Macroeconomic Research Report on the Cryptocurrency Market: Under the “Wash Effect,” a Contractionary Cycle Is Upon Us—How Will Crypto Assets Be Priced?

TechFlow Selected TechFlow Selected

Macroeconomic Research Report on the Cryptocurrency Market: Under the “Wash Effect,” a Contractionary Cycle Is Upon Us—How Will Crypto Assets Be Priced?

Looking ahead, regardless of the final outcome of Wash’s nomination, the crypto market has already entered a new, irreversible phase.

Executive Summary

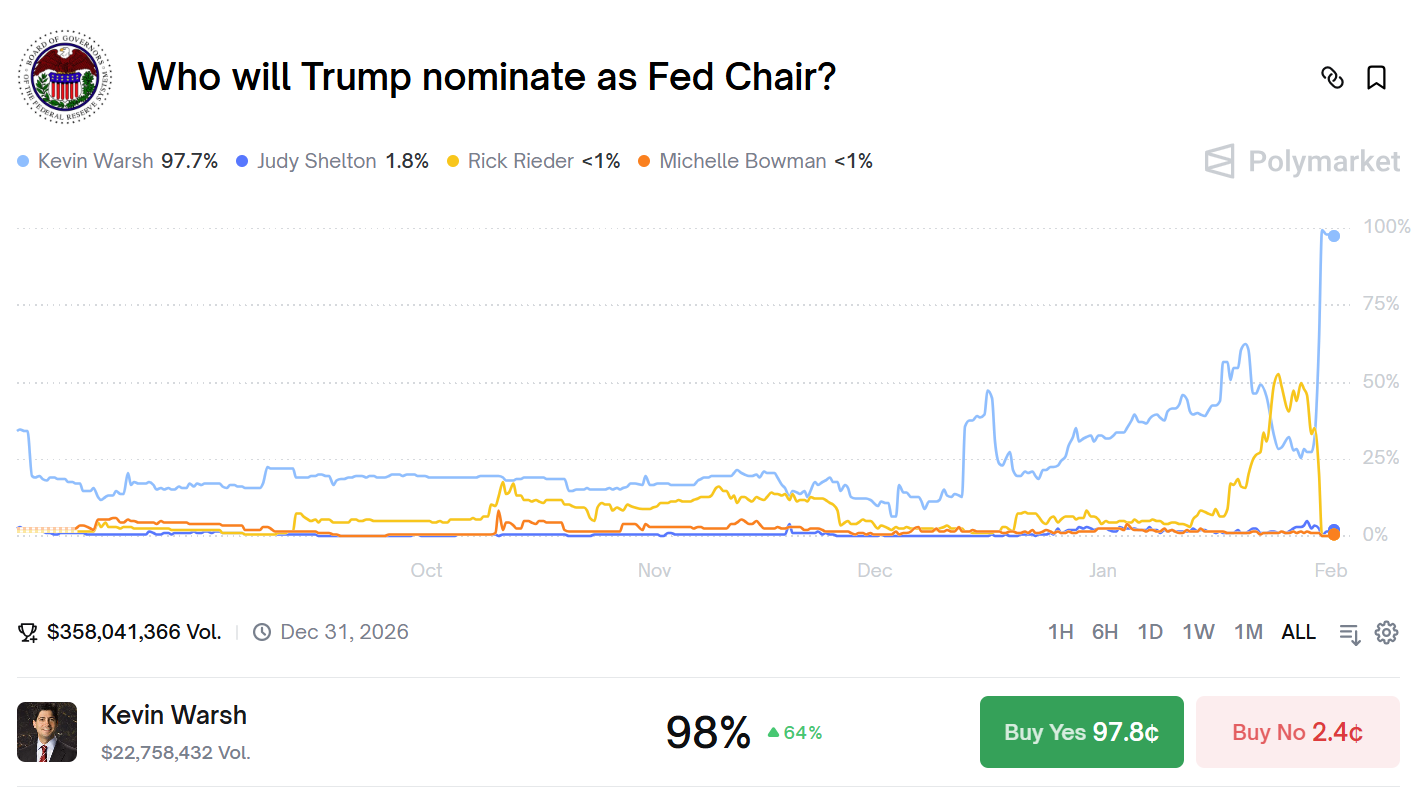

In early February 2026, Donald Trump nominated Kevin Warsh—a former Federal Reserve Board governor and prominent monetary policy hawk—as the next Chair of the Federal Reserve. This personnel appointment triggered violent turbulence across global financial markets, with the crypto market dubbing it the “Warsh Effect.” Major cryptocurrencies plunged sharply, and spot Bitcoin ETFs recorded nearly $1 billion in net outflows on a single day. Our deep analysis concludes that the essence of the Warsh Effect is a “reference-point shift” in the market’s underlying monetary-policy logic—from the old narrative of “persistent inflation driving fiat depreciation, benefiting crypto assets as stores of value,” to a new paradigm of “strengthened interest-rate discipline reinforcing dollar credibility, while liquidity contraction penalizes risk assets.” Within this paradigm shift, crypto-asset pricing mechanisms are undergoing structural reconfiguration: Bitcoin’s correlation with tech stocks continues to strengthen, forcing it into the identity of a “high-beta risk factor”; market valuation drivers are shifting from liquidity expansion to real-interest-rate pricing; and pronounced internal market divergence will emerge, with assets possessing genuine cash flows and real-world use cases commanding valuation premiums.

Looking ahead, crypto assets may evolve into “non-sovereign digital collateral,” rather than traditional safe-haven assets. Investors must systematically recalibrate their allocation frameworks—treating cryptocurrencies as “high-beta risk factors” highly sensitive to macro liquidity—and place greater emphasis on fundamental analysis, risk management, and liquidity reserves during tightening cycles.

Chapter One: Decoding the Warsh Effect—Why Did One Personnel Appointment Trigger a Market Earthquake?

On January 30, 2026, a personnel announcement sent shockwaves across global financial markets—its impact exceeding even most major economic data releases or monetary-policy adjustments. News that Kevin Warsh, former Fed governor, had been nominated as the next Fed Chair caused the U.S. Dollar Index to surge violently, gold and silver to crash, and the cryptocurrency market to suffer a bloodbath—Bitcoin fell roughly 7% in a single day, Ethereum plunged over 10%, and total market capitalization evaporated by more than $800 billion. On the surface, this appeared merely a routine leadership transition. Yet deeper analysis reveals that the market’s extreme reaction stemmed from the nomination of Warsh specifically—the individual whose career trajectory and policy stance collectively form a complete portrait of a monetary hawk. In 2006, at just 35 years old, Warsh became the youngest-ever member of the Federal Reserve Board—a move signaling extraordinary potential from the outset. During the 2008 global financial crisis, while most of his peers advocated aggressive quantitative easing (QE) to rescue a collapsing financial system, Warsh emerged as its most steadfast dissenter. He publicly opposed QE2 and repeatedly warned, in post-crisis reflections, that large-scale asset purchases and prolonged zero-interest-rate policies were distorting market signals, fostering moral hazard, and undermining long-term price stability. These views clashed starkly with prevailing crisis-era sentiment—but over time, increasing numbers of observers have revisited his warnings. After leaving the Fed, Warsh further refined his theoretical framework through academic work at the Hoover Institution and Stanford Graduate School of Business. He especially emphasized the importance of the “real interest rate” as the anchor of monetary policy, arguing that negative real rates punish savers and encourage capital misallocation. In a 2025 public speech, he stated unequivocally: “A healthy economy requires positive real interest rates as a signal mechanism for resource allocation; artificially suppressed rates generate only illusory prosperity and inevitable bubble bursts.” Such statements stand in direct, sharp opposition to the very liquidity environment upon which today’s crypto market depends.

The Warsh Effect’s deepest insight lies in exposing a long-overlooked contradiction between crypto markets and monetary policy. Cryptocurrency’s original narrative was built on resistance to central-bank currency debasement: Satoshi Nakamoto’s Genesis Block inscription—“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”—clearly reflects this adversarial stance. Yet as the crypto market matured, it did not evolve—as early idealists hoped—into a fully independent parallel financial system, but instead became increasingly embedded within the existing system, developing structural dependencies upon it. The approval of spot Bitcoin ETFs marked a milestone in this process: it opened the floodgates for institutional capital into crypto markets, yet simultaneously transferred pricing power over crypto assets from decentralized communities to Wall Street trading desks. Today, Bitcoin’s price is no longer set by miners, holders, or developers—but by BlackRock’s and Fidelity’s asset-allocation models and risk-management systems. These models naturally categorize crypto assets as either “high-growth tech stocks” or “alternative risk assets,” making buy/sell decisions based on the same macro variables as traditional assets—interest-rate expectations, liquidity conditions, and risk appetite. This structural dependency renders crypto markets exceptionally vulnerable to figures like Warsh: institutional investors mechanically adjust positions according to interest-rate forecasts, disregarding Bitcoin’s “non-sovereign store-of-value” narrative. It is a cruel irony: an asset born to oppose central banks now has its price determined by the very traditional institutions most sensitive to central-bank policy.

Chapter Two: Historical Backtesting of Tightening Cycles—How Are Crypto Assets Priced?

To truly grasp the Warsh Effect’s far-reaching implications, we must look to history—to examine how crypto assets performed across past tightening cycles. This historical backtesting is not mere data aggregation, but an effort to extract structural patterns from past price movements, offering a reference framework for judging likely future market trajectories. The first period worth deep analysis is the 2017–2018 balance-sheet normalization and rate-hiking cycle. The Fed officially began shrinking its balance sheet in October 2017 and raised rates seven times over the following two years. Bitcoin’s performance during this cycle displayed clear lagged characteristics: in December 2017—while the Fed was already hiking—Bitcoin instead hit a record high of $19,891, completely ignoring monetary-tightening signals and remaining immersed in rampant bull-market euphoria. Yet this willful ignorance exacted a heavy toll. As rate hikes accelerated and balance-sheet reduction expanded throughout 2018, persistent liquidity contraction ultimately crushed the market. Bitcoin entered a 13-month bear market, bottoming at $3,127—a staggering 84.3% decline. The lesson here is profound: monetary-policy impacts accumulate over time; markets may ignore tightening signals in the short term, but once a critical threshold is breached, corrections tend to be severe and painful. More importantly, the 2017–2018 cycle revealed an early characteristic of crypto markets—their relatively weak linkage to traditional financial markets, driven more by internal cycles (e.g., Bitcoin halvings) and retail sentiment.

The second key period is the 2021–2022 inflation-response cycle, which bears higher comparability to current conditions. The Fed launched tapering in November 2021 and initiated its first rate hike in March 2022, raising rates seven times for a cumulative 425 basis points over the year. Bitcoin peaked at $69,000 in November 2021 before plunging to a low of $15,480 in November 2022—a ~77% decline. Compared to the 2017–2018 cycle, the most significant change during this period was the sharp rise in crypto’s correlation with tech stocks. Data shows Bitcoin’s 120-day rolling correlation with the Nasdaq Index surged from ~0.3 in early 2021 to 0.86 by mid-2022. This dramatic increase was no accident—it reflected a structural shift in crypto markets: massive institutional inflows led them to incorporate crypto assets into unified risk-asset frameworks. When the Fed launched aggressive rate hikes to combat inflation, institutions simultaneously reduced exposure to both tech stocks and crypto assets, triggering a “multi-asset deleveraging” vicious cycle. Another notable phenomenon emerged: intense internal market divergence. Amid broad declines, Bitcoin proved relatively resilient, whereas most altcoins suffered deeper losses—many falling over 90%. This divergence foreshadowed the market’s growing distinction between “core assets” and “peripheral assets,” with capital concentrating in those with superior liquidity and stronger consensus.

The third period is the 2024–2025 high-rate maintenance phase—the most recent and thus most relevant for comparison. The Fed held the federal funds rate steady at 5.25%–5.50% for 16 months while continuing to shrink its balance sheet at $95 billion per month. During this period, crypto markets exhibited complex structural features. On one hand, Bitcoin surged significantly following spot ETF approval—from $45,000 to over $100,000; on the other, most altcoins declined 40–70%, with over 80% of the top-100 tokens underperforming Bitcoin. This divergence reveals a crucial trend: amid overall liquidity contraction, capital concentrates in the “safest risk assets”—those with strongest liquidity, highest institutional acceptance, and lowest regulatory risk. For other crypto assets, the challenge is twofold: coping with macro liquidity contraction, plus contending with Bitcoin’s “blood-sucking effect.” Another noteworthy phenomenon emerged: changes in real interest rates began directly influencing crypto valuations. When the 10-year TIPS yield rose from 1.5% to 2.5%, Bitcoin’s price fell ~15%—a sensitivity previously unobserved in earlier cycles.

Based on these three historical periods, we can summarize several key patterns governing crypto markets during tightening cycles. First, monetary-policy impacts exhibit cumulative effects and lags—markets may initially ignore tightening signals, but eventually respond via severe adjustments. Second, as institutional participation rises, crypto’s correlation with traditional risk assets strengthens continuously, peaking during tightening environments. Third, intense internal market divergence emerges, with capital flowing toward top-tier assets and the Matthew effect intensifying. Fourth, accumulated leverage amplifies the magnitude and speed of downturns, creating a “price decline → liquidation triggers → further decline” vicious cycle. Fifth, real interest-rate changes are increasingly becoming the core variable affecting crypto valuations—rising risk-free yields directly elevate the opportunity cost of holding crypto assets. What makes the Warsh Effect unique is that it arrives at crypto’s highest level of institutionalization—and at relatively elevated market valuations. The confluence of these two factors may render this adjustment more complex and protracted than any prior episode. Moreover, Warsh—a hawk with a coherent, consistent theoretical framework—represents not a temporary policy response, but a potential long-term policy paradigm shift. Its implications will extend far beyond cyclical policy adjustments.

Chapter Three: A New Crypto Pricing Model Under Tightening Cycles

In the new environment inaugurated by the Warsh Effect, traditional crypto-asset pricing models have become obsolete, requiring a fresh analytical framework to understand market dynamics. Drawing on historical data and current market structure, we propose a three-factor pricing model designed to explain crypto-asset price formation under tightening cycles. The first factor is liquidity conditions, assigned a weight of 40%. This factor measures global money-supply trends—including the Fed’s balance-sheet size, global M2 growth, and overnight reverse-repo volumes. Data shows a strong correlation (R² = 0.62) between global liquidity shifts and crypto market capitalization: every 1% liquidity contraction corresponds, on average, to a 2.1% decline in total crypto market cap. Under the policy framework Warsh may pursue, we project the Fed’s balance sheet will shrink 15–20% over the next two years—roughly $1.2–1.6 trillion. According to our model, this alone could contract total crypto market capitalization by 25–30%. More critically, liquidity contraction often exhibits nonlinear characteristics: initial impacts may be muted, but once cumulative contraction reaches a certain threshold, it risks triggering a self-reinforcing liquidity-crisis feedback loop. Current crypto leverage structures amplify this fragility—large amounts of collateralized lending and derivatives positions face liquidation pressure amid tightening, further accelerating market declines.

The second factor is real interest rates, weighted at 35%. This factor captures the opportunity cost of holding crypto assets, anchored by the 10-year TIPS yield and the real federal funds rate. Every 1-percentage-point rise in real rates necessitates a corresponding 280-basis-point increase in Bitcoin’s required risk premium to sustain current valuations. Thus, if real rates climb from today’s 1.5% to Warsh’s likely target of 3%, Bitcoin’s expected annualized return would need to rise from its historical average of ~60% to nearly 70%—a formidable hurdle.

The third factor is risk appetite, weighted at 25%. This factor gauges market participants’ willingness to assume risk, measured by indicators including the VIX Volatility Index, high-yield bond spreads, and tech-stock valuation premiums. Crypto markets exhibit extreme sensitivity to shifts in risk appetite, with an elasticity coefficient of 1.8—meaning a 10% decline in overall market risk appetite could depress crypto valuations by 18%. This disproportionate amplification stems from crypto’s high volatility and peripheral status: during market optimism, investors embrace elevated risk for outsized returns; during pessimism, crypto assets are typically the first sold. During tightening cycles, risk appetite usually declines systemically, since high-rate environments inherently suppress risk-taking. Rising real rates alter not only absolute valuations but also investors’ risk tolerance: when risk-free assets deliver attractive yields, investors no longer need to assume excessive risk for returns. This psychological shift manifests across multiple dimensions—slowing venture investment, compressed growth-stock valuations, widening high-yield spreads. As one of the most risk-appetite-sensitive domains, crypto markets naturally bear the brunt of such shocks.

Within this three-factor model, different crypto-asset categories display distinct pricing characteristics. Bitcoin, as the market benchmark, sees 60% of its price movement explained by macro liquidity factors, 25% by ETF flows, and chain-level fundamentals contributing less than 15%. This structural shift implies Bitcoin’s correlation with traditional risk assets will remain high—at 0.65–0.75—with annualized volatility staying within 55–70% and sensitivity to real-rate changes reaching 12–15% price reversal per 1% change. Ethereum and other smart-contract platform tokens follow more complex pricing logic: network revenue accounts for 40%, developer activity for 25%, DeFi total value locked (TVL) for 20%, and macro factors for 15%. This mix means Ethereum retains some fundamental support yet cannot fully escape macro influences. Crucially, smart-contract platforms harbor intricate interdependencies: failure of one protocol can cascade across the entire ecosystem via asset linkages and sentiment transmission, generating systemic risk. Application-layer and governance tokens will diverge most sharply: tokens with genuine cash flows (annual protocol fees > $50 million) may retain valuation support, whereas pure governance tokens face liquidity drought. Data shows fewer than 30% of the top-200 tokens generate >$10 million in annual protocol revenue, and only ~15% feature sustainable dividend or buyback mechanisms. During tightening cycles, capital will concentrate increasingly in a narrow cohort of high-quality assets, while most tokens risk entering a “zombie state.”

Chapter Four: Investment Strategy Adjustments and Risk Management

Facing the tightening environment inaugurated by the Warsh Effect, all market participants must fundamentally revise their strategy frameworks and risk-management approaches. For traditional institutional investors, the first step is to redefine crypto assets’ role and positioning within portfolios. Bitcoin should no longer be viewed as “digital gold” or an inflation hedge, but explicitly classified as a “high-beta growth asset,” grouped alongside tech stocks under the same risk-factor category. This reclassification carries concrete operational implications: crypto’s risk budget within asset-allocation models must be adjusted downward—from 5–8% of total portfolio risk to 3–5%; performance benchmarks should shift from gold or commodity indices to tech-stock indices; and risk-management stress tests must incorporate extreme scenarios such as “liquidity shocks” and “correlation spikes.” Institutions also require more systematic decision-making processes—dynamically adjusting positions based on macro signals (real rates, liquidity metrics, risk appetite), rather than relying on conviction-driven long-hold strategies. Specifically, they can establish clear trigger conditions: automatically reducing positions when real rates breach predefined thresholds; initiating hedges when liquidity metrics deteriorate to specified levels; and gradually adding exposure when risk appetite falls to historic lows. Hedging strategies become critical—consider using Bitcoin futures, options, or correlation-based trades to manage downside risk. Notably, during tightening cycles, crypto’s correlation with traditional assets may intensify further, diminishing its diversification benefits within portfolios—a dynamic that must be accurately reflected and promptly addressed in risk models.

Looking ahead, regardless of the final outcome of Warsh’s nomination, the crypto market has entered an irreversible new phase. Its defining features include deep integration with traditional finance—and the resulting fundamental transformations in pricing mechanisms, volatility patterns, and correlations. Regulatory frameworks will gradually solidify, valuation methodologies will professionalize, market structures will grow more complex, and cyclical behavior will weaken. From a broader perspective, the Warsh Effect may ultimately catalyze necessary industry self-renewal. As liquidity tailwinds fade, markets will be forced to refocus on essentials: creating real value, solving tangible problems, and building sustainable economic models. Projects reliant solely on speculation and narrative—without substantive progress—will be culled, while genuinely innovative protocols will gain room to flourish.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News