Kyle has left the crypto industry, and I feel a bit sad.

TechFlow Selected TechFlow Selected

Kyle has left the crypto industry, and I feel a bit sad.

Kyle’s departure is, in essence, a “value choice.”

By Duola B Meng, TechFlow

*This article reflects the author’s personal views.

February 5 began with a sharp market drop. As usual, I scrolled through Twitter—and suddenly, a resignation announcement from Kyle Samani, Partner at prominent crypto VC Multicoin, appeared in my feed. My finger paused on the screen for a few seconds. My heart sank: Why him?

I “know” Kyle—more precisely, I know *of* him.

In my junior year of university back in 2020, I read Multicoin’s now-famous “thesis-driven” research paper for the first time—and it was revelatory. “Thesis-driven” stuck in my mind.

I realized VCs could write like this—not with PowerPoint-style platitudes like “We believe in the long-term value of the XX sector,” vague and noncommittal—but like traders: clear long/short logic, no hedging, bold and unambiguous positions.

Kyle’s Twitter persona has always been sharply defined: aggressive, blunt, and deeply polarizing.

He publicly shorted Ethereum’s scaling roadmap when everyone else was bullish; he doubled down on Solana when others dismissed it; and after the FTX collapse—when Multicoin suffered massive losses—he promptly disclosed the damage transparently and conducted an honest post-mortem.

Many in the Western crypto community dislike him, calling him “too arrogant.” Yet I’ve always believed this industry needs people like him.

Now he’s leaving—for AI, longevity tech, and robotics. And I feel unexpectedly sad: If even Kyle is walking away, what’s wrong with this industry?

When Kyle Leaves

What saddens me isn’t just another VC pivoting to AI—everyone’s talking about AI these days.

What hurts is that it’s Kyle from Multicoin—a figure I perceived as exceptionally resolute.

What’s the typical investment logic among most crypto VCs? Cast wide nets, bet on sectors, deliver polished rhetoric without taking real stances—or simply follow other investors’ leads.

Flip through any top-tier firm’s public reports, and you’ll find endless variations of “We believe in the decentralized future” or “We’re excited about innovation in the XX space.” But you’ll never see a definitive statement like, “We believe Project A will outperform Project B.”

That’s not prudence—it’s political savvy. Either way, they can claim, “See? We were positioned early.”

Kyle—or rather, Multicoin—was different. He dared make life-or-death calls.

In 2017, he declared Ethereum’s sharding roadmap a dead end. He backed EOS—and lost big. In 2018, he doubled down on Solana. In 2020, he championed Helium, arguing DePIN was crypto’s only viable non-financial use case.

Yes—he missed many bets and made major errors. EOS and FTX stand as stark, bloody lessons. But he never hid. Losses were disclosed fully; mistakes owned unflinchingly.

He wasn’t the smartest VC. He wasn’t the gentlest evangelist. But he ranked among the most *authentic*. His departure symbolizes the fading of “honesty and sharpness” from this industry.

The Tweet That Vanished in a Second

What struck me even more was the tweet he posted moments before stepping away—then deleted instantly.

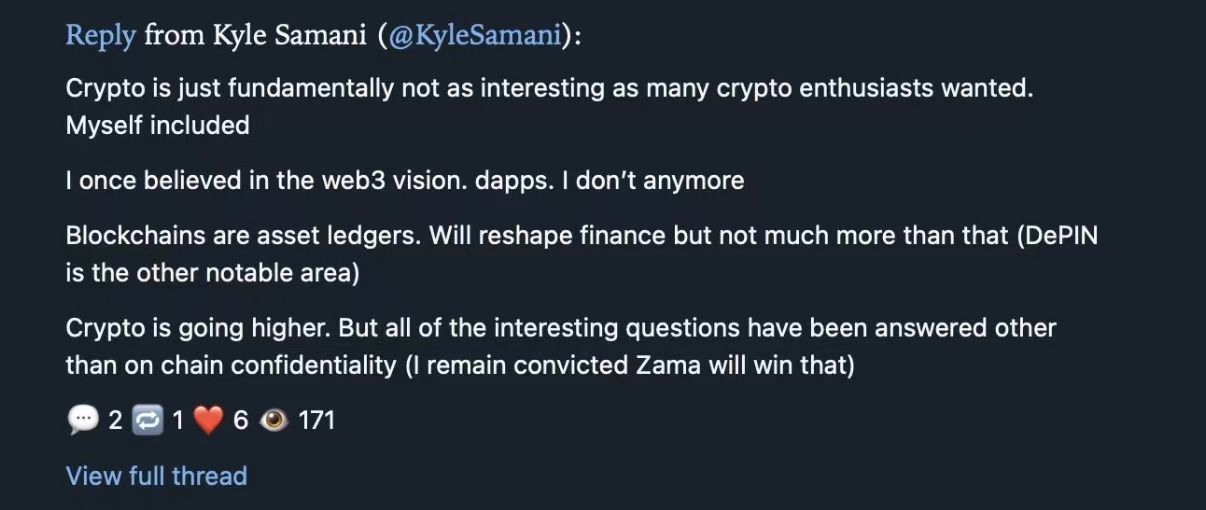

He wrote: “Cryptocurrencies aren’t, in essence, as interesting as many crypto enthusiasts hope. I once believed in the Web3 vision, in dApps. Now I don’t. Blockchains are primarily asset ledgers—capable of reshaping finance, but with limited potential elsewhere.”

Why delete it so fast? Because speaking that truth brands you a heretic.

Yet why post it at all? This was the hard-won conclusion of someone trapped between faith and reality—after eight years and over $100 million invested.

I understand that feeling completely—because it mirrors my own journey this past year.

What did we believe when we entered in 2021? That decentralized social media would topple Twitter; that on-chain identities (DIDs) would let users truly own their data; that GameFi would finally let players “own their assets.” Back then, every tweet debated “How Web3 will change the world,” and every new project felt like a portal to the future.

What’s the reality in 2025? Friend.tech is dead. Lens Protocol sees near-zero usage. ENS has devolved into a speculative tool—used for wallet addresses, but nothing else. DID remains unused beyond wallets. The collapses of Axie and StepN proved “X-to-Earn” is merely Ponzi dressing.

Yet Kyle didn’t reject everything. He still backs stablecoins, DeFi, RWAs—and DePIN projects like Helium. He continues betting on Zama’s fully homomorphic encryption.

The question is: Do these areas still require “faith”—or just rational calculation?

Some call Kyle’s exit a betrayal. To me, it’s *disenchantment*: a shift from Crypto Evangelist to Crypto Realist. That transition may well be the industry’s necessary coming-of-age.

Last Time We Lost Money—This Time, We’re Losing Confidence

When FTX collapsed in 2022, the industry hit rock bottom. Luna went to zero. Three Arrows Capital imploded. Markets halved—then halved again. Yet beneath the rubble, a conviction remained: “The market crashed—but we weren’t wrong. Hold on. The bull market will vindicate us.”

Back then, we still believed in Ethereum’s “endgame narrative”: PoW to PoS, monolithic to modular, the inevitable path to the “world computer.”

We still believed in Solana’s “performance revolution”—convinced that, given time, high-throughput chains would win.

We still believed in Web3’s “paradigm shift”—certain the internet’s next chapter would be decentralized.

What about now—in 2025?

Objectively, fundamentals are far stronger than during the last trough: Bitcoin briefly breached $100,000; spot ETFs launched; crypto is more tightly interwoven with Wall Street.

Subjectively, though, the mood is inverted: Prices are higher—but confidence is lower.

The “villain”—or perhaps the “truth mirror”—is AI.

When ChatGPT launched in 2023, everyone asked, “How will AI change the world?” Meanwhile, crypto debated: “Should L2 sequencers be decentralized?” One discussed a productivity revolution; the other quibbled over technical minutiae.

Over the next two years, AI progress was dizzying: Gemini, Claude, and ChatGPT locked in a three-way arms race—new breakthroughs daily. Recently, OpenClaw has captivated everyone.

What about crypto? More L2s and more chains—but no one can clearly explain *why we need 100 L2s*. Even Vitalik has publicly questioned past architectural assumptions. NFTs, GameFi, SocialFi rose and fell—all fleeting.

Today, the cycle’s biggest “innovation” is meme coins—and “reinventing gambling.”

I often ask myself late at night: AI is redefining productivity with technology. Crypto is redistributing wealth via financial games. One creates; the other transfers. What, exactly, are we building?

Kyle’s departure, at its core, is a *value choice*.

He’s chasing AI, longevity tech, and robotics—fields actively expanding the frontiers of human capability. Crypto, at least for now, feels more like a high-stakes casino.

But I’m Not Leaving—Yet

By now, you might assume I’m about to announce my own exit.

I’m not. I want to place one more bet.

Kyle can walk away because he’s financially free—to pursue grander ambitions. For young people like me, crypto still represents: a relatively fair channel for upward mobility; a permissionless sandbox where credentials, pedigree, or connections matter less than insight and courage; and an emerging field not yet fully monopolized by elite gatekeepers.

More importantly—perhaps the grand Web3 narrative failed, but that doesn’t mean crypto holds no value.

The financial infrastructure revolution has already happened: Stablecoin daily settlement volume now exceeds Visa’s. DeFi enables 24/7 global access to financial services—and to real-world assets (RWAs).

Most crucially: I haven’t found my answer yet.

Kyle spent eight years arriving at his conclusion—“Crypto is just an asset ledger.”

But I’m still a rookie. Why rush to judgment now?

Maybe in a few years, I’ll leave just like him. But for now, I want to stay at the table—and see whether this industry still hides possibilities we’ve overlooked.

Years from now, crypto may no longer be “the revolution that changes everything.” Instead, it may become the value settlement layer of the AI era.

Then, I’ll order a coffee—and tell you about the view along the way.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News