Will 17 million ETH ($28 billion) be unstaked after the Shanghai upgrade?

TechFlow Selected TechFlow Selected

Will 17 million ETH ($28 billion) be unstaked after the Shanghai upgrade?

Factors influencing exit decisions, the role of liquid staking in the market, and the potential impact of the upcoming Shanghai upgrade.

Written by: Salazar.eth

Translated by: TechFlow

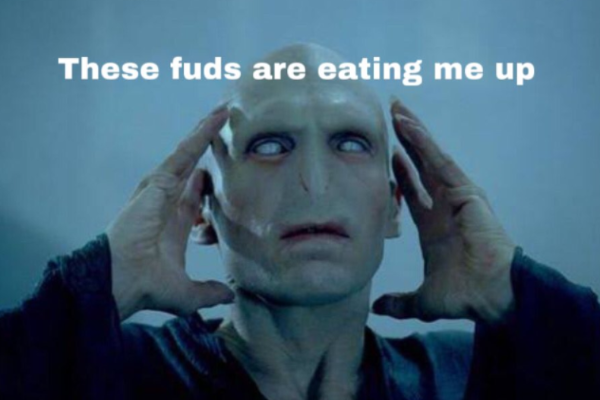

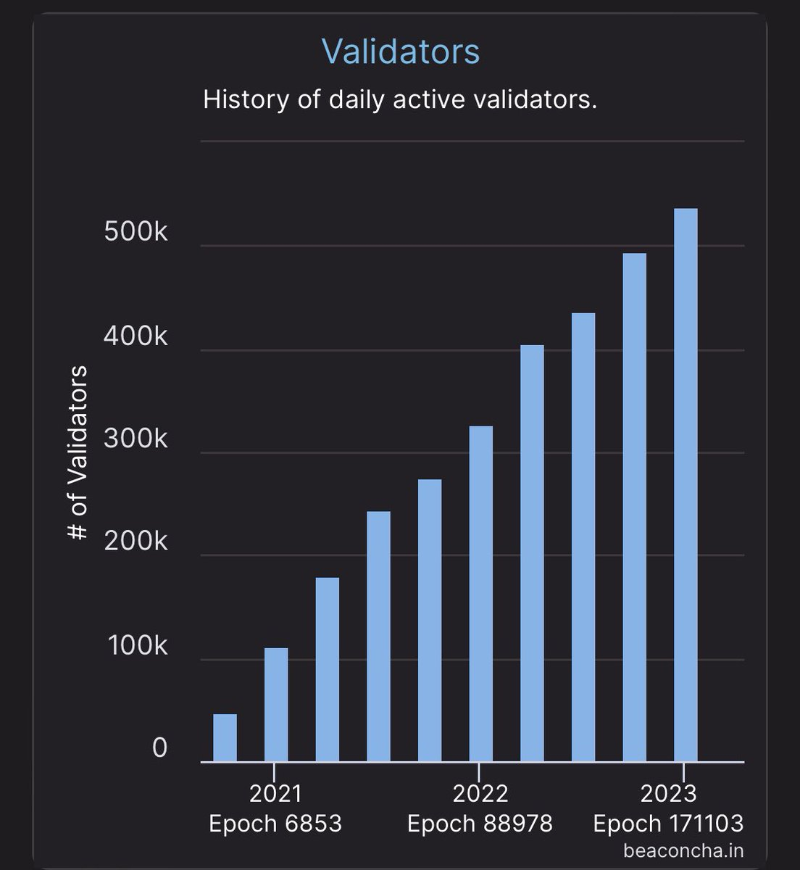

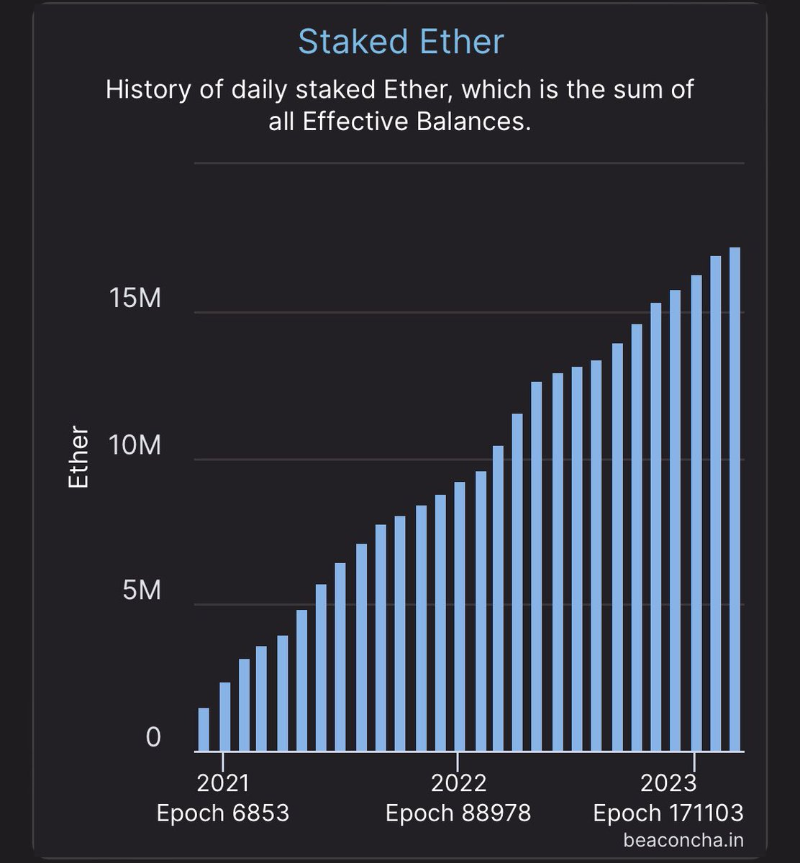

As the Ethereum network continues to evolve, staking on the Beacon Chain has created new opportunities for investors to earn yields and support the network. Currently, over 17 million ETH are staked, and the impact of withdrawals on the market remains a topic of interest. In this article, we will explore the factors influencing exit decisions, the role of liquid staking in the market, and the potential implications of the upcoming Shanghai upgrade.

The media and FUD merchants tell you that 17 million ETH (worth approximately $28 billion) will be unstaked during the Shanghai upgrade—but will they really? I’ll show you the truth through data.

The Shanghai upgrade is an EL (Execution Layer) upgrade for ETH, while Capella refers to the CL (Consensus Layer), or Beacon Chain, upgrade. However, since these upgrades occur simultaneously, "Shanghai" refers to both. Although Shanghai includes several EIPs, the most significant one is ETH withdrawals. Since the Beacon Chain launched in December 2020, validators have been able to stake ETH but could not initiate withdrawals—this has placed social pressure on EF developers.

Following the regular All Core Developers Call (ACDC) in December last year, ETH withdrawals were originally scheduled for March 2023. However, it has now been postponed to April. Now, let's dive into the details.

Due to the design of The Merge and the integration between the Beacon Chain and ETH, all validators must update their withdrawal credentials to the 0x01 format to perform withdrawals. According to Benjaminion, an ETH core developer, there are currently around 302,154 validators with 0x00 credentials and 186,722 validators with 0x01 credentials.

Once the Shanghai upgrade is implemented, the ETH network will process 16 full or partial withdrawals per block, with each block taking 12 seconds to produce. This means the network would require approximately 104 hours to process withdrawals for all ~500,000 validators on the Beacon Chain. It should be noted that only validators with 0x01 credentials will be eligible for withdrawals.

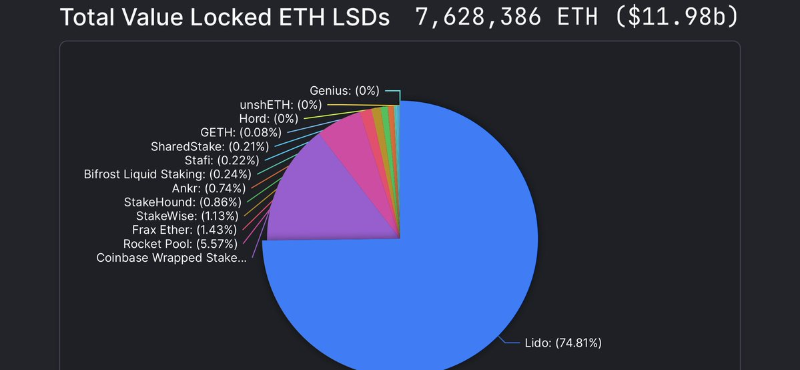

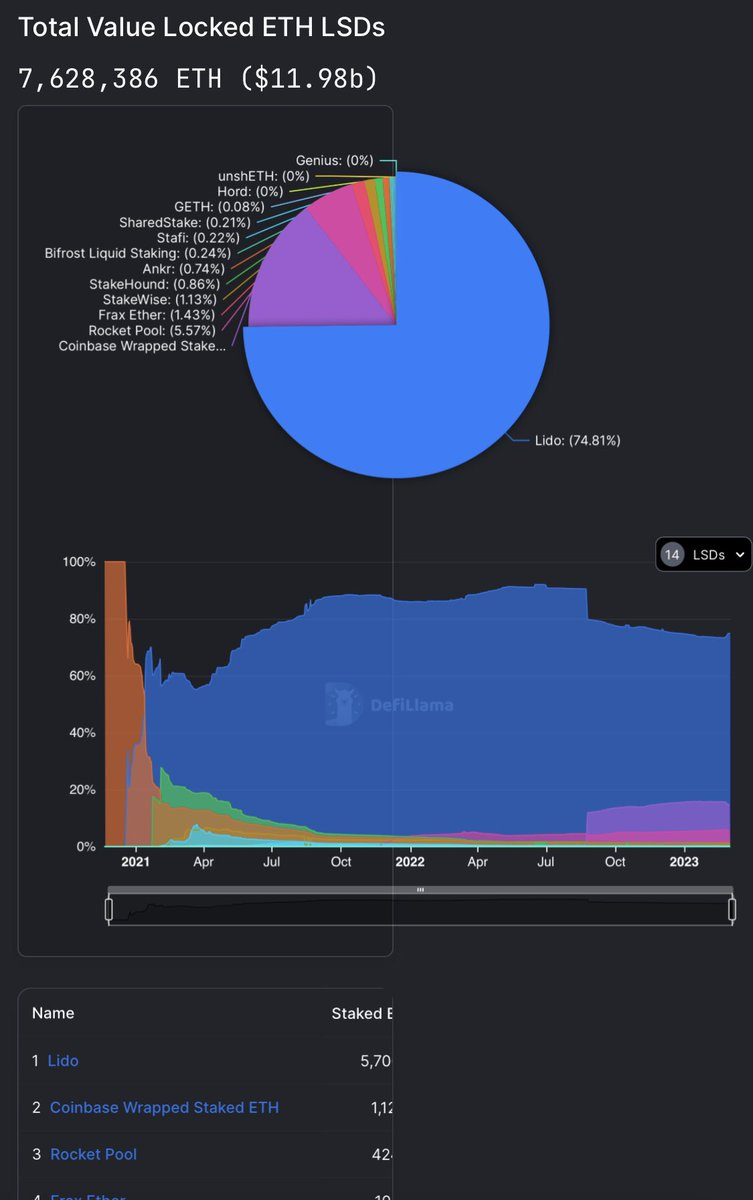

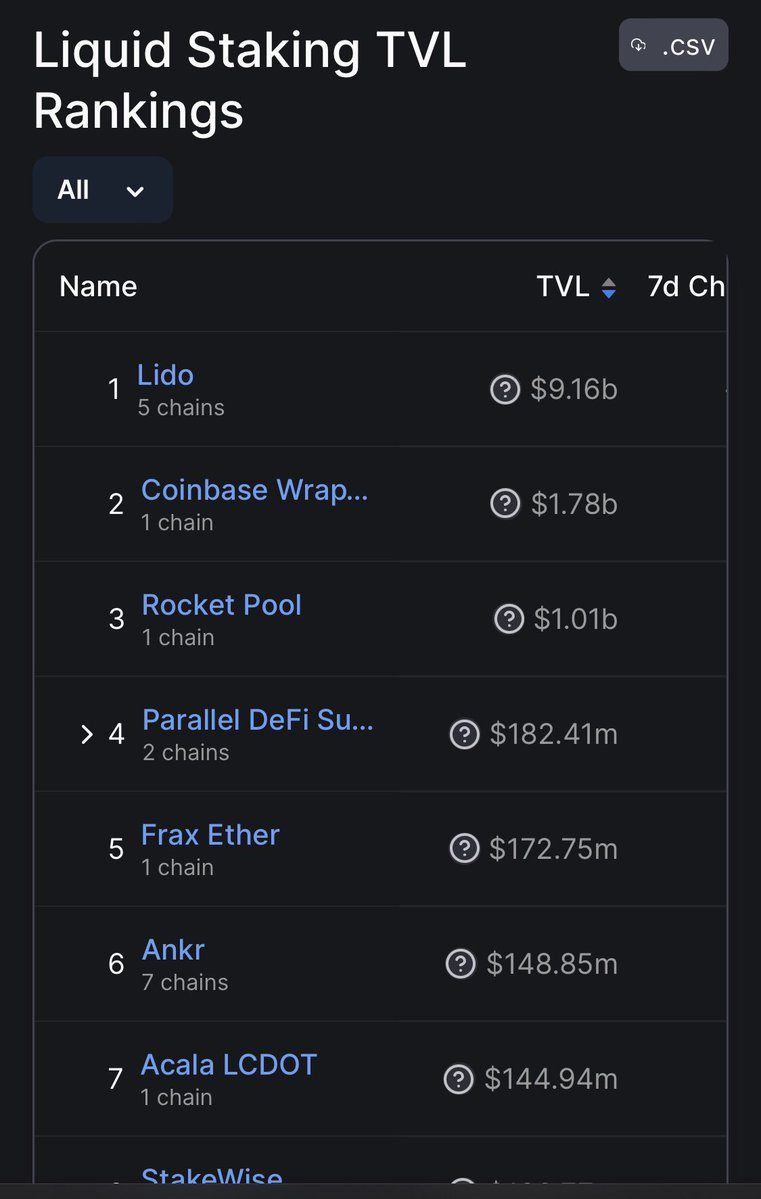

Yes, 17.2 million ETH—but here’s an important addition. According to Defillama data, LSDs have staked 7.6 million ETH. That means 7.6 million ETH have remained illiquid. Now let’s do some simple math: 17.2 million ETH - 7.6 million ETH = 9.6 million ETH.

The question is: Will these 9.6 million ETH be withdrawn?

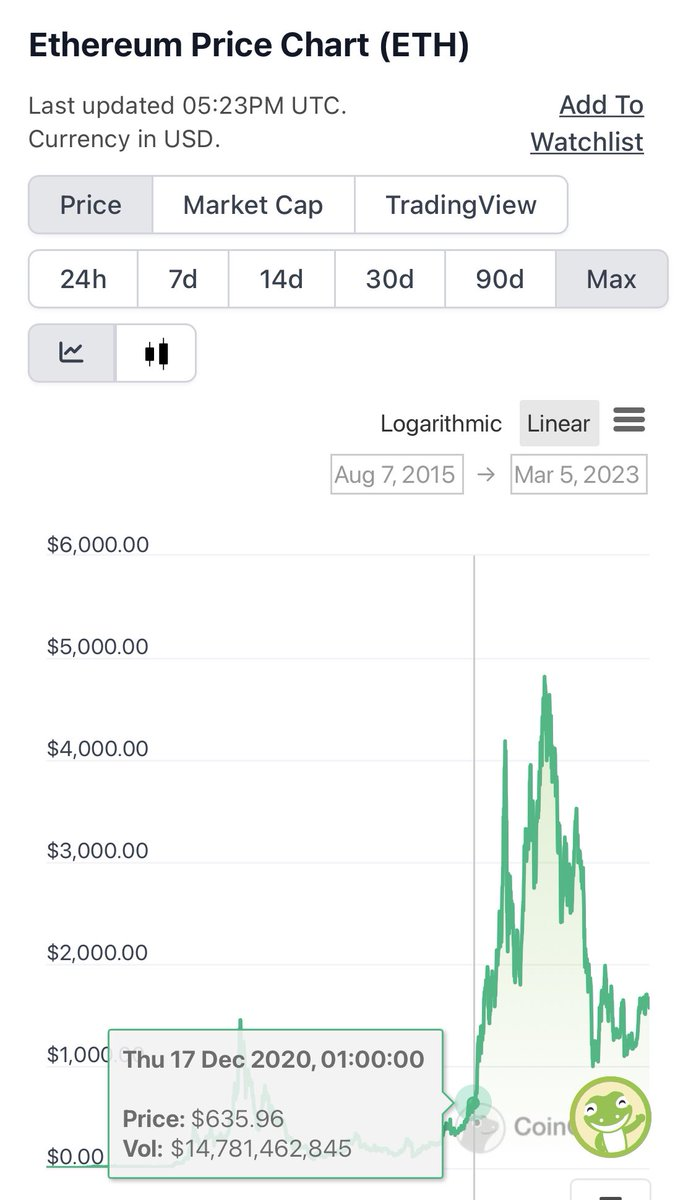

Let’s go back in time. Based on Beacon Chain contract data obtained via Etherscan, the total amount of ETH staked in December last year was 1.4 million.

According to CoinGecko data, the average price of ETH from December 1 to December 31, 2020—the month the Beacon Chain launched—was $681.10.

Currently, ETH is priced at $1,570. All 1.4 million ETH staked last December are sitting in profit.

The question remains: Will these 1.4 million ETH be withdrawn? To date, 1,084 validators have exited the Beacon Chain.

Once Shanghai goes live, 34,688 ETH (from 1,084 validators) will be automatically unstaked. Out of these 1,084 validators, 864 exited voluntarily, while 220 were slashed.

From this data, we can see that only a tiny fraction of validators (864 out of 500,000) have voluntarily exited, while the rest may remain long-term bullish and continue earning rewards.

When staking launched on the Beacon Chain in December 2020, there was no news about withdrawals or concerns regarding ETH. Based on psychological analysis, many stakers are long-term bulls who seek to accumulate more assets.

Now, with the involvement of liquid staking providers and centralized exchanges (CEXs), the situation becomes more interesting. Through my research, I found discrepancies between Defillama and Etherscan regarding liquid staking.

I discovered that Defillama classifies Coinbase as a liquid staking provider—which is correct. Centralized Exchanges (CEXs): Some CEXs use liquid ETH, while others adopt designs similar to staking pools, where stakers don't receive immediate withdrawals and face locked staking periods.

Currently, no one knows exactly how much ETH will be unstaked, nor can anyone predict it precisely. However, based on existing data and analysis, we can infer that although some tokens might be unstaked, overall selling pressure is likely to be limited because many validators remain bullish on ETH’s long-term prospects and will continue holding and accumulating ETH.

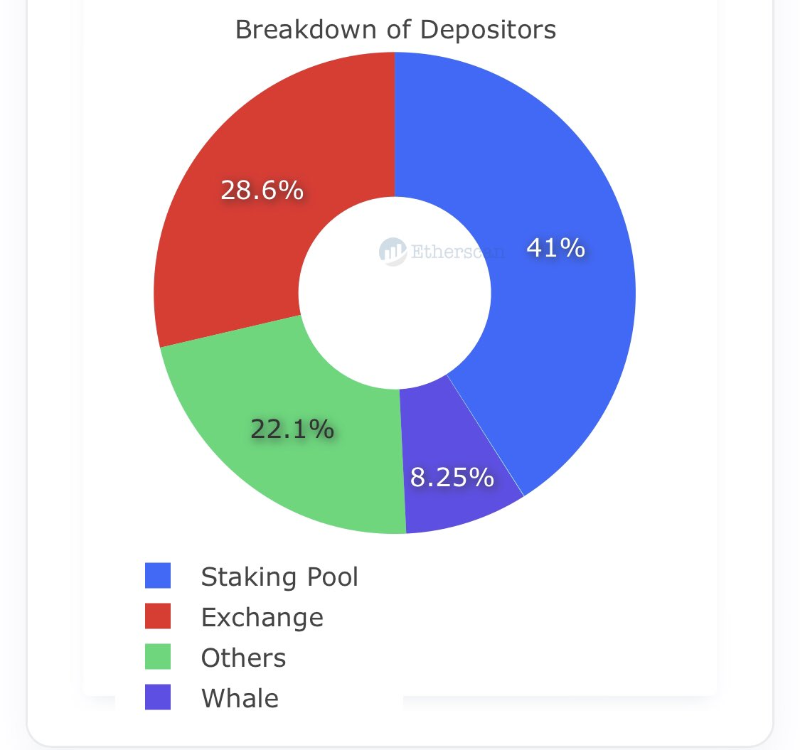

From this chart, we can see that the combined share of liquid staking, centralized exchanges, and staking pools is 69.6%. That’s 69.6% of 17 million, meaning 11.9 million ETH fall under the management of these institutions.

If we subtract 11.9 million from 17.2 million, we’re left with 5.3 million ETH held by whales and others. Whales have staked large amounts of ETH, indicating they are long-term holders and highly confident in the market—although some will inevitably sell.

How much ETH will actually be withdrawn? Nobody knows, and no one can predict.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News