, to speculators, its groundbreaking narrative offered irresistible hype potential.

Since ORDI’s launch, BRC-20 tokens have proliferated. According to OKX Web3 Wallet, as of July 18, 2023, the platform had listed 613 BRC-20 tokens.

Driven by strong market interest, BRC-20 continues to evolve, spawning various derivative protocols and standards.

ORC-20: Developed by OrcDAO, this is an improved protocol targeting BRC-20 functionality.

BRC-20S: Proposed by the OKX Web3 team, this is an extended version of the BRC-20 protocol that introduces deposit, minting, and withdrawal functions. Under this proposal, users can stake their BRC-20 tokens and Bitcoin to receive corresponding BRC-20S tokens in return.

BRC-21: Proposed by Alexei Zamyatin, founder of cross-chain interoperability project Interlay, aiming to introduce fully decentralized cross-chain assets to the Bitcoin network and enable their use within the Lightning Network.

BRC-721: An experimental standard for issuing non-fungible tokens (NFTs) on the Bitcoin network, designed to overcome limitations of native Ordinals NFTs by offering greater functionality and flexibility—for example, storing images off-chain via IPFS.

2. The Key Supporters Behind the Scenes

Who are the forces building the infrastructure behind Bitcoin’s growing ecosystem?

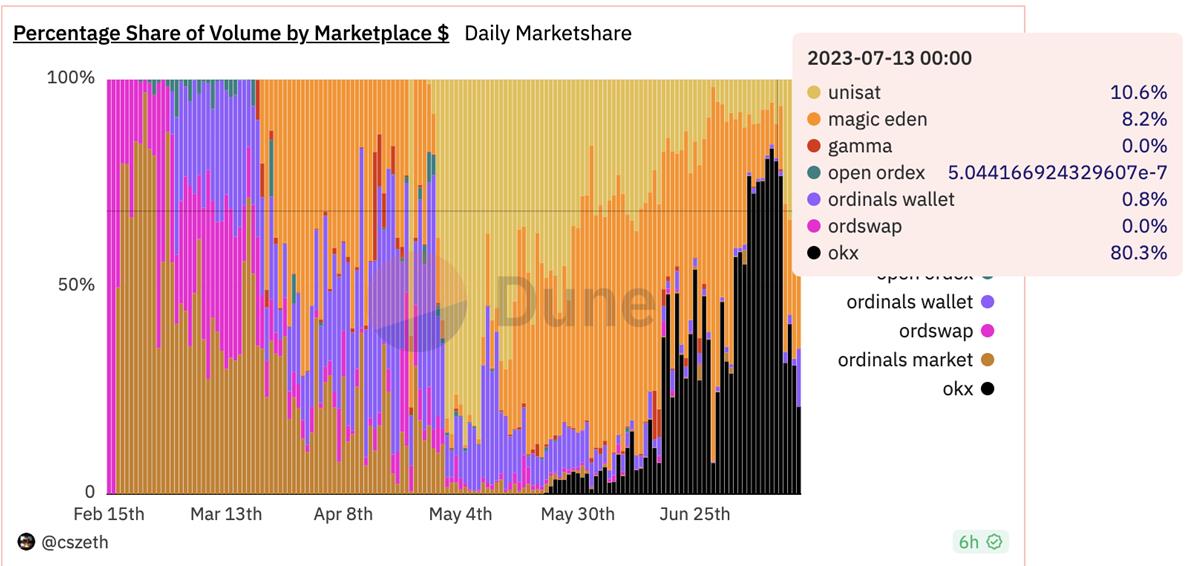

According to Dune analytics dashboards, OKX, Unisat, and Magic Eden consistently rank among the top three marketplaces in the Ordinals ecosystem. Among them, OKX Web3 Ordinals Market has become the largest marketplace by trading volume, capturing over 70% of the market share. Even after filtering out volume inflated by bot activity due to its zero-fee policy, OKX still holds around 40% of the market.

Unisat: A Pioneer in the Industry

Unisat emerged to meet the demand for BRC-20 trading, providing liquidity and enabling the initial surge in tokens like ORDI, which captured widespread attention.

Looking back, Unisat’s decision to enter this space early was exceptionally strategic. While Bitcoin’s ecosystem infrastructure was barren, they bet on growth rather than competing in saturated markets, leveraging emerging narratives to attract traffic.

OKX: Rising Fast, Rooted in the Ecosystem

On May 20, OKX became the first exchange to list ORDI with live trading.

Currently, OKX Web3 Wallet supports BRC-20 trading markets, BRC-20 token swaps, cross-chain BTC swaps, minting of Ordinals inscriptions and BRC-20 tokens, and trading of Ordinals NFTs. On July 19, it officially launched staking functionality for BRC-20 tokens.

Beyond basic infrastructure like trading tools, OKX Web3 Wallet’s support extends deep into protocol-level standards.

BRC-20S, an extension of the BRC-20 protocol led by OKX, introduces deposit, minting, and withdrawal functions. Users can stake their BRC-20 tokens and Bitcoin to earn rewards.

A PhD economist and Bitcoin ecosystem enthusiast known as “BRC-20白菜” believes OKX is attempting to replicate DeFi Summer. While BRC-20 only supports transfers, BRC-20S adds staking capabilities, allowing new projects to distribute tokens by requiring users to stake ORDI or other BRC-20 tokens—an effective way to attract early adopters.

“OKX’s BRC30 (now renamed BRC20-S) doesn’t alter BRC-20 nor push forward under the BRC-21 banner—it’s a gentle approach. OKX isn't forcing top-down control over BRC ecosystem development, leaving room for community developers like Domo to improve BRC-20. Instead, it offers a semi-centralized, compatible path toward BRC-based DeFi. That’s what real builders do.”

From wallets and browsers to marketplaces and protocol standards, OKX has become the first-ever exchange to provide technical support for the Bitcoin network’s evolution.

But this didn’t happen overnight. OKX Chief Innovation Officer Jason Lau revealed in a media interview that “OKX noticed the BTC ecosystem very early on, going through stages of discovery, research, skepticism, internal debate, and finally full commitment by late April.”

Why did OKX ultimately choose to fully embrace the Bitcoin ecosystem?

Jason Lau believes zero-knowledge proofs, MPC multi-sig wallets, and the BTC ecosystem represent today’s three dominant narratives—and the BTC ecosystem may be the most promising.

“Bitcoin has long been seen as digital gold, but with the Ordinals protocol, users can now mint NFTs directly on Bitcoin’s mainnet—data that will never be lost. This opens doors to future innovation. The introduction of BRC-20 and BRC-20-S could spark a true breakout moment for Bitcoin.”

Additionally, Jason Lau revealed that OKX Web3 Wallet will soon launch a decentralized liquidity market—an innovation on par with the Lightning Network—enabling peer-to-peer self-custodial trading without relying on third-party services.

3. What Is the True Value of the Bitcoin Ecosystem?

OKX has gradually assumed a leading position in the Bitcoin ecosystem market. Using OKX Web3 Wallet for BTC NFT and BRC-20 transactions is becoming habitual. Yet, whether discussing BTC NFTs, BRC-20, or even Bitcoin Layer 2s like STX, skepticism remains widespread.

To Bitcoin purists, Ordinals disrupt Bitcoin’s core narrative, cluttering the main chain with “junk” and causing network congestion. Bitcoin, they argue, should remain purely a store of value.

So, does building an ecosystem on Bitcoin have long-term value?

Since the Ordinals mainnet launch in late January, six months have passed—and the market seems to have answered: The value of the Bitcoin ecosystem isn’t determined by online debates, but by bottom-up validation from developers and users through code and on-chain activity.

The “stagnant politics” in Bitcoin’s ecosystem criticized by Vitalik—what we might call “lying flat” in Chinese internet slang—is simply waiting passively for Bitcoin to reach new highs.

Meanwhile, Ethereum has expanded its narrative beyond smart contracts to include “value storage.” But passive waiting won’t bring a better tomorrow for Bitcoin.

In our view, the Bitcoin ecosystem—including Ordinals—remains undervalued, offering significant long-term opportunities for development and investment.

1. Strongest Consensus Foundation

When people think of blockchain or cryptocurrency, the first thing that comes to mind is Bitcoin. Whether in terms of decentralization’s “cultural legitimacy” or security, Bitcoin enjoys the broadest consensus—its cultural premium and moat—which fundamentally distinguishes it from other ecosystems.

2. Deepest Capital Base

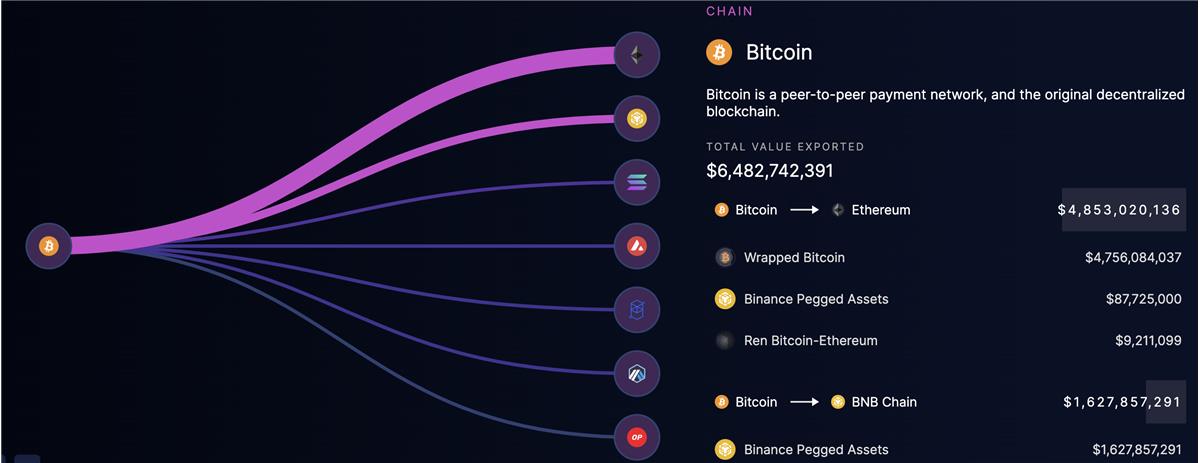

For a new public chain ecosystem, attracting external capital is a constant challenge. But the Bitcoin ecosystem faces no such issue. With a current market cap exceeding $580 billion and over $6.4 billion worth of Bitcoin bridged to ecosystems like Ethereum, Bitcoin already possesses immense capital depth. The real question is how to activate these existing assets.

Source: CryptoFlows

3. Market and Industry Demand

In an expectation-driven crypto market, a new narrative is needed to drive sector rotation. As Bitcoin approaches its next halving, miners will face increasingly difficult economic conditions. A thriving Bitcoin ecosystem can generate substantial transaction fees, giving miners strong incentives to secure the network—fulfilling Satoshi Nakamoto’s original vision.

4. Growing Developer Ecosystem

Driven by market potential and wealth effects, more and more developers—from former Solana and BSV ecosystems to teams like OKX Web3—are flocking to Bitcoin development.

On July 17, Star Xu stated on social media: “OKX Web3 Wallet is open-sourcing signature algorithms for all chains. We hope to make a small contribution to the industry.”

It is through the efforts of these innovators and builders that Bitcoin’s technological progress and ecosystem growth continue to accelerate.

July 19—just 282 days remain until the next Bitcoin halving.

In 282 days, Bitcoin’s block reward will halve to 3.125 BTC, ushering in a new phase of narrative anticipation.

Of course, challenges remain—such as Bitcoin network congestion caused by BRC-20 traffic, bringing the need for scaling solutions back to the forefront.

Ethereum co-founder Vitalik Buterin noted during a Twitter Space: “If we want Bitcoin to be more than just a payment system, it needs scaling solutions like Plasma or ZK Rollups—both of which have already been tested on Ethereum.”

While Bitcoin has long pursued its role as a store of value, compared to Ethereum, its ecosystem remains in the exploratory, trial-and-error phase. Much remains uncertain. For those bravely moving forward, perhaps we should offer more tolerance and encouragement.

The crypto world has always been a game that rewards innovation and construction—a game for the brave.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News