FOO Token Model: A Design for Sustainable Protocol Development

TechFlow Selected TechFlow Selected

FOO Token Model: A Design for Sustainable Protocol Development

Address liquidity mining issues and increase token price by using options-based token rewards and granting voting rights through LP tokens to enhance governance.

*Note: In this article, "farmer" refers to participants who engage in liquidity mining within a protocol by providing liquidity and receiving protocol rewards; while "LP" refers to those who provide liquidity for the protocol's tokens and earn transaction fees as income.

Introduction

Traditional liquidity mining faces several major problems and challenges.

-

First, reward tokens from liquidity mining are often immediately sold by farmers upon receipt, leading to downward pressure on token prices and harming existing token holders.

-

Second, the reward mechanism distorts interest rates and pricing within the protocol, pushing out genuine users and reducing the actual utility of the protocol.

-

Furthermore, the management of liquidity mining rewards is often opaque, with unclear allocation and use of tokens, and ownership overly centralized.

-

Finally, the reward mechanism may increase security risks for the protocol, potentially resulting in fund theft or loss and damaging the protocol’s reputation.

The FOO (Fungible Ownership Optimization) model is a new token model that attempts to address these issues through multiple mechanisms.

-

First, it merges the roles of farmer and LP, requiring participants to hold tokens to receive rewards, thereby reducing selling pressure on reward tokens.

-

Second, it uses option tokens as rewards, enabling the protocol to collect cash proceeds and support the token price.

-

Additionally, the FOO model uses LP tokens as proof of voting rights, allowing token holders to participate in governance and share in protocol revenues.

-

Lastly, the FOO model ensures high liquidity of tokens within trading pools.

Starting with Curve

Curve incentivizes liquidity through its Gauge system:

▪️CRV tokens are emitted each period as rewards

▪️Reward tokens are distributed across different pools

▪️Voters decide the distribution ratio of rewards among pools

Voting power comes from veCRV obtained by locking CRV tokens. Voting weight is proportional to both lock-up duration and amount, and as a farmer accumulates more veCRV, their CRV reward multiplier increases—up to a maximum of 2.5x.

Core Mechanisms

*Note: In the remainder of this article, LIT is used as the protocol token.

Merging Farmer and LP Identities

To fully suppress farmer "mine-and-dump" behavior, under the FOO mechanism, a farmer without any voting power receives no reward tokens regardless of how much liquidity they provide.

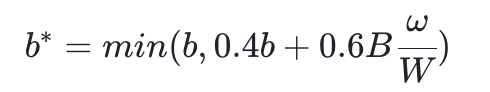

In Curve, the proportion of token emissions received by a farmer is determined by the following formula:

Where

-

b* is the weight during reward distribution;

-

b is the liquidity provided;

-

B is the total liquidity in the pool;

-

ω is the number of veTokens held by the farmer;

-

W is the total supply of veTokens.

This means that if a farmer holds no veToken, their liquidity share is multiplied by only 0.4 when calculating reward weights. When they hold sufficient veTokens, their weight increases from 0.4x to 1x, translating into a 2.5x boost in actual rewards received.

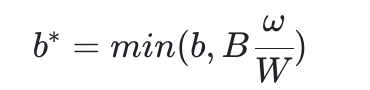

In the FOO model, the formula changes to the following:

This means that if a farmer has no veToken, their reward token allocation becomes zero. This forces farmers to become holders of LIT, thus suppressing sell-offs at each LIT emission cycle.

Option Tokens as Reward Tokens

In the FOO model, call options on LIT are used as reward tokens instead of distributing LIT directly. This allows the protocol to accumulate significant revenue regardless of market conditions, while loyal holders can purchase protocol tokens at a discount.

For example, suppose LIT is priced at $100, and there exists an option token oLIT, which grants the holder the perpetual right to buy LIT at 90% of the market price. The protocol issues 1 oLIT to farmer Alice, who immediately exercises her right to buy 1 LIT at $90 and sells it on a DEX for $100. The profit and loss breakdown is as follows:

▪️Protocol: -1 LIT, +$90

▪️Farmer Alice: +$10

▪️DEX LP: +1 LIT, -$100

Compare this with conventional liquidity mining where the farmer pays nothing to the protocol:

▪️Protocol: -1 LIT

▪️Farmer Alice: +$100

▪️DEX LP: +1 LIT, -$100

Comparing the two scenarios reveals the following characteristics of the FOO model relative to traditional liquidity mining:

-

Cash redistribution: Using oLIT instead of LIT as the reward effectively transfers cash gains from farmers to the protocol, while DEX LPs remain unaffected;

-

Trading incentive efficiency for protocol cash flow: Under the FOO model, farmers receive lower incentives, but the protocol gains stronger cash inflows;

-

Effectively incentivizing the secondary market: Compared to one-time token distributions, issuing options reduces immediate selling pressure in the secondary market.

In FOO, where the identities of farmer and LP are merged, the P&L becomes:

▪️Protocol: -1 LIT, +$90

▪️farmer-LP: +1 LIT, -$90

This means that when a farmer receives an oLIT reward, they have the right to purchase tokens from the protocol at a discount, increasing their ownership stake. Over time, protocol ownership shifts from non-liquidity-providing holders to liquidity-providing farmers, thereby optimizing ownership distribution.

Conclusion

The advantages of this model include effectively curbing farmer arbitrage, aligning interests between farmers and token holders, providing stable liquidity and cash flow to the protocol, and promoting long-term development. The disadvantages include potentially reduced incentive efficiency for farmers, increased complexity and risk for participants, and reduced freedom and flexibility for farmers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News