Analysis of Economic Token Models for Web3 Applications

TechFlow Selected TechFlow Selected

Analysis of Economic Token Models for Web3 Applications

Economic tokens are the monetary representation of in-app economies and wealth (not applicable to governance tokens).

Author: Jake

-

Economic tokens are monetary representations of in-app economies and wealth (not applicable to governance tokens). Objectively, economic tokens lacking sufficient consumption scenarios and friction mechanisms will eventually collapse; subjectively, economic tokens lacking sufficient credibility and consensus require a longer time to build trust and recognition, otherwise leading to the breakdown of the token economic model.

-

The real purchasing power of economic tokens should remain relatively stable and balanced compared to real-world purchasing power. For users, economic tokens offer opportunities for exchange, investment, and arbitrage; for project teams, economic tokens help lubricate different modules within the application, trace economic热度 across various sectors, and adjust internal numerical systems accordingly.

-

Similar to the trilemma in real-world monetary policy, project teams cannot simultaneously achieve all three elements of the triangle model for their app’s economic token system: stable "exchange rate" between fiat and economic tokens, free capital convertibility, and independent adjustment of staking token interest rates.

-

For project teams, monitoring consumed economic tokens versus user-held tokens requires observing user investment and arbitrage behaviors. When necessary, project teams must promptly adjust the app's internal numerical system.

Introduction

Unlike national currencies that rely on institutional credit and authority backing, Web3 project economic tokens (distinct from governance tokens) depend on consumption scenarios and credibility mechanisms. Token economics encompasses aspects such as token creation, distribution, voting rights, and utility.

This article analyzes the creation, design, and consumption mechanisms of economic token models with practical use cases, offering investors reference points when evaluating economic token models.

Due to space limitations, this article presents conclusions and summaries directly regarding mathematical and economic models related to economic tokens, minimizing derivation processes. Readers interested in the quantitative or economic modeling details, or wishing to discuss further about economic token design and analysis, are welcome to connect with Jake.

Definition and Scope of Application Economic Tokens

Generally speaking, applications targeting end-users (C-end) have built-in usage and consumption scenarios.

Tokens used, consumed, and exchanged within an application constitute its economic tokens. There may be multiple types of economic tokens within one application. For example, in Web3 games, apps might adopt gold coins, gems, points, etc., similar to Web2 game designs.

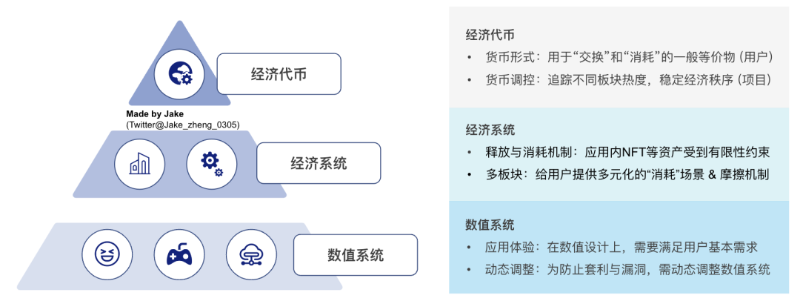

Numerical System, Economic System, and Economic Tokens – Source: Jake Analysis

In Web3 applications, token economic models are generally divided into economic token models and governance token models. From a long-term value perspective, basic use cases for economic tokens typically involve exchange and consumption (settlement and application), while governance tokens map more closely to equity functions. Some projects assign rights (partial equity-mapped functionalities) to their governance tokens, such as voting and delegation rights (though note these rights carry reversibility risks). Since governance tokens partially mirror equity functions, if a Web3 project utilizes Ethereum’s ERC-4626 proposal protocol, it can reference financial asset cash flow standards to estimate governance token prices (e.g., using methods based on cash flows and dividend mechanisms). If the ERC-4626 protocol is not adopted, alternative valuation methods can be applied.

Governance tokens will not be analyzed in depth here; the remainder of this article focuses primarily on analyzing economic tokens in Web3 applications.

Comparison Between Web2 and Web3 Application Economic Tokens

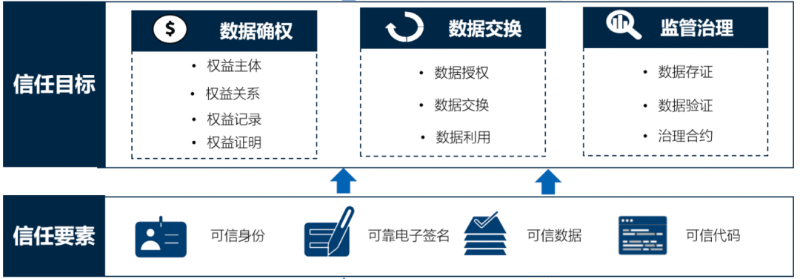

Blockchain technology provides an interoperable way at the technical level to store, exchange, and program property rights, money, assets, and identity.

Source: Public Market Information

Since Web2 platforms do not utilize blockchain technology to verify and confirm end-user ownership of property, assets, and identity, there is no clear ownership of tangible and intangible assets within Web2 apps, resulting in inability to transfer or share property rights, assets, and identity across networked applications.

Fragmented Web2 applications create barriers between them. Moreover, because Web2 applications (including those with usage and consumption scenarios like gaming apps) lack “cash-out” financial channels and open financial API endpoints, they only support “cash-in” (recharge) functionality. End-users cannot monetize their assets and property rights within Web2 apps, nor fully validate cross-application investment and consumption behaviors. (Cross-application verification still requires official confirmation by Web2 project parties, but cannot prevent possible data additions, modifications, or deletions by Web2 operators.)

For instance, on regulated Web2 lending platforms, users seeking loans require the platform to access personal credit reports, transaction histories, and other essential information from banking systems. As mentioned above, since Web2 lending apps themselves cannot verify users' investment behavior, spending patterns, or credit history, they must rely on bank-issued reports.

Therefore, in the Web3 world, due to blockchain-enabled ownership verification and immutability, applications become open and interoperable; whereas Web2 applications tend to be relatively conservative and closed. Under conditions of openness and verifiable ownership, economic tokens gain potential and feasibility for “cash-out” financial operations.

Thus, comparing economic tokens in Web2 and Web3 applications, Web2 economic tokens circulate and get consumed only within individual apps, lack “cash-out” capability, and cannot reflect users’ investments, consumption, and trading activities across applications. Web2 economic tokens remain confined within their respective apps; in contrast, in Web3 applications, user data and NFT assets belong to users, economic tokens are clearly owned, and thus Web3 economic tokens possess liquidity.

Because users can cash out their economic tokens and NFT assets, Web3 application economic tokens transcend the “consumption attribute” of Web2 tokens, introducing a new “financial attribute.” Economic tokens expand from “consumption scenarios” to “consumption + financial scenarios,” enabling users to consume, invest, and arbitrage using Web3 economic tokens. To some extent, the economic tokens issued by Web3 application projects serve as the “currency” for usage and consumption within those apps.

Attributes of Web3 Economic Tokens

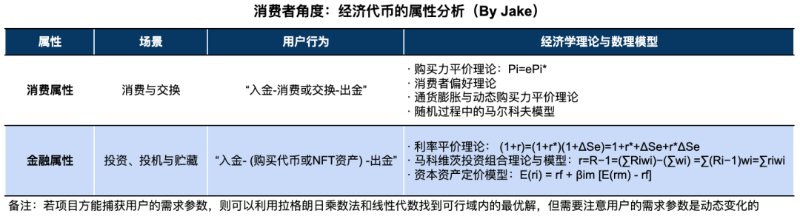

For Web3 users, in-app economic tokens possess multiple attributes including medium of exchange, investment vehicle, store of value, and arbitrage instrument. Below, we break down these attributes based on user behaviors such as consumption, investment, and arbitrage, and analyze corresponding mathematical and economic models:

1) Medium of Exchange (General Equivalent): Within the application, economic tokens primarily function to facilitate usage and consumption to obtain utility within the project—essentially completing the entire process of “cash-in → consumption/exchange → cash-out.” As a general equivalent, economic tokens make it easier for users to find counterparties within the app to conduct transactions, exchanges, and purchases (network effects enabled by a common medium).

- Rational consumers evaluate real-world purchasing power denominated in fiat currencies (such as USD or EUR), comparing services and products between real life and the Web3 application, ultimately choosing higher-value options. Theoretically, during consumption, rational users select lower-priced goods given equal quality and service. Therefore, amid price volatility, rational consumers opportunistically buy economic tokens and in-app assets at low prices, helping stabilize token prices and asset valuations, thereby boosting user confidence in the application.

2) Investment and Store of Value: In Web3 applications, both NFT assets and funds have accessible “cash-out” channels, providing incentives for investment. Users may purchase economic tokens and in-app assets at low prices, then sell them at higher prices after some time. Additionally, purchased assets that generate yield mean from an investment and storage standpoint, user actions can be summarized as “cash-in → buying NFT assets → cash-out” or simply “cash-in → cash-out.”

3) Arbitrage: Compared to stablecoins, Web3 application economic tokens inevitably experience price fluctuations, creating arbitrage opportunities. Opportunistic users engaging in “long” or “short” positions on economic tokens can realize profits (but also face significant risks). Skilled arbitrageurs often exploit loopholes in economic system and rule design to capture excess profits through undervalued assets. From the project team's perspective, eliminating opportunistic arbitrageurs from the system or banning arbitrage altogether is neither feasible nor desirable. Jake believes project teams should maintain inclusivity, allowing arbitrageurs to exist within the ecosystem. Project teams can view arbitrageurs as early detectors of systemic vulnerabilities, treating token movements as indicators to track flows and identify weaknesses, subsequently implementing corrective measures to stabilize economic order.

For projects with poorly designed economic systems and token structures: if opportunistic users flood the Web3 application, numerous inefficient transactions occur, causing economic token price volatility. This amplifies investor, speculator, and consumer emotions of greed and fear, severely destabilizing token prices, widening price swings, damaging user experience and psychological expectations, disrupting in-app economic activities, and ultimately collapsing the internal economic system.

Source: Jake Analysis and Compilation

For Web3 project teams, economic tokens serve multiple roles including currency, lubricating interactions among different modules, and assessing equilibrium states across various segments. Project teams must consider the operational status of the in-app economy when issuing economic tokens. Projects relying solely on theoretically sound economic models while neglecting intrinsic application characteristics inevitably fall into Ponzi-like unsustainable schemes (“passing the parcel”). When designing economic systems and tokens, teams must align with the app’s utility value and pricing levels. The following elaborates from different angles concerning issuance and adjustment:

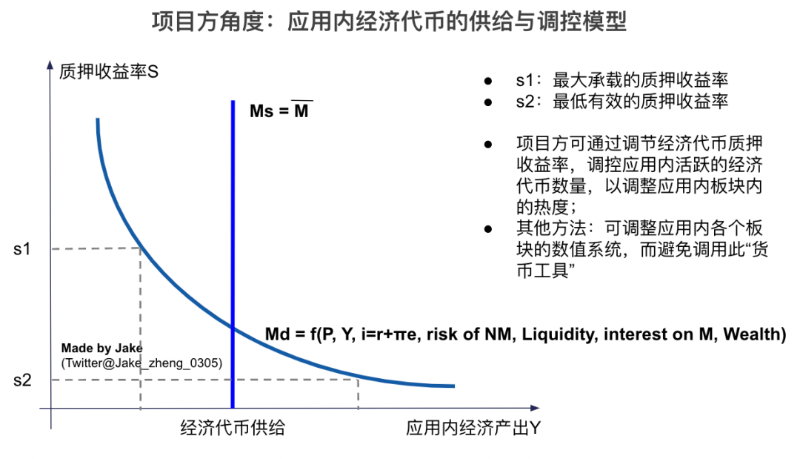

1) “Currency Issuance and Creation”: As previously stated, Web3 users need a medium of exchange (general equivalent) for in-app consumption and transactions; correspondingly, Web3 project teams must issue and create economic tokens to meet user demand for consumption and exchange. In designing economic token models, factors such as current in-app price levels, real purchasing power of tokens, consumption scenarios, liquidity, and current user holdings must be considered.

-

Staking yields can regulate the issuance and creation of economic tokens and influence their liquidity within the app. When setting staking yields, project teams must account for the money multiplier effect and impacts on consumption scenarios during monetary expansion. Teams can dynamically adjust staking yields based on deposit volumes and staking ratios.

-

The operational mechanisms of governance tokens (release and burn mechanisms) differ from those of economic tokens. Economic tokens aim to maintain users’ relatively stable real purchasing power, lubricate interactions among different modules, and uphold stable economic order within the app. Governance tokens have fewer consumption use cases, so user demand for investment returns (financial use cases) far exceeds demand for utility.

2) Lubricating Different Modules: Since applications contain various consumption modules, friction exists between them, increasing user demand for specific economic tokens per scenario. To address diverse consumption needs, project teams can introduce distinct economic tokens tailored to each module. Given varying numbers of consumption scenarios across apps, there is no universal requirement for exactly one or two token types.

-

Based on existing market practices, too many economic tokens degrade user experience, while too few limit detailed analysis and control over the economic system. Practically, most Web3 projects implement 1–4 types of economic tokens.

3) Tracking Token Flows: Monitoring where economic tokens flow helps project teams analyze user transaction behaviors and gauge activity热度 across different modules, enabling adjustments to numerical parameters and utilities to achieve overall balance within the application.

If module prices remain stable, token flow trends reveal arbitrage opportunities, prompting timely corrections to module values and utilities. If prices float, token flows drive upward price pressure, squeezing arbitrage margins, yet potentially making certain economic modules overly active. When supply growth outpaces demand, some modules see disproportionate price increases. In such cases, Web3 project teams must promptly adjust module parameters to mitigate overheating.

Source: Jake Analysis

Considerations and Design Mechanisms for Web3 Economic Tokens

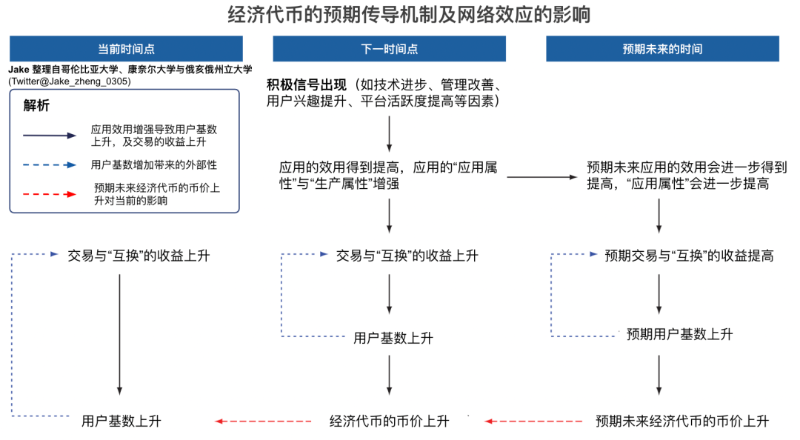

Based on the above analysis of economic token attributes, project teams can issue and adjust economic token models according to project-specific features (including system architecture, user profiles, and numerical design). Since economic tokens represent the top-layer manifestation of in-app economic and “production systems,” driving network and transmission effects among users, the operational mechanics are illustrated below.

Source: Columbia University, Cornell University, Ohio State University

Designing Web3 application economic tokens affects the entire system. Given the critical importance of economic tokens, Jake offers the following considerations and design principles for project teams. Note that due to differing economic properties between economic and governance tokens, these guidelines may not apply to governance tokens.

1) Economic token issuance must match in-app consumption mechanisms. If released tokens exceed consumption volume within a period, circulating supply grows compared to prior periods, triggering inflation within the app. Moderate inflation can stimulate consumption and improve retained earnings.

Historical practice suggests a stable inflation range of 2%–4%. Beyond this, even without real-world costs like “shoe leather cost” or “menu cost,” pricing confusion and inconvenience arise. With uniform inflation affecting different goods and services unevenly, user consumption decisions shift, leading to misallocation and dislocation of resources within the app.

Additionally, inflation imposes hidden costs and drains on the application’s economic system.

-

Negative impact on user experience and consumption behavior: According to expectation theory, rational Web3 users form expectations based on past inflation experiences. Unexpected inflation leads to erroneous consumption and arbitrage decisions, negatively impacting user retention and future engagement.

-

Variability and uncertainty in relative prices. Price changes alter Web3 user purchasing behavior and prompt “resource owners” to adjust production methods and allocations, thereby shifting resource distribution and counterbalancing operations across modules.

-

Wealth inequality among users. Inflation causes disparate price increases across modules, benefiting owners of high-growth “resources” who accumulate wealth faster, exacerbating wealth disparity. Over time, some users may evolve into rent-seekers, negatively impacting the in-app economy.

2) The real purchasing power of economic tokens should remain relatively stable and balanced compared to real-world purchasing power. Due to the openness of Web3 applications, economic tokens are inevitably influenced by external factors such as Federal Reserve rate hikes/cuts, national economic policies, and business cycles. Rational consumers will compare purchasing power between Web3 apps and real life.

-

Compared to Web2 applications: Web2 apps are relatively closed “economies” with only “cash-in” channels and no “cash-out” ports, thus immune to dollar tides. However, Web3 apps are relatively open, requiring real-world purchasing power as a benchmark. Poorly designed Web3 economic token models allow arbitrageurs to fully exploit “cash-out” exits to drain retained earnings. Although teams may employ time locks, exit taxes, or high staking yields, fundamental issues persist, eventually facing selling pressure and systemic collapse.

-

Economic tokens need relatively enduring and stable purchasing power: Rational Web3 users assess current token purchasing power against expected future purchasing power. Large discrepancies incentivize consumption when purchasing power is high (i.e., low price levels). Frequent large fluctuations attract arbitrageurs and convert consumers into arbitrageurs (due to higher financial gains), disrupting economic order and transferring retained earnings to arbitrageur wallets. Hence, maintaining relatively stable price levels and consistent real purchasing power is essential for sustaining a vibrant app ecosystem.

-

Independence of economic tokens: Through economic tokens, Web3 project teams monitor token flows, retain control over token and numerical model adjustments, and maintain economic order. Abandoning economic tokens in favor of USD stablecoins forfeits direct control (though other means may preserve overall economic regulation). Strictly speaking, in-app economic token purchasing power does not need to equal USD parity or peg to stablecoins. Regarding in-app real purchasing power, Web3 teams can choose either USD stablecoins or their own economic tokens and internal “monetary policy” to stabilize the app’s economic and “production systems.”

3) Web3 applications must fully leverage inherent app attributes to retain earnings internally rather than relying on Ponzi-style models to attract users. In relatively stable economic systems, token prices stay balanced and steady, and tokens themselves do not generate excessive profit but instead broaden and sustain revenue channels for Web3 projects. Web3 projects profiting from selling economic tokens face continuous selling pressure, making such ventures unsustainable. A collapse of the economic token model precedes governance token failure, ultimately leading to total economic and production system collapse.

Excessively high staking yields create arbitrage opportunities for Web3 users. Overly generous staking yields and incentive mechanisms transform users from consumers into arbitrageurs. These arbitrageurs capture retained economic value and contribute to selling pressure. When setting staking yields and incentives, project teams should benchmark real-world capital gains.

-

Rational arbitrageurs compare real-world capital gains with those in Web3 apps. Ignoring “exit tax” and fees, if Web3 returns vastly exceed real-world ones, arbitrageurs adopt “cash-in → stake → cash-out” strategies, leading to two outcomes. First, token prices drop until Web3 economic token returns roughly equalize with real-world capital gains. Second, the Web3 project acts as counterparty, repurchasing dumped tokens to maintain high staking yields, enabling sustained arbitrage until the project’s retained earnings are completely drained.

-

Exercise caution with economic tokens having high total supply but low circulation. Besides yield arbitrage, users have other tactics. Arbitrageurs hold tokens to maintain liquidity for future sales. High circulation and low reserves indicate strong consumption attributes and weak arbitrage tendencies; low circulation and high reserves suggest strong arbitrage and weak consumption. Thus, project teams can monitor circulating token volume and ratio to identify and predict user behavior, adjusting numerical systems to reduce arbitrage and retain consumer users and their spending.

Regulatory Mechanisms: Observations show Web3 projects mainly adopt weak or strong regulatory approaches to stabilize economic order and reduce capital outflows.

-

Weak Regulation: Refers to minimal intervention by Web3 project teams in the in-app economy, focusing instead on conveying positive economic signals or attracting external players.

-

Transparent Treasury Systems: Displaying user deposits and stakes in public treasuries sends positive signals and stabilizes user expectations. However, large holders dumping tokens can trigger panic among retail investors. The key lies in stabilizing whales and market makers.

-

Integration with DeFi: Offering additional yields via staking governance or economic tokens. As noted, users may exploit “cash-in → stake → cash-out” arbitrage. But unsustainable ultra-high annualized returns burden projects. Those integrating DeFi must evaluate arbitrage space to minimize loss of retained earnings. (Stress testing is required before launching DeFi features.)

-

-

Strong Regulation: Project teams implement strict controls to stabilize the in-app economy and slow capital outflows. Common strong regulation methods include:

-

Adjusting Exit Taxes: Increasing exit tax thresholds raises the cost of leaving the app, improving retained earnings.

-

Adjusting Time Taxes: Changing instant withdrawals (T+0) to next-day (T+1) or delayed (T+N) settlements calculated at withdrawal exchange rates. During price drops, this slows capital outflows but may intensify user anxiety.

-

Adjusting Staking Yields: Lowering yields reduces arbitrage profits, eases cost pressures, retains loyal users, and pushes arbitrageurs out of the app.

-

Project teams should carefully exercise “minting rights.” When releasing economic tokens, learn from past projects’ experiences and lessons, adopt a cyclical perspective, and apply mathematical and economic methodologies to design tokenomics. Consider the following (not limited to):

-

During initial issuance, the relative value measured in USD and other fiat currencies is crucial for establishing real purchasing power; absolute issuance amounts matter less than relative values unless affecting trade and arbitrage.

-

For economic tokens (not governance tokens), issuance and release mechanisms should align with user inflow, real purchasing power, and consumption scenarios. This builds solid credibility and consensus, enhancing user confidence and retention from economic and model perspectives. Arbitrary releases lead to token price collapses, user and arbitrageur bank runs, and eventual model failure.

4) Other Gameplay and Operational Strategies

- Incentives and Distribution: Applications often require multiple contributors. Project teams can provide appropriate economic token incentives to reward contributors. (Also applicable to governance tokens.) Well-designed incentive and distribution systems encourage greater project contributions.

- Voting Rights via VeToken: Excessively high staking yields risk economic model collapse. Some projects shift staking rewards from economic tokens to veTokens. Holding veTokens grants voting rights on major project decisions.

- Liquidity: Liquidity is vital for project teams. Lack of liquidity forces users to demand extra price compensation. Teams must monitor economic token liquidity and watch for user arbitrage motivations. When needed, collaborate with market makers to prevent sharp token price swings.

Reference economic indicators (not limited to): number of accounts consuming economic tokens / number of long-term holders; inactive accounts / total accounts; amount of consumed tokens / amount retained by users.

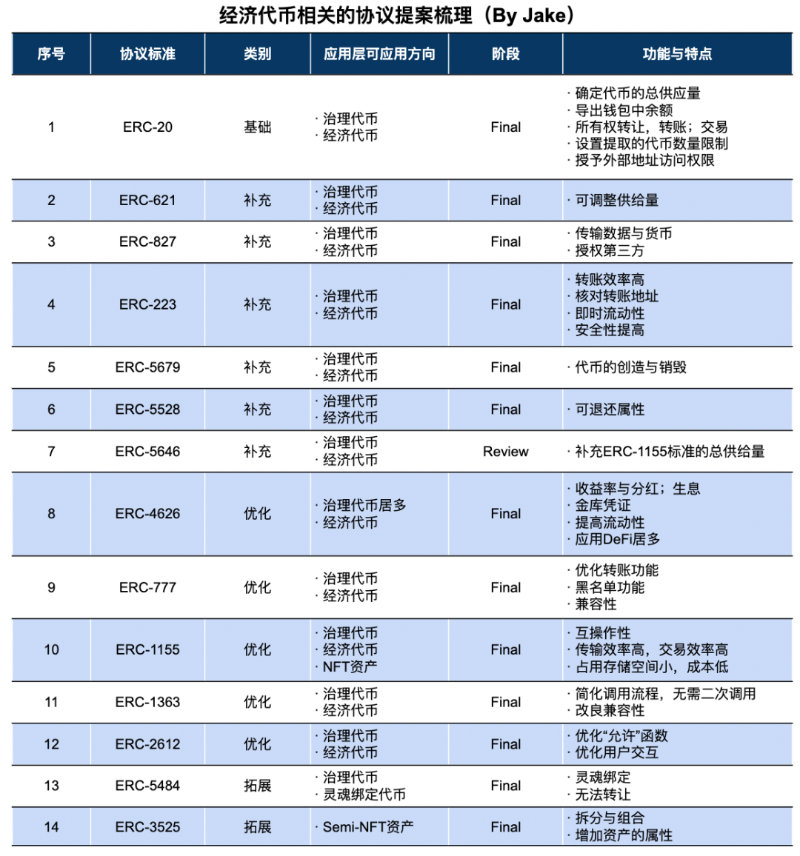

Related Protocols and Standards for Web3 Economic Tokens

Based on the above analysis, project teams should consider selecting appropriate token invocation and execution standards. As of December 2022, the following summarizes relevant Ethereum proposals for economic and governance tokens:

Source: Ethereum Improvement Proposals

Beyond the listed Ethereum standards, other protocols remain unlisted, some still in draft or stalled stages, such as ERC-823, ERC-1080, ERC-1462, ERC-5095, among others;

Moreover, different blockchains like Solana, Avalanche, and Binance Smart Chain (BSC) support their own standards, which are not elaborated here. Interested readers are welcome to contact Jake for discussion.

Ponzi Model Analysis of Economic Token Systems

Healthy economic systems complement robust “production systems,” yet some current projects exploit Ponzi models (“robbing Peter to pay Paul”) to lure users, ultimately collapsing the economic system and failing to sustain long-term, stable ecosystems. The following briefly outlines Ponzi dynamics in Web3 application economic systems and root causes.

1) Unrealistically High Returns. When project teams act as user counterparties and offer excessive token rewards, they cannot withstand resulting selling pressure, causing sustained depreciation of the token-to-fiat “exchange rate,” accelerating user panic, and ultimately collapsing the token model.

-

In Web2 apps, fiat-denominated return mechanisms eventually revert to lower levels (e.g., fast-version apps); converting fiat to economic tokens doesn’t fundamentally change reality—detached from core app utility, capturing excessive economic gains via tokens is highly unlikely. Forcing sustained high token returns inevitably leads to continued devaluation against fiat.

-

For economic token models, project teams cannot simultaneously achieve: stable fiat-token “exchange rate,” free capital convertibility, and independent staking rate adjustments.

2) Insufficient Consumption Scenarios for Economic Tokens. When designing economic systems and models, project teams need adequate consumption use cases to attract and absorb user spending. Single-use scenarios fail to create user networks and connectivity effects, cannot sustain repeated consumption, and encourage “mine-sell-cash out” arbitrage mentality and behavior.

3) Unlimited Currency Issuance. As previously mentioned, scarcity determines token value. Infinitely issued economic tokens will eventually approach zero value.

4) Total user cash-in (in fiat) being less than cash-out and arbitrage payouts (in fiat) defines a Ponzi economic model. Wealth cannot be created from nothing. Even replacing fiat-denominated accounting with token-based metrics fails to fix structural flaws in the token model.

5) Whale dumps causing panic-driven bank runs. Sudden liquidation by large in-app holders creates short-term liquidity shortages, temporarily crashing token prices, sending negative signals to ordinary users, triggering panic-driven sell-offs. Liquidity shortage combined with bank run hysteria can collapse the application’s economic system. Therefore, project teams must nurture relationships with whales, market makers, and large holders to avoid such crises.

Model Planning and Development Recommendations for Economic Tokens

1) Strengthen inherent app attributes, avoiding Ponzi models to attract users; “pass-the-parcel” schemes are inherently unsustainable. When designing economic token models, selectively reference the app’s intrinsic value.

For asset strategy, focus on core incremental assets mapped on-chain, gradually enhancing utility and value of on-chain NFT assets, increasing their activity and participation within the app.

2) Anti-cheating and Security: Even well-designed economic token models and systems remain vulnerable to bot farming, user cheating, and hacker attacks. Project teams must thoroughly test security and economic systems pre-launch, track token flows post-launch, and continuously refine numerical designs to prevent users and bots from draining retained earnings.

3) Robust economic token model design to enhance in-app retained earnings and value.

-

Externalities Compensation: When user willingness to pay falls below marginal costs, project teams can compensate for economic losses via externalities. Otherwise, the economic system risks collapse.

-

•Avoid Consensus Expectations, Allow Divergent User Expectations, and Use Diverse Forecasts as Hedges; Expected Returns and Costs Across App Modules Should Reach Equilibrium. Limited and scarce resources mean apps should avoid offering users persistent static “return” expectations. Uniform expectations create resonance effects, amplify emotional extremes of greed and fear, widen token price volatility, and easily trigger model collapse.

-

•Theoretically, project teams can reference stochastic process theories under continuous time, e.g., Markov models, which offer useful insights.

-

When designing economic token models, project teams should avoid becoming users’ counterparties.

-

Other considerations for token model design

-

Pure Ponzi economic models cannot sustainably attract users.

-

Diversified consumption scenarios and friction mechanisms can increase in-app economic retention.

-

From a user perspective,

-

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News