The Rise and Fall of FTX: A Mountain for Many, a Speck of Dust for the Era

TechFlow Selected TechFlow Selected

The Rise and Fall of FTX: A Mountain for Many, a Speck of Dust for the Era

Only in a single moment is one's entire life and destiny decided.

Author: longcrypto

It is only a moment that determines a person's life, as well as his entire destiny.

决定一个人的一生,以及整个命运的,只是一瞬之间。

——Goethe

In May 2022, the Terra UST depeg event shook the entire crypto industry. Within just five days, LUNA, once a top-five blockchain by market capitalization, plummeted from $23 billion to $500 million in value, while UST, the stablecoin issued on the Terra network, dropped from $1 to $0.10—nearly collapsing to zero.

Following this incident, hedge fund Three Arrows Capital, lending platform Celsius, Canadian publicly traded company Voyager Digital, crypto trading and lending platform BlockFi, and crypto asset management firm Babel Finance all faced bankruptcy, delisting, or restructuring to varying degrees, causing massive shocks across the industry.

By November, as U.S. inflation data slowed and the Federal Reserve signaled a potential pause in rate hikes, the long-suppressed crypto sector finally caught its breath.

However, an even more shocking event unfolded: within less than ten days, FTX—a top-ten exchange with a $32 billion valuation and over $24 billion in assets—collapsed rapidly amid overwhelming FUD and liquidity failure.

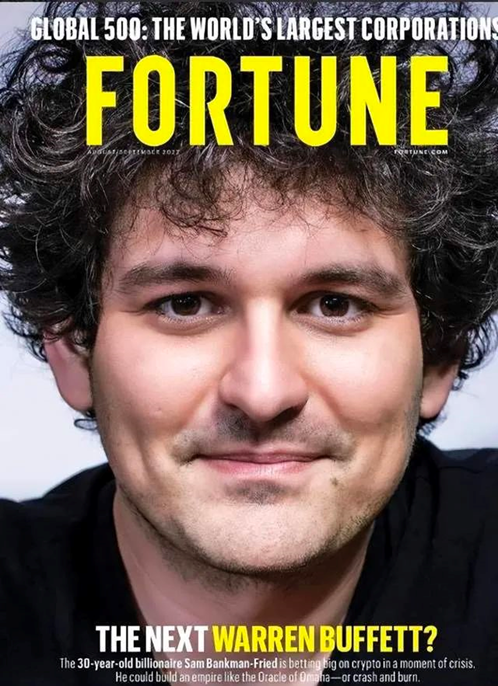

As the FTX empire crumbled, its once-glamorous origin story instantly faded, revealing behind-the-scenes scandals such as fraud, insider trading, misappropriation of user funds, and poor governance. Overnight, SBF, founder of FTX, saw his reputation collapse—from being hailed as a genius trader, “Crypto Robin Hood,” philanthropist, savior, altruist, symbol of the American Dream in crypto, and embodiment of “talent and hard work”—to being labeled a super villain and traitor of the crypto world.

How could such a dramatic downfall happen in just about ten days? This article aims to review FTX’s four-year development and marketing strategies. Indeed, FTX’s comprehensive marketing approach offers valuable lessons for marketers across industries. The signs of decline were evident long before the collapse—but everyone overlooked them. In the long run, we must turn these lessons into building a healthier crypto ecosystem.

PART01: The Rise of FTX – Ambitious, Profitable, and Fearless

In May 2019, FTX was officially founded in Hong Kong, focusing on derivatives trading. The name FTX is a shorthand for "Futures Exchange." Its founder was 27-year-old Sam Bankman-Fried, widely known as SBF in the crypto community.

Born in 1992, SBF grew up on Stanford University’s campus, where both his parents were law professors—his father Joseph Bankman, a tax law expert, and his mother Barbara Fried, who specialized in law, economics, and philosophy. After graduating with a degree in physics from MIT, he worked for three years at Jane Street, a quantitative trading firm on Wall Street. In 2017, he launched Alameda Research from a rented house in Berkeley, California, marking the beginning of a classic crypto-era American Dream.

1.1 2019: FTX had a quiet first year, with one major highlight—the investment from Binance—which would later become pivotal to its story.

-

July 29, 2019: FTX launched its global ecosystem token, FTT;

-

August 2019: FTX introduced leveraged tokens and secured $8 million in seed funding;

-

October 2019: Launched perpetual contracts;

-

December 2019: Received investment from Binance to jointly expand the derivatives sector.

1.2 2020: As crypto gradually emerged from the bear market, FTX seized the momentum and emerged as a dark horse.

-

January 2020: FTX achieved a record-breaking 24-hour two-sided trading volume of over $20 billion;

-

February 2020: During the U.S. presidential election, FTX added a new futures contract: TRUMP-2020;

-

March 2020: Secured Series B funding from Liquid Value Capital;

-

April 2020: Launched WTI crude oil futures contract (OIL);

-

May 2020: Launched U.S.-based trading platform FTX.US;

-

August 2020: Sina Nader, former head of crypto at Robinhood, joined FTX.US as COO;

-

August 26, 2020: FTX acquired Blockfolio, a crypto price tracking app, for $150 million;

-

October 2020: Listed stock tokens such as TSLA and AAPL;

-

November 2020: It was revealed that SBF donated $5.2 million to Joe Biden during the U.S. presidential election.

1.3 2021: FTX rode the massive crypto bull market and aggressive spending on marketing to become the fastest-growing crypto company in history, reaching a $32 billion valuation.

-

January 2021: Launched GME equity token and Wall Street Bets index quarterly contracts;

-

February 2021: SBF ranked second on Forbes’ list of crypto billionaires with a net worth of $4.5 billion;

-

February 8, 2021: FTX announced the establishment of a charitable foundation;

-

February 23, 2021: FTX announced zero withdrawal fees, with plans to subsidize millions in gas fees throughout the year;

-

April 2021: Launched Coinbase Pre-IPO product;

-

April 20, 2021: FTX single-day trading volume exceeded 10% of global volume, an 8,000% increase year-on-year;

-

May 18, 2021: Introduced futures contracts betting on the outcome of Brazil’s presidential election;

-

May 20, 2021: FTX ranked second globally in 24-hour open interest;

-

May 29, 2021: Invested in Circle, the issuer of USDC;

-

July 21, 2021: Raised $900 million in Series B funding at an $18 billion valuation—the largest round in crypto history at the time;

-

First half of 2021: Daily average trading volume on FTX.US increased 150x year-on-year;

-

August 3, 2021: Ryne Miller, former counsel to SEC Chair, joined FTX.US as General Counsel;

-

August 11, 2021: FTX captured the second-largest share of Bitcoin futures market;

-

August 26, 2021: Liquid Global received a $120 million loan from FTX;

-

August 27, 2021: Both FTX and FTX.US passed GAAP audits in the U.S.;

-

September 17, 2021: ZUBR, FTX’s subsidiary in Gibraltar, obtained a DLT provider license;

-

September 20, 2021: Approved by the Bahamas Securities Commission to operate locally;

-

September 24, 2021: Relocated headquarters from Hong Kong to Nassau, Bahamas;

-

October 21, 2021: Raised over $420 million in Series B-1 at a $25 billion valuation, with participation from BlackRock, Tiger Global, and others;

-

November 2, 2021: Mark Wetjen, former CFTC commissioner, joined FTX US as Head of Policy and Regulatory Strategy;

-

December 8, 2021: SBF testified at a U.S. Congressional hearing on crypto.

In this year, FTX’s sports marketing strategy, akin to throwing money into the sky, brought immense visibility and brand recognition:

-

April 2021: FTX.US signed a $135 million, 19-year deal with the NBA’s Miami Heat, becoming the exclusive naming rights partner for the team’s arena;

-

May 19, 2021: Partnered with the International Chess Championship;

-

June 4, 2021: Signed a $210 million deal with esports giant TSM for naming rights;

-

June 16, 2021: Became a diamond sponsor of the Wall Street Ride & Roll;

-

June 23, 2021: Partnered with Major League Baseball (MLB);

-

June 29, 2021: NFL legend Tom Brady and supermodel Gisele Bündchen became shareholders;

-

August 4, 2021: Signed a 7-year sponsorship deal with the League of Legends Championship Series (LCS);

-

August 23, 2021: Paid $17.5 million to rename UC Berkeley’s Memorial Stadium;

-

September 8, 2021: NBA star Stephen Curry became a global ambassador and shareholder;

-

September 23, 2021: Signed a long-term sponsorship deal with Mercedes-AMG Petronas F1 Team;

-

October 18, 2021: Announced partnership with the International Cricket Council;

-

November 3, 2021: Signed NIL sponsorship deals with University of Kentucky basketball players;

-

November 17, 2021: MLB star Shohei Ohtani became a global brand ambassador;

-

December 7, 2021: Appointed golfer Albane Valenzuela as a sports ambassador;

-

December 14, 2021: Agreed to pay $10 million to sponsor the Golden State Warriors.

1.4 2022: The Federal Reserve began raising rates early in the year, tightening market liquidity and marking a turning point in the bull market. Yet few believed the party was ending—much like those who still believed the Titanic was unsinkable until it hit the iceberg.

-

January 14, 2022: FTX announced the launch of FTX Ventures, a $2 billion venture fund;

-

January 26, 2022: FTX.US raised $400 million in Series A at an $8 billion valuation;

-

January 31, 2022: FTX raised $400 million in Series C at a $32 billion valuation, backed by SoftBank and Paradigm;

-

February 2, 2022: Acquired Qrypto and parent company Liquid to serve Japanese clients;

-

February 9, 2022: SBF testified at a U.S. Senate hearing on crypto;

-

February 14, 2022: Spent $32.5 million on a 2.5-minute ad during Super Bowl LV, the most expensive crypto ad ever;

-

March 1, 2022: Launched FTX Future Fund, aiming to distribute at least $100 million that year;

-

March 7, 2022: Announced FTX Europe to offer crypto derivatives to European users;

-

March 15, 2022: Obtained a crypto service provider license in Dubai;

-

March 21, 2022: Naomi Osaka, four-time Grand Slam champion, became a global ambassador and shareholder;

-

March 21, 2022: Launched FTX Australia, licensed to operate;

-

March 23, 2022: Participated in Yuga Labs’ $450 million round at a $4 billion valuation;

-

March 29, 2022: Appointed former Liechtenstein financial regulator as EU Strategic Lead;

-

April 5, 2022: Forbes listed SBF as second richest in crypto with $24 billion net worth;

-

April 26, 2022: Crypto Bahamas conference launched by FTX and SALT in the Bahamas, attended by former UK PM, ex-U.S. President, Bahamian PM, Super Bowl champions, former CFTC Chair, and ARK CEO Cathie Wood;

-

April 28, 2022: Announced a $1 billion charity fund;

-

May 2022: SBF and FTX regulatory team visited the White House;

-

May 25, 2022: SBF said he might spend $1 billion in 2024 to block Trump’s comeback;

-

May 26, 2022: SBF named to TIME’s 2022 “100 Most Influential People”;

-

May 30, 2022: FTX surpassed Coinbase to become the second-largest centralized crypto exchange;

-

June 3, 2022: Announced FTX Japan, a compliant exchange offering derivatives;

-

June 17, 2022: Acquired Canadian compliant exchange Bitvo;

-

July 2, 2022: Announced a $680 million credit line and acquisition option agreement with BlockFi;

-

July 25, 2022: Led Aptos’ $150 million raise alongside Jump Crypto;

-

August 21, 2022: CNBC reported FTX earned over $1 billion in 2021, a 10x+ growth;

-

September 1, 2022: Jill Sommers, former CFTC commissioner, joined FTX US Derivatives board;

-

September 8, 2022: Led Mysten Labs’ $300 million Series B for Sui blockchain;

-

September 9, 2022: FTX Ventures to acquire 30% stake in SkyBridge Capital;

-

September 13, 2022: Participated in Doodles’ $54 million raise at a $700 million valuation;

-

September 22, 2022: Reportedly negotiating $1 billion funding at ~$32 billion valuation;

-

September 27, 2022: Voyager announced FTX US won asset auction with $1.422 billion bid;

-

September 28, 2022: SBF reportedly considering bid for Celsius’ assets;

-

October 2022: SBF attended Saudi Arabia’s Future Investment Initiative hosted by PIF.

The rest, as they say, is history.

-

November 2, 2022: CoinDesk published a report on Alameda Research’s finances;

-

November 6, 2022: Binance CEO CZ publicly announced intent to liquidate all FTT holdings;

-

November 9, 2022: FTX reached out to Binance for help;

-

November 10, 2022: Binance abandoned acquisition after due diligence;

-

November 11, 2022: FTX filed for Chapter 11 bankruptcy protection.

Undeniably, in just three and a half years, FTX rose from an obscure tier-three exchange to among the top three globally—an exemplary case study in business development, showcasing unmatched connections and execution power.

Fundraising: Raised over $3.2 billion from top-tier institutions including BlackRock, Ontario Teachers’ Pension Plan, Temasek, Sequoia, SoftBank, Tiger Global, Multicoin, Paradigm, and Coinbase Ventures, reaching a $32 billion valuation—the fastest-growing crypto company in history.

Products & Services: Guided by the principle “built by traders, for traders,” FTX introduced features beloved by traders: one-click stablecoin swaps, multiple sub-accounts with cross-margin functionality, compliant USD deposits/withdrawals. It launched innovative products like leveraged tokens and volatility-tracking tokens. Beyond crypto, FTX created tradable instruments based on public interests—from presidential elections to Olympic opening dates.

Marketing: Superior products alone don’t guarantee success—it takes awareness. SBF admitted Alameda Research nearly collapsed, shifting from flawless to survival mode within a month. That experience taught him the critical importance of marketing. FTX adopted a sports-centric marketing strategy, pushing it further than any predecessor, bringing crypto and Web3 to mainstream audiences.

Building Trust: SBF frequently appeared in mainstream media like The New York Times, The Economist, Wall Street Journal, Forbes, and Bloomberg, crafting a public image of success. TIME named him one of the “100 Most Influential People” in 2022. FTX relocated its headquarters to Nassau, where the Prime Minister personally thanked SBF for boosting the economy.

Under intense media influence, many found it hard to believe FTX had collapsed. It happened so fast—over one million users suffered losses, many losing their entire wealth. Major investors wrote down their stakes to zero.

Alameda played a crucial role in FTX’s collapse. According to Alameda CEO Caroline Ellison, after the crypto market crash in spring, lenders pulled back, and funds Alameda spent became harder to recover—so it used FTX customer funds to cover payments. As a closely linked entity, SBF’s tolerance toward Alameda far exceeded normal business standards. Per The Wall Street Journal, Alameda owed FTX about $10 billion, while FTX held approximately $16 billion in customer assets—meaning more than half of customer funds were used to finance Alameda’s ventures.

Why did FTX go bankrupt so quickly?

SBF later attributed the collapse to excessive leverage, a bank run, and liquidity drain.

According to FTX’s balance sheet filed before Chapter 11, as of November 5, FTX had $14 billion in liabilities and $24 billion in total assets—leverage ratio of 1.4x. Macro analyst Degg_GlobalMacroFin noted that FTX typically processed $250 million in withdrawals per day, meaning $6 billion in liquidity could cover 24 days. But on November 6, it faced 25x normal demand—$5 billion net outflows in a single day, leaving only $1 billion in liquidity. Left unchecked, FTX would have survived only hours. On November 8, FTX halted withdrawals. Meanwhile, FTT and holdings like SRM and SOL crashed, dropping FTX’s total assets to around $9 billion against $9 billion in liabilities—effectively insolvent.

This collapse was a textbook case of an investment bank-style run: using customer funds for high-risk, illiquid investments, severely underestimating run risk, triggering a death spiral of redemptions → sell-offs → falling asset prices → declining equity → intensified runs.

PART02: The Impact of FTX’s Collapse on the Crypto Industry

2.1 Exchanges:

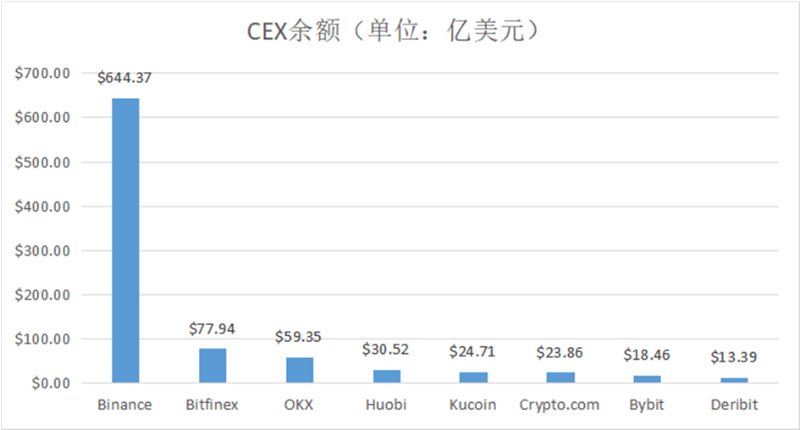

Before the collapse, SBF claimed FTX could fully cover all customer assets and never invested customer funds—even in Treasuries. He later deleted those statements. Centralized exchanges’ lack of transparency reignited trust crises. Rumors spread about exchange reserves, triggering massive withdrawals. Data shows over $8 billion flowed out of centralized exchanges in the week following November 6—including $3.7 billion in Bitcoin, $2.5 billion in Ethereum, and over $2 billion in stablecoins. Exchange Bitcoin balances hit record lows, and overall crypto holdings dropped to their lowest since November 2018.

Industry KOLs and professionals called for centralized exchanges to adopt transparent proof-of-reserves with on-chain dashboards instead of relying solely on verbal assurances.

Under industry pressure, exchanges began enhancing transparency.

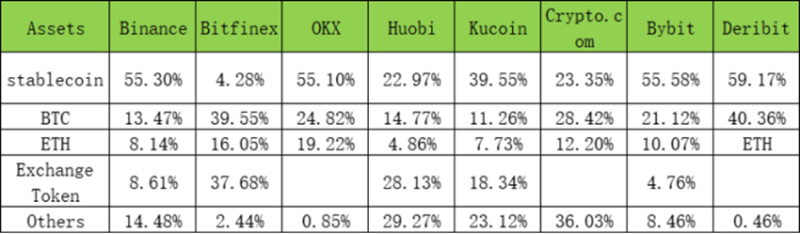

OKX, Binance, Huobi, Gate.io, and others led the way by publicly sharing auditable Merkle tree-based Proof of Reserves (PoR). PoR is a common audit method proving on-chain reserves fully cover user liabilities. For example, OKX disclosed a 100% reserve ratio, excluding its native token OKB. Its largest holdings consist mainly of top-five cryptocurrencies—89,000 BTC, 1 million ETH, and stablecoins—totaling about $6 billion.

Proof of Reserves verification involves three key steps: First, verifying user balances are included in the Merkle tree; second, confirming platform ownership of wallet addresses and their total balances; third, comparing total user liabilities with on-chain wallet balances to verify reserve ratios.

As of November 21, nine of the top 15 centralized exchanges had disclosed wallet addresses for major reserves or published third-party Proof of Reserve audit reports, some partnering with Nansen to launch reserve dashboards.

Huobi transferred 10,000 ETH to Binance and OKX deposit wallets after taking an asset snapshot on November 13, sparking speculation. Huobi responded that user assets remain secure with 100% redeemability and no withdrawal restrictions. Media reports indicated the withdrawal was initiated by an institutional whale, not Huobi itself.

Even with PoR disclosures, concerns persist over asset composition. For instance, Crypto.com’s reserves included 20% SHIB—far higher than other exchanges.

However, as Cobo founder Shen Yu pointed out, Merkle trees only prove account balances exist—they don’t verify ownership of on-chain addresses. Due to information asymmetry between exchanges and users, evidence provided can be hard to authenticate. StarSky, founder of Bixin Ventures, noted that while Merkle trees help internal monitoring, they offer little external assurance since private key control remains unclear.

Clearly, merely publishing PoR isn’t enough for exchanges to prove solvency. Some chose third-party custody partnerships. For example, PowerTrade, a derivatives-focused crypto exchange, partnered with Copper to provide custody and settlement services for institutional clients, minimizing counterparty risk. Fund segregation is indeed a relatively better solution. In mature securities markets, client funds are custodied by third-party banks, preventing brokers from misusing them.

On November 21, OKX CMO Haider tweeted that OKX would roll out major updates in the coming two weeks, including PoR functionality for global users and features for institutional clients.

In response to skepticism, OKX adopted greater transparency to boost user confidence. According to its official announcement, OKX launched Proof of Reserves (PoR) on November 23, allowing all users to independently verify the match between OKX’s on-chain wallet balances and the total user assets in the Merkle Tree. Initially, PoR covers only BTC, ETH, and USDT—excluding OKB and other assets—with a current reserve coverage rate of 100%.

FTX’s aftershocks spread to other platforms. Japanese exchange Liquid Global, which had debt financing from FTX, suspended all withdrawals. Brisbane-based Digital Surge paused all deposits and withdrawals due to FTX Australia’s operational issues. Several smaller centralized exchanges also faced disruptions—BitCoke and AAX both suspended withdrawals on November 13. BitCoke cited its CFO cooperating with a foreign law enforcement investigation, rendering private keys inaccessible. AAX initially blamed a third-party partner error, then admitted severe capital strain requiring new fundraising.

Looking at the evolution of crypto exchanges, turnover is rapid. Once-dominant Mt.Gox controlled 80% of trading volume but lasted only three years. Eight years after its bankruptcy, creditors still haven’t been fully compensated. Bitfinex, once a top-three global exchange, lost 120,000 BTC to hackers in 2016. Fortunately, it survived by issuing platform tokens to compensate users. Most hacked exchanges weren’t so lucky and collapsed shortly after.

2.2 Wallets: Two Types of Decentralized Wallets – Hardware and Software

Storing assets in decentralized wallets is safer and more crypto-native. Even Tesla CEO Elon Musk says: Not Your Keys, Not Your Wallet.

After the FTX collapse, Chinese hardware wallet OneKey sold out, while sales of Ledger and Trezor surged globally.

Among software wallets, MetaMask leads with 30 million monthly active users as of March 2022. Meanwhile, well-funded exchanges with massive user traffic launched their

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News