How to Maximize Profits on Meme Coins?

TechFlow Selected TechFlow Selected

How to Maximize Profits on Meme Coins?

How to Find, Evaluate, and Invest in Meme Coins?

Written by: Miles Deutscher

Compiled by: TechFlow

$PEPE has surged 375,000x in just 21 days, reshaping many people’s perceptions. So how should we invest in meme coins?

In this article, analyst Miles explores how to discover, evaluate, and invest in meme coins, offering strategies to maximize returns while minimizing risk.

When you buy any token, you do so on the premise that someone in the future will be willing to buy it from you at a higher price.

This is even more true for meme coins, which rely far more on psychological drivers than fundamentals.

In economics, this is known as the "greater fool theory"—the idea that "investors try to build castles in the air and focus more on potential future price increases than estimating intrinsic value."

But of course, this is gambling—meme coins have weaker fundamental drivers than typical investments. Therefore, you must treat meme coin investing as gambling.

You can think of meme coins as games inside a casino, while Layer-1s like Ethereum + exchanges act as the house. And the house always wins.

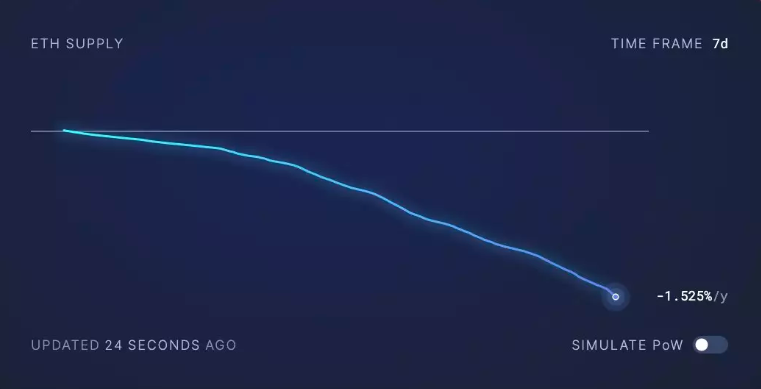

We've seen this over the past week—the amount of $ETH burned has significantly increased. More on-chain activity = more $ETH burned.

However, the key difference between meme coins and pure casino games lies here:

When you place a bet on a roulette spin, the house automatically holds about a 5.26% edge. But when investing in meme coins, there are ways to tilt the odds more in your favor.

Granted, memes are harder to predict than other trades due to numerous unknown variables affecting their success. But you can take several steps to improve your edge:

1. Monitor outperforming coins.

Check sites like DEXTools' top gainers section to identify which memes are performing well from a price perspective. Only invest in rising memes.

2. Confirm the token has strong cultural resonance.

Meme coins succeed only if they have a strong community. In the meme space, community outweighs all other variables. A meme must be fun, engaging, and easy to understand. Here are several ways to track a token's social performance:

• Monitor social metrics on Lunar Crush

• Determine whether the token is being discussed across social circles such as Twitter, Telegram, and Discord

• Is the token trending on Twitter, Google, DexTools, or CoinGecko?

3. Research fundamentals.

Ask yourself:

• Who is the team? Are they doxxed? If not, what evidence shows their ability to generate hype?

• What is the tokenomics like? Are there mechanisms for dilution or burning?

Honestly, these questions aren’t that important when it comes to meme coins. Still, doing some basic research is worth the effort to gain an edge.

One of the biggest risks in this space is rugs and scams. While you can't completely avoid them, two tools can help reduce exposure:

-

Run audits through Token Sniffer;

-

Use Bubblemaps to assess wallet distribution;

4. Decide whether to follow leaders or participate in rotation plays.

Leaders typically have higher market caps and lower risk.

For example, $DOGE is the leader among "Inu" coins. Now, $PEPE is the leader among "Frog" coins.

New liquidity flows first into the leader, then spreads to smaller coins within the niche. When liquidity moves within a specific sector, profits from smaller coins often flow back into the leader.

The second approach is participating in rotations—investing in smaller-cap coins emerging beneath the leader. This can yield solid returns if timed correctly, but carries higher risk due to the reasons mentioned above.

5. Follow the smart money.

To spot new meme opportunities, see what whales and successful meme traders are buying:

1. Go to Etherscan and examine early buyers of successful meme coins like $PEPE;

2. Use Lookonchain to identify other "smart money" wallets;

3. Track their wallets on DeBank to see what they’re purchasing;

4. Use these purchases as a basis for further research (identify patterns).

Now assume you’ve completed your research and selected a coin to buy. How should you execute the trade (entry and exit)? I use a three-step plan:

1. Treat it like a casino.

Investing in meme coins is fun, and you might get extremely lucky. But treat it exactly like a casino visit. If you don’t, you’re highly likely to allocate too much capital to memes.

2. Use a separate wallet for meme trading.

Don’t mix your investment funds with your meme coin funds. This helps keep your strategies distinct and reduces emotional stress.

3. Use technical analysis to help identify entry points.

Accurate technical analysis is difficult due to limited liquidity and lack of historical price data. But I find using charts to create some kind of plan helpful—it prevents blind entries.

Additionally, consider dollar-cost averaging into positions instead of going all-in at once.

Now suppose you’ve made profits. It’s time to take gains. What’s the strategy? Meme coins can change your life in a short period. But make sure you actually use those gains to improve your life.

Take profits early.

A simple rule: after doubling your position, withdraw your initial capital. That way, you're now trading with "the house’s money." Technically, the remaining capital is still yours, so holding isn’t truly "risk-free"—but at least you've locked in profit on the original stake.

After each additional 2x, I exit a predetermined percentage.

If you’re more degenerate, you can choose lower thresholds—for example, sell 20% or 30% every time the price increases by 100%. This strategy works well until the peak forms. After that, you may face severe drawdowns. However, certain indicators signal that a top may be forming, allowing you to reduce exposure accordingly.

These include:

• 24-hour trading volume exceeding market cap;

• Declining number of holders, or significantly slowing holder growth;

• Large whales starting to sell;

• Funding rates shifting from negative to positive.

However, no method guarantees 100% accurate top prediction. Hopefully, the above indicators can help you reduce risk when warning signs appear.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News