"Grassroots" Rise Through MEME: Unveiling the NFT Forces Behind PEPE

TechFlow Selected TechFlow Selected

"Grassroots" Rise Through MEME: Unveiling the NFT Forces Behind PEPE

"Unexpected vinegar," the PEPE legend reignites everyone's anxiety over others' get-rich stories.

Produced by: TechFlow

Author: 0xmin

"Out of the blue," the PEPE legend is once again making people anxious with stories of others getting rich.

Every time this happens, numerous articles emerge using highly academic theories to justify the rationality of MEMEs—stories, emotions, triggers, and so on. But in my view, the success of MEME coins lies precisely in their simplicity, directness, and honesty—free from incomprehensible technical jargon or false marketing. They attract attention instantly with zero cognitive barriers. A key feature of the crypto industry is the financialization of attention and traffic—the competition lies in who can best capture public attention through narrative and price action.

MEMEs are also rebellious—they represent mockery, satire, and grassroots resistance.

One type is a top-tier project, at the forefront of technology, claiming to change the world, backed by elite VCs. Naturally, most tokens are held by the project team and VCs. The tokenomics are aggressive: minimal circulation, high FDV, with continuous selling by insiders, leaving retail investors to bear the brunt as liquidity providers.

The other is a pure MEME project—no utility, no technological foundation, transparent and fair token distribution, where everyone participates in the liquidity pool on equal footing.

As a retail investor, how do you choose between the two?

At least for now, it's nearly impossible for retail investors to get rich off high-FDV VC-backed projects. In contrast, MEMEs, with their exaggerated wealth stories, have become a lifeline for many underdogs to turn their fortunes around—much like early Bitcoin, which had no utility but allowed fair acquisition (through mining), gained fame through repeated tales of rags-to-riches, and gradually became an industry consensus.

Another overlooked factor is that every successful MEME relies on a "big brother"—another name for what we might call a "whale" or "market maker."

Undeniably, Doge’s “big brother” is Elon Musk—the public promoter. Shib’s early boost also came from Musk, whether intentional or not, followed by massive inflows from whales and market makers like Jump Trading, which helped build its substantial market cap.

Who is the big brother behind PEPE?

By analyzing numerous top PEPE holding addresses, we found that many early buyers held a specific NFT—Milady.

For example, the address Dimethyltryptamine.eth, which bought 0.125 ETH worth of PEPE on day one, holds large amounts of Milady and its sister project remilio. This address has already cashed out over $6 million and still holds PEPE worth more than $9.7 million.

Moreover, one of the new multi-sig wallets managing 6.9% of PEPE’s total supply received its first ETH from a chain address that holds significant quantities of Remilio, a sister project to Milady.

According to Milady holders, they first discovered and purchased PEPE as early as April 17. Additionally, many Milady holders who profited from PEPE reinvested their gains back into Milady, causing its floor price to surge recently despite an otherwise sluggish NFT market.

In short, for a MEME to succeed, it needs not only a compelling story but also a powerful backer. It is now confirmed that an NFT community along with Chinese expatriates based in Dubai formed an early coalition to buy PEPE, serving as a crucial driving force behind its initial rise.

How do you spot a promising MEME?

Execution and information access are both essential—and sometimes, a bit of serendipity helps too.

The key is early detection—either off-chain or on-chain.

-

Off-chain: Rely on Twitter or communities. Follow quality Twitter accounts and community updates, staying curious and attentive to early alpha projects being discussed.

-

On-chain: Use insights from influencers like @lookonchain or conduct your own research to identify early buyers of a token. Tag these addresses and track their on-chain purchasing behavior and portfolio changes.

Below are some tools I frequently use:

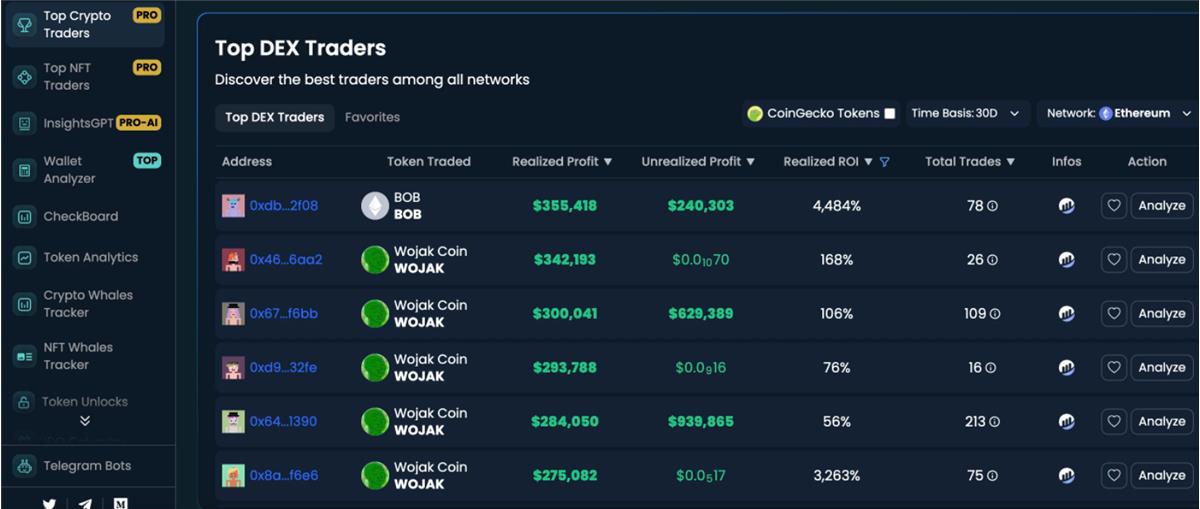

https://dexcheck.io/ @DexCheck_io

Discover which tokens/NFTs current traders are actively trading and profiting from. Track whale movements and perform on-chain analysis (code audits, holder distribution) for individual tokens.

https://dexscreener.com/ethereum @dexscreener

A DEX visualization and aggregation platform that shows which coins are currently trending across decentralized exchanges.

https://debank.com/ @DeBankDeFi

Track on-chain portfolio changes of smart money.

https:// bubblemaps.io @bubblemaps

Visualize token holder distribution. If a token is overly centralized—controlled by just a few wallets—be cautious.

MEME coins are full of scams. Use this tool to detect whether a project is a honeypot.

Finally, wishing you all good luck and riches in the world of MEMEs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News