After the narrative reignites, pay attention to eBTC and Bitcoin's future in DeFi

TechFlow Selected TechFlow Selected

After the narrative reignites, pay attention to eBTC and Bitcoin's future in DeFi

Bitcoin is the earliest cryptocurrency, and its invention permanently changed the landscape of the financial world.

Written by: BadgerDAO, Yield Aggregator

Translated by: TechFlow

This article will discuss Bitcoin's value proposition and the recent resurgence of interest in it. Additionally, it will analyze BTC's current adoption in decentralized finance (DeFi), explore the reasons behind its underrepresentation, and introduce a product designed to address this imbalance by expanding Bitcoin’s footprint within the DeFi space.

Bitcoin is the original cryptocurrency, and its invention permanently transformed the financial landscape. Even today, it remains far ahead of all other digital assets—its $540 billion market cap is more than double that of its closest competitor. Yet, in the marketplace of ideas, this pioneering orange coin has seemingly failed for years to capture public attention. In the crypto world, it's altcoins that have driven narratives and fueled bull markets. Think of Ethereum’s smart contract introduction, the birth of decentralized finance, and the explosion of interest in NFTs—the altcoin ecosystem has pushed BTC into the background. For a time, newcomers began to downplay Bitcoin’s value.

Recently, however, attention has begun shifting back toward Satoshi’s creation. What is happening with Bitcoin now?

Renewed Interest in Bitcoin

Over the past few months, the narrative has shifted as analysts on Crypto Twitter have started revisiting the 2024 halving story. Anticipation around the halving has reignited interest in BTC, driving prices upward—exactly what we’ve observed.

But that was only setting the stage. The launch of Bitcoin Ordinals brought everyone’s focus back to the original coin. Introduced in January, Ordinals enable non-fungible inscriptions on satoshis—essentially native Bitcoin NFTs. In the first few weeks, Ordinals caused a surge in network usage, with over 50,000 inscriptions minted. But perhaps more important than any number was the sentiment it created: that we can do more with Bitcoin than previously thought possible.

Bitcoin’s Strengths

Fortunately, this revival isn’t just a shift in sentiment. Charts confirm it: from November to March, Bitcoin’s market cap surged from $303 billion to $544 billion. Bitcoin dominance—the percentage of the total crypto market cap held by BTC—rose remarkably by 20.78% during the same period.

So why is this happening?

First, Bitcoin has several key value propositions that set it apart from other cryptocurrencies.

-

Bitcoin has a fixed supply of 21 million coins, predetermined in the genesis block and never to be increased. This alone positions Bitcoin as an antidote to fiat monetary systems, where authorities can erode the purchasing power of savings through inflation. In this sense, it serves as a hedge against monetary dilution.

-

Bitcoin enjoys strong first-mover advantage; during economic downturns, liquidity tends to flow from altcoins into Bitcoin as a relatively safe haven.

-

Bitcoin is a truly public blockchain, with no entity or foundation responsible for its initial distribution.

Bitcoin started re-entering conversations before the new year, and its characteristics make it particularly well-suited to certain macroeconomic environments. It turns out a series of events may be fueling a mini-revival for the original cryptocurrency.

Why Now?

BTC’s current rally began with the bank run on Silicon Valley Bank and its subsequent collapse on March 10. The failure stemmed from declining values of its below-par treasury bonds, a consequence of a full year of Federal Reserve rate hikes. When similar issues emerged at Signature Bank and Credit Suisse, it sent a clear signal: the Fed’s tightening cycle was beginning to impact the financial system’s health, leading markets to anticipate a pause in rate hikes in the near future.

The February CPI data released days later worsened the sentiment, coming in below expectations with a 0.4% month-on-month increase. After digesting these two macro signals, markets began pricing in a potential pause in rate hikes, and Bitcoin surged 47.88% in just 12 days.

So what’s the takeaway here?

It’s the threat of recession and a potential shift in the Fed’s stance that reminds us once again of the need for a more reliable store of value than banks can offer. As described, Bitcoin represents permanent hard money—immune to central bank devaluation and custodial mismanagement.

The clear conclusion is that Bitcoin is likely to continue proving its worth as a hedge against current conditions—and likely lead among other digital assets. Weeks ago, when asked which cryptocurrencies the U.S. government considers securities, SEC Chair Gary Gensler replied: “Everything except Bitcoin.” BTC is not only tailor-made for deteriorating monetary conditions but may also uniquely withstand the regulatory scrutiny that intensified in the weeks following the banking turmoil.

But what if we want to do more with BTC? What if we could enjoy all the benefits of banking without worrying about custody risk?

This brings us to the second part of our article: Bitcoin’s role in decentralized finance.

Bitcoin in DeFi

If Bitcoin was designed as an alternative store of value, then permissionless smart contracts were designed to function as a financial system. They not only provide a way to access digital assets outside of centralized channels but also offer mechanisms for generating yield and hedging positions. For Bitcoin holders, these benefits are obvious: as more users join the ecosystem, holding BTC long-term becomes increasingly attractive, and DeFi activity should grow accordingly.

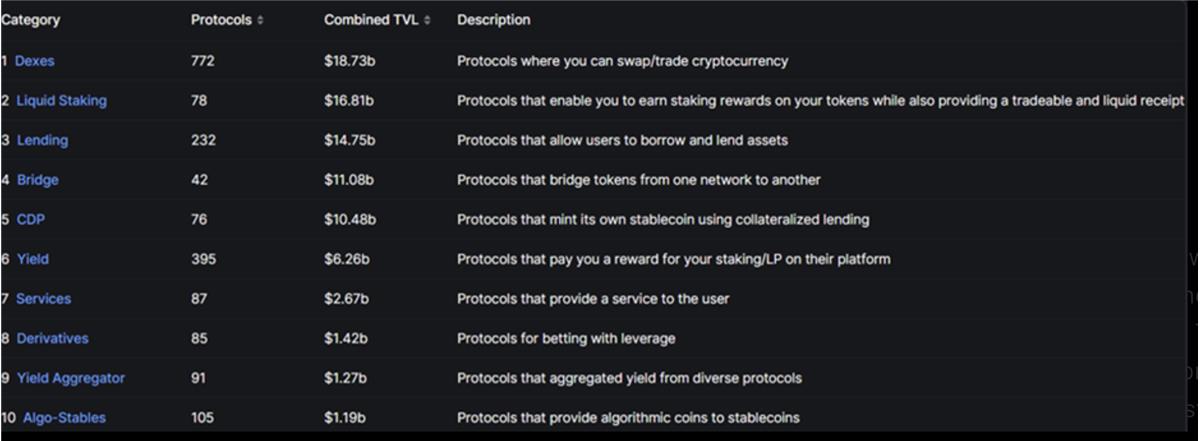

While you might expect Bitcoin and DeFi to go hand-in-hand, the reality is otherwise. Total DeFi TVL stands at $47.8 billion, yet the combined market cap of the top three Bitcoin derivatives (wBTC, hBTC, and renBTC) is only $4.59 billion. While BTC accounts for 48% of the total crypto market cap, it represents just 9.6% of DeFi TVL. Clearly, something is off—what explains this?

Perhaps we can find answers by examining the Ethereum ecosystem, the undisputed center of the DeFi universe. With $27.93 billion in TVL, Ethereum controls 58% of the decentralized finance market—nearly triple the combined share of its next two competitors, TRON and BSC. If BTC is to gain traction in DeFi, this is where it must take root.

Bitcoin’s Current State on Ethereum

On Ethereum, Bitcoin is primarily represented through 1:1 backed ERC-20 tokens. The three largest by market cap are wBTC, hBTC, and renBTC.

-

wBTC ($4.21 billion): The most widely used Bitcoin derivative, wBTC was launched by BitGo in 2019. Users deposit their BTC with BitGo, and “merchants” mint or burn equivalent amounts of wBTC on-chain.

-

hBTC ($248.9 million): Similar to wBTC, but issued by Huobi. BTC is held on Huobi’s centralized exchange, and hBTC is minted in return.

-

renBTC ($114.2 million): A decentralized alternative to wBTC and hBTC. Users send their BTC to a network of darknodes, which then mint renBTC in return. Locking BTC into smart contracts like this is theoretically a way to avoid centralization risks.

You may notice a pattern: holders send their Bitcoin elsewhere and bridge it onto Ethereum. That sounds risky.

Centralization Risk: Cryptocurrencies were invented to escape institutional control, yet we repeatedly forget this core principle. We saw it multiple times last year, but even earlier with Mt. Gox—we learned that when you leave your funds with someone else, they tend to disappear in interesting ways.

renBTC serves as a particularly stark cautionary tale, as it appeared to be the most decentralized option for creating Bitcoin derivatives. So, users were understandably surprised to learn last year that all renVM nodes were actually operated by Ren itself. Worse, the company had been acquired by FTX prior to its bankruptcy and became entangled in its legal aftermath. They announced a phased shutdown of the Ren 1.0 network in December, urging all renBTC holders to immediately bridge back to Bitcoin. Such an event in a system marketed as decentralized should alarm any staker.

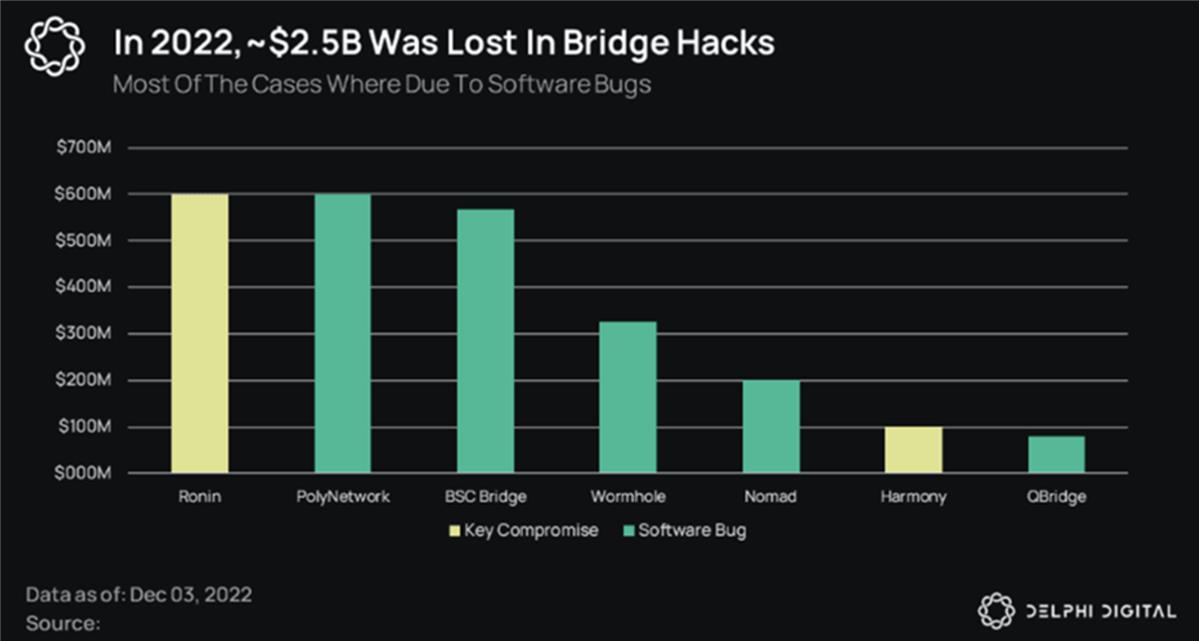

Bridging Risk: Even without custodians, smart contract vulnerabilities remain a major threat. Historically, cross-chain bridges have been one of DeFi’s biggest weak points—over $2.5 billion in bridge hacks occurred in 2022 alone. Many Bitcoin holders are naturally security-focused, so the inherent risks of bridging BTC to Ethereum are likely a primary reason for Bitcoin’s limited presence in DeFi.

Alternatives do exist—tBTC is a good example of a trustless, decentralized Bitcoin bridge that avoids some of the drawbacks mentioned above. However, decentralized custody solutions are still custody solutions, and the threat of bridge exploits remains.

Clearly, there’s room for improvement in Bitcoin derivatives—but are there other options?

Advantages of Synthetic Assets

One solution to avoid both pitfalls is synthetic derivatives. While these tokens track the price of the underlying asset, they aren’t backed by the asset itself. Instead, they’re minted using other forms of collateral, allowing users exposure to an asset’s price—even when the asset doesn’t exist natively on the same network.

Synthetix’s sBTC is a prime example. Users stake Synthetix’s native token SNX into a large collateral pool. They can then mint synthetic derivatives against their SNX, provided they maintain a minimum collateral ratio to avoid liquidation. The result? Exposure to BTC’s price without any bridging involved and without trusting any entity—centralized or otherwise—to hold their actual Bitcoin.

However, users do take on SNX risk, which may or may not align with their goals. There’s also liquidation risk if the collateral ratio drops too low—especially dangerous if BTC rises while SNX falls. Additionally, Synthetix charges fees, which can eat into user returns.

At this point, we’ve built a bullish case for Bitcoin’s future. We’ve identified the need for stronger DeFi integration, examined existing options on Ethereum, and pinpointed the risks deterring adoption. Now, the question remains: where can we find a synthetic derivative that doesn’t require custody of Bitcoin, involves no bridging, charges no fees, and minimizes price volatility in the collateral token? We know what we’re looking for—now we arrive at the real subject of this article: BadgerDAO’s newest product, eBTC.

Introducing eBTC

eBTC is a new Bitcoin derivative launched by BadgerDAO, designed to solve many of the problems plaguing existing products and aiming to elevate Bitcoin to a core DeFi asset. It’s an ambitious goal, but the design is clever, and the demand clearly exists. Let’s examine how eBTC works.

A Solution Beyond Wrapped Bitcoin

Most existing Bitcoin products rely on wrapped BTC, trusted intermediaries, and token minting on Ethereum. eBTC, however, uses a CDP (Collateralized Debt Position) model. Users open a loan position by depositing collateral into a vault and borrowing another asset against it. Similar to how MakerDAO allows users to deposit ETH and mint the stablecoin DAI, eBTC uses staked ETH as collateral to mint eBTC—a token pegged to Bitcoin.

For many reasons, this design proves more resilient than any peer in Ethereum DeFi. When reviewing the shortcomings of existing BTC derivatives, the biggest risks are bridge vulnerabilities and centralization. eBTC eliminates bridge risk entirely—no cross-chain transfers are involved. It also completely avoids custody, sidestepping centralization risk. BadgerDAO does not hold your tokens; instead, your collateral is locked in an immutable smart contract inaccessible to anyone.

eBTC further promotes decentralization by using staked ETH as collateral. While staked ETH carries the same smart contract risks as any DeFi protocol, there’s no risk of the asset going to zero due to issuer mismanagement. By design, eBTC has no indirect centralization risk whatsoever.

A Better Synthetic Asset

Certainly, other synthetic assets exist on Ethereum, but we’ve already noted reasons users might avoid them. Take Synthetix: while a solid project, its synthetics can only be minted against staked SNX. This may suit long-term believers in the platform, but others may not want exposure to an unrelated token’s price volatility.

eBTC solves this through its choice of collateral. ETH is a more conservative holding—it’s the network’s native token, making it more aligned with users’ interests. Badger’s selection of liquid staking derivatives as collateral is also significant, leading to a crucial aspect of eBTC’s design: its handling of staking rewards.

When comparing eBTC to similar products—such as MakerDAO and Synthetix, which share some traits but differ in key ways—we note that such platforms typically charge fees. In most lending scenarios, users pay for the privilege of borrowing against their collateral.

eBTC bypasses this issue by using staked ETH. Since ETH staking yields average 4–5% APY, stakers earn this return simply by holding ETH. When used as collateral to mint eBTC, the protocol shares a portion of these rewards, while the rest is compounded back into the user’s debt position, gradually reducing their outstanding balance.

This is highly appealing to ETH bulls—a way to maintain ETH exposure, earn yield, and gain Bitcoin exposure simultaneously. On the flip side, it enables a more capital-efficient strategy for speculation: going long ETH while shorting BTC. In this regard, eBTC serves as a one-click solution for leveraged trading of your favorite assets, charging zero fees, securing the network, and continuing to earn yield on your underlying collateral.

Additional Benefits and Use Cases

Beyond the features described above, launching the product on Ethereum offers intrinsic advantages, bridging the gap between the Bitcoin and Ethereum ecosystems. While most crypto-native users hold both BTC and ETH, each community includes skeptics with divergent visions for crypto’s future. By offering clear benefits to both groups, eBTC encourages cross-ecosystem participation.

Benefits for BTC Users

-

Provides true believers—who may avoid wrapped or bridged assets—with exposure to BTC’s price.

-

Enables BTC holders to earn yield through lending or liquidity provision.

-

Likely to be integrated into derivatives platforms, allowing BTC holders to hedge long-term BTC positions.

-

When this happens, they’ll also gain access to leverage and compounding on their BTC positions.

Benefits for ETH Users

-

Simply put, eBTC gives Ethereum enthusiasts an easy way to gain BTC exposure—highly valuable during inflation or market turbulence.

-

Most comparable CDP products lend stablecoins against ETH, creating high liquidation risk if ETH crashes. Because ETH and BTC prices have historically been highly correlated, this risk is reduced—users’ debt declines alongside their collateral.

-

Since it’s backed by staked ETH, opening a long BTC CDP position allows ETH holders to hedge against ETH/BTC depreciation.

-

Bitcoin dominates global crypto assets. If TradFi begins using DeFi to hedge Bitcoin exposure and earn yield, it could funnel massive liquidity into the Ethereum ecosystem.

We’ll have to wait and see what integrations emerge to fully assess eBTC’s potential. For now, it represents a thoughtful design that avoids many pitfalls of its peers and offers clear advantages over traditional Bitcoin lending methods. By providing Bitcoin maximalists with safer DeFi access and Ethereum-based DeFi natives with greater BTC exposure, eBTC stands a strong chance of giving Bitcoin the same prominence in DeFi that it holds across the broader crypto landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News