Top 10 Low-Market-Cap LSD-fi Projects: Hunting for Undervalued New Opportunities

TechFlow Selected TechFlow Selected

Top 10 Low-Market-Cap LSD-fi Projects: Hunting for Undervalued New Opportunities

Investors are actively seeking low-market-cap, high-potential projects in hopes of achieving substantial returns in this emerging sector.

Author: Nikyous

Translation: TechFlow

LSD and LSD-fi have once again become hot narratives. Investors are actively searching for low-market-cap, high-potential projects to achieve substantial returns in this emerging sector. In this article, researcher Nikyous will introduce 10 undervalued LSD-fi tokens that hold significant potential in the market and deserve investor attention.

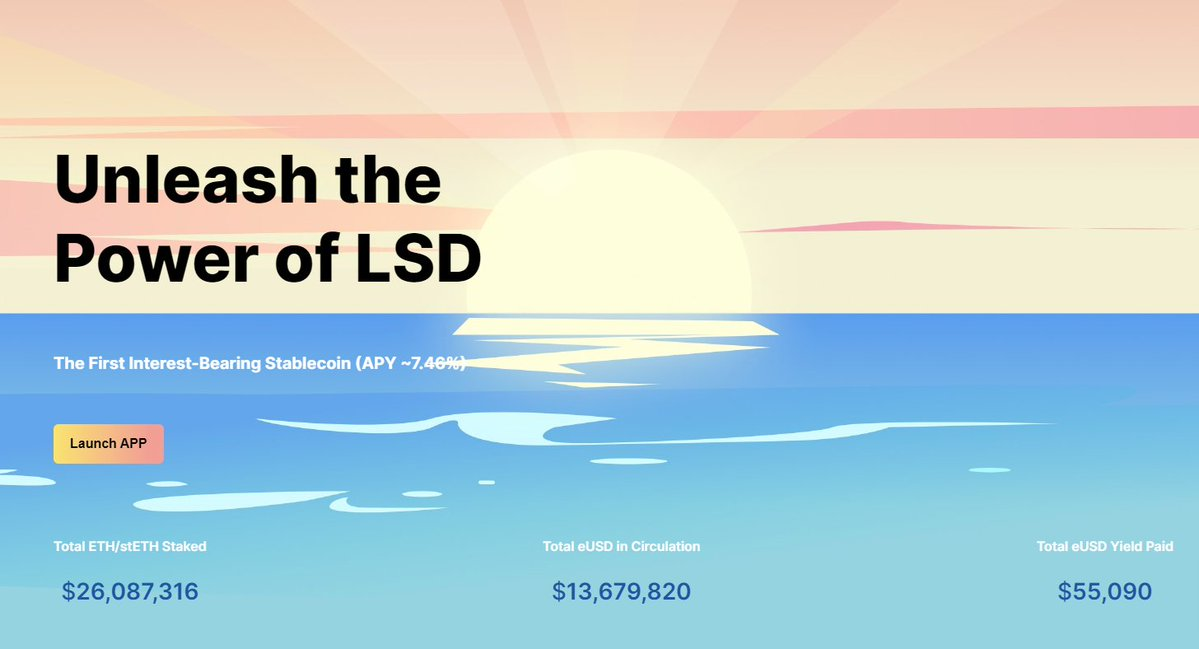

Lybra Finance LSD

$LBR offers $eUSD, the first interest-bearing omnichain stablecoin. TVL - $242 million, Market Cap - $43 million, Market Cap/TVL - 0.17.

Features:

→ Backed by LSD;

→ 1:1 hard peg;

→ 0% minting/loan fees;

→ ~8% base annual yield.

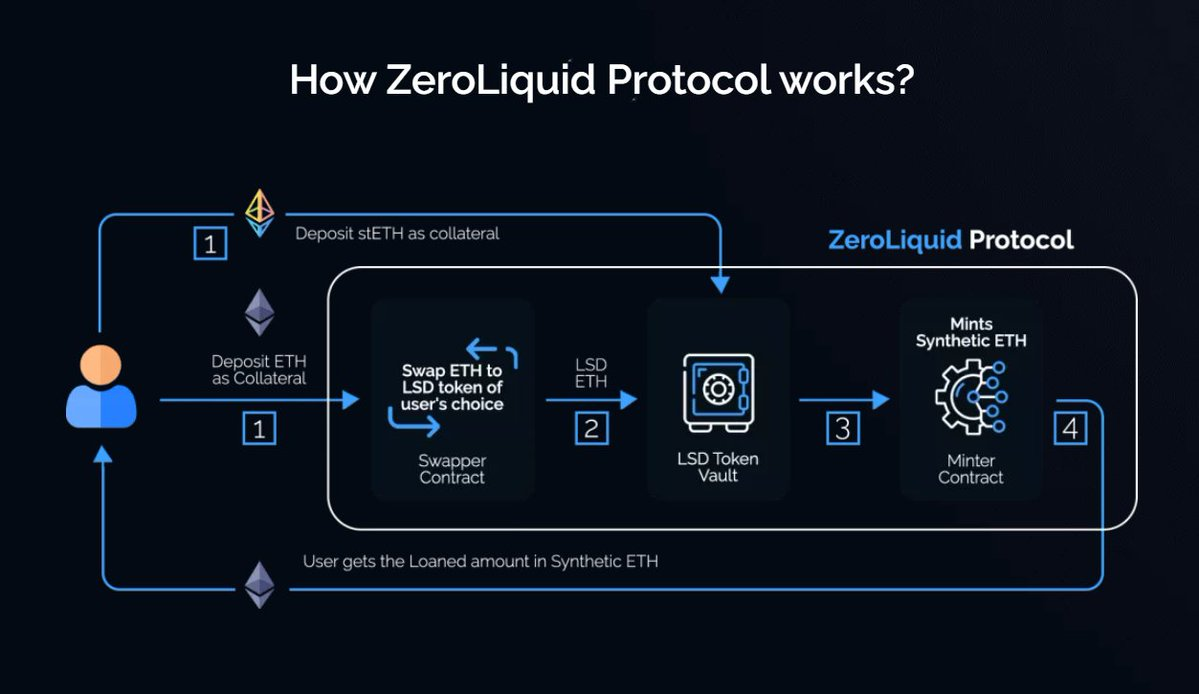

ZeroLiquid

$ZERO enables self-repaying loans through LSD tokens.

Additionally, their loan features:

→ 0% interest;

→ No liquidation risk.

Simply deposit your LSD tokens (e.g., $stETH) as collateral for a loan. As your LSD generates yield, it automatically repays your loan.

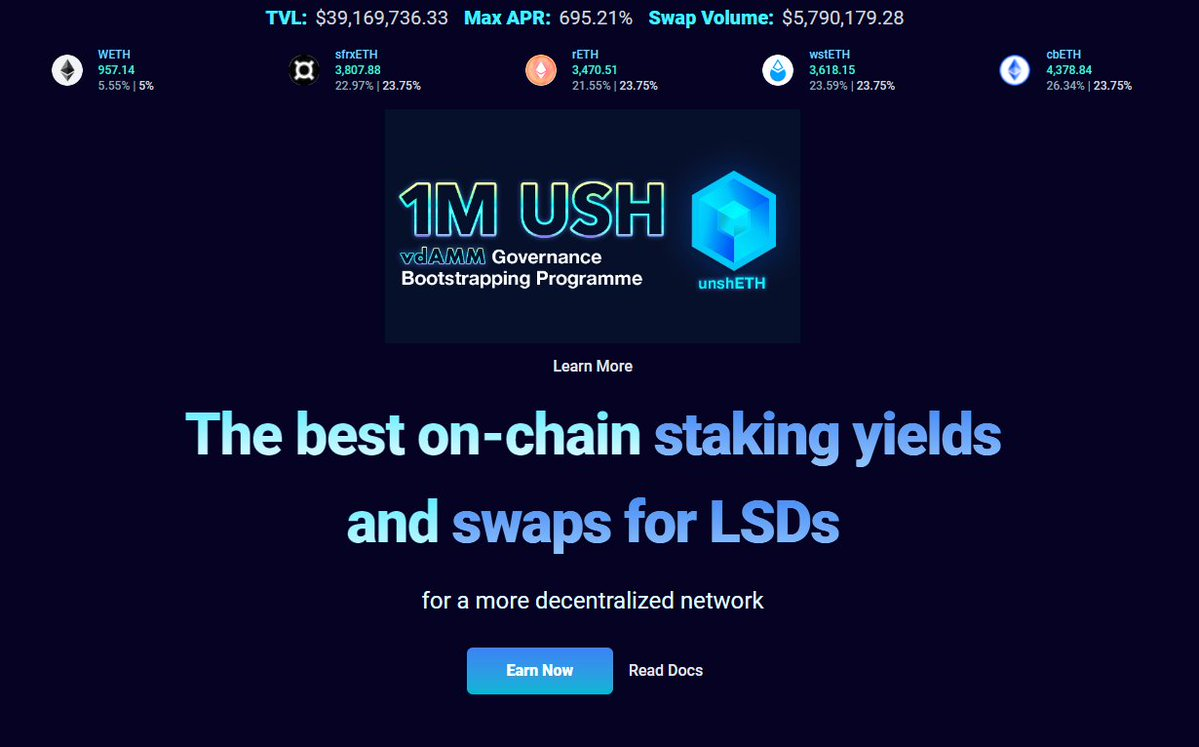

unsheth

$USH has one goal → decentralization through incentives.

They offer higher yields to smaller validators, allowing stakers to earn more while making $ETH more decentralized. Think of it as a yield aggregator prioritizing decentralization.

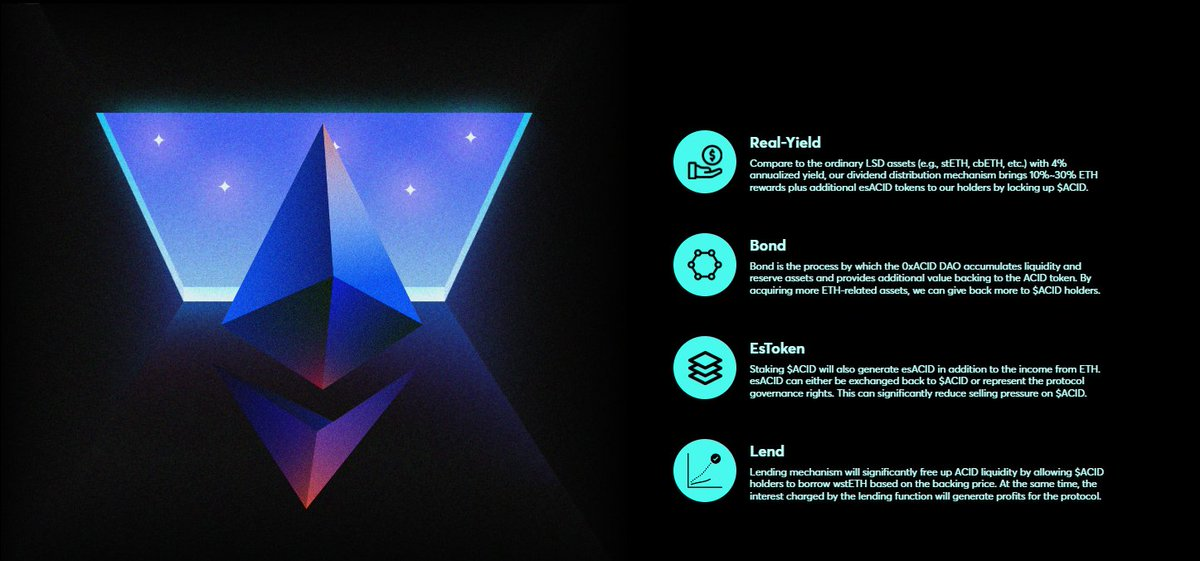

AcidDAO

$ACID aims to maximize returns on LSD tokens such as:

→ $stETH;

→ $rETH;

→ $frxETH.

And more, offering significantly higher yields than the typical 4-5% APY from LSD assets. $ACID holds LSD assets and earns real income from $ETH nodes.

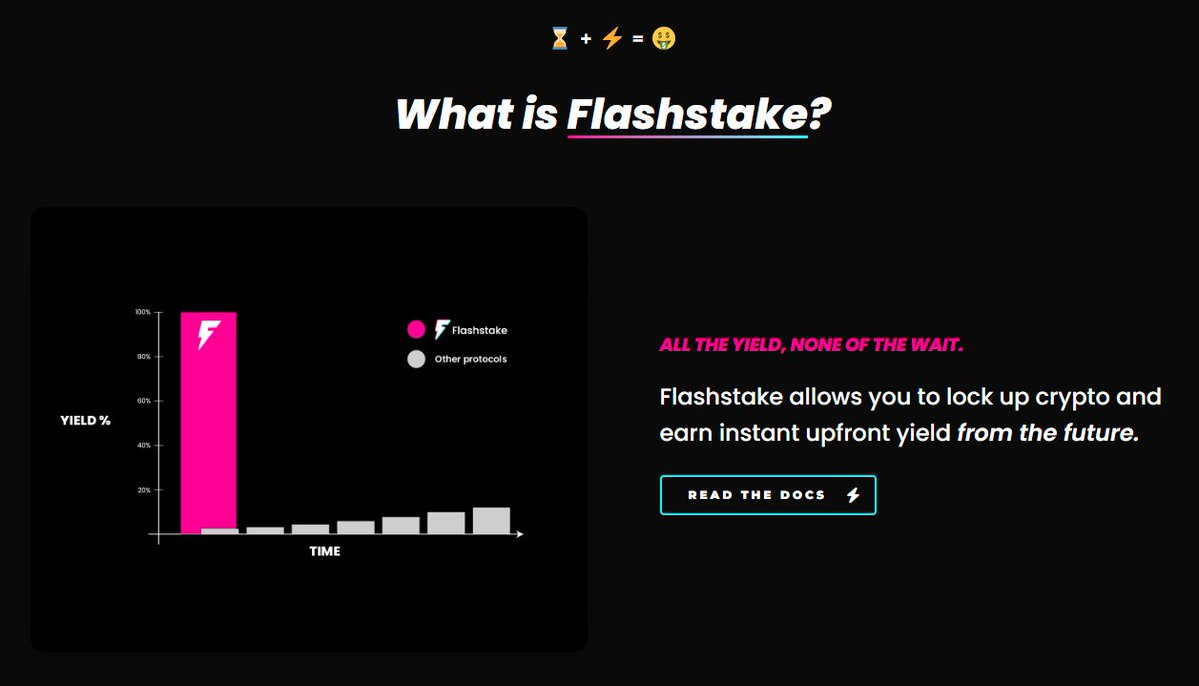

Flashstake

$FLASH allows you to receive immediate prepaid yield. Normally, you'd wait 365 days to get 4-5% annual $ETH yield. With $FLASH, you can instantly claim it by locking your principal.

Supported assets:

→ $stETH;

→ $sUSD;

→ $GLP;

→ $rETH coming soon.

Agility Protocol

$AGI is both an aUSD trading platform and an LSD liquidity distribution platform.

Agility Protocol aims to help LSD projects boost initial liquidity—LSD/ETH. They provide various strategy vaults for different yield strategies.

LSDx Finance

$LSD currently offers two products:

→ ETHx: A basket of LSDs enabling fast conversions;

→ UM: A stablecoin backed by sovereign bonds based on $ETH staking rewards.

It's the hyper-liquidity protocol for all LSDs.

SharedStake

$SGT is a decentralized staking solution allowing users to stake $ETH and earn additional yield on top of ETH2 rewards. If you hold their NFT, you also gain access to LSD APR—the first project to offer this.

-

TVL - $29 million;

-

Market Cap - $2 million;

-

Market Cap/TVL - 0.069.

Parallax

$PLX is a liquidity layer infrastructure supporting DeFi participants, DAOs, and protocols. It consists of four main components:

-

Orbital - Yield optimizer;

-

Andromeda - Multi-variable yield;

-

Supernova - Powers LSDfi;

-

Black Hole - Liquidity market.

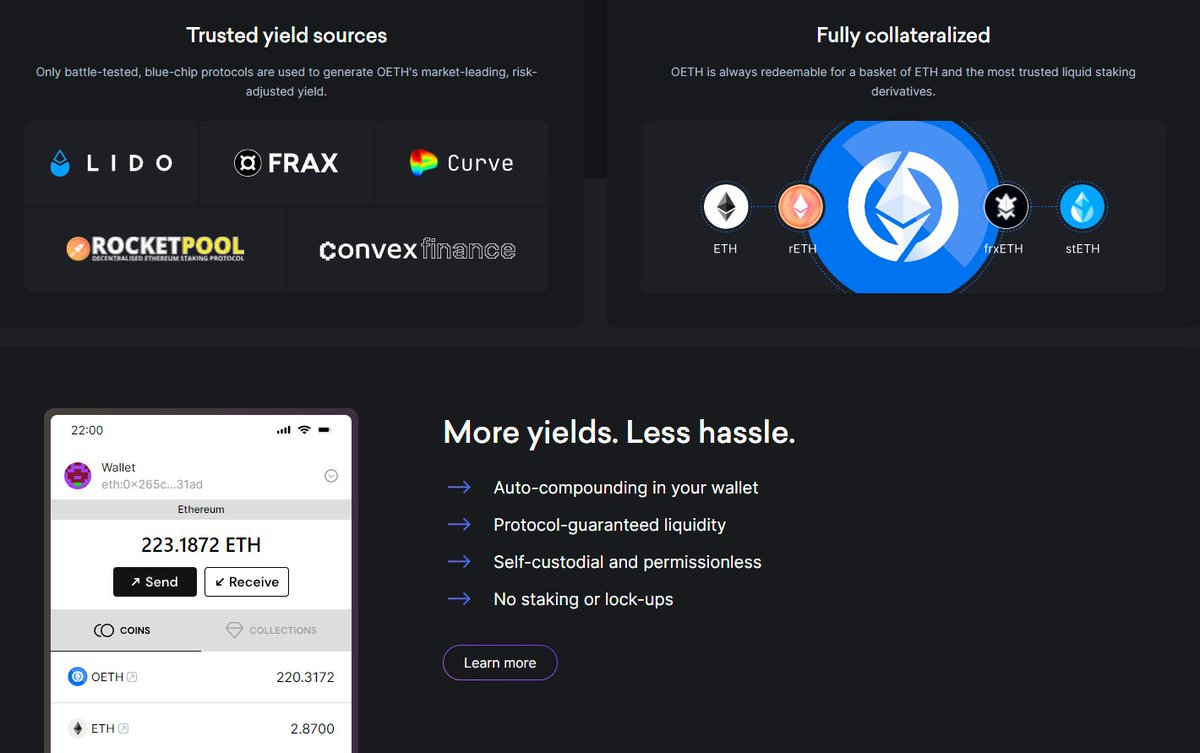

Origin

An upcoming new entrant in the LSD space. They already have $OUSD—a yield-generating stablecoin. Additionally, they plan to launch $OETH—an $ETH token that accumulates value from:

→ $LDO;

→ $FRAX;

→ $RPL;

→ $CRV;

→ $CVX.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News