Data Analysis: Who Is the Mysterious Entity Influencing ETH Price?

TechFlow Selected TechFlow Selected

Data Analysis: Who Is the Mysterious Entity Influencing ETH Price?

In the cryptocurrency space, the Shanghai upgrade has become a new undercurrent in the market.

Written by: BEN LILLY

Compiled by: TechFlow

Three months ago, a historic shift began.

It's similar to an undercurrent beneath the ocean surface. These currents act like conveyor belts, transporting warm equatorial waters toward the poles and bringing cold polar waters back toward the equator. For anyone fishing or living near the equator, fish species here are incredibly abundant.

In the cryptocurrency space, the Shanghai upgrade has become a new market undercurrent. Users can now withdraw their staked ETH. This marked a significant risk reduction, leading to an explosive surge in staked ETH—increasing approximately 38% since then.

Researcher BEN LILLY and the entire Jarvis team will share this Alpha with you, especially as it appears to be becoming an increasingly important factor to consider amid the ever-changing landscape of crypto prices.

The Real Reason Behind ETH’s Declining Volatility

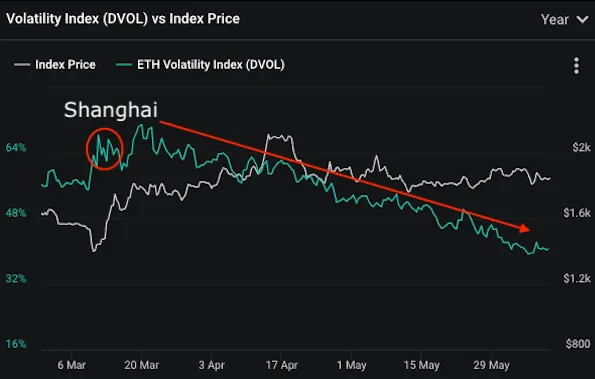

In reality, volatility hasn't changed dramatically—it has simply become smoother. Below is the ETH volatility measured by the Deribit Volatility Index.

This compression in volatility is a market phenomenon we’ve been observing. As for why, let’s quote some insights from Paradigm’s Joe Krueger.

First, Joe explained that there is a clear institutional player actively operating in the options market:

A large systematic options trader rolled over 90,000 March-expiring $1,800 call options into June-expiring $1,800 calls, injecting approximately 125,000 net volatility units into the market, alleviating the natural shortage of bullish buyers in ETH.

He went on to add:

Paradigm’s flow data indicates that due to this selling activity, dealers have accumulated substantial positions in June $1,800 expiry options. This causes dealers to expand their vega and gamma when selling, resulting in a “price drop / volatility decline” pattern as they adjust long-term volatility exposure tied to these expiries.

Let me clarify: when someone sells a call option, they’re providing a contract to the market. The buyer is likely a bullish investor betting on the asset’s price increase.

The buyer is also long volatility. All else being equal, higher volatility increases the premium or value of the contract—for the buyer. Conversely, the seller profits more as volatility decreases.

Now, to measure your exposure to volatility, the options market uses a term called vega. Joe tells us that someone sold 90,000 June call options. This makes them bearish on volatility—or short “vega.” In fact, they've been selling contracts precisely when volatility begins to rise, which is exactly what happened at the end of 2022.

But that was just the beginning...

There has been a lot of similar activity throughout Q1 and Q2 of 2023. Quoting Joe again:

After massive unwinding in the June/September contracts, sellers offloaded around 40,000 vega through call options (25,000–35,000 contracts) in February and March. Post-Shanghai, volumes increased significantly, including 63,000 June/September $2,200 calls and additional September options, totaling a net negative vega of 200,000.

Downward pressure on backend volatility persists, further intensified by 28,500 September/December $2,300 call options (negative 45,000 vega) and 10,000 June $1,800/March $2,300 call spreads (negative 45,000 vega), continuing to suppress the already weak natural demand in the 6M to 9M volatility range.

This is large-scale activity unfolding in the Ethereum options market—and this type of behavior repeats itself over and over. Whenever volatility starts rising, this entity aggressively sells call options.

This again suppresses volatility. In fact, if the price rises above any of the sold strike prices (e.g., the June $1,800 contract), the original seller would need to hedge themselves.

When the situation reverses, this entity begins closing these positions. According to Paradigm, last weekend the entity repurchased 100,000 June contracts. The price responded accordingly.

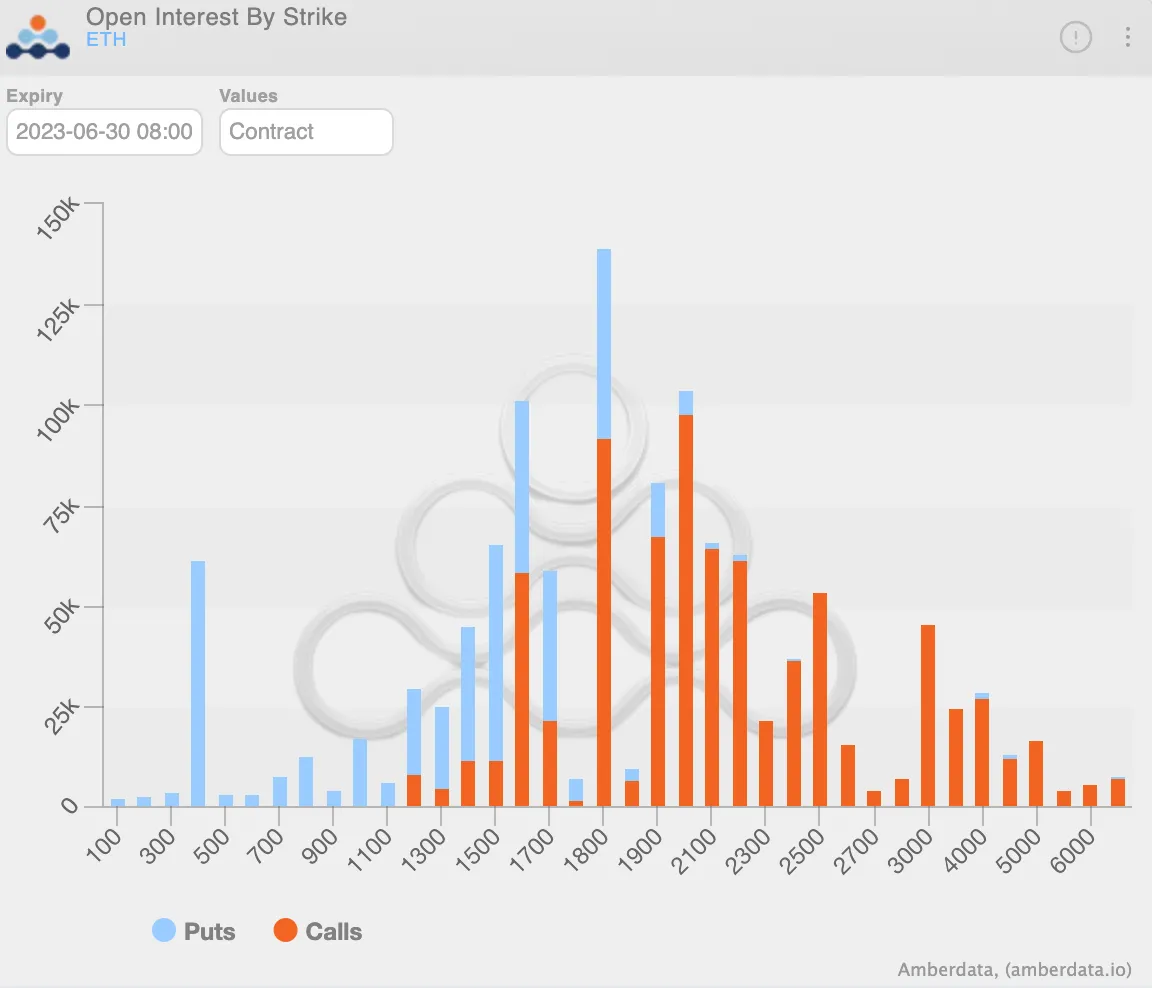

Although this is a large volume, the impact on volatility remains relatively small because many open contracts still remain. You can see this in the bar chart below, which shows contract volumes by strike price for June 30. Notice how the $1,800 strike still has a large number of open call options—the tallest bar in the chart.

This behavior unfolding in the ETH options market is striking. As Joe put it,

Q2 appears to be witnessing major microstructural changes in the crypto options market.

This raises the question: why is this suddenly happening?

The Latest Market Landscape

Just as changes in ocean currents affect ecosystem dynamics, the Shanghai upgrade appears to have influenced activities involving Ethereum. It's believed this upgrade triggered the behavior of this entity.

Back to Paradigm’s analysis:

The surge in ETH volatility supply boils down to two factors: Ethereum’s transition to proof-of-stake and the implementation of the Shanghai upgrade. By enabling withdrawals, the Shanghai fork drove a notable increase in staking activity aimed at earning yield alongside validators.

At the end of that quote lies the key point: the party involved may be attempting to extract additional yield from staked ETH using this options strategy. Now that staked ETH can be withdrawn, they are using their tokens as collateral.

The positions being moved are enormous. If something were to go wrong with this kind of activity, it’s hard to say what might happen. However:

Staking these trades requires substantial margin requirements, prompting us to question whether this strategy is truly the most efficient way to extract extra yield from ETH. We also speculate there may be unique arrangements between underwriters and Deribit preventing automatic liquidations during Q1’s strong rebound, particularly in scenarios of spot price rallies combined with rising volatility.

Keep in mind, when you stake your ETH, you cannot unlock it immediately. So, as Joe implied, such unique arrangements may indeed exist.

As for who might be behind this new market dynamic:

While still purely speculative, given these trades don’t occur on Paradigm, it’s highly likely this large seller is a major validator node. This could explain their impact on the supply-demand imbalance of ETH volatility, significantly compressing both implied and realized ETH volatility...

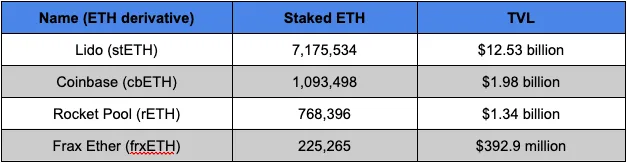

Out of curiosity, I wanted to see if this entity exists on-chain. Based on the volume of active contracts, we can narrow down LSDs (liquid staking derivatives) to around 250,000 ETH.

This gives us a starting point, narrowing dozens of LSDs with sufficient scale down to a few: stETH, cbETH, rETH, and frxETH.

None of the positions of these tokens in yield aggregators, options platforms, vault strategies, or liquidity pools stood out to me. Here, I expected to see something like a Ribbon Finance options vault with a $100 million deposit, but what I found falls far short.

This suggests the entity may be operating outside on-chain protocols.

Regardless, this is at least something to watch, as this entity grows increasingly influential. The larger it becomes, the greater its impact on price movements.

We should also consider that their upside exposure likely extends beyond just spot ETH. As rising prices create positive feedback loops that amplify with increasing activity, the entity likely earns additional revenue from other operations.

I’ll leave the speculation game to you all.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News