Twitter KOL Investment Portfolio Overview: ETH, Real Yield Protocols, and Alternative Public Chains

TechFlow Selected TechFlow Selected

Twitter KOL Investment Portfolio Overview: ETH, Real Yield Protocols, and Alternative Public Chains

Crypto KOLs believe the most promising opportunities and investment portfolios for the future.

Written by: The DeFi Investor

Translated by: TechFlow

Take a look at the most promising opportunities and portfolios for the future. This article covers:

- The reasoning behind my investments

- Projects I am monitoring

Here are the details of my strategy this month:

Portfolio Overview:

- Approximately 40% in stablecoins

- Large position in $ETH

- $GMX

- $GNS

- $KUJI

- $JOE

New Positions:

- $EGLD

- $MATIC

$GMX

This is the second-largest perpetual DEX. With former FTX users seeking alternatives, I expect trading volume on this platform to continue rising.

GMX recently received a $4 million grant from Avalanche. This funding will be used to incentivize trading, making the platform more attractive.

Downsides:

The team has been researching synthetic assets for six months. To allow GMX to compete with CEXs, the project’s development pace must accelerate. Without expanding the team to speed up delivery, GMX risks losing ground to competitors.

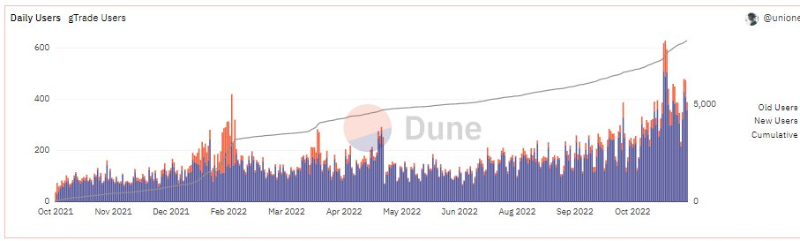

$GNS

The most popular perpetual DEX on Polygon.

Catalysts:

-

Deployment on Arbitrum within 1-2 weeks;

-

An upcoming $100,000 trading competition;

-

New DAI vault;

Gains Network supports crypto, stocks, and forex pairs.

The platform has accumulated over $4.4 billion in forex trading volume. No popular dApp currently supports forex trading on Arbitrum. That’s why I believe its deployment on Arbitrum could succeed. Additionally, the number of users on the platform has been steadily increasing recently.

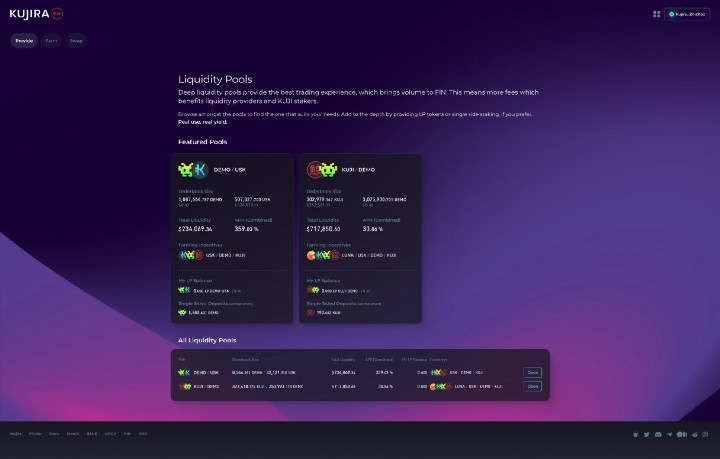

$KUJI

A Cosmos L1 platform where projects are community-selected. Recent developments:

-

CALC Finance, a DCA protocol, launched on their L1.

-

BOW, a market-making protocol, will launch on Kujira’s FIN exchange to narrow spreads.

Catalysts:

-

Margin trading on the FIN exchange;

-

Launch of the Kujira wallet;

-

LocalMoney platform launching on Kujira L1;

All things considered, Kujira’s future looks bright as long as the team continues executing.

$JOE

The primary DEX on Avalanche. I initially planned to stop buying $JOE, but two days ago, news broke that Trader Joe would expand to Arbitrum. Today, the Arbitrum ecosystem is receiving massive attention.

Moreover, it recently launched its new AMM, Liquidity Book.

LB is as efficient as UniV3 and minimizes impermanent loss, so it may capture some trading volume from UniV3 on Arbitrum.

A portion of Trader Joe’s swap fees is shared with $JOE stakers. If trading volume increases → price should follow.

$EGLD

A highly scalable blockchain network.

It caught my attention after the team unveiled several game-changing products:

-

xPortal – a novel wallet;

-

xFabric – Shopify for Web3;

-

xWords – a metaverse network;

Why I chose it:

→ The team is building great products;

→ xPortal will be one of the first wallets combining the best of Web2 and Web3: top-tier user experience + self-custody;

→ Nearly all EGLD supply is already circulating.

Downside: The MultiversX ecosystem is still in early stages.

Therefore, my investment in it is long-term.

$MATIC

A project focused on building Ethereum scaling solutions. Its recent partnerships have been impressive:

Reddit, Meta, and other Web2 giants are building on Polygon.

Moreover, leading Solana projects like Phantom are coming to Polygon.

Why I chose it:

→ Upcoming launch of Polygon zkEVM;

→ Possesses a world-class business development team;

→ $MATIC has recently outperformed the market;

I’m buying $MATIC in small amounts because its price has already tripled from its June lows.

Downside: $MATIC utility will decrease as it won’t be used for gas fees on upcoming Polygon chains.

Other Opportunities

If you’ve been following Cosmos, you’ve surely heard of the ATOM 2.0 proposal.

ATOM 2.0 is the updated roadmap for Cosmos Hub. It proposed significant changes to improve ATOM’s tokenomics.

However, it was rejected.

The team is now working on a second revision of the proposal. Once the future of Cosmos Hub becomes clearer, I will include $ATOM in my DCA strategy.

Reasons:

→ Protocols like dYdX are migrating to Cosmos;

→ $ATOM holders receive substantial airdrops;

→ Many bullish catalysts for $ATOM in 2023;

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News