Understanding the Current State of the Sui Ecosystem: An Analysis Based on Data and Facts

TechFlow Selected TechFlow Selected

Understanding the Current State of the Sui Ecosystem: An Analysis Based on Data and Facts

This article will discuss the current state of the Sui ecosystem from the perspectives of data, applications, and events.

Authors: Vincent, Xuan

The Sui mainnet has been live for nearly a month. Setting aside the tedious debate with ETH Maxi factions over roadmap preferences, Sui—hailed as the flagship Move-language blockchain and the most anticipated non-EVM Layer 1—has nonetheless drawn significant criticism in public discourse.

As long-term observers and ecosystem investors in Sui, we believe it's our responsibility to honestly assess what’s happening within the Sui ecosystem. This article will examine the current state of the Sui ecosystem from data, applications, and key events.

-

Sui On-Chain Fundamentals

-

Sui Ecosystem Progress

-

Recommendations for the Current State of the Sui Ecosystem

Sui On-Chain Fundamentals

1. Total Asset Liquidity

TVL - Sui's current on-chain TVL stands at $19.02M, peaking at $36M over the past month.

The largest application by TVL is the decentralized exchange Cetus, which currently accounts for over 65%, followed by Turbos. Over 60% of the TVL composition consists of stablecoins (e.g., USDT/USDC).

source: DeFillama

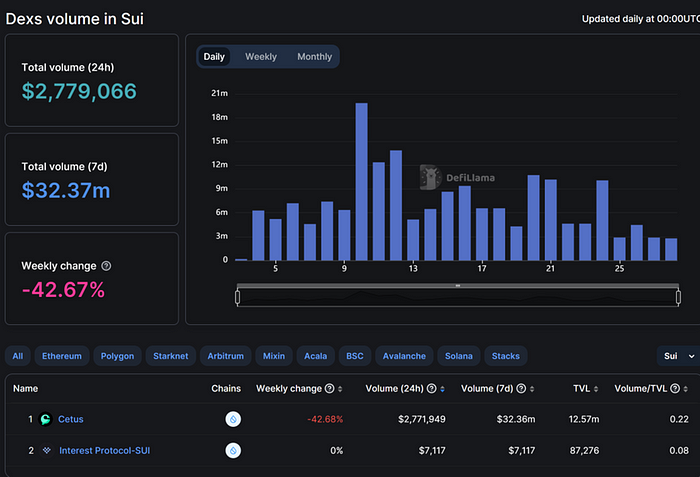

Trading Volume - Sui's 7-day trading volume is currently at least $32.37M, ranking 20th among all chains. The majority of on-chain trading occurs on Cetus.

2. Sui On-Chain Activity

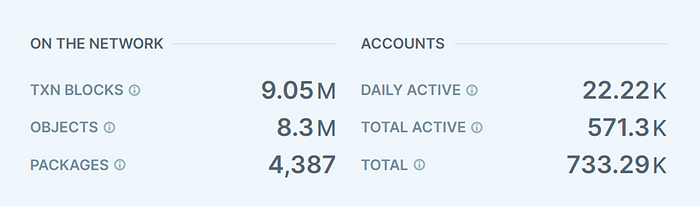

Current Sui On-Chain Activity (7-Day)

Total Transactions: 1,129,884

Total Objects (including smart contracts, tokens, NFTs, etc.): Over 8.3 million

Daily Active Addresses: 22,000

Total Active Addresses: 570,000

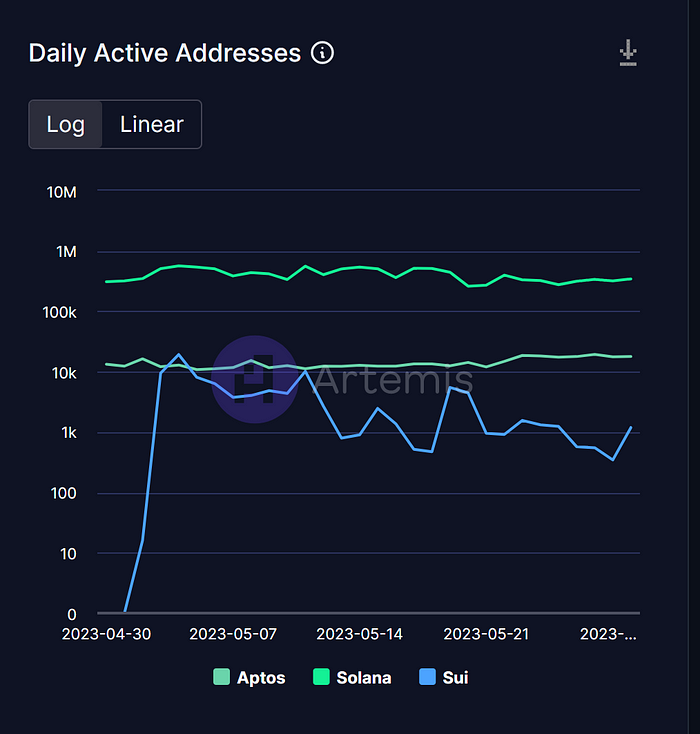

Using Artemis' methodology—counting unique wallets that transact within 24 hours—and comparing with other non-EVM chains like Solana and Aptos, the numbers are even lower:

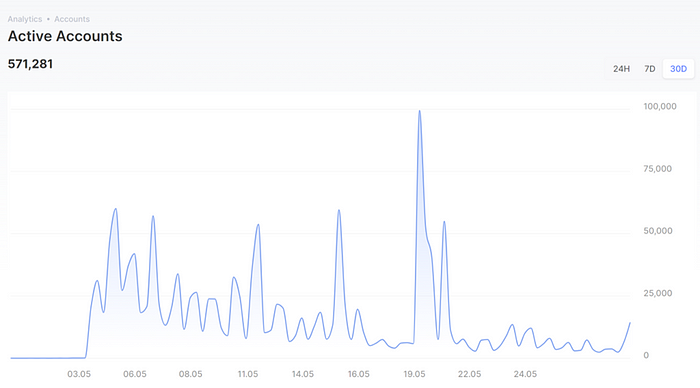

Trend-wise, Sui's on-chain activity has shown a decline over the past week. Notably, since the mainnet launch, Sui's on-chain activity has largely fluctuated in tandem with IDOs of major ecosystem projects and DeFi initiatives.

Key recent events corresponding to peaks in active addresses:

- May 10: Cetus IDO

- May 12: Turbos IDO

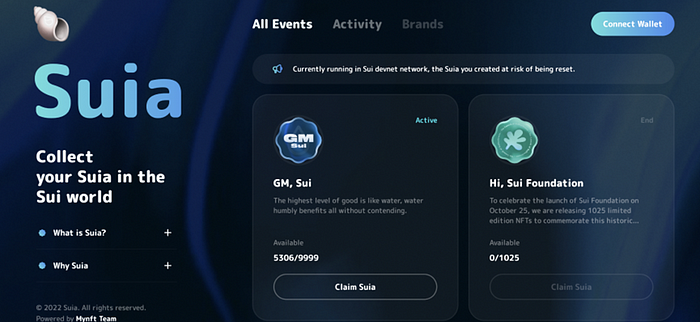

- May 15: Suia IDO

- May 19: Cetus launched permissionless pools; meme projects conducted network-wide airdrops

3. $SUI Liquidity

As Sui's native token and primary reserve asset, $SUI's liquidity largely determines overall on-chain asset liquidity—especially in the absence of a native stablecoin. Here, we won't discuss future $SUI unlocks, only its current circulating status.

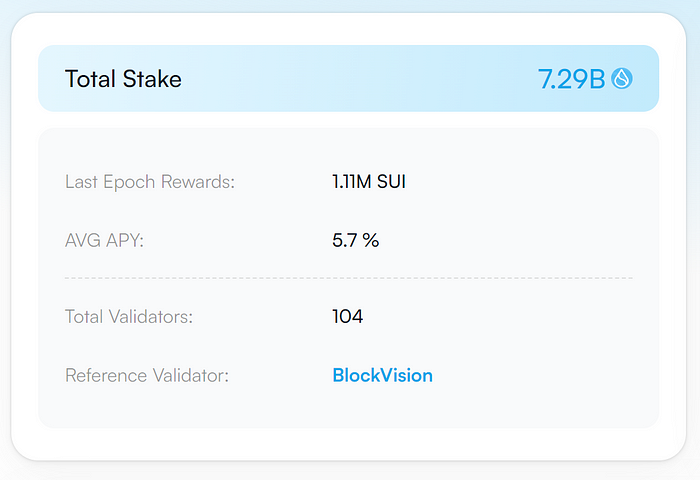

Sui uses a DPoS consensus mechanism. Currently, $SUI is staked across 104 validator nodes to earn fixed staking rewards. The current circulating supply of $SUI is approximately 528 million, while the staked amount totals 7.29 billion. Although the circulating value exceeds $500 million USD, this does not reflect in TVL and remains far below expectations.

This lack of on-chain liquidity, contrary to popular perception, was already evident during earlier IDOs. Cetus and SUIA saw oversubscriptions of 135x and 18x respectively, nearly draining $SUI lending pools on OKX and Binance—accounting for about 1/5 of the total $SUI supply.

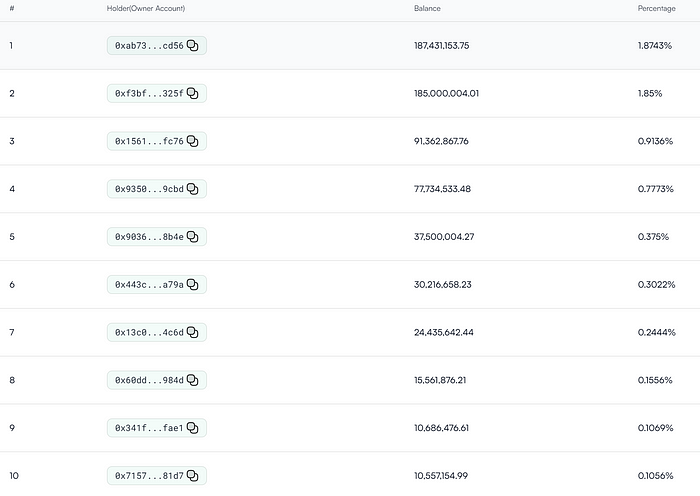

Examining current $SUI holder data reveals that almost all circulating tokens (likely including most staking rewards) remain unstaked. The largest holders are believed to be centralized exchanges (estimated at over 4%). In short, very little $SUI is being used for on-chain activities.

Staking can be seen as an on-chain risk-free rate (akin to U.S. Treasuries). Currently, Sui offers less than 6% APY—a figure unattractive to investors given the token hasn’t undergone large-scale unlocking. Moreover, without liquid staking token (LST) solutions, staked $SUI cannot be used as collateral to leverage higher yields on-chain. This further explains why most $SUI remains idle on centralized exchanges.

4. Cross-Chain Bridges

Currently, Sui supports only the Wormhole cross-chain bridge, enabling bridging of over ten assets from seven chains including Ethereum, BNB Chain, and Polygon.

Since Sui’s bridged USDC, USDT, and other pegged assets do not use the Sui-recommended object format, the totalSupply field in TreasuryCap cannot be read. As a result, the bridge’s stablecoin trading and minting volumes on Sui are not publicly available. Native USDC and USDT equivalents from ETH and SOL can be found via their respective pegged token addresses on Sui.

To date, research has identified only two small sets of cross-chain minting data: WFTM minted 1,949.96442242 and WAVAX minted 31.64116756.

Sui Ecosystem Overview

1. Who Is Driving Sui’s On-Chain Metrics?

DEX: Cetus

Cetus is the backbone of Sui’s DeFi and overall on-chain metrics. It dominates both TVL and trading volume. However, such centralization is unhealthy for the broader Sui chain.

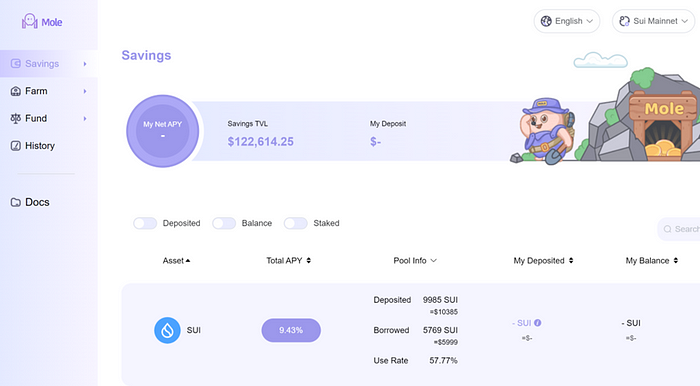

Yield Aggregator: Mole

Mole is a yield aggregator built on Sui and Aptos, supporting both single-asset and dual-asset vaults, along with leveraged mining similar to Alpaca on BNB Chain. Its current TVL is $180K.

NFT Marketplaces: Souffl3 / Clutchy

Souffl3 is an NFT marketplace on Aptos and Sui, offering zero royalties, launchpad functionality, free mints, and a mini-gaming module called Bake Off.

Clutchy.io is an NFT and gaming marketplace on Sui with strong IP backing—Fuddies NFTs, among others, debuted there. Early on, many NFT enthusiasts used Clutchy’s social sharing features to introduce Sui NFTs to the Twitter community. Clutchy also hosts a casual gaming platform akin to 4399, though user engagement remains low.

NFT Collection: Fuddies

The "Fuddies" meme NFTs are often called Sui’s version of 'BAYC', with total trading volume reaching 1.44M $SUI (per Clutchy.io data), and they hold the highest Twitter profile picture adoption rate among Sui NFTs. They are arguably one of Sui’s most breakout cultural symbols to date.

GameFi: Abyss World

Abyss World is a Souls-like ARPG game whose developer recently raised funds at a $100M valuation. Strong PR and marketing have made it the most well-known game in the Sui ecosystem.

However, Abyss World chose to conduct its IDO on Polygon while using Sui for all in-game asset settlements.

2. Traffic Entry Points

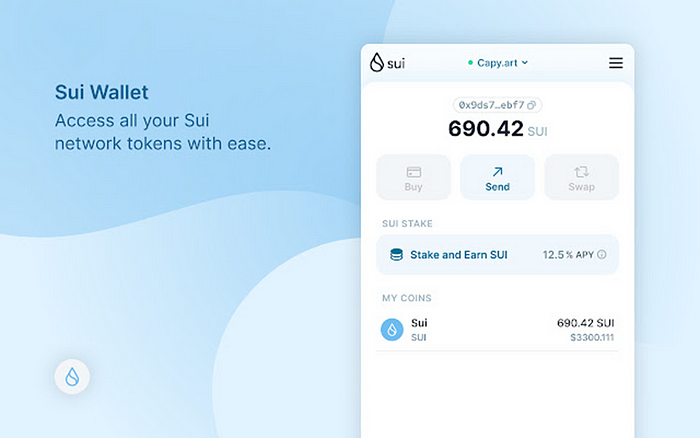

Wallets and activity platforms serve as primary entry points for on-chain activity. Wallets currently supporting the Sui ecosystem include:

Browser Wallets:

Sui (https://shorturl.at/sBJ02)

Suiet (Suiet.app)

Martian (martianwallet.xyz/)

Ethos (ethoswallet.xyz/)

OKX Wallet (www.okx.com/web3)

Surf Wallet (surf.tech)

Mobile Wallets:

Glass (https://glasswallet.app/)

Available for iOS and Android, but supported dApps are limited.

Bitkeep (https://bitkeep.com/)

Supports Sui wallet and dApp usage.

OKX (https://www.okx.com/web3)

Supports Sui wallet and $SUI assets, but does not yet allow adding other Sui-based tokens, and its browser does not support Sui dApps.

Activity Platforms

Port3

Port3 is a multi-chain activity platform supporting Sui and others, offering both on-chain and off-chain tasks. Users can link Web2 social identities and Web3 wallets to complete tasks and earn rewards.

Suia

Suia is a Sui-based activity NFT and social platform where users can mint commemorative NFTs and track project-related NFT events.

Recommendations for the Current State of the Sui Ecosystem

Given the current market and liquidity conditions, the challenges facing the Sui ecosystem are foreseeable: relatively few mainnet launches, underwhelming market performance of early IDO projects, and incomplete infrastructure.

Ecosystem development takes time and cannot happen overnight. Broader market conditions are beyond control, and negative sentiment has already taken root… Nevertheless, Mysten Labs and the Sui Foundation still have ample room for rapid improvement:

1. Lower Validator Thresholds and Introduce Liquid Staking (LST)

Currently, Sui has 104 validators. The barrier to becoming a new validator isn't technical—it's the requirement of 30 million $SUI in staking. This creates de facto centralization of $SUI and limits competition among validators.

Moreover, the current ~6% staking APY lacks appeal to community users. Without LST solutions, staked tokens can’t be reused as collateral to leverage higher yields on-chain. As a result, most $SUI remains idle on centralized exchanges—leading to poor on-chain liquidity and weak reserve consensus.

Liquid staking could effectively resolve this. Ethereum has already proven this model works—boosting liquidity and innovation without increasing inflationary pressure from higher staking rewards. Sui is far from worrying about “consensus overload” like Ethereum; instead, it should actively strengthen reserve consensus through every available means.

2. Expand Cross-Chain Infrastructure

Cross-chain assets form a critical component of on-chain liquidity. Love it or not, bridges remain irreplaceable today. A chain’s level of consensus is directly proportional to the number of bridges it supports—more bridges mean more arbitrage opportunities, more trading volume, more users, and ultimately stronger consensus. This advantage is especially pronounced for high-speed, low-fee chains like Sui.

Wormhole, backed by Jump Crypto and battle-tested, is trustworthy. But in practice, it doesn’t offer equal native asset availability or liquidity for users from every connected chain. Transaction failures on-chain remain a real risk. Wouldn’t encouraging multiple diverse bridge options be a better path forward?

3. Support a Native Stablecoin

Even with expanded cross-chain access, a native stablecoin remains key to vibrant on-chain trading. It lowers user entry barriers, reduces cross-chain anxiety, and forms the foundation for balance sheet expansion. From ETH to BNB to Solana, history shows native stablecoins are vital for both initial growth and long-term sustainability of a public chain ecosystem.

Pioneers have already experimented widely with stablecoins. Now is the time for Sui to leverage its first-mover advantages—an integrated team collaborating with DeFi protocols, featuring a clear credit expansion roadmap and continuously expanding use cases—is urgently needed to solve liquidity issues.

4. Accelerate Mobile Wallet Support

Sui’s core vision is bridging Web2 users to Web3. Clearly, most users—especially younger ones—are strictly “mobile-first.” Yet, as noted earlier, usable mobile wallets for Sui are extremely scarce. Imagine trying to participate in Cetus’ new token launch using 20 addresses via OKX Wallet, only to realize you must manually export each private key to a desktop wallet like Martian. How much harder would this be for someone who didn’t even know what crypto was before Sui?

We urgently need functional, user-friendly Sui mobile wallets for both iOS and Android. DApp teams should consider deeper integrations with existing mobile wallets—or better yet, middleware teams could step up to establish a WalletConnect-like standard or provide universal wallet API integration tools.

5. Improve Data Visualization

I hate to say it, but Sui’s current on-chain data visualization is among the roughest I’ve seen. Major explorers—Suiscan, Sui Explorer, SuiVision—often fail to clearly display basic metrics like total supply of Coins and NFTs.

I understand Sui uses UTXO rather than EVM, but that’s no excuse for poor data visibility. Secondary market participants expect seamless, comprehensive data tooling from EVM ecosystems, and these metrics are essential for their decision-making. Shouldn’t we aim to surpass competitors and deliver an unprecedentedly smooth user experience?

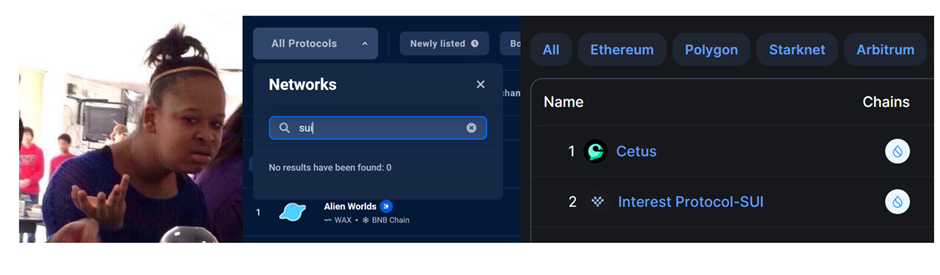

DApp teams also have unfinished work: Why doesn’t DappRadar yet feature a Sui dashboard? Why haven’t launched DeFi projects integrated TVL and volume data into DefiLlama? Why doesn’t Portal Bridge publish transaction and minting data for Sui? These are critical parameters for operations and marketing. Without data, I can’t even write threads to promote the Sui ecosystem effectively.

6. Let It Ride

As participants in the Sui ecosystem, we recognize that Sui’s team is exceptionally hardworking, engineer-driven, and particularly welcoming to Asian developers. They retain complex infrastructure work internally rather than offloading problems onto the community. While commendable, this approach is double-edged: it provides dense technical support but also fosters a de facto “metanarrative.” Over time, developments outside this narrative risk being deemed “non-canonical,” potentially marginalizing creative developers and driving them to other ecosystems—ultimately stifling innovation. At EDCON in Podgorica, the Ethereum community was already observed hitting this bottleneck, forcing Vitalik to re-examine the concept of “canonicity.” We must learn from this and avoid repeating it.

As meme communities often say: Let it ride. Empower developers to experiment freely. Let the ecosystem flourish organically. After all, flowers often bloom from weeds.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News