Daos.World: A New Wave of DAO Fund Frenzy Sweeps Through the MEME Community

TechFlow Selected TechFlow Selected

Daos.World: A New Wave of DAO Fund Frenzy Sweeps Through the MEME Community

This article will analyze the characteristics, potential, and risk factors of this emerging platform from multiple dimensions, including platform architecture, operational mechanisms, and participation methods.

Compilation: Yuliya, PANews

Following the popularity of Daos.fun—a DAO fundraising platform launched by ai16z—an innovative new DAO fund launchpad called Daos.World has recently attracted significant attention. Deployed simultaneously on Base and Solana (daos.fun), the platform introduces a novel paradigm for decentralized investment management through its operational model and mechanisms. This article analyzes the emerging platform from multiple dimensions including architecture, operation mechanisms, participation methods, as well as its potential and risks.

Core Platform Architecture

Daos.World adopts a three-layer architectural framework:

-

Fund Management Layer: The platform utilizes smart contracts for fund custody, ensuring fund security and operational transparency. All funds are held in smart contracts to prevent centralized control.

-

Token Economics Layer: The platform issues an ERC20 token with a total supply of 1.1 billion, allocating 1 billion tokens to fundraising participants and 100 million to establish a Uniswap V3 liquidity pool, thereby forming a complete token ecosystem. The liquidity pool features a price floor mechanism that ensures the value of assets within the pool never falls below the amount of raised ETH, providing investors with fundamental protection.

-

Governance Layer: The platform implements a fund expiration mechanism. Upon expiration, all trading activities halt and assets in the fund pool are distributed among investors proportionally based on token holdings. Fund managers retain flexible administrative rights, including the ability to extend the fund's maturity date, thus safeguarding investor interests under specific circumstances.

Operating Mechanism

The platform’s workflow is designed to be simple and efficient, consisting of the following key steps:

1. Fundraising and Fund Management: Initial capital is raised in ETH via a presale. All funds are deposited into a treasury controlled by the DAO manager, who holds full autonomy to conduct trades and investment operations according to market conditions.

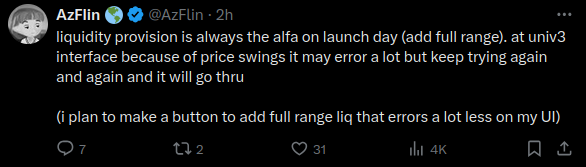

2. Liquidity Pool Design: After listing on Uniswap V3, the platform employs a single-sided liquidity pool—containing only the fund token—to ensure effective price discovery. Token trading occurs through this pool, with the platform charging a 1% transaction fee: 0.4% goes to the fund manager and 0.6% to the platform. Trading activity directly influences the token’s “true” price, helping traders make more informed decisions.

3. Transaction Fees and Incentive Mechanism: Fund managers earn 0.4% of trading volume as fees, while the platform collects 0.6%. Additionally, managers may receive performance-based profit sharing upon fund maturity, depending on fund performance.

4. Liquidity Pool Price Floor Protection: The liquidity pool includes a price floor mechanism that ensures the total asset value within the pool never drops below the initial amount of ETH raised, mitigating severe asset depreciation caused by market volatility.

Participation Methods

The platform offers differentiated return models for various participant types:

-

Fund Managers: In addition to earning transaction fees, fund managers may receive additional profit-sharing upon fund maturity based on performance.

-

Early Investors: Presale participants gain lower-risk investment opportunities, receiving token allocations proportional to their ETH contributions. They can also choose to provide liquidity for additional returns.

-

Liquidity Providers (LPs): Due to limited initial liquidity, LPs may achieve substantial annualized returns—potentially exceeding 1000%. However, they must remain cautious about market volatility, which could impact trading timing and profitability within the liquidity pool.

Technological Innovation

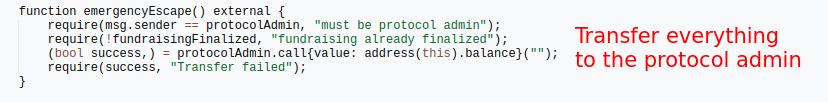

From a technical perspective, the platform uses smart contracts for fund custody. Fund managers execute investment actions via the onlyOwner execute() function, enabling them to invoke other smart contracts to implement DeFi strategies. Uniswap V3 liquidity NFTs remain locked until fund maturity, ensuring liquidity stability. An emergency exit mechanism serves as an initial safety feature, allowing activation during the fundraising phase if vulnerabilities are detected, preventing fund loss. Once the presale concludes and tokens go live, the platform loses intervention capabilities over fund flows, necessitating robust security measures post-stabilization.

The platform also enables fund managers to interact with various on-chain smart contracts based on market conditions, opening broad possibilities for implementing DeFi strategies such as leveraged trading, cross-protocol arbitrage, and yield farming. This enhances investment flexibility and efficiency, allowing managers to swiftly adapt strategies in response to market changes.

Risks and Outlook

Despite its promising outlook, investors should remain vigilant about several risk factors:

-

Fund Manager Investment Risk: Investment decisions by fund managers may carry substantial risk, especially when allocating to immature or poorly performing assets. For example, investing heavily in highly volatile meme coins that sharply decline could result in the fund’s underlying value dropping to zero and token devaluation.

-

Potential Smart Contract Risks: Although the platform’s smart contracts have undergone audits, unknown vulnerabilities or technical flaws may still exist. Investors should exercise caution.

-

Liquidity Risk from Market Volatility: With initially low liquidity, market fluctuations can significantly affect token prices and trading timing. Liquidity providers must bear the associated market risks.

Nonetheless, the platform effectively addresses many challenges faced by traditional meme coins, particularly in securing foundational value and defending against launch-time attacks. Looking ahead, as the platform evolves and expands its ecosystem, it holds promise to deliver more mature solutions for decentralized fund management.

Emergency Exit Function

The platform’s smart contract includes an emergency exit feature active during the fundraising phase. It allows fund protection in case of discovered vulnerabilities or anomalies. This mechanism ensures investors can safely withdraw if issues arise. However, this function becomes inactive after the presale ends, meaning investors must closely monitor platform security during the active period. As the platform matures, this feature may be further refined to enhance overall security.

Conclusion

Daos.World represents an innovative experiment in decentralized fund management, achieving a balance between efficiency, security, and flexibility through carefully designed mechanisms. With its unique tokenomics, flexible fund management, and diversified incentive structures, the platform offers cryptocurrency investors multiple avenues for profit. Nevertheless, investors should thoroughly understand the platform’s mechanics and carefully assess associated risks before participating, making rational investment decisions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News