MEV-Burn: The Next Major Upgrade for ETH, Further Reducing Token Emissions

TechFlow Selected TechFlow Selected

MEV-Burn: The Next Major Upgrade for ETH, Further Reducing Token Emissions

When EIP-1559 was implemented on Ethereum in August 2021, it marked the beginning of ETH being burned on the network.

Author: Donovan Choy

Compiled by: TechFlow

When EIP-1559 was implemented on Ethereum in August 2021, it marked the beginning of ETH being burned. This upgrade redirected a portion of transaction fees users previously paid to block validators (known as base fees) to be permanently destroyed instead.

To date, over 3.2 million ETH have been burned under EIP-1559—out of the current circulating supply of 120 million. Ethereum bulls love this mechanism because it makes ETH more scarce and thus more valuable.

But can we burn even more ETH? The next major "ETH burning" upgrade on Ethereum's roadmap is "MEV-Burn," which Ethereum researcher Justin Drake and Dom referred to as the "logical continuation" of EIP-1559 during an episode of the Bankless podcast.

Quick Introduction to MEV

Ethereum’s original protocol design was naive. It assumed users would simply send transactions to neutral block validators for inclusion in blocks. In reality, rent-seeking opportunities in block construction created an exploitable market. This phenomenon is known as MEV—“Maximal Extractable Value.” To date, a total of 566,000 ETH has been extracted from ordinary Ethereum users via MEV.

MEV presents several problems.

First, MEV extracts monetary value from regular users. Second, MEV distorts the incentive structure meant to keep block validators neutral, leading to blockchain instability. MEV bots engage in competitive attacks such as front-running, DDoS attacks, and chain reorganizations—all in pursuit of large MEV rewards.Alternatively, if the MEV reward is profitable enough, ETH stakers on the Beacon Chain might choose to slash their stake. While this scenario is rare, when it does occur, it poses serious risks to Ethereum.

The highly profitable nature of faster transaction execution—and the willingness of arbitrageurs and speculators to pay massive gas fees and create “bidding wars”—is precisely where MEV-Burn aims to intervene.

What Is MEV-Burn?

MEV-Burn is just one part of Ethereum’s broader roadmap to directly address the MEV problem. The solution involves burning the value currently extracted by MEV participants, effectively returning that value to ETH holders. This indirectly redistributes value back to ETH holders, increases scarcity, and reduces sell pressure from block validators.

A secondary goal of MEV-Burn is to reduce chain instability by equalizing MEV profits among block builders—a process also known as “MEV-smoothing.” Ethereum developers aim to make the pursuit of MEV profits predictable and stable, rather than the volatile and competitive race seen today.

Herein lies the challenge—In order to determine how much MEV can be burned, the Ethereum protocol must first find a way to quantify MEV based on what block proposers (also known as builders) would “neutrally” bid in an efficient market. We don’t know these numbers today because the current block-building market operates off-chain and lacks transparency.

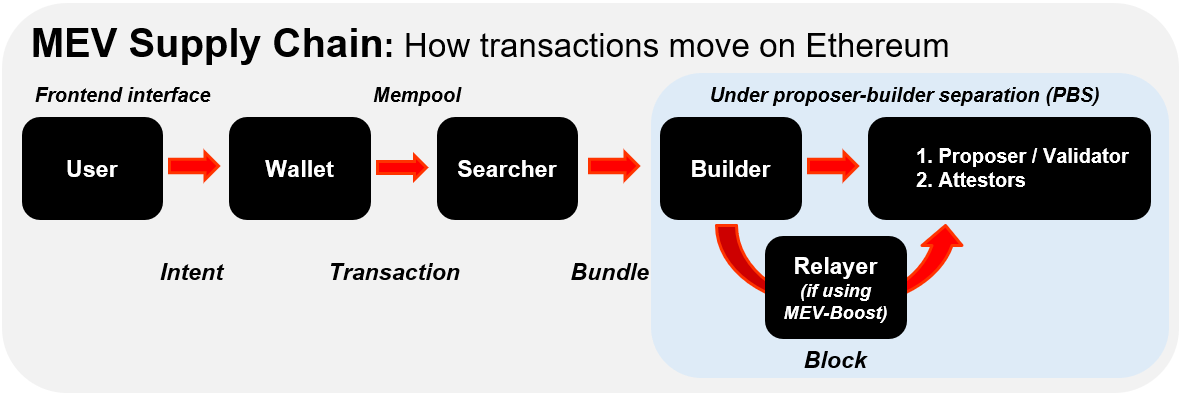

This is why MEV-Burn requires another major Ethereum network upgrade to be completed first: Proposer-Builder Separation (PBS). PBS splits the traditional validator role into two distinct roles: proposers and block builders. The goal of PBS is to prevent block builders from simultaneously choosing and ordering which transactions are included in a block. This separation removes the ability of block builders to discriminate between transactions—the very essence of MEV.

After PBS is implemented, block proposers will no longer be able to determine which transactions are more valuable. Proposers will have no choice but to submit “neutral” bids for blocks assembled by block builders. This market process will exist entirely on-chain, replacing today’s off-chain market supported by third-party software like Flashbots’ MEV-Boost.

Only after all of this happens will the path toward MEV-Burn truly begin. With full visibility into neutral block proposer bids on the Beacon Chain, the Ethereum protocol can then implement MEV-Burn.

Benefits of MEV-Burn

Currently, Ethereum issues 686K ETH annually as rewards to ETH validators. Note that this issuance is complicated by the fact that validators also earn MEV profits, which further increases net issuance. MEV-Burn is expected to reduce annual net issuance by an additional 400K–500K ETH.

Stable MEV profits also mean validators can reinvest capital into staking—especially during bull markets when issuance rewards rise. This expands ETH’s economic bandwidth and preserves capital for dapp collateral, such as decentralized stablecoin backing, lending, and other forms of staking.

Like many Ethereum proposals, MEV-Burn won’t be ready in the short term—it’s envisioned on a 3–5 year horizon. But if the reward for waiting is ultimately emerging from the dark forest of MEV, then the wait may well be worth it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News