Robinhood May Enter L2, Bringing a New Player to Tokenized US Stocks

TechFlow Selected TechFlow Selected

Robinhood May Enter L2, Bringing a New Player to Tokenized US Stocks

Robinhood's concept of tokenizing U.S. stocks is not a sudden idea.

Written by: TechFlow

As dollar-pegged stablecoins gradually gain market attention, companies both within and outside the crypto industry have begun targeting U.S. equities as the next frontier.

In late May, U.S. cryptocurrency exchange Kraken announced it would offer tokenized popular U.S. stocks to non-U.S. clients; on June 18, Coinbase Chief Legal Officer Paul Grewal revealed the company is seeking SEC approval to launch its “tokenized stocks” service.

Tokenization of U.S. equities is becoming an increasingly visible business.

Now, this space may be welcoming a new player — Robinhood, the well-known U.S. internet brokerage firm and a key force behind the "retail investor uprising" that challenged Wall Street.

Earlier, two sources familiar with Robinhood told Bloomberg that the company is developing a blockchain-based platform enabling retail investors in Europe to trade U.S. stocks.

According to these sources, the platform’s technical infrastructure could be built on either Arbitrum or Solana, though specific partners have not yet been finalized and agreements remain unsettled.

This news carries at least two implications.

First, Robinhood might directly integrate Arbitrum L2 into this new platform—allowing European users to trade U.S. stocks—with Arbitrum serving as the foundational blockchain layer for transactions.

Second, and more likely, Robinhood plans to leverage Arbitrum's Arbitrum Chains functionality to build its own dedicated L2 chain using Arbitrum's tech stack (Rollup protocol, EVM compatibility, etc.).

Regardless of which scenario unfolds, market sentiment has already shifted.

This suggests Robinhood may be preparing to launch its own L2 for U.S. stock tokenization, enabling more efficient on-chain settlement and specialized operations tailored to this business.

At EthCC in Cannes, France, happening today, Robinhood is scheduled to make a major announcement at 17:00 local time (23:00 Beijing time), fueling speculation about its potential L2 development and equity tokenization plans.

Meanwhile, A.J. Warner, Chief Strategy Officer of Offchain Labs—the company behind Arbitrum—will also attend, raising further expectations of a joint announcement.

ARB, whose price had recently appeared sluggish, saw its 24-hour gain briefly surge beyond 20%, ranking among the top performers in the cryptocurrency market.

Adding further hints, Robinhood’s European X account replied “Stay tuned” under a user’s post discussing the conference agenda. Given the earlier Bloomberg report about offering U.S. stock trading in Europe, the likelihood of announcing this feature has increased.

Everything Points Forward

Robinhood’s vision for tokenizing U.S. equities did not come out of nowhere.

In January, CEO Vlad Tenev criticized current U.S. regulations, stating that the country lacks a clear framework and rules for registering security tokens, hindering the rollout of tokenized products.

Then in March, during a podcast episode, Tenev stated bluntly: “Right now, if you're overseas, investing in a U.S. company is extremely difficult.”

This resonates deeply with many investors globally who follow U.S. markets but reside outside the United States—they urgently need a smoother way to access U.S. equities.

At the time, Tenev also mentioned he was considering tokenizing securities, noting it would be part of a broader push to integrate digital assets into the financial system.

In hindsight, all the groundwork has been laid step by step.

Currently, Robinhood’s customers in the EU can only trade cryptocurrencies. However, last month the company obtained a brokerage license in Lithuania, allowing it to offer stock trading and other investment services across the EU.

Additionally, Robinhood signed an agreement last June to acquire cryptocurrency exchange Bitstamp. Once completed, this acquisition will allow Robinhood to use Bitstamp’s MiFID Multilateral Trading Facility (MiFID) license to provide crypto-related derivatives.

With licenses secured and regulatory compliance addressed, the next logical step is choosing a blockchain infrastructure.

Why Arbitrum?

From a technical standpoint, Arbitrum is a fully EVM-compatible L2 solution, meaning Robinhood can seamlessly migrate its existing Ethereum smart contracts and development tools without significant changes to its tech stack.

EVM compatibility is crucial for large fintech firms like Robinhood looking to rapidly deploy on-chain solutions. Why ignore Ethereum’s vast developer community and robust infrastructure when they’re readily available?

Moreover, Arbitrum’s Optimistic Rollup technology strikes a balance between transaction confirmation speed and cost. In contrast, ZK Rollups tend to incur higher costs and slower finality. For a platform like Robinhood, which must handle massive volumes of retail trades, Arbitrum’s mature technology and lower development barrier make it a more attractive choice.

On the commercial side, this decision also allows Robinhood to avoid Coinbase.

Base, Coinbase’s own L2, uses the same OP stack. But given Robinhood’s competitive relationship with Coinbase in core businesses, it’s unlikely Robinhood would run its tokenized stock operations directly on Base.

Arbitrum’s support for custom L2 chains (via Arbitrum Chains) enables Robinhood to differentiate itself from Base.

One often overlooked detail: Robinhood and Arbitrum already have prior collaboration experience.

Back at ETHDenver 2024, Robinhood officially announced a partnership with Arbitrum to streamline user access to the Arbitrum network via Robinhood Wallet.

This existing foundation of technical integration and strategic alignment makes it natural for Robinhood to extend the partnership, leveraging Arbitrum’s proven support and brand recognition to expand its offerings.

Mimicking Base, Yet Different From Base

Although Robinhood’s plan to build its own L2 on Arbitrum hasn’t been officially confirmed, it has already sparked widespread discussion in the crypto community.

The harshest criticism is that this move amounts to a direct imitation of Base.

Base, launched by Coinbase, adopted an open strategy, inviting external developers to build DApps, thereby expanding its ecosystem and attracting users and capital. Part of Base’s success stems from this openness—projects like Aerodrome and Uniswap migrated or launched there.

If Robinhood builds a custom L2 on Arbitrum and opens it to third-party developers to create real-world asset tokenization use cases, despite differing tech stacks, its business model would closely mirror Base’s.

The perception of “imitation” largely comes down to timing.

Remember, Coinbase launched Base back in late 2023, while Robinhood is only now announcing its L2 plans. This time lag makes Robinhood’s move appear reactive—a follower rather than an innovator.

In traditional finance, fintech companies often replicate proven models, which is indeed a safer approach. But mimicking Base means competing directly with Coinbase, which already enjoys first-mover advantage. To surpass it, Robinhood will need to invest significantly more resources and effort.

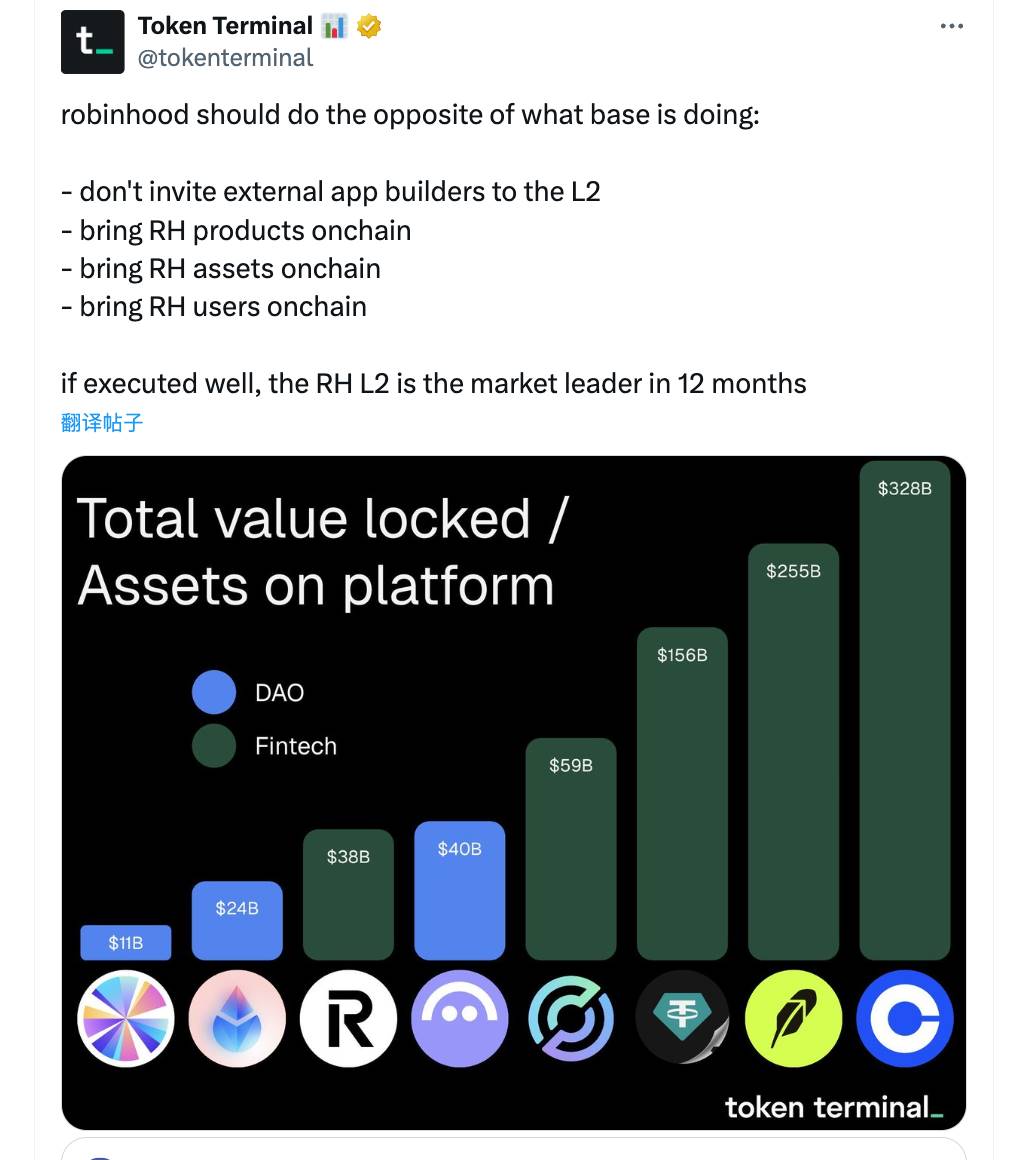

Data platform Token Terminal offered Robinhood a different path forward: leverage its strength as an online brokerage and pursue a “closed ecosystem” model—opposite to Base’s open approach.

Instead of inviting external developers, Robinhood could migrate its existing financial products (such as trading or investment tools), assets, and users entirely onto the blockchain, allowing users to operate directly on-chain rather than relying on centralized systems.

This idea is more crypto-native—merging Robinhood’s existing user base with pure on-chain mechanics—but also more radical, likely facing greater internal resistance. Robinhood may ultimately choose not to take this route.

Beyond Robinhood, some voices within the Ethereum ecosystem worry this trend could deepen fragmentation among Ethereum L2s.

Ethereum L1 has already lost significant influence amid a fragmented landscape of numerous L2s. Whether performance improves is secondary—the real concern is complete marginalization and commoditization into mere data pipes. Building a purpose-built L2 is easy; restoring Ethereum’s centrality is hard.

We may get our answer soon—perhaps right after today’s ETHCC keynote.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News