Bankless: 5 Crypto Projects Growing During the Bear Market

TechFlow Selected TechFlow Selected

Bankless: 5 Crypto Projects Growing During the Bear Market

It's undeniable that cryptocurrencies are still in a bear market.

Written by Lucas Campbell

Translated by TechFlow

It's undeniable that cryptocurrency remains in a bear market. But another undeniable truth is that a small number of sectors and projects are currently thriving based on key fundamental performance metrics.

Here are five projects that are defying adversity and experiencing their own bull runs.

1. Lens Protocol

Lens Protocol is a Web3 social platform hitting all-time highs across various metrics.

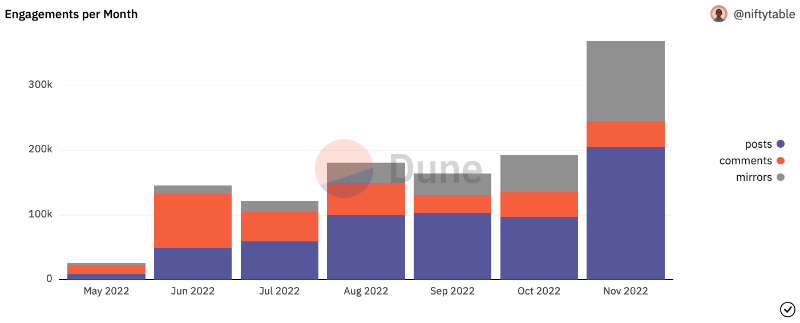

First, monthly engagement has nearly doubled, reaching 370,000 interactions per month in posts, comments, and mirrors (equivalent to retweets).

Despite the bear market, people are interacting with Lens Protocol and its primary application, Lenster, more than ever before.

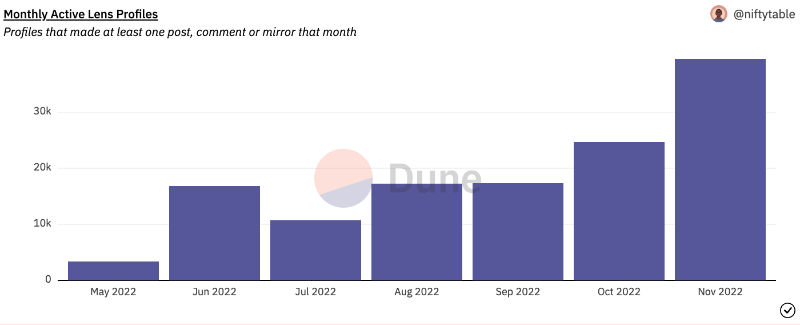

As user engagement grows, the number of monthly active profiles is also setting new all-time highs, reaching nearly 40,000 unique profiles on the protocol. This includes an addition of approximately 14,800 profiles in November alone—an increase of 59% from the previous month.

Naturally, as engagement increases, the number of wallets holding Lens tokens continues to rise steadily, now exceeding 98,000. At this rate, we should expect the total number of Lens-holding wallets to surpass 100,000 in the coming days.

2. Sound

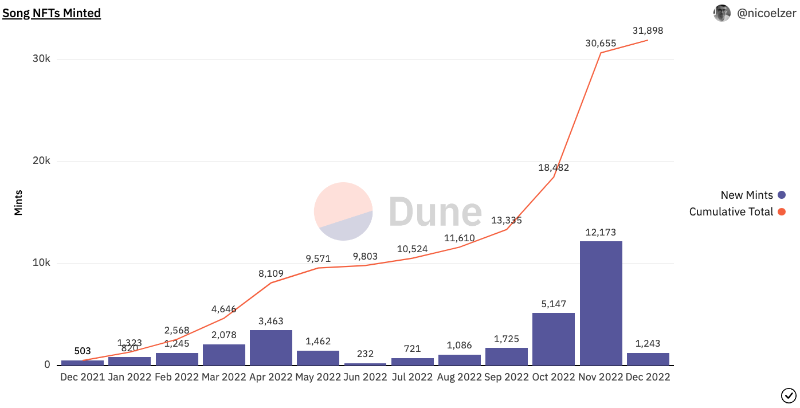

Since peaking in April, activity on music NFT platforms is resurging.

The number of songs minted on the platform reached an all-time high back in October, then more than doubled in November, with over 12,000 music NFTs minted in a single month. For reference, this represents a 242% increase compared to the previous record set in April 2022, when ETH was trading above $3,000.

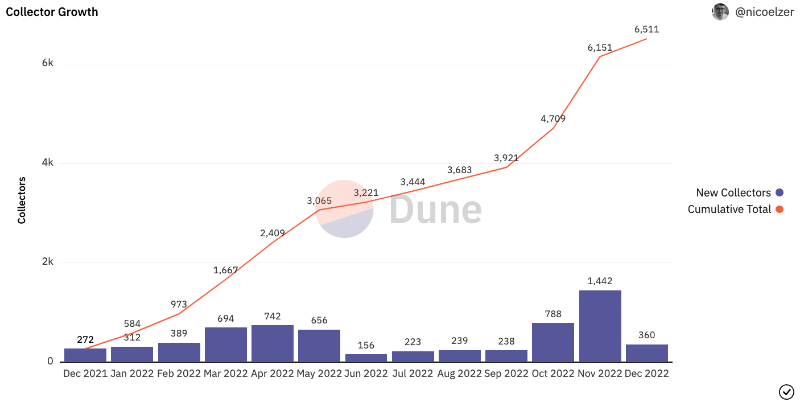

However, song minting is just the beginning—collector numbers are also surging. In November, 1,442 active collectors emerged, bringing the total number of unique addresses collecting these new media NFTs to 6,500.

Although it hasn’t surpassed prior records, we’re seeing a significant upward trend in secondary market volume from its lows. Secondary market trading volume reached $271,000 in November, bringing the protocol back to levels seen during 2021/2022.

That said, Sound Protocol has just celebrated its one-year anniversary.

3. Optimism

While Web3 social platforms like Lens and Sound are making big strides, another sector is also gaining substantial adoption: Layer 2.

After launching its token in May, Optimism has seen dramatic growth across multiple key metrics.

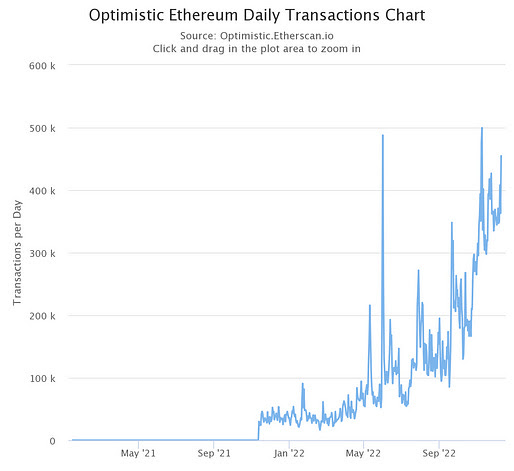

The first and arguably most critical metric—transaction count (blockchains have no value without transactions)—has reached astonishing levels on Optimism.

Daily transaction volume on Optimism is skyrocketing, hitting a record high of 500,000 transactions per day. For context, Ethereum currently processes slightly more than double that amount—around 1 million transactions daily—at its current pace.

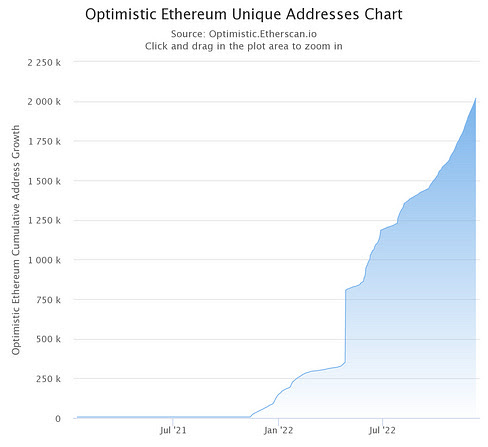

Predictably, the number of unique addresses on the network is also multiplying. The network has just surpassed 2 million unique addresses—an important milestone for the second-largest L2 by value locked.

The final metric for Optimism hitting new highs is the number of deployed and verified contracts. This is a key indicator of project activity and developer engagement on the network. The trend is clear: after spiking to a record high of 115 contracts deployed just over a month ago, it has remained elevated ever since.

4. Arbitrum

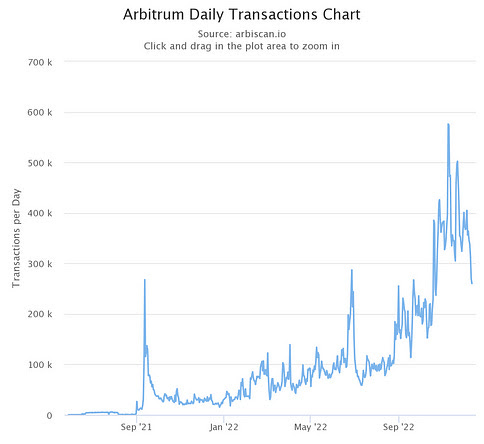

Optimism isn’t alone. Its strongest competitor, Arbitrum, has reached similar heights.Let’s look at the exact same metrics to clearly see how these projects compare.

Daily transaction volume on Arbitrum has now also hit an all-time high, surpassing its rival with 575,000 transactions per day.

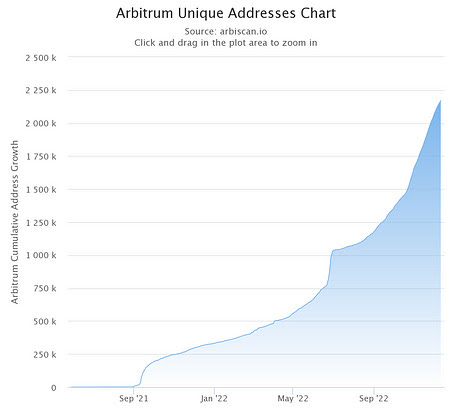

Arbitrum already has over 2 million unique addresses and is now approaching 2.25 million—slightly ahead of its main competitor.

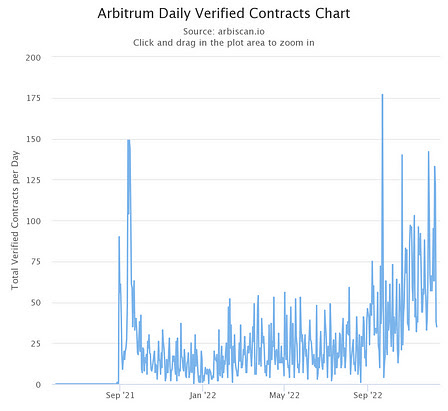

In terms of deployed and verified contracts, Arbitrum recently peaked at 176 contracts deployed in a single day, consistently surging past 100 daily deployments over recent months.

It's now clear that the trend for Layer 2 is upward.

What’s the key difference between Optimism and Arbitrum today?

-

Optimism launched its OP token back in May.

-

Arbitrum has not yet launched its token—their strongest catalyst remains unused.

5. Rocket Pool

So far, we’ve covered Web3 social and Layer 2. Now, let’s turn to another area maintaining strong momentum: liquid staking. More specifically, Rocket Pool—which has seen staggering growth over recent months.

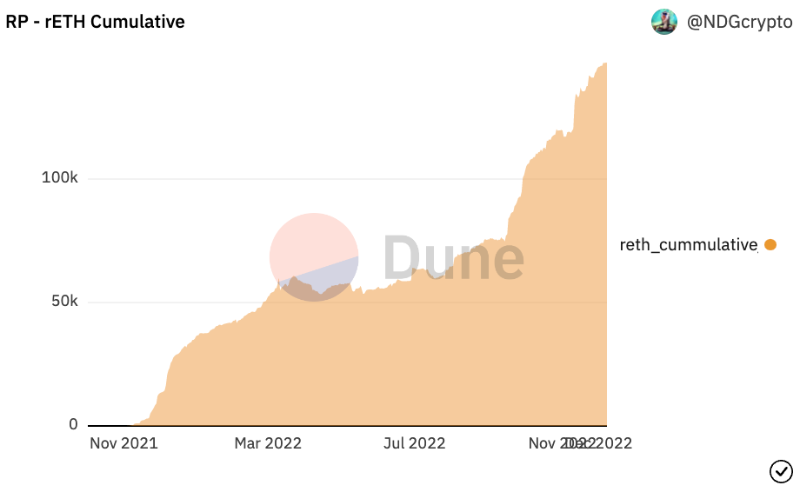

Although cumulative, adoption across several key metrics at Rocket Pool is accelerating. The primary metric is the circulating supply of rETH, which has surged to new highs above 150,000 rETH. For reference, this number was only 75,000 in September—meaning they doubled the total supply within three months.

While impressive, it still lags significantly behind market leader Lido, which currently holds 4.5 million ETH under its purview. That said, there’s a crucial design difference between Rocket Pool and Lido: anyone can run a Rocket Pool validator (called Minipools), whereas Lido does not allow this.

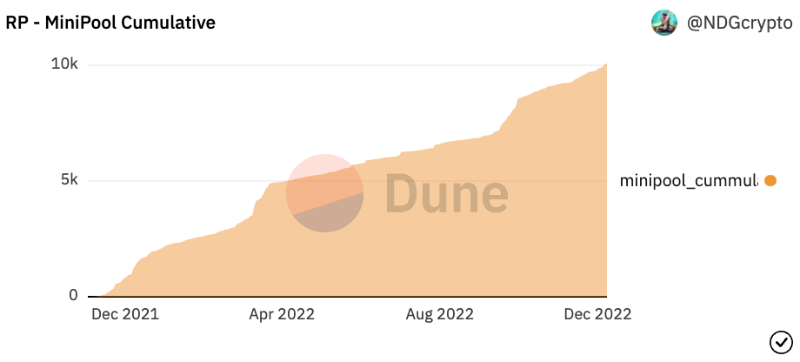

When examining the data, this proves to be a powerful growth engine, as the number of Minipools has just reached 10,000 independent nodes.

When users operate a Minipool, they must stake an additional amount of RPL as "insurance" to secure the ETH they "borrow" to run a full validator. As a result, with the growing number of Minipools on the network, the total staked RPL has increased to 7.8 million RPL. This means 41% of the network’s current supply is locked, supporting validation for liquid stakers.

It’s Not All Doom and Gloom

While crypto prices have declined significantly over the past year, it’s important to look beyond surface-level trends.

Why?

Because these are often the opportunities that pay off in bull markets.

This article isn’t claiming these projects will become the next major narrative. Rather, it highlights that these projects show strong chart patterns while others continue to decline aimlessly.

So, as we search for light at the end of the dark tunnel, these projects serve as our guiding beacons.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News