Blockspace Market Structure Overview: Exploring MEV in Ethereum, Solana, and Cosmos Ecosystems

TechFlow Selected TechFlow Selected

Blockspace Market Structure Overview: Exploring MEV in Ethereum, Solana, and Cosmos Ecosystems

The topic of MEV has largely focused on Ethereum, but this article will explore MEV in the Solana and Cosmos ecosystems.

Author: Natalie Mullins

Translation: TechFlow

So far, discussions around MEV have largely centered on Ethereum. However, this article explores MEV within the Solana and Cosmos ecosystems. It highlights various approaches to addressing MEV and related incentive-alignment challenges, including comparative analyses of trade-offs. By broadening our scope, we can learn from diverse practices in operation, better anticipate potential issues, and ultimately design improved solutions.

ETH

On Ethereum, the rise of financial applications catalyzed broader research and understanding of MEV. The seminal Flashboys 2.0 paper published in 2019 not only coined the term "MEV," but also clarified how this phenomenon manifests concretely on-chain. For most of us, it was the first introduction to concepts like priority gas auctions (PGAs) or searchers. Shortly thereafter, Flashbots was founded to address many of the incentive-alignment challenges associated with MEV. They initially set three core goals:

- Illuminating the dark forest

- Democratizing value extraction

- Distributing benefits

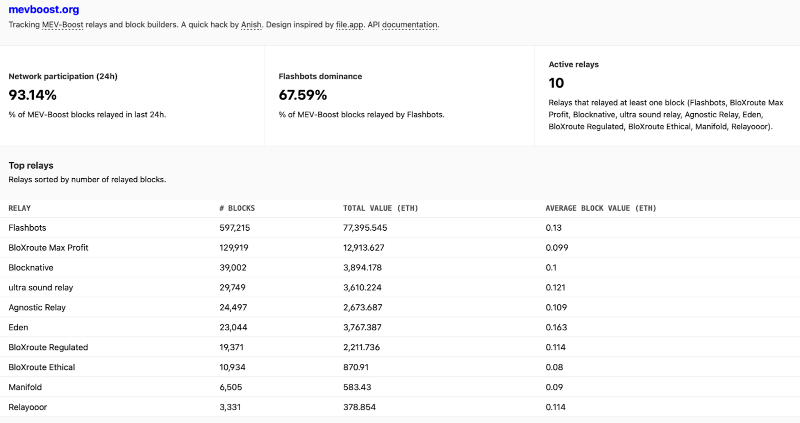

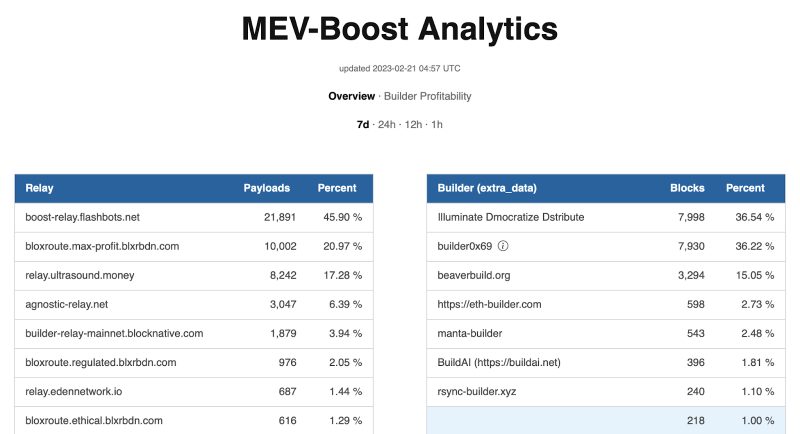

Since then, their two major product releases have achieved over 90% network adoption. It's fair to say these goals evolved into guiding principles that have significantly shaped the development of Ethereum’s blockspace market.

Flashbots’ Core Products

-

Flashbots Auction (mev-geth + mev-relay) created a private transaction pool and an off-chain sealed-bid auction. This enables searchers to express more granular preferences for transaction ordering through bundles and bid for inclusion at the top of blocks—without clogging Ethereum’s public mempool or spiking gas fees due to failed arbitrage attempts.

-

Flashbots Protect is an RPC endpoint that can be added to consumer wallets like MetaMask, extending the benefits of the product suite to regular users.

-

MEV-Boost was designed ahead of Ethereum’s Merge, as MEV was expected to become an increasingly centralizing force under proof-of-stake. It represents the first implementation of proposer-builder separation (PBS), aiming to separate the role of block builders from block proposers by creating a more decentralized and competitive block-building market.

-

MEV-Share (unreleased) outlines the design of a protocol that privately and permissionlessly matches transactions from users, wallets, and/or applications with searchers. Decentralized access to order flow and programmable privacy are key long-term objectives of this protocol.

-

SUAVE (unreleased) is an upcoming solution aimed at tackling the remaining centralization pressures from (1) exclusive order flow and (2) cross-domain MEV. Details remain scarce, but SUAVE appears poised to function as a decentralized mempool and ordering layer for the EVM ecosystem. It will feature an encrypted mempool and introduce new participants into the MEV supply chain: executors—who will compete to deliver optimal execution for users.

Solana

Like Ethereum, growing financial activity on Solana has attracted MEV activity, beginning to degrade end-user experience. However, unlike Ethereum—where gas fees became prohibitively expensive—Solana’s issues stem from a combination of factors:

(1) Extremely low gas fees.

(2) Absence of a fee market.

(3) A suboptimal transaction propagation protocol offering limited tools to prevent network spam.

During periods of high volatility or popular on-chain events (e.g., NFT mints), the volume of spam transactions sent to the network can become so large that it causes network outages.

Some may wonder why Flashbots’ product suite cannot simply be adapted for Solana. However, it’s important to recognize that Solana’s architectural design differs fundamentally from Ethereum’s, requiring distinct approaches. Key differences include Solana’s speed (400ms block intervals), unique data propagation protocols, no-mempool transaction forwarding, native fee markets, and parallel transaction processing.

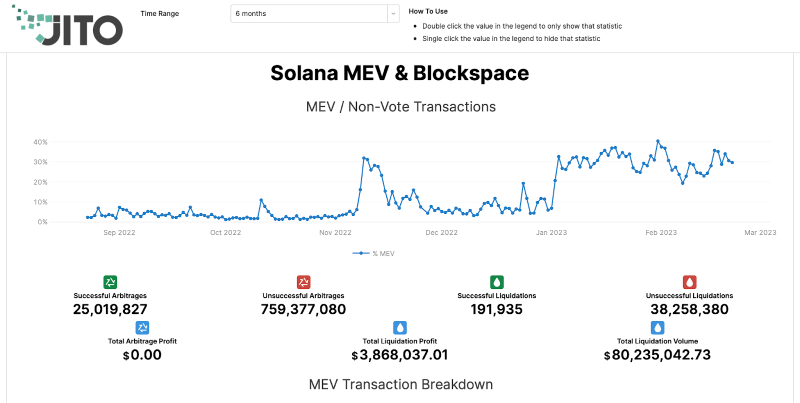

In 2022, Jito Labs stepped in, introducing a Solana-native approach to provide much-needed MEV infrastructure. Like Flashbots, they began with several key goals:

- Minimize negative externalities from MEV

- Prevent centralization

- Distribute MEV rewards

Jito Labs’ Core Products

Since then, Jito has emerged as the dominant MEV solution provider on Solana, releasing several products including:

-

Jito-Solana is the first third-party Solana client optimized for efficient MEV extraction. Similar to mev-geth, it supports transaction bundling and seamlessly integrates with Jito Relayer and Jito Block Engine.

-

Relayer serves as a protective layer between validators’ TPUs (transaction processing units) and network spam. Validators can run their own relayer or use a version hosted by Jito Labs.

-

Block Engine is essentially a high-performance block builder—it runs a sealed-bid auction for blockspace and forwards the most profitable bundle of transactions to the current leader for immediate execution. The Block Engine is also globally distributed to offer low-latency open access.

Searcher Tools:

- Jito Mempool — although Solana lacks a traditional mempool, it allows searchers to subscribe to “accounts of interest” and automatically extract MEV via bundles, enabling a more proactive search strategy.

- ShredStream — running on the Jito-Solana client, it sends shreds directly to locally connected block engines and allows searchers to access shreds forwarded by leaders, reducing latency by hundreds of milliseconds. (Shreds are fragments of a block—the smallest unit—continuously emitted as validators produce blocks. They are distributed across the network based on stake-weighted shuffling, meaning servers with higher stake weight may receive shreds faster, providing a meaningful advantage in high-frequency trading.)

- MEV payout and distribution enables validators to seamlessly distribute MEV rewards to their stakers in the form of airdrops.

Chorus One, one of the largest node operators across major crypto ecosystems, recently released a whitepaper outlining a prototype for Solana-MEV. It proposes a modified client designed to further decentralize validator-based extraction without adding unnecessary latency. The client would make it easy for validators to check for potential MEV opportunities after each batch of user transactions and insert their own transactions to capture value.

Cosmos

Although Cosmos arguably hosts the most nascent DeFi ecosystem, it holds promise as a fertile ground for experimentation in blockspace market design and cross-domain MEV.

Unlike Ethereum, where trading and lending volumes have reached tens of billions of dollars, or Solana, which focuses on low-latency financial applications, Cosmos appears to be progressing slowly in terms of MEV.

There are several possible reasons, but the most apparent explanation is that Tendermint clients default to first-in-first-out (FIFO) transaction ordering, combined with limited financial activity.

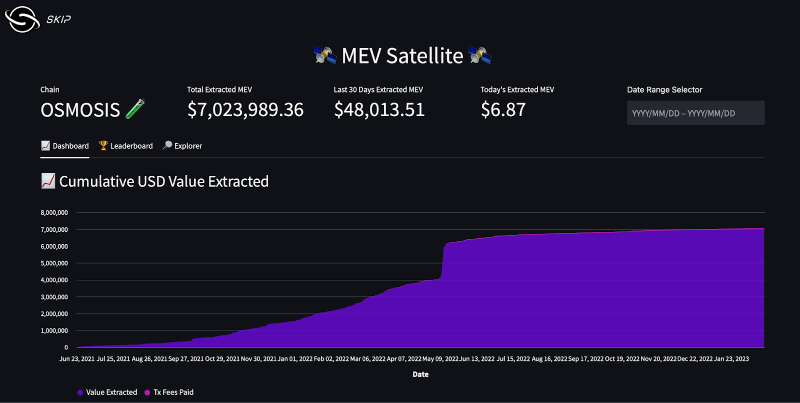

It wasn’t until Osmosis launched at the end of 2021—and even more so following Terra’s collapse in May 2022—that meaningful amounts of captured MEV began to be noticed and measured within the Cosmos ecosystem. Combined with bear-market conditions such as plummeting fees, it becomes clear why validators began exploring alternative revenue streams to maintain profitability.

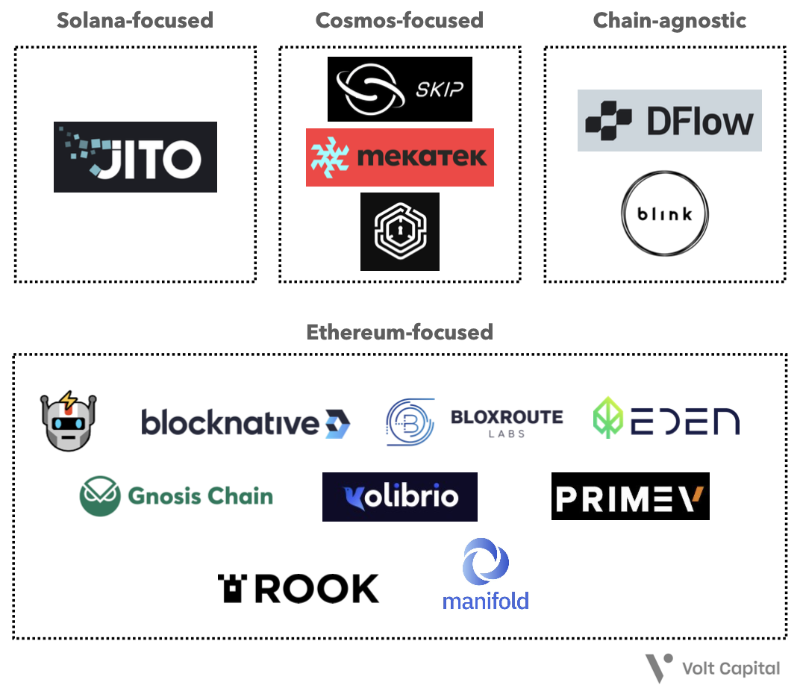

As a result, several Cosmos-native MEV solution providers have begun entering the space, most notably Skip Protocol and Mekatek.

Mekatek’s Core Products

- Zenith aims to create an open market for block building in Cosmos. Searchers can submit transaction bundles and compete for priority within blocks, while validators can outsource block construction to Zenith and sell their blockspace for maximum profit.

Skip Protocol’s Core Products

-

Mev-Tendermint is a modified version of Tendermint that allows validators to accept transaction bundles and introduces a sealed-bid auction for top-of-block inclusion. (Skip does not build entire blocks—only the top portion.)

-

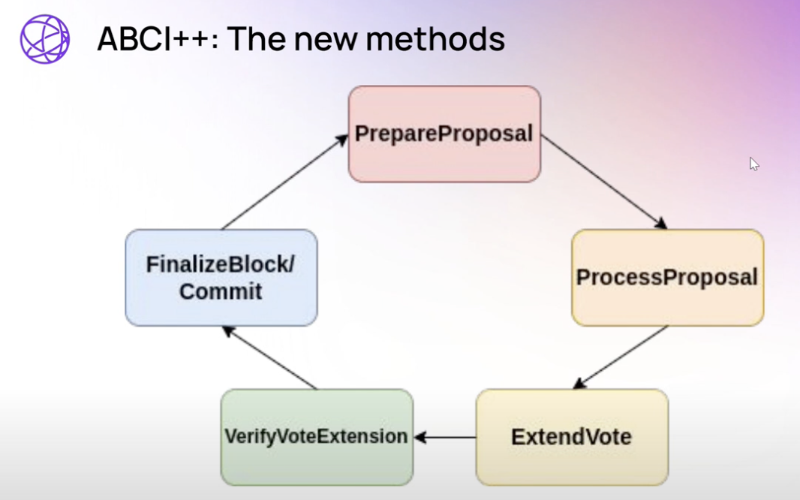

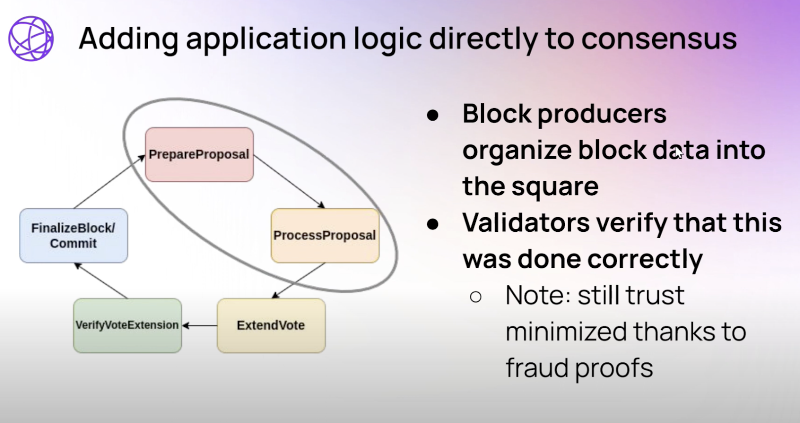

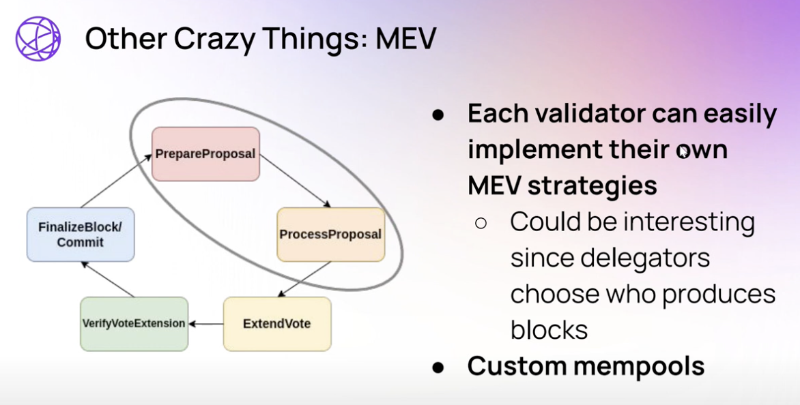

Skip-Select brings sovereignty over MEV to Cosmos by enabling fully configurable, governance-driven blockspace auctions. It allows validators to easily decide how MEV rewards are allocated, what percentage of a block should be outsourced to Skip, whether to protect blocks from frontrunning/sandwiching, and more. Skip-Select also lays the foundation for future on-chain governance votes and implementation of protocol-level MEV preferences—enabled by the Cosmos SDK and ABCI++ (Application Blockchain Interface).

-

Skip Secure closely resembles Flashbots Protect—a private transaction RPC that end users and frontends can leverage for private execution.

-

Proto-Rev is arguably Skip’s most exciting product—a custom module to embed certain MEV preferences directly into core protocols. Its first implementation helped Osmosis internally capture meaningful arbitrage-based MEV rewards, but the service will be offered on a per-chain basis.

Though less publicly documented, FairBlock is building IBE-based solutions (identity-based encryption) to tackle MEV-related challenges. The team plans to use Cosmos Hub’s Interchain Security to manage and distribute validator decryption keys across its consumer chains.

Key Takeaways

-

Success of PBS — The concept of proposer-builder separation (PBS) has spread beyond the Ethereum ecosystem; some version of it now exists in both Cosmos and Solana;

-

The Latency Race — Due to Solana’s network architecture, Jito Labs’ approach to MEV extraction is latency-sensitive, giving advantages to users running servers or validators outside the U.S. or Europe;

-

Enshrined Solutions — Because of the Cosmos community’s high degree of sovereignty and autonomy over their tech stack, MEV solutions (like PBS) are often easier to enshrine directly into core protocols. Reasons include the ability to conduct on-chain governance (despite its challenges), without needing to consider impacts on other applications. Technically, innovations like ABCI++ enable new possibilities for how Cosmos-based apps communicate directly with the consensus layer, such as supporting threshold encryption;

-

Cross-Domain MEV — As outlined in the Flashbots SUAVE whitepaper, incentives to capture cross-domain MEV will grow in the coming years and could pose validation threats to economic security models across ecosystems. Since Cosmos is built for cross-chain interoperability, it may be exposed to centralizing forces from cross-domain MEV. Already, some large entities operate validators across multiple Cosmos chains. Without safeguards, this could lead to a world where only a few well-capitalized validators control significant staked shares across various chains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News