Arkadiko: A DEX built on Stacks and a stablecoin protocol within the Bitcoin ecosystem

TechFlow Selected TechFlow Selected

Arkadiko: A DEX built on Stacks and a stablecoin protocol within the Bitcoin ecosystem

Every ecosystem needs a decentralized stablecoin.

Author: Kaduna

Translation: TechFlow

Every ecosystem needs a decentralized stablecoin. Ethereum has $MKR / $DAI — but what about the Bitcoin ecosystem? Arkadiko, built on Stacks, plays this crucial role.

What is Arkadiko Finance?

Arkadiko is a decentralized liquidity protocol built on Stacks, offering a suite of DeFi solutions such as:

• A DEX built on Stacks;

• $USDA lending;

• Staking;

• Self-repaying loans.

$USDA Lending

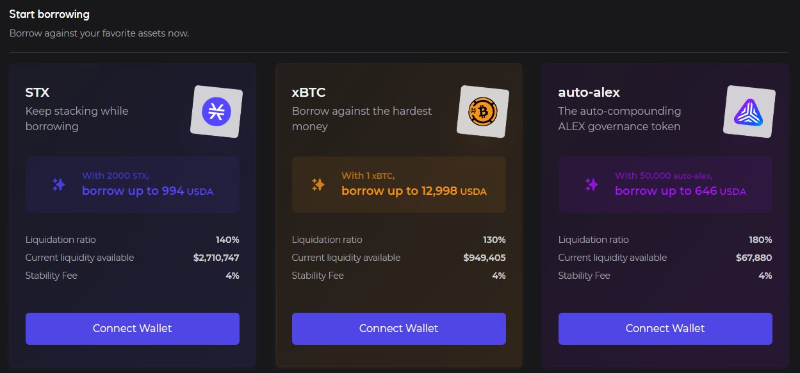

Through Arkadiko Finance, users can use their $STX (the native token of Stacks) as collateral to mint Arkadiko’s own stablecoin, $USDA. $USDA can then be used within the Arkadiko protocol for staking or loan repayment.

By using assets as collateral, users gain liquidity through minting a soft-pegged stablecoin while maintaining exposure to their original assets.

But how does Arkadiko Finance fund these yields? The funds used to pay stablecoin rewards come from participation in the Stacks consensus mechanism known as Proof-of-Transfer (PoX).

PoX works similarly to PoS consensus, allowing users to stake or lock up their $STX tokens, helping secure and support the network. Arkadiko uses users’ staked STX to participate in Stacks staking, then channels the earned rewards into yield generation.

A DEX Built on Stacks

Stacks as a platform has experienced explosive growth, with its TVL surging from $7 million to $22 million in just a few weeks. With this growth, a DEX becomes an essential tool for user participation in the ecosystem.

Arkadiko has built a DEX on top of Stacks to meet the needs of users who want to engage in Arkadiko’s collateralized lending and the broader Stacks ecosystem. Through ArakadikoSwap, users can earn additional passive income by providing liquidity and earning a share of trading fees.

Staking

The native $DIKO token of Arkadiko Finance can be staked via the protocol, granting users $stDIKO in return, which can be used for governance voting.

Self-Repaying Loans

By holding STX tokens, you can deposit them as collateral into Arkadiko and borrow up to 25% of their value in USDA.

Since your USDA is now backed by STX staked in the PoX consensus mechanism we discussed earlier, the staking rewards are automatically used to repay the borrowed USDA. At current yield rates, it takes approximately three years to fully repay the loan — all without worrying about monthly payments.

$DIKO Token Info:

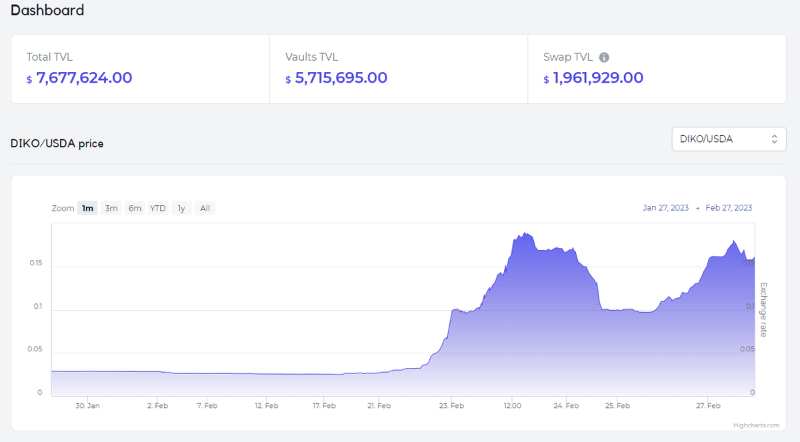

- Price: $0.16;

- Market Cap: $5.7 million;

- Circulating Supply: 35.8 million;

- Max Supply: 100 million.

The Stacks ecosystem is currently booming. $DIKO has already accumulated $7.6 million in TVL, showing no signs of slowing down. With a market cap of only $5.7 million, Arkadiko Finance clearly has substantial room for growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News