Although the crypto bear market bottom hasn't been reached yet, I remain firmly bullish on Ethereum ZK Rollup.

TechFlow Selected TechFlow Selected

Although the crypto bear market bottom hasn't been reached yet, I remain firmly bullish on Ethereum ZK Rollup.

If we simply regard crypto-economics as merely a technological transformation, that恐怕 wouldn't be enough.

If we simply regard crypto-economics as a technological revolution, that would probably not be enough.

Many crypto practitioners or enthusiasts struggle to adapt, largely because the cycles here are too apparent and the volatility too intense. Ordinary people can indeed make tenfold or even hundredfold returns during a crypto bull market, but lose everything in a bear market. Ultimately, no matter who you are, entering crypto means investment education is unavoidable.

The Federal Reserve's rate hikes and tightening capital markets are the main reasons behind this bear market. DeFi has long moved past the era of 20% crazy yields; today, mainstream lending protocols offer interest rates generally below 2%. Meanwhile, real-world U.S. Treasury bond yields have already exceeded 3%, which is the primary motivation driving institutional investors and stablecoin projects to shift their crypto funds into real-world government bonds.

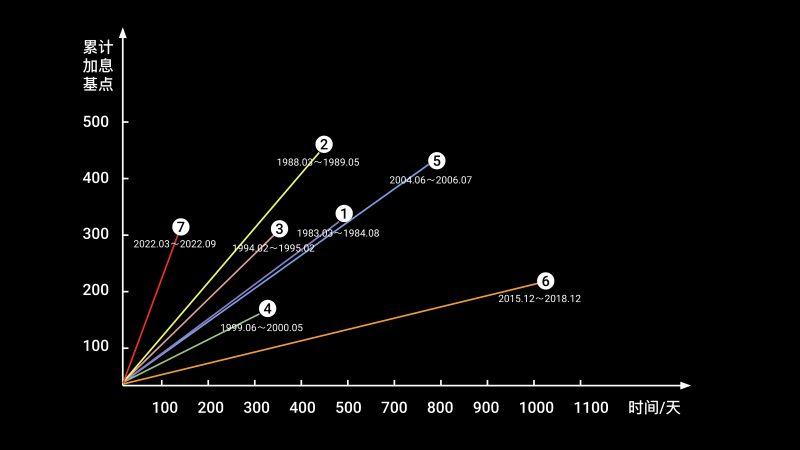

Since the 1980s, the Federal Reserve has gone through six rate-hiking cycles, each lasting 1–3 years, with an average of up to 10 rate increases per cycle. The slower the rate hikes, the less effective they are at controlling inflation. For example, the sixth hiking cycle from 2015 to 2018 was very gradual, and commodity prices driven by crude oil not only failed to decline but kept rising. Crude oil prices remained strong after October, prompting the Fed to continue its aggressive rate-hiking policy. Undoubtedly, both global stock markets and the crypto market will continue facing pressure in 2023 from institutional capital outflows. The bear market bottom has not yet arrived—don’t rush to catch the falling knife.

Figure 1: Historical Fed rate hike statistics; Data source: Federal Reserve

Bullish on Ethereum zkRollup Solutions

However, if we set aside macro financial cycles and focus solely on the technological transformation brought by crypto and the likely upcoming Web3.0 wave, we remain strongly bullish on Ethereum and its zkRollup scaling solutions—especially next-generation zkEVM-based zkRollups.

At Circle’s Converge22 conference on September 30, Vitalik Buterin stated: "After The Merge, Ethereum’s next step is scalability." Scalability remains the core bottleneck preventing many cryptocurrencies and blockchain applications from going mainstream. As widely known, zkRollups scale by bundling hundreds of transactions into a single execution task and verifying all transactions within that single proof.

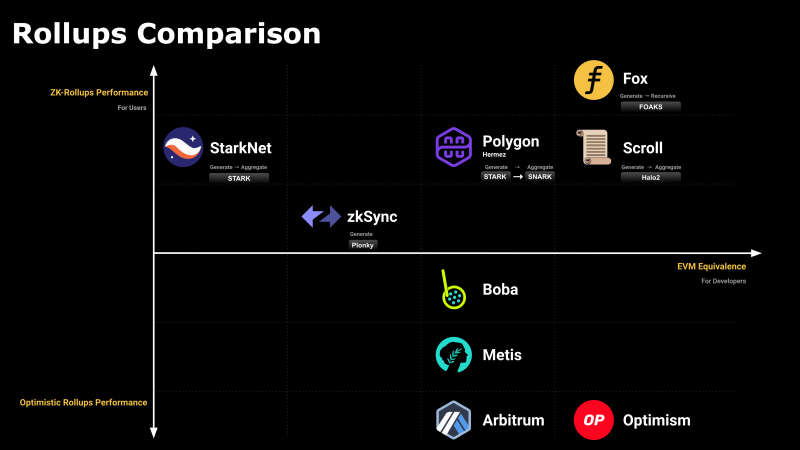

With strong support from Vitalik, Rollup has become the mainstream solution for Ethereum scalability. Rollup solutions fall into two categories based on technical approach: Optimistic Rollup and zkRollup. Their key difference lies in how transaction validity is ensured. Optimistic Rollup uses fraud proofs, while zkRollup relies on mathematical zero-knowledge proofs.

In Optimistic Rollup networks, challengers can detect fraudulent data submitted to Ethereum and trigger network consensus to roll back invalid transactions. In contrast, zkRollup uses zero-knowledge proof technology when batching transaction data. It directly submits validity proofs to Ethereum, achieving immediate finality without waiting periods.

Compared to Optimistic Rollup, zkRollup’s use of mathematical zero-knowledge verification offers greater technical advantages. Projects like Starkware and zkSync have been pioneering this space for several years.

However, there’s a problem: EVM was not designed to support zero-knowledge proofs, making it extremely difficult to build a virtual machine that is both Solidity-compatible and ZK-friendly. For instance, Starkware cannot support Solidity for smart contract development.

To solve this, Scroll, Polygon, and Fox Tech are developing a new virtual machine that supports zero-knowledge computations and is compatible with Solidity—this is called zkEVM.

Unlike traditional VMs, zkEVM can prove the correctness of execution, including the validity of inputs and outputs used during computation.

Figure 2: Comparison of scaling solutions

Why Redesign zkEVM?

-

Polygon compiles bytecode into micro-operations, uses STARK to generate state transition validity proofs, then verifies them via SNARK before submitting to Ethereum for final validation.

-

Scroll's approach is somewhat similar to Polygon’s, but it uses Halo 2 as its zero-knowledge proof method.

-

zkSync compiles Solidity contracts into Yul—an intermediate language that can be compiled into bytecode for various VMs—then recompiles Yul bytecode into a custom, circuit-compatible instruction set specifically designed for zkSync’s zkEVM.

Are these systems good enough for production? Do we need to redesign a better zkEVM?

zkRollups typically use zero-knowledge protocols to prove and aggregate all transactions before publishing the summary proof on-chain.

In principle, this allows Layer 1 chains to verify a short "proof" covering thousands of complex transactions—with no possibility of cheating.

However, after Scroll and Polygon launched their zkEVM testnets, the reality became clear—it’s extremely slow, taking dozens of minutes to execute just a few transactions.

Fox has optimized the zkEVM architecture and redesigned zkEVM to make it more efficient than any existing solution. This is primarily due to its well-designed hierarchical structure, which compresses redundant space in circuits and reduces the size of commitment polynomials, ultimately shortening proof generation time. At the same time, its Sequencer runs an Ethereum node, receives user transactions, generates new states, and produces a special zkEVM-friendly Trace.

Fox Folder is the proof generator, which takes this Trace from the sequencer and processes it using many small tables (instead of one massive table) within zkEVM, significantly reducing redundancy and accelerating proof generation.

Why Faster Zero-Knowledge Proofs Matter?

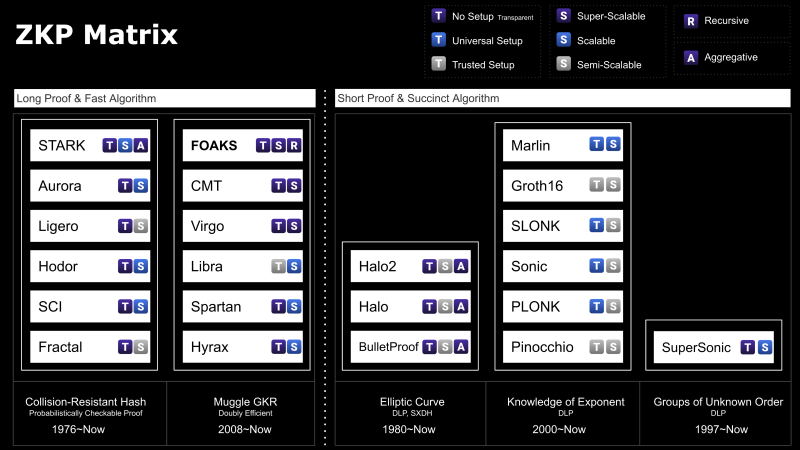

SNARKs are succinct but less efficient than STARKs. However, STARKs themselves became outdated with the emergence of FOAKS. Since speed is the bottleneck for zkEVM, comparing computational efficiency is critical. STARKs achieve quasi-linear proof and verification times. They’re faster than SNARKs but noticeably slower than FOAKS. FOAKS is the world’s first ZKP system to achieve linear proof time and sublinear verification time—reaching theoretical optimality. FOAKS is transparent and requires no trusted setup, meaning it maintains the highest level of security.

FOAKS stands for Fast Objective Argument of Knowledge, a fast and objective zero-knowledge proof system developed by Fox Tech. Based on linear-time encodable codes, FOAKS is the fastest among all existing ZKP schemes. Additionally, thanks to recursive techniques, FOAKS reduces proof size to just 1/7 of existing solutions, allowing end users to access Ethereum Layer 2 services for as little as one cent.

Figure 3: Zero-Knowledge Proof Matrix

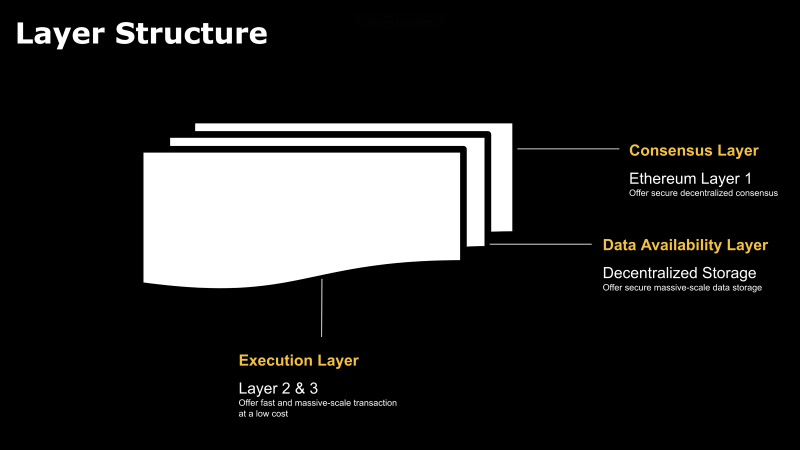

Why a Dedicated Data Availability Layer Is Needed?

Current zkRollups mainly focus on reducing the computational burden of transaction verification. This is especially important for Ethereum, where validating complex smart contract executions is extremely costly.

However, Ethereum nodes still need to store raw transaction data. This isn’t ideal, as Ethereum is better suited as a consensus layer rather than a storage layer. This means the scalability bottleneck persists—nodes get overwhelmed when bandwidth and storage run out (not computing power).

That’s why Ethereum needs a dedicated data availability layer to store raw transaction data, preventing entire smart contracts from freezing due to failures in zkRollup servers or Ethereum nodes.

More importantly, it decouples Layer 2 costs from Layer 1, further reducing transaction costs for zkEVM-based zkRollups by over half.

Figure 4: Ethereum Layered Architecture

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News