Alliance DAO General Counsel: SEC's Political Maze

TechFlow Selected TechFlow Selected

Alliance DAO General Counsel: SEC's Political Maze

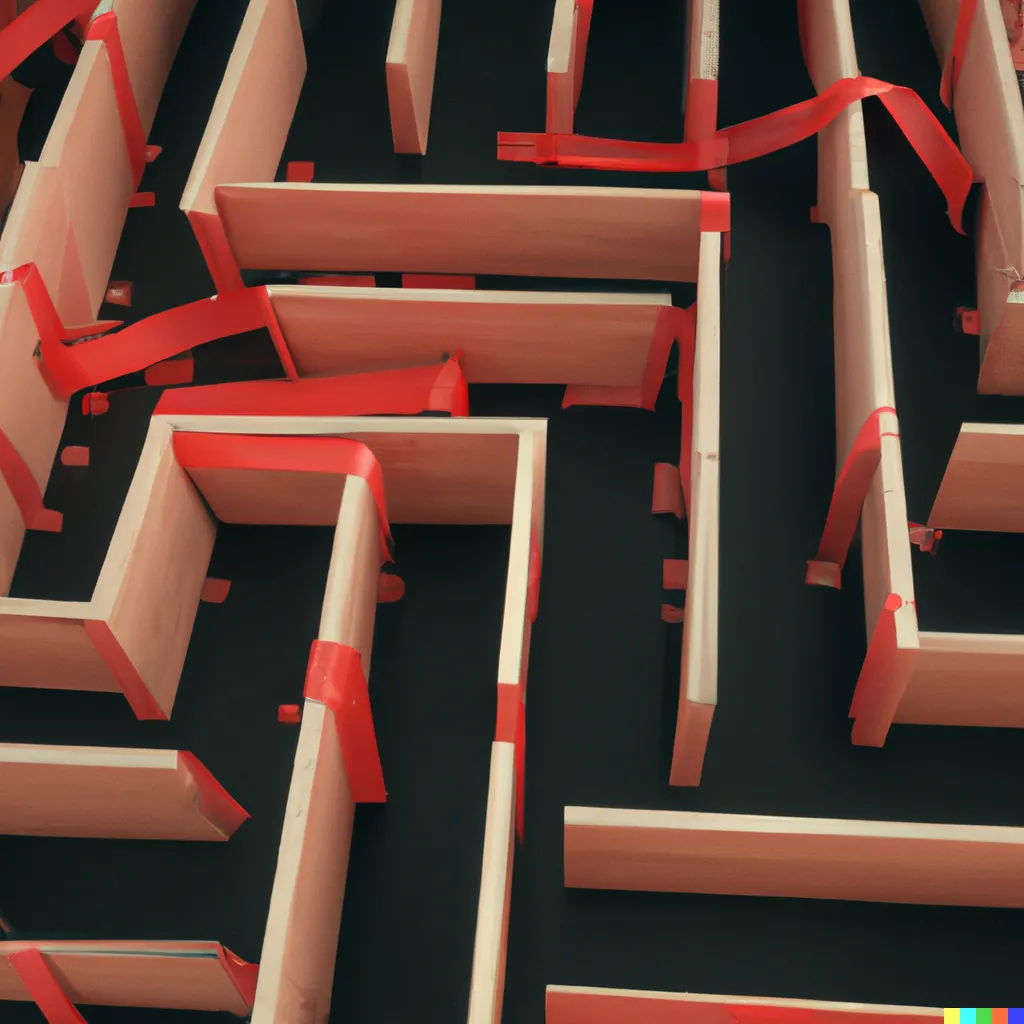

They are building a bureaucratic maze, politely inviting us to "come in and register," then blocking the exit.

Written by: Mike Wawszczak, General Counsel of Alliance DAO

Translated by: TechFlow

Disclaimer: The following views are personal only and do not constitute legal or financial advice.

As Miller Whitehouse-Levine, CEO of DEF, put it, over the past two weeks, “The SEC’s position has been clear: either centralize, shut down, or leave the United States.”

*TechFlow Note: DEF (Defi Education Fund) is a nonprofit organization created by the Uniswap team to fund education and research initiatives within the DeFi ecosystem. Established in 2021 with a $50 million donation from the Uniswap team. (Related content: Uniswap-affiliated group responds to UK tax authorities—how should DeFi taxation be viewed?)

Explaining the SEC’s stance to founders is becoming increasingly stressful. Every time a new lawsuit emerges, founders contact their lawyers, who must then revise their advice to align with the SEC’s latest allegations. Lawyers analyze comments made by Chairman Gensler in speeches and TV appearances, only for the SEC to later argue in court that “these statements are not, and cannot constitute, agency action.”

In 2021, Gensler stated, “We don’t have a regulatory framework at the SEC or our sister agency, the CFTC,” yet now, despite no change in law, he claims “the law is clear.”

Back in 2021, lawyers advised clients there were multiple ways to comply with SEC rules—perhaps through being “sufficiently decentralized” or via Reg A+ offerings. Now, most lawyers tell their clients they likely cannot achieve compliance unless they “centralize, shut down, or leave.”

A rational founder might ask: what’s the point? If there are no new rules, laws, or guidance, why should legal compliance advice change?

Even after the recent wave of lawsuits, it remains difficult to answer this directly. Perhaps because the SEC’s approach isn’t based on legal or economic logic, but rather on overt political considerations. Lawyers simply aren’t trained to give political advice on legal matters for their clients.

But politics is exactly the game the SEC is playing here. The U.S. Securities and Exchange Commission clearly wants to ban cryptocurrency, but lacks explicit legal authority to do so. Their allies in Congress can’t secure votes; their staff can’t craft legally or technically coherent rules. Their only remaining option is to persuade courts—but judicial rulings cannot impose blanket bans.

They won’t ban crypto because they can’t. Instead, the SEC aims to convince courts to grant them full jurisdiction over all token transactions as “investment contracts,” and then render those investment contracts unregistrable—effectively making public trading impossible.

The SEC’s Crypto Regulatory Plan

They’re building a bureaucratic labyrinth, politely inviting us to “come register,” then locking the exits.

Over the past few weeks, the SEC has laid out its full strategy in legal and regulatory filings:

Step One: All token transactions are securities transactions.

Everyone in crypto knows the Howey Test: the SEC considers tokens to be investment contracts—and thus securities—when token transactions involve (i) an investment of money, (ii) in a common enterprise, (iii) with an expectation of profits derived from the entrepreneurial or managerial efforts of others.

If a token is a security, it falls under SEC jurisdiction and must comply with U.S. securities laws before being offered or sold to the public.

Unlike over 30 other categories of securities, “investment contract” functions best as a catch-all category for instruments that behave like securities but don’t neatly fit into classical types such as stocks or swaps. In theory, projects wishing to design tokens outside securities law could structure around one or more of these elements.

For example, you could try avoiding the “investment of money” element, as Bitcoin did through protocol rewards without an ICO. Or you could avoid the “common enterprise” element by removing governance rights from the token. Or you could attempt to satisfy none of the three elements through being “sufficiently decentralized.”

Unfortunately, these escape routes are now blocked. Based on the SEC’s Howey analysis in the Coinbase case regarding DASH and the Binance case regarding BUSD, the SEC now believes nearly all tokens essentially meet both the “investment of money” and “common enterprise” prongs.

In the Coinbase case, just as in the Bittrex case, the SEC alleges DASH is a security. DASH started as a Bitcoin-inspired token with additional privacy features enabled by specialized masternodes. Anyone can lock up 1,000 DASH to run a masternode, serving as a native mixing-style privacy mechanism for the protocol.

As the SEC alleges, “DASH’s initial issuance was as a reward to miners providing value by mining blocks on the blockchain, with miners receiving rewards directly from the protocol.” DASH had no pre-mine, no VC allocation, and no ICO. Today, protocol rewards are distributed among miners, masternodes, and the DASH Treasury, with Treasury allocations decided through a DAO-like voting process among masternodes.

Yet because DASH has a secondary market, the SEC argues the “investment of money” element is satisfied. Because masternodes indirectly control the Dash Core Group (DCG) through Treasury allocations, the SEC claims masternodes and DCG form a “common enterprise.” Finally, because DCG “promoted” Dash on social media and proposed most (though not all) accepted protocol upgrades, the SEC asserts investors relied on DCG’s “managerial efforts.” These arguments are broad enough to effectively cover the entire design space of token issuance, regardless of decentralization level.

In SEC v. Binance, the SEC further claims even stablecoins like BUSD were issued and sold as securities. They allege token holders form a “common enterprise” with each other and a company, where “investors’ purchases of tokens” are “pooled in reserves,” and the company uses “at least some of the returns to promote and drive the ecosystem that makes [the token] potentially profitable.” According to the SEC, between DASH and BUSD, all token holders appear to form a “common enterprise” merely by holding tokens with some secondary market value—even if indirectly.

Notably, stablecoins inherently lack profit expectations, but the SEC argues potential profitability suffices for the third Howey prong. In their view, users’ ability (or choice not) to earn yield via Binance Earn is evidently sufficient.

Plainly put: if DASH and BUSD are securities, then every token—including Bitcoin—could be deemed a security under similarly expansive logic, should the SEC choose to make that argument.

Many projects attempted to comply with SEC guidance by relying on “sufficient decentralization.” However, as revealed by the Hinman emails at the time and the SEC’s current arguments, the SEC grants no legal weight to decentralization. So long as any “relevant third party” provides investors with “statements…” when the project trades publicly, the SEC is willing to assert the project is centralized and thus satisfies the Howey Test.

The SEC has also directly claimed many major tokens—including BNB, SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO—are securities. If these tokens were introduced today on Coinbase and Binance, the few unnamed ones (notably BTC and ETH) would almost certainly meet their Howey analysis as well.

The only reasonable conclusion from these two complaints is: the SEC is stretching legal logic to its limits to claim any token is a security. No project operating in the U.S. market can confidently assume it won’t face unacceptable business risks from costly SEC enforcement actions.

Step Two: No securities exchange will be allowed to trade tokens.

If a token is deemed a security, it must either register with the SEC or qualify for an exemption to be publicly tradable. As explained in detail here, registering a token is practically impossible under current regulations without undermining the entire value proposition of using decentralized blockchains. As the SEC argued last week in Coinbase v. SEC, they have no intention of telling anyone—not even the court—whether or when they plan to change the rules.

If a token qualifies for an exemption, two new problems arise. First, tokens purchased under an exemption are considered restricted securities. This means they cannot be resold again without another applicable exemption. In other words, restricted securities cannot be publicly traded.

Second, even if a token somehow becomes unrestricted, as a security it can only be publicly traded on a registered securities exchange—including national securities exchanges or alternative trading systems—or through brokers. No cryptocurrency exchange in the world is registered as a securities exchange, nor is any registered securities exchange approved by the SEC for crypto trading. During the SEC’s lawsuit against Coinbase for operating an unregistered securities exchange, Robinhood—a platform already registered with the SEC as a securities trading platform—testified that it tried to register as a crypto securities exchange but was rejected by Gensler without explanation:

“When SEC Chair Gensler said ‘come in and register’ in 2021, we went and registered. We engaged in a 16-month process with SEC staff trying to register as a special purpose broker-dealer. In March, we were told the process was over and we wouldn’t see any results from our efforts.”

Currently, there remains one final loophole: decentralized exchanges do not meet the definition of “exchange” under the 1934 Securities Exchange Act. They are merely protocols people can use to peer-to-peer swap tokens.

At least in theory, you could conduct peer-to-peer purchases and sales of restricted securities under private placement exemptions.

However, as many leading industry participants argued last week in comment letters opposing the SEC’s proposed revision to the “exchange” definition, the SEC is attempting to change the rules to force decentralized exchange software providers to register under the Exchange Act—closing this loophole (even if it truly qualifies as one).

What Happens Next?

There is still hope for a good outcome.

First, Congress is aware of the issue, with influential Republicans like Patrick McHenry and influential Democrats like Ritchie Torres publicly criticizing Gensler’s overreach. Shortly before the SEC filed its lawsuits, McHenry introduced a new market structure draft bill that is gaining bipartisan attention despite Gensler’s public opposition. It could receive a House vote as early as next month.

Second, judges in Coinbase v. SEC and SEC v. Binance have expressed skepticism toward the SEC’s litigation strategy, echoing early judicial doubts heard in the Voyager bankruptcy case. Remember: it is ultimately courts—not the SEC—that interpret the law.

Third, major players outside our industry are beginning to pay attention. The U.S. Chamber of Commerce—one of America’s most influential lobbying groups—filed an amicus brief supporting Coinbase’s motion to compel, while SIFMA, a powerful banking trade group, submitted sharp comment letters opposing the SEC’s proposed exchange rule changes. Public opinion may begin to shift.

(A potential fourth point might be that the SEC has finally issued special-purpose licenses to entities like Prometheum—beyond the scope of this article, but noteworthy. Many believe Prometheum is a trap. As one lawyer noted: “If Prometheum indeed represents the only ‘compliant’ path for crypto trading platforms, the SEC’s failure to create new rules for crypto effectively amounts to a ban on the industry in the U.S.”)

Nevertheless, I believe regulatory clarity in the U.S. remains distant. The SEC asserts all tokens are securities, while the Commodity Futures Trading Commission (CFTC) asserts many tokens are commodities. In two seemingly contradictory rulings involving the bZx protocol and Ooki DAO, federal judges found the same DAO’s governance token could simultaneously be a general partnership interest and a non-corporate organization interest. Under U.S. law, securities, commodities, and partnership interests are typically considered mutually exclusive categories.

Although Congress is increasingly supportive of legislative solutions to address this regulatory assault, powerful voices in the Senate and White House remain firmly opposed to anything short of an outright ban. Despite growing optimism within the industry, I see no reason to believe President Biden would consider a House bill led by Republicans.

How Can Businesses Operate Compliantly in This Environment?

So what should businesses do if they want to operate compliantly in this environment?

Lawyers across the industry are reluctantly advising their clients it’s time to exit the U.S. market. At minimum, practical steps include geoblocking traffic from U.S.-based IP addresses. If your project involves activities claimed by the SEC or CFTC to fall under their regulations, consider blocking all VPNs as well. For maximum protection against U.S. regulatory pressure, consider implementing Know-Your-Customer (KYC) checks and fully banning participation by all Americans.

Businesses need to plan for the future. Even if the law ultimately sides with crypto, even if Congress eventually holds substantive debates on crypto legislation, meaningful change will take years. In the meantime, U.S. regulators have made clear they will adopt a hostile posture toward any crypto business serving U.S. users. This is not an environment in which operators can function.

It’s deeply unfortunate it has come to this, but we can no longer assume U.S. regulators act in good faith. They are openly hostile toward our industry. They care more about political power struggles than faithful execution of the law.

Through the exploitation of regulatory ambiguity, they have made their position clear.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News