May VC Funding Trends: Which DeFi Protocols Are Most Favored?

TechFlow Selected TechFlow Selected

May VC Funding Trends: Which DeFi Protocols Are Most Favored?

In this article, analyst Ignas tracks the flow of funds and shares several innovative protocols that have won favor with investors.

Author: Ignas | DeFi Research

Compiled by: TechFlow

Insights from crypto VCs can help you spot the latest DeFi trends. In this piece, analyst Ignas tracks funding flows and highlights several innovative protocols winning investor support. Here’s where the money went last month:

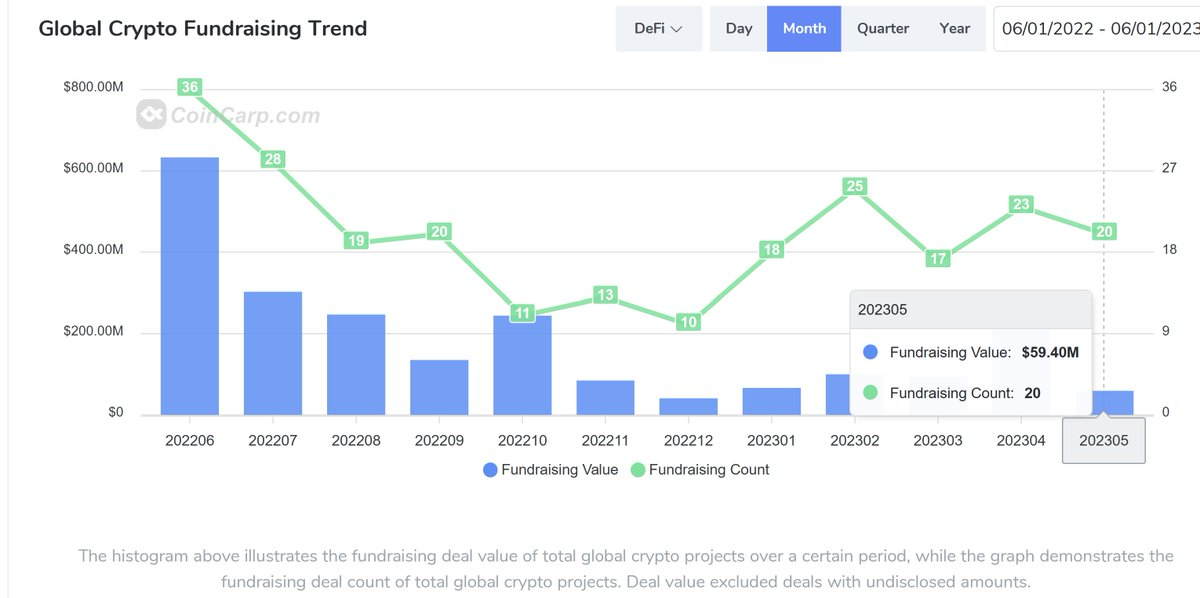

Unfortunately, funding data shows no bullish signals. There were 120 crypto fundraising deals in May totaling $1.2 billion—down from 130 deals the previous month.

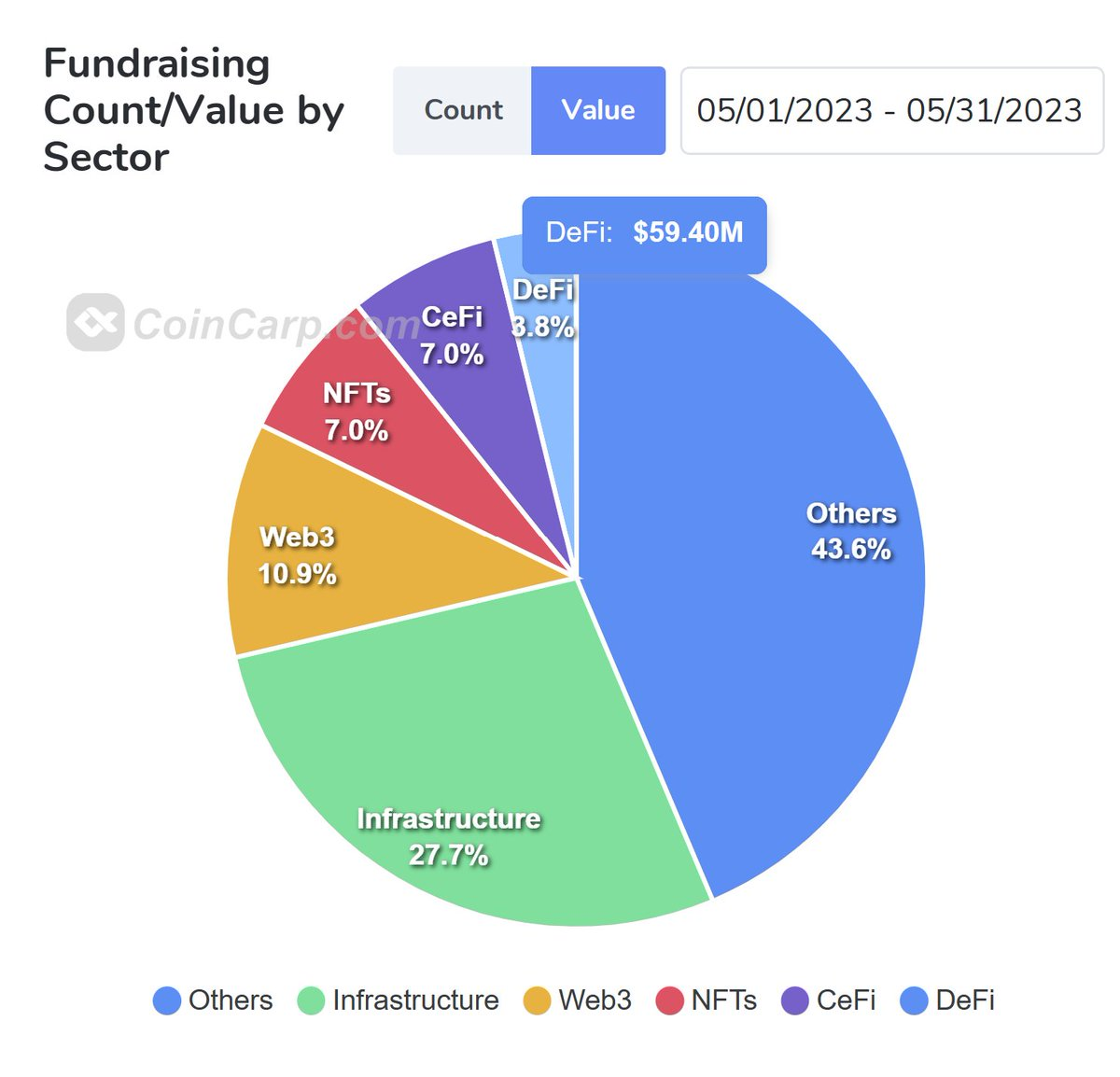

The situation is even more pronounced in DeFi. Following April's bull run, only 20 DeFi projects raised funds last month, securing just $59 million. In fact, DeFi was the crypto sector that raised the least amount of capital.

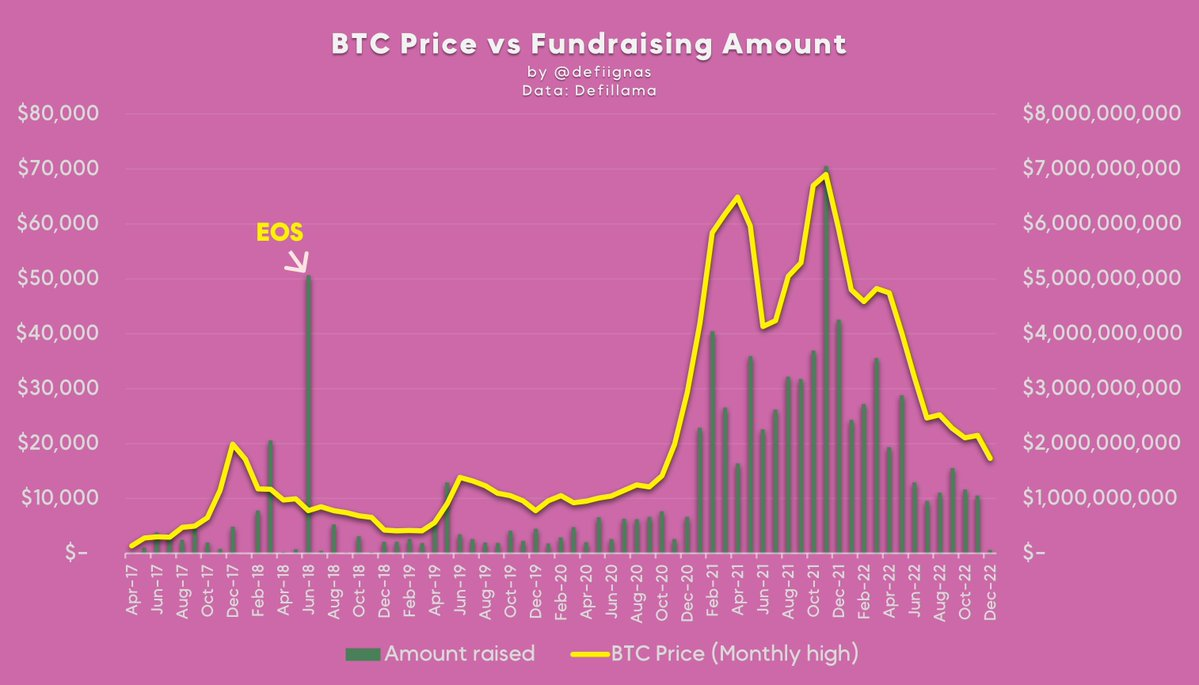

The chart below highlights a key point worth noting: it shows the relationship between Bitcoin's price and fundraising amounts. Clearly, there's a correlation between funding volume and BTC. Therefore, as market sentiment and prices improve, venture funding volumes are likely to rise.

However, I believe early-stage projects that secure funding during bear markets have strong potential to thrive when the next bull cycle arrives. And since so few projects manage to raise capital now, it's easier to identify potential winners. Below are my top four picks:

zkLink

zkLink is building a unified multi-chain trading layer secured with zk-SNARKs for DeFi and NFTs. It connects various L1s and L2s into a zk-Rollup middleware to aggregate assets and liquidity. You can try their orderbook DEX and potentially qualify for an airdrop.

zkLink promises a CEX-like experience, including multi-chain token listings, trading, and unified portfolio management. The team raised $10 million from Coinbase, Ascensive Assets, Big Brain Holdings, and other venture firms.

Dolomite

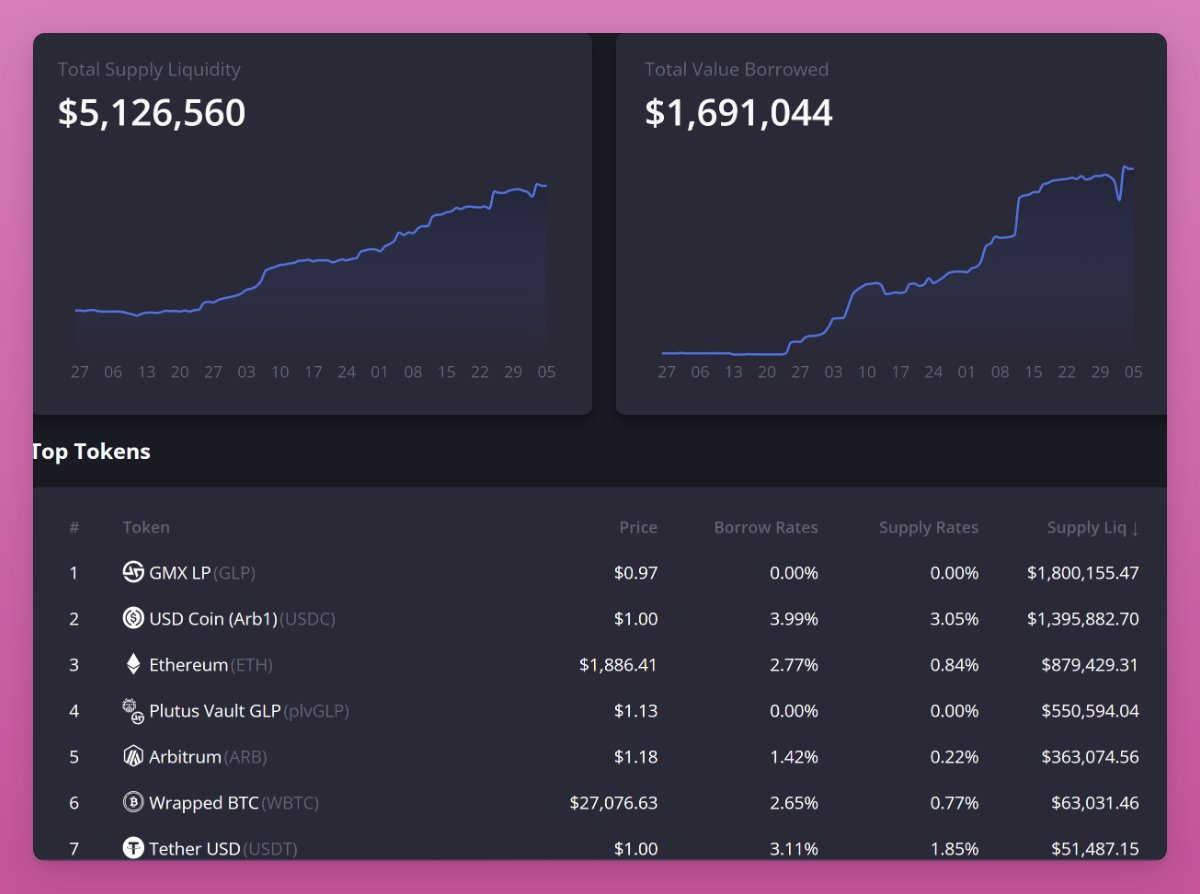

Dolomite offers next-generation money markets and margin trading on Arbitrum. Powered by its capital-efficient "virtual liquidity" system, it enables over-collateralized lending, margin trading, and spot trading. Its total value locked (TVL) has reached $5 million. No token has been launched yet.

Dolomite aims to become a DeFi hub where protocols, yield aggregators, DAOs, market makers, and hedge funds can manage portfolios and execute on-chain strategies. The team raised $2.5 million from Coinbase, NGC Ventures, and other institutions.

Asymmetry Finance

Asymmetry Finance addresses centralization risks in the staking market. Its solution is simple: safETH diversifies deposits across various liquid staking tokens (LSTs), coordinating incentives while delivering market-leading yields to users. Instead of all ETH flowing into wstETH, deposits are diversified.

In theory, because safETH consists of multiple staked Ethereum derivatives, you gain risk diversification compared to holding a single derivative. The Asymmetry team raised $3 million at a $20 million valuation from Ecco, Republic Capital, and Ankr.

Hourglass

Hourglass has launched a marketplace for trading time. The innovation lies in Time-Bound Tokens (TBTs). After staking tokens for a fixed period, you receive a TBT. For example, if you stake frxETH for three months to earn yield, you can sell that position before maturity.

The team raised $4.2 million from Electric Capital, Coinbase, Circle, and others.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News