Analyzing Chronos: A ve(3,3)-based DEX, a key piece of the Arbitrum ecosystem

TechFlow Selected TechFlow Selected

Analyzing Chronos: A ve(3,3)-based DEX, a key piece of the Arbitrum ecosystem

Before Chronos, Arbitrum had not yet witnessed the true power of the ve(3,3) flywheel.

Written by: Aylo, Alpha Please

Translated by: TechFlow

Liquidity is the foundation of DeFi. Chronos is an Arbitrum-based decentralized exchange (DEX) aiming to provide more stable and sustainable liquidity through its maNFT LP model and ve(3,3), positioning itself as a potential primary liquidity layer for Arbitrum.

This is a community-driven launch with no venture capital, seed round, or private token sale. Let’s follow analyst Aylo’s insights to dive deep into Chronos.

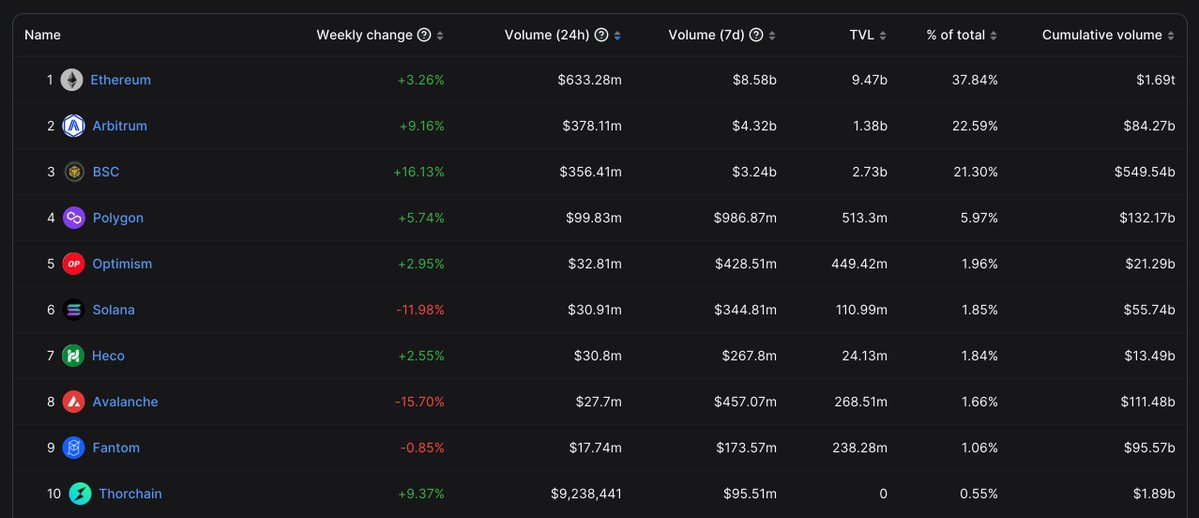

Over the past year, Arbitrum has been one of the chains I’ve closely watched. It currently ranks second in DEX trading volume, and all key metrics continue to rise sharply.

However, one thing has been missing on Arbitrum: a ve(3,3) DEX.

Enter Chronos—potentially one of the most important protocols on Arbitrum in the coming months. Velodrome achieved massive success on Optimism and became the dominant liquidity layer on that chain. Chronos could replicate that success on Arbitrum.

So what is Chronos?

Chronos is a ve(3,3) DEX inspired by Solidly, Thena, Equalizer, and others. While it shares similarities with these platforms, it also introduces key innovations.

And this "difference" might be the key to dominating liquidity.

After analyzing the successes and failures of other ve(3,3) DEXs, the team built a new model—combining strengths, addressing weaknesses, and introducing novel mechanisms to enhance liquidity retention. We’ll explore their key differentiators shortly.

They believe their model realigns incentives so that everyone in the Chronos ecosystem benefits, fulfilling Solidly’s original vision.

Why ve(3,3)?

Let’s revisit four core problems with traditional DEXs:

1. Traditional DEXs like Uniswap often struggle to attract sufficient liquidity providers (LPs), especially for new trading pairs, because trading fees alone are insufficient.

To address this, many DEXs introduced liquidity mining with native token emissions—but over time, this approach has often destroyed token value. Since the experimental DeFi Summer days, markets have matured.

2. DEX governance token holders find it difficult to redirect income from LPs to the protocol, as doing so may drive LPs away and reduce liquidity. If liquidity dries up, trading volume and fees suffer. This is a major issue for existing DEX protocols that eventually need to generate returns by selling tokens to sustain operations.

3. Innovations like Uni v3’s concentrated liquidity pools help increase LP revenue for blue-chip token pairs. However, the same fundamental issues persist.

4. Concentrated liquidity pools don’t work well for most long-tail assets—especially those still in price discovery phases—because LPs may face significantly higher impermanent loss when concentrating positions.

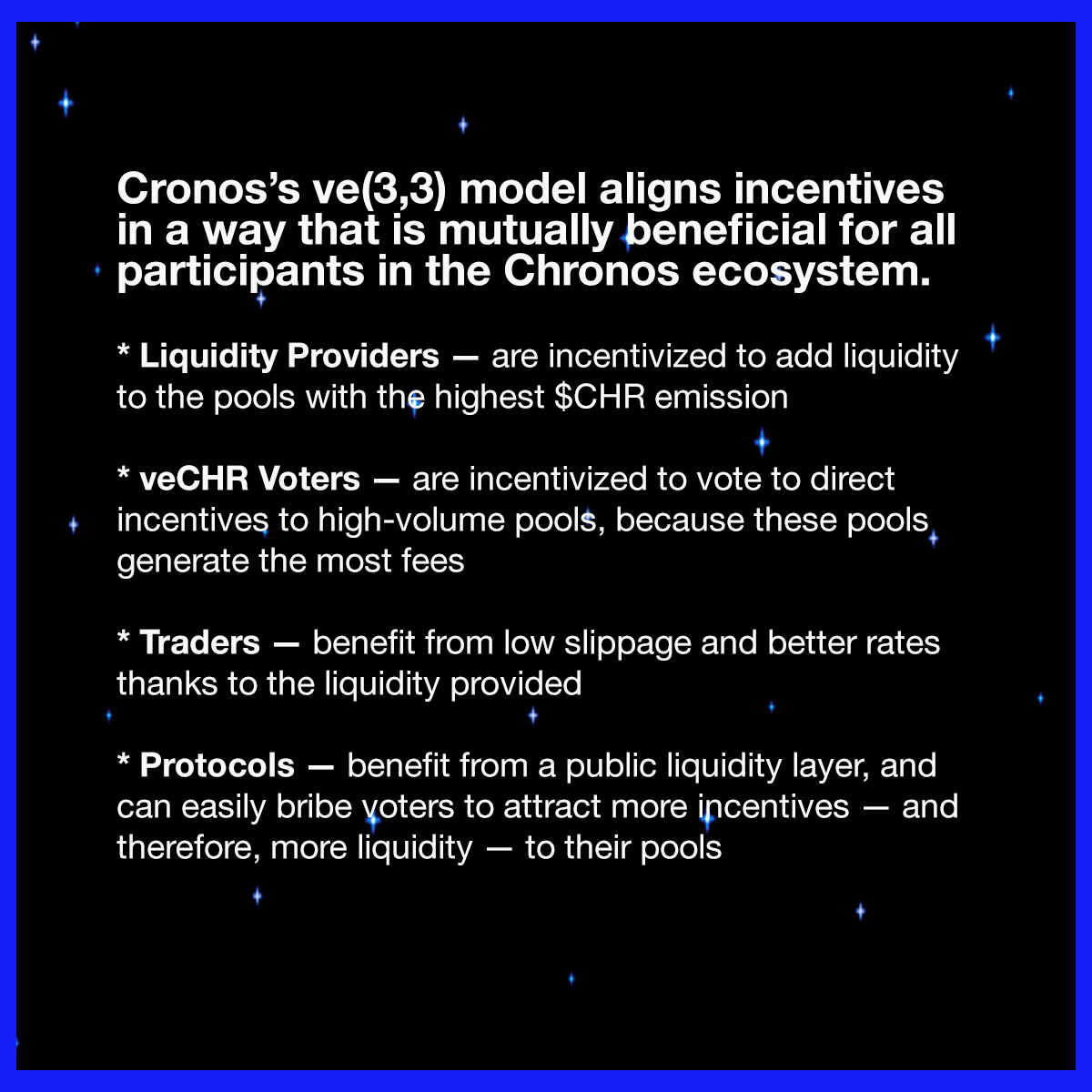

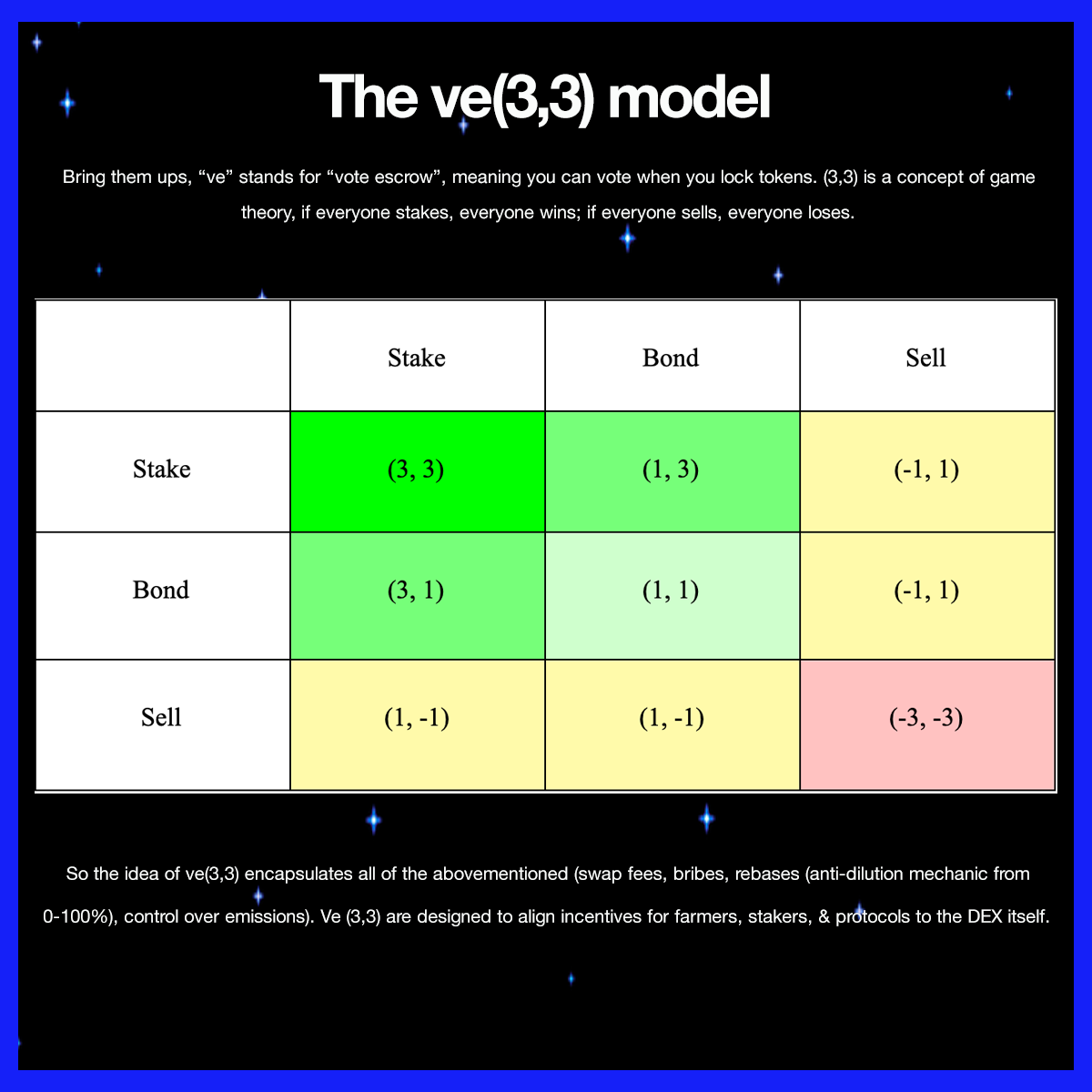

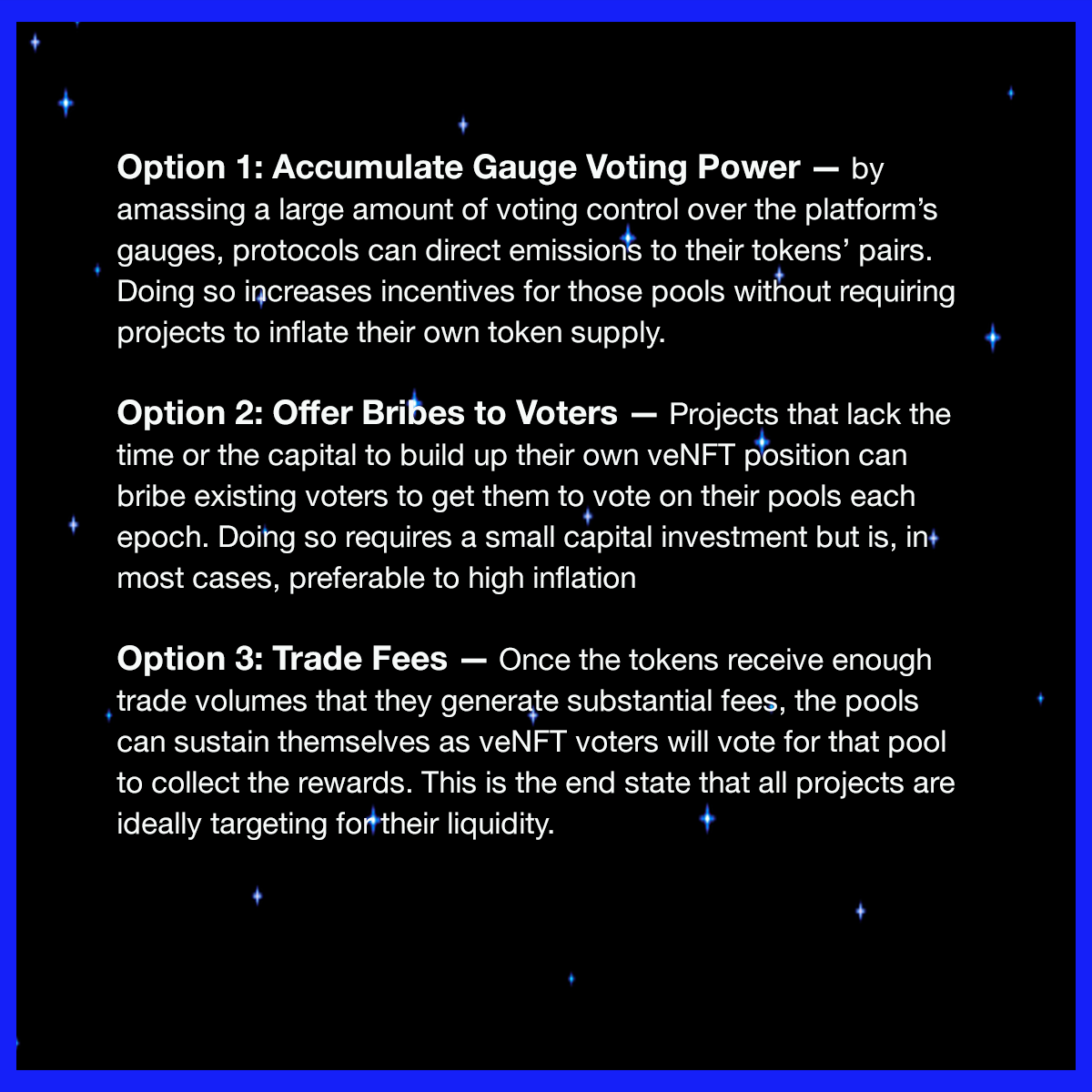

Thus, as we know, the ve(3,3) model successfully aligns incentives across all participants. For projects seeking to incentivize token liquidity, achieving the right balance between short-term and long-term incentives remains challenging.

ve(3,3) shifts incentives to the “liquidity layer.” Projects can offer LPs new incentive options in a more economical and sustainable way over the long term.

For the DEX itself, all of the above is beneficial. Incentivizing protocols and participants to lock their emissions helps protect the native token’s price, enhancing its value. This creates a beautiful “flywheel effect.”

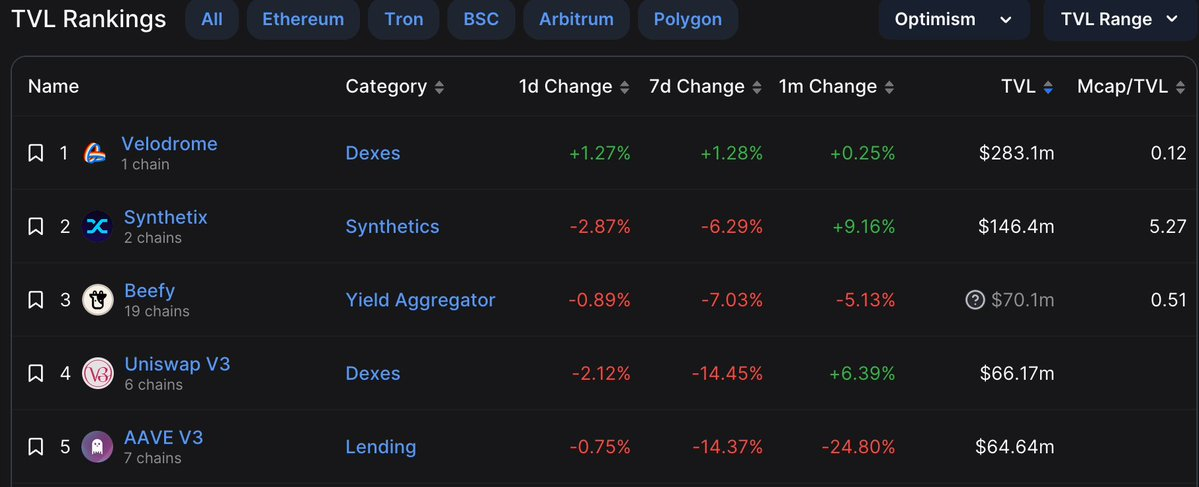

How is Chronos different?

We’ve seen many ve(3,3) iterations—so why am I bullish on Chronos? While previous mechanisms helped attract token liquidity, they haven’t been as effective at retaining liquidity over extended periods.

“Speculative capital” still chases high APRs. Although the ve(3,3) model effectively draws capital into the DEX, it’s less effective at keeping that capital locked in.

APR fluctuates between epochs, causing LPs to move their capital to whichever pool offers the highest returns. Liquidity becomes unstable, making it hard for protocols to forecast liquidity needs and provide appropriate incentives to meet their goals.

While the ve(3,3) model aligns incentives among participants, it fails to align LPs with the protocol’s long-term success. The Chronos team identified a critical flaw in the flywheel:

“The moment the token price drops, LP incentives decline, and TVL flees elsewhere in pursuit of better yields.”

This is a fundamental weakness, and Chronos aims to fix it.

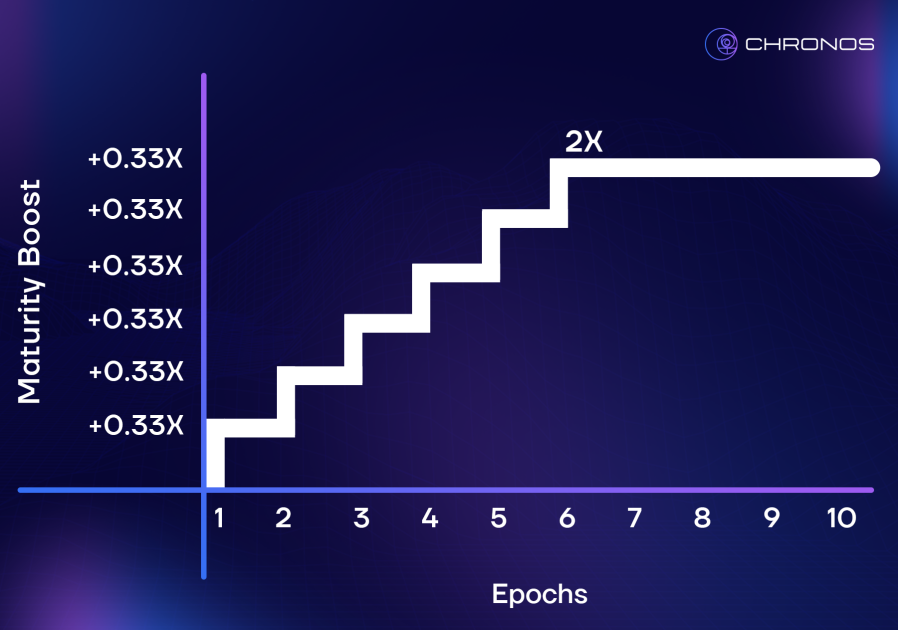

Chronos is introducing maNFTs (maturity-adjusted liquidity positions)—a special type of fNFT issued to users who deposit liquidity on the DEX in exchange for LP tokens. These maNFTs track both the deposited tokens and the duration since the LP tokens were staked.

Over time, maNFTs can increase $CHR emissions, reaching up to 2x after 6 weeks. The potential yield grows linearly, ensuring new LP stakers receive a fair share of rewards that scale with Chronos’ growth.

Users can withdraw liquidity at any time without penalty but will forfeit previously earned reward boosts. maNFTs can also be sold on NFT marketplaces, creating a time value for liquidity.

The maNFT LP model introduces a time-value component to LP positions, creating stickier and more resilient TVL, maximizing support for $CHR emissions—benefiting both LPs and the protocol.

Overall, this encourages LPs to maintain their positions longer, fostering a more stable ecosystem.

At Chronos, time is money—LPs earn higher returns for staying longer.

Chronos Partnerships

To get off to a strong start, Chronos needed multiple protocols to commit early by pledging to receive veCHR airdrops (locked for 2 years).

Their business development efforts have been highly active, securing 32 confirmed partners.

CHR Tokenomics and Airdrop

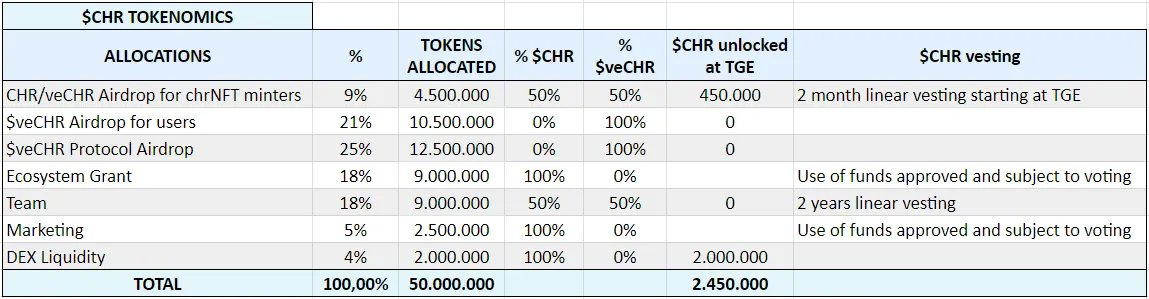

Chronos plans one of the most exciting airdrops in the ecosystem, targeting over 16,000 participants with 53% of the initial supply allocated.

On day one of the exchange launch, the supply distribution based on liquidity, allocation, and locked tokens will look like this:

I’ve been waiting for Chronos to complete its full audit before writing anything about it.

Now, they’ve passed the Certik audit and resolved all major issues. Of course, this doesn’t mean zero smart contract risk, but having a full audit provides significant reassurance.

In summary, in the words of the Chronos team:

“Before Chronos, Arbitrum had not yet witnessed the true power of the ve(3,3) flywheel.”

Project link: https://twitter.com/ChronosFi_

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News