With big players entering and the halving narrative, is now the best time to buy Bitcoin?

TechFlow Selected TechFlow Selected

With big players entering and the halving narrative, is now the best time to buy Bitcoin?

Bitcoin's price has rebounded from 24,800 to a high of 31,000, suggesting "the bull is back."

Describing BTC's price movement since June this year as "wild swings" is no exaggeration—in fact, it first plunged sharply before rebounding strongly. BTC prices initially dropped to a low of 24,800 in early June due to the black swan event of Binance being sued by the SEC, compounded by negative factors such as U.S. Treasury bonds draining liquidity.

Just when market sentiment hit rock bottom, BlackRock—the world’s largest asset manager with over $10 trillion in assets under management and an almost perfect track record of ETF approvals—filed an application with the SEC for a spot Bitcoin ETF, creating a seismic shift. This "shot heard round the world" prompted traditional financial institutions like WisdomTree, Invesco, and Fidelity Investments to follow suit with their own applications, while EDX—a crypto exchange specifically designed for institutional clients—officially launched in the United States.

A series of news items about traditional financial institutions entering the crypto space have energized investors. Against the backdrop of Bitcoin’s upcoming halving, are these institutions positioning themselves to “get on board” ahead of the next bull run? Regardless of the answer, Bitcoin’s price has already rebounded from 24,800 to a high of 31,000, suggesting that “the bull may be back.”

Institutional Giants Enter: What Sparks Will Fly Between Traditional Finance and Crypto?

Looking back, native crypto exchanges like Binance and Coinbase were hit with lawsuits from the SEC, plunging the market into a deep freeze—yet precisely at this moment, traditional financial giants like BlackRock chose to enter. Is this mere coincidence or calculated strategy? The timing certainly raises eyebrows.

Regardless of whether the SEC is rolling out a regulatory red carpet for traditional finance, what matters more is understanding how the entry of traditional financial institutions will impact the crypto world—and how ordinary investors should respond.

First, the involvement of traditional financial institutions will undoubtedly inject massive liquidity into the digital currency market. ETFs can be listed and traded on stock exchanges, offering investors a much more convenient channel to access Bitcoin. The introduction of ETFs will allow more traditional and institutional investors to easily participate in the Bitcoin market, driving significant capital inflows. Markus Thielen, head of cryptocurrency research at digital asset platform Matrixport, pointed out: “Once approved, BlackRock’s Bitcoin ETF could attract $10 billion within three months and $20 billion within six months—this would provide strong support for Bitcoin’s price.” Institutional participation could bring more stable capital flows, enhancing market depth and liquidity.

Second, the participation of traditional financial institutions will help further improve regulatory compliance in the crypto industry. This year, the SEC has intensified its crackdown on crypto-friendly banks, exchanges, and staking service providers. Traditional financial institutions operate under strict regulatory oversight and rigorous compliance standards. Their entry into crypto will push the industry toward greater standardization and transparency.

At present, incomplete regulatory frameworks and unclear rules frequently lead to regulatory "black swan" events, undermining investor confidence and hindering healthy market development. With traditional institutions leading the way, regulators may become more proactive in formulating and refining policies, establishing a more comprehensive regulatory framework to ensure market stability and investor protection. This would strengthen market participants’ confidence and attract more traditional and institutional investors into the crypto space.

Third, ETF applications may influence Bitcoin’s price volatility. In the short term, regardless of approval outcomes, news surrounding ETF filings will cause significant market fluctuations. On June 30, when the SEC stated that the spot Bitcoin ETF application was incomplete, Bitcoin’s price swung around 5% within one hour. Investors must therefore pay close attention to risks arising from news flow.

In the long term, according to data provided by crypto researcher @TheCryptoLark, BlackRock alone manages $10 trillion in assets. By comparison, only about 10% of Bitcoin’s total supply—roughly $50 billion—is actively circulating on exchanges. This means BlackRock would need just 0.5% of its AUM to purchase all Bitcoin currently available on exchanges.

Once approved, Bitcoin’s price could experience extreme volatility due to a surge in trading volume. Over the longer horizon, however, BTC prices are likely to rise as ETF approval drives increased trading demand.

Finally, the entry of traditional financial institutions will serve as a catalyst for the broader industry’s development. Nicolas Bertrand, head of crypto at Nomura Securities, believes that diversified products and increased competition drive industry growth. While the initial phase may involve some “competition” among new entrants, the overall effect will be expansion of the market. As traditional finance explores and engages deeper with crypto markets, it will accelerate recognition and adoption of Bitcoin and other digital assets, fostering greater integration between traditional finance and the crypto world.

The Halving Narrative: Will the Bull Market Arrive on Schedule?

After the initial rally following BlackRock’s ETF announcement, BTC has been oscillating between 30,000 and 31,000. This sideways movement lasting over 20 days indicates strong buying pressure around 30,000 and equally strong selling resistance near 31,000. In the short term, traders should closely monitor Bitcoin’s price action—its next directional move may be triggered by macroeconomic data such as U.S. CPI figures. The potential approval of a spot Bitcoin ETF will also be a key factor influencing price dynamics. Looking further ahead, against the backdrop of the upcoming halving, historical patterns suggest Bitcoin may be on the verge of another major bull market.

According to Bitcoin’s design, miners receive a fixed amount of newly minted Bitcoin as a reward for successfully mining a block. However, to control supply, the Bitcoin protocol mandates that this block reward is cut in half approximately every four years. The upcoming halving will reduce the block reward to 3.125 BTC.

This halving mechanism aims to cap Bitcoin’s total supply and gradually slow its issuance rate, preserving its scarcity and inflation resistance.

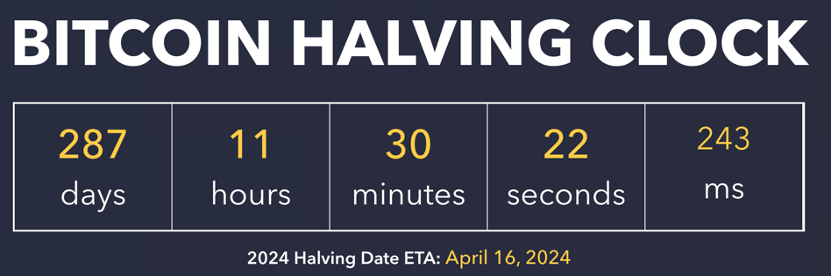

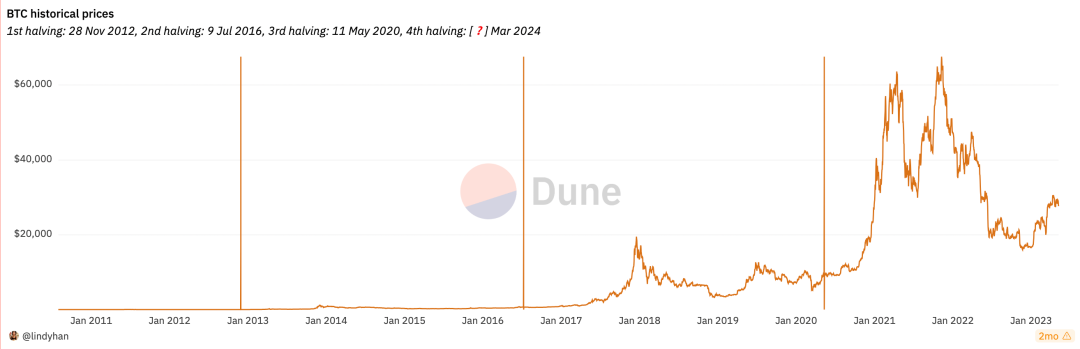

With less than 300 days until Bitcoin’s fourth halving, a look back at history shows each previous halving was followed by a significant price surge:

-

November 28, 2012 – First halving: Block reward reduced to 25 BTC; Bitcoin price rose from $12 to $1,217.

-

July 8, 2016 – Second halving: Block reward reduced to 12.5 BTC; Bitcoin price surged from $647 to $19,800.

-

May 12, 2020 – Third halving: Block reward reduced to 6.25 BTC; Bitcoin price climbed from $8,787 to a peak of $64,507.

Looking at Bitcoin’s three past halvings, we see a clear pattern of sharp price increases following each event, supporting the view that halvings do have a positive impact on Bitcoin’s price.

On the demand side, the recent boom in BRC-20 tokens suggests Bitcoin’s ecosystem is finally blossoming. Previously seen mainly as “digital gold” for value storage, Bitcoin now benefits from increased utility and ecosystem activity, which boosts demand. Additionally, institutional entry and growing trading interest will further increase demand for Bitcoin.

On the supply side, Bitcoin’s total supply is capped at 21 million, and the quadrennial halving reduces its inflation rate and slows new supply. For an asset with such low supply elasticity, rising demand coupled with decreasing supply makes a price increase highly probable.

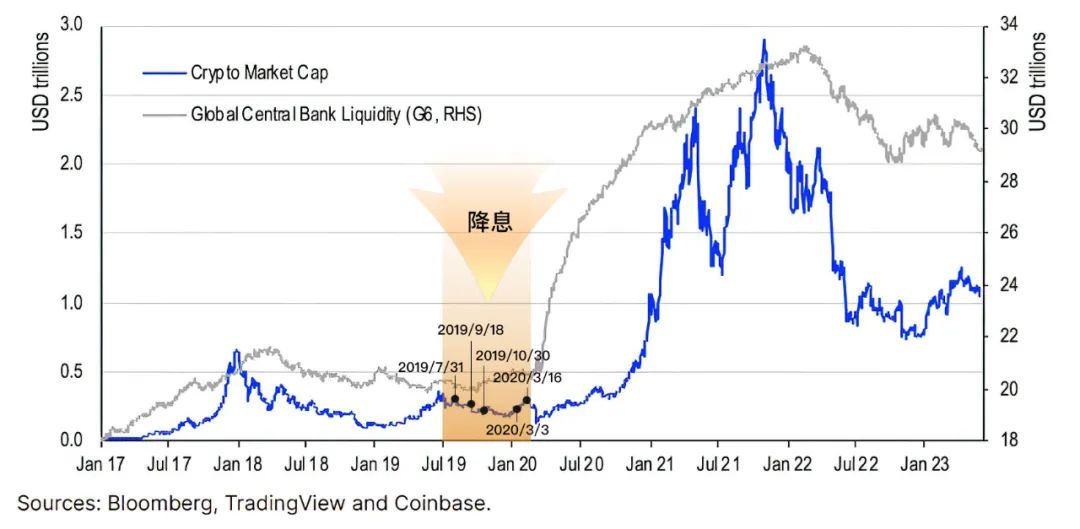

Examining past Bitcoin bull and bear markets reveals that macro liquidity plays a crucial role in price movements. Specifically:

-

The 2012 bull run occurred amid the Federal Reserve’s third round of quantitative easing and accommodative policies from the European Central Bank;

-

The 2016 bull market coincided with Brexit, prompting the Bank of England to restart bond purchases and release more liquidity. At the same time, the launch of Bitcoin futures attracted substantial off-exchange capital;

-

The 2020 bull run was fueled by the global pandemic and massive U.S. monetary stimulus, including unlimited QE, which flooded markets with liquidity and drove capital into Bitcoin and other crypto assets.

Conversely, bear markets typically align with global liquidity tightening.

During the bear markets of 2014, 2018, and 2022, global liquidity contraction led to capital outflows from Bitcoin, depressing prices.

These patterns show that central bank monetary policy and liquidity conditions significantly impact the Bitcoin market. Loose monetary policy and abundant liquidity tend to lift Bitcoin prices, while tightening policy and reduced liquidity exert downward pressure.

By late 2022, global liquidity appeared to have bottomed out, suggesting Bitcoin may have reached its price floor. Meanwhile, U.S. inflation has cooled, and the Fed paused rate hikes in June. Under these conditions, investors may seek higher returns by allocating capital to equities and crypto markets, raising the prospect of sustained asset price appreciation.

Conclusion

According to statistics from Cailian Press, a horizontal comparison of various asset classes in the first half of this year shows Bitcoin leading all others with an 83.81% gain.

Should investors “press forward” or “stand down”? R3PO believes that against the backdrop of the upcoming halving, the approval of a spot Bitcoin ETF could very well serve as the catalyst for Bitcoin’s next bull market.

Moreover, Bitcoin’s price has bounced multiple times from key lows, exhibiting clear signs of a bottom formation in its price action.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News