Delphi Ventures Partner: Key Projects Driving the Cosmos Ecosystem Boom

TechFlow Selected TechFlow Selected

Delphi Ventures Partner: Key Projects Driving the Cosmos Ecosystem Boom

The Cosmos ecosystem has demonstrated strong growth momentum and technological innovation to the outside world.

Author: José Maria Macedo, Partner at Delphi Ventures

Translation: TechFlow

The Cosmos ecosystem is demonstrating strong momentum in growth and technological innovation.

José Maria Macedo, partner at Delphi Ventures, highlights key developments driving activity within the Cosmos ecosystem: dYdX launching v4, the permissionless launches of Neutron and Sei, MetaMask integration, and more—all expected to bring significant new users and dApps. This article provides a deeper analysis of these developments. Below is the original piece:

We’ve long been bullish on Cosmos, selecting it as the home for our Delphi Labs incubated projects. Now, this conviction is beginning to be validated, with many exciting projects on the horizon.

1) Native $USDC on Noble

Thanks to Noble, native USDC has finally arrived in Cosmos. The significance of this stablecoin cannot be overstated.

Every ecosystem needs a native stablecoin—especially in today’s environment where cross-chain bridge attacks have exceeded $2 billion and continue to grow. No one wants to hold non-native assets long-term. $UST once filled this role in Cosmos, but its collapse left a massive gap in stablecoin liquidity.

Native USDC will be issued on Noble and circulated across Cosmos via IBC, meaning it can be used on any of the 60+ Cosmos chains.

2) dYdX v4

dYdX is the most successful on-chain derivatives DEX by trading volume in history, with approximately $1 trillion in total trading volume.

The team embraced Layer 2 early, choosing Starkware back in 2020. Similarly, they began exploring application-specific chains early, announcing in 2022 their move to a Cosmos-based app chain.This was a bold and deeply conviction-driven decision.

This is a team behind one of the most successful dApps in its sector, already processing nine- to ten-figure daily trading volumes. Yet they chose to rebuild from scratch using the Cosmos SDK.

Why?

In founder Antonio’s words, he isn’t interested in building a relatively successful protocol—he wants to “win the entire market and drive real change/innovation.”He believes app chains are the best path to achieve that.

Why?

Primarily and fundamentally: sovereignty.

This move means dYdX’s product no longer depends on Ethereum core developers or the roadmap and pace of any specific L2. They can now develop at their own speed and customize the chain to fit their unique use case.

It allows them to choose their own point in the scalability-decentralization-security trilemma. While L2s are fast, they’re still orders of magnitude slower than what’s needed for large-scale DEX operations—and often sacrifice decentralization for speed.

The customizability of an app chain enables dYdX to maximize scalability by having validators run in-memory order books (off-chain), with only matched trades reaching consensus on-chain.

It also enhances decentralization compared to L2s, as both on-chain and off-chain components can be operated by a decentralized network of nodes rather than relying on a single centralized sequencer or other central points of failure.

While a single sequencer doesn’t pose a security risk—since users can always withdraw back to L1—it does represent a liveness risk. For a derivatives DEX, liveness is critical because high leverage means even brief outages could result in user losses and/or bad debt for the protocol.

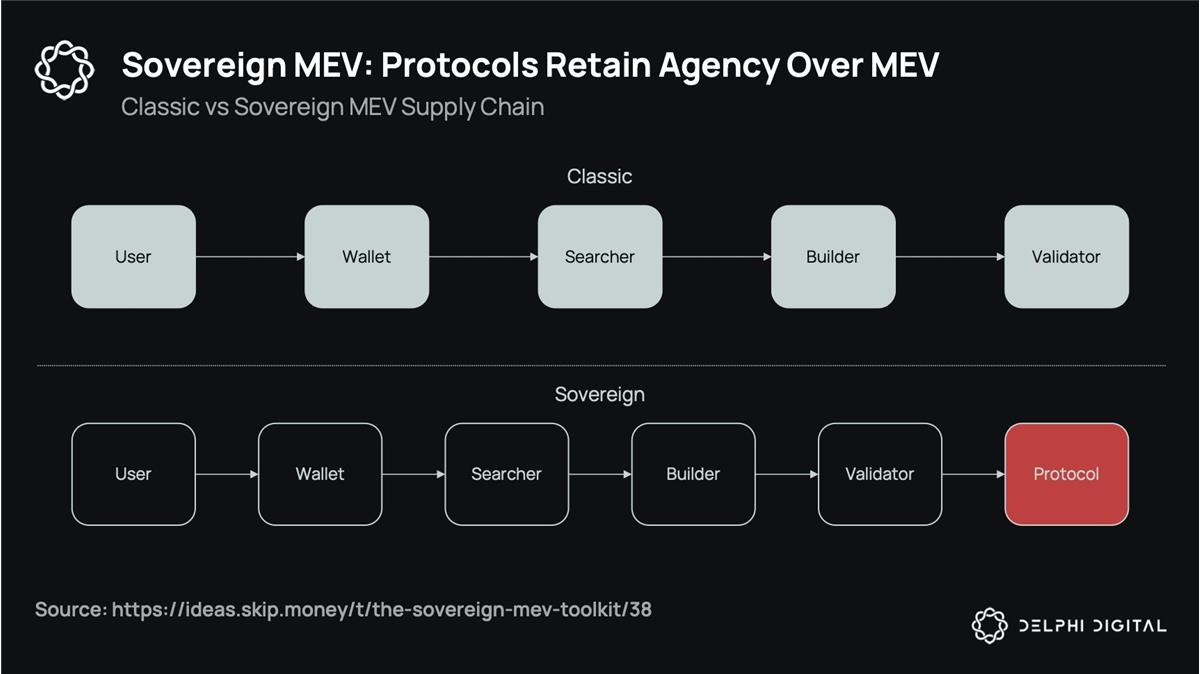

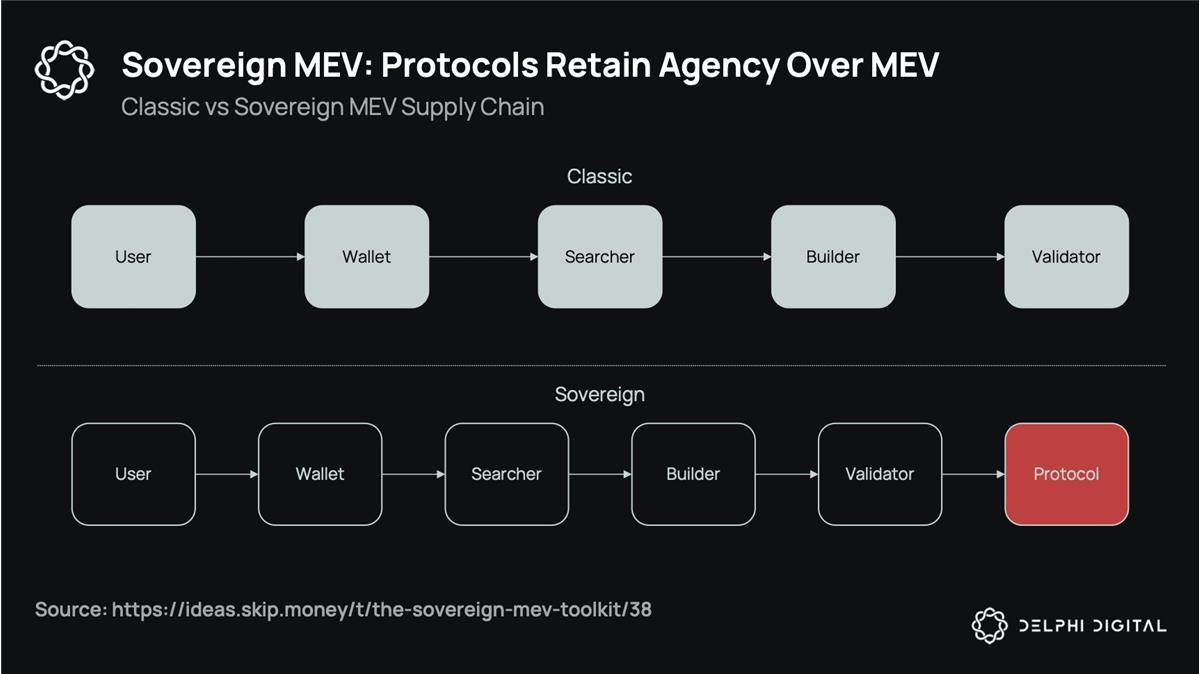

App chains also allow dYdX to explore further innovations: sovereign MEV, mempool encryption, native oracles, and more. All of these reduce external dependencies and capture additional value for stakers and users.

In summary, the launch of dYdX v4 will:

-

Bring significant new users and liquidity to Cosmos;

-

Showcase the power and versatility of the Cosmos SDK tech stack;

-

Set a precedent for other teams aiming to build customized app chain products.

3) Neutron

Neutron is the first general-purpose, permissionless CosmWasm smart contract chain secured by the Cosmos Hub (i.e., $ATOM).

As the name suggests, Neutron positions itself as a “neutral” hub for developers to deploy dApps permissionlessly on Cosmos.

While general-purpose app chains may not align with every narrative, not every dApp needs to become an app chain. Launching an app chain is more expensive and time-consuming than deploying a smart contract. For many dApps that don’t benefit significantly from customization, this cost simply isn't justified.

Juno and Terra previously attempted to fill this role, but neither had the backing of $ATOM to secure them, making them less credible in terms of neutrality compared to Neutron. Beyond offering the highest economic security in Cosmos, the greater advantage may lie in narrative/meme value and philosophical alignment.

Neutron makes dApp deployment easier by incorporating modules directly into its chain binary. It also aims to become a governance and staking hub for cross-chain dApps, such as Mars Protocol and Astroport. This is a clever strategy, as it channels cash flows from various Cosmos outposts back into Neutron, boosting its internal GDP.

Finally, Neutron is built by the P2P Validator team—the founders and core contributors of Lido Finance. This not only signals that one of crypto’s strongest builder teams is focusing on Cosmos, but also strengthens Neutron’s potential as a liquidity hub for LSDs.

4) Sei

Sei is another permissionless smart contract chain. But unlike Neutron, it doesn’t position itself solely within Cosmos—it aims much broader.

Sei aims to become the fastest L1, competing directly with Solana, Aptos, and Sui.

Unlike its competitors, Sei acknowledges a fundamental truth: speculation drives crypto today, and it seeks to build a chain fully optimized for trading.

This means prioritizing speed and throughput (Sei has already achieved 500ms finality and 22,000 TPS on testnet), along with infrastructure like orderbook-matching engines, natively validator-backed oracle price feeds, and frontrunning protection.

But great technology is only half the battle.

Sei understands that winning in DeFi requires not just good tech, but a thriving ecosystem that fosters and fuels speculation.

Learning from other L1s, Sei has developed what I consider the best growth and business development strategy I’ve seen in crypto—rare in general, and even rarer within Cosmos.

As a result, they’ve built a powerful ecosystem via social media in under a year—375,000 Twitter followers and 440,000 Discord members. While it remains to be seen how many will convert to actual chain usage, Sei’s launch could bring a flood of new users and dApps to Cosmos.

5) MetaMask Snaps

MetaMask has 30 million monthly active users—several times more than any other wallet. Beyond native stablecoins, MM integration is undoubtedly the biggest boost to adoption, allowing users to interact with new chains without learning new UX patterns.

Think of MM Snaps (Note: MetaMask Snaps is a system that extends MetaMask’s functionality, allowing developers to add new APIs, support different blockchain protocols, or modify existing features) as an app store where developers can create plugins that users install directly into their MetaMask. Some Cosmos OGs are currently developing a new Snap enabling users to sign Cosmos transactions using their MM.

This will dramatically lower the barrier to entry for interacting with Cosmos. Instead of installing a new wallet, managing new seed phrases, and learning a new interface, users will be able to seamlessly access Cosmos through MetaMask.

At this point, the article is already long enough—but there are still many catalysts unmentioned. Here’s a quick list of others:

-

Privacy chains beyond Secret—such as Anoma, Namada, and Penumbra—are about to launch, potentially positioning Cosmos as the leading privacy ecosystem;

-

Osmosis launching concentrated liquidity and order book features;

-

Injective launching Project X, a one-click platform for fundraising and launching projects on Cosmos;

-

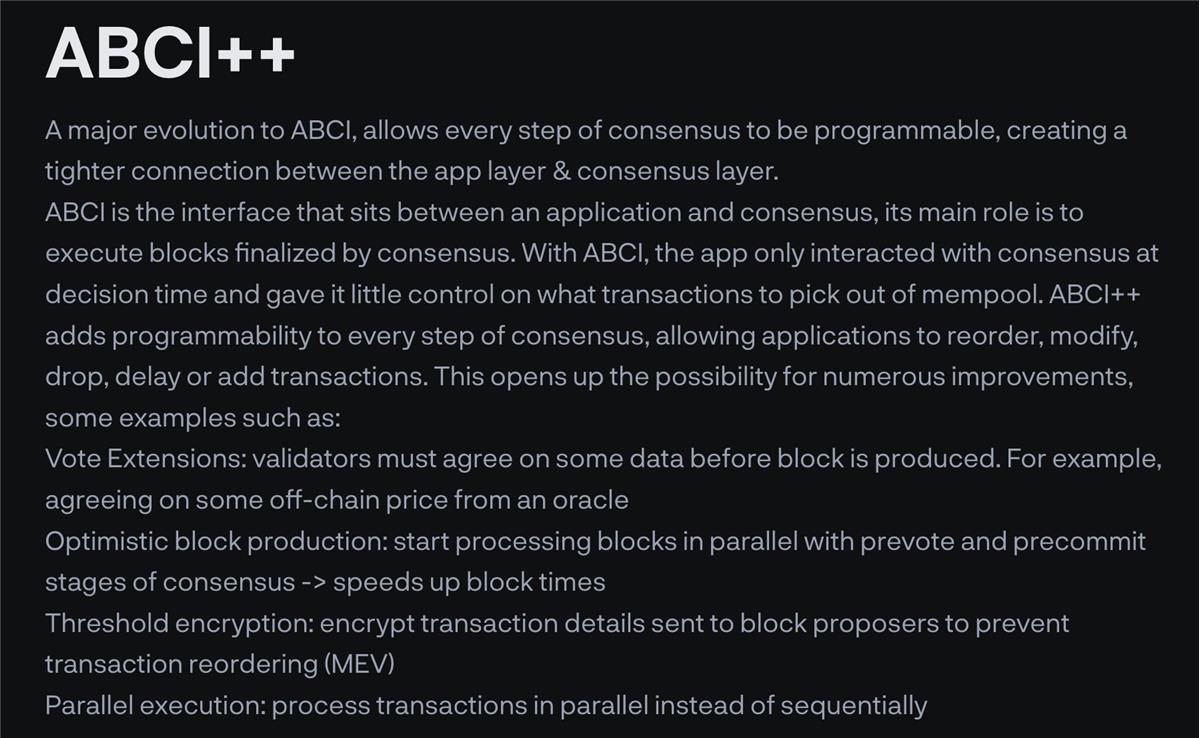

The rollout of ABCI++ will further expand the customizability supported by the Cosmos SDK.

Disclaimer: Delphi Ventures is an investor in dYdX, Sei, Neutron, and Anoma. The author personally holds $INJ and $OSMO.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News