Interview with y2z Ventures Partner: The World is a Game, and Hunters Must Have Their Prey

TechFlow Selected TechFlow Selected

Interview with y2z Ventures Partner: The World is a Game, and Hunters Must Have Their Prey

Walking alongside young people who have light in their eyes.

Interviewer: Claudia

What comes to mind when you think of y2z Ventures?

Mentor to young entrepreneurs? Mysticism? Or founders tt and Alen?

While most VCs prefer "adding flowers to brocade," y2z Ventures often chooses to "send charcoal in the snow." When countless young founders have nothing—when they’re down and out—y2z is often the one standing firmly beside them. Behind emerging Chinese Web3 forces like Mask, Rct.ai, Pure White Matrix, SeeDAO, Ethsign… stands y2z Ventures.

At the same time, y2z Ventures maintains its own unique investment methodology and value-add: face reading,八字 (BaZi), divination… Their mystical indicators stand apart. Two idealistic yet unconventional and irreverent partners use manga and games as metaphors for life and work, adventuring through the world and launching their Great Voyage DAO into the Web3 universe.

With curiosity and respect, TechFlow speaks with y2z Ventures partner Alen about Web3, youth, and this world…

From Fan to Pathfinder

TechFlow: Could you introduce yourself? How did you enter the crypto world, meet tt, and become a partner at y2z Ventures?

Alen: Sure. I'm Alen. Before, I worked at a traditional A-share secondary market hedge fund. Joining the crypto space and meeting tt was pure serendipity.

In 2016, A-shares had a blockchain hype cycle. Ethereum launched in 2015, and by year-end, Vitalik’s face appeared on The Economist. I attended a blockchain summit hosted by Guotai Junan, listening to endless speeches about how “smart contracts will transform industries.” It all felt too distant from real-world implementation—hard to tie to actual performance. Then I heard tt speak. His talk was different from the official narratives.

He said: Ethereum was worth one dollar during ICO, now it's up 100x in a year. We’re building China’s version of Ethereum—how many multiples do you think it could reach? I was instantly hooked—so raw, so direct, so heart-striking! First, it represented an arbitrage opportunity between primary and secondary markets. Second, it operated without regulation, enabling liquidity premiums. Anyone doing IPO arbitrage in traditional stocks would’ve immediately seen the potential. I joined an ICO QQ group and quietly observed. At that point, I just thought it could make money—I didn’t truly believe in it yet. The people involved seemed overly imaginative and grandiose, clearly defying common sense and securities laws.

In 2017, I encountered the peak of ICO mania. Seeing Neo rise, I started paying attention again, seriously studying concepts like Bitcoin and Ethereum. What fascinated me most was the sheer possibility. For example, Decentraland came to Shanghai for a roadshow. I found their concept compelling and went to listen. It was pouring rain that day—only two or three people showed up—so we ended up talking for two hours. Never imagined years later their market cap would be so high. Blockchain gave even ordinary individuals access to equal dialogue with project teams halfway across the globe, who were genuinely willing to engage. And you could even invest—and possibly make big returns. That was a huge shock to me. In traditional finance, this is unimaginable. Of course, making money was part of it, but what really drew me in was the chance to access and invest in world-class innovation—the atmosphere itself was magnetic.

I always thought tt was special. Whenever he spoke, I made sure to attend. By late 2017, he was already discussing DAOs, teal organizations, complex networks, causality, human-machine integration—topics that are mainstream today but were extremely rare in China’s crypto scene back then. Every talk introduced something new, delivered in his uniquely authentic way. I always walked away enriched—though honestly, I still saw him through fan-tinted glasses, never really interacting much.

In 2019, during a bear market, I noticed X-order (tt’s team) was hiring. With my fan bias intact, I joined. I remember him painting a vision of “a billion tokens” back when NFTs hadn’t taken off—proof of deep conviction in crypto and financialization.

At X-order, we roughly had three parts:

-

Donut: Scoured Twitter for interesting new projects and regularly shared alpha.

-

Data research: Aimed to combine social and on-chain data to uncover alpha.

-

Labs: Focused on frontier research in complex disciplines.

We also experimented internally with various DAO-like organizational forms—many failures along the way.tt never dictated what we should do—if it was interesting, go for it. We even did things like fortune-telling for Bitcoin and researching mysticism.

In 2021, a turning point: tt’s early investments in Mask’s Suji and Pure White Matrix’s Wu Xiao began bearing fruit. This unlocked a new passion—watching talented youth grow and fulfilling their dreams. Internally, tt often asked colleagues: “Tell me your dream.” That sparked the idea of creating a fund dedicated to supporting gifted Chinese youth.

Meanwhile, being an early NFT adopter, I noticed several signs:

1) NFTs merge finance and culture. The key insight: price appreciation leads people to embrace the information, culture, and ideology behind an image. If DeFi is just about making money, it feels hollow. But when it conveys ideology and culture, it becomes a powerful weapon. Given that narrative has long been a weakness among Chinese projects, this felt urgent.

2) Metaverse feels too distant, but NFTs serve as excellent capital vehicles—they create a speculative shell first, then pull users into the future Metaverse. This is exactly what crypto excels at.

3) Compared to DeFi, Metaverse allows more traditional Web2 content and companies to integrate into Web3. At that historical moment and within China’s context, this offered significant arbitrage opportunities. Based on these insights, plus the trust built through surviving multiple market cycles together, we founded Yuan Cosmos Capital. Why that name? We considered edgy names like “Red Pill Blue Pill,” but deemed them unlucky. “Metaverse” wasn’t widely used—so we claimed it.

If you know tt, you might recall his essay “All-In on the Chinese Dream.” Overall, growing alongside young people felt deeply meaningful.

TechFlow: For many in the industry, mentioning Yuan Cosmos Capital (y2z ventures) or tt brings forth the word “gratitude”—thanks for supporting young founders when they had nothing, especially during the toughest market times. On y2z’s homepage, there’s a line: “We are dedicated to supporting young people and startups…” Why do you focus on investing in youth and make rapid decisions? Any particularly memorable cases?

Alen: Yes, our investment approach has path dependency and reflects tt’s personal traits. Anyone who meets tt tends to resonate with him—he possesses rare qualities: foresight, intuition, creativity, storytelling ability, charisma, straightforwardness, and fearless courage beyond conventional limits. These traits naturally attract outliers—those several standard deviations from the norm.

tt especially loves investing in such youth—he finds them vibrant, full of life, diverse. Internally, he has a catchphrase: “What’s your dream?” He genuinely wants to help people achieve their dreams and derives joy from it. His self-perception is “bridging generations.” This shapes our vibe and internal consensus.

Also, we often see a spark in young people’s eyes—that helps us make fast decisions.

Our early investment criteria were simple:

-

Young, preferably post-95s;

-

International outlook;

-

Team has taste and aesthetic;

-

Unique and innovative, strong financial sense;

-

Crucially, the team or founder must have endured hardship.

Back in 2017, there was a concept called “personal tokenization” or Social Tokens—your personal token. A key aspect of personal tokens is that individuals become tradable—like a stock chart. If you can share income with your fans, your personal token inevitably gets tokenized.

Imagine you're trading stock B—what kind of chart do you want? You’d prefer to enter after a March 12 crash, when leverage has been cleared and prices stabilize. We apply the same logic to people. If someone has suffered, it’s like their leverage has been liquidated. Growing alongside such youth feels meaningful—and the deeper the pain, the better.

As for examples, take rct, the hot AIGC company. In early 2021, we met co-founder Xiankun. He radiated charm, eyes alight, passionately talking about Metaverse.

Back then, most people had shallow understandings of Metaverse. Yet rct’s 2020 article showed profound insight—arguably surpassing many Western analyses. He said: Content consumption is too fast. Creating a AAA game takes 3–4 years, but players finish it in dozens of hours. Content production can’t keep up with consumption. AIGC is inevitable—we need AI to generate human-like elements. NPCs must become more lifelike to enhance immersion. AI will play a crucial role—it’ll be central to Metaverse.

We were thrilled—an energetic young team with brilliant ideas wanting to enter crypto, strong narrative and aesthetics. Extremely rare. Toward the end, we awkwardly asked: “What hardships have you endured?” He replied: “Since you ask, I don’t usually tell others…” After sharing his struggles, we didn’t offer sympathy—we excitedly thought: “We found him!” Quickly decided to lead the round.

Then there’s Tang Han, founder of SeeDao. When she came in early 2021, she looked petite and delicate. Her understanding of NFTs aligned closely with ours. She spoke passionately about how NFTs merging culture and finance could disrupt the traditional world, expressing deep anxiety. At a time when most in China focused on flipping art images, a seemingly fragile woman articulating such a bold vision stood out—her foresight and contrast were striking. We thought: Whatever she does, we’ll back her. Never imagined Tang Han and Baiyu would come this far. The past year hasn’t been easy, but every time we meet, they’re energized—exhausted physically, but eyes shining: “We overcame another hurdle, validated some assumptions, moved one step closer to the right future.” We’re easily infected by their spirit. That’s why we love investing in such teams—they have fire in their eyes.

The World Is a Game

TechFlow: There are rumors in the industry about y2z’s investment methods—philosophical, even feng shui-related questions. Can you share y2z Ventures’ investment philosophy? What sets you apart from other VCs?

Alen: You can’t disprove that our world isn’t a game. And I’m increasingly convinced it is—one possibly generated by AI. When designing an open-ended game, you create many NPCs, assigning them base attributes via algorithms. Initially, these NPCs follow scripts, engaging in preset dialogues with the protagonist. But in an intelligent future, each NPC’s attributes are set at birth, modified by location and time—buffs and debuffs—like matrix multiplication in linear algebra. Interactions evolve based on time, place, and plot. Since we’re building Metaverse this way, given sufficient tech and computing power, we could fully create such a new world.

It sounds mystical, but events over the past year force me to believe it. Maybe because tt and I both love manga and gaming. While it may seem far-fetched, under this worldview, concepts like “dungeons” and “main quests” feel natural. Certain people are meant to complete these main quests. tt excels at spotting these “main quests”—public chain nation-building, supranational stablecoins—and hopes to find or back the protagonists who fulfill them. This explains a lot.

Those familiar with tt know he often discusses collective intelligence, emergence, causality, complex systems—all interconnected. He even invested in Zhihui, which researches complex networks and causality (check their academic papers). In early-stage investing, we aim to back “key nodes in emergent environments.”

Crypto changes too fast for rigid frameworks. Strategically, we use first principles; tactically, randomness (luck) dominates. Yet crypto offers ample risk premium for uncertainty. Overall, the industry rewards innovation and risk-taking. Environments where innovation emerges are thus highly valuable.

Take Ethereum—it’s an emergent environment. Though constantly surpassed in performance, its consensus remains strongest, developer community most vibrant. The more diverse and numerous its nodes, the greater its network value, cementing its irreplaceable, self-sustaining status.

Some founders truly have that spark—they discover differentiated paths aligned with first principles, occupy niches, possess unique traits that attract collaborators, and connect to ever more nodes, becoming key hubs in emergent ecosystems.

And thanks to tokens, they can capture network value at the right moment via tokenomics. This is what tt firmly believes. Beyond sectors, we prioritize backing such youth and enjoying the journey of growth. Of course, theory is beautiful—but practice is hard, especially judging people. So we sometimes lean on mysticism—face reading, BaZi, etc. (laughs). Call it “integrating fine traditional Chinese culture to accelerate the construction of Chinese-characteristic modern crypto investing.”

TechFlow: You once expressed long-term optimism about Chinese Web3 on Twitter. Regarding the current situation of Chinese founders—“globally scattered, facing hardship”—you said, “I’m not pessimistic, nor do I think there’s no hope for Chinese in Web3.” Where does this confidence come from? How do you view the current state of Chinese Web3 going global?

Alen: I have immense confidence. When we started y2z last year, whenever tt met Beijing-based founders, he’d say: “Move to Shanghai.” Shanghai uniquely combines crypto, culture, and finance—its cosmopolitan culture is perfect for open Metaverse startups. We persuaded Tang Han to relocate to Shanghai, but soon faced policy issues, so advised them to move overseas. Now they’ve successfully gone global. This shows capable, mission-driven, highly motivated founders won’t hesitate to adapt or relocate to achieve their goals.

If it’s a game, and completing the main quest requires relocating—you just do it. The question isn’t whether to run, but how. This brings us to the core reason we’re bullish on Chinese teams: these are founders who’ve left their comfort zones—already filtered or baptized by determination. They’ll fight tooth and nail to survive.

Second, our Web2 foundation is strong—many excellent internet entrepreneurs, solid methodologies and experience in user growth and product optimization. We excel in productivity and efficiency. Take exchanges—the most Web2-like sector in Web3—we dominate here. These are internal reasons for confidence.

Externally, the environment is shifting. Current conditions don’t favor Chinese strengths. Domestic constraints force teams to target overseas markets—a tough challenge when operating from China. Also, Chinese founders aren’t adept at structured narratives or integrating into established ecosystems. Currently, most focus on infra—because infra takes longer to falsify. For example, launching a public chain with strong team background, technical differentiation, and novel narrative—given sufficient legitimacy—is hard to disprove short-term. Technologies like zk have high falsification barriers; narrative cycles, token launches, vesting, and performance timelines can be decoupled—making it relatively easier to recoup investment. But apps have many experts, face users directly, and are quickly falsifiable. Under current infrastructure, replicating Web2 UX for the same demand is difficult. Success requires blending product, ponzi mechanics, and narrative—but timing ponzi is tricky, and narrative isn’t our strength—so apps are currently weaker. Infra demands technological innovation and ecosystem-building—areas where Chinese teams lag. Right now, Chinese founders excel most at product iteration.

But this external environment will change:

-

Once infra matures, the focus shifts to bringing users into Web3. Applications will be essential as gateways—this is when Chinese founders shine. This timing won’t be long in coming.

-

After baptism and selection, founders going global undergo demystification and information-gap reduction. Once they engage face-to-face with overseas investors, projects, and users, they realize foreign investors aren’t fundamentally different—operating at similar levels. Currently, Western capital holds discourse and structural pricing power, leading us to doubt and follow. But after thorough two-way exchanges, realizing our cognition isn’t behind, we’ll learn from each other, confidently pursuing paths we believe in—like targeting Africa, Latin America, etc.

-

Once overseas Chinese teams complete demystification and build confidence through deeper engagement, they may better integrate into mainstream circles. Examples: Mask donating to Gitcoin’s ecosystem, Scroll team hosting multiple talks and workshops at Devcon, openly engaging developers. The Rollup Day they hosted before Devcon invited only top-tier figures—proof of deep integration into the mainstream. These practices can gradually spread to teams emerging from China’s “rat race” culture, helping more outstanding founders integrate into the global system.

In the words of “On Protracted War,” we possess inherent strengths, while unfavorable factors will undergo significant shifts in intensity and form.

Ethereum Culture Like a Nation

TechFlow: You just returned from Devcon in Bogotá. What were your biggest takeaways? Any standout projects or sectors?

Alen: My biggest takeaway was seeing Ethereum ideologically evolving into a cultural superpower—like a nation conducting soft power outreach. At the opening ceremony, they featured a local Afro-Colombian dance troupe—felt like a Spring Festival Gala or Olympic opening, evoking genuine cultural resonance.

Why host it in Bogotá?

Because most of the world lives in developing countries. Organizers wanted to support developers and locals there. They challenged stereotypes—many assume it’s unsafe, but Latin America is a vibrant, diverse market worth promoting. In that setting, talking to people, I felt the event was non-commercial, welcoming to newcomers. OGs freely shared knowledge, eager to onboard new developers—including those from developing nations. The whole venue felt like a human-centered co-working space—a community deeply respectful of developers, giving them full voice. My biggest impression: it encourages innovation, exchange, open-source collaboration. I believe this culture is why, despite Ethereum’s performance flaws, developers still choose to build on it.

Technically, topics included zk, MEV, Layer2, Dank Sharding, account abstraction, and public scrolls’ global impact.

Three projects I’m most excited about:

First, DankSharding launching next year—it solves data availability, benefiting all OP Rollups.

Second, account abstraction and smart contract wallets—enable seamless C-end Web3 experiences, smoother onboarding. As smart contract wallets, they unlock advanced features (see Argent or UniPass articles). Due to gas costs, they’ll mainly operate on Layer2 rather than Layer1.Together, DS and AA—DS improving infrastructure supply, AA enhancing user experience and demand—will likely yield exciting L2 app ecosystems next year.

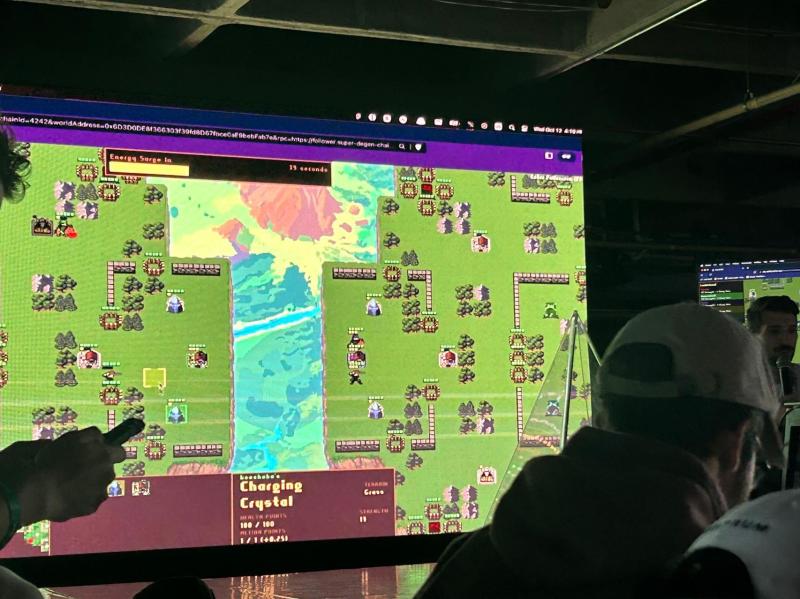

Third, On-Chain Gaming—I find it fascinating, potentially forming a self-sustaining ecosystem. On-chain games require deep technical consideration—MEV, Rollup design. These builders are hardcore techies, rigorously testing new technologies unlike typical app founders.

From a user perspective, early on-chain gamers are often developer-players—tech-savvy users. Feels reminiscent of Ethereum’s early days. Through game mechanics and rules, foundational consensus forms—defining scarcity, setting basic constraints. Early scientists and players compete for artificially defined scarce resources, building bots, front-end plugins, third-party tools—mirroring early public chain ecosystems.

Many players also develop strong identity and narrative control. Take Dark Forest—games often require teamwork, creating short-term goal-oriented, rapidly responsive governance environments. I believe a successful on-chain game could form a public-chain-like ecosystem—or even a mini-Metaverse—worth watching, though monetization and investment models need further thought.

Event snapshots

Great Potential in Developing Nations

TechFlow: With increasing professionals entering the space, Singapore and North America seem increasingly “crowded.” Some are now eyeing Thailand, Vietnam, Southeast Asia, Africa, and South America’s crypto markets. What’s your view on Crypto in developing nations? Will they be the next big opportunity?

Alen: I believe so. I once loved a book called “Rogers'环球 Investment Adventure”—basically Rogers traveling by motorcycle, investing along the way. Its core idea resembles the time-machine theory, combined with localization—unlocking spatial-temporal and geographical arbitrage.

Now, Singapore’s costs are high—not ideal for startups, overly commercialized. The U.S. is great in talent, tech, and capital—but also expensive, even more than Singapore. Safety isn’t great either. For teams without large funding, living in Singapore or the U.S. is tough.

Europe faces cost issues too. South America has language barriers. Many Chinese founders, after trying the U.S. and Singapore, look toward Thailand and Bali. This is elimination by default.

Regarding developing nations, I see vast potential. Domestic and international conditions have led some countries to embrace crypto.

For instance, Argentina suffers hyperinflation; El Salvador has adopted USD and Bitcoin as legal tender—no national currency at all. Locals have no loyalty to their native currency; fiat payment relies on de facto consensus. USD stablecoins easily meet this need. Many countries have high cross-border mobility, inevitably requiring remittances—crypto solves this. Also, banking systems in these countries are underdeveloped—high account-opening barriers. Many still rely on cash-to-top-up cards. In such nations, simply offering traditional quick payments and transactions, with proper localization—UX and regulatory compliance—could be a game-changer, no ponzi model needed.

Many Latin American countries also boast demographic advantages—low-cost hiring, high smartphone penetration, strong education. For internet projects, it’s a blue ocean. Chinese founders are diligent and methodical. With proper localization, targeting markets less obsessed with orthodoxy and natively Western norms, solving real needs—there’s massive growth potential.

Recently, I had an interesting encounter at Hash House in Medellín. When I mentioned my optimism about Latin America, the feedback was: “When Chinese talk about ‘market,’ it sounds like ‘neo-colonialism’—quite sensitive.” Founders may need to build value from the ground up, sincerely improving lives, to gain local acceptance.

Hunters Must Have Something to Hunt

TechFlow: Currently, which sectors is y2z Ventures focusing on or optimistic about?

Alen: As mentioned, the priority is backing reliable teams and promising youth. We reverse-engineer investments based on predicted future main narratives. Back in 2019, tt envisioned a future of billions of tokens—mostly FTs then. By last year’s NFT boom, we’re already beyond that. Believing in that future could have revealed many investment opportunities.

This year, after traveling in May to Bali, I strongly sensed the future of “Network Nations.” Global conditions may worsen, prompting more people to seek better environments. The digital nomad trend proves this. New populations will accelerate physical mobility. During this flow, new ideologies may go mainstream, new offline embodied social experiments may emerge—crypto can clearly aid these mobile individuals.

Bitcoin’s original journey may repeat—not by code, but by flesh-and-blood believers reliving it.

Then, which crypto projects can serve these people? What new products, governance models, organizational structures will emerge? These are our focus areas.

tt’s vision of the Great Voyage DAO was precisely such exploration—seeking survival strategies for Chinese going global in the age of digital exploration. Many friends still hope to carry this forward.

TechFlow: Throughout the investment journey, what’s the greatest insight or lesson tt has taught you?

Alen: tt has taught me countless things through words and actions. If I had to summarize: live authentically and courageously. I’ve spent a long time with tt—our team is like family. He treats the world as a game, always seeking the current version’s main quest and his optimal role within it, striving relentlessly regardless of outside noise—living authentically.

This profoundly inspired me—reminding me of the first Hunter Oath from *Hunter x Hunter*, one of our favorite mangas: Hunters must have something to hunt. In the manga, every hunter must have a goal, pursuing it relentlessly—yet goals are limitless, diverse, and deeply respected. Everyone must find their own main quest, then live authentically, ignoring distractions. That’s where true joy lies.

Alen and tt

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News